Market Overview:

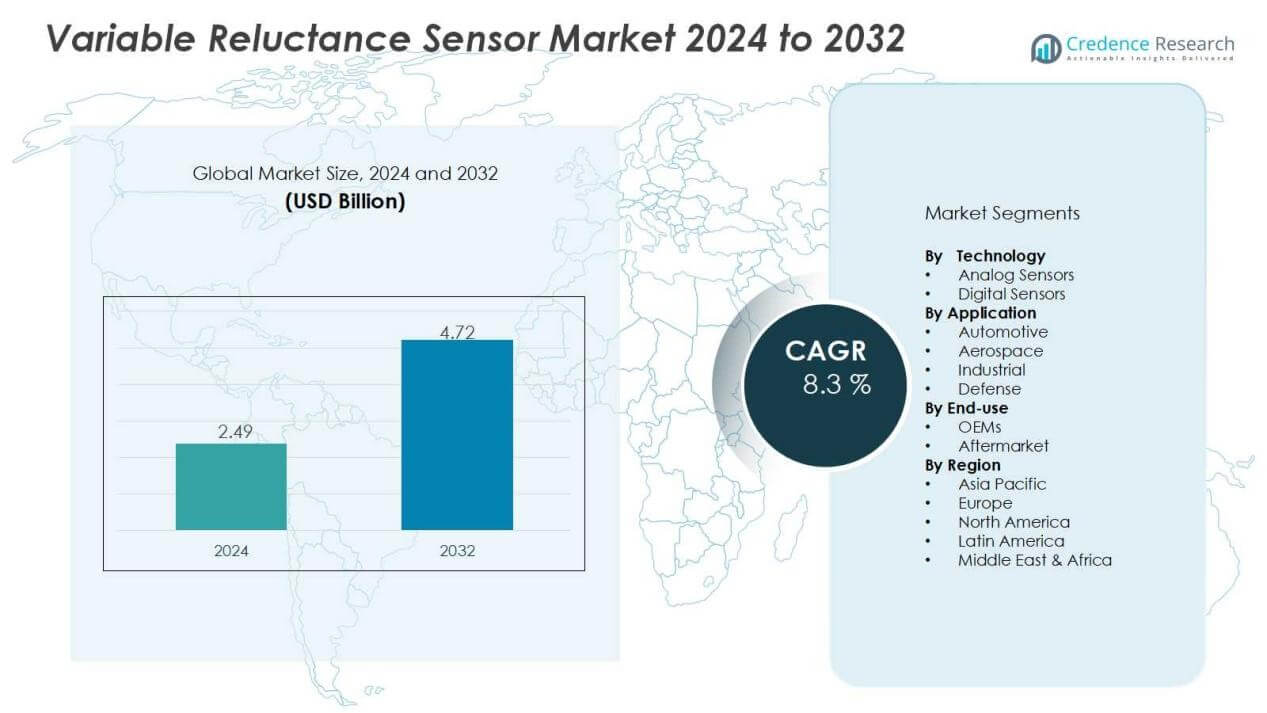

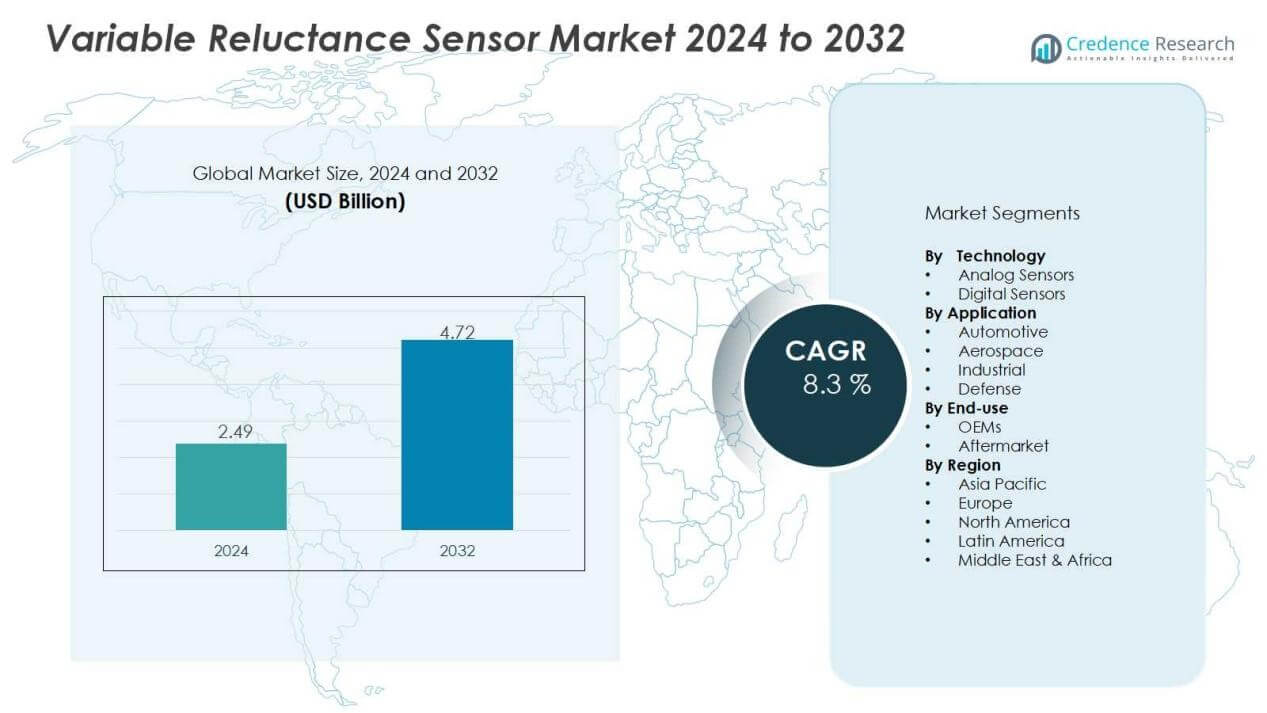

The variable reluctance sensor market size was valued at USD 2.49 billion in 2024 and is anticipated to reach USD 4.72 billion by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Variable Reluctance Sensor Market Size 2024 |

USD 2.49 Billion |

| Variable Reluctance Sensor Market, CAGR |

8.3% |

| Variable Reluctance Sensor Market Size 2032 |

USD 4.72 Billion |

Key market drivers include the growing automotive industry, particularly the integration of variable reluctance sensors in anti-lock braking systems (ABS) and engine management. Industrial automation is also boosting demand, as sensors play a critical role in process monitoring and predictive maintenance. Furthermore, the aerospace sector leverages these sensors for precise measurement and safety-critical applications. Continuous technological improvements in sensor accuracy, durability, and miniaturization strengthen adoption across end-user industries.

Regionally, North America holds a significant market share, supported by strong automotive manufacturing and early adoption of sensor technologies. Europe follows closely, driven by stringent vehicle safety regulations and advanced industrial infrastructure. Asia-Pacific is expected to record the fastest growth due to rapid automotive production, expanding industrial automation, and rising investments in sensor technologies across China, India, and Japan. Emerging regions, including Latin America and the Middle East & Africa, present gradual opportunities with improving industrialization and automotive demand.

Market Insights:

- The variable reluctance sensor market was valued at USD 49 billion in 2024 and is projected to reach USD 4.72 billion by 2032 at a CAGR of 8.3%.

- Strong demand from the automotive sector, especially in ABS, engine control, and transmission systems, drives consistent adoption.

- Industrial automation boosts demand, as sensors enable predictive maintenance, reduce downtime, and support machinery efficiency.

- The aerospace and defense sectors use these sensors for turbine speed monitoring, navigation, and mission-critical systems.

- Technological advances in sensitivity, durability, and miniaturization expand applications and build trust among end users.

- Competition from Hall-effect and magnetoresistive sensors poses a challenge, pressuring manufacturers to focus on innovation and cost.

