Market Overview

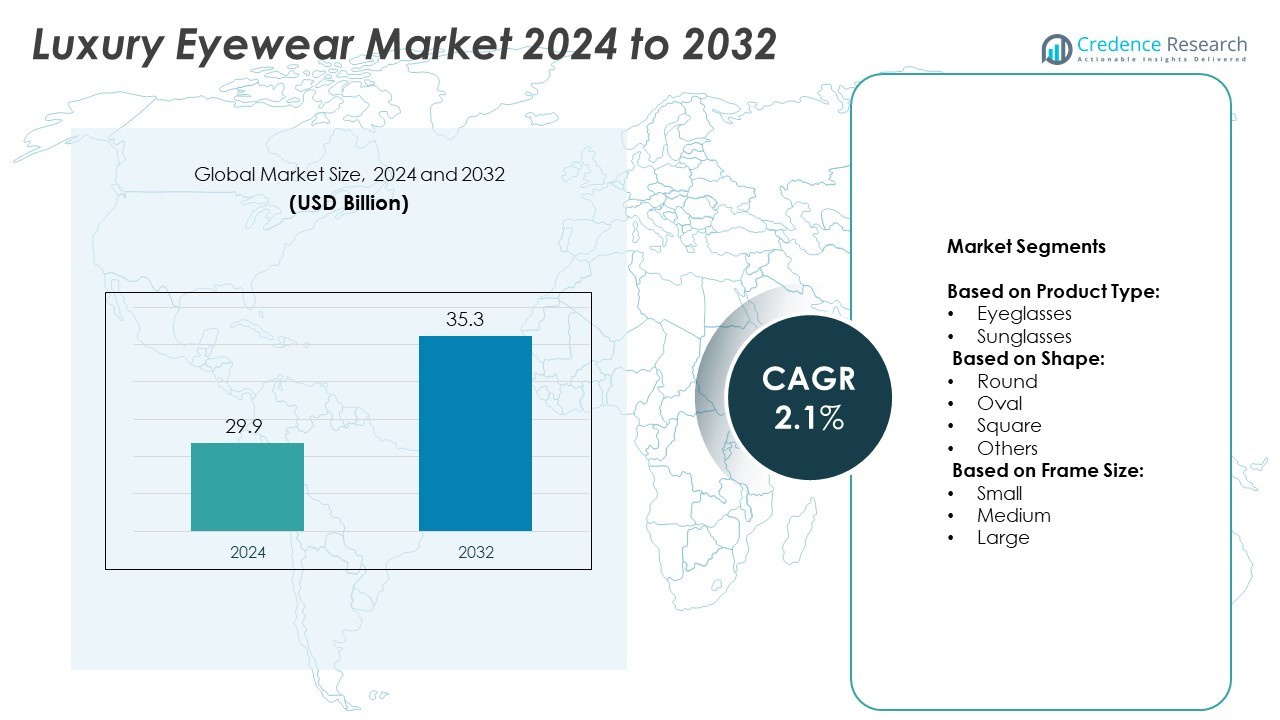

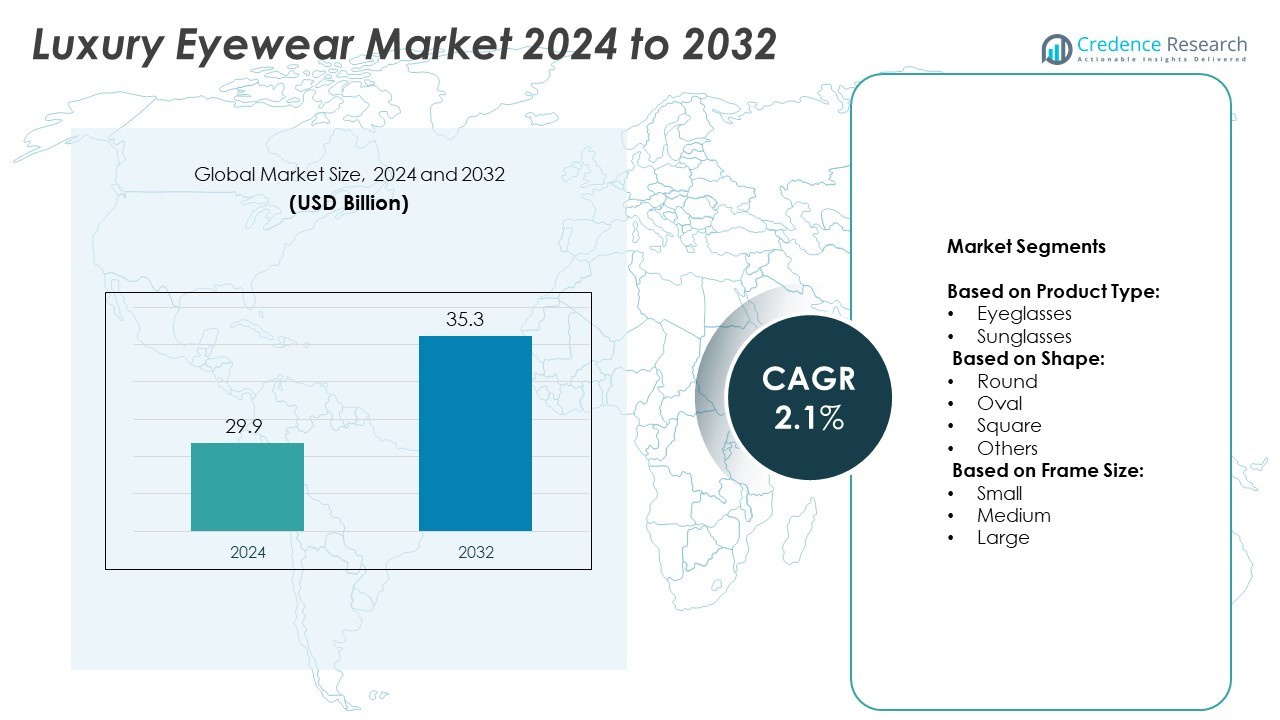

Luxury Eyewear Market size was valued at USD 29.9 billion in 2024 and is anticipated to reach USD 35.3 billion by 2032, at a CAGR of 2.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Eyewear Market Size 2024 |

USD 29.9 Billion |

| Luxury Eyewear Market, CAGR |

2.1% |

| Luxury Eyewear Market Size 2032 |

USD 35.3 Billion |

The Luxury Eyewear market grows steadily due to rising demand for premium fashion accessories and increasing consumer preference for branded products. Higher disposable incomes and changing lifestyle trends drive adoption of stylish and functional eyewear. Technological advancements, including smart glasses and personalized designs, enhance product innovation and customer appeal. Sustainability initiatives further influence purchasing behavior as brands introduce eco-friendly materials. Expanding e-commerce platforms and influencer-driven marketing strengthen global reach, boosting market competitiveness and accelerating overall growth.

North America leads the Luxury Eyewear market, driven by high consumer spending and strong retail infrastructure. Europe follows closely, supported by renowned fashion hubs and a rich heritage of premium craftsmanship. Asia-Pacific shows rapid growth due to rising disposable incomes and increasing demand for luxury products. Leading players such as EssilorLuxottica, LVMH, Gucci, and Giorgio Armani focus on innovation, exclusive collections, and strategic collaborations to strengthen their presence and meet evolving consumer preferences across diverse global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Luxury Eyewear market was valued at USD 29.9 billion in 2024 and is projected to reach USD 35.3 billion by 2032, growing at a CAGR of 2.1% during the forecast period.

- Rising disposable incomes, increasing brand consciousness, and growing demand for premium fashion accessories drive overall market growth.

- Key trends include the adoption of sustainable materials, smart eyewear technologies, personalized designs, and expanding virtual try-on solutions to enhance consumer engagement.

