| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Cheese Market Size 2024 |

USD 4,920.72 Million |

| Latin America Cheese Market, CAGR |

4.12% |

| Latin America Cheese Market Size 2032 |

USD 6,796.96 Million |

Market Overview

Latin America Cheese Market size was valued at USD 4,920.72 million in 2024 and is anticipated to reach USD 6,796.96 million by 2032, at a CAGR of 4.12% during the forecast period (2024-2032).

The Latin America cheese market is primarily driven by the rising demand for convenient and protein-rich food products, fueled by changing dietary habits and a growing working population. Increasing urbanization and the expansion of the foodservice sector, particularly quick-service restaurants and bakeries, have significantly boosted cheese consumption across the region. Additionally, consumers are showing a strong preference for premium and specialty cheeses, encouraging manufacturers to diversify their product offerings. The market is also benefiting from the influence of Western cuisines and the growing popularity of international dishes that incorporate cheese. Health-conscious trends have further spurred the development of low-fat and organic cheese variants. Moreover, advancements in packaging technology and cold chain logistics are improving product shelf life and distribution efficiency. Together, these factors are shaping a dynamic and evolving cheese market in Latin America, poised for steady growth throughout the forecast period.

The Latin America cheese market spans diverse geographies, with Brazil, Argentina, Chile, Colombia, and Peru emerging as major contributors due to their strong dairy farming traditions and growing urban populations. Countries like Brazil and Argentina boast robust domestic production and consumption, driven by widespread culinary use and an expanding retail sector. Meanwhile, Chile and Colombia are witnessing increasing demand for premium and specialty cheeses, supported by evolving consumer tastes and improved distribution networks. In Peru and other parts of the region, local cheeses dominate, but international varieties are gaining ground through modern trade channels. Key players operating in the market include Grupo Lala, Nestlé S.A. (Latin America Operations), Alpina Productos Alimenticios, Lactalis do Brasil, Sigma Alimentos, Conaprole, Gloria S.A., Cooperativa Central Aurora Alimentos, Polenghi Industria Alimentícia, and Laive. These companies are focusing on product diversification, regional expansion, and innovation to cater to changing consumer preferences and capture growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Latin America cheese market was valued at USD 4,920.72 million in 2024 and is expected to reach USD 6,796.96 million by 2032, growing at a CAGR of 4.12% during the forecast period.

- The global cheese market was valued at USD 97,440.00 million in 2024 and is projected to reach USD 1,46,171.12 million by 2032, growing at a CAGR of 5.20% during the forecast period.

- Rising urbanization and changing dietary habits are fueling the demand for processed and premium cheese across the region.

- Increasing popularity of international cuisines and gourmet food is driving interest in flavored, spreadable, and specialty cheeses.

- Key players such as Grupo Lala, Nestlé S.A., Lactalis do Brasil, and Sigma Alimentos are expanding their product portfolios and regional reach to strengthen market presence.

- Market growth faces challenges due to volatile raw milk prices, weak cold chain infrastructure, and informal dairy markets.

- Brazil and Argentina lead the market due to strong dairy sectors and high cheese consumption, while Chile, Colombia, and Peru show rising demand.

- Health-focused innovations like low-fat, lactose-free, and plant-based cheese present emerging opportunities.

