Market Overview

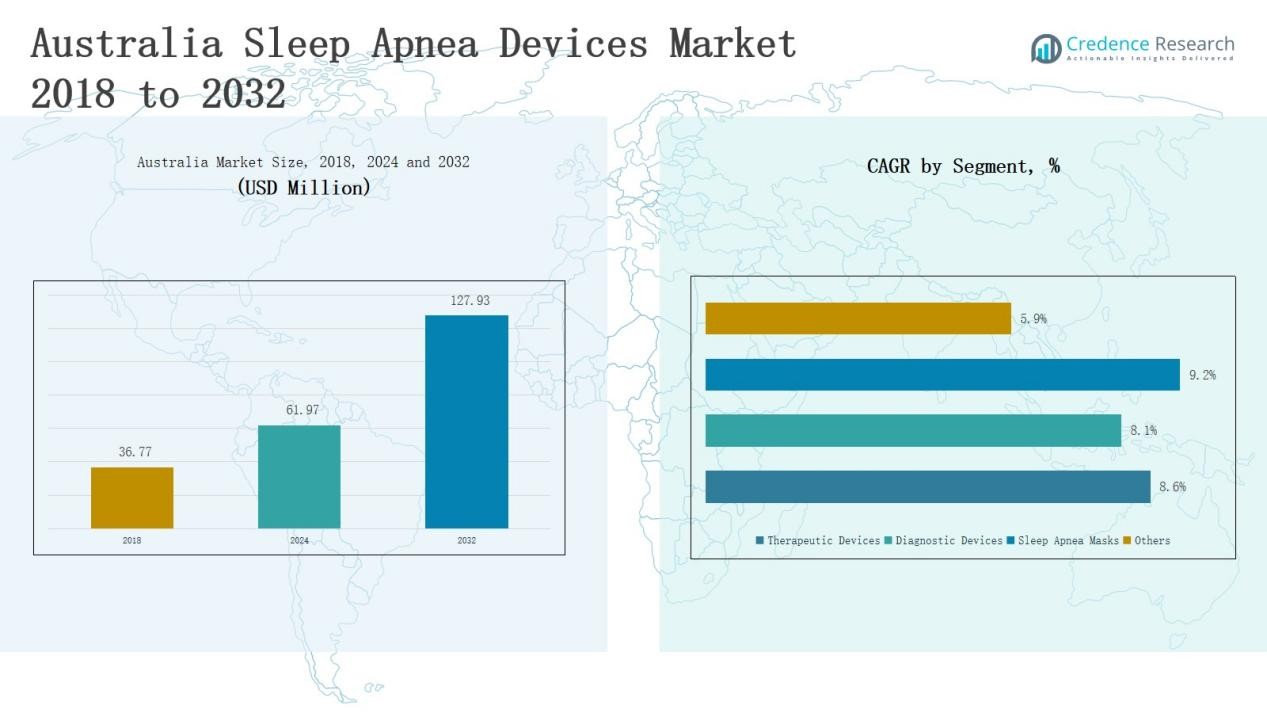

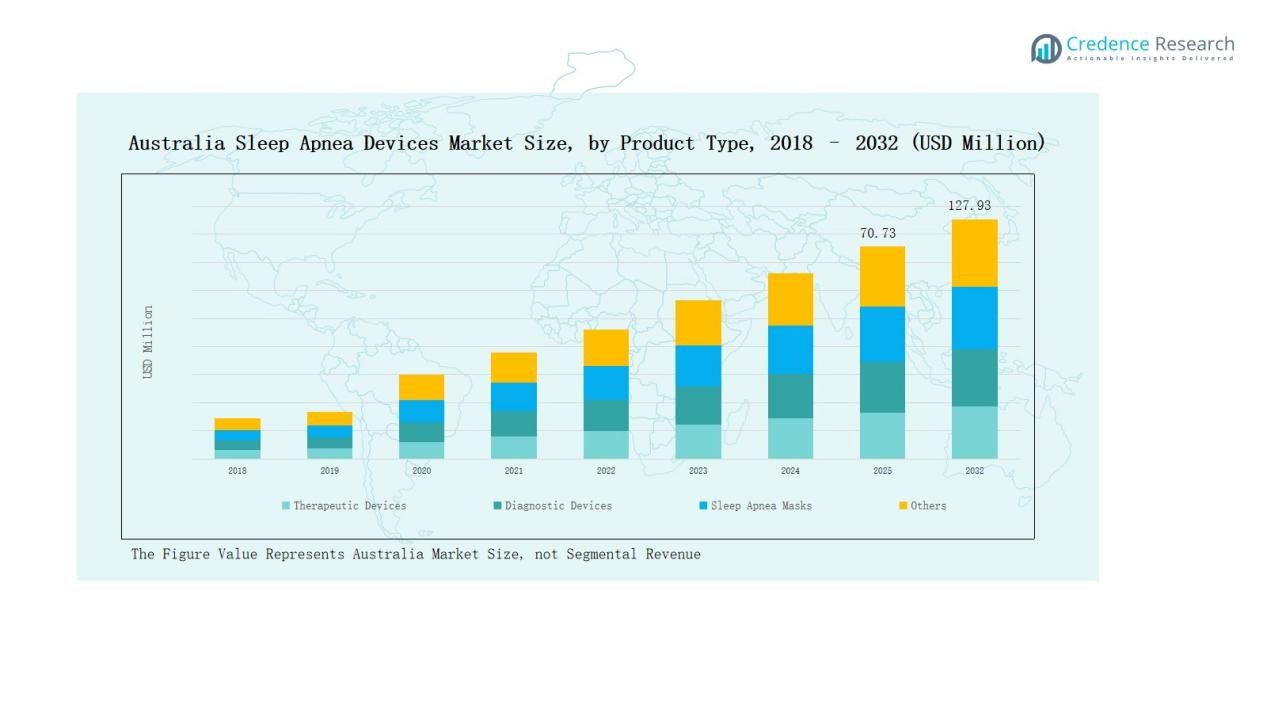

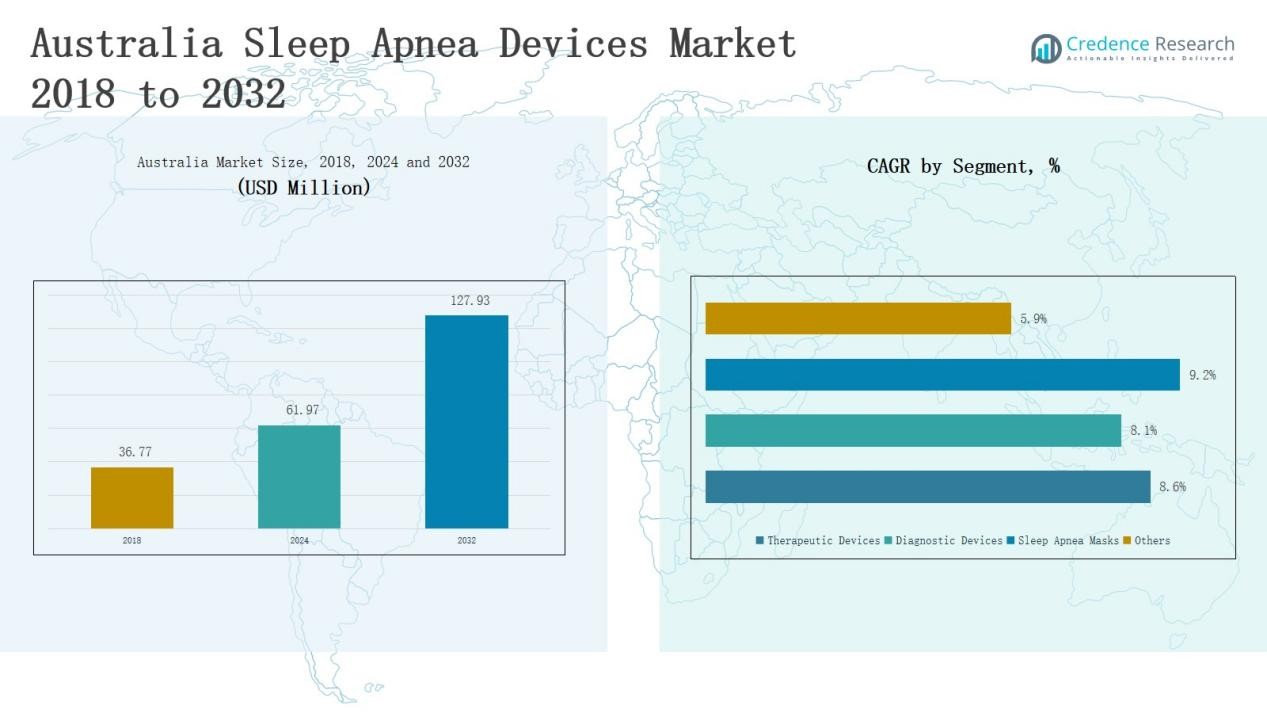

