| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Billboard MarketSize 2024 |

USD 3,876.10 Million |

| LED Billboard Market, CAGR |

8.32% |

| LED Billboard Market Size 2032 |

USD 7,683.48 Million |

Market Overview:

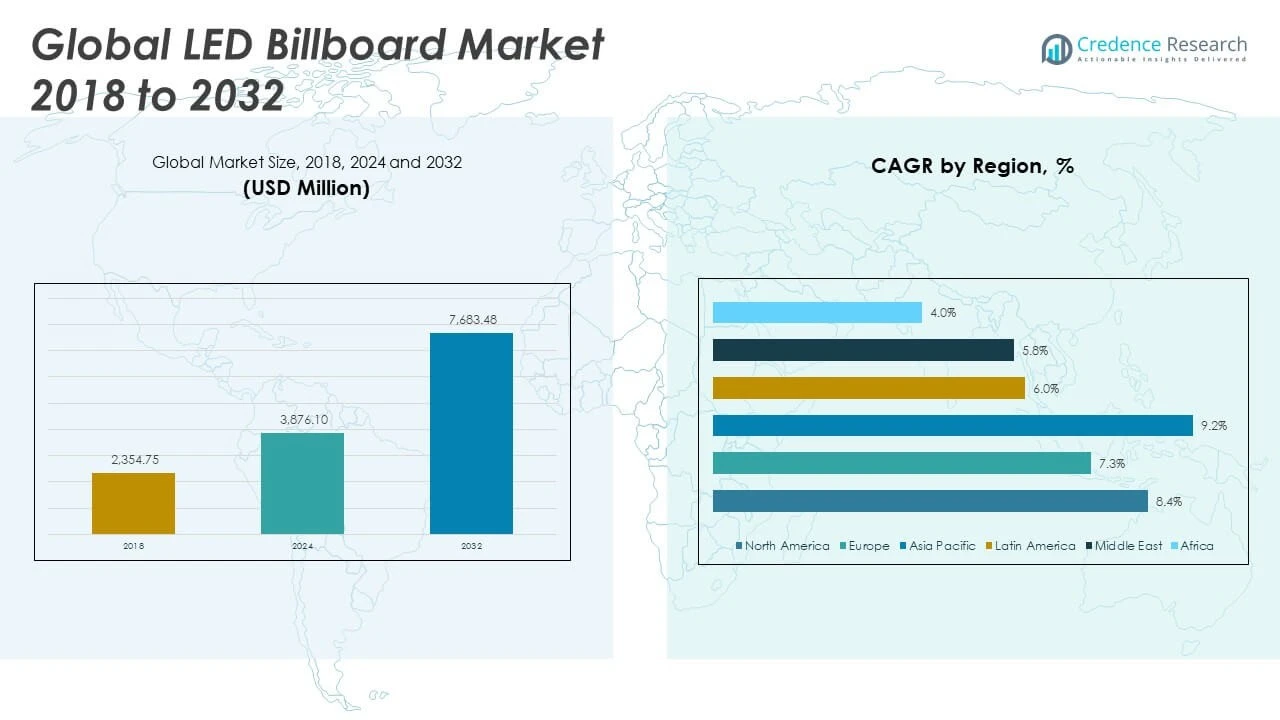

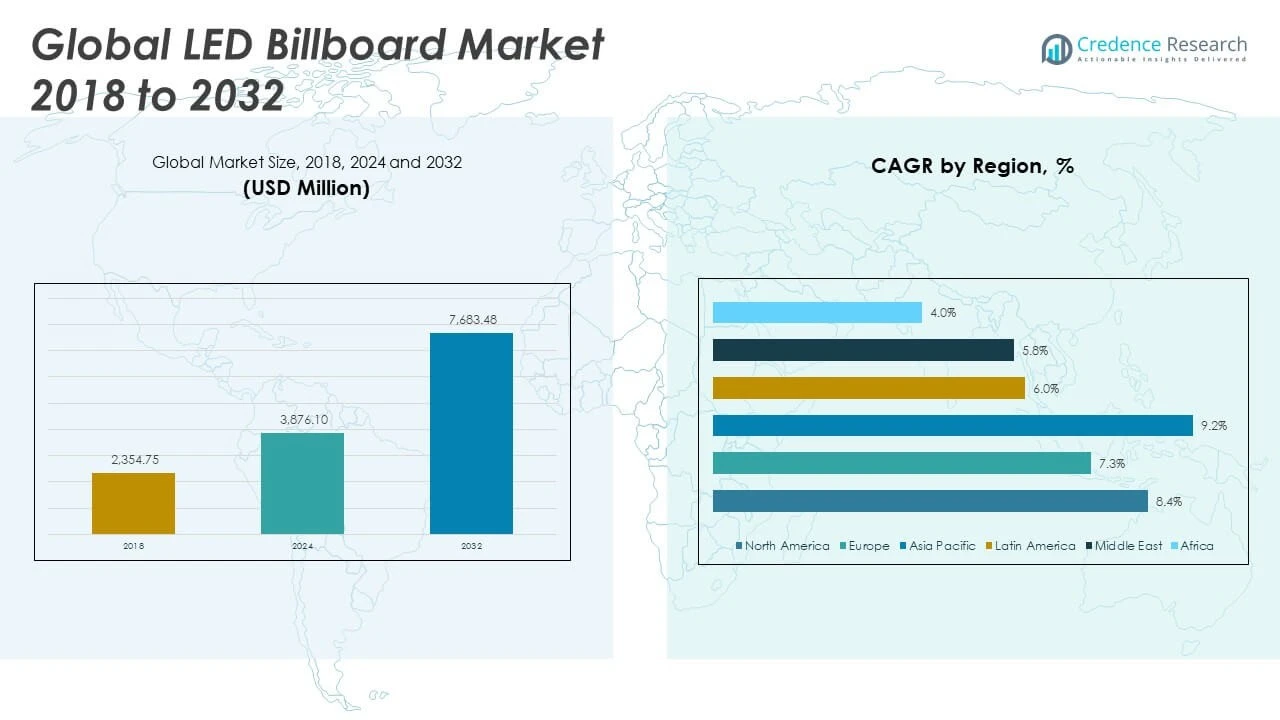

The Global LED Billboard Market size was valued at USD 2,354.75 million in 2018 to USD 3,876.10 million in 2024 and is anticipated to reach USD 7,683.48 million by 2032, at a CAGR of 8.32% during the forecast period.

Several factors are propelling the expansion of the LED billboard market. Foremost among these is the global shift towards digital advertising, which offers enhanced flexibility and real-time content updates, enabling advertisers to deliver timely and targeted messages. The superior brightness and clarity of LED billboards ensure high visibility, even in adverse weather conditions, making them an attractive option for outdoor advertising. Additionally, advancements in LED technology have led to improved energy efficiency and reduced operational costs, further incentivizing adoption. The integration of smart technologies, such as remote content management and data analytics, allows for more effective audience engagement and campaign performance tracking. Moreover, the growing urbanization and infrastructure development in emerging economies are creating new opportunities for market penetration.

Regionally, the Asia-Pacific market is experiencing rapid growth, driven by increasing urbanization, rising disposable incomes, and the proliferation of digital advertising platforms. Countries like China, India, and Japan are leading this surge, with significant investments in smart city projects and public infrastructure. North America maintains a substantial market share, attributed to its advanced technological infrastructure and high advertising expenditures. The presence of major industry players and a strong emphasis on innovation contribute to the region’s market dominance. Europe also holds a significant position in the global market, with a focus on sustainable and energy-efficient advertising solutions aligning with the region’s environmental regulations. The Middle East and Africa, along with Latin America, are emerging markets, showing promising growth potential due to increasing urban development and adoption of digital technologies.

Market Insights:

- The Global LED Billboard Market is projected to grow from USD 3,876.10 million in 2024 to USD 7,683.48 million by 2032, registering a CAGR of 8.32%.

- Rising adoption of digital out-of-home (DOOH) advertising is driving demand for LED billboards that deliver real-time, high-impact content.

