Market Overview

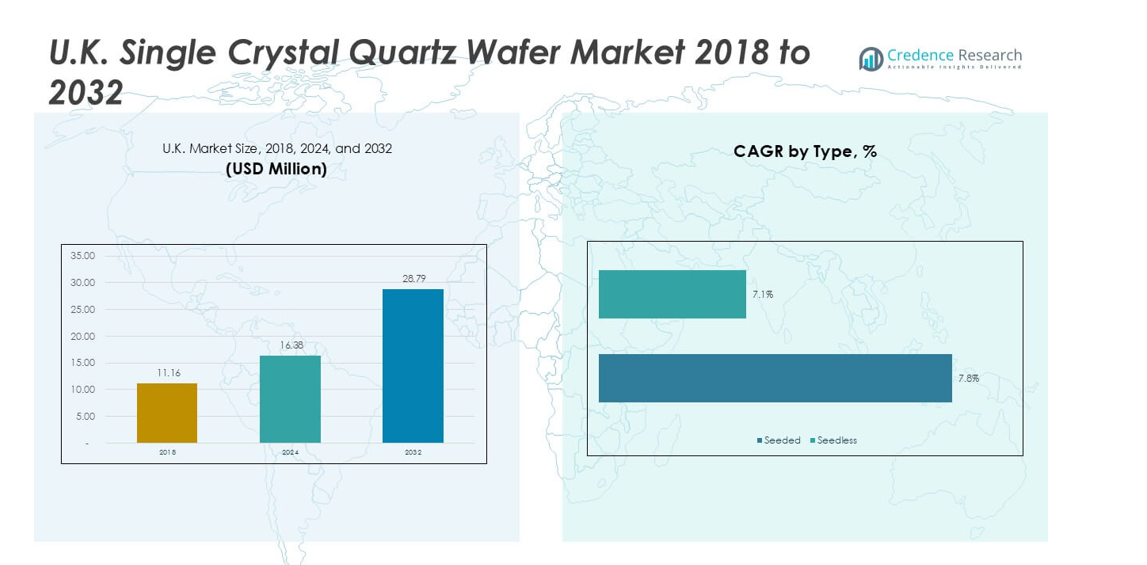

The UK Single Crystal Quartz Wafer market size was valued at USD 11.16 million in 2018, increasing to USD 16.38 million in 2024, and is anticipated to reach USD 28.79 million by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Single Crystal Quartz Wafer Market Size 2024 |

USD 16.38 million |

| U.K. Single Crystal Quartz Wafer Market, CAGR |

7.4% |

| U.K. Single Crystal Quartz Wafer Market Size 2032 |

USD 28.79 million |

The UK single crystal quartz wafer market is led by key players including Wafer Technology Ltd., Corning Incorporated, MTI Corporation, Nihon Dempa Kogyo Co., Ltd., Testbourne Ltd., and UniversityWafer, Inc. These companies dominate through advanced wafer fabrication technologies, strong global supply chains, and strategic partnerships with semiconductor and electronics industries. Domestic leaders such as Wafer Technology Ltd. and Testbourne Ltd. play a critical role in catering to regional demand, while global firms like Corning and Nihon Dempa Kogyo enhance market competitiveness with high-purity, large-diameter wafers. Regionally, England accounted for 55% of the market share in 2024, supported by its strong semiconductor ecosystem and research hubs, followed by Scotland with 20%, driven by its established electronics sector. Wales and Northern Ireland contributed 15% and 10%, respectively, reflecting growing roles in semiconductor and niche applications.

Market Insights

- The UK single crystal quartz wafer market was valued at USD 16.38 million in 2024 and is projected to reach USD 28.79 million by 2032, growing at a CAGR of 7.4%.

- Growth is driven by rising semiconductor demand, expanding MEMS applications, and technological advancements in wafer fabrication that enhance purity, uniformity, and production efficiency.

- Key trends include the shift toward larger-diameter wafers above 8 inches for high-performance electronics and growing opportunities in biotechnology and healthcare applications through biosensors and microfluidics.

- Leading players such as Wafer Technology Ltd., Corning Incorporated, Testbourne Ltd., and Nihon Dempa Kogyo compete through innovation, partnerships, and product diversification, while high production costs and competition from alternative materials like SiC and GaN act as restraints.

