Market Overview:

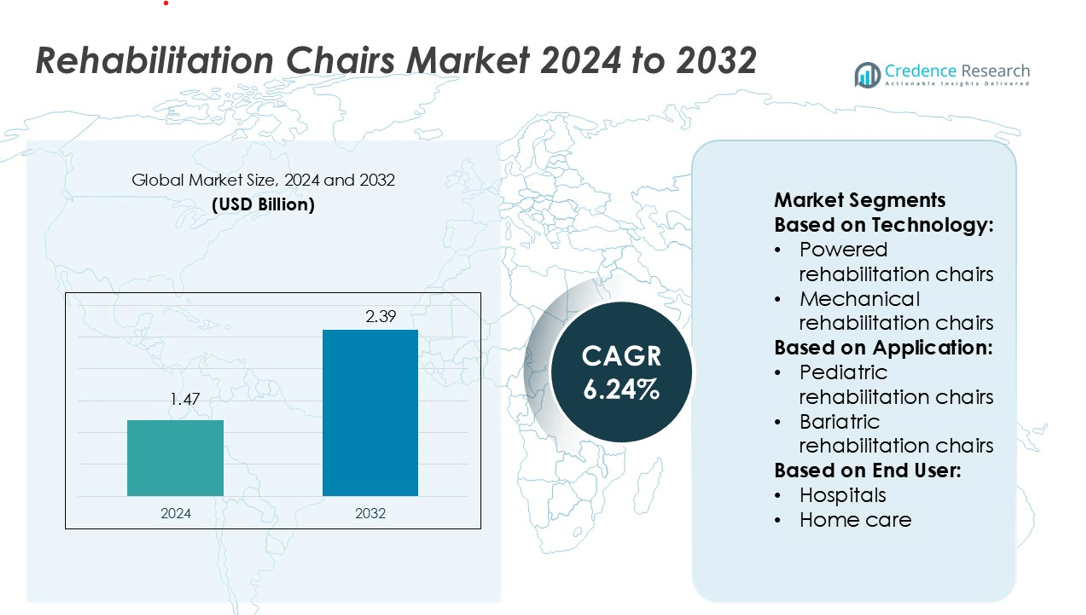

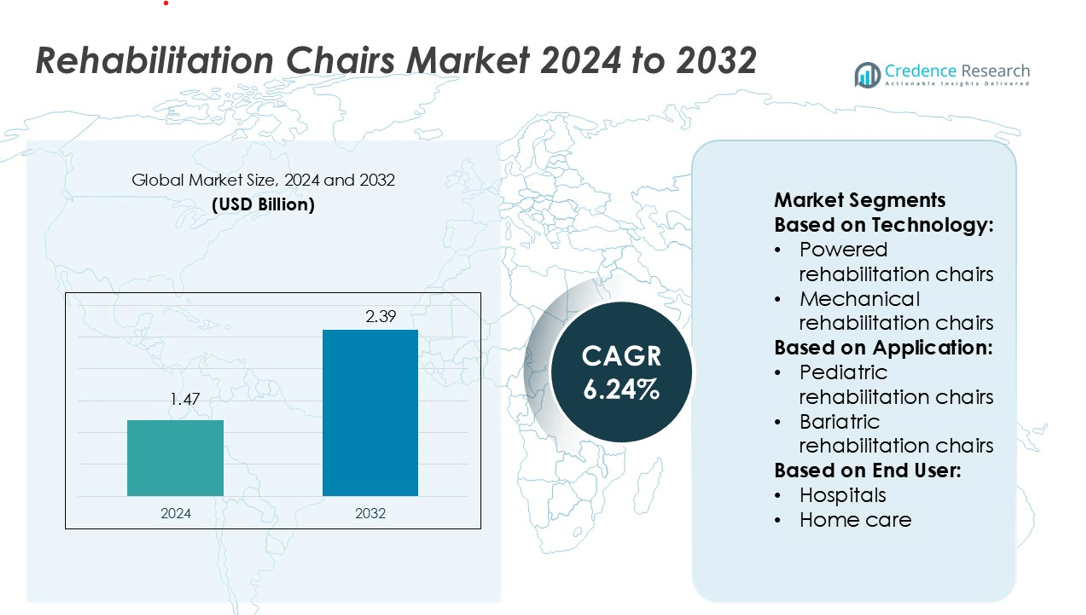

Rehabilitation Chairs Market size was valued USD 1.47 billion in 2024 and is anticipated to reach USD 2.39 billion by 2032, at a CAGR of 6.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rehabilitation Chairs Market Size 2024 |

