Market Overview:

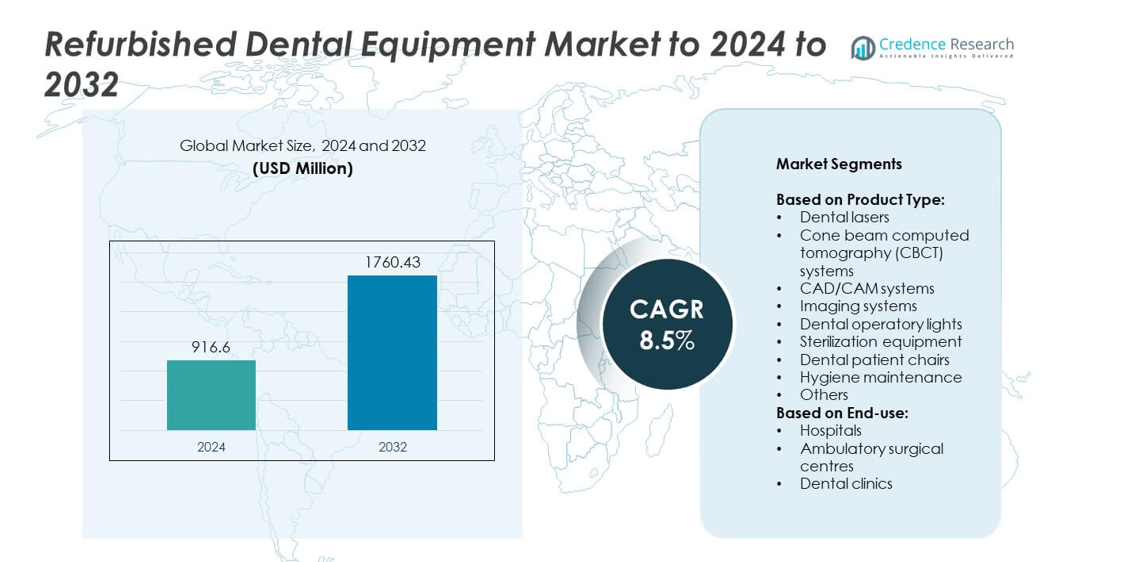

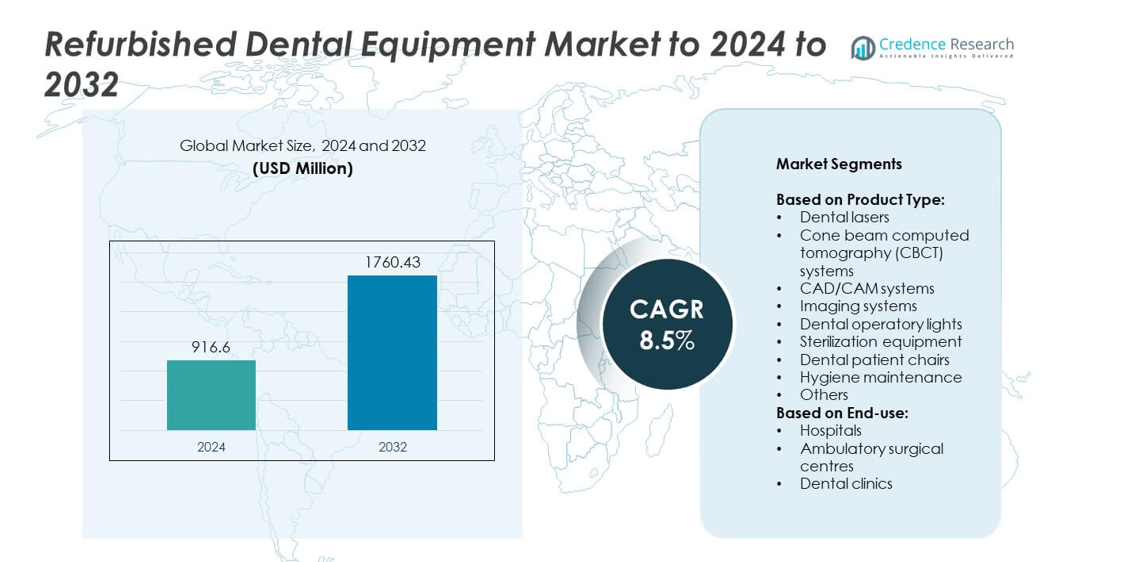

Refurbished Dental Equipment Market size was valued USD 916.6 Million in 2024 and is anticipated to reach USD 1760.43 Million by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refurbished Dental Equipment Market Size 2024 |

