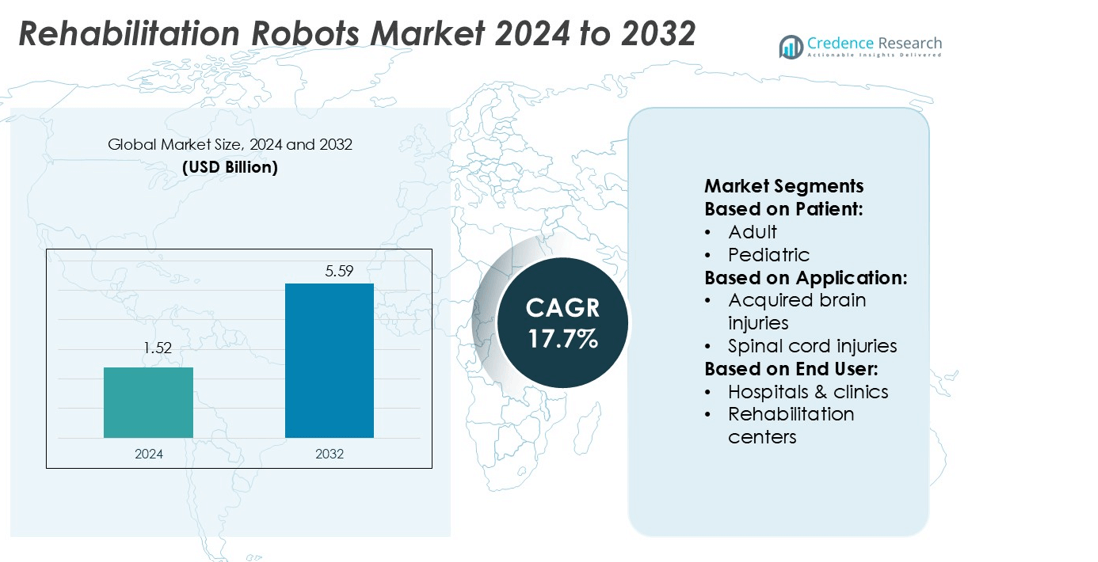

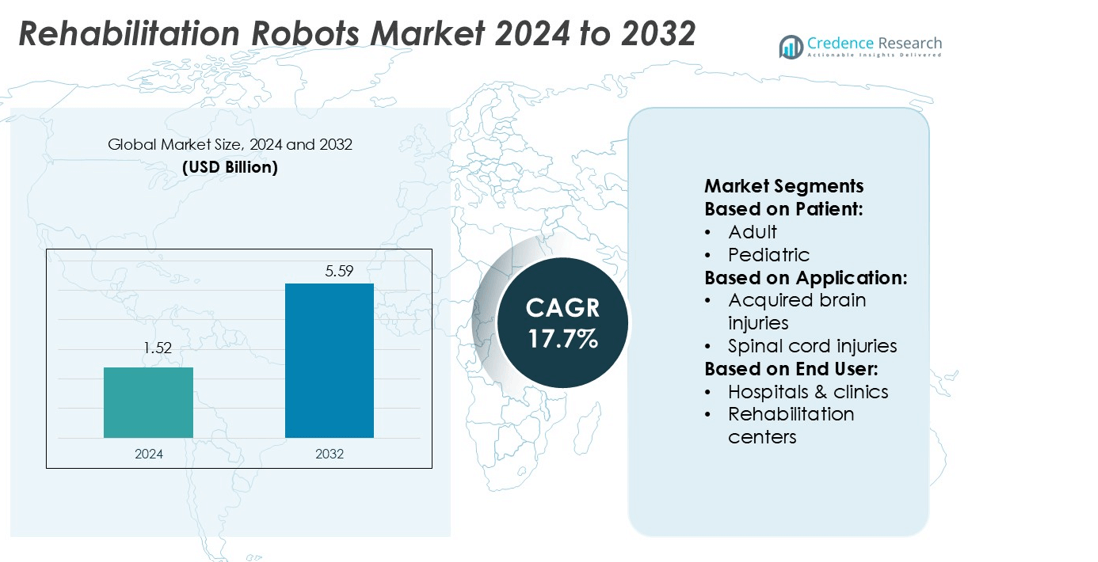

Rehabilitation Robots Market size was valued USD 1.52 billion in 2024 and is anticipated to reach USD 5.59 billion by 2032, at a CAGR of 17.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rehabilitation Robots Market Size 2024 |

USD 1.52 billion |

| Rehabilitation Robots Market, CAGR |

17.7% |

| Rehabilitation Robots Market Size 2032 |

USD 5.59 billion |

The rehabilitation robots market features strong competition with key players including Cyberdyne Inc., Rehab-Robotics Company Limited, Leaders Rehab Robot Co. Ltd., MediTouch, Bionik Laboratories Corporation, Ekso Bionics Holdings Inc., AlterG, Fourier Intelligence, DIH Medical, and Bioxtreme. These companies emphasize product innovation, AI integration, and partnerships with healthcare institutions to enhance adoption. Advanced solutions such as exoskeletons, anti-gravity treadmills, and upper-limb robotic devices highlight their focus on improving patient recovery outcomes. North America leads the global market with a 38% share, supported by robust healthcare infrastructure, high investment in robotic rehabilitation technologies, and favorable reimbursement policies that encourage widespread deployment.

