Market Overview

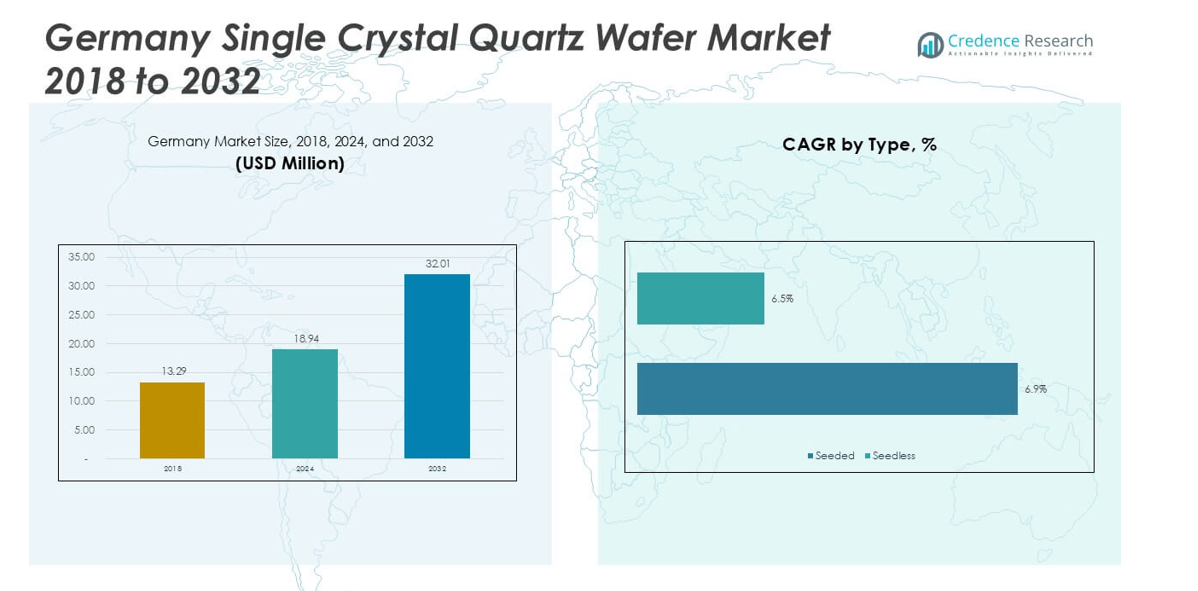

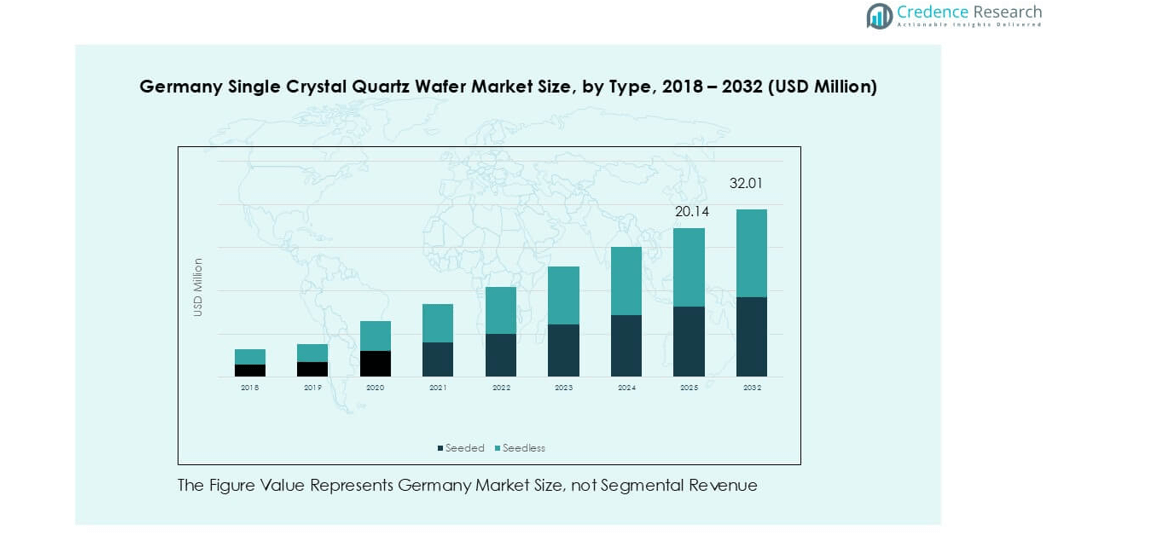

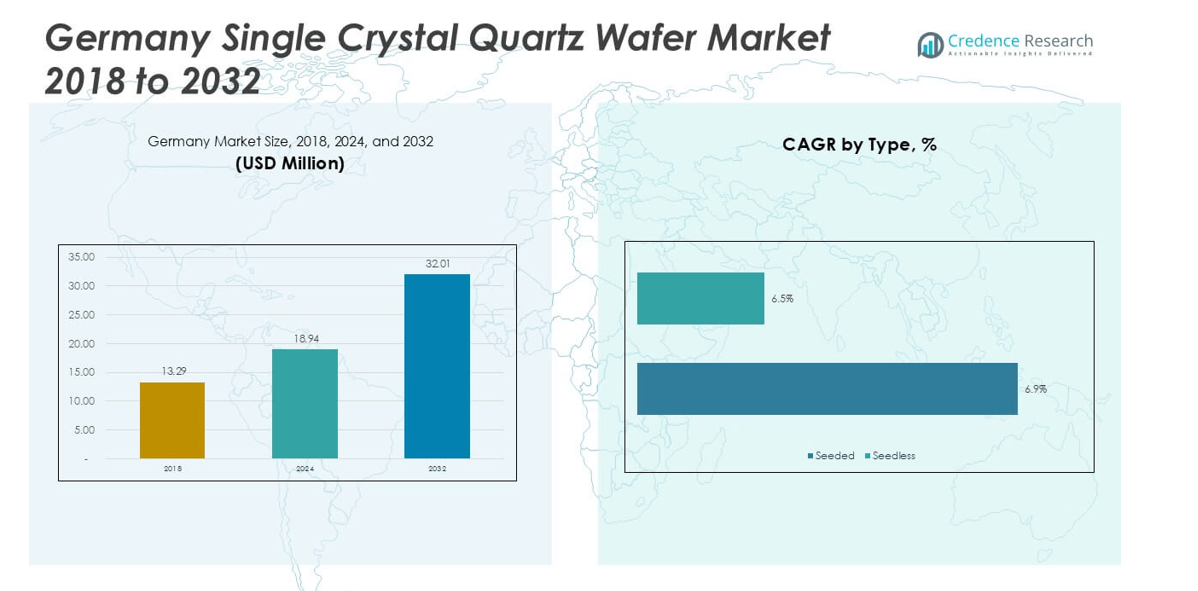

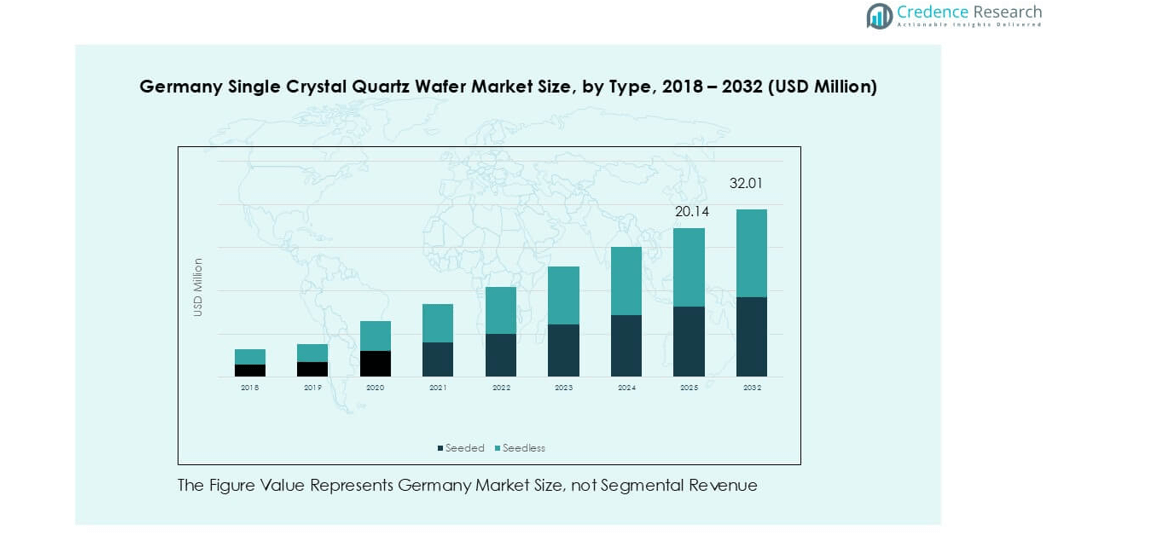

The Germany Single Crystal Quartz Wafer market size was valued at USD 13.29 million in 2018, increased to USD 18.94 million in 2024, and is anticipated to reach USD 32.01 million by 2032, at a CAGR of 7.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Single Crystal Quartz Wafer Market Size 2024 |

USD 18.94 million |

| Germany Single Crystal Quartz Wafer Market, CAGR |

7.15% |

| Germany Single Crystal Quartz Wafer Market Size 2032 |

USD 32.01 million |

The Germany single crystal quartz wafer market is shaped by prominent players such as Wafer Technology Ltd., Semiconductor Wafer Inc., MTI Corporation, Corning Incorporated, Vritra Technologies, Xiamen Powerway, MicroChemicals