Market Overview

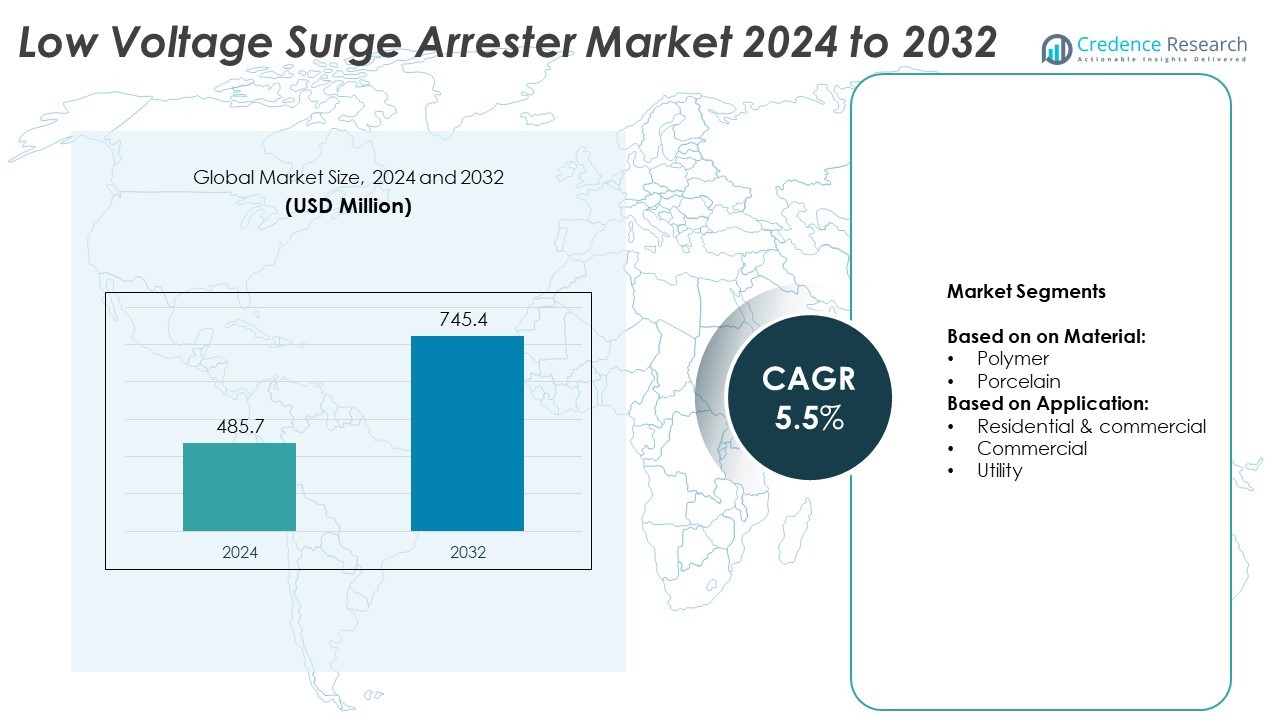

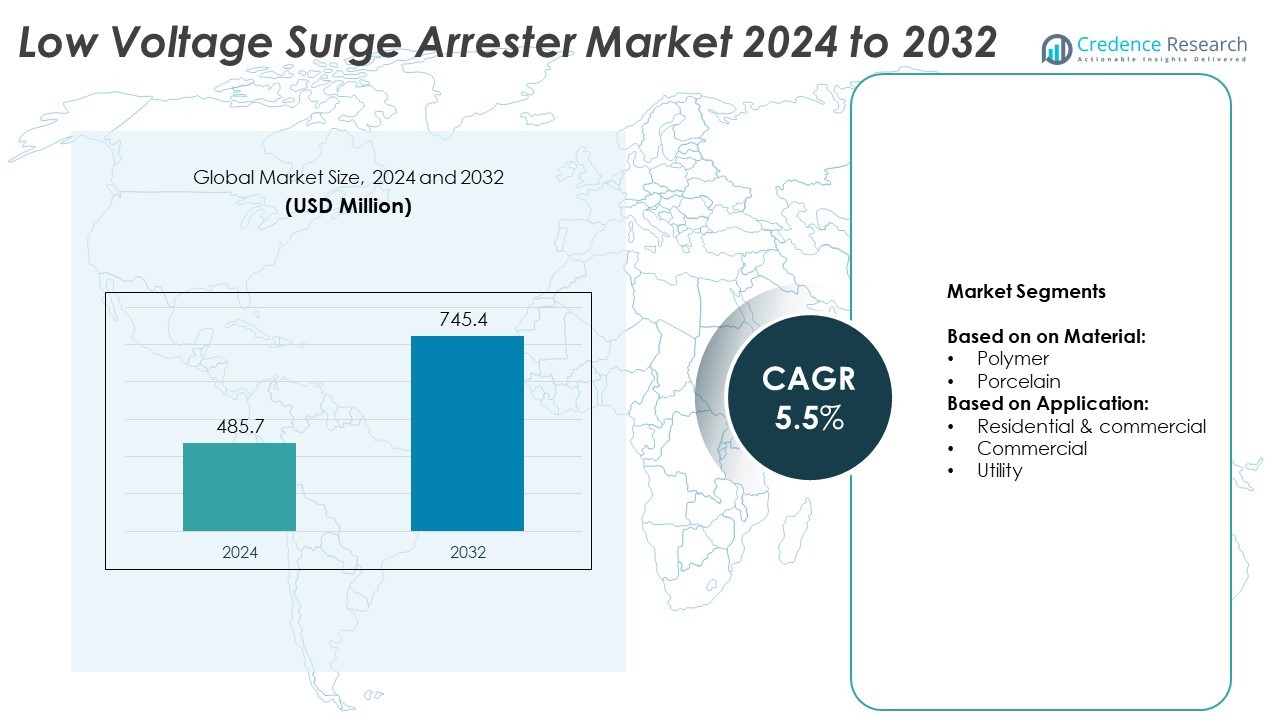

Low Voltage Surge Arrester Market size was valued at USD 485.7 million in 2024 and is anticipated to reach USD 745.4 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Voltage Surge Arrester Market Size 2024 |

USD 485.7 Million |

| Low Voltage Surge Arrester Market, CAGR |

5.5% |

| Low Voltage Surge Arrester Market Size 2032 |

USD 745.4 Million |

The Low Voltage Surge Arrester market grows due to increasing demand for power reliability, rising use of sensitive electronics, and expansion of EV charging and renewable energy systems. Utilities and industries invest in advanced protection devices to prevent damage from voltage surges and maintain system uptime. Polymer-based arresters gain popularity for their durability and lightweight properties, replacing traditional porcelain units. Compact designs, smart monitoring, and IoT integration emerge as key trends in both developed and developing regions.

North America leads the Low Voltage Surge Arrester market due to strong infrastructure and widespread safety regulations. Europe follows with demand supported by smart grid expansion and renewable energy integration. Asia-Pacific shows rapid growth driven by urbanization, industrial development, and rising electrification in emerging economies. Latin America and the Middle East & Africa see steady progress with infrastructure modernization and energy access initiatives. Key players such as DEHN, Eaton, ABB, and General Electric focus on delivering advanced, compact, and reliable solutions to meet the needs of utilities, industries, and