Market overview

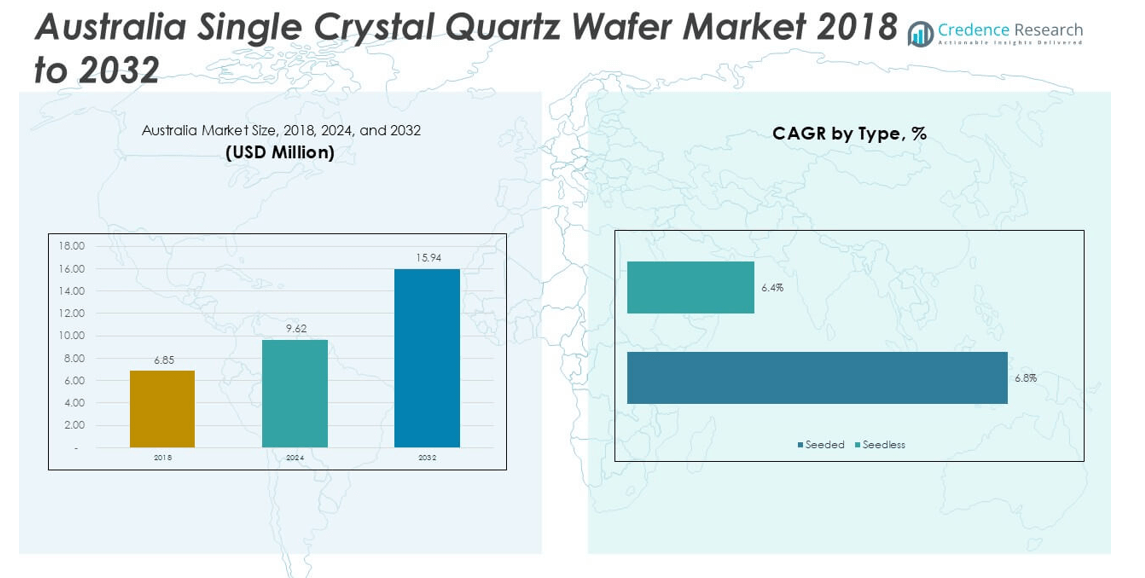

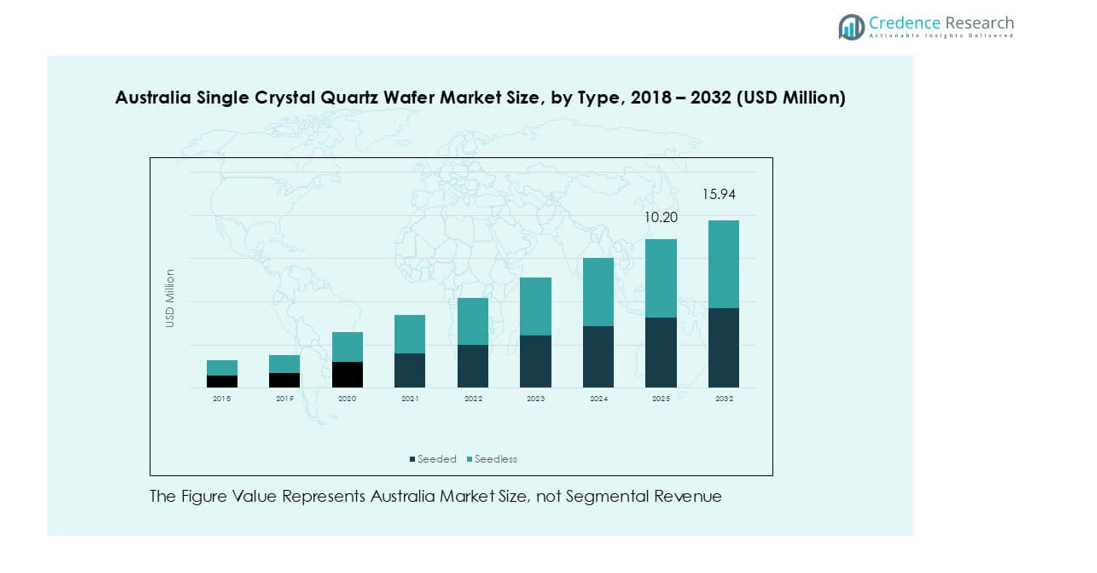

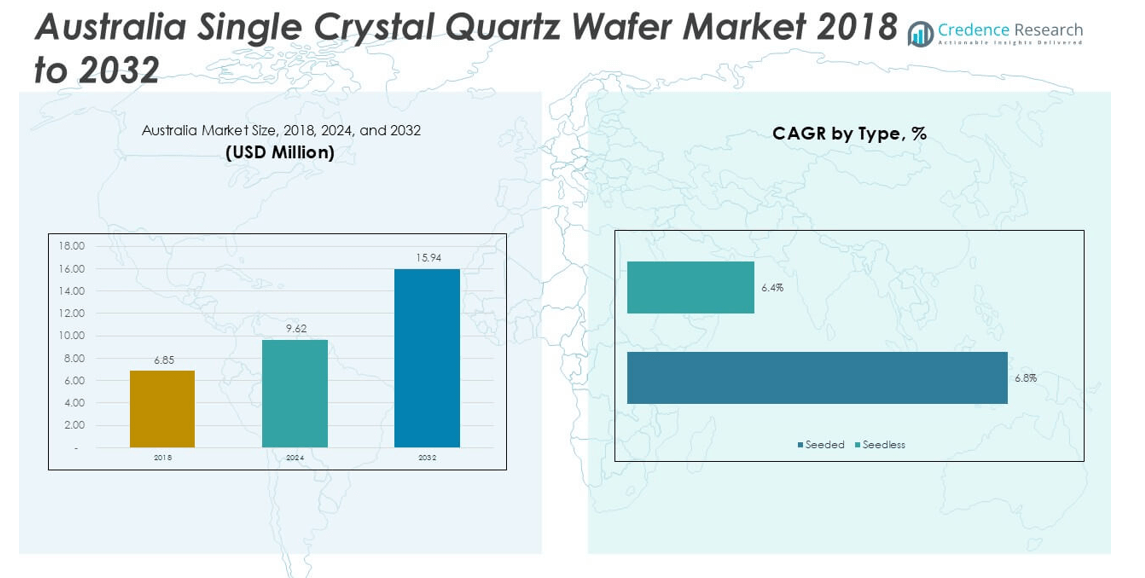

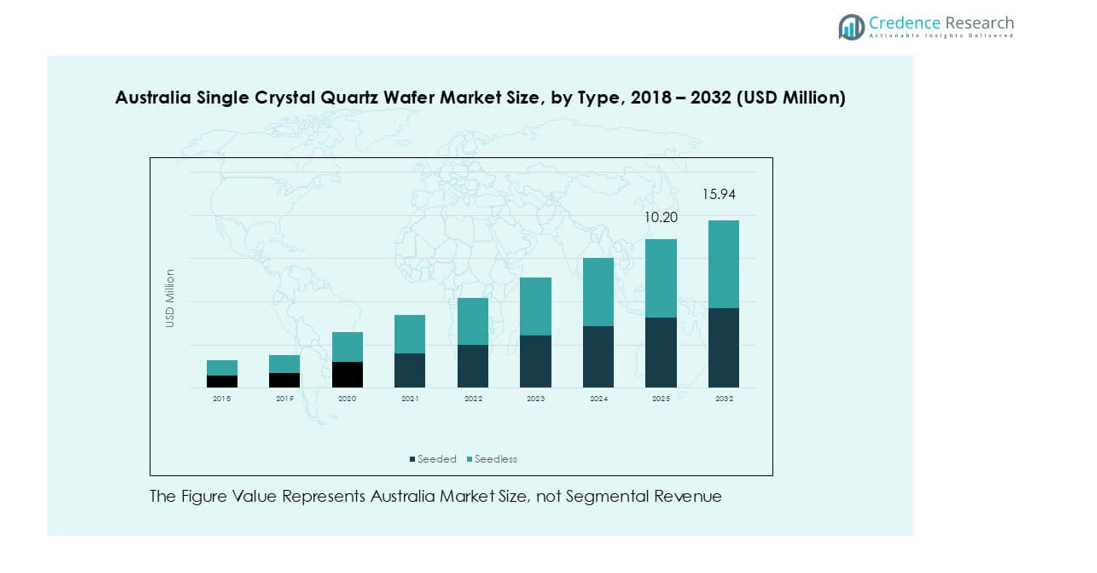

Australia Single Crystal Quartz Wafer market size was valued at USD 6.85 million in 2018, reached USD 9.62 million in 2024, and is anticipated to reach USD 15.94 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Single Crystal Quartz Wafer Market Size 2025 |