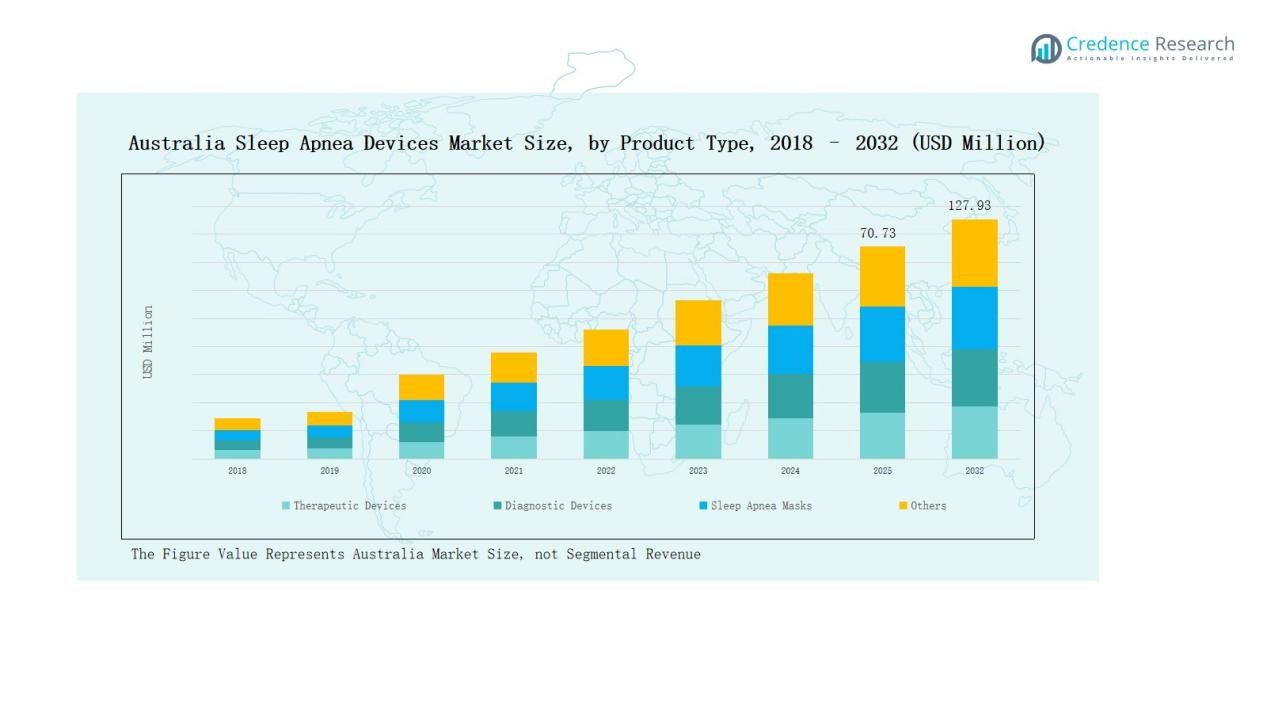

The Australia Sleep Apnea Devices Market size was valued at USD 36.77 million in 2018, reached USD 61.97 million in 2024, and is anticipated to reach USD 127.93 million by 2032, growing at a CAGR of 8.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Sleep Apnea Devices Market Size 2024 |

