Market Overview

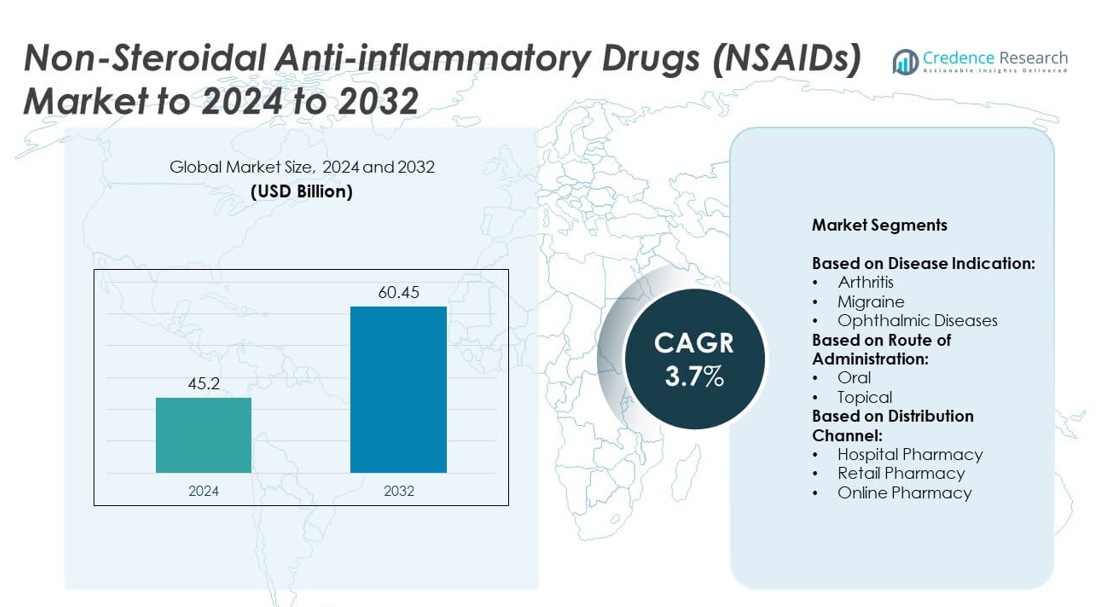

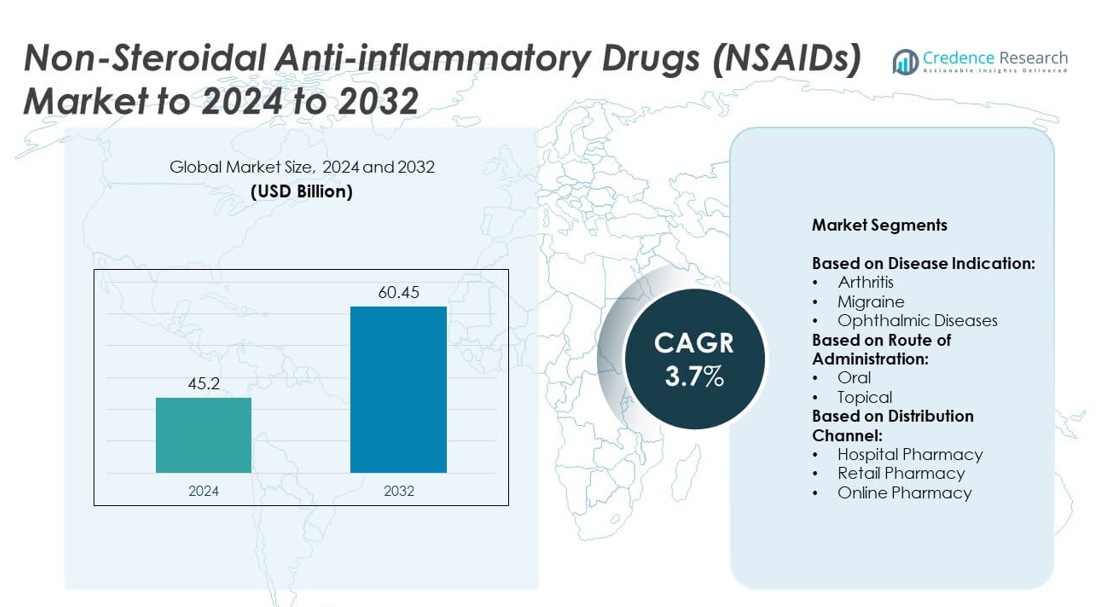

Non-Steroidal Anti Inflammatory Drugs (NSAIDs) Market size was valued at USD 45.2 Billion in 2024 and is anticipated to reach USD 60.45 Billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non-Steroidal Anti-inflammatory Drugs (NSAIDs) Market Size 2024 |