Report Scope

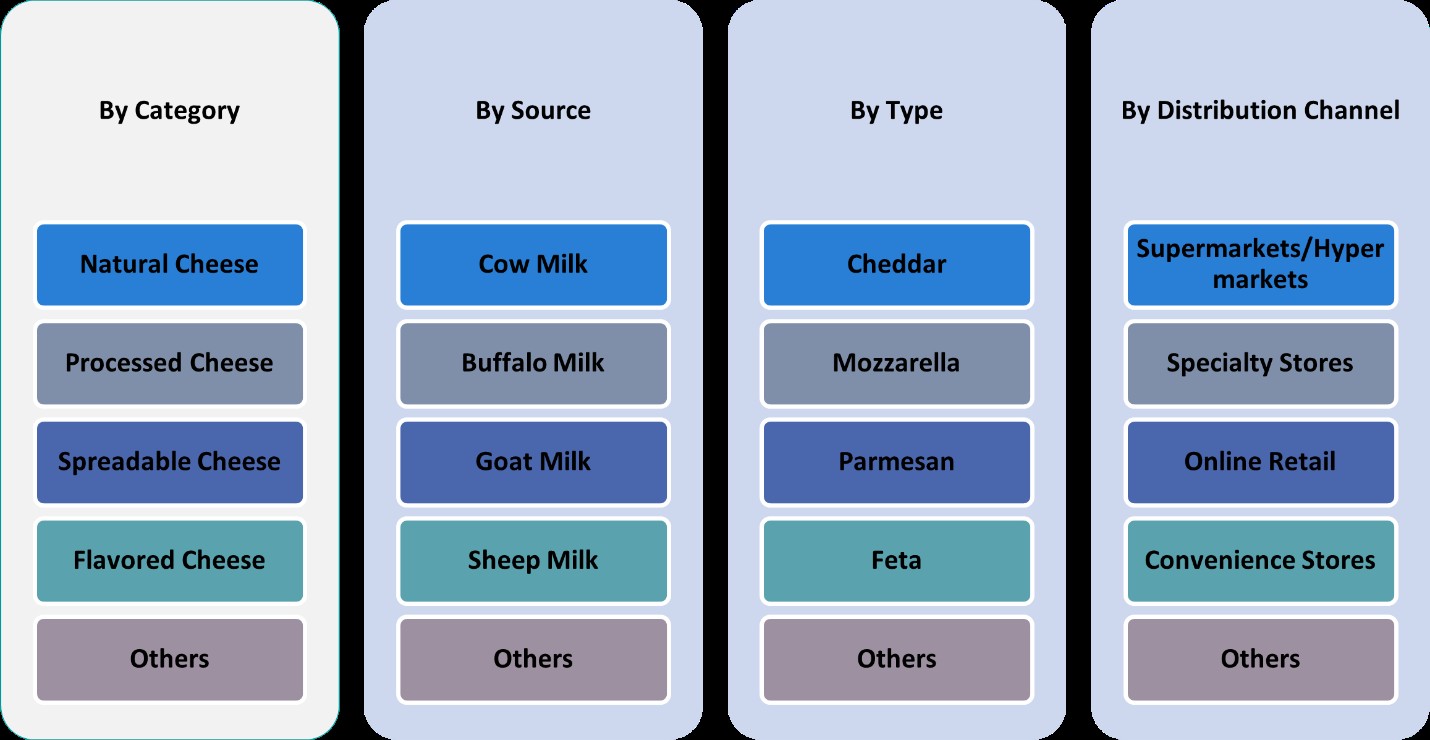

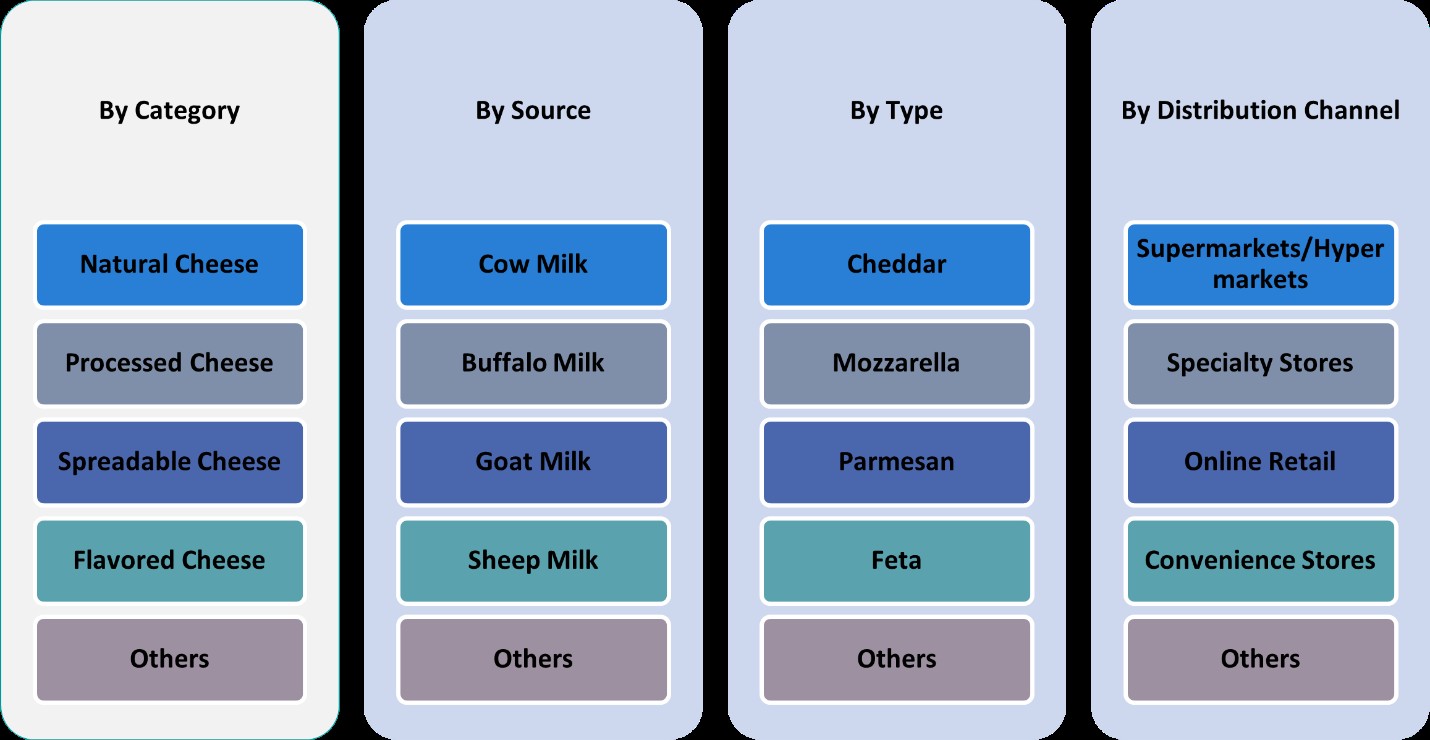

This report segments the Latin America Cheese Market as follows:

Market Drivers

Growing Demand for Convenient and Protein-Rich Foods

One of the primary drivers propelling the Latin America cheese market is the increasing demand for convenient, ready-to-eat, and protein-rich food products. As urban lifestyles become more fast-paced, consumers are actively seeking quick meal options that do not compromise on nutrition. For instance, data from the Food and Agriculture Organization (FAO) indicates that urban families in Latin America are increasingly choosing cheese as a staple due to its versatility and nutritional value, incorporating it into quick dishes like arepas, sandwiches, and empanadas. The rise in dual-income households and working professionals has also boosted the preference for packaged and processed cheese that can be easily stored and consumed. Moreover, cheese consumption is not limited to any particular age group, further enhancing its market appeal across a diverse consumer base in the region.

Expansion of Foodservice Industry and Western Culinary Influence

The Latin America cheese market continues to benefit from the dynamic foodservice industry, particularly the adoption of Western culinary trends. For instance, a study by the World Tourism Organization notes that international food chains such as Papa John’s and Subway have significantly increased their footprint in Latin America, leveraging cheese-rich menu items to attract customers. Western staples like pizza, pasta, and cheesy casseroles have gained massive traction, leading to a rise in cheese consumption across restaurants and delivery services. Additionally, cloud kitchens specializing in gourmet cheese-based menus are gaining popularity, reflecting a shift in consumer behavior driven by convenience and adventurous palates.

Rising Affinity for Premium and Specialty Cheese Varieties

A noticeable trend in the Latin America cheese market is the increasing consumer inclination toward premium, organic, and specialty cheese products. Rising disposable income, coupled with a growing awareness of global culinary trends, is pushing consumers to explore higher-quality and artisanal cheese options. Local and international manufacturers are responding by expanding their product portfolios to include exotic cheese varieties such as brie, gouda, feta, and blue cheese. This diversification is not only elevating the market value but also fostering innovation in flavor, texture, and packaging. Moreover, consumers are becoming more health-conscious and are seeking clean-label products, thus creating demand for organic and low-fat cheese alternatives, which are gaining traction across health-aware segments.