- North America led with 36% share in 2024, while Asia-Pacific is expected to witness the fastest growth through rising automotive production and industrial automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand in Automotive Applications Boosting Market Growth:

The variable reluctance sensor market is strongly supported by the expanding automotive industry. These sensors are widely used in anti-lock braking systems, engine control units, and transmission systems. Automakers are adopting them to meet safety and performance requirements set by regulators. It helps improve efficiency in fuel management and vehicle stability. Growing vehicle production worldwide ensures consistent demand.

- For Instance, Continental unveiled its inductive eRPS rotor position sensor, which was engineered to deliver ±0.5° accuracy at speeds of up to 24,000 rpm.

Increasing Role in Industrial Automation and Machinery Efficiency:

Industrial automation is driving higher adoption of variable reluctance sensors across factories and manufacturing plants. These sensors enable accurate measurement of speed, torque, and vibration in heavy machinery. It supports predictive maintenance strategies, reducing downtime and operating costs. Industries focused on productivity improvements are turning to reliable sensor solutions. Their versatility across multiple applications creates strong opportunities in the industrial sector.

- For instance, in June 2021 Bosch Rexroth deployed its HDD1 variable reluctance speed sensor across automotive stamping lines, enabling rotational speed measurement from 0.1 Hz to 20 000 Hz.

Expanding Aerospace and Defense Applications Strengthening Adoption:

The variable reluctance sensor market benefits from rising aerospace and defense investments. Aircraft systems rely on these sensors for monitoring turbine speed, engine control, and navigation systems. It provides high accuracy in harsh conditions, making the technology vital for mission-critical operations. Defense organizations prioritize reliable sensors that withstand extreme environments. Growing aircraft production and modernization programs support adoption in this sector.

Advancements in Sensor Technology Enhancing Performance and Reliability:

Ongoing innovation is improving the design and performance of variable reluctance sensors. Manufacturers focus on increasing sensitivity, reducing noise, and extending durability. It strengthens trust among end users, particularly in safety-critical environments. Miniaturization and integration with digital control systems are expanding application possibilities. These technological advancements position the market for long-term growth.

Market Trends:

Growing Integration with Advanced Automotive and Industrial Systems:

The variable reluctance sensor market is witnessing a trend of deeper integration into modern automotive and industrial systems. Automakers rely on these sensors to support advanced safety features and improve fuel efficiency. It is also used in electric and hybrid vehicles for monitoring motor performance and energy management. Industrial sectors adopt these sensors to align with Industry 4.0, where real-time monitoring and predictive maintenance are essential. The focus on efficiency, safety, and reliability strengthens the role of these sensors across multiple sectors. Manufacturers continue to expand design options to meet specific performance and regulatory requirements.

- For instance, Continental has developed its e-Motor Rotor Temperature Sensor (eRTS) technology that reduces temperature measurement tolerance from 15°C to just 3°C in electric vehicle motors, enabling manufacturers to reduce rare earth element usage while maintaining magnet heat resistance.

Rising Focus on Miniaturization, Durability, and Digital Connectivity:

Technology advancements are reshaping how variable reluctance sensors perform in demanding environments. Miniaturized designs allow integration into compact systems without compromising accuracy. It also ensures reliability in harsh conditions such as extreme temperatures and vibrations. Manufacturers emphasize materials and designs that extend sensor lifespan and reduce maintenance needs. Integration with digital platforms supports real-time data processing and connectivity with broader control systems. This trend aligns with the growing demand for smart solutions across automotive, aerospace, and industrial markets. The expansion of connected and durable sensors strengthens the long-term outlook for adoption.

- For instance, TE Connectivity’s DSE 1610.15 AHZ variable reluctance speed sensor incorporates a 3 mm pole-piece diameter within an M16×1.5 housing, delivers an inductance of 50 mH at 1 kHz ±10%, and supports output signal frequencies up to 30 kHz, enabling seamless integration into space-constrained, high-speed control systems.

