Market Overview

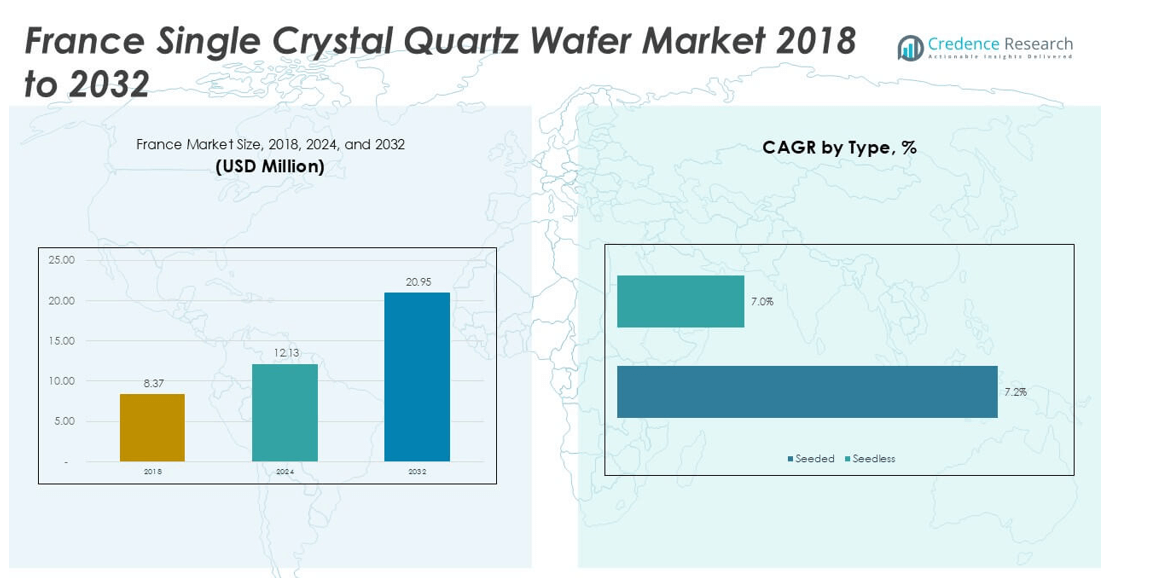

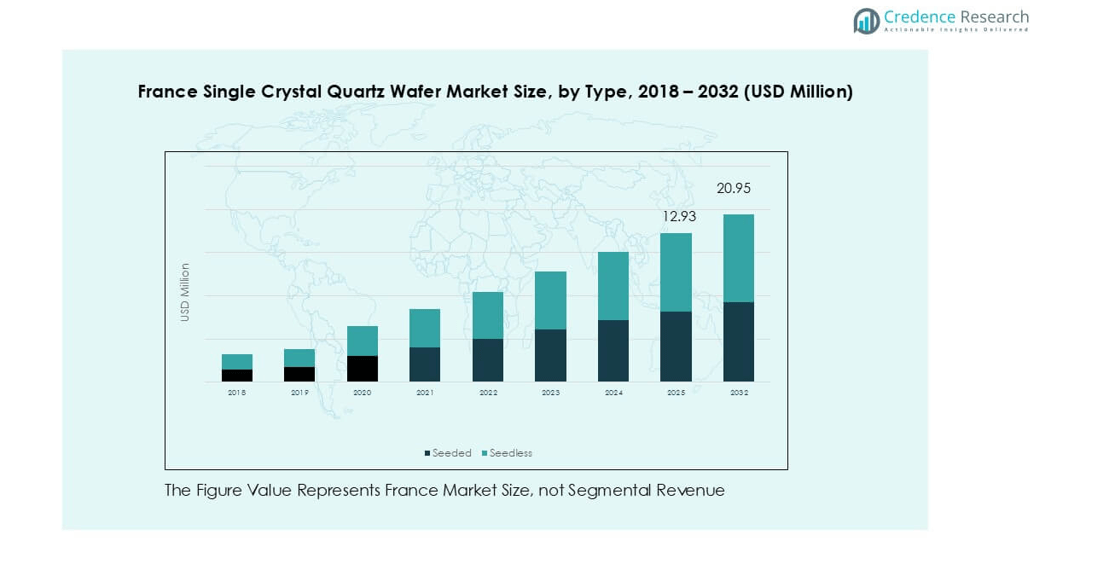

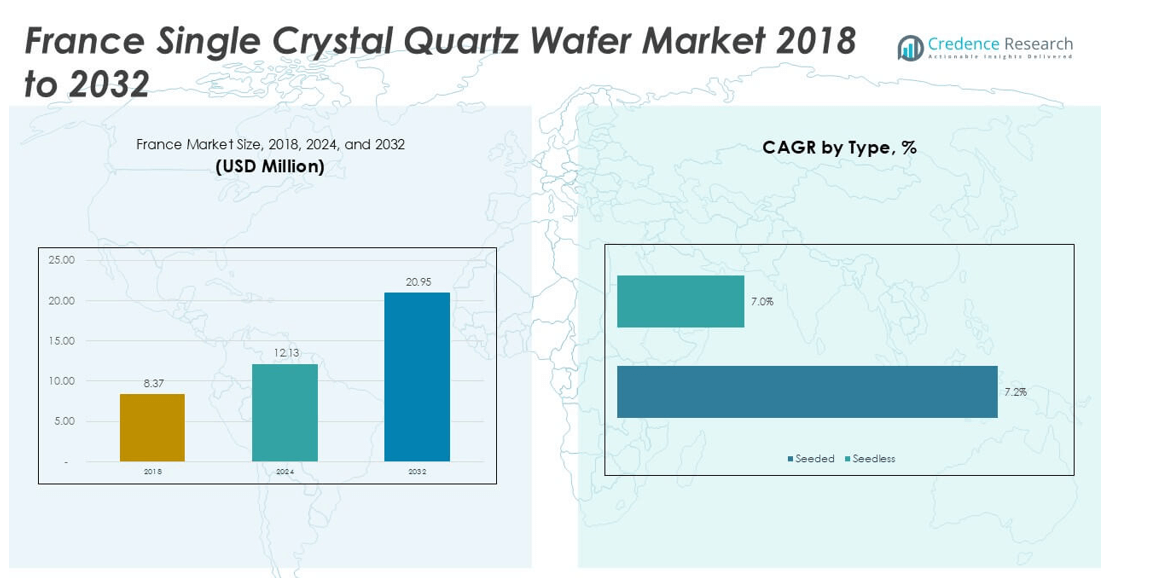

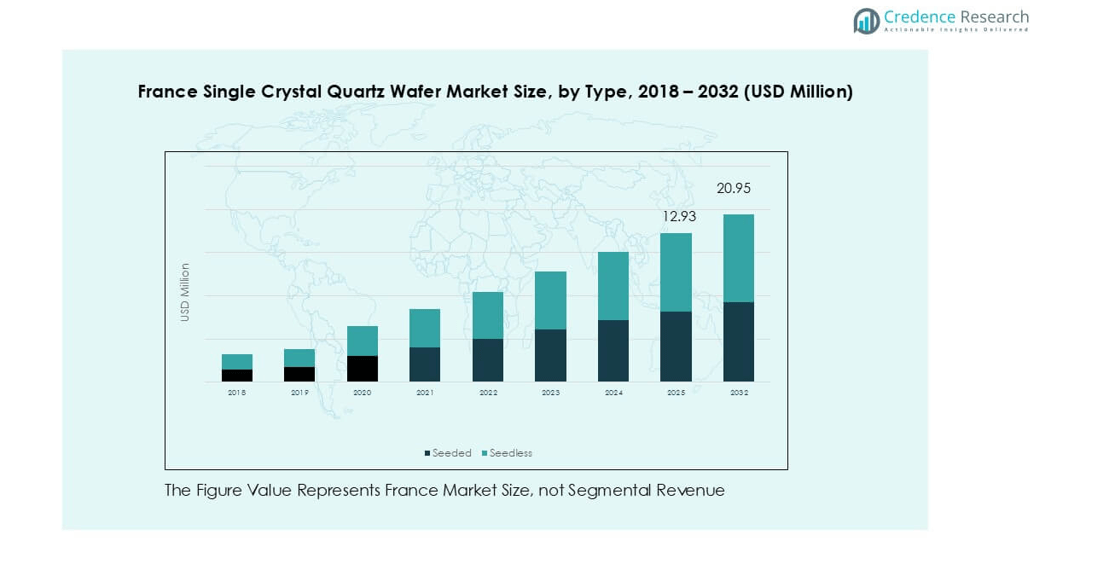

The France Single Crystal Quartz Wafer market size was valued at USD 8.37 million in 2018, increasing to USD 12.13 million in 2024, and is anticipated to reach USD 20.95 million by 2032, at a CAGR of 8.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Single Crystal Quartz Wafer Market Size 2024 |