- Advancements in LED technology are lowering operational costs while enhancing durability, energy efficiency, and image quality.

- Integration of AI, analytics, and wireless connectivity is boosting advertiser interest in data-driven and measurable campaigns.

- Urban infrastructure development and government-backed smart city projects are expanding deployment opportunities across emerging economies.

- High initial investment and maintenance costs remain a challenge, particularly for small and medium advertisers in cost-sensitive regions.

- Asia-Pacific leads regional growth, while North America and Europe maintain strong shares due to high advertising spend and technological maturity.

Market Drivers:

Rising Adoption of Digital Out-of-Home (DOOH) Advertising is Strengthening Market Momentum

The growing shift from traditional print and static billboards to digital out-of-home (DOOH) advertising is a major catalyst for growth in the Global LED Billboard Market. Advertisers are increasingly leveraging LED billboards to deliver dynamic, real-time messages that adapt to context and audience behavior. This shift is driven by the ability to update content remotely and schedule time-specific campaigns, significantly improving message relevance. The vibrant display quality and high brightness of LED screens ensure visibility across all lighting conditions. This capability enhances viewer engagement and brand recall, making LED billboards a preferred medium in both urban and transit-heavy areas. The expansion of digital marketing budgets among brands and agencies further supports this transition to DOOH solutions.

Advancements in LED Technology are Reducing Operational Costs and Enhancing Display Capabilities

Technological improvements in LED display components have significantly contributed to market growth. The development of energy-efficient LEDs has reduced power consumption, lowering long-term operational costs for advertisers and operators. Modern LED billboards now offer better color accuracy, higher resolution, and longer operational lifespans, improving return on investment. Integration of weather-resistant materials and modular design has extended billboard durability, even in harsh environmental conditions. These enhancements make LED billboards more reliable and scalable for outdoor advertising networks. The Global LED Billboard Market is benefiting from these innovations, as companies continue to replace aging infrastructure with newer, cost-effective systems.

For example, Samsung reports that LED signage consumes between 50% and 70% less electricity than traditional lighting alternatives, resulting in immediate cost savings for operators.

Smart Integration and Data-Driven Capabilities are Elevating User Engagement and Ad Effectiveness

The incorporation of smart technologies, such as wireless connectivity, AI-based analytics, and sensor integration, is reshaping the LED billboard landscape. Operators can now track real-time viewer engagement, demographic insights, and campaign performance through connected platforms. It enables advertisers to refine their messaging strategies based on accurate data and feedback. Programmatic advertising is also gaining ground, allowing automated buying and placement of ads based on location, weather, or time-specific triggers. These digital enhancements increase operational flexibility and enhance content personalization. The Global LED Billboard Market is expanding its appeal to advertisers who prioritize performance-driven, measurable marketing outcomes.

For example, PsiBorg Technologies developed an IoT digital signage solution for PostMyAd, enabling advertisers to schedule content, access real-time demographic insights, and manage campaigns remotely. This platform provides detailed analytics on viewer age, gender, and engagement, allowing advertisers to optimize messaging strategies with precision.

Urban Infrastructure Development and Government Initiatives are Fueling Deployment in Emerging Regions

The rapid pace of urbanization in developing economies is creating new opportunities for LED billboard installations. Governments are supporting smart city projects that include digital signage systems for public communication and commercial advertising. Rising consumer foot traffic in shopping malls, transit stations, and urban centers has further accelerated demand for visual display technologies. Real estate developers and municipal authorities are collaborating with media companies to monetize high-visibility spaces. It is encouraging private investment in large-format LED billboards across metropolitan zones. The Global LED Billboard Market is seeing increased penetration in Asia-Pacific, the Middle East, and Latin America due to these supportive infrastructure developments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Trends:

High Demand for Dynamic and Contextual Advertising is Shaping Content Strategies

Advertisers are increasingly shifting toward dynamic content to improve viewer engagement and message relevance. LED billboards now feature real-time updates based on environmental triggers such as time, weather, or location-specific events. Brands are using these adaptive campaigns to connect with audiences more personally and increase impact. This trend is driving content management platforms that enable seamless scheduling, customization, and localization. The demand for dynamic formats supports more effective storytelling and stronger calls to action. The Global LED Billboard Market is aligning with this trend by integrating responsive content delivery solutions that support rapid adjustments across networks.