GmbH, NIHON DEMPA KOGYO CO., LTD., Testbourne Ltd., and UniversityWafer, Inc. These companies compete through innovations in wafer quality, precision manufacturing, and tailored solutions for semiconductor and MEMS applications. Regionally, North Germany leads with 32% market share, driven by its strong semiconductor clusters and electronics manufacturing base. South Germany follows with 28%, supported by high-tech industries, automotive electronics, and biotechnology. East and West Germany each hold 20%, with East benefitting from “Silicon Saxony” initiatives and West leveraging industrial electronics and 5G infrastructure growth. This competitive and regional balance underscores the market’s dynamic nature.

Market Insights

- The Germany Single Crystal Quartz Wafer market was valued at USD 18.94 million in 2024 and is projected to reach USD 32.01 million by 2032, growing at a CAGR of 7.15%.

- Growth is driven by rising demand in semiconductors (45% share) and MEMS electronics, supported by Germany’s strong automotive and industrial base.

- A key trend is the shift toward 5–8 inch wafers (50% share), offering higher efficiency and compatibility with advanced foundry processes, while larger wafers above 8 inches are gradually gaining adoption.

- Competition includes global players such as Corning Incorporated, MTI Corporation, and NIHON DEMPA KOGYO CO., LTD., alongside local firms like MicroChemicals GmbH, with strategies focusing on innovation, partnerships, and supply chain resilience.

- North Germany leads with 32% market share, followed by South Germany at 28%, while East and West Germany each account for 20%, reflecting a balanced but regionally diverse demand pattern.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