- The market is highly competitive, with established brands focusing on innovation, exclusive collections, and strategic collaborations, while emerging players target niche audiences with unique designs.

- High product prices and the rising availability of counterfeit products act as restraints, limiting wider adoption in price-sensitive markets and impacting overall profitability.

- North America leads the market due to strong luxury consumption, Europe remains dominant in craftsmanship and designer offerings, and Asia-Pacific shows the fastest growth driven by increasing fashion awareness.

- Companies invest in omnichannel strategies, influencer-driven marketing, and global expansion to enhance reach, strengthen brand visibility, and capture growing opportunities in emerging economies.

Market Drivers

Rising Demand for Premium Fashion and Lifestyle Products

The Luxury Eyewear market experiences strong growth driven by rising consumer preference for high-end fashion. Increasing awareness of personal style and brand value influences purchasing decisions. Leading brands expand collections to cater to changing consumer tastes and seasonal trends. Collaborations between luxury fashion houses and eyewear manufacturers boost product innovation. It benefits from growing celebrity endorsements and social media influence on luxury fashion choices. Rising disposable incomes in urban markets further support premium eyewear adoption.

- For instance, Ray‑Ban Meta smart‑glass units exceeded 2 million, driving tripled sales in early 2025 for EssilorLuxottica, reflecting strong consumer demand for fashionable smart eyewear

Technological Advancements and Product Innovation

Innovation in frame materials, lens technology, and design drives significant demand in the Luxury Eyewear market. Brands introduce lightweight, durable, and eco-friendly products to meet consumer expectations. Smart eyewear features, such as augmented reality lenses and blue light protection, attract tech-savvy buyers. Manufacturers invest in advanced production techniques to deliver unique customization options. It strengthens brand positioning and improves customer engagement through enhanced functionality. Growing focus on sustainable materials aligns with evolving consumer preferences.

- For instance, researchers have developed innovative SiC diffractive waveguide AR glasses prototypes that have demonstrated impressive specifications. Some prototypes featured a single waveguide weighing only 2.685 grams and measuring 0.55 mm thick, while a later version featured a single packaged lens weighing 3.795 grams at 0.75 mm thick.

Increasing Penetration of E-Commerce and Omni-Channel Strategies

The Luxury Eyewear market benefits from the rising influence of online platforms and digital retail channels. E-commerce expands product accessibility, offering consumers a wider range of premium collections. Brands adopt omni-channel strategies combining physical stores and online presence to improve shopping experiences. Virtual try-on technologies and AI-driven recommendations increase customer confidence in purchasing online. It helps brands target younger consumers seeking seamless buying options. Expanding global logistics networks improve timely product deliveries.

Growing Consumer Awareness of Eye Health and Wellness

Rising awareness about eye health and vision protection supports growth in the Luxury Eyewear market. Increasing exposure to digital screens drives demand for eyewear with advanced UV and blue light protection. Brands integrate health-focused features into premium designs to attract wellness-conscious consumers. Collaborations with ophthalmologists and healthcare providers enhance product credibility. It boosts adoption across various consumer segments seeking fashion and functionality together. Expanding awareness campaigns highlight the importance of high-quality lenses and protective materials.

Market Trends

Growing Influence of Celebrity Collaborations and Brand Partnerships

The Luxury Eyewear market witnesses increasing collaborations between fashion houses, celebrities, and designers. These partnerships drive brand visibility and create limited-edition collections that attract premium buyers. Consumers seek products endorsed by global icons, boosting exclusivity and aspirational value. Fashion influencers and social media platforms amplify awareness and influence purchasing behavior. It helps brands connect with younger demographics demanding personalized and stylish eyewear. Strategic collaborations strengthen positioning in competitive luxury segments.