USD 9.62 million |

| Australia Single Crystal Quartz Wafer Market, CAGR |

6.8% |

| Australia Single Crystal Quartz Wafer Market Size 2032 |

USD 15.94 million |

The Australia single crystal quartz wafer market is shaped by leading players such as Jiaxing AOSITE Photonics Technology Co., Ltd., Semiconductor Wafer, Inc., MTI Corporation, Hangzhou Freqcontrol Electronic Technology Ltd., Ferrotec Global, MicroChemicals GmbH, NIHON DEMPA KOGYO CO., LTD., MSE Supplies Inc., and UniversityWafer, Inc. These companies compete through product quality, innovation, and partnerships with local distributors and research institutions. Regionally, New South Wales (NSW) leads the market with over 35% share in 2024, supported by its strong semiconductor research base, advanced electronics manufacturing, and government-backed innovation programs. Victoria follows with about 25% share, driven by biotechnology, healthcare, and renewable energy applications. Together, these regions account for over 60% of national demand, reinforcing their dominance in shaping Australia’s quartz wafer market landscape.

Market Insights

- The Australia single crystal quartz wafer market was valued at USD 9.62 million in 2024 and is projected to reach USD 15.94 million by 2032, growing at a CAGR of 6.8% during the forecast period.

- Strong demand from the semiconductor industry drives growth, supported by quartz wafers’ high purity, thermal stability, and reliability in advanced electronics and MEMS applications.

- Key trends include rising adoption of larger wafer diameters above 8 inches, expanding use in biotechnology and healthcare innovations, and opportunities in renewable energy and optoelectronics applications.

- The competitive landscape features global players such as Jiaxing AOSITE Photonics Technology, Semiconductor Wafer Inc., Ferrotec Global, and NIHON DEMPA KOGYO CO., LTD., focusing on product innovation, cost optimization, and strategic collaborations.

- Regionally, New South Wales leads with over 35% share, followed by Victoria at 25%, while by segment, semiconductors dominate with over 40% share, reinforcing their critical role in market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

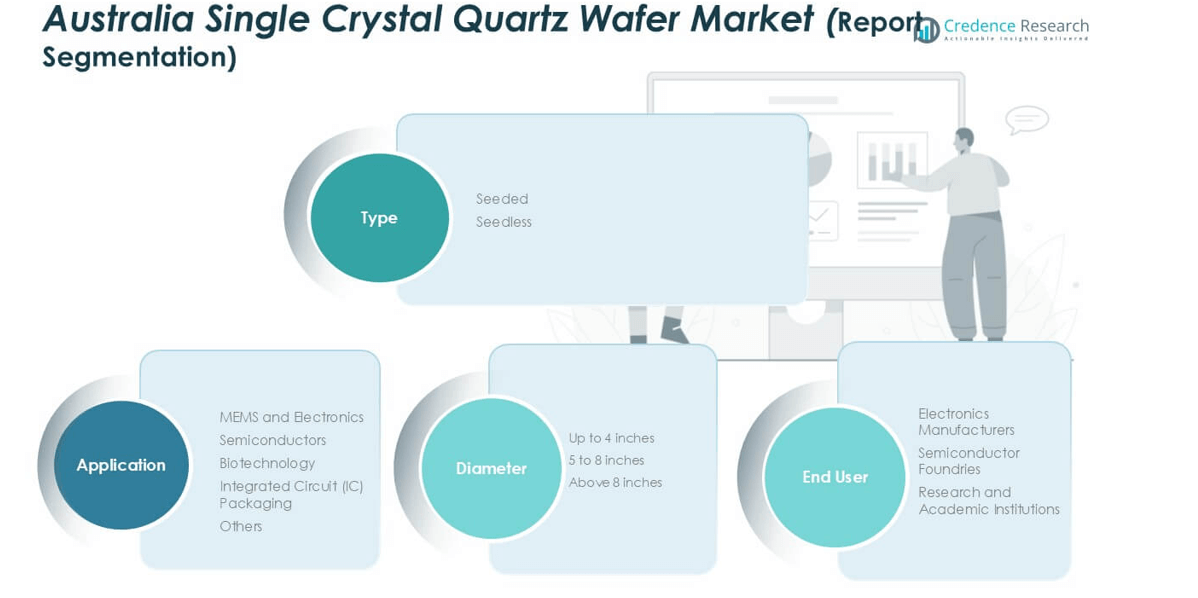

By Type

The seeded segment dominated the Australia single crystal quartz wafer market in 2024, accounting for over 65% share. Seeded wafers are preferred due to their superior structural integrity, controlled crystal orientation, and consistent quality, which are essential in semiconductor and MEMS production. Their high adoption stems from established manufacturing practices and ability to support large-scale fabrication processes. The seedless type holds a smaller share, primarily used in niche applications where defect-free crystal growth is required, but limited scalability and higher production costs restrict broader market penetration.