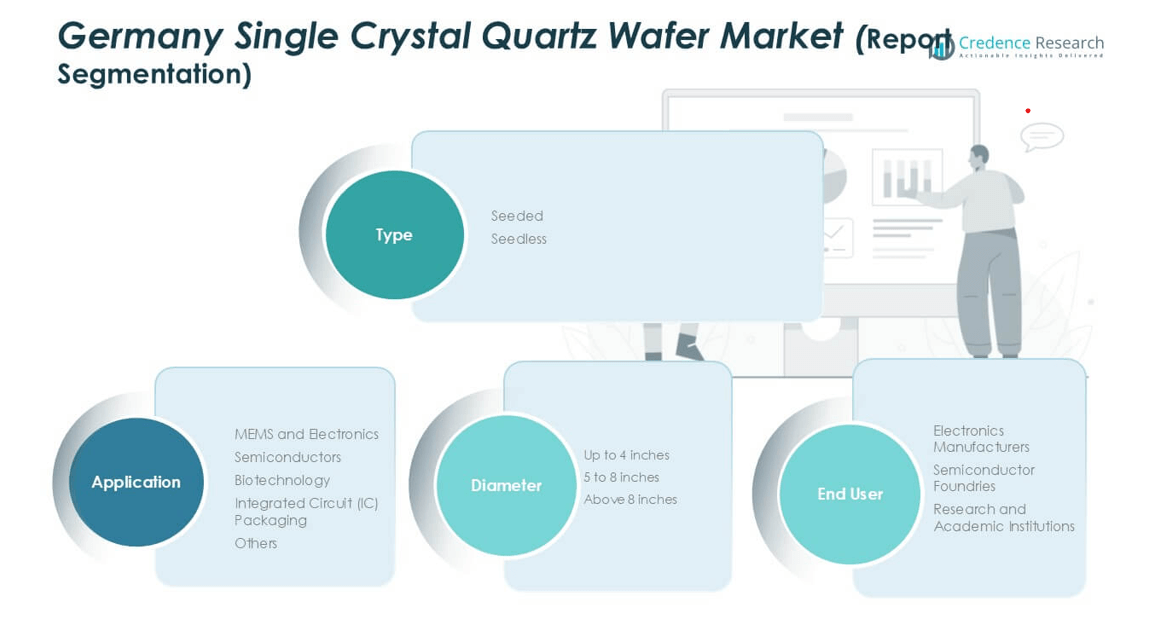

Market Segmentation Analysis:

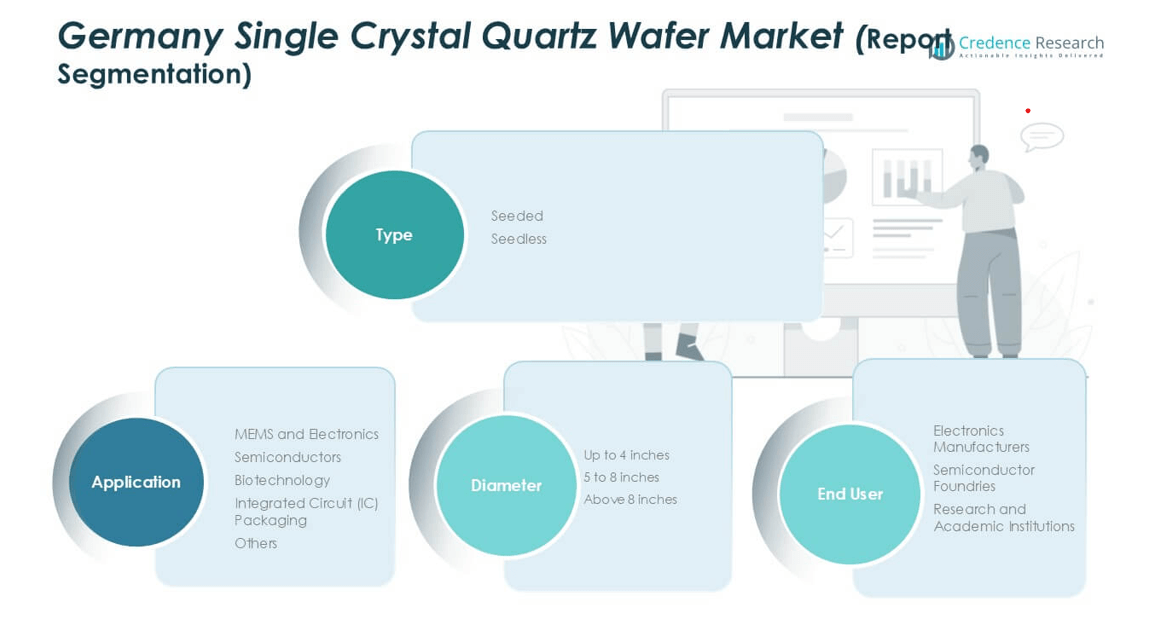

By Type

The seeded segment dominated the Germany single crystal quartz wafer market in 2024, accounting for over 60% share. Seeded wafers ensure uniform crystal growth, higher structural stability, and improved surface quality, making them vital for high-precision electronics and semiconductor applications. Demand is driven by their consistent performance in MEMS devices and integrated circuits, where accuracy and durability are critical. Meanwhile, seedless wafers hold a niche presence, favored in research and niche applications, but slower adoption limits their overall market share compared to seeded wafers.

