Market overview

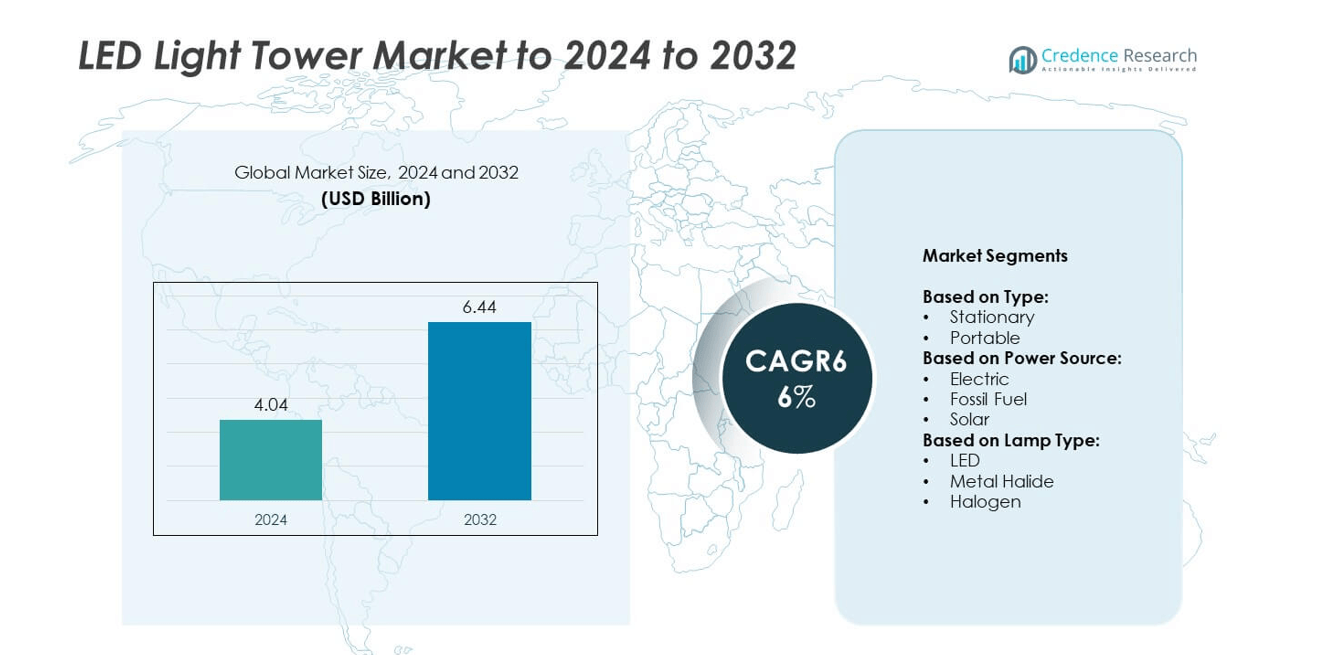

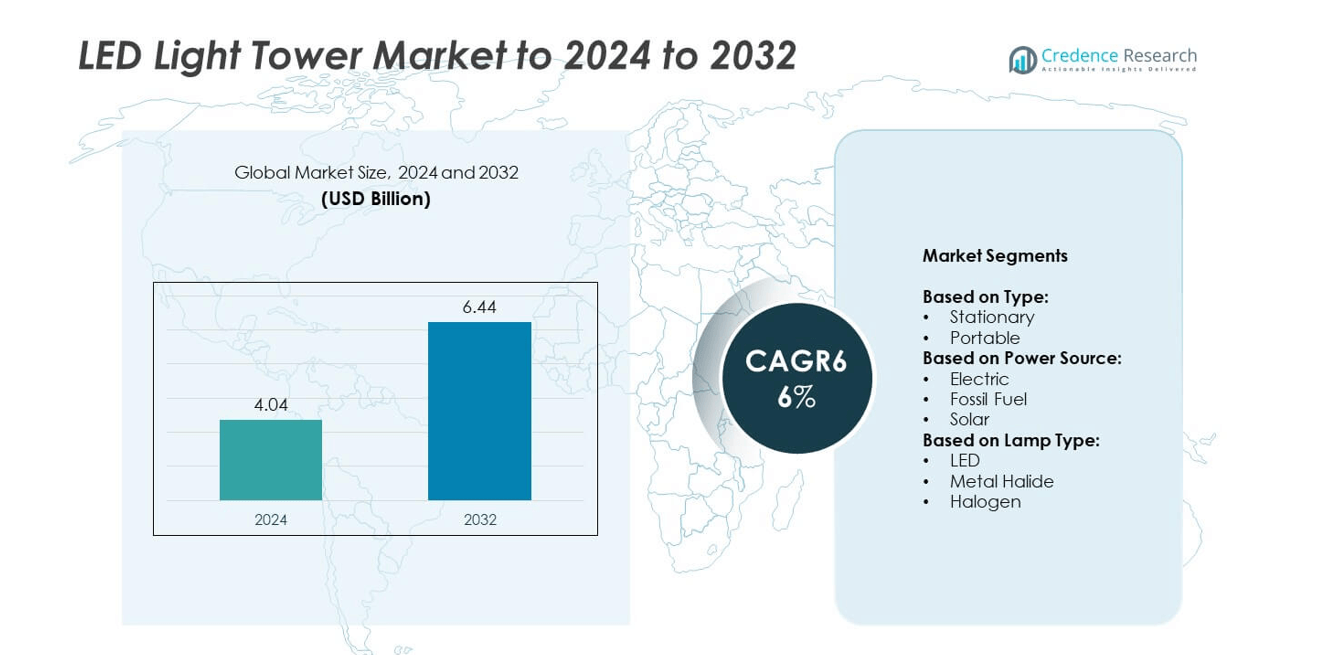

The LED Light Tower Market size was valued at USD 4.04 billion in 2024 and is anticipated to reach USD 6.44 billion by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Light Tower Market Size 2025 |

USD 4.04 billion |

| LED Light Tower Market, CAGR |

6% |

| LED Light Tower Market Size 2032 |

USD 6.44 billion |

The LED light tower market is highly competitive, with prominent players such as Doosan Bobcat, Caterpillar, Atlas Copco, Generac Power Systems, HIMOINSA, Allmand Bros., Inc., Progress Solar Solutions, Wacker Neuson SE, Mitsubishi Heavy Industries, TRIME s.r.l., PR Industrial Srl Unipersonale, Larson Electronics, PowerLink, Chicago Pneumatic, Maxar Technologies, The Will Burt Company, and Sigma Search Lights Limited driving industry growth. These companies emphasize energy-efficient designs, hybrid and solar-powered models, and advanced features like remote monitoring to strengthen their positions. Regionally, North America led the market in 2024 with 35% share, supported by robust construction, mining, and oil & gas activities, while Europe and Asia Pacific followed as strong growth regions.

Market Insights

- The LED light tower market was valued at USD 4.04 billion in 2024 and is projected to reach USD 6.44 billion by 2032, growing at a CAGR of 6% during the forecast period.

- Growth is fueled by rising construction projects, infrastructure expansion, and increasing demand from mining and oil & gas industries requiring reliable, portable, and energy-efficient lighting solutions.

- Key trends include the adoption of solar-powered and hybrid towers, along with integration of smart monitoring systems, which enhance operational efficiency and support sustainability goals.

- The market is competitive with global players focusing on innovation, rental service expansion, and product durability, while high initial investment costs and dependence on fossil fuels in remote areas act as restraints.

