Market Overview

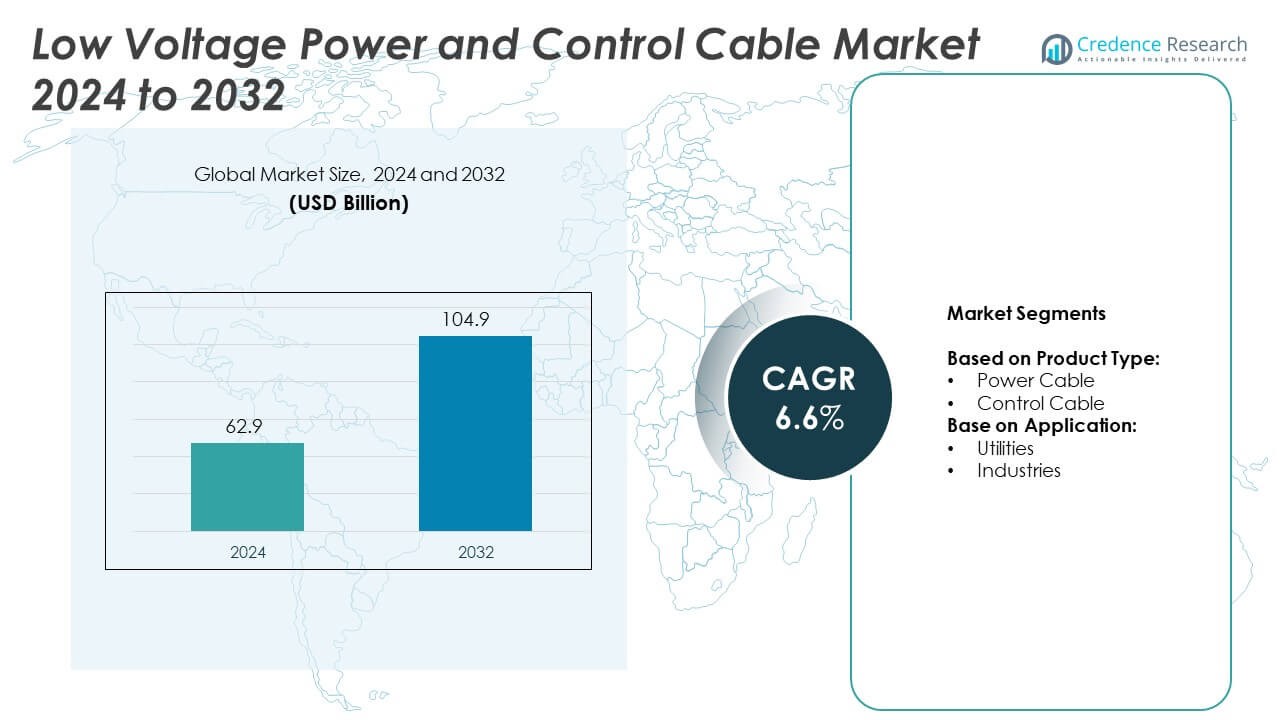

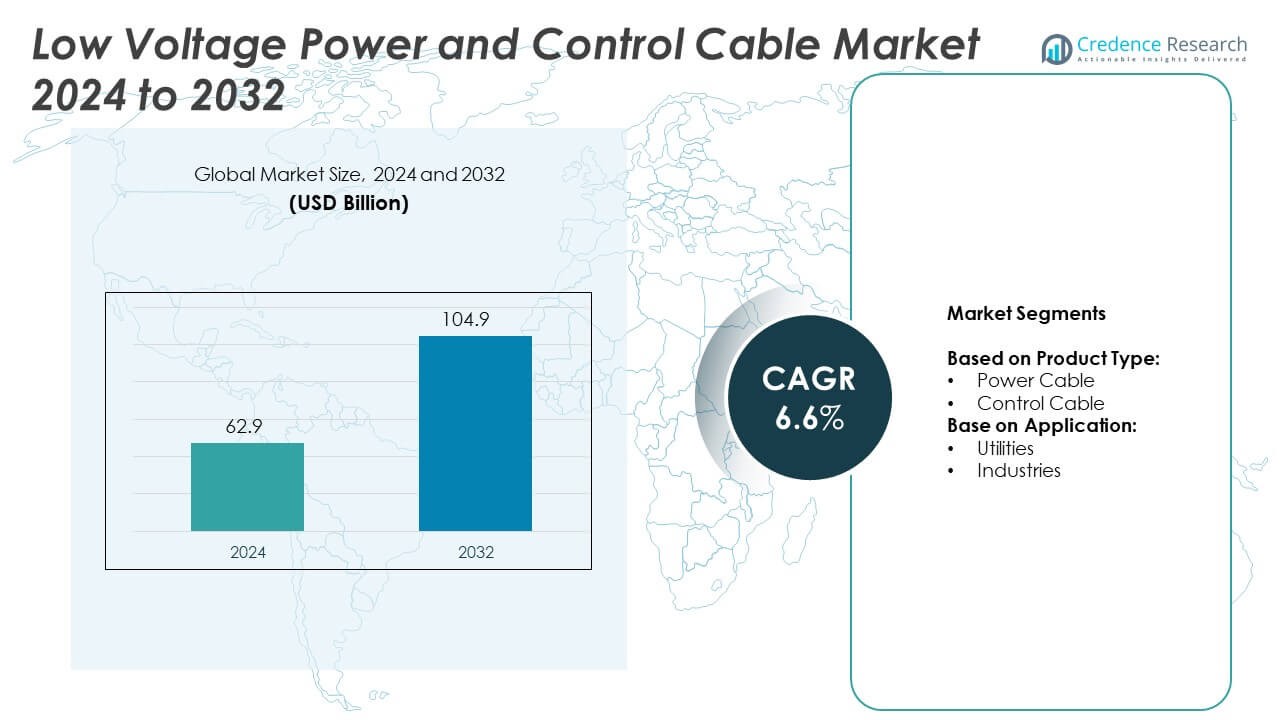

The Low Voltage Power and Control Cable Market size was valued at USD 62.9 billion in 2024 and is anticipated to reach USD 104.9 billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Voltage Power and Control Cable Market Size 2024 |

USD 62.9 Billion |

| Low Voltage Power and Control Cable Market, CAGR |

6.6% |

| Low Voltage Power and Control Cable Market Size 2032 |

USD 104.9 Billion |

The Low Voltage Power and Control Cable market is driven by rapid infrastructure development, renewable energy integration, and rising industrial automation. Growing investments in smart grids and electrification projects enhance demand for reliable and energy-efficient cabling solutions. Industries adopt advanced control cables to support automation, robotics, and digital infrastructure, while utilities focus on modernizing distribution networks. The market also trends toward eco-friendly, fire-resistant, and halogen-free designs to comply with strict safety and environmental standards.

The Low Voltage Power and Control Cable market shows strong growth across regions, with North America and Europe focusing on smart grid modernization and renewable energy integration, while Asia Pacific leads with rapid industrialization and urban development. Latin America and the Middle East & Africa record steady expansion through electrification and infrastructure projects. Key players such as KEI Industries, Furukawa Electric, LS Cable & System, and Nexans drive innovation with advanced, eco-friendly, and high-performance cable solutions to meet global demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Low Voltage Power and Control Cable market was valued at USD 62.9 billion in 2024 and is projected to reach USD 104.9 billion by 2032, growing at a CAGR of 6.6%.

- Growing demand from utilities, infrastructure development, and industrial automation drives consistent adoption of power and control cables.

- Rising focus on renewable energy integration and smart grid projects creates opportunities for advanced and energy-efficient cabling solutions.

- The market remains competitive with global leaders investing in innovation, eco-friendly designs, and fire-resistant technologies to strengthen their position.