Market Insights

- The Rehabilitation Robots market was valued at USD 1.52 billion in 2024 and is projected to reach USD 5.59 billion by 2032, registering a CAGR of 17.7% during the forecast period.

- Rising incidence of neurological disorders, spinal injuries, and an aging population are key drivers boosting demand for robotic-assisted rehabilitation solutions across hospitals and rehabilitation centers.

- The market is witnessing strong trends in AI integration, wearable exoskeleton technologies, and home-based rehabilitation robots, improving accessibility and personalized therapy programs for diverse patient groups.

- Competitive intensity remains high, with players focusing on innovation, affordability, and partnerships; however, high system costs and limited reimbursement policies continue to act as restraints, particularly in emerging markets.

- Regionally, North America leads with a 38% share due to advanced infrastructure and strong investments, while Europe follows with 29%; by application, spinal cord injury rehabilitation dominates with over 40% share, reflecting strong demand for mobility restoration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Patient

The adult segment dominates the rehabilitation robots market with a share exceeding 65%. High prevalence of stroke, spinal cord injuries, and mobility impairments among aging populations drives adoption in this segment. Adults also benefit from advanced robotic-assisted therapies that improve recovery timelines and reduce long-term care costs. Increasing demand for personalized rehabilitation programs, along with hospital investments in robotics for adult neurorehabilitation, further supports growth. In contrast, the pediatric segment is expanding steadily, supported by growing awareness of early intervention for congenital and developmental disorders.

- For instance, Bionik’s InMotion® devices enable patients to complete between 600 and 1,000 assisted arm/hand movements per hour—far above the 30–60 repetitions per hour typical in conventional therapy—while continuously measuring position, acceleration, and speed to adapt assistance dynamically.

By Application

Spinal cord injuries represent the largest application segment, accounting for over 40% market share. The dominance is driven by the rising number of accident-related injuries and demand for intensive, repetitive training offered by robotic systems. Rehabilitation robots support mobility recovery, gait training, and motor function restoration, making them essential in spinal injury care. Acquired brain injuries follow closely, fueled by higher stroke incidence globally. Other applications, including orthopedic and post-surgical rehabilitation, are expanding as healthcare providers adopt robotics to improve functional outcomes and reduce manual therapist workload.

- For instance, AlterG’s Anti-Gravity Treadmill uses patented Differential Air Pressure (DAP) technology to offload up to 80% of body weight in precise 1% increments, while simultaneously collecting gait analytics data (e.g. stride length, cadence) in real time.

By End-user

Hospitals and clinics lead the market, holding more than 50% share, driven by early adoption of robotic technologies and larger budgets for advanced rehabilitation infrastructure. Hospitals integrate robotics into multidisciplinary rehabilitation programs, offering patients comprehensive care under medical supervision. Rehabilitation centers are the second-largest segment, supported by specialized therapies and growing demand for outpatient recovery services. Other end-users, including homecare and research institutions, show gradual adoption, mainly influenced by the development of compact and affordable rehabilitation robots that extend therapy beyond clinical settings.

Market Overview

Rising Incidence of Neurological Disorders and Injuries

The growing prevalence of neurological conditions such as stroke, traumatic brain injuries, and spinal cord injuries is driving demand for rehabilitation robots. These conditions often result in impaired mobility and require intensive therapy for recovery. Rehabilitation robots provide repetitive, precise, and efficient training sessions that enhance patient outcomes. With an aging population and rising healthcare expenditures, hospitals and rehabilitation centers are increasingly adopting robotic systems to meet the growing rehabilitation needs. This surge in neurological cases continues to expand the market for advanced robotic solutions.

- For instance, the CyberKnife S7 system delivers sub-millimeter stereotactic treatments anywhere in the body and integrates real-time motion synchronization (Synchrony®) across six degrees of freedom, adjusting beam targeting dynamically without interrupting treatment.

