Market Overview

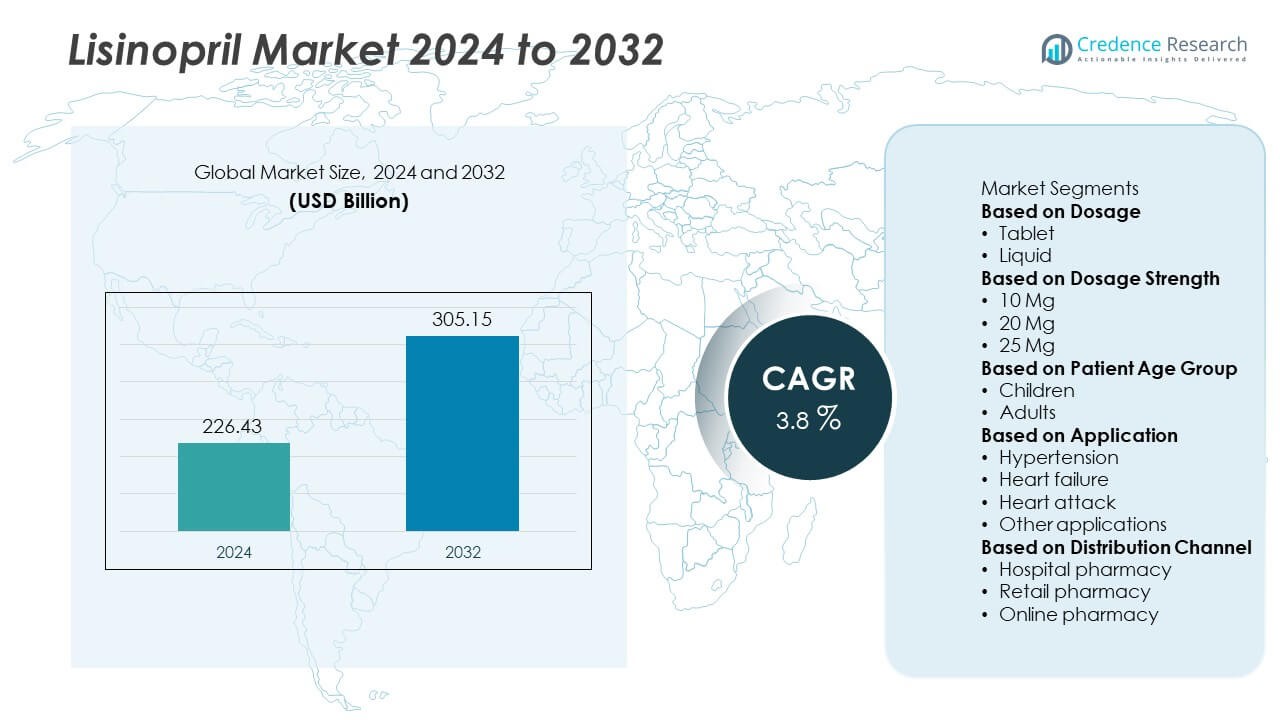

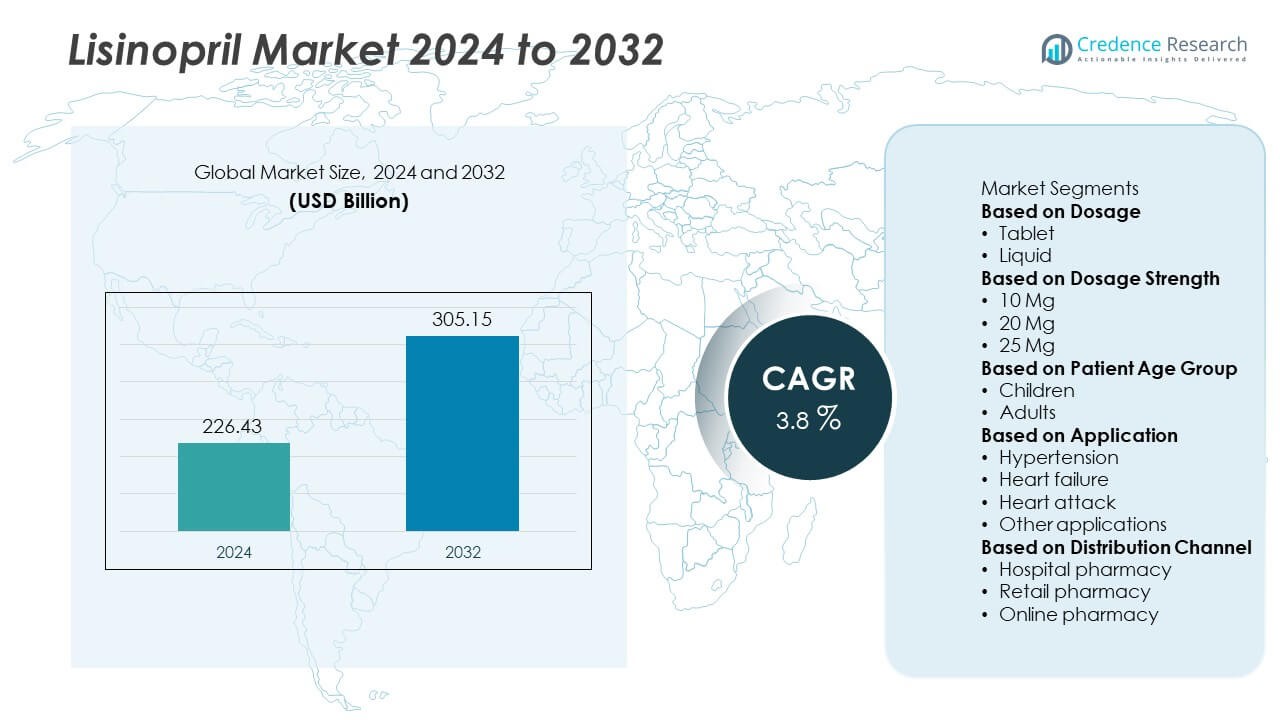

The Lisinopril market was valued at USD 226.43 billion in 2024 and is projected to reach USD 305.15 billion by 2032, expanding at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lisinopril Market Size 2024 |

USD 226.43 Billion |

| Lisinopril Market, CAGR |

3.8% |

| Lisinopril Market Size 2032 |

USD 305.15 billion |

The lisinopril market is led by key players including Bausch Health Companies, Inc., Lupin Limited, Cipla Limited, AbbVie Inc., Aurobindo Pharma Ltd., Merck & Co., Inc., Hikma Pharmaceutical PLC., Amneal Pharmaceutical, Inc., Apotex Inc., and AstraZeneca, all of which emphasize affordable generics, regulatory compliance, and global distribution. These companies compete by expanding manufacturing capacity and strengthening their reach across both developed and emerging markets. Regionally, North America dominated the lisinopril market with 37% share in 2024, supported by advanced healthcare infrastructure and high generic adoption. Europe followed with 29% share, driven by robust insurance systems and strong demand for cost-effective therapies, while Asia-Pacific held 23% share, emerging as the fastest-growing region with rising hypertension prevalence and improved access to generics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The lisinopril market was valued at USD 226.43 billion in 2024 and is projected to reach USD 305.15 billion by 2032, growing at a CAGR of 3.8%.

- Rising prevalence of hypertension and cardiovascular diseases is driving demand, with adults representing the dominant patient group at 81% share in 2024.

- Key trends include increasing use of lisinopril in combination therapies and expanding distribution through online and retail pharmacy networks, supporting better accessibility and adherence.

- The market is competitive with players such as Bausch Health Companies, Lupin, Cipla, AbbVie, Aurobindo Pharma, Merck, Hikma, Amneal, Apotex, and AstraZeneca focusing on affordable generics, global expansion, and regulatory compliance.

- Regionally, North America led with 37% share in 2024, followed by Europe at 29% and Asia-Pacific at 23%, while Latin America and the Middle East & Africa together accounted for 11%, supported by growing healthcare access and rising adoption of cost-effective generic formulations.