- Fluctuating raw material prices and compliance with strict international standards act as key restraints for manufacturers.

- Asia Pacific leads growth with rapid industrialization and urbanization, while North America and Europe focus on grid modernization and sustainability.

- Latin America and the Middle East & Africa expand steadily through electrification, construction projects, and renewable energy initiatives.

Market Drivers

Rising Demand from Utilities and Infrastructure Development

The Low Voltage Power and Control Cable market gains strong momentum from rapid expansion in utility and infrastructure projects worldwide. Growing investments in power distribution networks, urbanization, and industrial expansion create significant demand for reliable and durable cabling solutions. Governments prioritize upgrading aging infrastructure to ensure stable energy supply, which strengthens adoption. It supports new transmission and distribution lines that require enhanced safety and efficiency standards. Rapid urban development in emerging economies accelerates installations in residential and commercial construction. Strong growth in public infrastructure projects sustains consistent market demand.

- For instance, Prysmian Group secured a strategic framework contract with France’s transmission system operator RTE and French network operators including Prysmian to supply and install ~5,200 km of underground cables, manufactured in Europe, for a total value of nearly €1 billion, which will support modernization efforts through 2028.

Industrial Automation and Smart Manufacturing Growth

Expanding industrial automation and adoption of smart manufacturing processes drive significant usage of control cables. Automated production facilities require advanced connectivity and control systems, creating steady demand. The Low Voltage Power and Control Cable market addresses rising needs for signal transmission and machine-to-machine communication. It helps ensure seamless integration of robotics, sensors, and industrial equipment. Rapid deployment of Industry 4.0 technologies increases reliance on reliable cabling infrastructure. Strong adoption across automotive, food processing, and heavy machinery sectors strengthens growth.

- For instance, NKT will deliver approximately 1,300 km of 20 kV cables to distribution system operator Tauron, supporting enhancements to Poland’s power grid.

Renewable Energy Integration and Smart Grid Expansion

Global transition toward renewable energy accelerates demand for low voltage cabling solutions. Expanding solar and wind projects depend on safe, efficient power transmission networks, driving adoption. The Low Voltage Power and Control Cable market benefits from strong investments in smart grid projects that require high-quality cables. It enhances energy efficiency and supports intelligent monitoring systems. Expanding deployment of distributed energy resources boosts installation across multiple sectors. Rising environmental concerns and regulatory mandates further increase adoption.

Safety Regulations and Technological Advancements in Cable Design

Stringent safety regulations across industrial and residential environments create steady demand for advanced low voltage cables. Fire-retardant, halogen-free, and eco-friendly designs gain popularity to meet compliance standards. The Low Voltage Power and Control Cable market grows through innovations that enhance durability, thermal resistance, and energy efficiency. It ensures reliable performance under diverse environmental conditions. Strong preference for cables that reduce operational risks supports replacement demand in older networks. Technological advancements enable longer lifecycle performance, driving competitiveness and wider adoption.

Market Trends

Increasing Adoption of Smart and Energy-Efficient Cables

The Low Voltage Power and Control Cable market is experiencing rising adoption of energy-efficient and smart cabling solutions. Growing awareness of energy conservation encourages the use of cables that minimize losses and enhance system performance. Manufacturers focus on producing cables with higher conductivity and lower resistance to meet sustainability goals. It supports advanced applications in smart grids, renewable power, and modern infrastructure. Demand for eco-friendly, recyclable, and halogen-free materials further strengthens this trend. Regulatory support for energy efficiency standards accelerates the adoption rate across global markets.

- For instance, Prysmian Group has an existing agreement that delivers 300 km of 0.4 kV low voltage cable per year, alongside 380 km of 24 kV one-core cable annually

Expansion of Renewable Energy Projects and Grid Modernization

Global investments in renewable energy projects create new opportunities for advanced low voltage cable solutions. The Low Voltage Power and Control Cable market gains traction from solar, wind, and distributed energy projects that require reliable cabling for power transmission. It enables grid connectivity and efficient integration of renewable sources into existing infrastructure. Expanding smart grid modernization initiatives in developed and emerging economies increase demand for durable cables. Rising adoption of microgrids and decentralized systems also strengthens this market trend. Continuous focus on sustainability drives innovation in cable technology tailored for renewable applications.