USD 61.97 Million |

| Australia Sleep Apnea Devices Market, CAGR |

8.83% |

| Australia Sleep Apnea Devices Market Size 2032 |

USD 127.93 Million |

The Australia Sleep Apnea Devices Market is shaped by a mix of global leaders and strong domestic players offering both therapeutic and diagnostic solutions. Key companies include ResMed Australia, Fisher & Paykel Healthcare, Philips Respironics, Compumedics Limited, SomnoMed, Drive DeVilbiss, BMC Medical, Inspire Medical Systems, Braebon Medical Corporation Australia, and Zephyr Sleep Technologies Australia. These firms compete through innovation in PAP devices, oral appliances, sleep masks, and digital integration to enhance therapy adherence. New South Wales emerged as the leading region in 2024 with a 32% share, driven by advanced healthcare infrastructure, higher diagnosis rates, and strong adoption of connected solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Sleep Apnea Devices Market grew from USD 36.77 million in 2018 to USD 61.97 million in 2024 and is projected to reach USD 127.93 million by 2032.

- Therapeutic devices dominated with 62% share in 2024, led by Positive Airway Pressure (PAP) devices at 45%, supported by strong adoption in hospitals and home care.

- Hospitals and clinics held 48% share, sleep laboratories accounted for 27%, while home care settings expanded rapidly with 22% share driven by portable PAP systems and HST kits.

- New South Wales led with 32% share in 2024, followed by Victoria at 25%, Queensland at 18%, Western Australia at 12%, and South Australia with others at 13%.

- Key players include ResMed Australia, Fisher & Paykel Healthcare, Philips Respironics, Compumedics Limited, SomnoMed, Drive DeVilbiss, BMC Medical, Inspire Medical Systems, Braebon Medical Corporation, and Zephyr Sleep Technologies Australia.

