Market Overview

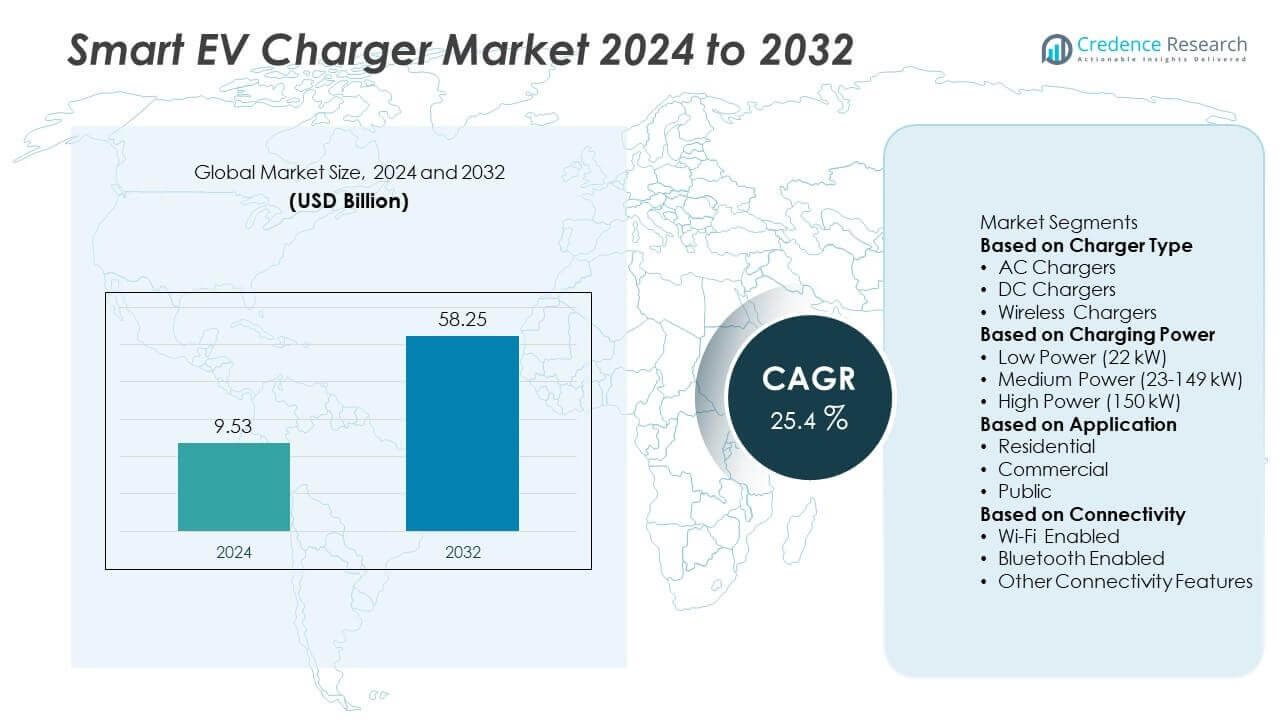

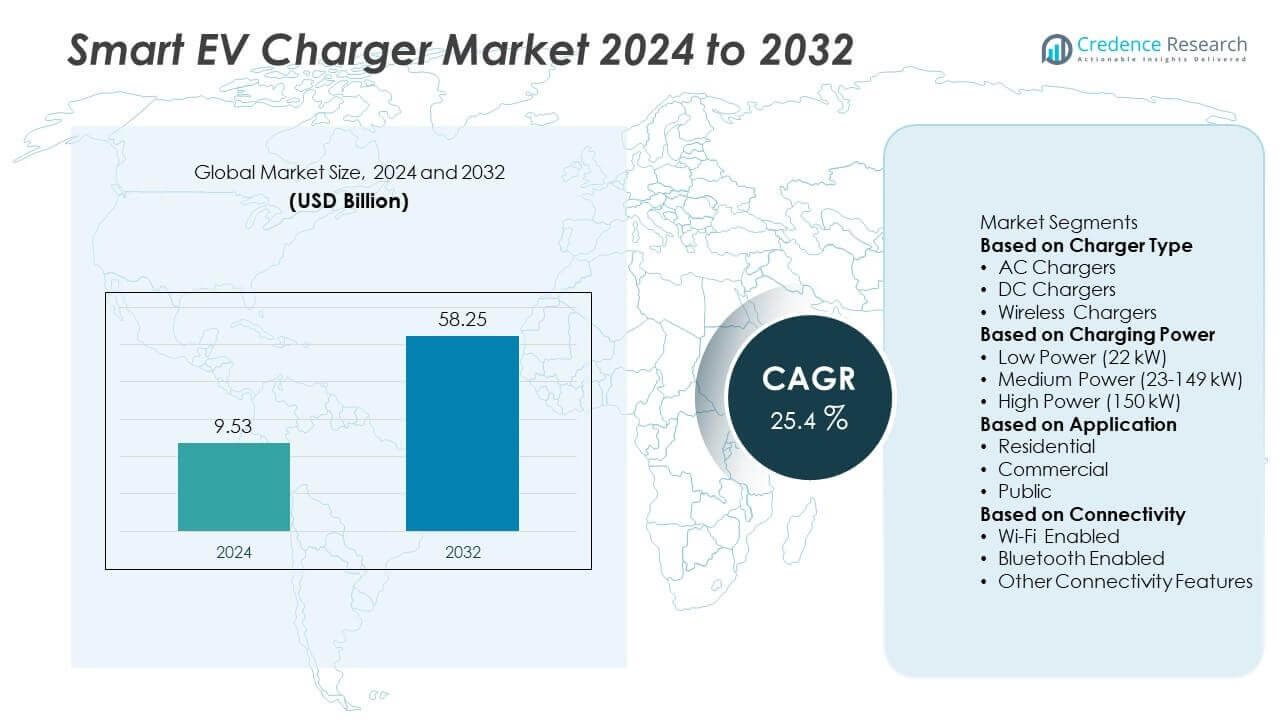

The Smart EV Charger Market was valued at USD 9.53 billion in 2024 and is projected to reach USD 58.25 billion by 2032, growing at a CAGR of 25.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart EV Charger Market Size 2024 |

USD 9.53 Billion |

| Smart EV Charger Market, CAGR |

25.4% |

| Smart EV Charger Market Size 2032 |

USD 58.25 Billion |

The Smart EV Charger Market grows with rapid adoption of electric vehicles and expanding charging infrastructure supported by strong government incentives. It benefits from rising demand for fast and ultra-fast charging solutions that reduce downtime and enhance user convenience. North America leads the Smart EV Charger Market with strong deployment of residential, commercial, and highway charging stations supported by federal and state-level programs. Europe follows closely with widespread installation of fast-charging corridors and government policies that mandate interoperability and promote renewable energy integration. Asia-Pacific shows rapid growth driven by large-scale investments in charging infrastructure in China, Japan, and India, along with policies supporting local manufacturing. Latin America and Middle East & Africa are emerging markets with growing adoption in urban centers and pilot projects for public and fleet charging. Key players shaping the market include Zaptec, Wallbox, ABB, Siemens, and Tritium, which focus on developing fast and ultra-fast chargers, digital connectivity, and load management solutions. Companies such as EVBox and Alfen invest in modular and scalable chargers that support residential, workplace, and public applications, driving innovation and improving accessibility across regions.

Market Insights

- The Smart EV Charger Market was valued at USD 9.53 billion in 2024 and is projected to reach USD 58.25 billion by 2032, growing at a CAGR of 25.4%.

- Rising EV adoption and government incentives drive demand for smart charging solutions across residential, commercial, and public sectors.

- The market trends show strong growth in fast and ultra-fast charging, integration with renewable energy, and vehicle-to-grid capabilities.