- For instance, Shin-Etsu Chemical produces quartz wafers with diameters up to 200 mm for high-temperature semiconductor processing applications. The number of semiconductor chips produced per wafer is dependent on the size of the individual chip.

By Diameter

Quartz wafers with diameters of 5 to 8 inches led the market in 2024, holding around 55% share. This segment benefits from strong demand in semiconductor and electronics manufacturing, where mid-range wafer sizes balance cost-efficiency and performance. Larger diameters, such as above 8 inches, are gaining traction due to their role in advanced semiconductor devices, but their higher production complexity slows adoption. Smaller wafers, up to 4 inches, remain relevant in research, prototyping, and specialized electronics applications, though their commercial demand is relatively limited compared to mid-sized wafers.

- For instance, Heraeus Covantics (formerly Heraeus Quarzglas) produces high-purity quartz and fused silica components, such as process tubes, windows, and liners, for the equipment used to manufacture 12-inch wafers. These components are crucial for enabling next-generation power semiconductor production on standard silicon (Si) wafers, though some power devices are now being manufactured on other materials like silicon carbide (SiC).

By Application

The semiconductor segment captured the largest share of over 40% in 2024, driven by Australia’s growing focus on microelectronics and chip fabrication. Single crystal quartz wafers play a vital role in producing high-performance semiconductor devices, benefiting from rising demand in consumer electronics, automotive electronics, and communication technologies. MEMS and electronics also form a strong sub-segment, fueled by applications in sensors and precision instruments. Biotechnology and integrated circuit packaging contribute steadily, though their shares remain smaller, with growth linked to emerging healthcare applications and miniaturization in IC packaging technologies.

Key Growth Drivers

Rising Demand from Semiconductor Industry

The semiconductor sector is the primary growth driver for Australia’s single crystal quartz wafer market, holding significant influence on consumption volumes. Quartz wafers are indispensable in semiconductor manufacturing due to their thermal stability, high purity, and ability to maintain structural integrity under extreme conditions. The growing demand for advanced microchips used in consumer electronics, automotive electronics, and industrial automation has accelerated the adoption of these wafers. Australia’s semiconductor industry is also aligning with global supply chain expansion, supporting local wafer consumption. With global semiconductor sales expected to grow steadily, the demand for reliable substrates like quartz wafers continues to rise. This positions the semiconductor segment as a long-term anchor for market expansion, especially as investments in chip fabrication and microelectronics production increase across Asia-Pacific.

- For instance, Taiwan Semiconductor Manufacturing Company (TSMC) produced a total of 12.9 million 12-inch equivalent wafers in 2024, many requiring high-purity quartz substrates for lithography and etching processes.

Expansion of MEMS and Electronics Applications

Micro-electromechanical systems (MEMS) and electronic components represent another key growth driver for the Australia single crystal quartz wafer market. These wafers are extensively used in sensors, oscillators, and precision instruments, making them essential in automotive, aerospace, and telecommunications applications. The increasing adoption of MEMS in smartphones, wearable devices, and connected technologies has further boosted demand. Quartz wafers offer superior piezoelectric properties that make them ideal for frequency control and signal processing devices, strengthening their role in MEMS. Australia’s growing adoption of smart devices and IoT-enabled solutions provides a steady growth platform for this segment. The push for advanced sensor technologies in healthcare and defense industries also supports rising demand. With continuous miniaturization trends in electronics, quartz wafers are likely to remain critical in supporting the high precision and durability requirements of modern MEMS-based devices.

- For instance, Bosch Sensortec shipped over 1 billion MEMS sensors featuring integrated microcontrollers and software in 2024. In general, Bosch Sensortec’s consumer-grade accelerometers and gyroscopes utilize standard silicon-based technology with capacitive detection, not quartz-based resonators.

Growth in Biotechnology and Healthcare Innovations

The biotechnology sector is emerging as a niche yet powerful driver for the Australia single crystal quartz wafer market. Quartz wafers are used in medical diagnostic systems, biosensors, and lab-on-chip devices due to their chemical inertness and stability. The growth of personalized medicine, point-of-care diagnostics, and advanced research applications has accelerated the integration of quartz wafers in biotech solutions. Australia’s focus on strengthening healthcare research infrastructure and increasing R&D investments supports this growth trajectory. Demand for high-performance substrates in biomedical devices, including DNA sequencing and microfluidic platforms, further underpins the segment’s relevance. The COVID-19 pandemic has also spurred greater interest in diagnostics and healthcare innovation, indirectly supporting quartz wafer adoption. As biotechnology companies in Australia and the wider Asia-Pacific region scale their research and production, quartz wafers are expected to play an expanding role in supporting innovation across diagnostic and therapeutic technologies.