Market Challenges Analysis:

High Competition from Alternative Sensor Technologies Limiting Growth:

The variable reluctance sensor market faces strong competition from newer sensor technologies such as Hall-effect and magnetoresistive sensors. These alternatives often provide higher accuracy, better signal stability, and lower susceptibility to noise. It creates a challenge for manufacturers to maintain relevance in advanced applications where precision is critical. Automotive and aerospace sectors are gradually shifting toward digital and solid-state solutions. The presence of cost-effective alternatives may reduce the adoption rate of variable reluctance sensors in high-end systems. Companies must focus on innovation and cost optimization to counter competitive pressure.

Performance Limitations and Maintenance Requirements Creating Barriers:

The technology behind variable reluctance sensors can face issues in environments requiring high sensitivity and real-time accuracy. It is prone to signal distortions in low-speed or fluctuating conditions, which limits use in critical systems. Maintenance costs also rise when sensors operate in harsh environments with vibrations, dust, or extreme temperatures. Industrial users often demand longer lifespan and reduced calibration needs, which can challenge this sensor type. Limited adaptability in emerging smart systems creates further obstacles for market penetration. Overcoming these barriers requires advances in design, materials, and integration strategies.

Market Opportunities:

Expanding Applications in Electric Vehicles and Smart Mobility:

The variable reluctance sensor market holds strong opportunities in the transition toward electric and hybrid vehicles. Automakers seek efficient sensors for motor speed monitoring, regenerative braking, and energy optimization. It delivers durability and cost-effectiveness, making it suitable for large-scale adoption in evolving mobility systems. Growing investment in autonomous and connected vehicles also increases the need for accurate sensing technologies. Governments supporting electrification create a favorable environment for sensor integration. This shift in automotive design opens new avenues for revenue growth and product innovation.

Increasing Demand in Industrial Automation and Aerospace Systems:

Industrial modernization creates strong prospects for variable reluctance sensors across manufacturing and automation processes. These sensors provide essential input for predictive maintenance, efficiency tracking, and real-time monitoring of heavy machinery. It ensures reliability in critical operations, aligning with the global trend of Industry 4.0 adoption. Aerospace and defense sectors also present rising opportunities with demand for durable sensors in turbine monitoring and navigation systems. Expansion in smart factories and advanced aircraft programs strengthens the long-term growth potential. Companies focusing on high-performance designs can capture significant opportunities across these industries.

Market Segmentation Analysis:

By Technology:

The variable reluctance sensor market is segmented by technology into analog and digital sensors. Analog sensors remain widely used in traditional automotive and industrial applications due to their cost-effectiveness and durability. It offers reliable performance where basic speed and position detection is required. Digital sensors are gaining traction with advanced features, higher precision, and integration with control systems. Industries adopting automation and smart technologies prefer digital formats for enhanced functionality. This balance between traditional and modern technologies ensures steady demand across end users.

- For Instance, TE Connectivity’s E38S analog VR sensor features an inductance of 170 mH at 1 kHz and a resistance of 850 Ω ±10% at ambient temperature. It supports accurate speed detection under varying air-gap conditions.

By Application:

The variable reluctance sensor market finds application in automotive, aerospace, industrial, and defense sectors. Automotive leads adoption, driven by requirements for anti-lock braking systems, transmission monitoring, and engine control. It supports efficiency and safety standards demanded by regulators and manufacturers. Aerospace and defense also rely on these sensors for turbine speed monitoring and navigation systems. Industrial applications include machinery monitoring and predictive maintenance, aligning with global automation trends. Broad adoption across diverse applications enhances the resilience of this market.

- For instance, National Instruments’ myRIO system paired with the Jaquet ATS-1 DSE 1010 sensor measured turbocharger shaft speeds up to 400 000 rpm.

By End Use:

The variable reluctance sensor market is classified by end use into OEMs and aftermarket. OEMs hold a dominant position due to integration in new vehicles, aircraft, and machinery systems. It ensures reliable adoption through partnerships between manufacturers and sensor providers. The aftermarket segment grows steadily with demand for replacements and upgrades in existing systems. Strong focus on performance and compliance drives preference for quality aftermarket solutions. Together, these segments sustain long-term opportunities across industries.