Technological Advancements and Improved Distribution Channels

Technological progress in dairy processing and packaging, along with improved cold chain logistics, has played a pivotal role in the growth of the Latin America cheese market. Enhanced manufacturing capabilities have allowed producers to maintain the quality and safety of cheese while scaling up production. Innovations in packaging—such as vacuum sealing, resealable packs, and eco-friendly materials—are extending shelf life and improving product appeal. Simultaneously, improvements in distribution networks, including refrigerated transport and modern retail formats, are making cheese products more widely available in both urban and rural regions. These advancements not only reduce wastage but also help manufacturers tap into emerging markets, thereby fueling long-term growth.

Market Trends

Surge in Artisanal and Specialty Cheese Consumption

A prominent trend shaping the Latin America cheese market is the growing consumer preference for artisanal and specialty cheese products. For instance, data from the Latin American Cheese Guild shows that cheeses like Oaxaca (Mexico) and Turrialba (Costa Rica) are gaining recognition for their cultural significance and handmade techniques. This has led to a surge in demand for handcrafted cheeses such as blue cheese, camembert, gouda, and feta. Local producers and small-scale dairies are capitalizing on this trend by introducing high-quality, region-specific cheese varieties that cater to gourmet and health-conscious segments. Additionally, the rising popularity of wine and cheese pairings in social gatherings and fine-dining experiences is further fueling interest in specialty cheese offerings across urban centers.

Increasing Popularity of Organic and Clean-Label Cheese

Health and wellness trends are strongly influencing consumer behavior in Latin America, leading to a rising demand for organic and clean-label cheese products. For instance, the International Federation of Organic Agriculture Movements (IFOAM) notes a growing number of certified organic dairy farms in countries like Argentina and Brazil, leading to greater availability of organic cheese products. Shoppers are now more attentive to ingredient lists and nutritional content, seeking products that are free from artificial additives, preservatives, and hormones. This shift has prompted dairy manufacturers to introduce organic cheese lines that emphasize natural sourcing and ethical production practices. Furthermore, plant-based and lactose-free cheese alternatives are gradually gaining popularity among consumers with dietary restrictions or lifestyle preferences, expanding the scope of innovation within the market. As transparency and health consciousness become key purchase drivers, clean-label cheese is expected to witness steady growth.

Rising Adoption of Processed and Packaged Cheese Formats

Convenience continues to drive innovation in cheese packaging and product formats across Latin America. Consumers, particularly in metropolitan areas, are gravitating toward processed and pre-packaged cheese products that offer longer shelf life and ease of use. Formats such as sliced, shredded, cubed, and spreadable cheese are witnessing increased demand for use in snacks, lunchboxes, and quick meal preparations. Single-serve and resealable packaging options are also gaining traction, particularly among busy households and on-the-go consumers. This trend not only supports product portability and storage efficiency but also aligns with evolving retail strategies focused on consumer convenience and accessibility.

Expansion of E-Commerce and Direct-to-Consumer Channels

Digital transformation and the rise of e-commerce platforms are significantly influencing cheese sales in Latin America. With the growing penetration of online grocery services, more consumers are purchasing cheese products via digital marketplaces and specialty food websites. Direct-to-consumer (DTC) strategies are also emerging, allowing local cheese brands and artisanal producers to reach niche audiences without the need for traditional retail intermediaries. Subscription boxes, online promotions, and doorstep delivery models are becoming effective tools for expanding brand visibility and consumer engagement. As digital literacy and logistics infrastructure improve, online cheese retail is poised to become a major growth avenue in the region.

Market Challenges Analysis

Volatile Dairy Prices and Supply Chain Disruptions

One of the significant challenges facing the Latin America cheese market is the volatility in dairy prices and frequent disruptions in the supply chain. Fluctuating costs of raw milk, driven by seasonal variations, feed prices, and climate change, have a direct impact on cheese production costs. Small-scale dairy farmers often struggle to maintain consistent quality and supply, affecting the availability of raw materials for cheese manufacturers. In addition, inadequate cold chain infrastructure in some parts of the region leads to inefficiencies in storage and transportation, resulting in increased spoilage and operational costs. These challenges are particularly burdensome for artisanal and regional cheese producers who lack access to advanced processing and distribution resources. The inability to stabilize input costs while maintaining product quality poses a significant hurdle for sustainable market growth.