Market Segmentation Analysis:

By Dosage

The tablet segment dominated the lisinopril market with 72% share in 2024, driven by its convenience, wide availability, and patient compliance. Tablets remain the most prescribed form due to standardized dosing, longer shelf life, and lower production costs compared to liquid formulations. The liquid segment, though holding a smaller share, is increasingly prescribed for pediatric and geriatric patients who face swallowing difficulties. However, the tablet segment continues to lead as the primary treatment format for hypertension and related cardiovascular conditions, supported by its accessibility in both hospital and retail pharmacies.

- For instance, Sun Pharmaceutical is a major global manufacturer and supplier of lisinopril and other generic medications, offering multiple dosage strengths and distributing its products to numerous regions, including North America and Europe.

By Dosage Strength

The 20 mg strength accounted for the largest share of 44% in the lisinopril market in 2024. This dominance is attributed to its common use in managing moderate hypertension and heart failure, making it the most frequently prescribed dose by healthcare professionals. The 10 mg dosage follows, often used as an initial therapy or for patients requiring lower intensity treatment. The 25 mg dosage holds a smaller share, typically reserved for patients with severe hypertension or those unresponsive to lower doses. The 20 mg category’s balance of efficacy and tolerability ensures its leading position.

- For instance, Mylan (now Viatris) is a major pharmaceutical manufacturer that produced significant quantities of generic 20 mg lisinopril tablets for treatment protocols in hospital and outpatient settings across Asia-Pacific and Europe.

By Patient Age Group

Adults represented the dominant segment with 81% share of the lisinopril market in 2024, reflecting the high prevalence of hypertension and cardiovascular diseases among middle-aged and elderly populations. Adult patients drive the majority of demand, as lisinopril is a first-line therapy for blood pressure control and heart failure management. The children’s segment, while smaller, is growing gradually due to rising cases of pediatric hypertension and renal conditions. Pediatric use remains limited because of stricter dosing requirements and reliance on liquid formulations. Nonetheless, adults continue to account for the overwhelming share of global lisinopril prescriptions.

Key Growth Drivers

Rising Prevalence of Hypertension and Cardiovascular Diseases

The increasing incidence of hypertension and cardiovascular disorders is a major growth driver for the lisinopril market. With sedentary lifestyles, unhealthy diets, and rising obesity levels, the global burden of high blood pressure continues to climb. Lisinopril, as an ACE inhibitor, is widely prescribed for managing hypertension, heart failure, and post-heart attack recovery. The drug’s proven efficacy, long history of use, and cost-effectiveness make it a preferred treatment option. Growing diagnosis rates and greater access to healthcare services further support the consistent demand for lisinopril worldwide.

- For instance, in 2024, based on WHO data, approximately 1.4 billion adults aged 30–79 years globally were living with hypertension, with only about 20% having controlled blood pressure, highlighting the sustained need for effective antihypertensive drugs like lisinopril.

Expanding Geriatric Population

The global rise in the elderly population significantly contributes to market growth. Older adults are more prone to hypertension, heart failure, and kidney-related conditions, where lisinopril is a standard therapy. The drug’s effectiveness in reducing cardiovascular risks and improving survival rates makes it an essential treatment for this demographic. Increased life expectancy and improved healthcare infrastructure in both developed and emerging markets expand access to long-term therapies. The growing geriatric base ensures steady demand for lisinopril, reinforcing its importance in chronic disease management.

- For instance, as the global population aged 65 and above grew to over 730 million, and with cardiovascular diseases being the leading cause of death in this demographic, the pharmaceutical industry adapted by adjusting the production and distribution of relevant medications, such as lisinopril, to meet the rising demand driven by these demographic and health trends.

Wider Accessibility through Generics

The availability of generic versions of lisinopril has expanded patient access globally, driving market growth. Generic formulations offer the same therapeutic effectiveness at significantly lower prices, making treatment affordable in both developed and emerging economies. This has led to high prescription volumes across hospitals, retail pharmacies, and online platforms. Governments and insurers also encourage the use of generics to reduce healthcare costs. The widespread presence of generic manufacturers enhances supply reliability, ensuring consistent availability and supporting the steady expansion of the lisinopril market.