- Regionally, North America led with 35% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while the portable segment accounted for over 60% of global share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The portable segment dominated the LED light tower market in 2024, accounting for over 60% of the total share. Its leadership is supported by rising demand in construction, mining, and outdoor event applications where mobility and ease of deployment are critical. Portable towers offer compact designs, quick setup, and versatile usage across temporary worksites, which drives their adoption globally. Meanwhile, stationary units remain relevant in large-scale industrial and infrastructure projects but lag due to limited flexibility compared to portable models, making portability the primary growth driver in this segment.

- For instance, the Generac MLT6SMD portable LED tower can achieve a maximum continuous runtime of up to 215 hours with the lights only, based on fuel consumption data for certain configurations.

By Power Source

The fossil fuel-powered segment held the dominant position in 2024 with nearly 55% of the market share. This dominance is attributed to their reliability in remote or off-grid areas where electric supply is scarce, especially in mining and oil & gas operations. Despite this, solar-powered LED light towers are gaining momentum due to rising sustainability regulations and cost savings in fuel expenditure. Electric-powered units are also expanding in urban settings supported by grid availability. However, fossil fuel units continue to lead due to their established use in heavy-duty operations.

- For instance, Atlas Copco’s HiLight V5+ offers up to 88 hours of runtime with lamps on using its 80 L fuel tank.

By Lamp Type

LED-based towers led the market in 2024, capturing over 65% of the global share. The segment’s dominance is driven by energy efficiency, longer lifespan, and reduced maintenance compared to halogen and metal halide lamps. LEDs also offer higher lumen output per watt and better illumination quality, making them suitable for construction, emergency, and outdoor event applications. Metal halide and halogen lamps are witnessing steady decline due to higher energy costs and shorter operational lives, further reinforcing the position of LED technology as the preferred choice in the light tower market.