- For instance, Shin-Etsu Chemical operates multiple facilities in Japan that produce materials for the electronics and semiconductor industries, including quartz glass products and silicon wafers.

By Diameter

Wafers sized 5 to 8 inches emerged as the leading diameter category in 2024, capturing nearly 50% of the market share. Their dominance comes from compatibility with advanced semiconductor foundry processes and growing demand in MEMS and electronics manufacturing. Mid-range diameters balance production efficiency with performance, making them ideal for both commercial and industrial use. Smaller wafers up to 4 inches are widely used in academic and prototyping work, while wafers above 8 inches are gaining traction in high-volume semiconductor manufacturing, though adoption remains gradual due to higher production costs.

- For instance, Murata Manufacturing Co. acquired the quartz crystal device manufacturer Tokyo Denpa Co., now Iwate Murata Manufacturing Co., Ltd., in 2013. The company manufactures synthetic quartz and crystal devices, such as oscillators and resonators, which are supplied to makers of timing devices.

By Application

The semiconductors segment led the application market in 2024, securing around 45% share. Its strength stems from the increasing need for high-performance wafers in microelectronics, IC packaging, and advanced chip production. Germany’s robust semiconductor industry and investments in next-generation electronics strongly support this segment. MEMS and electronics followed closely, reflecting strong adoption in sensors, communication devices, and automotive electronics. Biotechnology and other applications contribute steadily, with growing research use, but their share remains smaller compared to semiconductor-driven demand, which continues to dominate the market outlook.

Key Growth Drivers

Rising Demand in Semiconductor Manufacturing

Germany’s strong semiconductor ecosystem is a key driver for single crystal quartz wafer demand. These wafers are critical in producing microchips, sensors, and ICs, where precision and thermal stability are essential. With the country investing heavily in semiconductor foundries and local production capabilities, adoption of high-quality wafers continues to accelerate. The European Union’s push for regional chip independence further fuels growth, as quartz wafers provide the foundation for advanced photolithography processes. Expanding applications in automotive electronics, industrial automation, and 5G infrastructure further strengthen this segment’s momentum, ensuring steady demand across multiple industries.

- For instance, by the end of 2023, ASML had shipped more than 140 EUV lithography systems globally, with 53 of those systems delivered during that year alone. While many of these systems are in Asia-Pacific in fabs operated by major customers like TSMC and Samsung, some are deployed in European fabs.

Growth in MEMS and Electronics Applications

Micro-electromechanical systems (MEMS) represent another significant growth driver. MEMS-based sensors, accelerometers, and actuators increasingly rely on quartz wafers for their superior electrical and mechanical properties. Germany’s strong automotive and industrial base creates high demand for MEMS in driver-assistance systems, robotics, and smart devices. Single crystal quartz wafers deliver precision and consistency, meeting the requirements of miniaturized devices where accuracy and low energy consumption are vital. As adoption of smart manufacturing and IoT-enabled solutions grows, MEMS demand in Germany is expected to expand further, reinforcing quartz wafer consumption across electronics applications.

- For instance, Bosch produced over 4 million MEMS sensors daily from its facilities in Reutlingen and Dresden in 2022, and the sensors depend on silicon wafer substrates.

Advancements in Biotechnology and Research

Biotechnology and research applications are emerging as promising growth drivers for the quartz wafer market in Germany. Universities, laboratories, and biotech firms increasingly use quartz wafers in diagnostic devices, biosensors, and advanced microfluidic platforms. Their chemical stability and biocompatibility make them suitable for precision medical research and drug development. Germany’s expanding life sciences sector, supported by strong public funding and private investment, is accelerating adoption of these wafers. The integration of quartz wafers into next-generation biomedical instruments highlights their role in driving innovation, while also diversifying demand beyond semiconductors and electronics into healthcare-focused solutions.