USD 45.2 Billion |

| Non-Steroidal Anti-inflammatory Drugs (NSAIDs) Market, CAGR |

3.7% |

| Non-Steroidal Anti-inflammatory Drugs (NSAIDs) Market Size 2032 |

USD 60.45 Billion |

The Non-Steroidal Anti-inflammatory Drugs (NSAIDs) market is shaped by leading players such as Johnson and Johnson Services, Inc., Pfizer Inc., Bayer AG, Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Viatris Inc, Dr. Reddy’s Laboratories Ltd, and GSK plc. These companies maintain strong positions through extensive product portfolios, including branded, generic, and over-the-counter formulations addressing diverse pain management needs. North America emerged as the leading region in 2024, commanding 38% of the global market share, supported by a high prevalence of arthritis, advanced healthcare infrastructure, and widespread retail and hospital pharmacy networks. Europe followed with a 30% share, while Asia Pacific accounted for 22% and demonstrated the fastest growth, driven by expanding healthcare access, rising awareness, and strong demand for affordable generics. This competitive landscape highlights both the dominance of established players and the regional dynamics shaping market expansion.

Market Insights

- The Non-Steroidal Anti-inflammatory Drugs (NSAIDs) market was valued at USD 45.2 billion in 2024 and is projected to reach USD 60.45 billion by 2032, growing at a CAGR of 3.7%.

- Growth is driven by the rising prevalence of chronic diseases such as arthritis and musculoskeletal disorders, along with increasing over-the-counter availability of affordable generic NSAIDs.

- Key trends include the shift toward topical formulations for localized pain relief, rising adoption of online pharmacies, and growing focus on safer COX-2 inhibitors to minimize side effects.

- The competitive landscape features leading pharmaceutical companies with diverse portfolios, focusing on innovation, generics expansion, and strategic collaborations to strengthen their global presence.

- Regionally, North America led with 38% share in 2024, followed by Europe at 30%, Asia Pacific at 22% with fastest growth, while Latin America held 6% and the Middle East and Africa accounted for 4%; arthritis remained the dominant disease segment with over 45% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Disease Indication

Arthritis accounted for the dominant share in the NSAIDs market in 2024, representing over 45% of total revenue. The high prevalence of osteoarthritis and rheumatoid arthritis, particularly among the aging population, drives demand for long-term pain management solutions. Increasing cases of musculoskeletal disorders, combined with growing awareness of treatment options, further support this dominance. Migraine and ophthalmic disease segments are expanding steadily, supported by rising patient awareness and advanced formulations. However, arthritis remains the largest contributor due to the chronic nature of the condition and the strong reliance on NSAIDs for effective symptom relief.

- For instance, the drug celecoxib, which was originally marketed by Pfizer as Celebrex, had over 6.19 million prescriptions filled in the U.S. in 2023.

By Route of Administration

The oral route emerged as the leading segment, capturing more than 55% of the market share in 2024. Oral NSAIDs remain the most widely prescribed due to ease of use, rapid onset of action, and broad patient compliance. Tablets and capsules continue to dominate as first-line therapies for chronic pain and inflammation. While topical NSAIDs are gaining traction for localized pain relief with fewer systemic side effects, they hold a smaller share. The dominance of oral formulations is supported by large-scale availability, established prescribing patterns, and the strong presence of generic versions.

- For instance, Bayer’s Aleve (naproxen sodium) oral caplets contain 220 mg of active ingredient per tablet, with a recommended dosing of 220 mg every 8 to 12 hours.

By Distribution Channel

Retail pharmacies dominated the distribution landscape, holding nearly 50% of the market share in 2024. The widespread availability of NSAIDs as over-the-counter (OTC) products, coupled with consumer preference for easy accessibility, fuels this segment. Hospital pharmacies account for a significant portion due to prescription-based use for inpatients and post-surgical pain management. Online pharmacies are experiencing rapid growth, supported by increasing e-commerce penetration and home delivery services. Nonetheless, retail pharmacies remain the primary sales channel, driven by strong consumer trust, affordability of generic NSAIDs, and convenient product availability.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The growing incidence of chronic conditions such as arthritis, cardiovascular diseases, and musculoskeletal disorders is a major driver of the NSAIDs market. With aging populations in developed and emerging economies, the demand for long-term pain management continues to rise. Arthritis alone affects millions globally, creating sustained demand for effective treatment solutions. This increasing patient pool, coupled with greater healthcare access, ensures strong uptake of NSAIDs. The rising burden of chronic disease remains the key growth driver shaping consistent demand throughout the forecast period.

- For instance, in its 2022 Annual Report filing with the SEC, Teva stated that it produced approximately 75 billion tablets and capsules during that year.