Market Segment Insights

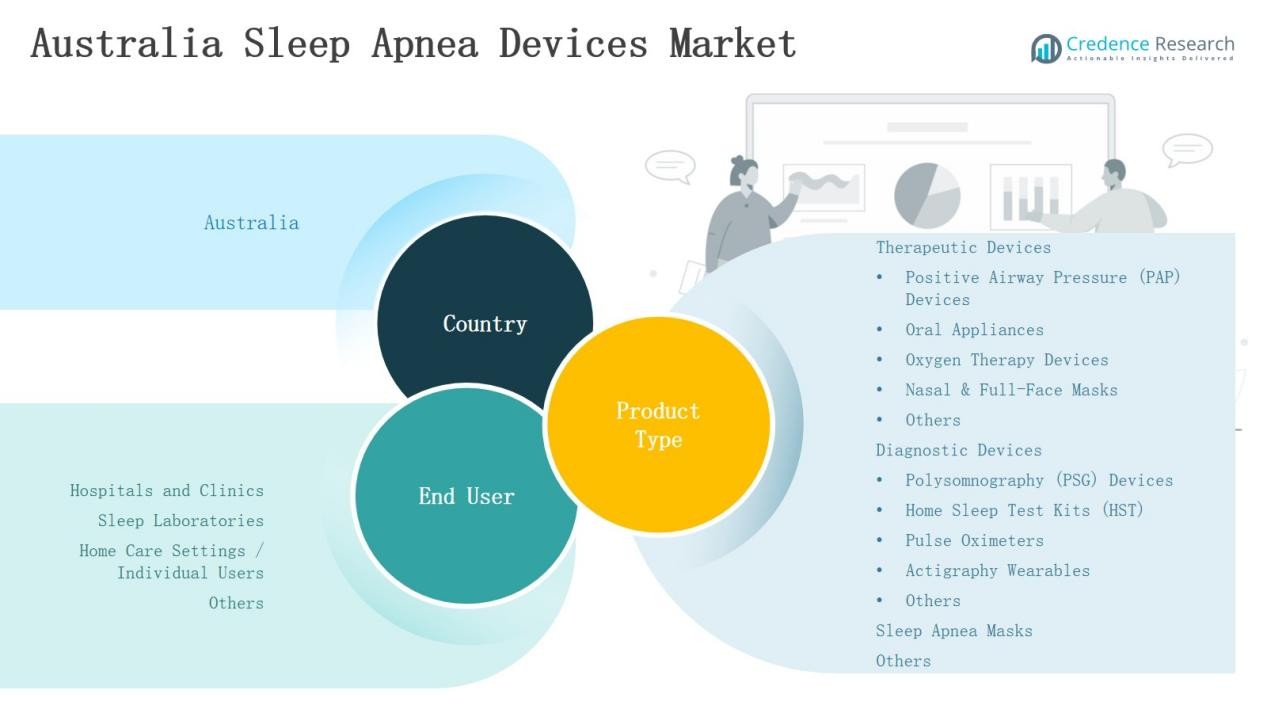

By Product Type

Therapeutic devices dominate the Australia sleep apnea devices market, holding about 62% share in 2024. Positive Airway Pressure (PAP) devices remain the largest sub-segment with 45% share, supported by proven clinical outcomes and strong adoption in both hospitals and home care. Nasal and full-face masks enhance adherence, while oral appliances, oxygen therapy devices, and other solutions provide alternatives for patients seeking less invasive options. Diagnostic devices hold 28% share, led by PSG systems, while HST kits are growing rapidly due to affordability and convenience. Sleep apnea masks contribute about 7%, with other niche devices such as neuromodulation implants and positional therapy adding 3% share.

- For instance, ResMed introduced the AirCurve 11 series of bilevel PAP devices, developed on the widely used AirSense 11 platform and compatible with all ResMed masks, expanding therapeutic options and comfort for patients managing obstructive sleep apnea.

By End User

Hospitals and clinics lead the market with nearly 48% share, supported by advanced diagnostic facilities and established treatment pathways. Sleep laboratories follow with 27% share, driven by referrals and clinical research activities. Home care settings are expanding quickly, holding 22% share due to rising demand for portable PAP systems, HST kits, and reusable masks that support long-term management. The remaining share comes from other end users, including wellness centers and specialized clinics, highlighting the broadening base of sleep apnea care in Australia.

- For instance, the Sleep Disorders Service at St Vincent’s Hospital Sydney provides comprehensive overnight diagnostic sleep studies such as CPAP titration for patients with sleep breathing disorders, including obstructive sleep apnea and nocturnal hypoventilation, leveraging specialized clinical teams and modern inpatient facilities.

Key Growth Drivers

Rising Prevalence of Sleep Apnea

Australia faces a growing burden of obstructive sleep apnea, with rising obesity and lifestyle disorders fueling prevalence. Increasing awareness campaigns by healthcare organizations encourage early diagnosis and treatment adoption. This trend is strengthening demand for PAP devices, sleep apnea masks, and home sleep test kits. Hospitals and clinics report higher patient inflows for diagnostics, while home care adoption expands through portable systems. The growing diagnosed patient pool remains a critical driver supporting sustained market expansion across both therapeutic and diagnostic segments.

- For instance, Fisher & Paykel Healthcare expanded availability of its Evora Full face mask in Australia, designed for greater comfort and ease of use in home settings.

Advancements in Therapeutic and Diagnostic Technologies

Continuous innovation in PAP devices, oral appliances, and wearable diagnostics is reshaping treatment approaches in Australia. Compact, portable, and digitally connected solutions improve patient adherence and convenience. Diagnostic technologies such as HST kits and actigraphy wearables gain traction due to their affordability and accessibility. Integration of cloud connectivity and AI-enabled monitoring further enhances clinical outcomes and supports long-term management. These advancements encourage higher adoption in both hospital and home care settings, significantly boosting the country’s sleep apnea devices market.

- For instance, ResMed integrated its myAir™ app with both Apple and Android smartwatches and launched a Generative AI-enabled sleep health assistant, providing patients with personalized guidance and improved engagement throughout their CPAP therapy journey.