Growth in Programmatic and Data-Driven Advertising is Enhancing Campaign Precision

The advertising industry is witnessing a surge in programmatic technologies that allow automated ad placements based on data analytics and consumer behavior. Programmatic DOOH (Digital Out-of-Home) platforms are being integrated with LED billboard systems to improve targeting, efficiency, and return on ad spend. These platforms use real-time data inputs to deliver relevant ads to specific audiences, boosting conversion potential. Location intelligence, foot traffic data, and demographic insights are now standard features in campaign planning. It is enabling advertisers to make informed decisions and optimize visibility in high-traffic zones. The Global LED Billboard Market is advancing by supporting the infrastructure required for intelligent and automated ad delivery.

For instance, a beverage company used programmatic billboards to target sports fans during a major tournament, displaying ads near stadiums and high-traffic fan zones, which resulted in a significant boost in brand visibility and product sales during the event.

Sustainable and Energy-Efficient Designs are Driving Product Innovation

Environmental considerations are influencing product design in outdoor advertising. Manufacturers are focusing on creating LED billboards with low energy consumption, recyclable materials, and long-lasting performance. These innovations help reduce carbon footprints and operational costs while aligning with global sustainability goals. Solar-powered LED systems and energy-efficient circuitry are gaining traction in both developed and developing regions. Governments and municipal authorities are also mandating the use of eco-friendly advertising solutions, further accelerating this trend. The Global LED Billboard Market is evolving with manufacturers introducing environmentally responsible and cost-efficient systems for large-scale deployment.

For example, Alight Media reports that its entire digital billboard network is powered by 100% renewable energy, reflecting the industry’s shift toward eco-friendly infrastructure.

Miniaturization and Fine-Pitch LED Displays are Expanding Use Cases

Technological advancement in pixel pitch reduction is enabling the use of high-resolution LED billboards in both outdoor and semi-indoor environments. Fine-pitch displays provide sharp image clarity and smoother visual output, supporting diverse content formats, including video and live feeds. These high-definition screens are increasingly being installed in transportation hubs, stadiums, shopping centers, and high-end retail environments. Miniaturization is also reducing installation constraints, making it feasible to deploy LED billboards in tighter urban spaces. It is opening new applications in vertical advertising and architectural media integration. The Global LED Billboard Market is responding by offering compact, high-performance systems that deliver superior visual impact in modern advertising spaces.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs are Hindering Widespread Adoption

Despite strong demand, the high upfront cost of LED billboard installation remains a major challenge for advertisers and media owners. Large-format displays require significant capital investment in display hardware, supporting infrastructure, and installation. Operating expenses such as electricity usage, content management systems, and regular maintenance add further financial burden. Smaller businesses often lack the budget flexibility to adopt LED billboard advertising, limiting market accessibility. The complexity of integrating advanced features like real-time data feeds and remote monitoring systems can also raise costs. The Global LED Billboard Market continues to face constraints in expanding adoption across cost-sensitive regions and industries.

For example, Lamar Advertising Company reported that the installation cost for a single large-format digital billboard can exceed $250,000, not including ongoing expenses.

Regulatory Barriers and Urban Planning Restrictions are Slowing Deployment

Strict government regulations concerning visual pollution, brightness levels, and placement permissions often slow the rollout of LED billboards. In urban areas, authorities may impose zoning rules that limit billboard density or restrict digital signage near residential zones, traffic intersections, or heritage sites. Compliance with these regulations requires lengthy approval processes and potential design modifications, delaying implementation timelines. Concerns over driver distraction and energy usage have prompted municipalities to introduce stricter guidelines for outdoor digital advertising. It creates uncertainty for investors and advertisers looking to scale quickly. The Global LED Billboard Market must navigate a diverse regulatory landscape that varies widely across countries and municipalities.

