Market Overview

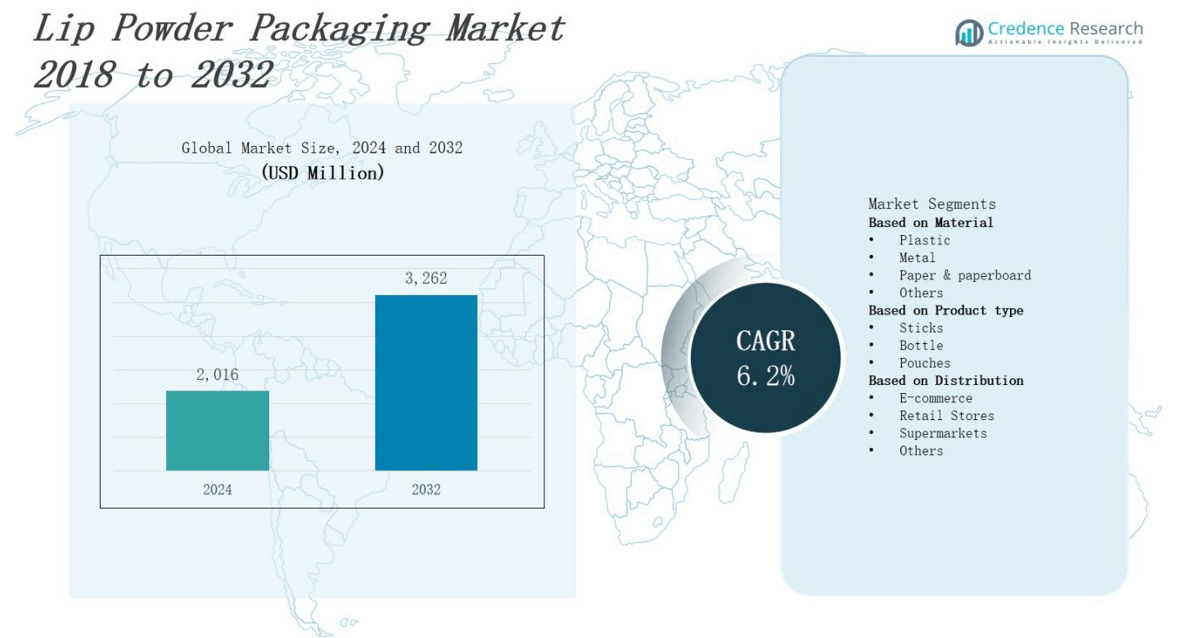

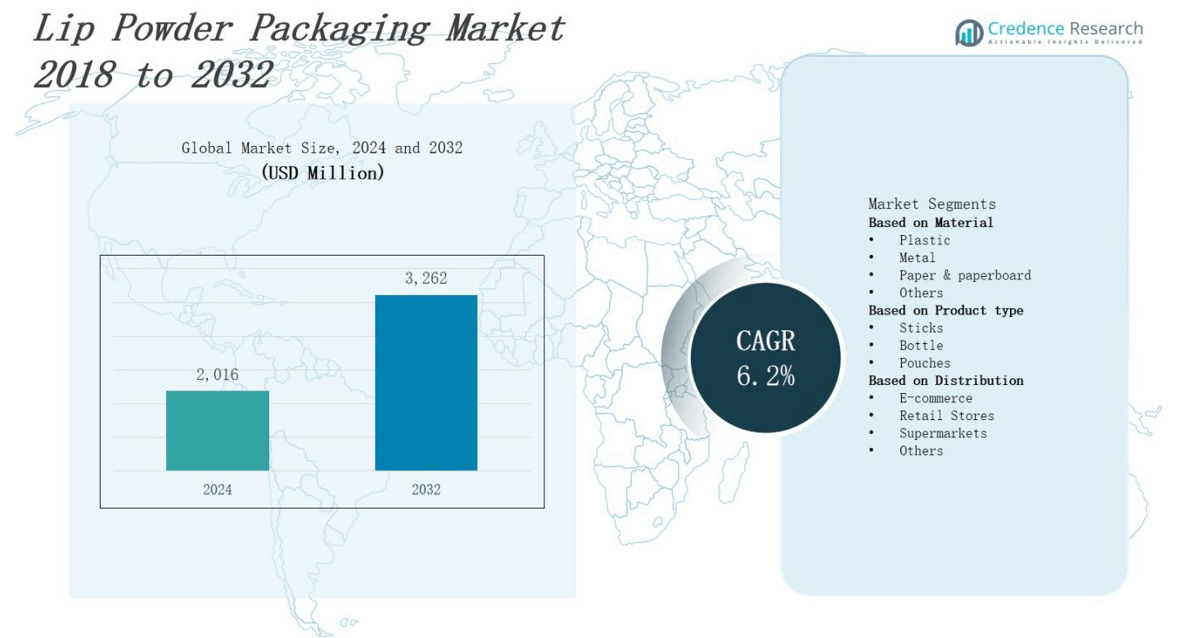

The lip powder packaging market is projected to grow from USD 2,016 million in 2024 to USD 3,262 million by 2032 at a CAGR of 6.2%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lip Powder Packaging Marke Size 2024 |

USD 2,016 million |

| Lip Powder Packaging Marke, CAGR |

6.2% |

| Lip Powder Packaging Marke Size 2032 |

USD 3,262 million |

Rising demand for compact, premium cosmetics drives the lip powder packaging market as beauty brands seek innovative formats that enhance portability and shelf appeal. Sustainable materials such as recyclable plastics and biodegradable composites gain traction under tightening environmental regulations. Brands adopt molded pulp, mono‑material structures, and refillable formats to reduce waste and support circular economy goals. Rapid growth in e‑commerce and social media influence stimulates demand for visually striking, digitally printable packaging that ensures brand differentiation. Advanced barrier coatings and airtight closures preserve product integrity, while anti‑counterfeit features and QR‑code integration improve consumer trust and supply chain transparency.

The lip powder packaging market spans North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. It attains 30% share in North America through premium brands such as L’Oréal, CHANEL, and Revlon. Europe emphasizes sustainable formats championed by Sephora and Kindu Packaging. Asia Pacific growth relies on high‑volume production by Accupac and The Packaging Company. Latin America adopts refillable and modular designs from local firms, while Middle East & Africa explores eco‑friendly materials via partnerships between Buxom and regional suppliers. Leading companies pursue innovation to capture market needs.

Market Insights

- The lip powder packaging market will grow from USD 2,016 million in 2024 to USD 3,262 million by 2032 at a CAGR of 6.2%.

- Demand for compact, premium cosmetics drives packaging that enhances portability and shelf appeal.