USD 916.6 Million |

| Refurbished Dental Equipment Market, CAGR |

8.5% |

| Refurbished Dental Equipment Market Size 2032 |

USD 1760.43 Million |

The refurbished dental equipment market is shaped by leading players such as Capital Dental Equipment, Henry Schein, Atlas Resell Management, Dental Equipment Liquidators Inc., Patterson Companies’, Superior DDS, and Pre-Owned Dental Inc. These companies focus on certified refurbishment, warranty-backed products, and advanced imaging and CAD/CAM systems to address the growing demand for affordable dental solutions. North America led the market in 2024 with a 36% share, driven by advanced dental infrastructure and high adoption of refurbished systems. Europe followed with 29%, supported by sustainability initiatives, while Asia Pacific accounted for 24% due to expanding dental tourism and cost-sensitive practices.

Market Insights

- The refurbished dental equipment market was valued at USD 916.6 Million in 2024 and is projected to reach USD 1760.43 Million by 2032, growing at a CAGR of 8.5%.

- Rising demand for cost-effective solutions and increasing prevalence of oral health disorders are the key drivers fueling adoption, particularly among small and mid-sized dental clinics.

- A major trend is the integration of digital dentistry into refurbished systems, including CAD/CAM and imaging technologies, coupled with a growing focus on sustainability and circular economy practices.

- The market is fragmented with players competing through warranty-backed products, certification standards, and expansion in emerging economies, while skepticism over quality and regulatory hurdles remain key restraints.

- North America led the market with 36% share in 2024, followed by Europe at 29% and Asia Pacific at 24%, while imaging systems held the dominant product segment with 28% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The refurbished dental equipment market by product type is dominated by imaging systems, holding nearly 28% of the market share in 2024. Imaging systems, including digital X-ray and CBCT units, are widely adopted due to their essential role in diagnostics and treatment planning. Their high cost when purchased new has accelerated demand for refurbished versions, especially in developing regions. Dental lasers and CAD/CAM systems are also experiencing strong growth, driven by the rise of cosmetic dentistry and digital workflows. Sterilization equipment and patient chairs remain steady contributors as core operatory essentials.

- For instance, For sterilization equipment, Midmark M11 has an 11″ × 18″ chamber; unwrapped cycle totals 48 min (hot).

By End-use

Among end-users, dental clinics led the refurbished dental equipment market in 2024, accounting for over 45% of the total share. Clinics adopt refurbished systems to expand service offerings while maintaining cost efficiency, particularly in small and mid-sized practices. The rising demand for affordable advanced imaging and hygiene solutions makes refurbished equipment attractive. Hospitals are also increasing adoption due to their growing focus on dental departments, while ambulatory surgical centres are gaining traction as they expand dental procedures with cost-effective infrastructure solutions. This trend highlights affordability and accessibility as key growth drivers.

- For instance, For hospitals expanding digital imaging: Align Technology reported an iTero installed base of 73,000 units (Q1 2022).

Market Overview

Rising Demand for Cost-Effective Dental Solutions

The primary growth driver in the refurbished dental equipment market is the increasing demand for cost-effective solutions. Dental practices, especially in emerging economies, face high budget constraints, making refurbished systems a viable alternative to expensive new equipment. The affordability of refurbished products enables small and mid-sized clinics to access advanced technologies such as CBCT systems and CAD/CAM devices. This driver is particularly influential in promoting wider adoption across regions where healthcare budgets are limited, ensuring advanced dental care remains accessible.

- For instance, Planmeca ProMax 3D Plus CBCT system achieves 75 μm voxel resolution and is widely refurbished for clinics seeking affordable diagnostics

Growing Prevalence of Dental Disorders

The rising prevalence of oral health disorders, such as cavities, gum disease, and tooth loss, has expanded the need for advanced dental diagnostics and treatment equipment. Refurbished systems offer a practical solution for clinics and hospitals to manage the rising patient load while controlling costs. With oral diseases affecting billions globally, the availability of affordable refurbished dental lasers, imaging systems, and hygiene equipment is critical. This driver continues to stimulate demand by aligning affordability with the growing global burden of dental health concerns.