USD 12.13 million |

| France Single Crystal Quartz Wafer Market , CAGR |

8.37% |

| France Single Crystal Quartz Wafer Market Size 2032 |

USD 20.95 million |

The France single crystal quartz wafer market is led by key players such as Corning Incorporated, MTI Corporation, NIHON DEMPA KOGYO CO., LTD., Neyco, and MicroChemicals GmbH, supported by suppliers like UniversityWafer, Inc. and MSE Supplies LLC. These companies maintain competitiveness through advanced wafer processing technologies, diverse product portfolios, and strong partnerships with semiconductor and MEMS manufacturers. Regionally, North France dominated the market with a 29% share in 2024, driven by established semiconductor clusters and cross-border trade with Germany and Belgium. South France followed closely with 23% share, supported by the Grenoble technology hub’s wafer fabrication and MEMS innovation capabilities.

Market Insights

- The France single crystal quartz wafer market was valued at USD 12.13 million in 2024 and is projected to reach USD 20.95 million by 2032, growing at a CAGR of 8.37% during the forecast period.

- Rising demand from the semiconductor industry, particularly for integrated circuits and MEMS applications, is a major driver, supported by government-backed initiatives under the EU Chips Act to boost local chip production.

- A key trend is the growing shift toward larger wafer diameters (5–8 inches), which captured nearly 58% share in 2024, offering higher output efficiency for large-scale semiconductor production.

- The competitive landscape includes global leaders like Corning Incorporated, MTI Corporation, and NIHON DEMPA KOGYO CO., LTD., alongside local and regional firms such as Neyco and MicroChemicals GmbH, focusing on specialized solutions.

- Regionally, North France led the market with 29% share in 2024, followed by South France at 23%, while semiconductors dominated applications with about 46% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

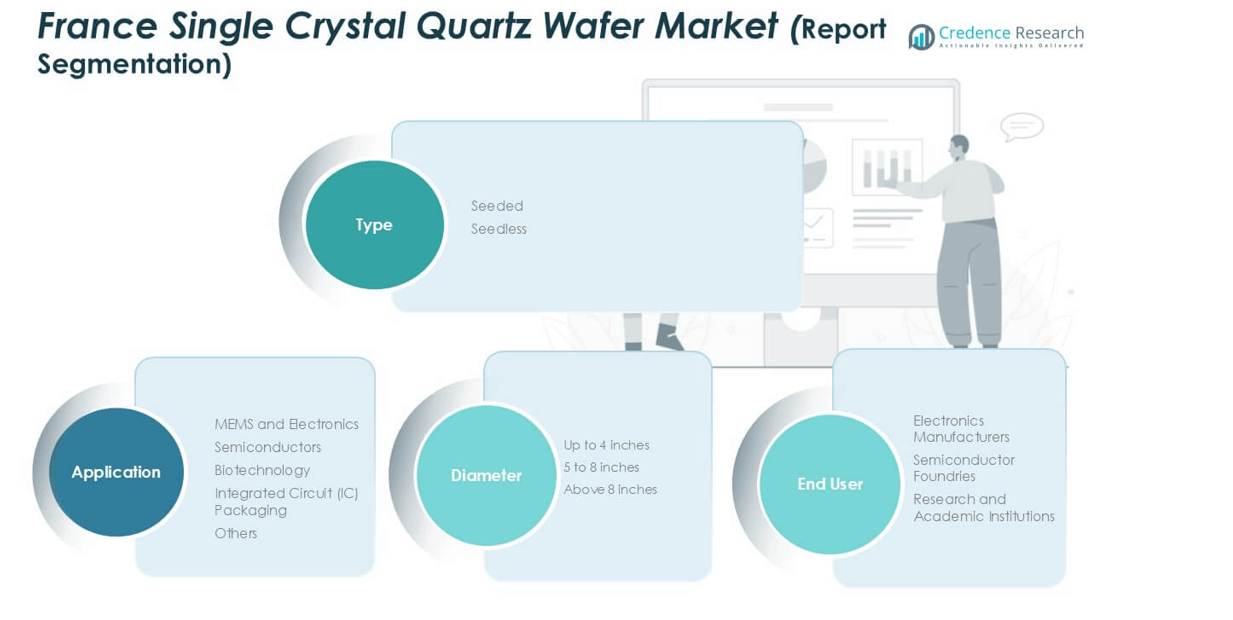

By Type

In the France single crystal quartz wafer market, the seeded type held the dominant share of around 63% in 2024. Seeded wafers remain the industry standard due to their superior crystalline uniformity and high yield in semiconductor and MEMS fabrication. Their ability to provide precise lattice orientation ensures better electrical performance, driving strong adoption in advanced electronics and IC applications. Seedless wafers are gaining niche demand in research and biotechnology due to reduced defects, yet their limited scalability restricts broader market penetration compared to seeded wafers.