- Leading players such as Zaptec, Wallbox, ABB, Siemens, Tritium, EVBox, and Alfen focus on digital connectivity, modular designs, and cost optimization strategies.

- High installation costs, grid capacity limitations, and lack of universal charging standards remain major restraints, slowing adoption in cost-sensitive regions.

- North America leads with robust infrastructure investments, Europe drives adoption through strict CO₂ targets, and Asia-Pacific shows fastest growth with government-backed EV initiatives.

- Opportunities emerge from residential charging installations, workplace and fleet charging hubs, and integration with smart grid systems to optimize energy use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Adoption of Electric Vehicles Worldwide

The Smart EV Charger Market grows with increasing sales of electric vehicles driven by decarbonization efforts and stricter emission norms. Governments set ambitious EV targets and offer incentives to boost adoption. It creates strong demand for smart charging solutions that support efficient energy use and faster charging cycles. Automakers invest in expanding EV portfolios, increasing the need for reliable charging infrastructure. Rising fuel costs push consumers toward electric mobility, strengthening demand for charging networks. This trend accelerates installation of smart chargers in residential, commercial, and public spaces.

- For instance, ABB launched its A400 All-In-One charger, capable of delivering up to 400 kW DC fast charging to a single vehicle, cutting charging time for heavy-duty EVs to under 15 minutes.

Supportive Government Policies and Infrastructure Investments

Policy frameworks encouraging electrification of transportation play a crucial role in market expansion. The Smart EV Charger Market benefits from subsidies, grants, and tax credits that lower installation costs. It gains momentum with government-backed programs for nationwide public charging infrastructure. Utilities collaborate with private players to upgrade grid capacity and integrate smart charging stations. Regulatory support ensures interoperability and standardization of chargers, simplifying consumer adoption. These measures create a favorable ecosystem for market growth.

- For instance, EVBox has supplied smart public chargers for projects in the Netherlands that can offer 22 kW AC charging capacity and are compatible with protocols such as OCPP 2.0.1, in line with broader government incentives for expanding the country’s EV infrastructure.

Integration with Renewable Energy and Smart Grids

Growing focus on renewable energy integration drives demand for smart chargers with advanced energy management features. The Smart EV Charger Market benefits from solutions that enable load balancing and optimize charging during off-peak hours. It supports vehicle-to-grid (V2G) applications, allowing EVs to act as energy storage units. Smart grid connectivity enhances grid stability while reducing overall energy costs. Businesses and residential users adopt these systems to maximize use of solar and wind power. This integration strengthens sustainability objectives and reduces carbon footprints.

Advancements in Charging Technology and User Experience

Continuous innovation in charging technology improves speed, convenience, and connectivity. The Smart EV Charger Market gains from development of fast and ultra-fast chargers that reduce charging time significantly. It benefits from mobile app integration, remote monitoring, and automated billing systems that enhance user experience. Cloud-based platforms enable predictive maintenance and usage analytics for operators. Manufacturers focus on developing compact, modular chargers suitable for diverse installation sites. These advancements increase consumer confidence and accelerate global adoption.

Market Trends

Growing Shift Toward Fast and Ultra-Fast Charging Solutions

The Smart EV Charger Market is witnessing a strong shift toward fast and ultra-fast charging technologies. Public charging operators deploy high-capacity DC chargers to reduce downtime for EV users. It supports rapid charging for long-range electric vehicles, improving convenience and adoption rates. Automakers collaborate with charging network providers to create highway fast-charging corridors. Demand grows for chargers capable of delivering 150 kW and above to support next-generation EV batteries. This trend positions fast charging as a key enabler of mass EV adoption.

- For instance, Tritium unveiled its PKM150 system, a modular 150 kW DC fast-charging solution that uses a microgrid architecture to dynamically allocate shared power to multiple EVs.

