Market Overview:

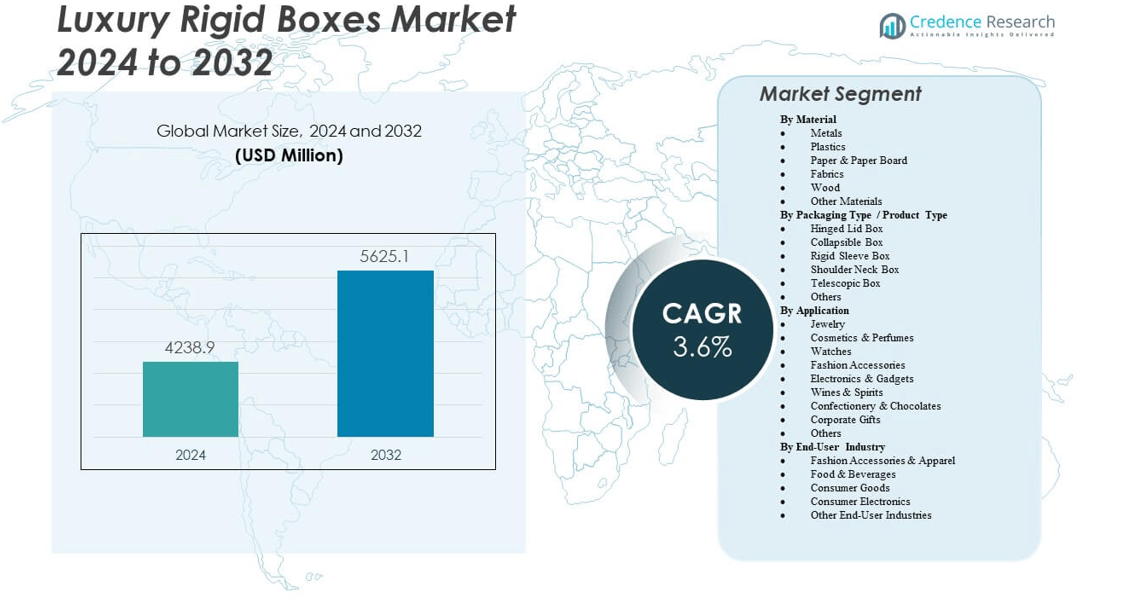

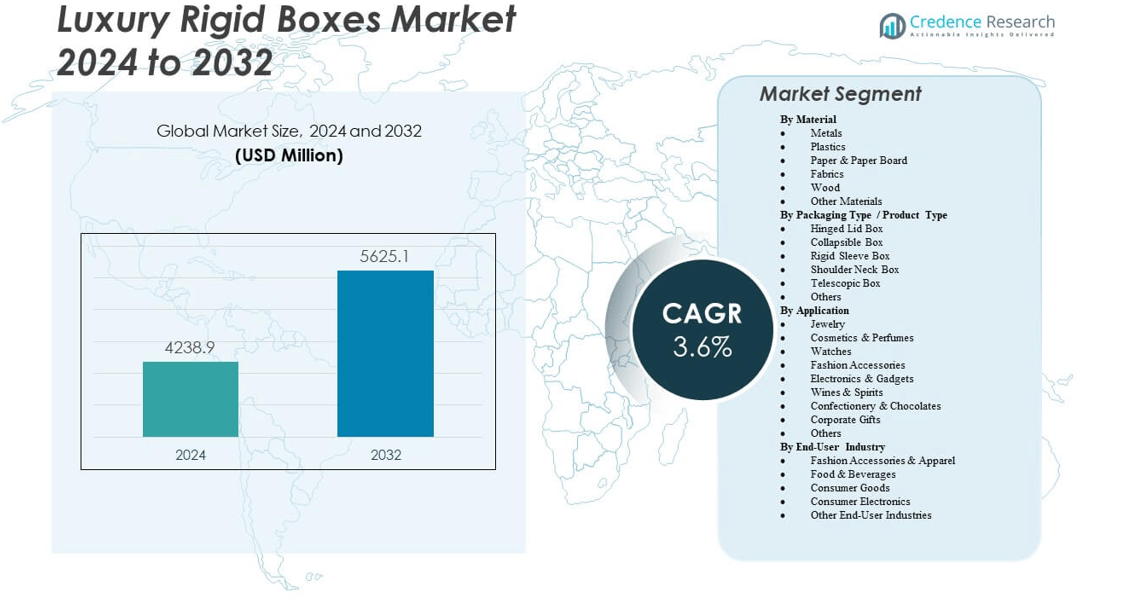

The Luxury Rigid Boxes Market is projected to grow from USD 4238.9 million in 2024 to an estimated USD 5625.1 million by 2032, with a compound annual growth rate (CAGR) of 3.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Rigid Boxes Market Size 2024 |

USD 4238.9 million |

| Luxury Rigid Boxes Market, CAGR |

3.6% |

| Luxury Rigid Boxes Market Size 2032 |

USD 5625.1 million |

Growth in the Luxury Rigid Boxes Market is driven by rising consumer demand for premium packaging across industries such as cosmetics, jewelry, electronics, and high-end fashion. Brands are investing in rigid boxes to enhance product presentation, support gifting culture, and strengthen brand identity. Sustainability initiatives are also fueling adoption, with manufacturers focusing on eco-friendly materials and recyclable packaging solutions. In addition, the shift toward e-commerce has increased the need for durable and visually appealing packaging that ensures both protection and luxury appeal.

Geographically, Europe and North America dominate the Luxury Rigid Boxes Market due to established luxury goods industries and strong consumer spending power. Asia Pacific is emerging as a high-growth region, supported by expanding middle-class populations, growing retail infrastructure, and rising demand for premium branded products in countries such as China and India. Meanwhile, Latin America and the Middle East are witnessing gradual adoption, fueled by rising luxury consumption and evolving packaging trends in retail and hospitality sectors.

Market Insights:

- The Luxury Rigid Boxes Market is projected to grow from USD 4238.9 million in 2024 to USD 5625.1 million by 2032, at a CAGR of 3.6%.

- Rising demand for premium packaging in cosmetics, jewelry, and fashion is driving market expansion.

- Sustainability-focused innovations in recyclable and eco-friendly materials strengthen adoption across industries.

- High production costs and complex manufacturing processes continue to limit adoption for smaller brands.

- Europe leads with 32% share, supported by established luxury houses and advanced packaging design.

