Market overview

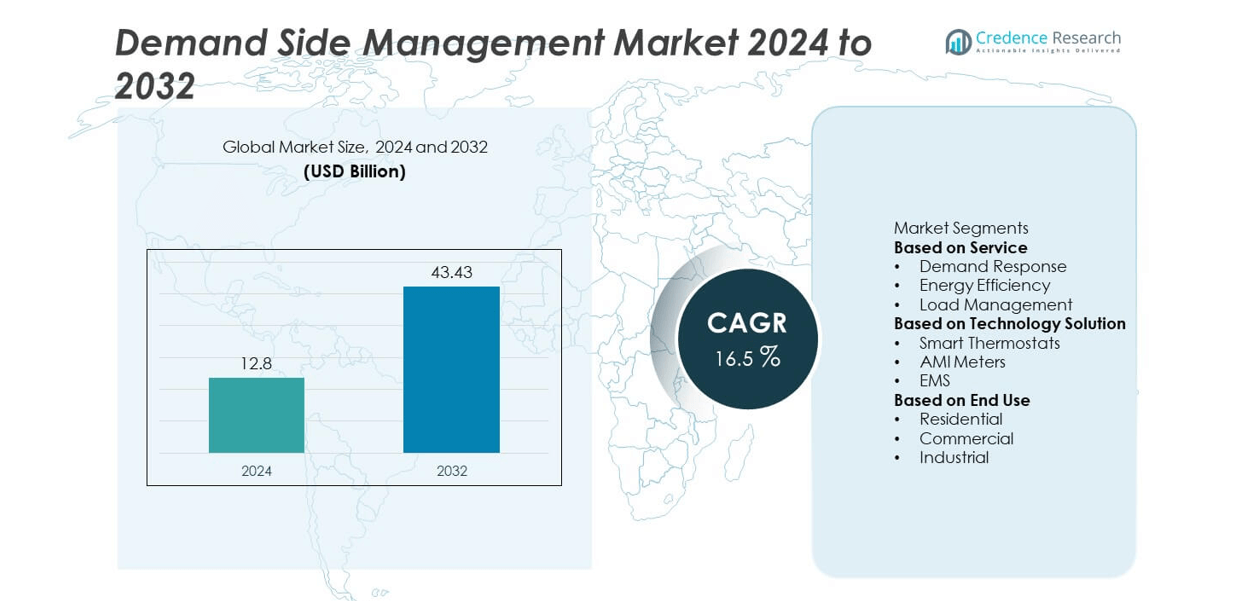

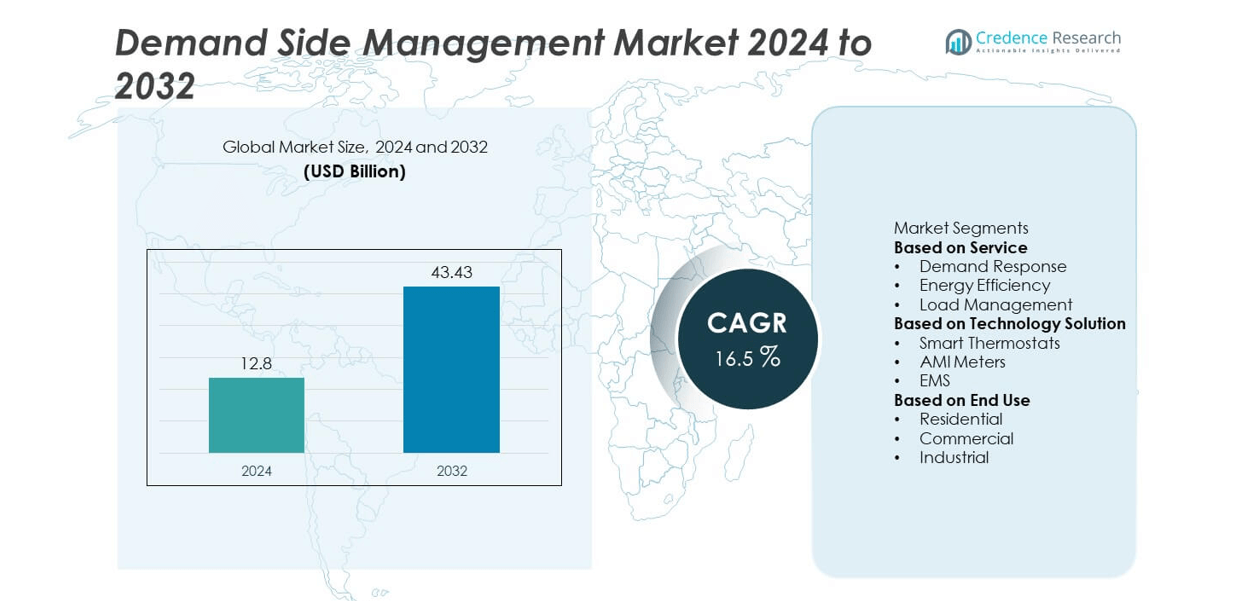

The Demand Side Management market was valued at USD 12.8 billion in 2024 and is projected to reach USD 43.43 billion by 2032, growing at a CAGR of 16.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Demand Side Management Market Size 2024 |