Key Growth Drivers

Rising Construction and Infrastructure Projects

The expansion of construction and infrastructure projects worldwide is a key growth driver for the LED light tower market. Growing investments in road development, urban housing, and large-scale industrial projects have increased demand for reliable and portable lighting systems. LED light towers offer efficient illumination for night operations, ensuring worker safety and extended productivity hours. Their durability and low maintenance requirements make them highly suitable for continuous use at construction sites, positioning this segment as a central driver of market growth during the forecast period.

- For instance, Wacker Neuson’s LTN4Y light tower uses 4 × 400 W LED panels and illuminates up to 7,700 m².

Shift Toward Energy-Efficient Lighting Solutions

The global transition to energy-efficient technologies is another key growth driver. LED towers consume significantly less power compared to halogen or metal halide alternatives while providing superior brightness. Governments and organizations are increasingly adopting energy-saving solutions to cut operating costs and reduce emissions. These factors accelerate the replacement of conventional light towers with LED-based systems. The long operational life of LEDs further strengthens their cost-effectiveness, making them the preferred choice across industries and driving adoption across developed and emerging economies alike.

- For instance, Trime’s X-ECO LED tower consumes 0.55 L/hour fuel and runs ~200 hours on a full 110 L tank.

Expansion in Mining and Oil & Gas Activities

Mining and oil & gas sectors represent a key growth driver as these industries require robust and portable lighting systems for continuous operations. LED light towers ensure enhanced visibility in remote and hazardous areas, improving worker safety and operational efficiency. Rising global demand for minerals and hydrocarbons has pushed companies to adopt reliable lighting solutions that can endure harsh conditions. The ability of LED towers to offer extended runtime, reduced fuel consumption, and low maintenance makes them indispensable for these industries, boosting market penetration.

Key Trends & Opportunities

Adoption of Solar-Powered LED Towers

The increasing adoption of solar-powered LED towers is a major market trend. Rising environmental concerns and government support for clean energy are driving the shift toward solar solutions. These systems reduce dependence on fossil fuels and lower operating costs while offering reliable illumination in remote areas. Manufacturers are innovating hybrid designs combining solar panels with battery storage to ensure uninterrupted performance. This trend creates significant opportunities for eco-friendly product adoption, particularly in regions with strong sunlight exposure and strict emission regulations.

- For instance, The Progress Solar SHYB (Solar/Hybrid) unit is available in various configurations. The higher-end models, such as the HELIOS-HYB-D, can be equipped with four 450W bi-facial solar panels, capable of generating up to 2,800 watts. These units also feature integrated LED lighting that provides up to 80,000 lumens, depending on the specified options.

Integration of Smart and Remote Monitoring Features

The integration of smart technologies into LED light towers presents a key opportunity. Modern units now feature IoT-enabled controls, remote monitoring, and automated adjustments, enhancing energy efficiency and operational convenience. These capabilities allow users to track performance, optimize usage, and reduce downtime, proving valuable for large-scale projects. With industries moving toward digital solutions, smart LED towers are gaining traction across construction, mining, and emergency services. This trend reflects a broader push toward automation and creates new revenue streams for manufacturers offering advanced, connected systems.

- For instance, Himoinsa’s HBOX+ Hybrid lighting tower reduces up to 2,600 kg/year of CO₂ when operated eight hours daily in hybrid mode.

Key Challenges

High Initial Investment Costs

One of the key challenges in the LED light tower market is the high upfront cost of LED systems compared to traditional lighting technologies. Despite offering long-term savings, the higher purchase price discourages small and mid-scale contractors from immediate adoption. This limits penetration, especially in price-sensitive regions where budget constraints play a major role in equipment selection. Manufacturers must address this challenge by offering flexible financing, rental models, or cost-efficient product lines to expand market reach among a broader customer base.

Dependence on Fossil Fuel in Remote Applications

Dependence on fossil fuels for remote operations remains another key challenge. While solar and electric-powered LED towers are expanding, their efficiency is limited in off-grid sites with poor solar resources or lack of electricity infrastructure. Heavy reliance on diesel generators increases fuel costs and carbon emissions, conflicting with sustainability goals. This dependence slows down the adoption of greener alternatives. Addressing this challenge requires innovations in hybrid systems and advancements in energy storage technologies to ensure uninterrupted lighting in remote, off-grid environments.

Regional Analysis

North America

North America held the largest share of the LED light tower market in 2024, accounting for 35%. The region benefits from robust infrastructure development, high adoption in construction, and widespread use in oil and gas projects. Strong demand from the U.S. mining sector and ongoing road expansion programs fuel growth. Adoption of energy-efficient and portable units is further supported by strict safety regulations and emission norms. The presence of leading manufacturers and rental companies also strengthens availability, making North America a dominant region in both technological adoption and overall market share.

Europe

Europe accounted for 28% of the global LED light tower market in 2024. The region is driven by stringent environmental regulations and the shift toward sustainable and energy-efficient lighting solutions. Countries such as Germany, France, and the UK are adopting solar and hybrid towers for infrastructure projects and public events. Rising investments in renewable energy installations also increase demand for portable lighting systems. Strong emphasis on reducing carbon footprints and fuel dependency accelerates the adoption of LED-based systems, positioning Europe as a leading market with steady growth prospects during the forecast period.