- Regionally, England holds 55% share, followed by Scotland at 20%, Wales with 15%, and Northern Ireland at 10%; by segment, seeded wafers (60%) and semiconductors (40%) dominate.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

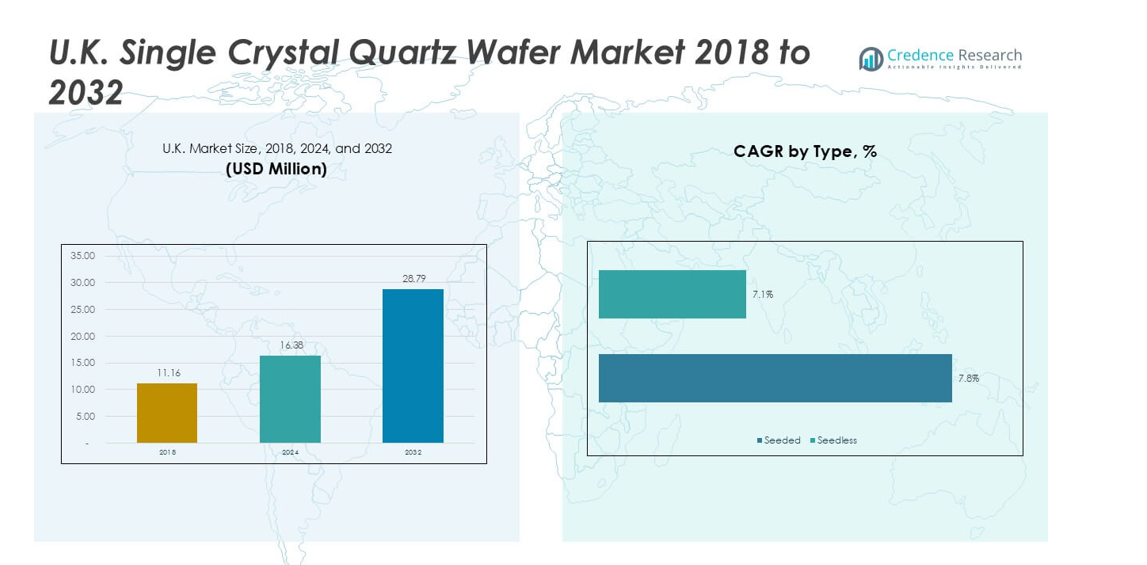

In 2024, the seeded segment dominated the UK single crystal quartz wafer market, accounting for over 60% share. Seeded wafers are widely adopted due to their superior structural uniformity, high crystal orientation, and stability, which ensure consistent performance in electronic applications. Their scalability and lower defect rates make them the preferred choice for advanced semiconductor fabrication. Seedless wafers continue to serve niche uses, mainly in specialty research and customized optical applications, but their market penetration remains limited compared to the broad commercial adoption of seeded wafers.

- For instance, Heraeus Conamic is a major global supplier of high-purity quartz and fused silica materials used for a variety of high-tech applications, including optical experiments at research institutes. The company produces different grades and forms of materials, including plates and discs, that are suitable for demanding optical and semiconductor uses.

By Diameter

The 5 to 8 inches diameter segment led the market in 2024 with around 55% share, reflecting its suitability for semiconductor manufacturing and MEMS production. This size balances cost efficiency and device performance, supporting higher yields in integrated circuit production. The growing need for mid-sized wafers in consumer electronics and telecommunications has reinforced its dominance. While wafers above 8 inches are gaining traction for high-performance applications, their adoption is slower due to high production costs and technical challenges in scaling. Smaller wafers remain relevant for prototypes and specialized testing.

- For instance, Iwate Murata Manufacturing Co., Ltd., formerly known as Tokyo Denpa Co., Ltd. until 2020, produces various high-quality crystal devices and synthetic quartz materials.

By Application

The semiconductors segment held the largest share of over 40% in 2024, driven by strong demand from the UK’s electronics and microfabrication industries. Single crystal quartz wafers provide excellent thermal stability and low thermal expansion, making them indispensable in advanced chip manufacturing. Rapid growth in 5G infrastructure, IoT devices, and automotive electronics further boosts demand for these wafers in semiconductor processing. MEMS and electronics represent another fast-growing segment, supported by rising adoption in sensors and actuators. Biotechnology and IC packaging continue to expand, but they remain secondary contributors compared to the semiconductor-driven demand.

Key Growth Drivers

Rising Demand in Semiconductor Manufacturing

The UK single crystal quartz wafer market is experiencing strong growth due to rising semiconductor production. Quartz wafers are crucial for delivering high stability, low thermal expansion, and precise electrical properties required in chip fabrication. Increasing demand for advanced consumer electronics, smartphones, and computing devices has intensified the need for reliable wafers in semiconductor foundries. Government support for local semiconductor supply chains and investment in advanced manufacturing facilities further drive adoption. As companies prioritize quality and production efficiency, quartz wafers remain indispensable in ensuring the performance of high-frequency and miniaturized devices.

- For instance, in May 2023, the UK government announced a £1 billion National Semiconductor Strategy, with investment to be spread over the next decade. The strategy includes funding to strengthen supply chains, along with a focus on areas where the UK already has expertise, such as design, research and development (R&D), and compound semiconductors.