- For instance, Hellenic Cables was awarded a contract to deliver and install a total of 290 km of 220 kV cables (comprising 80 km of submarine cables and 210 km of underground cables) to interconnect the Western Offshore Substation of the Gennaker offshore wind farm in the Baltic Sea.

Technological Innovation in Cable Materials and Design

Manufacturers focus on technological innovations that improve cable performance, safety, and longevity. The Low Voltage Power and Control Cable market benefits from advancements in insulation materials, flame-retardant coatings, and higher thermal resistance. It supports critical applications in harsh industrial environments and high-load conditions. Demand for lightweight yet durable designs increases across automotive, aerospace, and heavy engineering sectors. Rising emphasis on reducing maintenance costs boosts the adoption of cables with longer service life. Enhanced designs strengthen competitiveness and support wider market penetration.

Growing Demand from Industrial Automation and Digital Infrastructure

Expanding digital infrastructure and industrial automation trends continue to fuel market growth. The Low Voltage Power and Control Cable market sees significant demand from robotics, IoT devices, and automated systems that require efficient signal and power transmission. It plays a key role in connecting sensors, controllers, and equipment across smart factories. Rising adoption of Industry 4.0 technologies drives greater reliance on advanced control cables. Expanding data centers and telecommunication infrastructure also contribute to demand. Increasing dependence on high-speed connectivity and reliable energy supply sustains strong long-term growth.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions

The Low Voltage Power and Control Cable market faces significant challenges from fluctuating prices of raw materials such as copper, aluminum, and polymers. Constant volatility in commodity markets directly impacts production costs, reducing profit margins for manufacturers. It creates uncertainty in long-term pricing strategies and procurement planning. Supply chain disruptions caused by geopolitical tensions, trade restrictions, and transportation delays further intensify these issues. Manufacturers struggle to balance affordability with quality, especially when customers demand cost-effective solutions. Limited availability of critical materials adds pressure on production schedules and overall market stability.

Intense Competition and Compliance with Regulatory Standards

High competition among global and regional players creates pressure to continuously innovate and maintain cost efficiency. The Low Voltage Power and Control Cable market encounters difficulties in differentiating products in a highly commoditized industry. It requires companies to invest heavily in research, technology, and certification processes. Strict compliance with safety, environmental, and performance regulations increases operational costs and delays product launches. Small and medium enterprises often face challenges in meeting international standards, which limits their global reach. Rising demand for eco-friendly and halogen-free cables further complicates production for cost-sensitive manufacturers.

Market Opportunities

Expansion of Renewable Energy and Smart Grid Projects

The Low Voltage Power and Control Cable market holds strong opportunities through the global shift toward renewable energy and smart grid development. Governments and private players invest heavily in solar, wind, and distributed energy projects that require reliable and efficient cabling solutions. It supports grid modernization by enabling advanced monitoring, automation, and integration of renewable power sources. Growing emphasis on sustainable energy infrastructure creates continuous demand for fire-resistant, eco-friendly, and high-performance cables. Emerging economies present large-scale opportunities due to increasing electrification and renewable adoption. The transition toward decentralized energy systems further widens the growth potential.

Rising Adoption Across Industrial Automation and Digital Infrastructure

Expanding industrial automation and digitalization create new avenues for advanced cabling solutions. The Low Voltage Power and Control Cable market benefits from strong adoption in robotics, data centers, and telecommunication infrastructure. It plays a vital role in ensuring seamless connectivity, signal transmission, and reliable energy supply in smart manufacturing environments. Increasing deployment of IoT, AI-driven systems, and Industry 4.0 processes strengthens the need for durable and high-capacity control cables. The demand for high-speed, low-loss solutions in digital infrastructure accelerates market opportunities. Companies that align product innovation with automation and digital growth trends will capture significant competitive advantage.