- For instance, the Carestream Dental CS 8100 3D imaging unit offers selectable fields of view up to 8 x 9 cm, enabling clinics to manage a broad range of routine dental diagnostics. The system also features a high-resolution mode with a minimum voxel size of 75 µm.

Expansion of Dental Tourism

Dental tourism is a major driver supporting the adoption of refurbished equipment worldwide. Countries like India, Thailand, and Mexico are attracting international patients seeking advanced dental procedures at lower costs. Clinics in these regions often rely on refurbished systems to deliver high-quality care at competitive prices. The availability of advanced imaging and CAD/CAM systems at reduced investment costs enhances service offerings for dental tourism hubs. This growth driver strengthens global demand and makes refurbished equipment a cornerstone in expanding cross-border dental services.

Key Trends & Opportunities

Integration of Digital Dentistry

A key trend in the market is the integration of digital dentistry technologies, such as CAD/CAM systems and CBCT imaging, into refurbished equipment portfolios. As digital workflows become essential for precision in restorative and cosmetic procedures, refurbished systems allow clinics to adopt advanced solutions without excessive financial burden. This trend creates opportunities for vendors to expand portfolios and offer certified refurbished models that meet modern practice requirements. The combination of affordability and digital innovation is transforming adoption across both developed and developing markets.

- For instance, 3Shape reports that 81% of its support calls are answered within 60 seconds.

Sustainability and Circular Economy Focus

Sustainability is a growing opportunity shaping the refurbished dental equipment industry. With rising awareness of circular economy principles, refurbishing equipment reduces electronic waste and extends product lifecycles. Healthcare providers are increasingly favoring refurbished solutions to align with environmental and cost-efficiency goals. Vendors that emphasize eco-friendly refurbishment practices, backed by certifications and warranties, stand to gain a competitive advantage. This trend not only strengthens market adoption but also positions refurbished solutions as a sustainable alternative in the broader healthcare equipment industry.

- For instance, Henry Schein increased its North American recycling in distribution centres by 28.8% compared to 2020.

Key Challenges

Concerns Over Product Quality and Warranty

One of the key challenges in the refurbished dental equipment market is skepticism regarding product quality and reliability. Many dental professionals remain hesitant to adopt refurbished systems due to concerns over performance, lack of standardized refurbishing processes, and limited warranty coverage. These concerns can hinder adoption, particularly in high-income markets where practitioners prioritize equipment reliability and compliance with strict healthcare regulations. Overcoming this challenge requires vendors to adopt rigorous certification, transparent quality checks, and strong after-sales support.

Regulatory Compliance and Certification Barriers

The second major challenge is navigating complex regulatory frameworks for refurbished medical equipment. Different countries impose varied compliance requirements for safety, certification, and resale standards, complicating market entry for suppliers. These barriers can delay product availability and increase costs for refurbishment providers. Ensuring consistent compliance with regulatory standards such as CE marking and FDA approvals is critical for building trust among dental professionals. Addressing these challenges is essential to boost adoption and create a standardized framework for global refurbishment practices.

Regional Analysis

North America

North America held the largest share of the refurbished dental equipment market in 2024, accounting for 36%. The region’s dominance is supported by the presence of advanced dental infrastructure, high patient awareness, and a strong network of refurbishment providers. Dental clinics in the United States and Canada adopt refurbished imaging systems, lasers, and CAD/CAM solutions to reduce investment costs while maintaining service quality. Rising dental insurance coverage and the steady growth of dental tourism also contribute to demand. The region’s strict refurbishment standards further enhance trust and adoption among professionals and healthcare institutions.

Europe

Europe captured 29% of the refurbished dental equipment market share in 2024. The region benefits from strong adoption of sustainable healthcare practices and strict regulations that ensure quality standards for refurbished devices. Countries such as Germany, France, and the UK show strong demand from private dental clinics focused on cost efficiency. The growing prevalence of oral health disorders, along with high emphasis on advanced imaging and hygiene systems, supports adoption. Dental tourism in countries like Hungary and Poland also boosts market expansion, making refurbished solutions increasingly relevant in balancing affordability with advanced care.