Expanding Applications in MEMS and Electronics

The rapid expansion of micro-electro-mechanical systems (MEMS) and electronics applications is a significant growth driver. MEMS devices such as sensors, resonators, and actuators rely on quartz wafers for consistent performance in miniaturized formats. In the UK, demand is surging in automotive safety systems, industrial automation, and consumer wearables, where precision and durability are critical. The wafers’ stability and piezoelectric properties enhance MEMS reliability in high-performance conditions. As industries push toward smart devices and IoT adoption, quartz wafers are increasingly integrated into next-generation designs. Their role in ensuring accuracy and extending device lifecycles positions them as a central material in electronic innovation.

- For instance, Bosch, a global MEMS leader, manufactured over 1.5 billion MEMS sensors in 2022, with distribution across UK automotive and consumer markets supported by standard silicon wafer technology.

Technological Advancements in Wafer Fabrication

Technological progress in wafer processing techniques has become a major growth catalyst. Enhanced crystal growth methods, precision slicing, and polishing technologies are reducing defect rates while improving production yields. These advances allow manufacturers to deliver wafers with superior purity and uniformity, meeting the high standards required in semiconductors and biotechnology applications. In the UK, research institutions and wafer producers are investing in automation and AI-based monitoring systems to optimize output. Improved fabrication is also expanding the viability of larger-diameter wafers, catering to advanced integrated circuits and high-performance electronics. Such innovations ensure the industry can support both cost-efficiency and cutting-edge device manufacturing.

Key Trends & Opportunities

Adoption of Larger-Diameter Wafers

A notable trend in the UK market is the increasing adoption of larger-diameter quartz wafers, particularly those above 8 inches. These wafers enable higher production volumes and improved efficiency in integrated circuit manufacturing, supporting the growing demand for high-performance electronics. Although still emerging, advancements in crystal growth and slicing technologies are reducing technical barriers, making larger wafers more commercially viable. This trend creates opportunities for UK manufacturers to capture demand from global semiconductor firms seeking scalable solutions. As consumer electronics and 5G networks expand, larger wafers present a significant growth pathway for suppliers investing in advanced capabilities.

- For instance, in 2021, Siltronic AG broke ground on a new, state-of-the-art 300 mm (12-inch) wafer factory in Singapore, marking its largest single investment in capacity expansion. While the company did announce some investments to expand crystal pulling and epitaxy capabilities at its Freiberg site in Germany, the main 300 mm expansion project was in Singapore.

Integration in Biotechnology and Healthcare

The integration of quartz wafers in biotechnology and healthcare applications is opening new market opportunities. Their stability and biocompatibility make them ideal for use in biosensors, lab-on-chip devices, and diagnostic equipment. In the UK, increasing investment in precision medicine and healthcare research supports this shift, with quartz wafers being adopted in microfluidics and next-generation testing devices. The rise in chronic diseases and demand for rapid diagnostics further accelerates this trend. As healthcare technology evolves, quartz wafers are set to play a central role in enabling accurate, miniaturized, and durable biomedical solutions, providing strong diversification opportunities for manufacturers.

Key Challenges

High Production Costs and Complex Manufacturing

One of the key challenges in the UK single crystal quartz wafer market is the high cost associated with production. Growing large, defect-free crystals requires advanced equipment, precise conditions, and skilled expertise, which increase overall manufacturing expenses. Complex processes such as crystal growth, slicing, and polishing also demand significant investment in R&D and quality control. These factors make quartz wafers more expensive compared to other substrate materials. Smaller manufacturers in the UK face barriers to entry due to the capital-intensive nature of production, limiting competition and creating reliance on established players with scale economies.

Competition from Alternative Materials

Another challenge arises from the increasing adoption of alternative substrate materials such as silicon carbide (SiC) and gallium nitride (GaN), which are gaining traction in high-frequency and power electronics. These materials offer superior performance in certain applications, posing a competitive threat to quartz wafers. In the UK, the growing emphasis on renewable energy and electric vehicles is driving investment in SiC- and GaN-based devices, potentially diverting demand away from quartz. While quartz remains vital for precision electronics and MEMS, the rapid progress of alternatives requires wafer manufacturers to innovate and diversify applications to retain market relevance.

Regional Analysis

England

England dominated the UK single crystal quartz wafer market in 2024, accounting for over 55% share. The region’s leadership stems from its strong semiconductor ecosystem, supported by research hubs in Cambridge, Manchester, and London. High demand from electronics, telecommunications, and MEMS-based device manufacturing continues to drive adoption. Investment in advanced semiconductor facilities and collaborations with global technology players enhance production capacity and innovation. England’s strong role in supporting 5G infrastructure, IoT devices, and consumer electronics ensures its sustained dominance, while government-backed initiatives in digital technology and semiconductor supply chains strengthen long-term market opportunities.