Expansion of Over-the-Counter Availability

The availability of NSAIDs as over-the-counter (OTC) medications significantly fuels market growth. Consumers prefer easily accessible pain relief products, especially for headaches, muscle pain, and minor injuries. Pharmacies and retail outlets worldwide stock generic NSAIDs at affordable prices, making them a widely used self-medication option. The convenience of OTC access reduces dependency on prescriptions, expanding market penetration. The combination of affordability and accessibility continues to boost sales volumes and supports the dominance of retail pharmacies in distribution.

- For instance, Novartis manufactured over 20 billion treatments for patients in 2024.

Advances in Formulations and Drug Delivery

Continuous advancements in formulations and delivery mechanisms are enhancing NSAID safety and efficacy. Novel drug delivery systems such as extended-release tablets, topical gels, and combination therapies are gaining adoption. These innovations aim to minimize gastrointestinal side effects, a common concern with traditional NSAIDs. Improved formulations not only enhance patient compliance but also expand usage in sensitive patient populations. This focus on innovation ensures the market adapts to evolving healthcare needs, driving long-term growth prospects across both prescription and OTC categories.

Key Trends & Opportunities

Shift Toward Topical NSAIDs

A notable trend in the market is the growing adoption of topical NSAIDs, particularly among patients seeking localized pain relief. Topical gels and creams are increasingly favored for conditions like arthritis, sprains, and minor injuries due to reduced systemic risks compared to oral formulations. Regulatory support and rising awareness about safer alternatives have accelerated this shift. Pharmaceutical companies are investing in topical formulations, which represent a key opportunity to capture emerging demand while addressing long-standing safety concerns.

- For instance, By September 30, 2024, Alibaba Health had contracted with over 230,000 licensed physicians, pharmacists, and nutritionists to provide online health services.

Digital and Online Pharmacy Growth

The rise of e-commerce and online pharmacies is creating new growth opportunities for the NSAIDs market. Consumers increasingly prefer doorstep delivery, bulk purchasing options, and digital platforms offering price transparency. Online availability also supports discreet purchases for recurring pain management, enhancing consumer convenience. With internet penetration and healthcare digitization expanding globally, this distribution model is expected to register robust growth. Online channels are set to become a vital opportunity for NSAID suppliers, especially in emerging markets with younger, tech-savvy populations.

- For instance, According to Mylan’s 2014 press release, U.S. sales of celecoxib products (50 mg, 100 mg, 200 mg, 400 mg) over the 12 months ending September 30, 2014, were approximately 2.5 billion dollars.

Focus on Safer and Selective COX-2 Inhibitors

Pharmaceutical research is focusing on selective COX-2 inhibitors to reduce gastrointestinal and cardiovascular risks linked to traditional NSAIDs. These drugs provide targeted relief while minimizing side effects, improving patient outcomes. Although more expensive than standard formulations, they are gaining adoption among patients requiring long-term treatment. This trend reflects growing demand for safer and more specialized therapies. The focus on next-generation NSAIDs offers a clear opportunity for companies to differentiate through innovation and capture premium market segments.

Key Challenges

Adverse Effects and Safety Concerns

One of the biggest challenges for the NSAIDs market is the risk of side effects, particularly gastrointestinal bleeding, kidney damage, and cardiovascular complications. Long-term use raises significant safety concerns, limiting adoption among vulnerable populations. Healthcare providers often hesitate to prescribe NSAIDs for extended periods, shifting preference to alternative therapies. This ongoing issue impacts patient confidence and restricts market expansion. Addressing these risks remains critical for sustaining growth, as safety concerns continue to influence prescribing and consumption patterns.

Regulatory Restrictions and Patent Expiries

Strict regulatory guidelines surrounding NSAID safety and frequent patent expiries challenge market growth. Many blockbuster NSAIDs face generic competition, reducing profit margins for established players. Regulatory bodies are also tightening approval processes for new formulations due to safety concerns, slowing innovation cycles. Companies are forced to invest heavily in research and compliance to maintain market presence. These barriers create uncertainty for manufacturers while intensifying competition, making regulatory restrictions and expirations a persistent obstacle to sustainable revenue growth.

Regional Analysis

North America

North America held the largest share of the NSAIDs market in 2024, accounting for 38% of global revenue. The region benefits from high prevalence of arthritis, migraine, and musculoskeletal disorders, particularly among the aging population. Strong healthcare infrastructure, high adoption of prescription and over-the-counter NSAIDs, and widespread availability of generics support its dominance. Retail pharmacies and hospital distribution channels remain robust, while online pharmacy adoption is accelerating. Favorable reimbursement policies and strong R&D activity by leading pharmaceutical companies also strengthen growth, ensuring that North America continues to lead the global NSAIDs market during the forecast period.