Technological Advancements in Robotics and AI Integration

Continuous innovation in robotics and artificial intelligence is fueling adoption of rehabilitation robots. Advanced systems equipped with AI algorithms, sensors, and machine learning enable adaptive and personalized therapy programs. These technologies allow robots to analyze patient progress in real time, adjust treatment intensity, and support remote rehabilitation models. Improvements in exoskeleton designs, haptic feedback, and lightweight wearable systems also enhance patient comfort and usability. The integration of data analytics further supports clinical decision-making, making robotic rehabilitation a preferred solution in modern healthcare environments.

- For instance, Cascination’s HEARO robotic system drills a 1.8 mm diameter trajectory to the cochlea while maintaining an average 0.4 mm margin of distance from the facial nerve, using real-time torque feedback and neuromonitoring to avoid nerve damage.

Increasing Investments and Healthcare Infrastructure Expansion

Growing investments from both public and private sectors are supporting the expansion of rehabilitation robot adoption. Governments and healthcare organizations are funding research projects and pilot programs to integrate robotic therapies into mainstream rehabilitation. Expanding healthcare infrastructure in developed and emerging economies is further creating opportunities for advanced rehabilitation facilities. Favorable reimbursement policies and partnerships between hospitals and technology providers also drive market penetration. These investments not only improve accessibility to robotic solutions but also accelerate innovation, making rehabilitation robots more widely available.

Key Trends & Opportunities

Adoption of Home-Based Rehabilitation Solutions

The market is witnessing rising demand for compact, affordable rehabilitation robots designed for home use. Patients prefer continuing therapy outside clinical settings to reduce costs and improve convenience. Advances in tele-rehabilitation platforms, remote monitoring, and user-friendly robotic devices enable patients to receive guided therapy at home. This trend supports continuity of care, accelerates recovery, and reduces the burden on healthcare facilities. The expansion of home-based solutions represents a significant opportunity for manufacturers to address unmet needs in decentralized rehabilitation care.

- For instance, Elmed’s Avicenna Roboflex robotic system allows remote control of a flexible ureteroscope with a rotational range of up to 440° in more recent versions. The system also integrates a safety feature that activates the laser only when the fiber tip is properly positioned.

Shift Toward Wearable and Exoskeleton Technologies

Wearable robotic exoskeletons are emerging as a key growth area in the rehabilitation robots market. These systems enhance mobility, gait training, and independence for patients recovering from neurological injuries or age-related conditions. Lightweight designs, improved battery efficiency, and affordability are making exoskeletons more accessible in rehabilitation centers. Beyond medical use, exoskeletons are also gaining interest in occupational therapy and support for the elderly. This trend opens new revenue streams for manufacturers while improving patient adoption rates in both clinical and non-clinical settings.

- For instance, Globus Medical’s ExcelsiusGPS® robotic platform is widely used in spinal implant procedures, leveraging real-time intraoperative 3D imaging and navigation with accuracy under 2 mm.

Key Challenges

High Cost of Robotic Systems and Limited Reimbursement

The high cost of rehabilitation robots, coupled with limited reimbursement policies, remains a major challenge. Advanced robotic systems involve significant upfront investments and ongoing maintenance costs, making them less affordable for smaller hospitals and rehabilitation centers. In many regions, insurance coverage for robotic therapies is still limited, restricting patient access. These financial barriers slow down adoption, especially in emerging markets. Overcoming cost constraints through policy support, value-based pricing, and scalable models is critical to expanding market reach.

Shortage of Skilled Professionals for Operation and Training

The effective use of rehabilitation robots requires skilled professionals trained in both robotics and rehabilitation therapy. Many healthcare providers face a shortage of personnel capable of managing advanced robotic systems. Insufficient training programs and lack of awareness among therapists further limit adoption. Without proper operation and monitoring, the benefits of rehabilitation robots cannot be fully realized. Addressing this challenge will require collaboration between technology providers, hospitals, and training institutions to build specialized workforce capabilities and ensure widespread clinical adoption.

Regional Analysis

North America

North America leads the rehabilitation robots market with a 38% share, driven by advanced healthcare infrastructure and strong adoption of robotic technologies. The United States accounts for the largest share, supported by high healthcare spending, increasing incidence of neurological disorders, and favorable reimbursement policies. Leading manufacturers and research institutions in the region also drive innovation, resulting in faster adoption of AI-integrated robotic systems. Growing demand for home-based rehabilitation solutions and exoskeleton technologies further strengthens the market outlook. Canada contributes with rising investments in rehabilitation centers, while supportive government initiatives expand patient access to robotic-assisted therapies.

Europe

Europe holds a 29% share of the rehabilitation robots market, with Germany, the UK, and France leading adoption. The region benefits from robust healthcare policies, expanding geriatric populations, and strong funding for rehabilitation research. European hospitals and rehabilitation centers increasingly integrate advanced robotic systems into patient care, particularly for stroke and spinal cord injury rehabilitation. Government-backed initiatives for digital healthcare transformation enhance adoption across both Western and Eastern Europe. Moreover, the rising focus on wearable exoskeletons for elderly mobility support and post-surgical recovery is creating additional opportunities for manufacturers in the European market.