Segmentations:

By Technology:

- Analog Sensors

- Digital Sensors

By Application:

- Automotive

- Aerospace

- Industrial

- Defense

By End Use:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America held 36% share of the variable reluctance sensor market in 2024, supported by advanced manufacturing ecosystems and high automotive production. The United States remains the largest contributor, driven by strict safety regulations and strong adoption in anti-lock braking systems. It benefits from a mature industrial base where automation and predictive maintenance are widely implemented. Leading aerospace programs in the region further accelerate sensor demand for high-performance applications. Continuous investment in research and development strengthens the competitive positioning of manufacturers. Strong collaboration between automotive OEMs and sensor suppliers sustains growth momentum in this region.

Europe:

Europe accounted for 28% share of the variable reluctance sensor market in 2024, driven by stringent emission norms and robust automotive industries. Germany, France, and the United Kingdom lead adoption, with emphasis on advanced vehicle systems and electrification. It is supported by established aerospace infrastructure where sensors play a critical role in navigation and turbine monitoring. The region also benefits from Industry 4.0 initiatives that integrate advanced sensing solutions into production systems. European manufacturers invest heavily in innovation to improve durability and accuracy. Rising demand for sustainable mobility solutions continues to strengthen market prospects.

Asia-Pacific:

Asia-Pacific captured 24% share of the variable reluctance sensor market in 2024, fueled by rapid growth in automotive and industrial sectors. China, India, and Japan are at the forefront, supported by expanding vehicle production and rising adoption of automation technologies. It is also driven by government policies that encourage domestic manufacturing and innovation in smart mobility. Aerospace and defense programs across the region create further opportunities for advanced sensors. Increasing investment in electric vehicles and smart factories strengthens long-term growth potential. Local and international players are expanding presence to capitalize on this momentum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The variable reluctance sensor market is characterized by strong competition among global and regional players. Key companies include Shinano Kenshi Co., Ltd., NIDEC CORPORATION, MinebeaMitsumi Inc., MOONS, ORIENTAL MOTOR USA CORP., and TAMAGAWA SEIKI Co., Ltd. It is shaped by continuous investment in product innovation, miniaturization, and performance improvements to meet diverse industry demands. Companies strengthen portfolios by focusing on durability, precision, and integration with digital systems. Strategic partnerships with automotive OEMs and industrial manufacturers help expand customer reach. Aerospace and defense contracts also provide growth opportunities for suppliers delivering sensors capable of withstanding harsh environments. Competitive pressure drives firms to balance cost-efficiency with advanced features, ensuring relevance in both developed and emerging markets.

Recent Developments:

- In July 2025, Nidec realigned its battery supply strategy and acquired 100% of Nidec Energy AS (NEAS) in support of expanding Battery Energy Storage Systems in North America and Europe.

- In July 2025, MinebeaMitsumi entered a partnership agreement with Fukuroi City, Shizuoka Prefecture, to develop smart city technologies using MinebeaMitsumi’s digital and smart lighting solutions

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The variable reluctance sensor market will expand with strong demand from automotive safety systems.

- It will gain traction in electric and hybrid vehicles as manufacturers seek reliable motor monitoring.

- The market will benefit from industrial automation where predictive maintenance depends on precise sensing.

- It will strengthen its role in aerospace and defense applications requiring durability in harsh conditions.

- Manufacturers will invest in miniaturization and integration with digital platforms to improve usability.

- It will see rising opportunities in smart factories driven by Industry 4.0 adoption worldwide.

- The market will face pressure to compete with advanced alternatives but retain strength through cost-effectiveness.

- It will expand geographically as Asia-Pacific leads growth supported by vehicle production and automation.

- The market will evolve with demand for sustainable solutions aligning with global electrification trends.

- It will attract investments in research and partnerships to deliver next-generation sensing technologies.