Key Trends & Opportunities

Growth of Online and Retail Pharmacies

The rapid expansion of online and retail pharmacies presents a strong opportunity for lisinopril distribution. Digital platforms enable convenient access for patients, particularly those managing chronic conditions requiring regular refills. Subscription-based models and doorstep delivery further enhance adherence rates. In addition, retail chains offer competitive pricing and wide availability of generics, improving patient accessibility. With rising digital adoption and e-health trends, the role of online and retail pharmacies in expanding lisinopril’s reach is expected to strengthen over the forecast period.

- For instance, Apollo 24|7’s online platform, part of the larger Apollo HealthCo omnichannel ecosystem, facilitates a substantial volume of prescription refills and deliveries via its network of over 6,700 pharmacies and its Circle membership program. In Q1 FY26, Apollo 24|7 recorded over 74,000 daily orders, enabling the delivery of medicines to a large number of homes across India.

Rising Use in Combination Therapies

Combination therapies involving lisinopril and other antihypertensive drugs are gaining traction as healthcare providers seek more effective treatment options for patients with complex conditions. Fixed-dose combinations improve compliance, reduce pill burden, and deliver better blood pressure control. Growing R&D efforts to expand such combinations create opportunities for pharmaceutical companies. These therapies also appeal to patients with coexisting cardiovascular and metabolic disorders. The increasing adoption of combination products positions lisinopril as a core component of modern hypertension and heart failure management strategies.

- For instance, Healing Pharma offers an Angiotensin H tablet containing a fixed-dose combination of 5mg lisinopril and 12.5mg hydrochlorothiazide. Separately, Ocean Pharmaceutical is one of several manufacturers that produces a Lisinopril & Hydrochlorothiazide tablet with the strength 10mg+12.5mg.

Key Challenges

Adverse Effects and Safety Concerns

Despite its effectiveness, lisinopril use is associated with side effects such as cough, dizziness, hyperkalemia, and, in rare cases, kidney complications. These concerns sometimes lead to treatment discontinuation or switching to alternative therapies. Physicians remain cautious when prescribing to patients with chronic kidney disease or those on multiple medications. Safety-related issues may limit broader adoption in certain patient groups. Addressing these concerns through patient education, dose adjustments, and monitoring remains essential to sustaining lisinopril’s role in cardiovascular care.

Market Competition from Alternative Therapies

The lisinopril market faces stiff competition from newer antihypertensive drug classes such as angiotensin receptor blockers (ARBs) and calcium channel blockers. These alternatives are often preferred for patients who experience adverse effects from ACE inhibitors. With continuous innovation in cardiovascular therapies, patient and physician preferences may shift toward newer options offering improved tolerability. This competitive pressure requires manufacturers to focus on affordability, accessibility, and strategic positioning of lisinopril to retain its relevance in an evolving therapeutic landscape.

Regional Analysis

North America

North America held the largest share of 37% in the lisinopril market in 2024, driven by a high prevalence of hypertension and cardiovascular diseases. The U.S. leads the region, supported by advanced healthcare infrastructure, strong awareness programs, and broad insurance coverage for generic drugs. Canada also contributes with rising adoption of cost-effective generics and a growing elderly population. Expanding use of online pharmacies and patient assistance programs further boosts access. With continued emphasis on chronic disease management and preventive care, North America remains the leading region for lisinopril consumption during the forecast period.

Europe

Europe accounted for 29% share of the lisinopril market in 2024, supported by robust healthcare systems and strong generic drug penetration. Countries such as Germany, the UK, and France lead adoption, driven by government policies favoring cost-effective therapies. An aging population and rising cases of hypertension further strengthen demand. The region’s focus on preventive healthcare and early diagnosis ensures consistent prescription rates. Eastern Europe also shows growing uptake as healthcare accessibility improves. With widespread insurance coverage and emphasis on generic affordability, Europe continues to hold a significant position in the global lisinopril market.