Market Opportunities:

The rising number of smart city initiatives worldwide presents significant opportunities for LED billboard integration into public infrastructure. Governments and urban planners are incorporating digital signage to enhance communication, navigation, and advertising efficiency. These developments offer large-scale deployment potential across transportation hubs, commercial complexes, and public service areas. LED billboards support dynamic messaging and real-time updates, aligning with smart city goals. The Global LED Billboard Market stands to benefit from municipal partnerships and investments focused on modernizing cityscapes. It can drive adoption in both developed and developing economies.

Advertisers are exploring interactive and sensor-based LED displays to engage consumers more directly and measure campaign performance. Advances in facial recognition, gesture control, and mobile integration are transforming passive viewing into active participation. These features enhance audience engagement and deliver measurable ROI, attracting brands across sectors such as retail, automotive, and entertainment. As consumer demand for personalization increases, LED billboards offer a powerful medium for delivering relevant, timely content. The Global LED Billboard Market can expand its value proposition by offering solutions tailored to high-interaction and data-rich advertising environments. It strengthens market positioning in an evolving digital ecosystem.

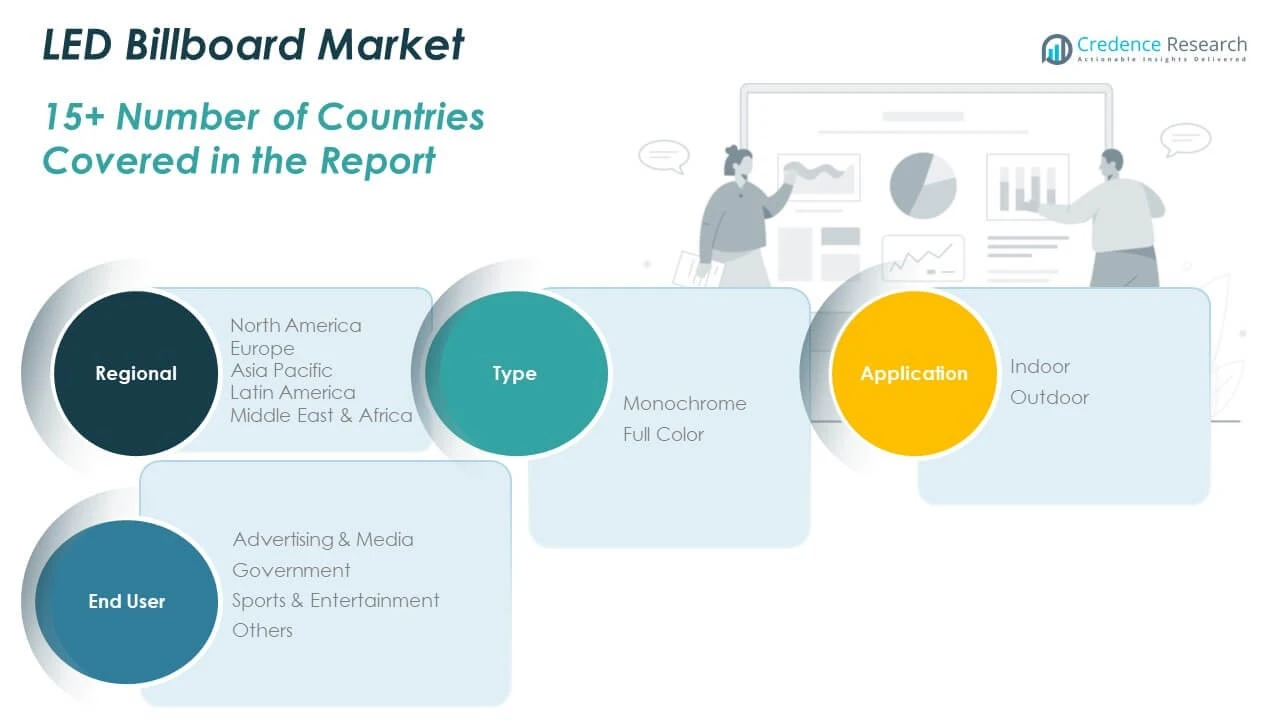