- For instance, EssilorLuxottica boosts smart‑glasses manufacturing in China and Southeast Asia to reach the 10‑million‑unit goal, reducing supply constraints

Rising Popularity of Sustainable and Eco-Friendly Eyewear

Sustainability emerges as a significant trend in the Luxury Eyewear market with growing consumer demand for ethical products. Brands adopt eco-friendly materials like bio-acetate, recycled metals, and plant-based plastics. Innovative production processes reduce environmental impact while maintaining quality and design appeal. Consumers prefer luxury products aligned with environmental responsibility and transparent sourcing. It encourages manufacturers to introduce green collections catering to conscious buyers. Leading brands position sustainability as a core value to enhance long-term loyalty.

- For instance, Zenni Optical sells more than 2,000 types of prescription glasses and sunglasses, plus 45 types of contact lenses, underlining its breadth in product variety

Integration of Smart Eyewear and Digital Technologies

Technological innovation transforms consumer preferences in the Luxury Eyewear market with rising adoption of smart eyewear solutions. Augmented reality-enabled lenses, fitness tracking, and digital integration drive demand among tech-focused buyers. Brands launch products with blue light filtering and vision enhancement features to attract professionals and gamers. Investments in AI-powered customization allow consumers to personalize designs and functionalities. It improves overall user experiences by merging style and technology. Increased research accelerates development of advanced optical solutions.

Expansion of Direct-to-Consumer and Omni-Channel Retailing

The Luxury Eyewear market experiences rapid adoption of direct-to-consumer business models. Brands enhance control over pricing, inventory, and customer engagement through dedicated digital platforms. Omni-channel strategies integrate physical boutiques with online shopping to improve accessibility. Virtual try-on tools and AI-powered recommendations encourage higher online conversion rates. It enables brands to reach global audiences and reduce dependency on third-party retailers. Personalized marketing campaigns further strengthen consumer relationships and brand loyalty.

Market Challenges Analysis

High Product Costs and Intense Market Competition

The Luxury Eyewear market faces challenges due to premium pricing, limiting adoption among price-sensitive consumers. High production costs, driven by advanced materials and designs, increase retail prices. Intense competition among established brands and emerging players pressures margins and brand differentiation. Counterfeit products in both online and offline markets reduce consumer trust and impact sales performance. It forces brands to invest heavily in authentication technologies and brand protection strategies. Maintaining exclusivity while reaching a broader audience remains a complex challenge for manufacturers.

Supply Chain Disruptions and Changing Consumer Preferences

Frequent supply chain disruptions pose significant challenges for the Luxury Eyewear market. Global shortages of raw materials and transportation delays affect timely production and delivery. Shifting consumer preferences toward sustainable, tech-integrated, and customized eyewear demand constant innovation from brands. It puts pressure on manufacturers to balance design trends, quality, and cost-effectiveness. Regulatory compliance related to sustainability and safety standards further complicates operations. Adapting quickly to evolving demands while managing production constraints remains a key difficulty for industry players.

Market Opportunities

Expansion into Emerging Markets and Growing Consumer Base

The Luxury Eyewear market presents strong opportunities through rising demand in emerging economies. Increasing disposable incomes and urbanization in regions like Asia-Pacific and Latin America drive premium product adoption. Younger consumers show higher interest in luxury fashion and exclusive designs, expanding the target audience. It enables brands to explore new geographies and strengthen their global presence. Strategic partnerships with local distributors and retail chains improve accessibility and visibility. Growing tourism in luxury shopping destinations further boosts international sales potential.

Technological Advancements and Personalization Opportunities

Rapid innovation creates growth prospects for the Luxury Eyewear market with rising demand for advanced eyewear solutions. Smart features, such as augmented reality lenses and blue light protection, attract tech-savvy consumers seeking enhanced functionality. AI-powered customization tools allow brands to deliver personalized products and improve customer experiences. It helps companies build stronger brand loyalty while targeting niche consumer preferences. Expanding investments in sustainable materials and eco-friendly production processes also open new avenues. Rising integration of fashion and technology drives long-term market opportunities.