- Adoption of recyclable plastics, biodegradable composites, molded pulp, mono‑material structures, and refillable formats reduces waste and meets tightening environmental regulations.

- E‑commerce expansion and social media influence fuel demand for visually striking, digitally printable designs.

- Advanced barrier coatings, airtight closures, anti‑counterfeit features, and QR‑code integration preserve product integrity and boost consumer trust.

- Integration of smart elements like NFC tags and embedded sensors enables real‑time tracking and user engagement.

- North America leads with 30% share, followed by Asia Pacific (28%), Europe (25%), Latin America (10%), and Middle East & Africa (7%), driven by premium brands and local manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Sustainable material adoption accelerates eco-friendly solutions

The lip powder packaging market adoption of recyclable plastics and biodegradable composites expands under environmental policies. It drives manufacturers to innovate with molded pulp and mono-material structures that simplify recycling. Brands integrate refillable formats to reduce single‑use waste. Consumers reward products bearing eco‑certifications through preferences. Governments enforce extended producer responsibility schemes influence design decisions. Industry invests in life‑cycle analyses to optimize efficiency.

- For instance, L’Oréal utilizes biodegradable corn-starch based materials for powder compacts, reducing reliance on conventional plastics.

Premium format demand intensifies competition

The lip powder packaging market sees demand for compact containers that boost shelf presence and convenience. It prompts brands to use metallic foils and soft‑touch coatings. Manufacturers apply digital printing for personalized graphics. Consumers favor products with luxury feel and distinct visuals. Retailers give prime shelf space to unique form factors. Suppliers scale production of lightweight units to meet deadlines. It drives design and innovation.

- For instance, CHANEL uses metal compact cases with soft-touch coatings and magnetic closures, enhancing the luxury feel and consumer experience in their powder products.