Europe

Europe captured 30% of the NSAIDs market share in 2024, driven by rising cases of arthritis and chronic pain conditions across the elderly population. Countries such as Germany, France, and the UK are leading contributors, supported by extensive healthcare access and insurance coverage. The availability of both generic and branded NSAIDs through hospital and retail pharmacies ensures widespread usage. Growing demand for topical formulations, supported by favorable regulatory guidelines, is boosting adoption. With an established pharmaceutical base and emphasis on patient safety, Europe remains a significant contributor, though slower adoption of new formulations poses a mild challenge.

Asia Pacific

Asia Pacific accounted for 22% of the NSAIDs market share in 2024 and is projected to record the fastest growth. Rising prevalence of arthritis and migraine in China, India, and Japan is creating significant demand. Expanding healthcare infrastructure, increasing availability of affordable generics, and growing adoption of e-pharmacies are key drivers. Urbanization and lifestyle changes are contributing to higher musculoskeletal disorders, further fueling NSAID consumption. Strong government focus on expanding healthcare access and rising consumer awareness of pain management solutions strengthen the outlook. Asia Pacific’s large patient pool makes it a high-potential region for sustained market expansion.

Latin America

Latin America represented 6% of the NSAIDs market share in 2024, with Brazil and Mexico being the primary contributors. The market benefits from growing healthcare access, rising incidence of arthritis and sports-related injuries, and expanding retail pharmacy networks. Affordability of generic NSAIDs supports high uptake, while increasing digital penetration is boosting online pharmacy growth. However, regulatory challenges and limited healthcare infrastructure in rural areas restrict broader adoption. Despite these barriers, Latin America continues to expand steadily, driven by consumer preference for low-cost pain management solutions and ongoing investments in pharmaceutical distribution systems.

Middle East and Africa

The Middle East and Africa accounted for 4% of the NSAIDs market share in 2024, making it the smallest regional contributor. Growth is supported by a rising prevalence of chronic pain conditions and improving healthcare infrastructure, particularly in Gulf Cooperation Council (GCC) countries. Increased investments in hospital facilities and expanding pharmacy networks are driving market penetration. However, limited affordability and restricted access in several African countries pose challenges to widespread adoption. Despite these barriers, the region is gradually witnessing higher uptake of generic NSAIDs, with ongoing government initiatives to improve healthcare access supporting future growth prospects.

Market Segmentations:

By Disease Indication:

- Arthritis

- Migraine

- Ophthalmic Diseases

By Route of Administration:

By Distribution Channel:

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Johnson and Johnson Services, Inc., Viatris Inc, Bayer AG, Dr. Reddy’s Laboratories Ltd, Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Pfizer Inc., GSK plc, and GlaxoSmithKline (GSK) plc are the leading players shaping the global NSAIDs market. These companies focus on strengthening their portfolios through a mix of branded, generic, and over-the-counter products that address both chronic and acute pain conditions. Competitive strategies include investing in safer formulations, expanding distribution networks across emerging economies, and leveraging digital platforms to improve consumer access. The emphasis on research to minimize adverse effects and improve drug delivery systems is also a key area of competition. Additionally, rising adoption of topical and selective COX-2 inhibitors is influencing innovation pipelines. Market players are actively pursuing partnerships, mergers, and acquisitions to expand global reach and maintain leadership in a highly fragmented and competitive environment, ensuring long-term growth opportunities despite regulatory and pricing challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson and Johnson Services, Inc.

- Viatris Inc

- Bayer AG

- Reddy’s Laboratories Ltd

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- GSK plc

- GlaxoSmithKline (GSK) plc

Recent Developments

- In 2025, Pfizer Inc. maintained a strong focus on its Inflammation & Immunology (I&I) pipeline, seeking new molecular entities (e.g., small molecules, biologics) that go beyond traditional NSAIDs to address the root causes of chronic inflammatory diseases at a molecular level.

- In 2025, GlaxoSmithKline (GSK) plc announced plans to invest over $30 billion in R&D and manufacturing in the US over the next five years, with Respiratory, Immunology, and Inflammation as one of its four core therapeutic areas. This signals a future focus on next-generation inflammation treatments.

- In 2025, Bayer AG launched Aspirina to the U.S. pain relief market, a strategic effort to appeal to the U.S. Hispanic community and reinforce the market presence of its foundational NSAID, Bayer® Aspirin.

Report Coverage

The research report offers an in-depth analysis based on Disease Indication, Route of Administration, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising cases of arthritis and chronic pain.

- Demand for safer NSAIDs with fewer side effects will increase.

- Topical formulations will gain more acceptance among patients.

- Online pharmacies will grow as digital health adoption rises.

- Generic NSAIDs will dominate due to affordability and wide availability.

- Research will focus on COX-2 inhibitors and advanced formulations.

- Aging populations worldwide will drive consistent demand for pain management drugs.

- Regulatory scrutiny will remain a challenge for new product approvals.

- Emerging markets will see faster growth with better healthcare access.

- Partnerships and acquisitions among pharma companies will strengthen global reach.