USD 1.47 billion |

| Rehabilitation Chairs Market, CAGR |

6.24% |

| Rehabilitation Chairs Market Size 2032 |

USD 2.39 billion |

The rehabilitation chairs market is driven by strong competition among leading players such as Invacare Corporation, Drive Devilbiss International, Etac AB, Healthline Medical Products, Graham-Field Health Products, Inc., Champion Manufacturing Inc., Akces Med, VELA Medical, Actualway, and Özgür Irmak Prosthetics and Orthotics Center. These companies focus on developing advanced powered chairs, ergonomic designs, and cost-effective solutions to address growing demand across hospitals, rehabilitation centers, and home care. North America leads the global market with a 38% share in 2024, supported by a robust healthcare infrastructure, favorable reimbursement policies, and rising adoption of technology-driven rehabilitation solutions.

Market Insights

- The Rehabilitation Chairs Market size was USD 1.47 billion in 2024 and is projected to reach USD 2.39 billion by 2032, growing at a CAGR of 6.24%.

- Market growth is driven by rising demand for elderly care, increasing prevalence of mobility-related disorders, and adoption of advanced powered rehabilitation chairs offering ergonomic designs and smart controls.

- Key trends include the shift toward home healthcare solutions, integration of connected technologies, and increasing focus on bariatric and pediatric rehabilitation chairs to address diverse patient needs.

- Strong competition exists among leading players such as Invacare Corporation, Drive Devilbiss International, Etac AB, Healthline Medical Products, and others, with strategies centered on innovation, cost-effective models, and regional expansion.

- North America leads with a 38% market share, while Europe holds 30% and Asia-Pacific accounts for 22%; powered rehabilitation chairs dominate the technology segment with 62% share, reflecting growing preference for advanced patient support systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Powered rehabilitation chairs dominate the market, holding 62% share in 2024. Their adoption is driven by advanced mobility features, adjustable positioning, and ease of use for patients with severe impairments. Innovations in battery efficiency and integration of smart controls make powered chairs more attractive to healthcare providers. Mechanical rehabilitation chairs remain relevant in low-cost settings but face slower growth due to limited functionality compared to powered options. The preference for technology-driven patient comfort and independence continues to strengthen powered chairs’ leading position across developed regions.

- For instance, the JORDI™ therapeutic chair supports up to 50 kg in Size 1, with seat depth adjustable between 230 mm and 290 mm, and a backrest tilt range of 90° to 135°.

By Application

Adult/geriatric rehabilitation chairs lead the segment with 54% market share in 2024. The dominance is fueled by the rising aging population, increasing prevalence of mobility-related conditions, and higher demand for supportive rehabilitation solutions in long-term care. Pediatric rehabilitation chairs are gaining traction, particularly in specialized therapy centers, but remain a smaller share. Bariatric chairs show steady growth due to rising obesity rates globally. Other applications, including post-surgical rehabilitation, also add incremental demand, though the primary driver remains the expanding geriatric patient base.

- For instance, the AVIVA STORM RX Invacare’s product literature for the AVIVA STORM RX with the Ultra Low Maxx positioning system explicitly lists a tilt range of up to 50°.

By End-user

Hospitals hold the largest share at 48% in 2024, supported by advanced infrastructure and higher patient intake. Hospitals prefer rehabilitation chairs with integrated monitoring systems, ensuring efficiency in post-surgical recovery and neurological rehabilitation. Rehabilitation centers follow closely, supported by growing investments in specialized therapy facilities. The home care segment is expanding rapidly, driven by increasing preference for in-home recovery and availability of compact powered chairs. Other end-users, such as elderly care institutions, also contribute to steady demand, but hospitals remain the dominant end-user segment.

Market Overview

Rising Geriatric Population

The growing elderly population is a primary driver of the rehabilitation chairs market. Aging individuals face higher risks of mobility disorders, stroke, and musculoskeletal conditions, creating strong demand for supportive rehabilitation solutions. Rehabilitation chairs designed with advanced ergonomic support, powered mobility, and customizable features address these needs effectively. Governments and healthcare systems are increasing investments in elder care infrastructure, further supporting adoption. As life expectancy rises globally, this demographic shift continues to expand the customer base for rehabilitation chairs, driving steady market growth.

- For instance, The Etac (Convaid) Cruiser is a pediatric wheelchair featuring a 30° fixed tilt for postural support and Convaid’s proprietary Self-Tensio® seating system for therapeutic pelvic positioning.

Advancements in Assistive Technologies

Technological innovations are enhancing the capabilities of rehabilitation chairs, making them more functional and user-friendly. Integration of powered mobility, smart sensors, remote monitoring, and adjustable designs improves patient comfort and clinical outcomes. Lightweight materials and longer battery life also expand usage in both hospitals and home settings. Manufacturers are focusing on AI-enabled systems that assist therapists in tracking recovery progress, creating a value-added dimension. These advancements not only increase adoption in developed markets but also support broader accessibility in emerging economies.