Asia-Pacific

Asia-Pacific accounts for 23% of the rehabilitation robots market and is the fastest-growing regional segment. Countries like China, Japan, and South Korea dominate adoption due to strong technological capabilities and rising healthcare investments. Japan leads with advanced robotic innovations for elderly care, while China expands adoption through government-supported healthcare reforms and domestic manufacturing. India and Southeast Asian nations are emerging markets, supported by rising awareness of rehabilitation robotics and increasing prevalence of neurological disorders. The growing geriatric population and preference for cost-effective, locally manufactured robotic systems are fueling expansion across the Asia-Pacific region.

Latin America

Latin America captures a 6% share of the rehabilitation robots market, with Brazil and Mexico as leading contributors. The region’s growth is supported by increasing demand for advanced rehabilitation therapies and gradual improvement in healthcare infrastructure. Rising cases of road traffic accidents and stroke-related disabilities are driving adoption of robotic-assisted therapies. However, high costs and limited insurance coverage remain barriers to widespread penetration. Multinational companies are expanding partnerships with local hospitals and rehabilitation centers, supporting technology transfer and training programs. Growing private healthcare investment in urban centers is expected to drive future opportunities across the region.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the rehabilitation robots market, primarily driven by demand from the Gulf Cooperation Council (GCC) countries. Nations such as the UAE and Saudi Arabia are investing in advanced healthcare facilities, including robotic rehabilitation systems, as part of broader healthcare modernization strategies. South Africa also shows growing adoption due to rising cases of stroke and neurological conditions. Despite limited adoption in other parts of Africa, international collaborations and government healthcare initiatives are gradually increasing awareness. The region presents long-term growth potential as infrastructure investments expand.

Market Segmentations:

By Patient:

By Application:

- Acquired brain injuries

- Spinal cord injuries

By End User:

- Hospitals & clinics

- Rehabilitation centers

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the rehabilitation robots market features leading players such as Cyberdyne Inc., Rehab-Robotics Company Limited, Leaders Rehab Robot Co. Ltd., MediTouch, Bionik Laboratories Corporation, Ekso Bionics Holdings Inc., AlterG, Fourier Intelligence, DIH Medical, and Bioxtreme. The rehabilitation robots market is highly competitive, driven by continuous innovation and rapid technological advancements. Companies are investing heavily in research and development to introduce systems with enhanced functionality, including AI integration, real-time monitoring, and personalized therapy programs. Strategic collaborations between technology providers, hospitals, and research institutions are expanding clinical applications and improving patient outcomes. Growing demand for exoskeletons, wearable devices, and home-based rehabilitation solutions is further intensifying competition. Market participants also focus on regional expansion, affordability, and product differentiation to strengthen their presence. This dynamic environment reflects a strong emphasis on innovation and accessibility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Care Hospitals in Hyderabad introduced the AI-driven Stryker Mako Robotic System to aid in robotic-assisted joint replacement surgeries. The system combines 3D CT-based surgical planning with real-time guidance, aiming to improve surgical accuracy while minimizing tissue damage.

- In June 2025, SS Innovations performed the first robotic cardiac surgery in the Americas using its SSi Mantra 3 system at Interhospital, Ecuador, with successful patient outcomes. The company is expanding globally, aiming for FDA clearance in 2026, and has 80 systems installed across 75 hospitals in India and other countries.

- In April 2025, Johnson & Johnson MedTech announced the successful completion of the first clinical cases using the OTTAVA Robotic Surgical System for gastric bypass surgery at Memorial Hermann-Texas Medical Center.

- In June 2024, Smith+Nephew introduced a new service called CORIOGRAPH, which is designed to enhance the capabilities of their CORI Surgical System. This service focuses on personalized pre-operative planning and modeling for both patients and surgeon

Report Coverage

The research report offers an in-depth analysis based on Patient, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for robotic-assisted rehabilitation in neurological care.

- Aging populations worldwide will drive greater adoption of advanced rehabilitation solutions.

- Exoskeleton technologies will gain traction for mobility recovery and elderly support.

- AI and machine learning will enhance personalized therapy and adaptive treatment programs.

- Home-based rehabilitation robots will see increased acceptance for cost-effective recovery.

- Emerging economies will contribute significantly as healthcare infrastructure modernizes.

- Strategic collaborations will accelerate innovation and clinical validation of robotic systems.

- Wearable rehabilitation robots will become more compact, affordable, and user-friendly.

- Government initiatives and supportive policies will improve accessibility and adoption rates.

- Integration of robotics with tele-rehabilitation platforms will strengthen remote therapy capabilities.