- For instance, Shin-Etsu Chemical is a major global supplier of silicon wafers for the semiconductor industry, with its products used in European fabs to support regional semiconductor production, including in France.

By Diameter

The 5 to 8 inches diameter segment accounted for nearly 58% share in 2024, making it the largest in France. These wafers balance cost efficiency with high throughput, supporting mass production in semiconductor and IC packaging industries. They are widely adopted for consumer electronics, communication devices, and automotive components, aligning with France’s growing semiconductor supply chain. While wafers above 8 inches are emerging for advanced logic chips, their adoption remains constrained by high production costs and limited local manufacturing capability. Smaller wafers up to 4 inches serve R&D and niche electronics.

- For instance, Murata Manufacturing Co., a major Japanese electronics manufacturer, acquired crystal device maker Tokyo Denpa Co. in 2013 and renamed it Iwate Murata Manufacturing Co. in 2020. The company supplies high-quality synthetic quartz blanks and resonators for use in various electronic components, including those required for communication and industrial equipment.

By Application

Semiconductors dominated the application segment with approximately 46% share in 2024. Rising demand for integrated circuits in smartphones, automotive electronics, and renewable energy systems has driven strong wafer consumption in this category. France’s semiconductor ecosystem benefits from EU-backed initiatives that promote local production and supply security, further boosting the segment. MEMS and electronics also hold significant demand, supporting sensors and actuators used in medical and industrial applications. Biotechnology applications are expanding slowly, driven by precision diagnostic tools, while IC packaging remains crucial for miniaturization in advanced electronic assemblies.

Market Overview

Expanding Semiconductor Manufacturing in France

The growth of France’s semiconductor industry is a primary driver of the single crystal quartz wafer market. Government-backed initiatives, aligned with the EU’s Chips Act, aim to increase local chip production and reduce reliance on Asian imports. This demand directly fuels the adoption of high-quality seeded quartz wafers, vital for producing reliable semiconductors. France’s robust automotive sector, which is rapidly shifting toward electric and autonomous vehicles, further boosts wafer consumption in advanced ICs and sensors. The rising integration of electronics in renewable energy systems, such as solar inverters and smart grids, creates additional demand. The expansion of research and development hubs in Grenoble and other technology clusters strengthens local innovation. As France pushes toward technological independence and advanced electronics, the semiconductor segment continues to act as a cornerstone, generating consistent growth opportunities for quartz wafer suppliers.

- For instance, Valeo expanded its Advanced Driver Assistance Systems (ADAS) business in 2022, growing its original equipment sales in this area by 29% and strengthening its market position with new orders.

Strong Demand for MEMS and Electronics Applications

Micro-Electro-Mechanical Systems (MEMS) and electronic devices represent another strong growth driver in France’s quartz wafer market. MEMS technology supports a wide range of sensors and actuators used in industries such as healthcare, aerospace, automotive, and industrial automation. France’s automotive industry heavily relies on MEMS-based solutions for airbag systems, tire-pressure monitoring, and advanced driver assistance systems (ADAS). In addition, MEMS sensors are increasingly used in smartphones, wearables, and medical devices, which are experiencing robust growth. Quartz wafers provide unmatched stability, durability, and precision required in MEMS fabrication, ensuring device reliability. Government support for healthcare innovation and aerospace R&D further enhances MEMS adoption, strengthening the market base for quartz wafers. As France positions itself as a leader in high-value electronics and connected technologies, MEMS-related demand will remain a sustained growth contributor, with increasing adoption across industries driving long-term wafer market expansion.

- For instance, Bosch, which operates MEMS production sites supplying French automakers, manufactured over 1.5 billion MEMS sensors globally in 2022, including accelerometers and pressure sensors essential for ADAS.