residential users across all major regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Low Voltage Surge Arrester market was valued at USD 485.7 million in 2024 and is expected to reach USD 745.4 million by 2032, growing at a CAGR of 5.5%.

- Increasing demand for electrical protection in residential, commercial, and utility applications drives market growth.

- Smart surge arresters with IoT and remote monitoring features are gaining traction among utilities and industries.

- Leading companies focus on R&D, modular designs, and certified products to strengthen their global presence.

- Lack of awareness among small-scale users and presence of low-quality products in unorganized markets limit wider adoption.

- North America leads in adoption due to grid upgrades and safety standards, while Asia-Pacific shows fastest growth driven by electrification.

- Manufacturers are shifting to polymer-based arresters, offering compact and weather-resistant solutions for indoor and outdoor use.

Market Drivers

Rising Demand for Grid Reliability and Equipment Protection

The need for uninterrupted power supply increases across residential, commercial, and industrial sectors. Surges from lightning or switching operations can damage expensive electronics and disrupt services. Surge arresters reduce such risks by safely diverting excess voltage. Utilities and businesses invest in these devices to ensure grid reliability and protect connected infrastructure. Governments also support grid modernization projects that prioritize surge protection. The Low Voltage Surge Arrester market benefits from these infrastructure resilience efforts.