Scotland

Scotland captured about 20% share of the UK single crystal quartz wafer market in 2024, supported by its established electronics and microelectronics sector. The “Silicon Glen” region hosts several global semiconductor and electronics firms, creating consistent demand for high-performance quartz wafers. Strong academic-industry collaborations with universities in Edinburgh and Glasgow further boost R&D activities in wafer processing and MEMS applications. Investments in precision engineering and photonics also enhance adoption across semiconductor fabrication. Scotland’s focus on high-value electronics, combined with ongoing government support for innovation, underpins its importance as the second-largest contributor in the UK market.

Wales

Wales accounted for approximately 15% market share in the UK single crystal quartz wafer industry in 2024, driven by its growing semiconductor cluster in South Wales. Companies engaged in wafer fabrication and electronics manufacturing have established facilities in the region, boosting demand for quartz wafers in semiconductor and MEMS applications. Strategic government support through initiatives like the Compound Semiconductor Applications Catapult has reinforced Wales’ role in advanced materials and device research. With expanding use in integrated circuits, telecom equipment, and industrial electronics, Wales continues to position itself as a vital contributor within the UK semiconductor value chain.

Northern Ireland

Northern Ireland held a smaller but notable 10% share of the UK single crystal quartz wafer market in 2024. The region benefits from its niche role in precision engineering, microelectronics research, and medical technology applications. Belfast and surrounding areas host innovation hubs that support R&D in electronics and advanced materials, generating opportunities for quartz wafer adoption in biotechnology and integrated circuit packaging. While semiconductor fabrication is less established compared to other UK regions, targeted investments in research-driven projects and partnerships with European firms are helping Northern Ireland strengthen its foothold in specialized applications of quartz wafers.

Market Segmentations:

By Type

By Diameter

- Up to 4 inches

- 5 to 8 inches

- Above 8 inches

By Application

- MEMS and Electronics

- Semiconductors

- Biotechnology

- Integrated Circuit (IC) Packaging

- Others

By End User

- Electronics Manufacturers

- Semiconductor Foundries

- Research and Academic Institutions

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK single crystal quartz wafer market is moderately consolidated, with both global and domestic players competing across diverse applications. Leading companies such as Wafer Technology Ltd., Testbourne Ltd., and UniversityWafer, Inc. hold strong positions due to their specialized product portfolios and established customer networks. International players like Corning Incorporated, MTI Corporation, and Nihon Dempa Kogyo Co., Ltd. strengthen market competition through advanced wafer fabrication technologies and global supply chains. Firms are increasingly focusing on high-purity seeded wafers and larger-diameter formats to meet the demands of semiconductors and MEMS. Strategic partnerships with research institutions, investments in automation, and development of customized wafer solutions further shape competitive dynamics. Smaller players, including Vritra Technologies and Xiamen Powerway, are enhancing their presence by targeting niche segments such as biotechnology and optical applications. Overall, competition is driven by technological innovation, product quality, and the ability to scale production while controlling costs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wafer Technology Ltd.

- Semiconductor Wafer, Inc.

- MTI Corporation

- Corning Incorporated

- Vritra Technologies

- Xiamen Powerway

- MicroChemicals GmbH

- NIHON DEMPA KOGYO CO., LTD.

- Testbourne Ltd

- UniversityWafer, Inc.

- Other Key Players

Recent Developments

- In July 2025, Xiamen Powerway (PAM-XIAMEN) remains an active supplier of single crystal quartz wafers, specializing in X-cut, Y-cut, Z-cut, and ST-cut orientations up to 3-inch diameters.

- In July 2025, NDK highlighted its advancement in mass-producing high-uniformity quartz crystals using proprietary technologies. Their latest offering includes synthetic quartz wafers with AT-cut and tuning fork wafers, and a development plan for larger 6-inch wafers to cater to growing SAW device demand and frequency control in next-gen electronics.

- In August 2024, NDK (NIHON DEMPA KOGYO CO., LTD.) showcased its synthetic quartz crystals and quartz wafers for timing and optical applications at electronica India 2024, participating through a distributor’s booth at the trade fair.

Report Coverage

The research report offers an in-depth analysis based on Type, Diameter, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand from semiconductor manufacturing.

- Seeded wafers will continue to dominate due to high structural stability and reliability.

- Larger-diameter wafers above 8 inches will gain traction in advanced applications.

- MEMS and electronics adoption will rise with growth in IoT and smart devices.

- Biotechnology will emerge as a promising segment with applications in diagnostics and biosensors.

- England will maintain leadership, supported by research hubs and strong supply chains.

- Scotland will strengthen its position with microelectronics and photonics investments.

- Wales will benefit from semiconductor cluster expansion in South Wales.

- Northern Ireland will find opportunities in niche medical and microelectronics applications.

- Competition will intensify as global players innovate and domestic firms target specialized markets.