Rising Adoption in Biotechnology and Healthcare

The biotechnology and healthcare industries are becoming significant growth contributors to the French quartz wafer market. Quartz wafers are increasingly used in precision diagnostic devices, biosensors, and lab-on-chip technologies, which demand superior chemical stability and low defect rates. France’s strong biotechnology sector, supported by public funding and private investment, drives innovation in advanced diagnostic platforms, including point-of-care testing and genetic sequencing tools. The COVID-19 pandemic accelerated adoption of lab-on-chip and biosensor technologies, and this momentum continues with growing emphasis on personalized medicine and chronic disease monitoring. Research collaborations between universities, biotech firms, and healthcare providers further expand demand for quartz wafers. The integration of biotechnology with MEMS and electronics also creates cross-industry applications, amplifying market potential. With France’s healthcare system prioritizing innovation and advanced diagnostic solutions, the biotechnology-driven demand for quartz wafers is expected to expand steadily over the forecast period.

Key Trends & Opportunities

Shift Toward Larger Diameter Wafers

A notable trend in the France quartz wafer market is the shift toward 5–8 inch and above 8 inch wafers. These larger wafers improve productivity by enabling higher chip output per unit, lowering costs for large-scale semiconductor fabrication. While 5–8 inch wafers currently dominate, the adoption of wafers above 8 inches is gradually increasing, driven by advanced IC packaging and next-generation microelectronics. France’s focus on boosting domestic semiconductor production provides opportunities for local suppliers to expand capacity in larger wafer formats. This transition supports innovation in consumer electronics, automotive, and renewable energy applications.

- For instance, STMicroelectronics and GlobalFoundries announced in July 2022 their €7.4 billion fab in Crolles, designed for 300 mm (12-inch) wafers, with capacity to produce 620,000 wafers annually once fully operational.

Integration with Emerging Technologies

The integration of quartz wafers into advanced technologies presents strong opportunities in France. Applications in quantum computing, photonics, and advanced sensors are expanding rapidly, requiring high-purity and defect-free wafers. Research hubs and collaborations with European technology initiatives are positioning France as a center for next-gen applications. Growing investments in aerospace, renewable energy, and 5G communication also create pathways for innovative wafer uses. The convergence of biotechnology and electronics further enhances demand, as hybrid applications like bio-MEMS and lab-on-chip solutions become more widespread.

Key Challenges

High Production Costs and Complexity

Manufacturing single crystal quartz wafers involves complex processes, precision engineering, and stringent quality standards, resulting in high costs. French producers face challenges in scaling production while keeping prices competitive with Asian suppliers. The capital-intensive nature of wafer production makes it difficult for smaller firms to enter the market. High costs also limit adoption in emerging sectors like biotechnology, where cost-sensitive devices often compete with alternatives. Without economies of scale or advanced automation, production efficiency remains a critical challenge for market expansion.

Supply Chain Dependence and Raw Material Availability

The France quartz wafer market is challenged by supply chain dependencies, particularly on raw quartz materials and advanced equipment sourced internationally. Limited domestic sources of high-purity quartz create reliance on imports, exposing the market to price volatility and geopolitical risks. Any disruption in supply chains, such as trade restrictions or logistics bottlenecks, directly impacts wafer production. Furthermore, reliance on advanced processing equipment sourced from outside Europe increases vulnerability. Ensuring stable supply of raw materials and strengthening local production capabilities remain vital challenges for sustaining market growth.

Regional Analysis

North France

North France held the largest share of the single crystal quartz wafer market in 2024, accounting for nearly 29%. The region benefits from strong semiconductor clusters and research hubs, particularly in Lille and surrounding areas. Proximity to Belgium and Germany enhances trade and technology collaboration, supporting a robust supply chain for wafers. North France also serves as a key hub for electronics and automotive component manufacturers, driving demand for quartz wafers in semiconductor and MEMS applications. Investments in innovation parks and cross-border R&D programs further strengthen the region’s market position.

West France

West France accounted for approximately 18% of the market in 2024. The region’s growth is supported by its expanding biotechnology and healthcare industries, with Nantes and Rennes emerging as innovation centers. Demand for quartz wafers is increasing in diagnostic tools, biosensors, and biotechnology research facilities. The presence of academic institutions and biotech startups provides steady adoption, particularly for MEMS-based healthcare solutions. West France also benefits from proximity to Atlantic ports, facilitating import of raw materials and export of processed wafers. This balance of healthcare-driven demand and logistics advantages sustains the region’s market relevance.

Central France

Central France represented around 15% share of the market in 2024. The region’s wafer demand primarily arises from research institutions and specialized electronics producers. With cities like Orléans and Tours fostering advanced material research, Central France contributes significantly to innovation in quartz wafer applications. Although industrial-scale production is limited compared to North and South France, the region plays a key role in R&D for biotechnology and advanced sensors. Local initiatives to attract high-tech startups and develop research clusters are expected to gradually expand Central France’s contribution to the quartz wafer market.