Asia Pacific

Asia Pacific represented 25% of the LED light tower market in 2024, supported by rapid urbanization and industrial growth. Expanding construction activities in China, India, and Southeast Asian countries drive adoption. Large-scale infrastructure projects, including highways, airports, and railways, create significant demand for portable lighting solutions. Mining operations across Australia and Indonesia further contribute to growth. Increasing government initiatives to modernize urban spaces and improve worker safety standards also encourage adoption of advanced LED towers. The region’s cost-sensitive market pushes manufacturers to offer affordable solutions, enhancing penetration across diverse industries.

Latin America

Latin America held 7% of the global LED light tower market in 2024. Growth is primarily supported by expanding construction projects in Brazil and Mexico, alongside strong demand from the region’s mining sector. Rising energy costs are encouraging the shift from conventional lighting technologies to LED-based systems. Infrastructure development supported by public and private investments also drives adoption. However, budget constraints in certain economies slow widespread penetration. Despite these challenges, demand for portable and energy-efficient towers remains strong, particularly in resource-rich regions, positioning Latin America as a steadily emerging market.

Middle East & Africa

The Middle East & Africa accounted for 5% of the LED light tower market in 2024. The region’s demand is driven by extensive oil and gas activities, mining projects, and infrastructure development in Gulf countries. The adoption of LED towers is increasing due to their durability, reduced maintenance, and suitability for harsh environments. Large-scale construction initiatives in the UAE and Saudi Arabia further support growth. However, dependence on fossil fuel-powered towers remains high in remote areas. Solar-powered units are gradually gaining traction, supported by government initiatives focused on sustainable energy development across the region.

Market Segmentations:

By Type:

By Power Source:

- Electric

- Fossil Fuel

- Solar

By Lamp Type:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the LED light tower market is shaped by leading companies such as Doosan Bobcat, Progress Solar Solutions, The Will Burt Company, Caterpillar, PR Industrial Srl Unipersonale, Larson Electronics, HIMOINSA, Allmand Bros., Inc., Chicago Pneumatic, Atlas Copco, TRIME s.r.l., PowerLink, Generac Power Systems, Inc., Wacker Neuson SE, Mitsubishi Heavy Industries, Maxar Technologies, and Sigma Search Lights Limited. These players focus on product innovation, expanding their portfolios with energy-efficient and portable lighting solutions. Manufacturers are integrating solar and hybrid technologies to meet sustainability goals and align with stricter emission regulations. Advancements in smart controls and remote monitoring features are further enhancing product differentiation. The market is also witnessing strong competition through rental models, enabling broader adoption among construction contractors and event organizers. Companies compete on reliability, fuel efficiency, and durability, positioning themselves to capture growth opportunities in infrastructure development, mining, and oil & gas industries worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Doosan Bobcat

- Progress Solar Solutions

- The Will Burt Company

- Caterpillar

- PR Industrial Srl Unipersonale

- Larson Electronics

- HIMOINSA

- Allmand Bros., Inc.

- Chicago Pneumatic

- Atlas Copco

- TRIME s.r.l.

- PowerLink

- Generac Power Systems, Inc.

- Wacker Neuson SE

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Maxar Technologies

- Sigma Search Lights Limited

Recent Developments

- In 2024, Generac Power Systems, Inc. Introduced the GLT Series of mobile lighting towers with compact designs, improved fuel efficiency, and lower noise. Later, they expanded this line with two hybrid models, the GLT4-A and GLT4-M.

- In 2024, Larson Electronics Releases 9000W Metal Halide Light Tower, 6 Lamps, Remote Ballast Box.

- In 2023, Atlas Copco launched its first hybrid light tower, the HiLight HVT 500, and the ultra-quiet HiLight B5+ LED tower.

Report Coverage

The research report offers an in-depth analysis based on Type, Power Source, Lamp Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The LED light tower market will continue expanding with steady growth across all regions.

- Portable towers will remain the preferred choice due to flexibility and ease of deployment.

- LED technology will dominate further, replacing halogen and metal halide systems globally.

- Solar-powered light towers will gain wider adoption driven by sustainability goals.

- Mining and oil & gas sectors will sustain strong demand for durable lighting solutions.

- Construction and infrastructure projects will create consistent opportunities for large-scale deployments.

- Smart and IoT-enabled towers will grow in demand for remote monitoring applications.

- Hybrid power solutions will emerge to reduce dependence on fossil fuels.

- Rental services will expand as contractors prefer cost-efficient short-term usage models.

- Regulatory focus on energy efficiency will accelerate the replacement of conventional light towers.