- North America holds 28% share, driven by strong consumer purchasing power and luxury retail presence.

- Asia Pacific accounts for 27% share, emerging as the fastest-growing region with expanding middle-class demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising consumer inclination toward premium packaging solutions across luxury product categories

The demand for luxury packaging continues to expand due to evolving consumer preferences toward exclusivity and sophistication. Luxury brands adopt rigid boxes to elevate customer experience and differentiate their offerings in a competitive retail environment. It delivers durability, visual appeal, and prestige value, making it the preferred choice for cosmetics, jewelry, and fashion labels. Consumer lifestyles focused on gifting culture strengthen the adoption of these packaging solutions. E-commerce platforms amplify this shift by requiring packaging that protects goods while enhancing unboxing appeal. Sustainability considerations also contribute, with eco-friendly rigid boxes gaining traction. Luxury retailers consistently emphasize packaging as a branding tool.

- For example, Estée Lauder Companies has committed to achieving 25% post-consumer recycled content in its packaging by 2025. As of 2023, it has reached roughly 19% PCR and reports that 71% of its packaging meets one of the “5 Rs” criteria, reflecting marked progress toward sustainable luxury packaging.

Expanding retail infrastructure and branding investments by global luxury companies

Global retailers and luxury manufacturers invest heavily in retail expansion and packaging design to reinforce customer loyalty. The Luxury Rigid Boxes Market benefits from these strategies, where packaging serves as a reflection of quality and exclusivity. It supports brand storytelling and creates strong first impressions for high-end products. Growth in personalized and custom-designed packaging strengthens consumer attachment to luxury brands. The increasing collaboration between packaging manufacturers and luxury labels fosters innovation in design and material choice. Retail infrastructure in emerging economies further supports this development. Growing emphasis on distinctive shelf appeal drives investment in superior packaging.