USD 12.8 billion |

| Demand Side Management Market, CAGR |

16.5% |

| Demand Side Management Market Size 2032 |

USD 43.43 billion |

The Demand Side Management market is dominated by leading companies such as IBM, Honeywell, Johnson Controls, Rockwell Automation, Eaton, Emerson Electric, Optimum Energy, Dexma Sensors, eSight Energy, and General Electric. These players drive innovation through smart grid integration, AI-powered analytics, and advanced energy monitoring solutions. North America leads the global market with a 38% share, supported by strong adoption of smart metering and government-led efficiency programs. Europe holds 31%, driven by stringent energy regulations and renewable integration, while Asia-Pacific accounts for 24%, emerging as the fastest-growing region due to rapid industrialization and increasing focus on energy optimization across commercial and industrial sectors.

Market Insights

- The demand side management market was valued at USD 12.8 billion in 2024 and is projected to reach USD 43.43 billion by 2032, expanding at a CAGR of 16.5%.

- Rising focus on energy efficiency, peak load reduction, and smart grid development is driving strong market growth.

- The energy efficiency segment leads with a 44% share, supported by widespread use of smart thermostats, AMI meters, and EMS technologies.

- Key players such as IBM, Honeywell, Eaton, and Johnson Controls are advancing digital energy management and automation platforms.

- North America holds a 38% share, followed by Europe at 31% and Asia-Pacific at 24%, driven by renewable integration, regulatory initiatives, and expanding smart infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

The demand response segment dominated the demand side management market in 2024 with a 46% share. This dominance is driven by its ability to balance grid loads and optimize electricity usage during peak hours. Utilities are increasingly deploying automated demand response programs to reduce strain on power infrastructure and enhance energy efficiency. Advancements in smart metering and two-way communication systems further strengthen adoption. The energy efficiency segment also shows steady growth, supported by regulatory initiatives and incentive programs promoting reduced energy consumption across commercial and residential sectors.

- For instance, Uplight’s AutoGrid Flex platform, acquired from Schneider Electric in 2024, works with utility partners to manage flexible loads, allowing utilities to reduce grid stress during high-demand intervals and achieve faster grid balancing with automated curtailment capabilities.

By Technology Solution

The EMS (Energy Management System) segment held the largest share of 43% in the demand side management market in 2024. EMS solutions offer real-time energy monitoring, predictive analytics, and automated control to optimize consumption across buildings and industrial plants. The rising focus on digitalization and IoT integration in power systems is boosting segment growth. Smart thermostats are also gaining traction due to increasing residential adoption for temperature control and energy savings, while AMI meters continue to expand their role in accurate billing and data-driven grid management.

- For instance, Johnson Controls’ OpenBlue Enterprise Manager is a smart building platform that uses AI-driven analytics to monitor building operations and performance. The platform can provide tailored energy-saving recommendations based on usage and weather data.

By End Use

The industrial segment accounted for a 41% share of the demand side management market in 2024, leading due to high energy consumption and the need for cost optimization in manufacturing and processing industries. Industries are adopting advanced energy monitoring and automated load control systems to enhance operational efficiency and reduce carbon footprints. The commercial segment follows, supported by the integration of smart building systems and renewable energy solutions. The residential segment is witnessing steady growth as smart appliances and connected home technologies become more accessible to consumers globally.

Key Growth Drivers

Increasing Focus on Energy Efficiency and Grid Stability

Rising global electricity demand and the need for efficient energy utilization are driving the adoption of demand side management (DSM) solutions. Governments and utilities are implementing DSM programs to reduce peak load pressure, enhance grid reliability, and minimize energy wastage. Smart meters, IoT-based control systems, and automation tools are helping end users monitor and optimize energy usage. Additionally, regulatory incentives for energy conservation and emission reduction are encouraging industries and households to participate actively in demand response and energy efficiency initiatives.

- For instance, Rockwell Automation deployed its FactoryTalk Energy Manager (formerly FactoryTalk EnergyMetrix). This system uses advanced analytics and automated controls to reduce industrial energy consumption, improve power stability, and enable efficient coordination between industrial consumers and utility providers.