Regulatory Barriers and Informal Market Competition

Stringent regulatory frameworks and the prevalence of informal dairy markets present another set of obstacles for the Latin America cheese industry. Compliance with food safety standards, labeling requirements, and export regulations can be complex and costly, especially for small and mid-sized producers. For instance, a report by Leatherhead Food Research highlights that varying food safety regulations across countries like Mexico and Chile create additional compliance costs for cheese exporters. These regulatory hurdles often slow down product innovation and limit the entry of new players into formal retail channels. Moreover, a considerable portion of cheese sales in rural and semi-urban areas occurs through informal markets where unregulated and non-packaged cheese is sold at lower prices. This informal competition creates pricing pressures on established brands and affects their market share. Additionally, limited consumer awareness regarding food safety in rural regions hampers the growth of certified, premium, and branded cheese products. Addressing these challenges requires coordinated efforts in regulatory reform, infrastructure development, and public education to promote standardized and high-quality cheese production across the region.

Market Opportunities

The Latin America cheese market presents significant growth opportunities driven by shifting consumer preferences and evolving retail dynamics. With rising disposable incomes and increasing urbanization, consumers across the region are exploring diverse cheese varieties beyond traditional offerings. This opens up opportunities for manufacturers to introduce premium, gourmet, and international cheese types tailored to local tastes. The growing popularity of global cuisines, combined with the influence of food-related content on social media, is encouraging experimentation and driving demand for specialty cheeses such as brie, gouda, mozzarella, and cheddar. Additionally, there is untapped potential in developing innovative product formats, such as plant-based and lactose-free cheeses, to cater to consumers with specific dietary requirements. These niche segments are gaining traction among health-conscious and environmentally aware consumers, especially in major cities.

Another promising opportunity lies in the expansion of modern retail infrastructure and e-commerce platforms across Latin America. As online grocery shopping becomes more widespread, cheese manufacturers and distributors can leverage digital channels to reach a broader audience, including consumers in remote and underserved regions. Direct-to-consumer models and subscription-based services offer new ways to market artisanal and locally produced cheese varieties while maintaining brand exclusivity and customer loyalty. Moreover, increasing investments in cold chain logistics and sustainable packaging are enabling better product preservation and distribution, allowing brands to extend their shelf life and reduce waste. Strategic partnerships with local dairy cooperatives and innovations in packaging formats can further enhance market reach and profitability. As consumer awareness regarding food quality and provenance continues to grow, companies that focus on transparency, ethical sourcing, and nutritional value are well-positioned to capture emerging opportunities in the Latin American cheese market.

Market Segmentation Analysis:

By Category:

The Latin America cheese market is segmented by category into cheddar, processed cheese, spreadable cheese, flavored cheese, and others. Among these, processed cheese holds a significant market share due to its longer shelf life, affordability, and widespread use in foodservice applications such as burgers, sandwiches, and snacks. Cheddar cheese follows closely, favored for its rich flavor and versatility in both household and commercial cooking. Spreadable cheese is gaining popularity, especially among younger consumers and urban households seeking convenient, ready-to-use options for breakfast and snacks. Flavored cheeses, infused with herbs, spices, and exotic ingredients, are also growing in demand as consumers explore new taste profiles. The “others” category includes specialty and artisanal cheeses, which are experiencing a gradual rise in interest, driven by gourmet trends and increasing disposable incomes. As consumer preferences diversify, manufacturers are expanding their portfolios to include both value-oriented and premium offerings, creating a competitive and evolving category landscape across the region.

