Market Overview

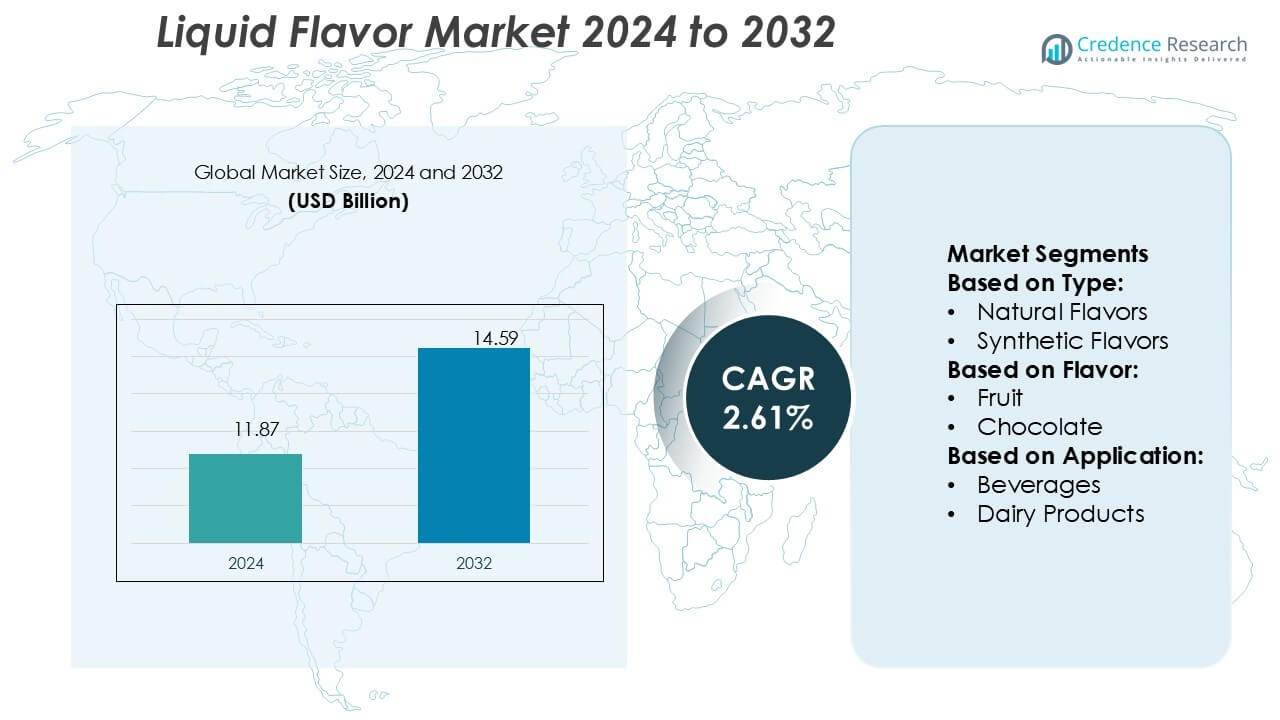

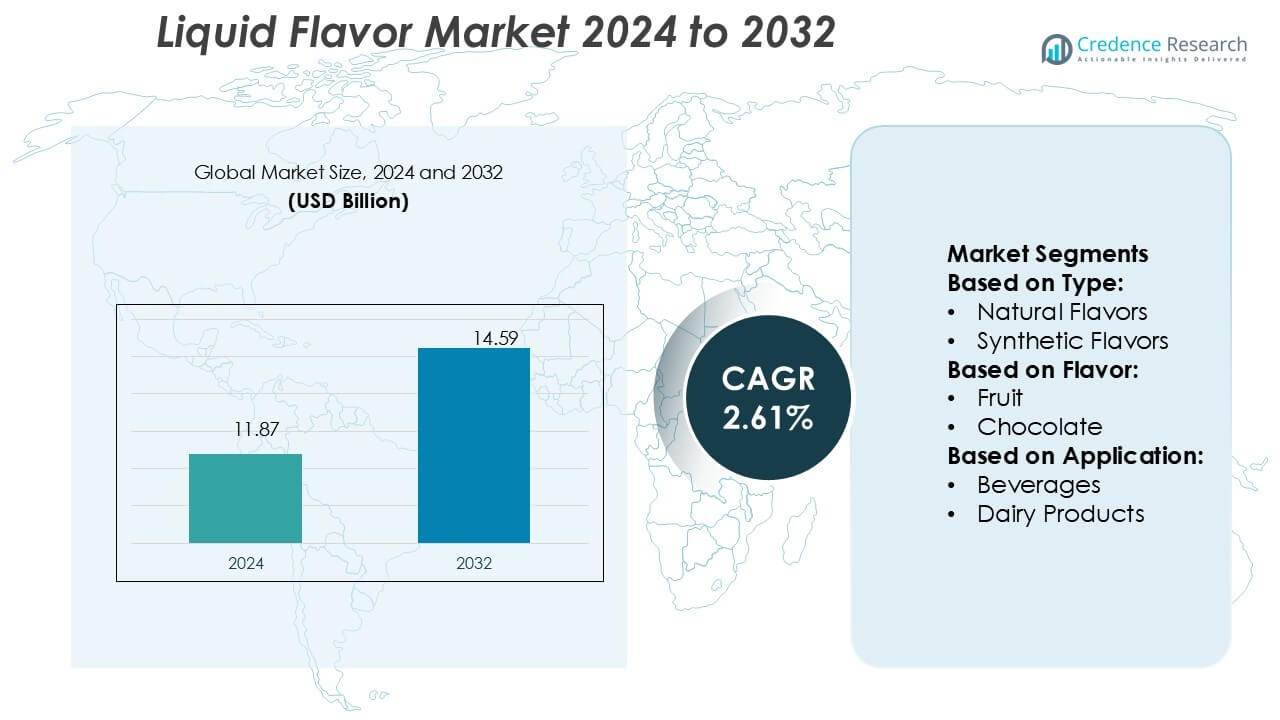

Liquid Flavor Market size was valued USD 11.87 billion in 2024 and is anticipated to reach USD 14.59 billion by 2032, at a CAGR of 2.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Flavor Market Size 2024 |

USD 11.87 billion |

| Liquid Flavor Market, CAGR |

2.61% |

| Liquid Flavor Market Size 2032 |

USD 14.59 Billion |

The liquid flavor market features strong competition from global leaders such as Givaudan S.A., Symrise AG, Kerry Group plc, International Flavors and Fragrances (IFF), Sensient Technologies, Frutarom, MANE Flavor & Fragrance Manufacturer, Gold Coast Ingredients, McCormick & Company, Inc., and Natures Flavors, Inc. These players emphasize product innovation, natural ingredient sourcing, and strategic expansion to address evolving consumer preferences across beverages, dairy, and confectionery sectors. North America leads the market with a 34% share in 2024, supported by advanced food processing industries, high consumer demand for premium flavors, and increasing adoption of clean-label and plant-based solutions.

Market Insights

- The liquid flavor market was valued at USD 11.87 billion in 2024 and is projected to reach USD 14.59 billion by 2032, registering a CAGR of 2.61%.

- Growing demand for natural and clean-label ingredients drives market expansion, particularly in beverages and dairy applications, where natural flavors dominate with 58% share.

- Trends highlight rising popularity of exotic fruit and botanical flavors, alongside technological advancements like microencapsulation that enhance flavor stability and intensity.

- The market is competitive, with leading companies focusing on innovation, sustainable sourcing, and acquisitions to strengthen global presence, while high production costs of natural flavors act as a restraint.