- For instance, Graham-Field’s Lumex Clinical Care Recliner supports up to 450 lb (≈ 204 kg) of evenly distributed weight. It offers three recline positions plus a caregiver-activated Trendelenburg mode, with overall depth in that mode extending to 76″ (1930 mm).

Increasing Home Healthcare Adoption

The shift toward home-based care is accelerating rehabilitation chair demand, especially after the pandemic. Patients and caregivers prefer solutions that allow recovery in familiar surroundings while reducing hospital costs. Compact, portable, and powered rehabilitation chairs are increasingly marketed for home use, offering convenience and independence. Insurance coverage and supportive reimbursement policies in several regions further encourage adoption. With rising healthcare costs and limited hospital capacity, the preference for decentralized rehabilitation care continues to grow, strengthening the market’s homecare-driven expansion.

Key Trends & Opportunities

Integration of Smart and Connected Features

Smart rehabilitation chairs with IoT connectivity are gaining traction, offering real-time monitoring and data sharing. These features allow healthcare professionals to track patient mobility progress and adjust therapy remotely. The trend aligns with the broader adoption of tele-rehabilitation and digital health ecosystems. Connected rehabilitation chairs improve compliance and engagement, creating opportunities for manufacturers to differentiate products. As digital health policies strengthen globally, integration of smart features represents a significant opportunity for sustained growth in both clinical and homecare markets.

- For instance, Healthline’s reclining shower-commode chair offers 5 discrete backrest positions, a padded leg rest, a slide-out footrest, and supports up to 300 lb (≈ 136 kg).

Growing Demand for Bariatric Rehabilitation Solutions

The rising global prevalence of obesity has created a growing market for bariatric rehabilitation chairs. These specialized chairs are designed with reinforced structures, larger weight capacities, and enhanced safety features. Healthcare facilities and rehabilitation centers are increasingly investing in bariatric-friendly equipment to cater to this expanding patient group. Manufacturers focusing on durable, comfortable, and powered solutions tailored for bariatric use can tap into a profitable segment. This trend represents a long-term opportunity, especially in North America and Europe, where obesity rates are highest.

- For instance, Actualway’s Therapy Chair Série II (3-motor or 4-motor versions) is tested to support a load capacity of 250 kg (≈ 551 lb). It features trendelenburg positioning of –12° achieved in 12 seconds via the handset

Key Challenges

High Cost of Advanced Rehabilitation Chairs

The premium pricing of powered and technologically advanced rehabilitation chairs poses a challenge to market penetration. Many patients, especially in developing economies, cannot afford high-cost solutions without adequate insurance coverage. Healthcare providers also face budget constraints when upgrading rehabilitation infrastructure. The price barrier limits adoption across low-income regions, creating reliance on basic mechanical chairs. Unless manufacturers develop cost-effective models or governments expand reimbursement frameworks, affordability will remain a significant hurdle in broadening access to advanced rehabilitation chairs.

Limited Awareness in Emerging Markets

Awareness about advanced rehabilitation equipment remains low in many developing economies. Healthcare systems in these regions often prioritize essential care over rehabilitation infrastructure. Patients and caregivers may lack knowledge of available solutions, reducing demand for specialized chairs. Additionally, limited availability of trained rehabilitation professionals constrains the adoption of advanced devices. Expanding educational programs, awareness campaigns, and distribution networks will be essential to address this challenge. Without such initiatives, emerging markets will continue to face slower uptake despite increasing patient needs.

Regional Analysis

North America

North America leads the rehabilitation chairs market with a 38% share in 2024, driven by advanced healthcare infrastructure and high adoption of assistive technologies. Strong demand comes from hospitals and rehabilitation centers, supported by favorable reimbursement policies and rising geriatric populations. The U.S. dominates the region, with widespread adoption of powered rehabilitation chairs due to their advanced features and ease of use. Increasing investments in home healthcare and expanding tele-rehabilitation programs further accelerate growth. Canada also contributes steadily, benefiting from government support for elderly care services and innovations in patient mobility solutions.

Europe

Europe holds 30% market share in 2024, supported by robust healthcare spending and strong demand for rehabilitation solutions. Germany, France, and the UK lead adoption, with hospitals and rehabilitation centers driving significant purchases. Aging demographics and rising obesity rates increase demand for both geriatric and bariatric rehabilitation chairs. The region also benefits from technological collaborations and strict healthcare quality standards that encourage use of advanced powered chairs. Government initiatives promoting elderly care and rehabilitation programs further strengthen market penetration. Home healthcare adoption continues to rise, providing new opportunities for manufacturers targeting compact and connected chair models.

