Market Overview

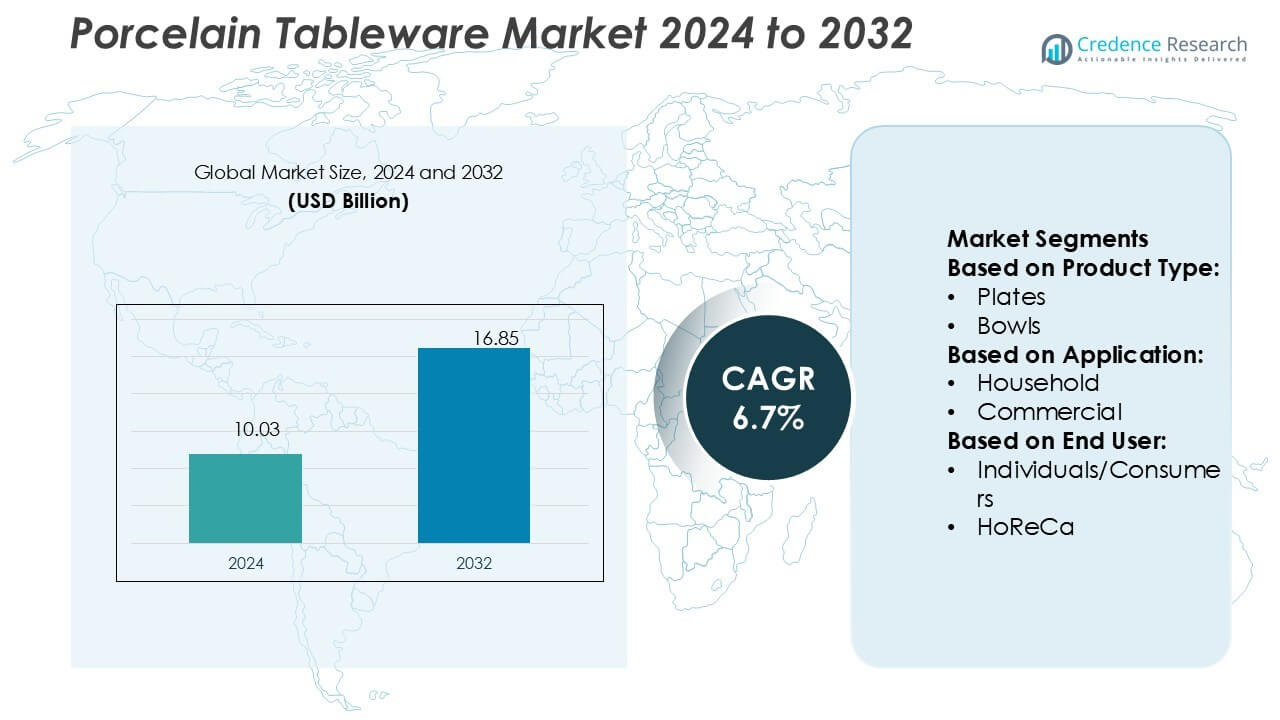

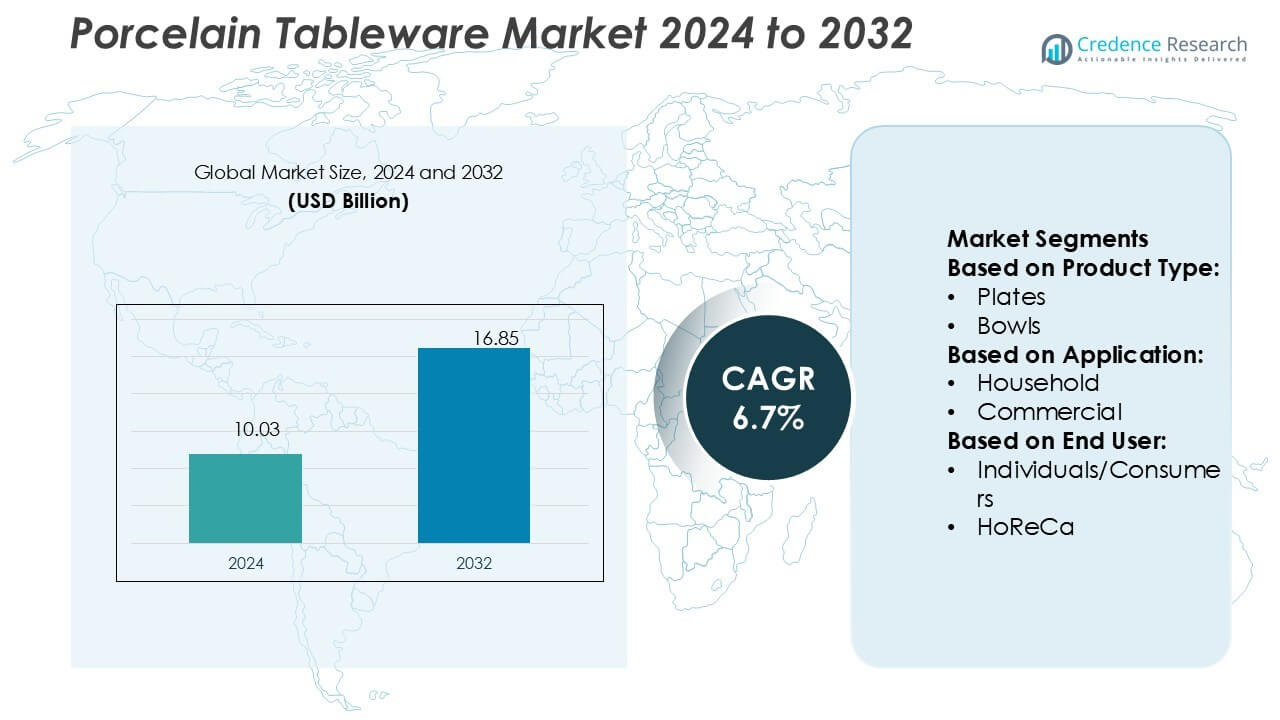

Porcelain Tableware Market size was valued USD 10.03 billion in 2024 and is anticipated to reach USD 16.85 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Porcelain Tableware Market Size 2024 |

USD 10.03 Billion |

| Porcelain Tableware Market, CAGR |

6.7% |

| Porcelain Tableware Market Size 2032 |

USD 16.85 Billion |

The porcelain tableware market is shaped by leading players such as Royal Copenhagen, Portmeirion Group, Wedgwood, Lenox Corporation, Spode, Rosenthal, Seltmann Weiden, Villeroy & Boch, Royal Doulton, and Noritake. These companies compete through design excellence, strong brand heritage, and product innovation, catering to both household and HoReCa segments. Many focus on premium positioning, sustainability initiatives, and expanding e-commerce channels to strengthen global reach. Europe emerges as the leading region, commanding 32% of the total market share, driven by cultural dining traditions, strong consumer demand for luxury tableware, and the presence of well-established premium brands that continue to set global benchmarks in design and quality.

Market Insights

Market Insights

- The porcelain tableware market size was USD 10.03 billion in 2024 and will reach USD 16.85 billion by 2032, growing at a CAGR of 6.7%.

- Rising consumer preference for premium dining products and growth in the HoReCa sector are key drivers boosting global demand.

- Sustainability, eco-friendly production, and customized designs are major trends, while e-commerce expansion further enhances brand visibility and global reach.

- The market faces restraints from high production costs and competition from affordable alternatives like melamine, glass, and stainless steel.

- Europe leads with 32% share, while household applications dominate overall demand; Asia-Pacific is set to grow fastest due to rising incomes and gifting culture.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Plates dominate the porcelain tableware market, accounting for the largest share due to their universal necessity in dining. Their wide use across households, restaurants, and hotels drives consistent demand. Growth is supported by rising consumer spending on premium and durable plates, especially in urban markets. Innovation in design and durability, such as scratch-resistant and microwave-safe plates, enhances adoption. While bowls, cups, mugs, and serving dishes contribute steadily, plates remain the leading product type, benefiting from their role as a core tableware item across all meal settings.

- For instance, Royal Copenhagen offers a 27 cm dinner plate in its Blue Fluted Plain collection, made of porcelain and hand-painted with three cobalt waves on the underside, and this exact size is central to their tableware line.