- Regionally, North America leads with 34% share in 2024, supported by mature food processing industries and strong clean-label demand, while Asia-Pacific follows closely with 29% share, fueled by rapid urbanization, growing middle-class populations, and increased consumption of flavored beverages and confectionery across emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The liquid flavor market by type is led by natural flavors, which account for 58% of the total market share in 2024. Demand for natural flavors is driven by consumer preference for clean-label and plant-based ingredients, particularly in beverages and dairy categories. Manufacturers increasingly invest in botanical extracts and fermentation-derived solutions to replace synthetic alternatives, aligning with regulatory pushes for healthier food formulations. Synthetic flavors continue to serve cost-sensitive applications, but growth is slower compared to natural variants due to rising health awareness and evolving consumer taste expectations.

- For instance, ICL introduced eqo.x, a biodegradable controlled-release coating for urea that boosts nutrient use efficiency by up to 80%, degrades faster, and provides predictable nutrient release for open-field applications.

By Flavor

Among flavors, fruit dominates with a 42% share of the liquid flavor market in 2024, supported by its broad application across beverages, confectionery, and dairy products. Growth is fueled by increasing demand for tropical and exotic fruit flavors in emerging markets and the expanding use of fruit-based concentrates in functional beverages. Chocolate and vanilla follow, with strong penetration in bakery and confectionery applications, while nut and caramel flavors capture niche but growing demand in premium snacks and desserts. The appeal of fruit-based flavors remains unmatched due to their versatility and natural association with health and freshness.

- For instance, AmeriGas, a part of UGI Corporation, operates a vast network across the United States. Recent UGI financial filings confirm a network of approximately 1,360 propane distribution locations serving customers across the country.

By Application

Beverages represent the dominant application segment, holding 46% of the liquid flavor market in 2024. Rising consumption of flavored soft drinks, energy beverages, and ready-to-drink teas drives this share, with fruit-based flavors playing a key role. The dairy sector also registers steady demand, especially in flavored milk and yogurt, while bakery and confectionery continue to leverage chocolate and vanilla. Savory and snack applications are expanding with nut and caramel flavors gaining traction in premium offerings. Beverage innovation and consumer inclination toward refreshing, flavored drinks will remain the primary growth driver for this segment.

Key Growth Drivers

Rising Demand for Natural and Clean-Label Ingredients

The liquid flavor market is expanding as consumers increasingly prefer natural and clean-label ingredients over synthetic options. Growing awareness about food safety, health, and sustainability has strengthened the demand for plant-derived and botanical-based flavors. Food and beverage brands are reformulating products with natural extracts to meet clean-label requirements, boosting the segment’s adoption. Regulatory pressure on artificial additives further accelerates this transition, positioning natural flavors as the primary growth driver across beverages, dairy, and confectionery applications.

- For instance, Nutrien’s retail arm markets its Riser® in-furrow nutrition system for row crops, which applies micronutrient blends (e.g., zinc, boron) at a rate of 2.0 to 5.0 gallons (approximately 7.6 to 18.9 liters) per acre along with base fertilizer, ensuring forage or feed crops receive balanced nutrition early in growth.

Expansion of the Functional Beverages and Dairy Sector

The surge in functional beverages, including energy drinks, flavored waters, and plant-based alternatives, fuels significant demand for liquid flavors. These products rely heavily on fruit, vanilla, and herbal notes to enhance taste and consumer appeal. Similarly, the dairy industry leverages flavors for innovation in yogurt, flavored milk, and cheese products. Rising global health consciousness and increased spending on nutritional drinks ensure consistent flavor use. Manufacturers are aligning portfolios with wellness-oriented launches, creating long-term growth opportunities within beverage and dairy applications.

- For instance, during a pilot program in Western Australia, CSBP, in partnership with Telstra, installed more than 150 IoT sensors on the fertilizer storage tanks of 26 growers.

Innovation in Flavor Customization and Technology

Advancements in flavor formulation and delivery systems drive market growth by enabling customization for regional tastes and niche segments. Microencapsulation and fermentation technologies allow manufacturers to enhance stability, intensity, and shelf life of liquid flavors. Growing interest in personalized nutrition also encourages companies to develop targeted flavor solutions for different demographics. Customizable flavor profiles, supported by advanced R&D, help brands cater to evolving consumer preferences. This innovation not only improves product acceptance but also enhances brand differentiation in competitive markets.