- For instance, Eaton introduced the Storm Trapper H.E., the first low‑voltage distribution‑class MOV surge arrester designed for transformer secondary bushings, with surge withstand capability of 40 kA

Expansion of Renewable Energy and Distributed Generation

Renewable energy sources like solar and wind often connect to the grid at low voltage levels. These distributed energy systems introduce variability and transient surges that require effective protection. Surge arresters help safeguard sensitive inverters, meters, and control systems from voltage spikes. Growth in rooftop solar installations further drives demand in residential settings. The Low Voltage Surge Arrester market responds by offering compact, high-performance units for decentralized setups. It plays a key role in protecting renewable investments and ensuring performance stability.

- For instance, DEHN released the DEHN guard MU 3PY 208 3W+G modular DIN-rail surge arrester tailored for 3-phase wye systems. This device delivers a nominal discharge current of 20 kA (8/20 µs), a maximum discharge capacity of 50 kA, and a short-circuit current rating (SCCR) of 200 kA.

Growing Urbanization and Smart Infrastructure Development

Smart cities use interconnected systems including surveillance, lighting, EV charging, and automation. These systems rely on low-voltage networks that are vulnerable to transient overvoltages. Surge arresters protect devices like sensors, data transmission lines, and distribution panels. Urban development plans increasingly integrate surge protection to support long-term performance and safety. The Low Voltage Surge Arrester market adapts by developing solutions suited for dense environments. It supports urban growth by preventing infrastructure downtime and damage.

Stringent Safety Regulations and Compliance Requirements

Governments enforce electrical safety standards to reduce risks in commercial and residential environments. Regulations require surge protection for specific equipment or buildings. This compliance pressure increases demand for certified, reliable surge arresters. Manufacturers focus on meeting international safety norms and performance benchmarks. Buyers seek products tested for high surge endurance and operational longevity. The Low Voltage Surge Arrester market aligns with these regulatory trends by ensuring product safety and reliability.

Market Trends

Shift Toward Compact and Modular Surge Protection Devices

Consumers and businesses seek space-saving electrical solutions for residential, commercial, and industrial setups. Compact surge arresters allow easy integration into modern distribution boards and control panels. Modular designs simplify replacement and upgrades without major rewiring. This trend improves system flexibility and lowers maintenance costs over time. Manufacturers respond by developing sleek, stackable units with consistent performance. The Low Voltage Surge Arrester market incorporates compact architecture to meet growing design and installation demands.

- For instance, CHINT introduced its NU6‑II modular DIN‑rail surge arrester, rated for 385 V or 460 V continuous operational voltage (Uc). It delivers nominal discharge currents of 15 kA, 25 kA, or 40 kA, with maximum discharge capacities reaching 60 kA or 100 kA.

Increased Use of Polymer-Housed Arresters Over Porcelain Types

Polymer-based housings offer lighter weight, better hydrophobicity, and enhanced resistance to pollution. Their superior mechanical strength and reduced risk of shattering improve safety and handling. These benefits drive replacement of traditional porcelain models in harsh or space-constrained environments. Utilities and industrial operators prefer polymer arresters for outdoor and coastal applications. Suppliers continue to innovate with new materials for higher insulation and durability. The Low Voltage Surge Arrester market adopts polymer technology to address evolving safety and performance requirements.

- For instance, Hubbell (Ohio Brass) unveiled the PVI‑LP station‑class polymer‑housed surge arrester, featuring ESP™ polymer housing, a 12.7 kV MCOV, and low-current long-duration (LCLD) capability of 550 A over 2000 µs. It achieves maximum discharge voltages of 44.9 kV at 20 kA, 50.6 kV at 40 kA, and withstands lightning and switching impulses of 33.7 kV and 52.8 kV respectively, with robust sealing to resist moisture and extend service life

Integration of Digital Monitoring and IoT Features

Smart grid expansion drives demand for condition-based monitoring and remote diagnostics. Surge arresters now include sensors that track performance, aging, and fault activity. These features allow real-time alerts, reducing unplanned downtime and enabling predictive maintenance. Digital surge arresters support data-driven asset management in utilities and factories. It improves operational visibility and extends service life of electrical infrastructure. The Low Voltage Surge Arrester market follows this digitalization path by embedding IoT-ready systems.

Focus on Customized Solutions for Sector-Specific Applications

Different industries need unique protection levels based on operating environments and load profiles. Surge arresters are now designed for niche uses in telecom, EV charging stations, and data centers. These environments require high-speed response and coordination with backup power systems. Product lines now vary in clamping voltage, discharge current capacity, and mounting type. Manufacturers tailor solutions to meet technical and compliance needs of each application. The Low Voltage Surge Arrester market supports this trend by offering industry-specific variants.