Integration of Vehicle-to-Grid and Energy Management Features

Energy management capabilities are becoming a major focus for manufacturers and operators. The Smart EV Charger Market benefits from chargers equipped with V2G and dynamic load balancing. It enables users to feed energy back into the grid and optimize power consumption. Businesses deploy energy management-enabled chargers to lower operational costs and manage peak demand. Integration with renewable energy sources supports sustainable charging practices. These features strengthen the role of smart chargers in future energy ecosystems.

- For instance, Wallbox partnered with Leap to launch a Virtual Power Plant program in California and New York, aggregating thousands of chargers and unlocking over 10 MW of grid-responsive capacity.

Rising Deployment of Connected and IoT-Enabled Chargers

Connected charging infrastructure is becoming a standard for public and private installations. The Smart EV Charger Market benefits from IoT-enabled chargers that allow remote monitoring and predictive maintenance. It provides real-time data on energy usage, helping optimize charging schedules. Cloud-based platforms improve user experience through automated payments and status updates. Operators use analytics to plan network expansion based on usage trends. Connectivity drives efficiency and reliability across charging networks.

Expansion of Residential and Workplace Charging Infrastructure

Home and workplace installations are rapidly expanding to support daily charging needs. The Smart EV Charger Market gains from growing demand for Level 2 smart chargers that offer faster charging than standard outlets. It allows EV owners to schedule charging during off-peak hours for cost savings. Employers install chargers to encourage EV adoption among employees and meet sustainability goals. Real estate developers integrate charging solutions into new construction projects to increase property value. This trend strengthens the presence of smart chargers in private spaces.

Market Challenges Analysis

High Installation Costs and Infrastructure Limitations

The Smart EV Charger Market faces challenges due to high installation costs and limited grid capacity in certain regions. Hardware, permitting, and construction expenses increase the total cost of deployment for operators. It creates financial barriers for residential users and small businesses. Upgrading existing grid infrastructure to handle higher loads requires significant investment from utilities. Limited availability of public charging points in rural areas slows EV adoption. These cost and infrastructure hurdles delay large-scale rollout of smart charging networks.

Interoperability Issues and Cybersecurity Concerns

Lack of universal standards for hardware and communication protocols creates compatibility issues for users. The Smart EV Charger Market must ensure seamless operation across different EV models and networks. It also faces cybersecurity risks due to increased connectivity and data exchange. Unauthorized access to charging systems can disrupt operations or compromise user data. Manufacturers must invest in robust encryption and secure software updates. Addressing these concerns is critical to building trust and ensuring reliable charging services.

Market Opportunities

Expansion of Public and Private Charging Infrastructure

The Smart EV Charger Market holds significant opportunity in the rapid expansion of public and private charging networks. Growing EV adoption pushes governments and businesses to invest in accessible, high-capacity charging stations. It creates strong demand for interoperable and scalable smart chargers across urban centers, highways, and workplaces. Fleet operators and logistics companies deploy smart charging hubs to support electrification of commercial vehicles. Real estate developers integrate charging infrastructure into residential and commercial projects to attract buyers and tenants. These initiatives create a favorable environment for market growth worldwide.

Integration with Renewable Energy and Energy Storage Systems

Pairing smart chargers with renewable energy and on-site storage solutions opens new avenues for innovation. The Smart EV Charger Market benefits from systems that allow solar-powered charging and energy arbitrage during peak and off-peak hours. It supports grid stability and enables vehicle-to-grid applications that provide additional revenue streams. Businesses and homeowners use this integration to lower electricity costs and reduce emissions. Smart energy management platforms optimize charging schedules to maximize use of clean energy. These opportunities strengthen the role of smart chargers in sustainable energy ecosystems.

Market Segmentation Analysis:

By Charger Type

The Smart EV Charger Market is segmented by charger type into wall-mounted chargers, pedestal chargers, and portable chargers. Wall-mounted chargers dominate residential installations due to their compact design and ease of use. It provides reliable Level 2 charging suitable for overnight home charging. Pedestal chargers are widely adopted in commercial and public spaces where multiple users require access. Portable chargers gain popularity for emergency use and convenience during travel. Manufacturers focus on developing chargers with advanced connectivity and load management features to improve user experience. Growing demand for smart-enabled chargers strengthens adoption across all charger types.