E‑commerce expansion drives protective packaging growth

The lip powder packaging market responds to surging online sales by adopting robust designs that withstand transit. It pushes adoption of padded inserts, leak‑resistant seals and rigid shells. Brands integrate tamper‑evident closures and tracking codes to ensure product integrity. Consumers expect intact, ready‑to‑use packaging. Retailers prioritize solutions that reduce returns and shipping damage. Suppliers develop automated, efficient processes to scale protective features rapidly globally.

Advanced technologies elevate packaging functionality

The lip powder packaging market integrates smart features like QR codes and NFC tags to support product authentication. It enables real‑time tracking and consumer engagement through mobile apps. Brands embed sensors to monitor temperature and humidity exposure. Packaging designers adopt barrier nanocoatings extend shelf life and preserve formulation quality. Manufacturers deploy anti‑counterfeit holograms and tamper‑evident seals enhance security. Industry explores biodegradable electronics for sustainable solutions.

Market Trends

Digital printing and customization empower brand differentiation

Digital printing and customization empower brand differentiation in competitive beauty segments. The lip powder packaging market leverages direct‑to‑surface printing to deliver vivid graphics and variable data. It supports seasonal campaigns and limited‑edition releases. Brands use unique designs to engage consumers and enhance shelf impact. Digital workflows streamline production cycles and reduce lead times. Printers adapt to small batches and variable runs. It attracts premium pricing.

- For instance, Mink Beauty’s Mink Printer allows users to print custom makeup shades at home by replicating exact colors from any image, offering personalized products tailored to individual preferences.

Refillable and modular designs drive repeat purchases

Refillable and modular systems redefine sustainability standards. The lip powder packaging market adopts cartridge‑based formats that support repeat use. It encourages consumer loyalty through convenient refills. Brands minimize waste and lower per‑unit costs. Modular components allow easy assembly and interchangeability. Suppliers optimize supply chains for refill distribution. It drives partnerships between beauty houses and packaging firms. It elevates brand reputation.

- For instance, Estée Lauder’s modular packaging for their lipstick line allows users to customize and swap components without discarding the entire product.

Integration of smart packaging enhances user engagement

Integration of smart packaging enhances user engagement through digital connectivity. The lip powder packaging market embeds QR codes and NFC chips for product authentication. It enables instant access to tutorials and reviews. Brands gather real‑time usage data and refine offerings. Consumers value interactive experiences that link physical products to digital content. Developers combine electronics and sustainable substrates. It drives partnerships with tech providers.

Minimalist design trends emphasize transparency and functionality

Minimalist design trends emphasize transparency and functionality to meet consumer expectations. The lip powder packaging market adopts clear shells and simple silhouettes. It highlights product color and texture through windowed panels. Brands remove excess ornamentation to convey purity. Consumers connect with honest aesthetics and easy‑to‑read labels. Designers balance minimalism with structural integrity. It reduces production complexity and lowers costs. It aligns with brand transparency goals.

Market Challenges Analysis

Regulatory compliance and cost volatility challenge growth

Regulatory bodies worldwide impose stricter sustainability targets and chemical safety standards. The lip powder packaging market must navigate mandates on recyclability and extended producer responsibility that evolve rapidly. It faces raw material price fluctuations that inflate production expenses and compress margins. Suppliers contend with unpredictable supply chains and variable lead times. It demands robust quality assurance systems to prevent batch failures. Smaller manufacturers lack scale to absorb compliance costs. It requires agile sourcing strategies to stabilize input availability.

Technical integration and scalability hinder production efficiency

Smart features such as NFC chips and anti‑counterfeit labels add design complexity. The lip powder packaging market must maintain structural integrity and accommodate electronic components. It struggles with biocompatible adhesives that ensure functionality without compromising safety. Mass production of refillable modules requires precise tooling and assembly workflows. It encounters high capital expenditure for advanced molding equipment. A switch to mono‑material formats demands redesign of existing production lines. Pilot runs of novel packaging prototypes risk production delays.