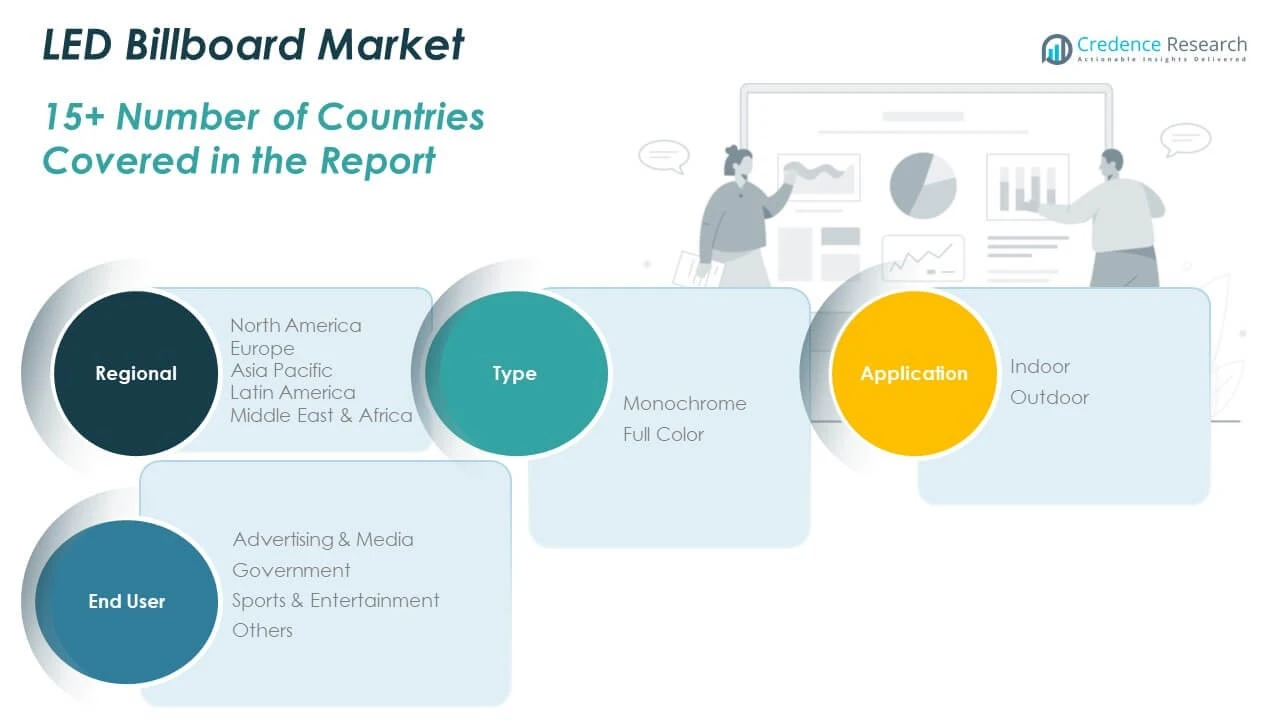

Market Segmentation Analysis:

By type, the Global LED Billboard Market is segmented into monochrome and full-color displays. Full-color LED billboards dominate the market due to their ability to deliver vivid, high-resolution content that enhances visual appeal and audience engagement. Monochrome displays maintain relevance in low-budget or information-specific applications, such as public service announcements and transit displays.

By application, the market is divided into indoor and outdoor installations. Outdoor LED billboards hold the majority share, driven by their use in high-traffic areas like highways, stadiums, and city centers. Their durability and brightness make them ideal for environments requiring visibility under varying weather and light conditions. Indoor LED billboards are growing steadily, particularly in malls, airports, and entertainment venues, where content targeting and space efficiency are critical.

By end user, the Global LED Billboard Market serves advertising & media, government, sports & entertainment, and others. Advertising & media leads adoption, supported by strong demand for dynamic content and digital out-of-home campaigns. Government institutions use LED billboards for public messaging and emergency alerts, while sports & entertainment venues rely on them for crowd engagement and sponsorship displays. It continues to diversify across industries that seek impactful, real-time communication platforms.