- For instance, Zaptec launched the Zaptec Go 2 wall-mounted charger with 22 kW capacity and built-in 4G modem, supporting dynamic load balancing for multi-home installations.

By Charging Power

Charging power segmentation includes less than 22 kW, 22–100 kW, and above 100 kW categories. The Smart EV Charger Market sees high demand for less than 22 kW chargers in residential and workplace settings. It supports cost-effective installations and aligns with off-peak charging preferences. Chargers in the 22–100 kW range cater to public charging networks and commercial fleets requiring faster turnaround. High-power chargers above 100 kW dominate highway corridors and fast-charging hubs, enabling rapid replenishment for long-range EVs. Growth in battery capacities drives demand for ultra-fast chargers to minimize downtime. Investments in grid upgrades support the expansion of higher power charging infrastructure.

- For instance, Alfen has installed a significant number of Eve Single Pro-line chargers, in the 3.7–22 kW range, for businesses and corporate offices in the Netherlands, including a project with Caparis that integrated 92 units with a smart microgrid.

By Application

Applications include residential, commercial, and public charging infrastructure. The Smart EV Charger Market experiences strong residential adoption as homeowners install smart chargers to take advantage of scheduled charging and energy savings. It enables remote monitoring and integration with home energy management systems. Commercial applications include retail outlets, offices, and fleet depots where charging services enhance customer convenience and operational efficiency. Public charging infrastructure continues to expand with government support for citywide and highway charging networks. Operators deploy chargers with digital payment solutions and real-time availability tracking to improve user access. Rising EV penetration ensures growth across all application segments.

Segments:

Based on Charger Type

- AC Chargers

- DC Chargers

- Wireless Chargers

Based on Charging Power

- Low Power (22 kW)

- Medium Power (23-149 kW)

- High Power (150 kW)

Based on Application

- Residential

- Commercial

- Public

Based on Connectivity

- Wi-Fi Enabled

- Bluetooth Enabled

- Other Connectivity Features

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Smart EV Charger Market, accounting for nearly 40% of the global market. The region benefits from rapid EV adoption supported by federal tax incentives, state-level rebates, and funding for public charging infrastructure. It sees significant deployment of Level 2 and DC fast chargers across residential, workplace, and highway networks. The United States leads demand, with initiatives such as the National Electric Vehicle Infrastructure (NEVI) program driving large-scale rollout of smart chargers. Canada supports expansion with programs promoting clean transportation and smart grid integration. It also benefits from rising investments by utilities to upgrade grid capacity and enable load management. Partnerships between automakers, charging network operators, and energy companies further strengthen regional growth.

Europe

Europe represents about 32% of the global market share, driven by ambitious EV adoption targets and strict CO₂ emission regulations. Countries like Germany, Norway, France, and the UK lead with extensive public charging networks and incentives for home charger installations. It benefits from EU policies supporting interoperability and standardization across charging stations. Growing focus on renewable energy integration supports deployment of chargers capable of dynamic load balancing and vehicle-to-grid functionality. Commercial fleets and logistics providers adopt smart chargers to support electrification goals. Investments in ultra-fast charging corridors across the continent enable long-distance EV travel. These factors make Europe a hub for smart charging innovation and deployment.

Asia-Pacific

Asia-Pacific accounts for nearly 22% of the global market, driven by strong government support for EV adoption and rapid urbanization. China dominates regional growth with extensive investment in both residential and public charging networks. It benefits from policies mandating smart charging capabilities to support grid stability. Japan and South Korea focus on V2G-ready chargers and integration with renewable energy sources. India shows rising adoption supported by government subsidies under schemes such as FAME-II. Expanding EV sales and the presence of leading battery manufacturers strengthen demand for fast-charging infrastructure. The region also emphasizes localized manufacturing to reduce costs and improve accessibility.