Asia-Pacific

Asia-Pacific captured 23% share of the lisinopril market in 2024, making it the fastest-growing region. China and India lead demand due to their large patient populations and increasing prevalence of hypertension. Expanding healthcare infrastructure and government initiatives to improve access to affordable generics boost adoption. Japan also contributes with advanced clinical practices and high awareness levels. Rising disposable incomes and urbanization further fuel market growth across Southeast Asia. With a growing middle-class base and emphasis on improving chronic disease management, Asia-Pacific presents strong opportunities for long-term lisinopril expansion.

Latin America

Latin America represented 6% share of the lisinopril market in 2024, led by Brazil and Mexico. Growing urban populations and increasing incidence of hypertension support market demand. Public healthcare initiatives focused on expanding access to generics further strengthen adoption. However, economic volatility and unequal access to advanced healthcare limit faster growth. Despite challenges, rising investments in healthcare infrastructure and expanding retail pharmacy networks provide steady opportunities. With governments emphasizing cost-effective treatments for chronic conditions, Latin America is expected to gradually increase its share of the global lisinopril market.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the lisinopril market in 2024, with demand concentrated in Gulf countries and South Africa. Hypertension prevalence is rising due to lifestyle changes, obesity, and aging populations. Improved access to generics and expansion of healthcare systems are supporting steady adoption. However, affordability challenges and limited local manufacturing constrain market growth in several African nations. Ongoing government investments in public health and rising awareness of cardiovascular risks are expected to drive gradual demand increases, positioning the region as an emerging contributor to the global lisinopril market.

Market Segmentations:

By Dosage

By Dosage Strength

By Patient Age Group

By Application

- Hypertension

- Heart failure

- Heart attack

- Other applications

By Distribution Channel

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the lisinopril market is shaped by leading players such as Bausch Health Companies, Inc., Lupin Limited, Cipla Limited, AbbVie Inc., Aurobindo Pharma Ltd., Merck & Co., Inc., Hikma Pharmaceutical PLC., Amneal Pharmaceutical, Inc., Apotex Inc., and AstraZeneca. These companies focus on producing affordable and high-quality generic formulations to meet the growing global demand for hypertension and cardiovascular therapies. Competitive strategies include expanding manufacturing capacity, strengthening distribution networks, and leveraging partnerships to enhance market penetration. Many players also invest in regulatory approvals and compliance to maintain a strong presence in developed markets like North America and Europe, where generic adoption is high. Meanwhile, expansion into emerging economies with rising chronic disease prevalence creates additional growth opportunities. Intense price competition among generics encourages continuous cost optimization, while product availability through retail, hospital, and online pharmacies ensures wide patient access. This competition sustains the dominance of established companies in the global lisinopril market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bausch Health Companies, Inc.

- Lupin Limited

- Cipla Limited

- AbbVie Inc.

- Aurobindo Pharma Ltd.

- Merck & Co., Inc.

- Hikma Pharmaceutical PLC.

- Amneal Pharmaceutical, Inc.

- Apotex Inc.

- AstraZeneca

Recent Developments

- In July 2025, Lupin Limited initiated a Class II voluntary recall for a batch of its lisinopril and hydrochlorothiazide tablets in the US due to a manufacturing mix-up involving foreign tablets.

- In July 2025, Lupin Limited initiated a voluntary recall of 58,968 bottles of Lisinopril + Hydrochlorothiazide tablets due to a product mix-up with foreign tablets.

- In 2023, Teva Pharmaceuticals temporarily discontinued lisinopril tablets, contributing to shortages of certain dosages.

Report Coverage

The research report offers an in-depth analysis based on Dosage, Dosage Strength, Patient Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising cases of hypertension and cardiovascular diseases.

- Adults will remain the dominant patient group due to higher disease prevalence.

- Generic formulations will drive affordability and wider accessibility across regions.

- Online and retail pharmacies will play a larger role in distribution.

- Combination therapies will gain traction for improved patient compliance and outcomes.

- North America will maintain leadership with strong healthcare infrastructure and insurance coverage.

- Europe will sustain growth with supportive reimbursement policies and high generic adoption.

- Asia-Pacific will emerge as the fastest-growing market with rising awareness and access.

- Manufacturers will focus on cost optimization to remain competitive against pricing pressure.

- Competition from alternative antihypertensive drugs will influence market positioning and growth strategies.