South France

South France accounted for nearly 23% of the quartz wafer market in 2024, making it the second-largest region. The Grenoble technology cluster is a major growth driver, housing leading semiconductor research centers, wafer fabrication units, and MEMS innovation hubs. Strong government and EU-backed funding for semiconductor expansion supports South France’s leadership in R&D and production. The region’s ecosystem attracts global partnerships, particularly in automotive, aerospace, and renewable energy applications, where quartz wafers are widely used. Proximity to Mediterranean trade routes also supports raw material inflow and product export, strengthening its industrial base.

Eastern France

Eastern France held about 15% of the market in 2024. The region benefits from its strategic position near Germany and Switzerland, both key semiconductor and electronics markets. Eastern France specializes in precision engineering and advanced manufacturing, which supports adoption of quartz wafers in integrated circuit packaging and electronics. Universities and research institutions collaborate with industrial players to enhance wafer applications, particularly in photonics and advanced sensors. While not a dominant hub like North or South France, the region’s cross-border industrial collaboration ensures steady demand, positioning Eastern France as an important contributor to the national market.

Market Segmentations:

By Type

By Diameter

- Up to 4 inches

- 5 to 8 inches

- Above 8 inches

By Application

- MEMS and Electronics

- Semiconductors

- Biotechnology

- Integrated Circuit (IC) Packaging

- Others

By End User

- Electronics Manufacturers

- Semiconductor Foundries

- Research and Academic Institutions

By Geography

- North France

- West France

- Central France

- South France

- Eastern France

Competitive Landscape

The competitive landscape of the France single crystal quartz wafer market is defined by a mix of global leaders and regional players focusing on innovation, quality, and capacity expansion. Companies such as Corning Incorporated, MTI Corporation, and NIHON DEMPA KOGYO CO., LTD. dominate through advanced fabrication technologies, strong global supply chains, and diversified application portfolios. Local firms like Neyco and European suppliers such as MicroChemicals GmbH cater to niche segments, offering specialized solutions for MEMS, semiconductors, and biotechnology. UniversityWafer, Inc. and MSE Supplies LLC serve academic and R&D needs, strengthening research-driven demand. Meanwhile, Hoshine Silicon Industry Co. Ltd. and Vritra Technologies expand their footprint by targeting semiconductor and electronics applications in France. Intense competition revolves around wafer purity, diameter scalability, and production efficiency, with players heavily investing in R&D to align with EU semiconductor initiatives. Partnerships, joint ventures, and regional collaborations remain critical strategies to strengthen market share and technological capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Neyco

- Semiconductor Wafer, Inc.

- MTI Corporation

- Corning Incorporated

- Vritra Technologies

- MSE Supplies LLC

- MicroChemicals GmbH

- NIHON DEMPA KOGYO CO., LTD.

- Hoshine Silicon Industry Co. Ltd.

- UniversityWafer, Inc.

- Other Key Players

Recent Developments

- In July 2025, Xiamen Powerway (PAM-XIAMEN) remains an active supplier of single crystal quartz wafers, specializing in X-cut, Y-cut, Z-cut, and ST-cut orientations up to 3-inch diameters.

- In July 2025, NDK highlighted its advancement in mass-producing high-uniformity quartz crystals using proprietary technologies. Their latest offering includes synthetic quartz wafers with AT-cut and tuning fork wafers, and a development plan for larger 6-inch wafers to cater to growing SAW device demand and frequency control in next-gen electronics.

- In August 2024, NDK (NIHON DEMPA KOGYO CO., LTD.) showcased its synthetic quartz crystals and quartz wafers for timing and optical applications at electronica India 2024, participating through a distributor’s booth at the trade fair.

Report Coverage

The research report offers an in-depth analysis based on Type, Diameter, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with strong demand from semiconductor manufacturing.

- Seeded wafers will continue dominating due to their precision and performance advantages.

- Larger diameter wafers will gain adoption, especially in advanced IC packaging.

- MEMS applications will expand with rising use in automotive and healthcare devices.

- Biotechnology adoption of quartz wafers will increase in diagnostics and biosensors.

- Regional clusters in North and South France will drive production and innovation.

- Companies will focus on R&D to improve wafer purity and scalability.

- Strategic collaborations and EU-backed initiatives will strengthen local supply chains.

- High production costs will push firms toward automation and efficiency upgrades.

- Growing integration with emerging technologies like photonics and quantum computing will create new opportunities.