Latin America

Latin America holds around 4% of the global market share, supported by growing interest in electric mobility and pilot charging infrastructure projects. Brazil, Mexico, and Chile lead investments in public charging corridors and private fleet charging solutions. It faces challenges such as high installation costs and limited grid capacity in rural areas. However, rising fuel prices and government incentives encourage adoption of EVs and related infrastructure. Collaborations between energy providers and automotive OEMs support market expansion. Demand for workplace and destination charging grows as urban centers shift toward sustainable transport solutions.

Middle East & Africa

The Middle East & Africa region accounts for nearly 2% of the global market share, with growth concentrated in Gulf countries and South Africa. Government initiatives in the UAE, Saudi Arabia, and Israel promote adoption of smart charging infrastructure as part of broader clean energy strategies. It benefits from large infrastructure projects that integrate EV chargers with renewable energy systems. Public-private partnerships drive installation of charging stations in urban areas and highways. South Africa leads adoption in Africa, supported by private sector investment in EV infrastructure. Rising awareness and diversification of energy sources create long-term opportunities for market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the Smart EV Charger Market features leading players such as Zaptec, Wallbox, ABB, Siemens, Tritium, EVBox, Alfen, Eaton, AeroVironment, and Tesla. These companies focus on developing fast and ultra-fast chargers with advanced connectivity, load balancing, and interoperability features to support growing EV adoption. Many invest in cloud-based platforms that enable remote monitoring, predictive maintenance, and seamless integration with renewable energy systems. Strategic collaborations with automakers, utilities, and governments help expand charging networks and ensure standardization across regions. Players prioritize modular and scalable charger designs that cater to residential, commercial, and public infrastructure needs. Investments in R&D aim to improve charging speed, grid compatibility, and cost efficiency to make solutions more accessible. Companies also expand production capabilities and deploy chargers globally to meet rising demand. Continuous innovation and competition drive advancements that strengthen user experience and support the transition to widespread electric mobility.

Recent Developments

- In July 2025, Wallbox launched Virtual Power Plants (VPPs) in California and New York via a partnership with Leap. The program aggregates energy capacity from thousands of residential chargers for grid flexibility under “Wallbox Rewards.”

- In April 2025, Siemens launched Depot360® Home Charging Reimbursement in the U.S. It enables fleet operators to reimburse drivers for home EV charging sessions using vehicle telematics and geofencing instead of requiring dedicated metered chargers.

- In February 2025, Zaptec released the Zaptec Go 2, which added phase-switching (between 1-phase and 3-phase), compliance with safety standard IEC 62955, improved thermal design allowing operation up to 50°C ambient temperature, enhanced mechanical impact rating IK10, and a new 4G modem for wider connectivity.

- In May 2024, ABB’s A400 All-In-One charger was introduced with a large 32-inch front screen, 200 kW continuous to two vehicles or up to 400 kW to one vehicle, modular silicon carbide blocks in 100 kW increments.

Report Coverage

The research report offers an in-depth analysis based on Charger Type, Charging Power, Application, Connectivity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart EV chargers will grow with rising global EV adoption and infrastructure expansion.

- Fast and ultra-fast charging solutions will dominate public and highway networks.

- Vehicle-to-grid technology will gain traction, enabling energy sharing and grid balancing.

- Integration with renewable energy sources will support sustainable and cost-efficient charging.

- Residential and workplace installations will rise, driven by incentives and consumer convenience.

- IoT-enabled chargers will allow remote monitoring, predictive maintenance, and automated energy management.

- Modular and scalable chargers will become standard to meet diverse power needs.

- Collaboration between automakers, utilities, and governments will accelerate network deployment.

- Advances in payment systems and digital platforms will enhance user experience and accessibility.

- Competitive pressure will drive innovation toward more compact, efficient, and affordable charger designs.