Market Challenges Analysis

Limited Awareness Among End-Users and Small Installers

Many small-scale users, including residential consumers and small businesses, lack technical awareness about surge protection. They often rely on basic circuit breakers or assume appliances are already protected. This limits the adoption of dedicated surge arresters despite rising risks of voltage spikes. Electrical contractors and local installers may also overlook surge protection in low-cost projects. Lack of training and minimal enforcement of local codes reduce demand in budget-sensitive markets. The Low Voltage Surge Arrester market faces delays in full penetration due to these knowledge and adoption gaps.

High Competition and Pricing Pressure Across Unorganized Markets

Low-cost surge arresters from unorganized or regional manufacturers affect quality perception and pricing stability. Many players offer similar-looking products without certified performance or safety tests. This creates confusion and pricing wars in cost-driven regions. Buyers often prioritize price over reliability, which leads to inconsistent protection results. Leading manufacturers must differentiate through brand strength, warranty terms, and technical support. The Low Voltage Surge Arrester market addresses these challenges by improving product standards and emphasizing long-term value.

Market Opportunities

Surge Protection Demand from E-Mobility and EV Infrastructure

The rise of electric vehicles increases reliance on charging stations and associated power electronics. These systems require strong surge protection to avoid costly equipment failure and downtime. EV chargers operate in outdoor or semi-protected areas, making them vulnerable to transients. Regulatory bodies recommend or mandate surge arresters in EV charging installations. Manufacturers and charging network operators seek durable, compact solutions that meet safety and performance codes. The Low Voltage Surge Arrester market leverages this growth by offering models tailored to e-mobility environments.

Expansion in Developing Economies with Power Quality Concerns

Emerging markets face frequent voltage fluctuations, unstable grids, and rising electronics use. Small factories, commercial buildings, and households invest in protective devices to prevent equipment loss. Governments and utilities roll out rural electrification programs that boost low-voltage connections. These new installations often include basic protection systems to improve resilience. Product demand grows in regions with poor grid infrastructure and limited service coverage. The Low Voltage Surge Arrester market expands its global footprint by targeting underserved areas with cost-effective protection.

Market Segmentation Analysis:

By Material:

The polymer segment holds a dominant share due to its superior mechanical strength and lightweight properties. Polymer-based surge arresters offer better resistance to pollution, UV rays, and moisture, making them suitable for outdoor use. Their non-brittle nature reduces breakage during transport or installation, which lowers maintenance and replacement costs. The porcelain segment remains relevant in traditional grids and indoor installations where environmental stress is lower. It offers good thermal stability and long-term durability but faces growing competition from advanced polymer designs. The Low Voltage Surge Arrester market sees a clear shift toward polymer materials, supported by rising demand for compact and rugged protection devices.

- For instance, for 120/240 V electrical systems, the Schneider Electric Multi9 PRD1 75r DIN-rail surge arrester, model M9L12240, is a Type 1 surge protection device designed for installation at service entrances, branch panels, or within control panels. It features a nominal discharge current (\(I_{n}\)) of 20 kA (L/PE), a maximum discharge current (\(I_{max}\)) of 75 kA, and a voltage protection level (\(U_{p}\)) of <600 V (L/N) and <1200 V (L/L). With a robust construction, it operates effectively within a temperature range of -25 °C to 60 °C and mounts securely on a DIN rail.

By Application:

The residential and commercial segment shows strong growth due to increasing use of sensitive electronics and appliances. Frequent power fluctuations and rising consumer awareness drive the need for basic surge protection. Small offices and retail spaces also adopt surge arresters to protect HVAC systems, computers, and lighting units. The commercial segment alone includes data centers, malls, hospitals, and industrial buildings that demand high-capacity, multi-phase protection systems. Utility applications contribute significantly due to ongoing grid upgrades and renewable energy integration. The Low Voltage Surge Arrester market meets utility needs by offering high-discharge capacity units that support fault-prone and outdoor installations. It supports all three segments by tailoring solutions for load types, environmental exposure, and safety requirements.

- For instance, the Rockwell Automation Bulletin 4983-DS is a series of compact, modular, DIN-rail surge protective devices (SPDs) for protecting 1- and 3-phase systems.