By Source:

Based on the source, the Latin America cheese market is divided into cow milk, buffalo milk, goat milk, sheep milk, and others. Cow milk remains the dominant source due to its wide availability, high yield, and familiarity among consumers. It serves as the primary base for producing various cheese types, including cheddar and processed cheese, and supports large-scale industrial production. Buffalo milk cheese, known for its creamy texture and rich taste, is gaining attention, particularly in gourmet and specialty segments. Goat and sheep milk cheeses, traditionally popular in Mediterranean-style diets, are slowly finding a niche in urban Latin American markets, especially among health-conscious consumers seeking alternatives with unique nutritional profiles. These variants are often perceived as easier to digest and lower in lactose. The “others” segment includes plant-based sources, which, though still in a nascent stage, are witnessing rising interest due to growing vegan and lactose-intolerant populations. The increasing focus on source diversification is likely to expand the market’s appeal and innovation potential.

Segments:

Based on Category:

- Cheddar

- Processed Cheese

- Spreadable Cheese

- Flavored Cheese

- Others

Based on Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Sheep Milk

- Others

Based on Type:

- Cheddar

- Mozzarella

- Parmesan

- Feta

- Others

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Based on the Geography:

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

Regional Analysis

Brazil

Brazil holds the largest share of the Latin America cheese market, accounting for more than 35% of the regional revenue in 2024. The country’s dominant position stems from its expansive dairy industry, robust consumer base, and increasing urbanization. Cheese is a staple in Brazilian cuisine, widely used in both traditional dishes and Western-style fast food. The rising popularity of bakery and QSR formats, along with the growth of retail chains and supermarkets, has further amplified cheese consumption. Additionally, Brazil’s large-scale milk production supports domestic cheese manufacturing, particularly for processed and mozzarella varieties. Manufacturers are also investing in product diversification, introducing premium and flavored cheese options to cater to changing consumer preferences. With growing interest in health-conscious and high-protein diets, Brazil is witnessing an uptick in demand for low-fat and organic cheese products.

Argentina

Argentina commands a significant share of approximately 22% in the Latin America cheese market. The country has a rich tradition of cheese production, supported by a strong agricultural base and favorable climate for dairy farming. Argentine consumers show a strong preference for natural and artisanal cheeses, with varieties like provoleta, reggianito, and mozzarella widely consumed across households and restaurants. The presence of local and regional players contributes to a well-established domestic cheese industry. In addition, Argentina’s export potential for specialty cheeses is gradually rising, owing to high-quality production and growing international interest. Despite economic challenges, the demand for cheese remains stable due to its cultural significance and incorporation in daily diets. The expansion of modern retail channels and innovations in packaging are expected to further drive growth in the coming years.

Chile and Colombia

Chile and Colombia are emerging as promising cheese markets, collectively holding around 18% of the regional share. In Chile, rising disposable income and increasing exposure to international cuisines have driven the consumption of gourmet and specialty cheese varieties. The growing presence of supermarkets and imported brands is also reshaping consumer preferences. Colombia, on the other hand, is witnessing steady growth driven by urbanization, evolving food habits, and expansion in the foodservice industry. Consumers in both countries are showing increased interest in value-added products such as spreadable and flavored cheeses. Government initiatives supporting the dairy industry, along with investments in cold chain logistics, are enhancing cheese accessibility across urban and semi-urban regions. Although still developing, these markets show strong potential for sustained growth through localized production and broader product portfolios.

Peru and Rest of Latin America

Peru and the rest of Latin America, including countries like Ecuador, Bolivia, and Paraguay, contribute close to 25% of the total market revenue. In Peru, cheese consumption is growing steadily, supported by traditional culinary practices and rising urban demand. Local cheeses such as queso fresco and andean varieties remain popular, while processed cheese is gaining traction in urban supermarkets. The rest of Latin America exhibits varied consumption patterns, heavily influenced by local taste preferences and socio-economic factors. While these regions are largely fragmented and dependent on informal markets, they offer considerable opportunities for branded and packaged cheese products. Improving infrastructure, rising awareness of food safety, and increasing investments in retail distribution are expected to enhance market penetration in these underdeveloped areas. As income levels improve, demand for diverse cheese types and convenient formats will likely boost growth across these emerging regional markets.

Key Player Analysis

- Grupo Lala

- Nestlé S.A. (Latin America Operations)

- Alpina Productos Alimenticios

- Lactalis do Brasil

- Sigma Alimentos

- Conaprole

- Gloria S.A.