Key Trends & Opportunities

Shift Toward Exotic and Functional Flavors

Exotic fruit flavors such as passion fruit, dragon fruit, and lychee are gaining traction, particularly in beverages and confectionery. Alongside, functional flavors linked to wellness—such as botanicals, herbal extracts, and spices—are seeing strong uptake. This shift caters to consumer demand for novel taste experiences and health benefits in a single product. The trend creates opportunities for brands to diversify portfolios and capture premium segments by offering unique, health-oriented liquid flavor formulations.

- For instance, Compo Expert began sourcing 25 % of its ammonia demand in low-carbon form from Q2 2024, a measure projected to avoid 15,000 tonnes CO₂ emissions annually.

Growth of E-commerce and Direct-to-Consumer Channels

The expansion of online retail and direct-to-consumer platforms provides new opportunities for liquid flavor manufacturers. Smaller flavor brands and artisanal producers can now directly engage consumers with customized offerings, particularly in bakery kits, DIY beverages, and home cooking solutions. Digital platforms also enable faster feedback loops, guiding product innovation in line with consumer preferences. As consumers increasingly explore specialty flavors online, e-commerce emerges as a key growth avenue for both established players and emerging startups in the liquid flavor industry.

- For instance, IFFCO’s cloud-based IFFCO Kisan Uday platform now manages data for 2,500 IFFCO Kisan drones, enabling farmers to book, view, and control nano-fertilizer spraying operations in real time.

Key Challenges

High Production Costs for Natural Flavors

While natural flavors dominate demand, their production involves high costs due to sourcing complexity, limited raw material availability, and intensive extraction methods. Seasonal variability of raw materials, such as fruits and botanicals, also impacts price stability and supply consistency. These challenges often translate into premium pricing, limiting affordability in cost-sensitive markets. Balancing demand for natural, clean-label solutions with sustainable and scalable production remains a significant obstacle for manufacturers seeking long-term growth.

Stringent Regulatory Frameworks and Compliance Issues

The liquid flavor industry faces strict regulations governing ingredient use, labeling, and safety standards across regions. Compliance with frameworks such as FDA, EFSA, and FSSAI requires continuous reformulation, testing, and documentation, increasing operational complexities. Differences in regional standards also create barriers for global trade and new product launches. Non-compliance risks legal challenges, reputational damage, and product recalls, making regulatory adherence a critical challenge. Manufacturers must invest heavily in R&D and quality assurance to navigate these hurdles effectively.

Regional Analysis

North America

North America holds a 34% share of the liquid flavor market in 2024, making it the leading regional contributor. Strong consumer demand for flavored beverages, dairy products, and confectionery drives growth across the United States and Canada. The region benefits from well-established food processing industries and high spending on premium and clean-label products. Natural fruit and vanilla flavors dominate due to rising health awareness, while innovative chocolate and nut flavors expand in the bakery segment. Continuous R&D investments, coupled with strong regulatory frameworks supporting clean-label trends, position North America as a mature yet innovation-driven market.

Europe

Europe accounts for 27% of the liquid flavor market in 2024, supported by the region’s strong bakery, dairy, and confectionery industries. Germany, France, and the UK lead consumption, with significant demand for chocolate, vanilla, and caramel flavors in bakery applications. Rising consumer preference for natural and organic ingredients boosts adoption of plant-based flavors. Regulatory frameworks such as EFSA guidelines further encourage clean-label formulations. Innovation in functional beverages and premium snacks continues to create growth opportunities. Europe remains a competitive market with established flavor houses introducing customized solutions aligned with regional taste profiles and sustainability priorities.

Asia-Pacific

Asia-Pacific commands a 29% share of the liquid flavor market in 2024, emerging as the fastest-growing region. High population density, rising disposable incomes, and urbanization drive demand for flavored beverages, dairy products, and confectionery. China, India, and Japan lead consumption, with strong adoption of fruit and exotic flavors. Rapid growth in ready-to-drink beverages and functional products also boosts flavor usage. Local and global manufacturers invest heavily in expanding portfolios and production capacities to meet rising demand. Asia-Pacific’s focus on innovation and evolving consumer tastes positions it as a key growth engine in the global market.