By Application

Household applications hold the largest market share in the porcelain tableware market, driven by rising demand from urban families and gifting preferences. Increasing consumer focus on aesthetics and durability boosts household adoption. Premium porcelain products are gaining traction as families shift toward branded and luxury tableware for both daily use and special occasions. While commercial usage in HoReCa is expanding, household buyers dominate due to consistent replacement demand and seasonal purchases. Gifting and collectibles remain niche but steadily grow through premiumization and specialty designs.

- For instance, Portmeirion’s Sophie Conran line offers a set of four measuring cups in fine porcelain, consisting of 1 cup, ½ cup, ⅓ cup, and ¼ cup sizes. The largest cup can hold up to 250 ml of liquid, and the set can be reliably used in home kitchens, as each piece is dishwasher, microwave, and freezer safe.

By End-user

Individuals and consumers form the dominant end-user group, capturing the highest share of the porcelain tableware market. Frequent product replacement cycles, cultural gifting traditions, and growing interest in aesthetic home décor sustain their demand. Rising disposable incomes and e-commerce availability further strengthen this segment’s growth. HoReCa contributes significantly through bulk purchases but remains secondary to individual demand. Corporate and institutional buyers adopt porcelain tableware mainly for events and hospitality, but their share is relatively smaller compared to individual consumers driving mainstream market demand.

Key Growth Drivers

Rising Demand for Premium Dining Experiences

The growing consumer preference for luxury dining has fueled demand for high-quality porcelain tableware. Rising disposable incomes, particularly in urban households, encourage spending on premium, durable, and aesthetically designed products. Hotels, restaurants, and fine-dining establishments also drive demand, as porcelain offers elegance and durability. The increasing use of porcelain tableware in premium gifting further strengthens market growth. This trend is particularly strong in regions with expanding middle-class populations, where aspirational lifestyles and brand consciousness boost adoption of high-value tableware.

- For instance, Wedgwood has launched Jasper 250, a generative AI design tool, allowing users to co-create new Jasperware patterns; the winning design will be 3D printed and added to their V&A collection.

Expansion of the HoReCa Sector

The rapid growth of the hospitality, restaurant, and catering (HoReCa) sector significantly supports the porcelain tableware market. Rising tourism, increasing foodservice outlets, and the expansion of global hotel chains drive large-scale procurement of porcelain tableware. Hotels and restaurants prefer porcelain for its durability, resistance to frequent washing, and ability to maintain premium presentation. Catering businesses also rely on porcelain for corporate and private events. As hospitality investments grow across Asia-Pacific, the Middle East, and Europe, bulk demand from HoReCa players is expected to be a consistent growth driver.

- For instance, Lenox bone china production plant The Kinston plant was approximately 218,000 square feet in size. At the time of its closure, the plant employed around 159 people.

E-commerce Growth and Accessibility

The expansion of e-commerce platforms has made porcelain tableware more accessible to consumers worldwide. Online retail enables customers to explore a wide variety of designs, price ranges, and brands, often with discounts and delivery services. This accessibility encourages both first-time buyers and repeat purchases. Social media marketing and influencer-driven promotions also increase awareness of premium tableware brands. Furthermore, cross-border online sales help manufacturers tap into international markets. With growing internet penetration and consumer preference for online shopping, e-commerce is becoming a crucial channel driving porcelain tableware sales.

Key Trends & Opportunities

Sustainability and Eco-Friendly Designs

Sustainable manufacturing and eco-conscious consumer choices present strong opportunities in the porcelain tableware market. Consumers increasingly prefer products that are lead-free, recyclable, and produced using energy-efficient processes. Manufacturers are introducing eco-friendly glazing techniques and responsibly sourced raw materials to align with these preferences. This trend strengthens brand image and attracts environmentally conscious buyers. Premium markets in Europe and North America, in particular, show rising demand for sustainable porcelain, while Asia-Pacific manufacturers are investing in greener technologies to capture emerging opportunities in eco-friendly tableware.

- For instance, Rosenthal operates its own combined heat and power plant and uses multiple heat recovery systems in its German factories to reduce energy losses. Rosenthal uses 100 % ecologically generated electricity at all sites (production + administration) to reduce carbon footprint.