Asia-Pacific

Asia-Pacific accounts for 22% of the global rehabilitation chairs market in 2024 and is the fastest-growing region. Rising healthcare investments in China, Japan, and India drive adoption, supported by expanding rehabilitation infrastructure. Japan leads with advanced elderly care solutions, while China benefits from a growing middle class and government-backed healthcare reforms. Increasing cases of stroke and neurological disorders add to demand. Rapid urbanization and rising awareness about home healthcare create strong growth opportunities. Manufacturers are expanding their presence through cost-effective powered chairs, making the region a focal point for future growth in rehabilitation equipment.

Latin America

Latin America captures 6% of the rehabilitation chairs market in 2024, with Brazil and Mexico as the largest contributors. Rising awareness of rehabilitation care and improving healthcare facilities support gradual adoption. However, the market faces challenges due to limited insurance coverage and high equipment costs. Demand is primarily driven by hospitals and rehabilitation centers, while home healthcare remains at an early stage. Growth opportunities lie in affordable mechanical and mid-range powered rehabilitation chairs. Government programs aimed at improving elderly care infrastructure are expected to boost market penetration in the coming years across major urban centers.

Middle East & Africa

The Middle East & Africa region represents 4% share of the rehabilitation chairs market in 2024. Demand is concentrated in Gulf countries, particularly the UAE and Saudi Arabia, where investments in healthcare infrastructure are strong. Rehabilitation centers are expanding in urban areas, driving adoption of both powered and bariatric chairs. However, large parts of Africa face slow adoption due to limited healthcare budgets and low awareness. International manufacturers are increasingly partnering with regional distributors to improve availability. Gradual improvement in elderly care services and rising cases of mobility disorders are expected to support steady regional growth.

Market Segmentations:

By Technology:

- Powered rehabilitation chairs

- Mechanical rehabilitation chairs

By Application:

- Pediatric rehabilitation chairs

- Bariatric rehabilitation chairs

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The rehabilitation chairs market features strong competition with key players including VELA Medical, Akces Med, Özgür Irmak Prosthetics and Orthotics Center, Invacare Corporation, Etac AB, Champion Manufacturing Inc., Graham-Field Health Products, Inc., Drive Devilbiss International, Healthline Medical Products, and Actualway. The rehabilitation chairs market is highly competitive, shaped by innovation, affordability, and expanding applications across healthcare settings. Manufacturers are prioritizing powered and ergonomic designs that enhance patient comfort, mobility, and recovery outcomes. The shift toward home healthcare has encouraged the development of compact, portable, and cost-effective models, while hospitals and rehabilitation centers continue to demand advanced, technology-driven solutions. Increasing focus on bariatric and geriatric rehabilitation further intensifies competition, as companies seek to address specialized needs. Strategic partnerships, product diversification, and regional expansion remain crucial strategies for sustaining growth and strengthening market presence globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- VELA Medical

- Akces Med

- Özgür Irmak Prosthetics and Orthotics Center

- Invacare Corporation

- Etac AB

- Champion Manufacturing Inc.

- Graham-Field Health Products, Inc

- Drive Devilbiss International

- Healthline Medical Products

- Actualway

Recent Developments

- In March 2025, Healing Innovations partnered with Barrett Medical to expand access to advanced rehabilitation technology across the U.S., combining Healing Innovations’ Rise&Walk InClinic with Barrett’s Burt robotic trainer to create a comprehensive neurorehabilitation solution.

- In February 2025, WellSky announced significant growth and new innovations in 2024, enhancing its position in the rehabilitation equipment market through technological advancements and expanded service offerings.

- In February 2024, Addverb introduced three robots designed for diverse applications. Venturing into healthcare robotics, the automation solutions provider launched Healan, an advanced medical cobot tailored for rehabilitation and imaging purposes.

- In August 2023, Nakanishi Inc. acquired DCI International, LLC, the U.S. fastest-growing dental equipment manufacturer. This was done in the aim to expand and serve the customers better in the U.S. market

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for elderly care solutions.

- Powered rehabilitation chairs will see faster adoption due to advanced features.

- Home healthcare will drive significant growth across developed and emerging regions.

- Integration of smart and connected technologies will enhance product value.

- Bariatric rehabilitation chairs will gain importance with increasing obesity rates.

- Hospitals and rehabilitation centers will remain dominant end-users globally.

- Cost-effective models will boost adoption in price-sensitive markets.

- Strategic collaborations will accelerate innovation and market penetration.

- Awareness programs will improve adoption in developing economies.

- Technological advancements will continue to enhance patient comfort and outcomes.