Market Opportunities

Collaboration with eco-material innovators unlocks growth

The lip powder packaging market can partner with startups developing advanced biopolymers and cellulose-based substrates. It benefits from shared R&D to scale cost-effective, compostable containers. Brands gain a competitive edge by introducing unique, plant‑derived formats. Customers require certification through third‑party audits that these designs meet circular‑economy criteria. It drives joint ventures between material scientists and packaging firms. Suppliers secure long‑term contracts for sustainable feedstocks. It strengthens brand reputation while complying with evolving environmental regulations.

Digital engagement and direct-to-consumer channels boost sales

The lip powder packaging market can leverage e‑commerce platforms and social media storefronts to reach new segments. It allows brands to offer personalized packaging bundles and limited‑edition designs directly to users. Data analytics inform packaging choices based on consumer preferences and purchase history. It supports subscription models with regular refill shipments that encourage loyalty. Companies expand global reach without traditional retail overhead. It reduces inventory risk by matching production to pre‑orders. It drives profitable growth through targeted marketing and higher margins.

Market Segmentation Analysis:

By Material Composition

The lip powder packaging market segments by material into plastic, metal, paper & paperboard, and others. Plastic leads volume due to low cost and design flexibility. Metal garners premium positioning through durability and luxurious finish. Paper & paperboard segments benefit from sustainability initiatives and recyclability credentials. Others include glass and hybrid composites to meet niche requirements. It drives suppliers to optimize material selection based on performance, cost, and environmental impact. Manufacturers update formulations to align with evolving regulations.

- For instance, L’Oréal and Albéa unveiled the first carton‑based cosmetic tube, replacing over 50% plastic with bio‑based, certified paper material in a pilot rollout slated for 2020.

By Product Type

The lip powder packaging market divides into sticks, bottles, and pouches to serve diverse consumer preferences. Sticks ensure precision application and portability. Bottles deliver volume capacity and refill options. Pouches offer lightweight, flexible packaging that reduces material usage. It encourages brands to tailor designs for convenience and aesthetics. Suppliers invest in specialized tooling and closures to maintain functionality. Designers emphasize ergonomic shapes and secure seals to enhance user experience and brand appeal.

- For instance, airless pump bottles are popular among cosmetic brands for packaging liquid products like foundations, preventing oxidation and allowing hygienic application with refill options.

By Distribution Channel

The lip powder packaging market distributes through e‑commerce, retail stores, supermarkets, and others, including specialty beauty outlets. E‑commerce channels drive demand for packaging optimized for safe shipping and unboxing experiences. Retail stores reward visually striking designs that boost impulse sales. Supermarkets demand cost-effective, standardized formats suitable for high‑volume displays. It compels manufacturers to balance packaging durability with shelf presence. Suppliers integrate tamper‑evident features and QR‑code labeling to improve traceability and consumer engagement.

Segments:

Based on Material

- Plastic

- Metal

- Paper & paperboard

- Others

Based on Product type

Based on Distribution

- E-commerce

- Retail Stores

- Supermarkets

- Others

Based on the Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The lip powder packaging market in North America commands 30% share. Europe holds 25%, Asia Pacific 28%, Latin America 10%, Middle East & Africa 7%. It benefits from a mature cosmetics industry and high consumer demand for premium formats. Leading manufacturers deploy advanced barrier coatings and smart labels. Brands leverage refillable modules to support sustainability. Retailers assign prime shelf space to innovative designs. Suppliers expand local production to reduce lead times and respond swiftly to trends.

Europe

The lip powder packaging market in Europe commands 25% share. North America holds 30%, Asia Pacific 28%, Latin America 10%, Middle East & Africa 7%. It enforces stringent environmental regulations that drive sustainable material adoption. Brands use certified compostable substrates to meet extended producer responsibility rules. Manufacturers test novel biopolymers under life‑cycle analysis. Designers emphasize minimalist aesthetics and transparency. Suppliers partner with eco‑material innovators to scale output. Retail channels prioritize recyclable formats and refill programs.

Asia Pacific

The lip powder packaging market in Asia Pacific commands 28% share. North America holds 30%, Europe 25%, Latin America 10%, Middle East & Africa 7%. It benefits from rising cosmetics consumption and broader e‑commerce penetration. Manufacturers invest in automated lines for high‑volume output. Brands tailor designs for local preferences with vibrant graphics and QR‑code integration. Suppliers develop protective features for long‑distance shipping. It promotes collaboration between beauty houses and packaging firms to meet regional demand peaks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sephora (New York)

- Kindu Packing (China)

- Accupac (U.S.)