Segmentation:

By Type

By Application

By End User

- Advertising & Media

- Government

- Sports & Entertainment

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America LED Billboard Market size was valued at USD 764.45 million in 2018 to USD 1,240.77 million in 2024 and is anticipated to reach USD 2,468.76 million by 2032, at a CAGR of 8.40% during the forecast period. North America holds a 25.9% share of the Global LED Billboard Market, supported by advanced digital infrastructure and high advertising expenditure. The U.S. dominates regional adoption due to large-scale campaigns across urban areas, highways, and sporting events. Strong demand for programmatic and data-driven advertising continues to fuel market expansion. Regulatory clarity and ongoing upgrades to smart city projects support billboard digitization. It benefits from mature advertising ecosystems and a high concentration of major industry players.

Europe

The Europe LED Billboard Market size was valued at USD 524.93 million in 2018 to USD 824.43 million in 2024 and is anticipated to reach USD 1,511.31 million by 2032, at a CAGR of 7.30% during the forecast period. Europe contributes 16.5% to the Global LED Billboard Market, with growth driven by sustainable advertising practices and integration with smart urban planning. Countries like the UK, Germany, and France lead innovation in energy-efficient, weatherproof billboard technologies. High environmental standards encourage the deployment of low-consumption LED systems. It reflects a steady transition toward digital formats, with government incentives fostering public-private collaboration. The market shows consistent growth backed by urban modernization.

Asia Pacific

The Asia Pacific LED Billboard Market size was valued at USD 896.50 million in 2018 to USD 1,538.25 million in 2024 and is anticipated to reach USD 3,261.60 million by 2032, at a CAGR of 9.20% during the forecast period. Asia Pacific leads the Global LED Billboard Market with a dominant 34.9% share, driven by rapid urbanization and infrastructure development. China, India, and Japan represent key high-growth areas where digital billboards are heavily deployed across highways, airports, and commercial zones. Government initiatives promoting smart cities and digitized public communication systems enhance demand. Local manufacturing lowers production costs and accelerates adoption. It remains the fastest-growing regional market with significant scalability.

Latin America

The Latin America LED Billboard Market size was valued at USD 81.56 million in 2018 to USD 131.98 million in 2024 and is anticipated to reach USD 220.44 million by 2032, at a CAGR of 6.00% during the forecast period. Latin America holds a 2.3% share of the Global LED Billboard Market. Brazil and Mexico lead in terms of adoption due to expanding retail sectors and digital modernization in outdoor advertising. Municipal investments in digital infrastructure support adoption in metropolitan hubs. Regional demand is rising with improving economic conditions and urban development. It presents emerging opportunities in retail-focused and government communication applications.

Middle East

The Middle East LED Billboard Market size was valued at USD 61.04 million in 2018 to USD 91.15 million in 2024 and is anticipated to reach USD 149.96 million by 2032, at a CAGR of 5.80% during the forecast period. The region represents 1.9% of the Global LED Billboard Market, supported by luxury retail, tourism, and large-scale public events. The UAE and Saudi Arabia drive demand through smart infrastructure and visually impactful public messaging platforms. Integration of LED displays in malls, airports, and highways supports market expansion. Government vision plans are accelerating digital transformation. It offers premium deployment opportunities, especially in high-density urban corridors.

Africa

The Africa LED Billboard Market size was valued at USD 26.26 million in 2018 to USD 49.52 million in 2024 and is anticipated to reach USD 71.42 million by 2032, at a CAGR of 4.00% during the forecast period. Africa contributes 0.8% to the Global LED Billboard Market and remains in an early adoption stage. South Africa, Kenya, and Nigeria are leading digital billboard initiatives in commercial districts. Infrastructure limitations and high initial costs challenge broader market penetration. Urbanization and mobile technology growth are gradually improving the digital advertising environment. It holds long-term growth potential, supported by public awareness and foreign investment.