Segments:

Based on Material:

Based on Application:

- Residential & commercial

- Commercial

- Utility

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Low Voltage Surge Arrester market, accounting for 32.4% in 2024. The region benefits from well-established utility infrastructure and high adoption of safety standards in electrical installations. Power grids in the United States and Canada continue to modernize, which increases the use of advanced surge protection systems. The growing number of residential solar panel installations and electric vehicle (EV) charging stations further drives demand. Commercial and industrial users invest in compact and durable polymer-based arresters for both indoor and outdoor setups. It also benefits from strong manufacturer presence and supportive government policies encouraging infrastructure upgrades.

Europe

Europe captures the second-largest market share with 27.1% in 2024. The region’s strict electrical safety regulations and large-scale renewable energy integration support steady demand. Countries such as Germany, France, and the UK enforce surge protection standards across residential and commercial projects. Smart building systems, industrial automation, and electric mobility infrastructure increase the need for low-voltage surge protection devices. The European market sees wide adoption of polymer-housed arresters due to compact design and high environmental tolerance. The Low Voltage Surge Arrester market grows steadily here due to a strong regulatory framework and focus on energy efficiency.

Asia-Pacific

Asia-Pacific holds 24.3% of the market and represents the fastest-growing region in the forecast period. Rapid urbanization, industrial growth, and increased electrification in countries like China, India, and Southeast Asia drive expansion. Many regions in Asia face unstable power supply and grid disturbances, increasing the use of low-voltage surge arresters. Demand rises in both residential and utility-scale applications, with governments funding infrastructure upgrades and electrification programs. Manufacturers target this region with cost-effective, high-performance solutions to serve large volumes. The Low Voltage Surge Arrester market sees strong growth in Asia-Pacific due to expanding construction and renewable energy adoption.

Latin America

Latin America contributes 9.1% to the global market share in 2024. Countries such as Brazil, Mexico, and Argentina improve their power distribution systems and promote safety in both residential and industrial sectors. Commercial projects like shopping complexes, telecom infrastructure, and smart lighting systems increase the demand for surge protection devices. Regional governments also support renewable energy development, including wind and solar farms that require reliable surge protection. The Low Voltage Surge Arrester market benefits here from rising energy access programs and increased investments in infrastructure modernization.

Middle East & Africa

The Middle East & Africa region holds the smallest share at 7.1% in 2024 but shows rising adoption. Investments in smart city projects, utility expansions, and commercial infrastructure create new opportunities. Power outages and voltage fluctuations are common, which raises awareness of electrical protection. The region shows increasing interest in polymer-based arresters due to performance in harsh climates. The Low Voltage Surge Arrester market grows gradually in MEA, supported by government-backed electrification and grid reliability initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DEHN

- General Electric

- Elpro

- CHINT Group

- Ensto

- Eaton

- Hubbell

- ABB

- CG Power

- INAEL

Competitive Analysis

The Low Voltage Surge Arrester market features strong competition among key players such as DEHN, General Electric, Elpro, CHINT Group, Ensto, Eaton, Hubbell, ABB, CG Power, and INAEL.These companies focus on expanding their product portfolios with advanced surge protection technologies. They invest in R&D to improve energy absorption capacity, reduce failure rates, and offer compact, modular solutions. Global players aim to strengthen distribution networks and after-sales services to improve market presence. Companies compete by offering certified, application-specific products that meet international safety standards. Strategic partnerships with utility providers and construction firms help secure large-scale projects. Price competitiveness and strong brand recognition also play a critical role in customer acquisition. Market leaders maintain a focus on reliability, fast response times, and long operational life to build customer trust.

Recent Developments

- In April 2025, Eaton finalized the acquisition of Fibrebond, expanding its capabilities in power distribution and surge arrester technology.

- In April 2024, Ensto launched a sub‑range named VARISIL HE Distribution surge arresters for distribution networks. These protect transformers, reclosers, switches, and cables with compact design and cost‑effective integration in underground substations.

- In 2023, Raycap introduced its advanced ProTec PV Box 7y surge protection solutions for photovoltaic systems and charging stations.

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for surge protection in EV charging stations will increase across urban areas.

- Utilities will adopt smart surge arresters with remote monitoring features.

- Polymer-based arresters will replace porcelain units in most outdoor applications.

- Surge protection will become mandatory in more building and safety codes.

- Asia-Pacific will continue to show the fastest market growth.

- Manufacturers will focus on compact and modular product designs.

- Smart cities will drive higher adoption of low-voltage surge arresters.

- Industrial automation will need surge protection for sensitive equipment.

- Growth in solar power installations will increase the need for system protection.

- Product innovation will focus on longer life and higher discharge capacity.