Latin America

Latin America holds a 6% share of the liquid flavor market in 2024, with Brazil and Mexico driving regional growth. Beverages and confectionery remain primary application areas, with fruit and caramel flavors witnessing strong demand. The market is supported by a growing middle-class population and increasing interest in flavored dairy products and snacks. However, limited purchasing power and higher costs of natural flavors restrain faster growth. Despite these challenges, regional manufacturers are introducing cost-effective formulations while multinational players invest in local production facilities. Latin America’s flavor market shows steady potential, particularly in fruit-forward beverage categories.

Middle East & Africa

The Middle East & Africa represent 4% of the liquid flavor market in 2024, with gradual expansion across beverages and bakery applications. Countries such as the UAE and South Africa are leading adopters, driven by demand for flavored dairy, juices, and confectionery products. Fruit and vanilla flavors dominate, supported by rising youth populations and shifting dietary habits. Limited local production capacity and dependency on imports remain challenges, impacting affordability of premium natural flavors. However, growing interest in innovative and exotic flavor profiles, coupled with urbanization trends, creates opportunities for future growth across this emerging regional market.

Market Segmentations:

By Type:

- Natural Flavors

- Synthetic Flavors

By Flavor:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The liquid flavor market is highly competitive, with key players including MANE Flavor & Fragrance Manufacturer, Sensient Technologies, McCormick & Company, Inc., Symrise AG, Gold Coast Ingredients, International Flavors and Fragrances (IFF), Givaudan S.A., Natures Flavors, Inc., Frutarom, and Kerry Group plc. The liquid flavor market is characterized by intense competition, driven by innovation, sustainability, and evolving consumer preferences. Companies are focusing on expanding portfolios of natural and clean-label flavors to meet rising demand in beverages, dairy, and confectionery. Technological advancements such as microencapsulation and fermentation enhance flavor stability, shelf life, and intensity, providing a competitive edge. Market participants are also investing in regional expansion, particularly in Asia-Pacific, to capture high-growth opportunities. Strategic mergers, acquisitions, and partnerships remain common approaches to strengthen market presence, diversify offerings, and cater to niche applications with tailored flavor solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, McCormick & Company unveiled Aji Amarillo as its Flavour of the Year, highlighting the pepper’s fruity, tropical notes with moderate heat. This selection reflects the company’s commitment to exploring diverse global flavours and catering to evolving consumer tastes.

- In September 2024, The Hershey Company declared a new addition to its Kit Kat lineup: Kit Kat Vanilla. The brand’s new flavor features crisp wafers enrobed in vanilla-flavored crème. It is now available in standard and king sizes at retailers nationwide.

- In March 2024, Essentia Water is taking hydration to the next level with Essentia Hydroboost, the brand’s first-ever flavored and functional water innovation designed to keep customers hydrated while pursuing their goals.

- In August 2023, Döhler has disclosed its acquisition of Boon Flavors, s part of this acquisition, Boon Flavors will be known as Döhler Thailand going forward and be managed by its founder, Piya Boonnamkitsawad.

Report Coverage

The research report offers an in-depth analysis based on Type, Flavor, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for natural and clean-label liquid flavors will continue to rise.

- Beverages will remain the leading application segment with strong innovation potential.

- Functional and fortified drinks will drive higher adoption of fruit and botanical flavors.

- Dairy products will expand flavor use in yogurt, flavored milk, and plant-based alternatives.

- Advanced technologies like microencapsulation will improve flavor stability and delivery.

- Exotic and ethnic flavor profiles will gain popularity across global markets.

- Sustainability in sourcing and production will shape competitive strategies.

- E-commerce will create new growth channels for niche and specialty flavors.

- Regulatory frameworks will increasingly favor natural and plant-derived ingredients.

- Emerging markets will fuel growth through rising urbanization and changing consumer diets.