Key Trends & Opportunities

Increasing Adoption of Larger Diameter Wafers

A major trend in the Australia single crystal quartz wafer market is the shift toward larger wafer diameters, particularly those above 8 inches. Larger wafers allow manufacturers to produce more chips per substrate, thereby improving cost-efficiency and productivity. While adoption remains limited by production complexities and higher costs, the trend is gaining traction in advanced semiconductor and electronics applications. As chip demand for data centers, AI, and 5G networks expands, the use of larger wafers offers clear opportunities for scaling production. Australia, benefiting from regional semiconductor investments, is well positioned to adopt these technologies in alignment with global manufacturing shifts.

- For instance, Intel operates 300 mm (12-inch) wafer fabs in Oregon and Ireland, each capable of processing over 40,000 wafers per month, supporting AI and high-performance computing chips.

Opportunities in Renewable Energy and Optoelectronics

Renewable energy and optoelectronics are emerging as new avenues for quartz wafer applications. Their use in solar technologies, photonic devices, and LED manufacturing presents growth opportunities for Australian producers and suppliers. The country’s commitment to renewable energy adoption and decarbonization targets strengthens the potential demand for quartz wafers in photovoltaic and optoelectronic systems. These applications require substrates with excellent transparency, stability, and precision, making quartz wafers highly suitable. Companies tapping into these emerging segments can diversify their revenue streams while supporting Australia’s broader sustainability agenda.

Key Challenges

High Manufacturing and Processing Costs

One of the main challenges in the Australia single crystal quartz wafer market is the high cost of production. Quartz wafer fabrication involves advanced processing techniques, stringent purity requirements, and significant capital investment in specialized equipment. These costs limit scalability and restrict adoption among smaller players. Additionally, the cost-sensitive nature of downstream industries like MEMS and semiconductors creates pressure on suppliers to maintain competitive pricing while ensuring product quality. The inability to achieve cost reductions at scale poses a barrier to broader market penetration and profitability, especially when competing with lower-cost international producers.

Limited Local Supply Chain and Dependence on Imports

Australia faces supply chain constraints in meeting the demand for single crystal quartz wafers due to limited domestic production capabilities. The market heavily relies on imports from established suppliers in Asia-Pacific and Europe, which exposes it to global price fluctuations and logistics challenges. Dependence on imports also creates vulnerability to trade disruptions, shipping delays, and geopolitical risks. The lack of a robust local supply chain limits Australia’s ability to capitalize fully on the growing semiconductor and electronics industries. Developing domestic manufacturing capabilities remains a challenge, requiring long-term investment and government support to reduce reliance on international suppliers.

Regional Analysis

New South Wales (NSW)

New South Wales dominated the Australia single crystal quartz wafer market in 2024, holding over 35% share. The state benefits from its strong presence of semiconductor research facilities, advanced electronics manufacturing, and university-led R&D programs. Sydney’s technology ecosystem further supports the integration of quartz wafers in MEMS and semiconductor applications. With government initiatives promoting high-tech industries and innovation hubs, NSW remains the leading region for market adoption. The concentration of skilled workforce and partnerships between academia and industry strengthen its leadership, making it the central hub for wafer demand and innovation in Australia.

Victoria (VIC)

Victoria accounted for around 25% share of the Australia single crystal quartz wafer market in 2024. Melbourne’s expanding biotechnology and healthcare sector has significantly contributed to the use of quartz wafers in biosensors, diagnostics, and lab-on-chip devices. The region’s investment in medical research institutes and advanced manufacturing clusters enhances market growth opportunities. Victoria’s push toward renewable energy technologies and integration of advanced materials in photonics also supports demand. Strategic collaborations with global semiconductor and biotech players ensure that Victoria remains a competitive and fast-growing contributor to the overall market landscape in Australia.

Queensland (QLD)

Queensland represented close to 15% share of the single crystal quartz wafer market in 2024, supported by growth in industrial electronics and mining technology applications. Brisbane’s focus on advanced materials research and the region’s growing renewable energy sector drive additional demand for quartz wafers in photovoltaic and optoelectronic systems. Government-backed initiatives to diversify Queensland’s economy beyond mining have created opportunities in advanced manufacturing and high-tech industries. The state’s research institutions continue to foster innovation in MEMS-based devices and semiconductor technologies, reinforcing Queensland’s position as a steadily growing region in the national wafer market.