Growing Integration of Smart Grid and IoT Technologies

The growing integration of smart grid systems and IoT devices is a major catalyst for DSM market expansion. Smart sensors and real-time monitoring tools enable better control over energy distribution and consumption patterns. Utilities use predictive analytics and cloud-based platforms to manage demand dynamically and prevent power outages. IoT-enabled devices like smart thermostats and AMI meters improve visibility into energy flows. This technological shift enhances operational efficiency, supports decentralized energy systems, and strengthens demand response capabilities across all major sectors.

- For instance, IBM collaborated with Tata Power Delhi Distribution Limited to implement a smart grid solution covering 270,000 smart meters across an area of 510 square kilometers. The system enabled real-time demand response and predictive outage management, integrating over 400 feeder automation units and achieving precise energy balancing across commercial and residential networks.

Rising Adoption of Renewable Energy Sources

The increasing integration of renewable energy sources such as solar and wind power has amplified the need for demand side management systems. DSM helps balance the variability of renewable energy generation by managing load flexibility. Grid operators rely on DSM programs to align consumption with renewable availability, ensuring grid stability. The growing focus on sustainable energy use and carbon reduction is prompting utilities to adopt DSM solutions. These systems play a key role in enhancing renewable integration, reducing reliance on fossil fuels, and improving grid resilience.

Key Trends & Opportunities

Expansion of AI and Data-Driven Energy Optimization

Artificial intelligence and big data analytics are transforming DSM operations by enabling predictive control and real-time decision-making. AI-driven platforms analyze consumption patterns to optimize load shifting and energy storage management. Utilities use these insights to design personalized energy-saving programs for consumers. The integration of machine learning algorithms improves forecasting accuracy, reduces operational costs, and enhances automation efficiency. This technological evolution creates opportunities for advanced analytics providers and energy service companies to deliver intelligent, adaptive DSM solutions tailored to specific end-user needs.

- For instance, GE Vernova provides a range of grid software solutions used by utility networks worldwide. These systems, like the GridOS software portfolio, utilize advanced data analytics, AI, and machine learning to aid utilities in demand forecasting and orchestrate the grid.

Growing Deployment of Smart Homes and Buildings

The growing adoption of smart homes and intelligent building systems is creating new opportunities for DSM growth. Smart thermostats, connected lighting, and energy-efficient HVAC systems are enabling households and commercial facilities to reduce consumption during peak demand periods. Integration with energy management systems allows for seamless control and real-time adjustments. As urbanization rises and awareness about sustainable living increases, the demand for smart energy control solutions in residential and commercial spaces continues to expand, driving steady market growth across developed and emerging regions.

- For instance, Honeywell International has deployed its Forge Energy Optimization platform across various commercial buildings and campuses. The system, also known as Forge Sustainability+, integrates IoT-enabled sensors and AI-based control algorithms to monitor and autonomously adjust HVAC and lighting operations in real time.

Key Challenges

High Implementation and Infrastructure Costs

The high upfront cost of deploying DSM infrastructure remains a major barrier to widespread adoption. Installation of smart meters, energy management systems, and communication networks requires significant investment. Small and medium enterprises and low-income households often struggle to afford such solutions. Furthermore, ongoing maintenance and integration with legacy grid systems increase overall expenditure. To overcome this, governments and utilities must offer financial incentives, rebates, and funding programs that make DSM technologies more accessible and economically viable for diverse user groups.

Data Privacy and Cybersecurity Concerns

The increasing use of connected devices and cloud-based systems in DSM raises significant data privacy and cybersecurity risks. Smart meters and IoT-based solutions collect sensitive consumption data that can be vulnerable to unauthorized access. Cyberattacks on energy networks could disrupt power distribution and compromise consumer trust. Ensuring data encryption, secure communication channels, and regulatory compliance is essential to safeguard energy systems. Utilities and technology providers are investing in robust cybersecurity frameworks to mitigate risks and maintain operational integrity in connected grid environments.

Regional Analysis

North America

North America held a 37% share of the demand side management market in 2024, driven by advanced smart grid infrastructure and strong government policies supporting energy efficiency. The United States leads regional growth through widespread deployment of AMI meters, smart thermostats, and automated energy management systems. Utility-driven demand response programs and federal incentives for grid modernization further enhance adoption. Canada contributes through renewable energy integration and commercial energy-saving initiatives. The presence of major technology providers and growing investments in smart home systems strengthen North America’s position in global DSM development and innovation.