Supportive Healthcare Policies and Reimbursement

Government initiatives and favorable reimbursement policies for sleep apnea diagnosis and treatment stimulate adoption in Australia. Subsidies on PAP devices and access to sleep studies through public healthcare programs improve affordability for patients. Insurance coverage also extends to home sleep tests, expanding early detection rates. Hospitals and clinics benefit from well-structured reimbursement pathways, strengthening their role as key providers of care. These supportive policies ensure broader access to effective solutions, driving consistent growth in both therapeutic and diagnostic device segments.

Key Trends & Opportunities

Growing Shift Toward Home Care Settings

Home care is emerging as a significant opportunity in Australia, supported by the rising use of portable PAP devices and HST kits. Patients increasingly prefer at-home treatment due to convenience, lower costs, and privacy. Manufacturers focus on lightweight, user-friendly devices to boost adherence. Integration of mobile applications and remote monitoring tools aligns with digital health adoption, ensuring better long-term outcomes. This trend provides opportunities for players to strengthen their product portfolios and capture the expanding home-based management segment.

- For instance, Philips’ DreamStation Go weighs about 854 g and uses Bluetooth to sync with the DreamMapper app, enabling remote tracking of usage data.

Digital Integration and Remote Monitoring Solutions

The integration of digital health technologies creates new opportunities in the Australia sleep apnea devices market. Cloud-based platforms, AI-enabled diagnostics, and wearable sensors support real-time monitoring and data sharing between patients and physicians. This digital shift enables proactive intervention, improved compliance, and personalized therapy adjustments. Companies leveraging remote connectivity can build stronger relationships with both healthcare providers and patients. Expanding telehealth services in Australia further boosts adoption, making digital integration a pivotal growth opportunity for device manufacturers.

- For instance, Sleep Right Australia provides remote monitoring services for ResMed’s AirSense devices, enabling clinicians to adjust therapy parameters remotely, enhancing personalized care and convenience for patients.

Key Challenges

High Device Costs and Limited Affordability

The relatively high cost of PAP devices, oral appliances, and advanced diagnostic systems remains a major barrier in Australia. Many patients struggle with affordability despite supportive reimbursement policies, especially in rural regions with limited healthcare access. Home care adoption often requires upfront investments that discourage continuous usage. Price sensitivity hampers market penetration, particularly for premium solutions. Manufacturers face pressure to introduce cost-effective models without compromising performance, highlighting affordability as a persistent challenge for long-term market growth.

Patient Non-Compliance with Treatment

Patient adherence to PAP therapy and oral appliances is a significant challenge in managing sleep apnea. Discomfort from masks, noise from devices, and inconvenience of long-term usage contribute to high dropout rates. Despite technological improvements, many patients abandon treatment prematurely, limiting clinical outcomes. Non-compliance not only reduces device sales but also impacts healthcare costs through unmanaged conditions. Manufacturers and healthcare providers must focus on comfort, education, and digital adherence tools to address this challenge effectively in the Australian market.

Limited Access in Rural and Remote Areas

Australia’s vast geography poses challenges in delivering sleep apnea diagnosis and treatment in rural and remote areas. Limited access to sleep laboratories and specialized clinics hinders early detection. While portable HST kits help bridge the gap, awareness and affordability remain low outside major cities. Distribution challenges restrict timely device availability, slowing adoption in underserved regions. Expanding telehealth, improving logistics, and deploying community-based diagnostic programs are essential to overcome this barrier and ensure equitable growth across the market.

Regional Analysis

New South Wales

New South Wales leads the Australia Sleep Apnea Devices Market with a 32% share in 2024. It benefits from advanced healthcare infrastructure, large urban populations, and strong adoption of PAP devices and diagnostic systems. Hospitals and sleep laboratories in Sydney and surrounding regions continue to drive demand. It also benefits from government-funded awareness programs supporting early diagnosis. The growing patient pool and high obesity rates strengthen uptake across both therapeutic and diagnostic segments. Strong distribution networks make New South Wales the primary hub for market growth.