Market Segmentation Analysis:

By Product Type:

The Luxury Eyewear market is segmented into eyeglasses and sunglasses, with both categories contributing significantly to overall demand. Eyeglasses dominate due to growing awareness of vision care and rising adoption of premium optical lenses. Fashion-driven consumers seek designer frames that combine functionality with aesthetics, boosting luxury eyeglass sales. Sunglasses also register strong growth, supported by lifestyle trends, celebrity endorsements, and advanced UV protection features. It benefits from rising demand for high-end collections with innovative materials and distinctive designs. Seasonal launches and limited-edition releases further strengthen segment performance.

- For instance, EssilorLuxottica operates 47 mass production facilities worldwide—33 for lens mass production and 14 for eyewear—to support greater product accessibility and health features.

By Shape:

The market offers a wide range of shapes, including round, oval, square, and others, catering to diverse consumer preferences. Round frames gain popularity among younger buyers seeking retro-inspired styles, while oval designs remain a classic choice for versatile looks. Square frames continue to lead among consumers preferring bold and defined aesthetics. Premium brands innovate with mixed shapes and custom designs to enhance exclusivity. It supports personalized buying experiences, attracting fashion-conscious customers across multiple age groups. Customization options also help brands expand their reach among niche style segments.

- For instance, e-Vision Optics, LLC has nearly 440-550 patents issued or pending worldwide, reflecting its strong commitment to optical innovation and smart eyewear development.

By Frame Size:

The Luxury Eyewear market segments frames into small, medium, and large sizes to meet varied comfort and styling needs. Medium-sized frames dominate sales due to their universal fit and balanced aesthetics, appealing to a broad customer base. Large frames gain traction in premium collections, offering a statement look and wider lens coverage. Small frames attract consumers seeking minimalistic and lightweight designs for everyday wear. It creates opportunities for brands to diversify offerings and develop targeted collections. Advanced materials and ergonomic designs further enhance comfort and performance across all size categories.

Segments:

Based on Product Type:

Based on Shape:

Based on Frame Size:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America captures a market share of 40% in the Luxury Eyewear market in 2024. It leads the global market due to strong demand for premium eyewear and the presence of established luxury brands. The United States contributes the highest revenue, supported by rising disposable incomes and growing awareness of eye health. Fashion-conscious consumers prefer exclusive designs and advanced eyewear features, driving strong adoption. It benefits from well-developed e-commerce platforms and omnichannel retail strategies that improve accessibility. Seasonal launches, celebrity endorsements, and advanced lens technologies further strengthen the region’s growth. Superior logistics and premium store networks help maintain leadership in this region.

Europe

Europe holds approximately 33% of the global Luxury Eyewear market share in 2024. Italy leads the region, producing a major share of premium eyewear and supporting the growth of global exports. France, Germany, and the UK follow with strong demand fueled by fashion-conscious consumers and luxury lifestyle preferences. The region benefits from world-renowned fashion hubs like Milan and Paris, where consumers favor heritage-driven craftsmanship and exclusive designs. It combines traditional boutique formats with modern digital shopping experiences to enhance customer engagement. Sustainability-focused innovations and high-end limited-edition launches continue to attract premium buyers. Strong production capabilities and deep-rooted brand heritage support the region’s consistent growth.

Asia-Pacific

Asia-Pacific accounts for about 19.5% of the Luxury Eyewear market in 2024. The region registers the fastest growth globally, driven by rising incomes, expanding urban populations, and increasing fashion awareness. China dominates regional sales, contributing the largest share, followed by Japan and South Korea with significant growth momentum. Consumers demand eyewear that combines style, technology, and wellness benefits, including AR-enabled features and blue-light protection. It benefits from booming e-commerce, influencer-led marketing, and direct-to-consumer retail strategies. Global brands invest heavily in personalized campaigns to target young, aspirational buyers. Rapid infrastructure development and increasing digital adoption strengthen future opportunities for luxury eyewear expansion in the region.