Market Segmentation Analysis:

By Product Type:

Power cables and control cables. Power cables account for a significant share due to their essential role in ensuring stable electricity transmission across residential, commercial, and industrial sectors. It supports expanding urban infrastructure, renewable energy integration, and modernization of power distribution networks. Rising demand from smart city projects and rural electrification further strengthens adoption. Control cables, on the other hand, gain traction from their role in automation, instrumentation, and process control across diverse industries. It enables efficient signal transmission, system monitoring, and seamless operation of robotics and sensors, particularly in Industry 4.0 environments. Advancements in design focused on flexibility, fire resistance, and durability continue to drive demand for control cables in complex industrial settings.

- For instance, under a framework agreement, NKT is set to supply up to 4,000 km of low‑ to medium‑voltage power cables over a five-year period to support grid upgrade projects across Denmark’s Zealand region.

By Application:

Utilities represent the leading segment, fueled by investments in grid modernization, renewable power integration, and electrification initiatives. The Low Voltage Power and Control Cable market benefits from strong utility demand to support reliable energy delivery and regulatory compliance with safety standards. It also plays a vital role in extending rural electrification in emerging economies and strengthening smart grid infrastructure in developed markets. Industrial applications form another critical growth area, with sectors such as automotive, oil and gas, and manufacturing driving consistent usage. Rising automation and deployment of digital infrastructure increase reliance on durable cabling solutions for operational safety and efficiency. Expanding global industrial projects and compliance with international standards ensure steady demand across this segment.

- For instance, Nexans committed to manufacture and supply approximately 5,000 km of medium- and low‑voltage photovoltaic (PV) and data cables to connect the Cestas solar farm in France.

Segments:

Based on Product Type:

- Power Cable

- Control Cable

Base on Application:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 28% of the Low Voltage Power and Control Cable market, supported by strong utility networks and advanced industrial infrastructure. The region benefits from large-scale investments in smart grid modernization and renewable energy projects, particularly solar and wind. It witnesses robust demand from industrial automation in sectors such as automotive, aerospace, and oil and gas. Increasing emphasis on sustainable energy distribution encourages the use of advanced power and control cables that comply with strict safety and environmental standards. It also gains traction from ongoing upgrades in residential and commercial construction that require efficient and fire-resistant cabling. Continuous innovation by key regional players further sustains North America’s growth momentum.

Europe

Europe represents 24% of the Low Voltage Power and Control Cable market, driven by stringent regulatory frameworks and strong renewable energy integration. The region emphasizes sustainable development, with high demand for eco-friendly, halogen-free, and energy-efficient cabling. It sees growing installations across offshore wind projects, smart building initiatives, and industrial automation systems. Expansion of high-speed rail and transport electrification further contributes to steady demand. European industries rely heavily on advanced control cables to optimize operations and ensure compliance with strict safety norms. Rising infrastructure modernization in both Western and Eastern Europe enhances the long-term market outlook.

Asia Pacific

Asia Pacific leads the market with the largest share of 32%, supported by rapid industrialization, urbanization, and infrastructure expansion. The region witnesses heavy demand from emerging economies such as China, India, and Southeast Asian countries, where electrification projects are expanding. It gains strong growth momentum from rising investments in smart cities, renewable energy integration, and manufacturing automation. Utilities in Asia Pacific prioritize expanding grid infrastructure to meet growing electricity consumption. Control cables see rising adoption in manufacturing hubs due to the widespread implementation of Industry 4.0 practices. Strong presence of local manufacturers and government-backed infrastructure initiatives further reinforce the region’s dominant position.