Western Australia (WA)

Western Australia held about 13% share of the Australia single crystal quartz wafer market in 2024. The region’s demand is driven primarily by mining automation, defense electronics, and niche MEMS applications. WA’s strong focus on defense technology projects and advanced industrial solutions supports quartz wafer integration in specialized electronics. While it lacks the extensive R&D base of NSW or Victoria, investments in industrial innovation and collaborations with national research bodies help sustain its growth. WA’s growing interest in renewable energy and smart infrastructure further positions the state as a contributor to emerging applications within the wafer market.

South Australia (SA)

South Australia contributed roughly 12% share to the Australia single crystal quartz wafer market in 2024. The state has carved out a role in defense manufacturing and aerospace technology, driving demand for MEMS sensors and high-performance semiconductor devices. Adelaide’s innovation ecosystem, supported by defense contractors and aerospace projects, provides opportunities for quartz wafer use in specialized applications. The government’s support for advanced manufacturing, along with investments in research-driven industries, adds to the state’s steady market presence. Though smaller compared to NSW and Victoria, South Australia’s targeted strengths ensure its importance in niche and high-tech segments of the wafer market.

Market Segmentations:

By Type

By Diameter

- Up to 4 inches

- 5 to 8 inches

- Above 8 inches

By Application

- MEMS and Electronics

- Semiconductors

- Biotechnology

- Integrated Circuit (IC) Packaging

- Others

By End User

- Electronics Manufacturers

- Semiconductor Foundries

- Research and Academic Institutions

By Geography

- New South Wales (NSW)

- Victoria (VIC)

- Queensland (QLD)

- Western Australia (WA)

- South Australia (SA)

Competitive Landscape

The Australia single crystal quartz wafer market features a moderately fragmented competitive landscape, with participation from global suppliers, regional distributors, and specialized technology providers. Key companies such as Jiaxing AOSITE Photonics Technology Co., Ltd., Semiconductor Wafer, Inc., MTI Corporation, and Ferrotec Global maintain a strong presence by offering high-quality wafers tailored for semiconductor, MEMS, and biotechnology applications. Players like MicroChemicals GmbH, NIHON DEMPA KOGYO CO., LTD., and UniversityWafer, Inc. contribute by supplying research-grade wafers to universities and R&D institutions, supporting innovation. Competitive strategies focus on expanding product portfolios, advancing wafer diameter capabilities, and improving purity standards to align with the growing needs of semiconductor and electronics industries. Recent developments emphasize partnerships with local distributors and collaborations with research institutions to strengthen regional reach. The market also witnesses increasing emphasis on cost optimization and technological advancements, enabling players to address demand for larger wafers and high-performance substrates across diverse end-use sectors in Australia.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Xiamen Powerway (PAM-XIAMEN) remains an active supplier of single crystal quartz wafers, specializing in X-cut, Y-cut, Z-cut, and ST-cut orientations up to 3-inch diameters.

- In July 2025, NDK highlighted its advancement in mass-producing high-uniformity quartz crystals using proprietary technologies. Their latest offering includes synthetic quartz wafers with AT-cut and tuning fork wafers, and a development plan for larger 6-inch wafers to cater to growing SAW device demand and frequency control in next-gen electronics.

- In August 2024, NDK (NIHON DEMPA KOGYO CO., LTD.) showcased its synthetic quartz crystals and quartz wafers for timing and optical applications at electronica India 2024, participating through a distributor’s booth at the trade fair.

Report Coverage

The research report offers an in-depth analysis based on Type, Diameter, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by rising semiconductor and MEMS applications.

- Demand for larger wafer diameters will increase to support advanced chip production.

- Biotechnology and healthcare will create new opportunities for quartz wafer integration.

- Local collaborations between research institutions and global suppliers will strengthen innovation.

- Growing adoption of IoT and smart devices will fuel MEMS-based wafer demand.

- Renewable energy and optoelectronics applications will open additional growth avenues.

- Competition will intensify as players invest in high-purity and defect-free wafer production.

- Import dependence may decline gradually with efforts to build domestic supply chains.

- New South Wales and Victoria will continue to lead regional consumption and growth.

- Continuous miniaturization in electronics will ensure long-term relevance of quartz wafers.