Customization and Personalization

Personalized porcelain tableware is gaining momentum, especially in premium gifting and event sectors. Consumers and businesses are seeking customized designs, monograms, and limited-edition collections to reflect individuality and exclusivity. This trend is popular among luxury consumers, wedding planners, and corporate buyers who value unique presentation. Advanced printing and digital glazing technologies allow manufacturers to offer personalized products at scale. As consumer preferences shift toward distinctive table settings and memorable gifting options, customization emerges as a profitable opportunity for brands catering to niche, premium segments.

- For instance, Royal Doulton’s fine bone china uses a soft-paste porcelain formula containing greater than 35 % tricalcium orthophosphate, enhancing hardness, translucency, and resistance to fluid absorption.

Rising Influence of Lifestyle Trends

Lifestyle-driven demand is reshaping the porcelain tableware market, as consumers increasingly view tableware as part of home décor. Social media platforms showcasing dining aesthetics have amplified this trend, encouraging purchases of stylish, visually appealing porcelain. The rise of home entertaining and dining at home also creates opportunities for tableware brands. Limited-edition collections and collaborations with designers further attract aspirational buyers. This lifestyle-driven approach shifts porcelain from being a necessity to a lifestyle statement, boosting its premium appeal across household and gifting segments globally.

Key Challenges

High Competition from Alternative Materials

The porcelain tableware market faces strong competition from glass, melamine, stainless steel, and stoneware products. These alternatives are often more affordable and durable, making them attractive to cost-conscious consumers and commercial buyers. Melamine and glassware dominate in casual dining, while stainless steel remains common in households across emerging markets. This price and durability advantage limits porcelain’s penetration in budget-sensitive segments. To overcome this challenge, porcelain manufacturers need to emphasize design, premium quality, and branding strategies that differentiate their offerings from low-cost substitutes.

High Production Costs and Pricing Pressures

Porcelain manufacturing involves high costs due to energy-intensive firing processes, raw material expenses, and labor requirements. Premium porcelain also demands fine craftsmanship and quality control, raising production expenses further. Rising energy prices and supply chain disruptions add additional pressures. As consumers become price-sensitive in some regions, maintaining profitability while keeping products competitively priced becomes challenging. Low-cost imports from Asia intensify competition, forcing manufacturers in Europe and North America to focus on premium positioning. These cost challenges restrict mass-market adoption and impact margins across the porcelain tableware industry.

Regional Analysis

North America

North America accounts for 28% share of the porcelain tableware market, driven by strong consumer preference for premium dining products and home décor trends. The United States leads demand, with households and restaurants adopting high-quality porcelain for both daily use and formal occasions. Growth is supported by rising gifting culture and increased spending on luxury homeware. The expanding HoReCa sector, particularly in urban areas, contributes to bulk procurement. E-commerce platforms strengthen accessibility and brand reach. With sustainability and design innovation gaining importance, North America continues to remain a lucrative market for premium porcelain tableware.

Europe

Europe holds 32% share, making it the largest regional market for porcelain tableware. Strong cultural heritage in fine dining and gifting traditions drives consistent adoption. Countries such as Germany, France, and the UK are key consumers, supported by well-established premium brands. The region’s strict focus on sustainability and eco-friendly production processes further boosts demand for high-quality porcelain. Growing tourism and hospitality investments across Southern Europe also fuel bulk orders from hotels and restaurants. With increasing interest in luxury homeware and collectible tableware, Europe maintains dominance in both household and commercial porcelain tableware segments.

Asia-Pacific

Asia-Pacific represents 27% share of the porcelain tableware market, supported by rising disposable incomes and expanding middle-class populations. China, Japan, and India lead demand, with China also playing a critical role as a global supplier. Rapid urbanization, lifestyle upgrades, and strong gifting culture fuel household purchases. Expanding HoReCa sectors across Southeast Asia and Australia contribute significantly to commercial demand. The region benefits from competitive production costs, making it both a manufacturing hub and a growing consumer market. With increasing brand awareness and e-commerce penetration, Asia-Pacific is expected to witness the fastest growth during the forecast period.