Key Trends & Opportunities

Shift Toward Larger Diameter Wafers

A major trend shaping the German market is the transition toward larger wafer diameters, particularly above 8 inches. Larger wafers increase production efficiency by enabling higher device yields per batch, which is crucial for meeting growing semiconductor and electronics demand. Semiconductor foundries are gradually scaling operations to adopt these wafers despite higher production costs. This shift also creates opportunities for local suppliers to invest in precision wafer production technologies, aligning with global semiconductor advancements. As high-performance computing, AI-driven devices, and automotive chips grow in demand, adoption of larger wafers is expected to accelerate.

- For instance, GlobalWafers announced in June 2022 a new $5 billion plant in Sherman, Texas, designed to produce 300 mm (12-inch) silicon wafers. The company had a planned annual capacity exceeding 1 million wafers, with initial goals of producing 1.2 million wafers per month.

Opportunities in IC Packaging and 5G Infrastructure

Germany’s rapid advancement in 5G networks and integrated circuit packaging presents strong opportunities for quartz wafer applications. Quartz wafers support the miniaturization and reliability requirements of advanced IC packaging, vital for high-speed communication systems. With Germany investing in 5G infrastructure to enhance connectivity for industries and consumers, demand for advanced IC packaging materials will rise. This development creates new opportunities for quartz wafer manufacturers to provide high-quality substrates tailored for telecom and data center applications. The synergy between 5G adoption and IC innovation positions Germany as a key growth hub in Europe.

Key Challenges

High Production Costs and Supply Constraints

One of the major challenges in the German single crystal quartz wafer market is high production costs. The process of producing defect-free wafers with high purity requires advanced technology, specialized equipment, and significant energy consumption. Local producers often face cost pressures from international suppliers who can deliver wafers at lower prices due to economies of scale. Additionally, sourcing raw quartz of required quality remains challenging, as Germany depends on imports for much of its supply. These factors collectively limit scalability, affecting the competitiveness of domestic wafer production against global rivals.

Technological Complexity and Competition

The increasing demand for advanced wafers poses another challenge due to the technological complexity involved in production. Manufacturing high-diameter, defect-free wafers requires precision growth processes, tight quality control, and constant innovation. German companies face strong competition from established global players in Asia and North America, who dominate the quartz wafer supply chain. This competitive pressure demands continuous R&D investment, which may strain smaller firms. Without technological advancements and strategic collaborations, German manufacturers risk falling behind in global markets where efficiency and innovation are critical for success.

Regional Analysis

North Germany

North Germany held the largest share of the single crystal quartz wafer market in 2024, accounting for 32%. The region benefits from advanced semiconductor clusters and strong industrial electronics manufacturing, particularly around Hamburg and Lower Saxony. Demand is fueled by integration of quartz wafers in communication technologies, MEMS devices, and automotive electronics. Strong logistics networks and proximity to European trade hubs enhance material flow and supply chain reliability. With growing investments in renewable energy technologies and smart grid solutions, North Germany is expected to remain a central hub for quartz wafer adoption.

South Germany

South Germany captured 28% market share in 2024, driven by its concentration of high-tech industries, including automotive electronics, industrial automation, and biotechnology. Bavaria and Baden-Württemberg host several semiconductor and research institutions, creating consistent demand for high-quality quartz wafers. The presence of advanced R&D facilities supports adoption in biotechnology and MEMS applications. Strong ties to the automotive sector, particularly in driver-assistance systems and connected mobility, further enhance demand. With robust innovation ecosystems and government-backed initiatives supporting microelectronics, South Germany continues to strengthen its position as a critical growth region for quartz wafer applications.