Latin America

Latin America contributes 8% of the Low Voltage Power and Control Cable market, supported by growing demand for electrification and renewable energy projects. Countries such as Brazil, Mexico, and Chile invest in solar, wind, and hydropower initiatives that require advanced cabling solutions. It experiences steady growth from industrial adoption in mining, oil and gas, and construction sectors. Rising focus on modernizing outdated power distribution systems supports demand for efficient and safe low voltage cables. The residential and commercial construction sector also provides steady momentum across urban centers. Increasing international collaborations with cable manufacturers enhance availability and quality in the region.

Middle East and Africa

The Middle East and Africa hold 8% of the Low Voltage Power and Control Cable market, with growth primarily fueled by infrastructure development and energy diversification projects. The Middle East invests heavily in smart city projects and large-scale construction, creating robust demand for durable cabling. Africa, meanwhile, focuses on expanding electrification across underserved regions, driving steady adoption of power cables. It benefits from renewable energy expansion, particularly solar power projects in countries such as South Africa and Saudi Arabia. Industrial adoption in oil and gas and heavy construction projects adds further strength to market growth. Rising investments in modernizing distribution networks sustain long-term opportunities across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Low Voltage Power and Control Cable market features strong competition among leading players including KEI Industries, Furukawa Electric, Klaus Faber, NKT A/S, Ducab, Bergen Cable Technology, LS Cable & System, Belden, KEC International, and Nexans. These companies focus on expanding product portfolios, technological innovations, and strengthening distribution networks to gain a competitive edge. Global players emphasize advanced insulation materials, eco-friendly designs, and fire-resistant features to meet strict international safety and environmental standards. Regional manufacturers strengthen their presence by catering to cost-sensitive markets and offering customized solutions for utilities, industries, and infrastructure projects. Intense competition drives continuous investment in research and development to improve energy efficiency, durability, and performance of cables. Strategic collaborations, acquisitions, and partnerships help leading companies expand their global reach and enhance market positioning. Strong focus on renewable energy integration, industrial automation, and digital infrastructure ensures sustained demand, while pricing pressures and regulatory compliance remain key challenges. The ability to balance innovation with affordability defines long-term success in this highly competitive landscape.

Recent Developments

- In 2024, Furukawa Electric opened a laser application laboratory in Budapest to accelerate e-Mobility component development; part of wider group reorganization moves during 2024.

- In May 2023, The LS cable and systems announced the completion of an HVDC submarine cable factory in Donghae, Gangwon Province. It is the only HVDC submarine cable factory in Korea. The factory unit was completed with an ultra-high-rise manufacturing tower standing 172 m tall.

- In 2023, Nexans had the sales of approximately USD 6.8 billion, significantly influencing the power and control cable sector. Nexans joined Authentic Vision in fighting cable counterfeiting through the adoption of Meta-Anchor technology, showing the industry’s fidelity towards product verification and supply chain security.

- In July 2024, Prysmian S.p.A completed the acquisition of Encore Wire Corporation, a U.S.-based cable producer. This acquisition will significantly create a strong impact on the cable industry, since Prysmian has a strong leverage for the technology, which will help them to gain considerable market share in power and control cable market in coming decades.

- In 2022, Nexans introduced AXQJ Easy 1 kV, a new generation of halogen-free power cable. The cable is equipped with unique sheathing material and is easy to cut along with enhanced flexibility, which makes its laying faster. The product can be frequently used across industry for energy supply to power equipment. This launch expanded the company’s product portfolio and enhanced its customer base across power and control cable industry.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand from utilities and industrial sectors.

- Renewable energy integration will drive higher adoption of advanced low voltage cables.

- Smart grid modernization will create consistent opportunities for innovative cabling solutions.

- Industrial automation will strengthen the need for reliable control cable systems.

- Digital infrastructure growth will increase demand for high-performance and durable cables.

- Eco-friendly and halogen-free cable designs will gain wider acceptance due to regulations.

- Technological advancements in insulation and fire resistance will enhance product value.

- Emerging economies will generate strong demand through electrification and urbanization projects.

- Strategic partnerships and acquisitions will shape competitive positioning among key players.

- Continuous R&D investment will support innovation and long-term market sustainability.