Middle East and Africa

Middle East and Africa represent nearly 4% of the Luxury Eyewear market share in 2024. High-net-worth individuals, particularly in the UAE and Saudi Arabia, drive strong demand for premium eyewear collections. Tourists and local consumers prefer luxury sunglasses offering superior UV protection suitable for the region’s sunny climate. It benefits from luxury shopping destinations, duty-free zones, and exclusive boutique stores. Brands customize collections to reflect regional fashion preferences and cultural aesthetics. Personalized styling services and premium in-store experiences attract affluent consumers. Rising tourism and expanding luxury malls create new growth opportunities for the region.

Latin America

Latin America holds around 3% of the Luxury Eyewear market share in 2024. Brazil and Mexico dominate the region’s sales, supported by growing urbanization and rising demand for branded fashion accessories. The middle-class population shows increased interest in premium eyewear, driving higher adoption rates. It enables brands to form partnerships with local distributors and duty-free retailers to boost visibility. E-commerce growth widens access to luxury products beyond metro areas. Brands adapt pricing strategies and product offerings to align with diverse economic conditions and consumer preferences. Improving retail infrastructure and rising luxury awareness contribute to steady market expansion across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EssilorLuxottica

- Gucci

- Cartier

- Dolce & Gabbana

- Balenciaga

- Calvin Klein

- LVMH

- Giorgio Armani

- Bulgari

- Christian Louboutin

Competitive Analysis

Balenciaga, Bulgari, Calvin Klein, Cartier, Christian Louboutin, Dolce & Gabbana, EssilorLuxottica, Giorgio Armani, Gucci, LVMH. The Luxury Eyewear market is highly competitive, with companies focusing on innovation, premium positioning, and consumer engagement. Market leaders dominate through extensive product portfolios, advanced manufacturing capabilities, and global distribution networks. The industry emphasizes craftsmanship, luxury branding, and distinctive designs to attract high-end consumers. Rising demand for sustainable materials, smart eyewear technologies, and personalized offerings drives continuous product innovation. Intense competition encourages players to adopt omnichannel retail strategies, blending online and offline platforms to enhance customer experience. Growing consumer preference for exclusive collections, limited editions, and premium aesthetics fuels competitive differentiation. Companies invest in marketing, digital transformation, and customization to meet evolving trends. Established brands maintain leadership through scale and heritage, while emerging labels gain traction by delivering unique designs and targeting fashion-conscious buyers seeking exclusivity.

Recent Developments

- In July 2025, LVMH (Thélios) inaugurated a new metal-frame production facility in Longarone, Veneto, enhancing its manufacturing capacity and reinforcing its eyewear capabilities.

- In April 2025, Kering Eyewear acquired Visard and took a minority stake in Mistral to strengthen its industrial capabilities

- In February 2025, EssilorLuxottica the company secured FDA clearance for its Nuance audio glasses, blending hearing assistance with prescription eyewear.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Shape, Frame Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Luxury eyewear brands will focus on smart glasses with enhanced health and lifestyle features.

- Sustainability will drive wider use of recycled and eco‑friendly materials in new eyewear collections.

- Brands will invest in virtual try‑on technology to create immersive online shopping experiences.

- Direct‑to‑consumer channels will expand globally, increasing access in emerging markets.

- Partnerships between luxury houses and tech firms will spur innovation in connected eyewear.

- Consumers will demand more personalization, prompting tailor‑made frame and lens options.

- Retailers will blend physical stores with AI‑powered personalization tools to boost engagement.

- Limited‑edition drops and exclusive collaborations will strengthen brand loyalty and desirability.

- Greater emphasis on eye wellness will lead to premium protective lenses for digital strain.

- Emerging regions will drive growth, with luxury eyewear gaining traction through rising affluence and fashion awareness.