East Germany

East Germany accounted for 20% of the market share in 2024, supported by semiconductor foundries and research institutions concentrated in Saxony, often called “Silicon Saxony.” Dresden and surrounding areas contribute significantly through microelectronics production and advanced wafer fabrication. The region’s universities and R&D centers also drive adoption in biotechnology and MEMS research. While its overall share is smaller compared to North and South Germany, East Germany benefits from strong government incentives and partnerships with European semiconductor programs. These factors position the region as an emerging growth center for quartz wafer demand, particularly in advanced electronics.

West Germany

West Germany held 20% market share in 2024, supported by a well-developed industrial base and growing adoption in integrated circuit packaging and telecommunications. The region, with hubs such as North Rhine-Westphalia, benefits from a mix of industrial electronics and academic research institutions. Demand is supported by expansion in 5G infrastructure, where quartz wafers play a vital role in IC packaging and communication devices. While smaller in comparison to North and South Germany, the West remains important for balancing production and end-use demand across industries. Ongoing collaborations with European semiconductor projects are expected to sustain future growth.

Market Segmentations:

By Type

By Diameter

- Up to 4 inches

- 5 to 8 inches

- Above 8 inches

By Application

- MEMS and Electronics

- Semiconductors

- Biotechnology

- Integrated Circuit (IC) Packaging

- Others

By End User

- Electronics Manufacturers

- Semiconductor Foundries

- Research and Academic Institutions

By Geography

- North Germany

- South Germany

- East Germany

- West Germany

Competitive Landscape

The Germany single crystal quartz wafer market is moderately fragmented, with a mix of global corporations and regional suppliers competing for market share. Leading companies such as Wafer Technology Ltd., Semiconductor Wafer Inc., MTI Corporation, Corning Incorporated, and Vritra Technologies play a central role, offering high-purity wafers tailored for semiconductor, MEMS, and biotechnology applications. Local players like MicroChemicals GmbH strengthen domestic supply by serving niche markets and research institutions, while Asian suppliers including Xiamen Powerway and NIHON DEMPA KOGYO CO., LTD. provide cost-competitive products. Competitive strategies focus on expanding product portfolios, investing in precision wafer manufacturing, and establishing strategic collaborations with semiconductor foundries. Recent developments highlight capacity expansions and partnerships aimed at meeting growing demand from electronics and automotive industries. With Germany’s strong position in semiconductors and industrial automation, competition is expected to intensify as companies focus on technological innovation, quality improvements, and regional supply chain resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wafer Technology Ltd.

- Semiconductor Wafer, Inc.

- MTI Corporation

- Corning Incorporated

- Vritra Technologies

- Xiamen Powerway

- MicroChemicals GmbH

- NIHON DEMPA KOGYO CO., LTD.

- Testbourne Ltd.

- UniversityWafer, Inc.

- Other Key Players

Recent Developments

- In July 2025, Xiamen Powerway (PAM-XIAMEN) remains an active supplier of single crystal quartz wafers, specializing in X-cut, Y-cut, Z-cut, and ST-cut orientations up to 3-inch diameters.

- In July 2025, NDK highlighted its advancement in mass-producing high-uniformity quartz crystals using proprietary technologies. Their latest offering includes synthetic quartz wafers with AT-cut and tuning fork wafers, and a development plan for larger 6-inch wafers to cater to growing SAW device demand and frequency control in next-gen electronics.

- In August 2024, NDK (NIHON DEMPA KOGYO CO., LTD.) showcased its synthetic quartz crystals and quartz wafers for timing and optical applications at electronica India 2024, participating through a distributor’s booth at the trade fair.

Report Coverage

The research report offers an in-depth analysis based on Type, Diameter, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing adoption in semiconductor manufacturing.

- MEMS and electronics applications will continue driving strong demand growth.

- Larger wafer diameters above 8 inches will gain wider acceptance.

- Biotechnology research will create new opportunities for niche applications.

- Automotive electronics and smart mobility will strengthen market relevance.

- Regional supply chains will focus on reducing import dependence.

- Companies will invest more in precision manufacturing and defect-free wafer technologies.

- Strategic collaborations between global and local players will intensify competition.

- Government and EU-backed semiconductor initiatives will support industry expansion.

- North and South Germany will remain the dominant regions for market growth.