Victoria

Victoria holds a 25% share in the market in 2024, supported by strong healthcare services and active adoption of digital health solutions. Melbourne acts as a key center for sleep disorder research, boosting demand for diagnostic devices such as PSG and HST kits. The presence of specialized sleep clinics and supportive insurance policies drive adoption of PAP devices. It shows steady growth across home care settings, where patients prefer portable systems. Local manufacturers and research institutions enhance innovation, strengthening the state’s market presence.

Queensland

Queensland commands a 18% share of the market in 2024. It is supported by expanding healthcare facilities and a growing patient population in Brisbane and regional centers. Rising awareness of untreated sleep apnea fuels adoption of PAP devices and oral appliances. Sleep laboratories report higher testing volumes, while home-based solutions continue to gain momentum. Government efforts to improve rural healthcare access also support the deployment of HST kits. Queensland’s geographic spread drives interest in portable, easy-to-use solutions.

Western Australia

Western Australia accounts for a 12% share of the Australia Sleep Apnea Devices Market in 2024. Perth serves as the primary hub for advanced sleep disorder treatment and diagnosis. It benefits from investment in diagnostic laboratories and increasing patient awareness campaigns. The market is supported by rising demand for therapeutic devices, particularly PAP systems and masks. Healthcare expansion in remote areas strengthens interest in portable diagnostic kits. Distribution improvements also ensure availability of devices to wider regions across the state.

South Australia and Others

South Australia, along with Tasmania, Northern Territory, and the Australian Capital Territory, together represents a 13% share in 2024. Hospitals in Adelaide act as the central providers of diagnostic and therapeutic services. Smaller states show increasing adoption of HST kits, driven by limited access to full-service laboratories. Awareness programs from local health bodies continue to support uptake. It also shows opportunities for manufacturers offering cost-effective and portable solutions. Collectively, these regions add steady growth to the overall market landscape.