Key Player Analysis:

- Daktronics

- Unilumin

- Absen

- Liantronics

- Barco

- Watchfire Signs

- Leyard Optoelectronic

- Lighthouse Technologies

- AOTO Electronics

- Sansitech

Competitive Analysis:

The Global LED Billboard Market features a competitive landscape dominated by leading manufacturers focused on innovation, energy efficiency, and modular design. Key players include Daktronics, Unilumin, Absen, Liantronics, Barco, Watchfire Signs, Leyard Optoelectronic, Lighthouse Technologies, and AOTO Electronics. These companies invest in advanced display technologies, including high-resolution panels and smart content management systems, to enhance viewer engagement and advertising performance. The market rewards players that offer scalable, durable, and weather-resistant solutions tailored to both urban and suburban environments. Strategic partnerships, mergers, and global distribution networks help expand regional footprints and product portfolios. The Global LED Billboard Market maintains high entry barriers due to capital-intensive manufacturing and complex regulatory compliance. It continues to evolve with increasing emphasis on sustainability, customization, and integration with smart city infrastructure, giving an edge to companies that deliver both visual impact and operational efficiency.

Recent Developments:

- Absen, a global leader in LED display technology, held its Spring Launch event on March 13, 2025, unveiling the X V2 Series, A25 Series, and upgrades to the NX, KLCOB V2, and CPS Series. These products focus on ultra-high resolution, stability, and energy efficiency for the ProAV and DOOH markets.

- In August 2024, Verde Outdoor Media, a prominent US-based outdoor and online advertising company, announced the acquisition of Great Outdoor Advertising. This strategic move significantly expanded Verde Outdoor Media’s advertising portfolio, particularly by adding a range of vibrant posters, bulletins, and digital billboards across the Philadelphia tri-state area and western New York. The acquisition aims to enhance Verde Outdoor Media’s market presence and provide more diverse and impactful advertising solutions to its clients, strengthening its position in the competitive outdoor advertising landscape.

- Barco, a leader in visualization technology, launched the Barco mFusion ICMP-XS integrated audio and media server and the Barco Smart Amplifier at CinemaCon on March 31, 2025, enhancing its cinema portfolio with advanced audio and content processing capabilities.

- Leyard Optoelectronic launched its new-generation MG-COB Cold Screen Series at ISLE 2025 on March 11, 2025. This product integrates RGB full flip Micro chips with COB packaging, resulting in lower energy consumption and stable screen temperatures, even during high-brightness operation. Leyard also introduced the MOK Series for outdoor advertising, featuring remote intelligent power control and robust environmental protection.

Market Concentration & Characteristics:

The Global LED Billboard Market exhibits moderate to high market concentration, with a few established players holding a significant share due to their technological expertise and broad geographic reach. It is characterized by rapid innovation, high capital investment, and strong demand for durable, high-visibility digital display solutions. Leading companies differentiate through advanced pixel technology, energy-efficient systems, and customizable formats. The market favors suppliers with capabilities in large-scale manufacturing and integrated content management platforms. Regional expansion, after-sales service, and compliance with urban planning standards are key competitive factors. It remains dynamic, with rising demand in emerging economies and continued growth in smart city deployments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global LED Billboard Market is projected to experience sustained growth driven by expanding urbanization and infrastructure development.

- Advancements in display resolution and smart content delivery will enhance user engagement and advertising ROI.

- Adoption of energy-efficient and eco-friendly LED technologies will align with global sustainability goals.

- Programmatic advertising integration will enable data-driven campaign optimization across billboard networks.

- Smart city initiatives will create new deployment opportunities in transportation, retail, and public communication.

- Demand for interactive and real-time content capabilities will shape product innovation.

- Lower manufacturing costs in Asia will support global supply chain scalability and pricing competitiveness.

- Emerging markets in Latin America and Africa will gradually increase their adoption of digital signage.

- Regulatory support for digital infrastructure and outdoor media will accelerate installations in developed regions.

- Strategic partnerships and mergers will drive market consolidation and geographic expansion for key players.