Europe

Europe accounted for 31% of the demand side management market in 2024, supported by strict energy efficiency regulations and climate goals under the European Green Deal. Countries such as Germany, the United Kingdom, and France lead in adopting DSM programs to reduce peak load and carbon emissions. Utilities are focusing on dynamic pricing, demand response, and real-time energy analytics. The increasing penetration of renewable energy and grid decentralization encourages adoption of energy management systems. Additionally, strong government backing for digital energy infrastructure and sustainability initiatives continues to drive consistent market expansion across the region.

Asia-Pacific

Asia-Pacific captured a 26% share of the demand side management market in 2024 and is the fastest-growing region. Rapid urbanization, rising energy consumption, and expanding industrialization drive demand for efficient energy management. China, Japan, and India are investing heavily in smart grid infrastructure and IoT-based energy solutions. Governments are promoting energy conservation programs and subsidies for smart metering systems. Growing awareness about energy savings among residential and commercial consumers supports adoption. The region’s focus on renewable integration and digital transformation of utilities positions Asia-Pacific as a key driver of global DSM market growth.

Latin America

Latin America held a 4% share of the demand side management market in 2024, driven by increasing investments in power infrastructure modernization and renewable energy integration. Brazil and Mexico are leading the region with growing deployment of AMI meters and industrial load management systems. Government initiatives to reduce electricity losses and improve energy efficiency support adoption. However, limited awareness and high implementation costs hinder faster expansion. The gradual shift toward smart grids and partnerships with global technology providers are expected to enhance energy optimization and expand the DSM market presence in the region.

Middle East & Africa

The Middle East & Africa accounted for a 2% share of the demand side management market in 2024. The region is witnessing steady growth due to rising energy demand, rapid industrialization, and increased renewable energy investments. The United Arab Emirates and Saudi Arabia are implementing DSM initiatives as part of national energy efficiency programs. In Africa, growing electrification and modernization efforts are driving the adoption of load management solutions. Despite challenges such as high installation costs and limited technical expertise, government incentives and infrastructure development are expected to accelerate market growth over the coming years.

Market Segmentations:

By Service

- Demand Response

- Energy Efficiency

- Load Management

By Technology Solution

- Smart Thermostats

- AMI Meters

- EMS

By End Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The Demand Side Management market is highly competitive, with key players including IBM, Honeywell, Johnson Controls, Eaton, Emerson Electric, Rockwell Automation, General Electric, Optimum Energy, Dexma Sensors, and eSight Energy. These companies dominate through advanced energy management platforms, IoT-enabled analytics, and integrated demand response technologies. Market leaders focus on developing AI-driven solutions to optimize energy consumption and enhance grid reliability. Strategic collaborations with utility providers and industrial clients strengthen their global footprint. Continuous innovation in smart meters, automation software, and building management systems supports long-term competitiveness. Additionally, rising regulatory pressure for sustainable energy practices and carbon reduction is prompting players to invest in scalable, cloud-based platforms that deliver real-time monitoring and predictive control. Expansion into emerging economies and digitalization of energy infrastructure further define competition, positioning these firms to capitalize on growing demand for efficient, data-centric energy optimization solutions worldwide.

[cr_cta type=”customize_now“]

Key Player Analysis

- Optimum Energy

- IBM

- Rockwell Automation

- Johnson Controls

- Dexma Sensors

- Eaton

- Honeywell

- eSight Energy

- Emerson Electric

- General Electric

Recent Developments

- In September 2025, Johnson Controls was named to Fortune’s Change the World list for its YORK YVAM magnetic-bearing chiller, which reportedly consumes 40% less energy annually while providing equivalent cooling capacity.

- In September 2025, GE Vernova (GE’s power/digital spin-off) agreed to sell its Proficy software business to TPG, which accounts for about 20% of its electrification software revenue.

- In April 2025, Honeywell published a survey showing 91 of 300 U.S. energy executives believe AI can enhance energy security, and 85 are already piloting AI in their operations.

- In 2024, Honeywell promoted advanced load flexibility and grid visibility via its load management solutions at a utility forum, emphasizing real-time control over demand

Report Coverage

The research report offers an in-depth analysis based on Service, Technology Solution, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven energy optimization platforms will increase across industrial and commercial sectors.

- Utilities will expand demand response programs to manage grid stability and renewable integration.

- Smart meters and IoT-based devices will enhance real-time energy monitoring and analytics.

- Governments will introduce stricter efficiency regulations and incentives to promote DSM adoption.

- Cloud-based energy management systems will gain traction for scalable and remote operations.

- Integration of DSM with distributed energy resources will improve grid flexibility.

- Residential consumers will adopt smart home technologies for automated energy control.

- Energy service companies will invest in predictive analytics to optimize consumption patterns.

- Asia-Pacific will witness rapid growth driven by urbanization and smart grid investments.

- Collaboration between utilities, technology providers, and regulators will shape the global DSM ecosystem.