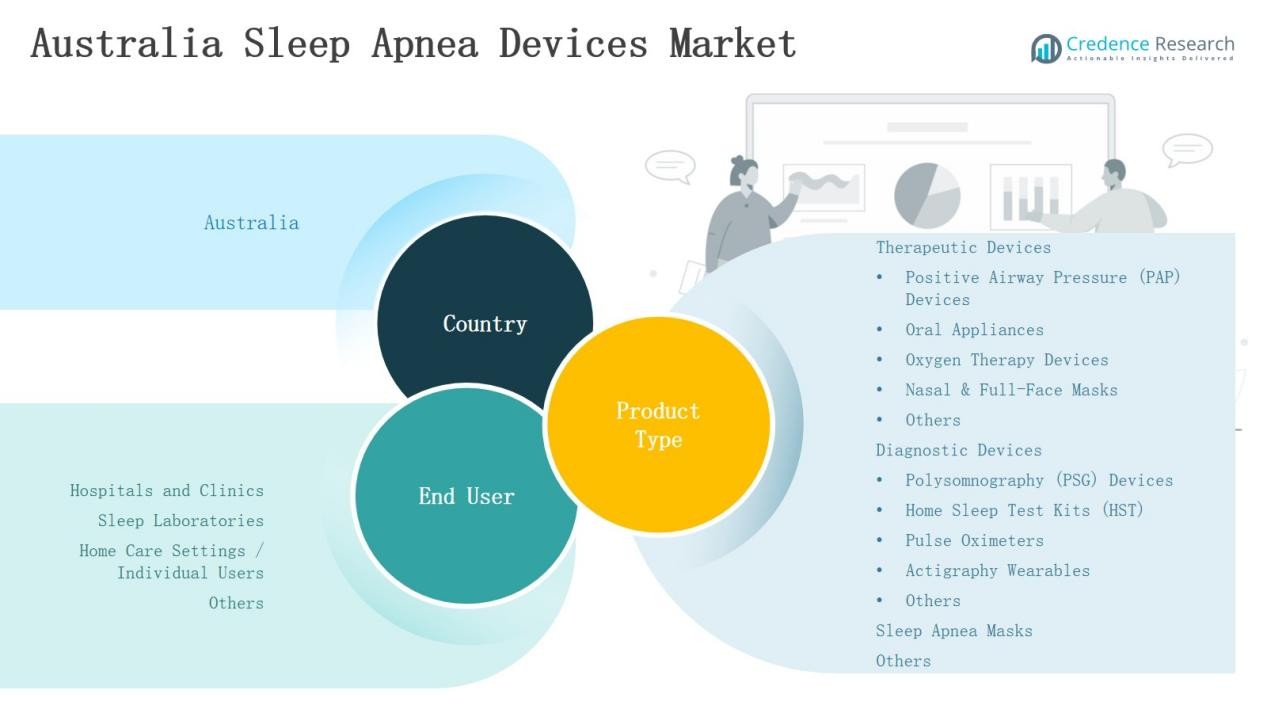

Market Segmentations:

By Product Type

Therapeutic Devices

- Positive Airway Pressure (PAP) Devices

- Oral Appliances

- Oxygen Therapy Devices

- Nasal & Full-Face Masks

- Others

Diagnostic Devices

- Polysomnography (PSG) Devices

- Home Sleep Test Kits (HST)

- Pulse Oximeters

- Actigraphy Wearables

- Other

Others

By End User

- Hospitals and Clinics

- Sleep Laboratories

- Home Care Settings / Individual Users

- Others

By Region

- New Southwales

- Victoria

- Queensland

- Western Australia

- South Australia

- Others

Competitive Landscape

The Australia Sleep Apnea Devices Market is moderately consolidated, with global leaders and domestic firms competing across therapeutic and diagnostic segments. ResMed Australia, Fisher & Paykel Healthcare, and Philips Respironics dominate the market through extensive product portfolios, strong distribution networks, and continued investment in PAP devices and connected solutions. Compumedics Limited and SomnoMed strengthen local presence with diagnostic systems and oral appliances tailored for regional needs. Drive DeVilbiss, BMC Medical, Inspire Medical Systems, Braebon Medical Corporation Australia, and Zephyr Sleep Technologies Australia also contribute to competition by addressing diverse patient requirements. Companies focus on innovation in portable devices, sleep masks, and digital integration to enhance therapy adherence and patient outcomes. Strategic partnerships with hospitals, sleep clinics, and research institutions further support market expansion. Pricing strategies, technological advancements, and product reliability remain critical differentiators influencing competitive positioning in this growing healthcare sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Fisher & Paykel Healthcare

- Compumedics Limited

- ResMed Australia

- SomnoMed

- Drive DeVilbiss

- BMC Medical

- Philips Respironics

- Inspire Medical Systems

- Braebon Medical Corporation Australia

- Zephyr Sleep Technologies Australia

Recent Developments

- In February 2024, ResMed launched a new bi-level respiratory support device called AirCurve 11, providing doctors with an alternative to CPAP machines for treating sleep apnea. This device is compatible with all ResMed masks and offers two forms of positive airway pressure therapy based on inhaling or exhaling phases

- In February 2024, Masimo’s MightySat Medical fingertip pulse oximeter received FDA 510(k) clearance for over-the-counter use, becoming the first such fingertip pulse oximeter available directly to consumers without a prescription.

- In July 2025, Apple introduced a TGA-approved sleep apnea detection feature for Apple Watch in Australia.

Report Coverage

The research report offers an in-depth analysis based on Product Type, end User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of portable PAP devices will continue to expand home-based treatment options.

- Digital integration and remote monitoring will improve patient adherence and clinical outcomes.

- Demand for home sleep test kits will increase due to convenience and affordability.

- Local manufacturers will strengthen market presence through cost-effective and customized devices.

- Hospitals and clinics will remain central to diagnosis and advanced therapy adoption.

- Rising awareness campaigns will drive early detection and treatment uptake across regions.

- Innovations in sleep apnea masks will enhance comfort and reduce therapy dropouts.

- Expansion of telehealth services will support wider access to sleep disorder management.

- Rural and remote healthcare initiatives will boost adoption of portable diagnostic solutions.

- Strategic collaborations among global leaders and domestic firms will shape market competitiveness.