Latin America

Latin America holds 6% share of the porcelain tableware market, with Brazil and Mexico emerging as key demand centers. Rising disposable incomes and increasing consumer interest in home décor support market growth. The hospitality sector, particularly in tourist-heavy regions, also drives bulk procurement of porcelain tableware. However, affordability remains a challenge, as consumers often opt for cheaper substitutes like glass and melamine. Import reliance from Asia-Pacific manufacturers ensures product availability at competitive prices. Growing e-commerce adoption and gifting culture are boosting premium tableware sales, making Latin America an emerging but gradually expanding regional market.

Middle East & Africa

The Middle East & Africa accounts for 7% share of the porcelain tableware market, with demand concentrated in premium hospitality and gifting segments. Countries such as the UAE, Saudi Arabia, and South Africa drive consumption through luxury dining and corporate gifting culture. High investments in hotels, resorts, and restaurants also contribute to commercial demand. Import reliance is significant, as local manufacturing remains limited. Growing urbanization and rising incomes are creating opportunities in household adoption. However, porcelain competes with affordable alternatives, limiting broader penetration. Still, premiumization and tourism-related projects are expected to sustain steady growth in the region.

Market Segmentations:

By Product Type:

By Application:

By End User:

- Individuals/Consumers

- HoReCa

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The porcelain tableware market is highly competitive, featuring prominent players such as Royal Copenhagen, Portmeirion Group, Wedgwood, Lenox Corporation, Spode, Rosenthal, Seltmann Weiden, Villeroy & Boch, Royal Doulton, and Noritake. The porcelain tableware market is defined by strong competition, with brands focusing on innovation, design aesthetics, and premium positioning. Consumer demand is shifting toward durable, stylish, and eco-friendly products, prompting manufacturers to invest in advanced glazing techniques and sustainable production practices. The market benefits from rising disposable incomes, growth in the HoReCa sector, and increasing popularity of premium gifting. E-commerce expansion has also enhanced accessibility, enabling global reach and diverse product offerings. Companies differentiate through limited-edition collections, customization, and collaborations with designers, while maintaining focus on quality and craftsmanship to strengthen customer loyalty and market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Royal Copenhagen

- Portmeirion Group

- Wedgwood

- Lenox Corporation

- Spode

- Rosenthal

- Seltmann Weiden

- Villeroy & Boch

- Royal Doulton

- Noritake

Recent Developments

- In June 2025, British artist Luke Edward Hall launched his second collection with Italian luxury porcelain brand Ginori 1735, titled “Il Viaggio di Nettuno. A New Chapter.” This series draws inspiration from Greco-Roman pottery and the Bloomsbury Group, featuring hand-drawn elements on porcelain tableware items like plates and mugs.

- In April 2025, British designer Faye Toogood introduced a porcelain collection named “Rose” in collaboration with Japanese ceramics brand Noritake during Milan Design Week. The collection includes 14 hand-painted pieces and 111 limited-edition platters, blending traditional Japanese porcelain painting with contemporary artistic spontaneity.

- In December 2024, Duni Group, a sustainable packaging and tabletop solutions provider, revealed plans to acquire UK-based tabletop company Poppies, aiming to enhance its presence in the European market and expand its sustainable product offerings.

- In June 2024, Steelite International, a leader in the global tableware market, announced its acquisition of Utopia Tableware Ltd, strengthening its position in the commercial dining sector and expanding its product portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for premium dining experiences.

- Growth in the HoReCa sector will drive large-scale procurement of porcelain tableware.

- E-commerce platforms will continue to boost global accessibility and consumer reach.

- Sustainability practices will gain importance, with eco-friendly production becoming a key focus.

- Personalized and customized designs will attract premium gifting and niche segments.

- Lifestyle-driven demand will strengthen as tableware becomes part of home décor trends.

- Emerging economies will witness faster adoption with growing middle-class spending power.

- Competition from alternative materials will push brands to emphasize quality and innovation.

- Strategic collaborations with designers will create exclusive collections to capture high-end consumers.

- Technological advances in glazing and manufacturing will improve durability and design diversity.

Market Insights

Market Insights