- Cooperativa Central Aurora Alimentos

- Polenghi Industria Alimentícia

- Laive

Competitive Analysis

The competitive landscape of the Latin America cheese market is characterized by the presence of both regional dairy giants and international food conglomerates striving to strengthen their market positions through innovation, expansion, and strategic partnerships. Leading players such as Grupo Lala, Nestlé S.A. (Latin America Operations), Alpina Productos Alimenticios, Lactalis do Brasil, Sigma Alimentos, Conaprole, Gloria S.A., Cooperativa Central Aurora Alimentos, Polenghi Industria Alimentícia, and Laive are actively focusing on diversifying their cheese portfolios to meet evolving consumer preferences across the region. These companies are investing in R&D to develop new product variants, such as low-fat, lactose-free, and specialty cheeses, catering to the growing health-conscious and premium consumer segments. Additionally, players are expanding distribution networks and improving cold chain logistics to ensure product availability across urban and rural markets. Marketing initiatives emphasizing product origin, nutritional value, and taste are further enhancing brand visibility. Despite fragmented regional markets and varying consumer preferences, these companies maintain competitive strength by leveraging their strong supply chains, local sourcing capabilities, and established brand trust. As competition intensifies, sustained innovation, value-added offerings, and regional customization will remain critical success factors for market leadership in the Latin America cheese industry.

Recent Developments

- In March 2025, Arla Foods Ingredients partnered with Valley Queen in South Dakota to increase production of Nutrilac® ProteinBoost, a high-protein whey concentrate, to meet growing demand in North America.

- In March 2025, Sargento introduced three innovations—Natural American Cheese, Seasoned Shredded Cheese in collaboration with McCormick, and Shareables snack trays in partnership with Mondelez International.

- In March 2025, Saputo USA debuted its spicy mozzarella cheese at the International Pizza Expo, combining traditional mozzarella with habanero jack for a zesty twist.

- In February 2025, Kraft Heinz emphasized innovation across three platforms—taste elevation, easy-ready meals, and snacking. This includes new product launches like Lunchables Spicy Nachos and value-sized Kraft Mac & Cheese to cater to shifting consumer preferences.

- In November 2024, Lactalis highlighted emerging trends such as premiumization, hot eating cheeses like Président Extra Creamy Brie, and sustainability-focused products like Seriously Spreadable Black Pepper cheese.

Market Concentration & Characteristics

The Latin America cheese market exhibits a moderately concentrated structure, with a mix of well-established domestic producers and international dairy corporations shaping the competitive landscape. A few leading players command significant influence due to their extensive product portfolios, strong distribution networks, and long-standing consumer trust. However, the market also accommodates numerous small and mid-sized producers, particularly in countries like Argentina, Peru, and Colombia, where traditional and artisanal cheese varieties are highly favored. The market is characterized by diverse consumer preferences, with demand ranging from affordable processed cheese to premium, flavored, and specialty options. Additionally, the rise of health-conscious consumption has led to an increase in low-fat and lactose-free cheese offerings, reshaping product development strategies. Distribution is expanding beyond conventional retail to include e-commerce and direct-to-consumer models, enabling broader access. Overall, while larger players hold competitive advantages, market dynamics remain fluid, driven by innovation, regional tastes, and the growing appetite for value-added cheese products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Category, Source, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for premium and specialty cheeses is expected to grow with rising urbanization and disposable incomes.

- Health-conscious consumers will drive the development of low-fat, high-protein, and lactose-free cheese products.

- E-commerce and modern retail formats will play a greater role in cheese distribution across the region.

- Manufacturers are likely to invest more in sustainable packaging and environmentally friendly production methods.

- Expansion of cold chain infrastructure will improve accessibility and shelf life of cheese in rural and semi-urban areas.

- Regional players may form strategic alliances or mergers to expand market reach and enhance production capabilities.

- Innovation in flavors and formats will continue to attract younger consumers seeking diverse food experiences.

- Plant-based and vegan cheese alternatives will gradually gain traction among health and environmentally conscious consumers.

- Government support for dairy farming and food processing may encourage localized cheese production.

- Export opportunities for Latin American cheese, especially artisanal varieties, will rise in global niche markets.