- LIBO Cosmetics (Taiwan)

- World Wide Packaging (U.S.)

- CHANEL (London)

- Buxom Cosmetics (U.S.)

- Baoyu Plastic (China)

- Yuga (U.S.)

- Revlon (U.S.)

- L’Oréal (France)

- The Packaging Company (TPC) (India)

Competitive Analysis

The lip powder packaging market features intense rivalry among global and regional suppliers. Leading players such as L’Oréal, CHANEL, and Revlon invest in sustainable substrates and advanced barrier technologies to maintain brand prestige and comply with evolving regulations. Sephora and Buxom leverage digital printing and customization to launch seasonal collections and limited‑edition releases that captivate consumers. Contract manufacturers like Accupac and Kindu Packaging optimize cost structures through lean production and rapid prototyping to attract emerging beauty brands. Regional specialists such as The Packaging Company in India tailor mono‑material designs to meet local recyclability mandates while reducing lead times. Companies integrate smart features, including QR codes and NFC tags, to strengthen supply chain traceability and boost consumer engagement. It drives continuous innovation in form factors, lightweight constructions, refillable modules, and anti‑counterfeit seals. Suppliers compete on material expertise, regulatory compliance, e‑commerce resilience, and strategic partnerships to secure contracts with cosmetic giants and indie labels worldwide.

Recent Developments

- In 17 March 2025, GEKA celebrated its centenary at Cosmopack Bologna 2025 with the launch of its Art Deco‑inspired Golden Grace collection, introducing a new range of powder‑compatible applicators and packaging formats tailored for products such as lip powders.

- In 26 July 2024, Silgan Dispensing announced its agreement to acquire Weener Packaging, expanding its footprint in sustainable, refillable and recyclable dispensing systems for powder and color‑cosmetic markets, including lip‑powder formats.

- In January 02 2024, Asquan introduced its sustainable, refillable glass packaging system—featuring rechargeable glass containers designed to house powder cosmetics, including lip powders.

- In March 2025, ICONS introduced its Mono‑material polypropylene pansticks optimized for powder cosmetics—featuring a single‑material design that simplifies recycling and suits lip powder formulations.

Market Concentration & Characteristics

The lip powder packaging market exhibits moderate concentration with the five largest suppliers accounting for roughly 60% of total revenue. It features a mix of global cosmetic giants and specialized packaging firms that compete on material innovation and design complexity. It experiences fragmentation among small and mid‑size manufacturers that serve niche and private‑label segments. It drives competitive pricing pressure and demands continual cost optimization. It values rapid prototyping capabilities to launch limited‑edition collections. It depends on strategic partnerships between beauty brands and packaging converters. It prioritizes regulatory compliance and sustainable sourcing as differentiators. It rewards suppliers with integrated digital printing and smart feature expertise. It demands flexible production to adjust volumes in response to seasonal product cycles. It values high entry barriers from capital‑intensive tooling and certification requirements. It sustains balanced power between brand owners and packaging providers.

Report Coverage

The research report offers an in-depth analysis based on Material, Product Type, Distribution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will adopt bio-based polymers and renewable feedstocks to drive sustainable lip powder packaging solutions.

- Brands will embed smart sensors and NFC tags to enhance authenticity verification and consumer engagement.

- Suppliers will expand modular refillable systems and interchangeable components to strengthen loyalty and waste reduction.

- Converters will implement digital printing technologies to deliver personalized packaging graphics for seasonal limited‑edition campaigns.

- E‑commerce platforms will require packaging designs that ensure product protection, tamper evidence, enhanced unboxing experiences.

- Manufacturers will invest in automated assembly lines to achieve quick turnaround and maintain quality standards.

- Partnerships between beauty brands and material innovators will accelerate novel sustainable substrate solutions, packaging technologies.

- Suppliers will adapt to mono‑material requirements to improve recyclability and simplify post‑consumer waste management processes.

- Designers will prioritize minimalist aesthetics showcasing product color and texture through transparent panels, form factors.

- Companies will implement anti‑counterfeit features to protect brand reputation, secure consumer trust against tampering, fraud.