Asia Pacific

Asia Pacific accounted for 24% of the market share in 2024, driven by rapid dental tourism growth and expanding healthcare infrastructure. Countries such as India, China, and Thailand are leading adopters, as clinics invest in refurbished systems to meet demand for affordable and advanced procedures. The rising middle-class population and higher incidence of dental disorders are expanding patient volumes, increasing the need for affordable equipment. The region also benefits from low refurbishment costs, attracting global suppliers. Strong emphasis on digital dentistry adoption further positions Asia Pacific as a fast-growing region in this market.

Latin America

Latin America represented 7% of the refurbished dental equipment market in 2024. Growth is supported by rising dental tourism in Brazil and Mexico, where cost-effective dental care attracts international patients. Refurbished imaging systems and sterilization equipment are widely adopted by clinics to reduce operating costs while improving service delivery. Economic constraints and limited healthcare budgets make refurbished products more appealing than new systems. However, the market faces regulatory challenges, and uneven access to refurbishment providers slows adoption in smaller economies. Still, affordability and expanding patient awareness continue to drive steady growth across the region.

Middle East and Africa

The Middle East and Africa region held a 4% market share in 2024. Demand is increasing in countries such as South Africa, the UAE, and Saudi Arabia, driven by growing investment in healthcare and expanding dental clinics. Refurbished equipment adoption is rising in dental practices aiming to offer advanced care at lower costs. Limited availability of refurbishment facilities and varying regulatory environments act as barriers to faster growth. Nonetheless, increasing focus on affordable dental care solutions, along with rising prevalence of oral diseases, supports steady market expansion in both urban and semi-urban areas.

Market Segmentations:

By Product Type:

- Dental lasers

- Cone beam computed tomography (CBCT) systems

- CAD/CAM systems

- Imaging systems

- Dental operatory lights

- Sterilization equipment

- Dental patient chairs

- Hygiene maintenance

- Others

By End-use:

- Hospitals

- Ambulatory surgical centres

- Dental clinics

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Competitive landscape in the refurbished dental equipment market features companies such as Capital Dental Equipment, Henry Schein, A & K Dental Equipment, Dental Equipment Liquidators Inc., Superior DDS, Atlas Resell Management, Pre-Owned Dental Inc., ABCDentalworks, Patterson Companies’, DuraPrHealth, Collins Dental Equipment, Bimedis, and A-de. The market is highly fragmented, with players focusing on offering certified, warranty-backed products to build trust among dental professionals. Vendors are strengthening supply chains, expanding refurbishment facilities, and integrating advanced digital technologies into their offerings to meet rising demand. Competitive strategies also emphasize sustainability by extending equipment lifecycles and reducing waste. Many companies are targeting emerging markets, where cost-sensitive clinics and growing dental tourism create strong opportunities. In developed regions, competition is driven by compliance with strict refurbishment standards and customer service excellence. Overall, the competitive environment is shaped by innovation in refurbishment practices, aggressive pricing, and the ability to assure quality and regulatory compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Capital Dental Equipment

- Henry Schein

- A & K Dental Equipment

- Dental Equipment Liquidators Inc.

- Superior DDS

- Atlas Resell Management

- Pre-Owned Dental Inc.

- ABCDentalworks

- Patterson Companies’

- DuraPrHealth

- Collins Dental Equipment

- Bimedis

- A-de

Recent Developments

- In 2023, Patterson Companies’ dental segment achieved year-over-year sales growth and operating margin expansion, supporting dental practices across various models.

- In 2023, A-de introduced a new line of digitally connected dental chairs and delivery systems (A-dec 300 Pro and A-dec 500 Pro) in North America, highlighting advancements in dental technology.

- In 2023, Henry Schein made a strategic investment to acquire a majority stake in Biotech Dental SAS, a rapidly growing French company specializing in digital dental software, clear aligners, and dental implants announced in late 2022.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow as dental clinics seek affordable solutions.

- Imaging systems will remain the leading product category due to high diagnostic demand.

- Dental tourism will drive adoption in emerging economies with cost-sensitive patients.

- Integration of digital dentistry will increase demand for refurbished CAD/CAM systems.

- Sustainability goals will boost acceptance of refurbished equipment as eco-friendly solutions.

- Vendors will expand warranty and certification programs to build customer trust.

- Hospitals and ambulatory centres will increase investments in refurbished devices.

- Regulatory harmonization will support smoother cross-border trade of refurbished products.

- Asia Pacific will emerge as the fastest-growing region in the forecast period.

- Rising prevalence of oral diseases will sustain long-term market demand globally.