Sustainability-focused innovations driving demand for recyclable and eco-friendly rigid boxes

Sustainability remains a major factor influencing packaging decisions for luxury brands worldwide. It encourages the adoption of biodegradable materials, recyclable components, and eco-friendly production processes. The Luxury Rigid Boxes Market adapts quickly by integrating recycled paperboard, plant-based inks, and minimalist designs. Brands highlight these eco-credentials in marketing campaigns to attract environmentally conscious consumers. Government policies and regulations promoting sustainable practices strengthen this shift further. Growing awareness among premium buyers accelerates the demand for packaging with reduced environmental impact. Innovations in lightweight designs without compromising durability expand market acceptance. Sustainability integration improves brand equity and customer trust.

- For example, Gucci genuinely reduced packaging weight by around 30% and achieved full renewable energy use for its operations. It also introduced recyclable and eco-conscious packaging designs. However, stating that all packaging is now 100% recyclable or that all production uses renewable energy may overextend the verified facts.

Rising demand from high-growth economies with growing disposable incomes

High-growth markets in Asia Pacific, Latin America, and the Middle East play a significant role in boosting demand. The Luxury Rigid Boxes Market gains momentum in these regions through expanding middle-class populations and rising disposable incomes. It responds to increasing demand for branded cosmetics, premium electronics, and fashion products. The growth of modern retail formats such as malls and exclusive boutiques enhances visibility for luxury packaging. Premium consumers in these regions value packaging that delivers durability and elegance. Local manufacturers explore partnerships with international brands to meet specific regional needs. Investments in urban infrastructure create new opportunities for packaging adoption.

Market Trends:

Growing focus on personalized and customized luxury packaging for consumer engagement

Personalization dominates the current market landscape with brands introducing tailor-made packaging solutions. It allows consumers to connect emotionally with products through monograms, engravings, and unique box finishes. The Luxury Rigid Boxes Market responds by offering design flexibility and innovative customization options. Brands view personalization as a strategic tool to create exclusivity and drive loyalty. E-commerce accelerates this trend, where consumers seek individualized experiences. High-end retailers often integrate digital tools enabling buyers to preview custom packaging online. This trend strengthens the perception of value-added exclusivity.

- For instance, Louis Vuitton offers personalized packaging with branded boxes and custom notes that enhance customer loyalty and emotional engagement. Studies indicate 72% of consumers care about packaging design during shopping, and 63% are likely to repurchase products with attractive and personalized packaging, which Louis Vuitton uses to create unique experiences and trust.

Integration of smart packaging technologies in luxury rigid box designs

Smart packaging adoption transforms consumer experiences and brand interaction in high-end markets. It includes RFID tags, NFC-enabled features, and QR codes that connect buyers to digital content. The Luxury Rigid Boxes Market leverages these technologies to improve authenticity verification and storytelling. It enables brands to address counterfeiting concerns while offering engaging consumer journeys. Technology-driven packaging also supports loyalty programs and interactive campaigns. Growing interest in tech-enabled packaging aligns with younger consumer expectations. Digitalization within packaging design delivers both value and security.

Rising adoption of minimalist and contemporary design aesthetics in packaging solutions

Minimalism emerges as a defining trend shaping luxury product presentation globally. It emphasizes clean lines, subtle textures, and understated elegance rather than heavy embellishments. The Luxury Rigid Boxes Market adapts by aligning with consumer preferences for refined simplicity. It helps brands stand out while maintaining sustainable design approaches. Packaging manufacturers introduce sleek and durable formats with muted color palettes. Modern consumers favor packaging that reflects premium quality with subtle sophistication. This design approach reduces material use and strengthens eco-appeal.

- For instance, Hermès redesigned its packaging using 100% recycled cardboard and FSC-certified paper, along with organic cotton ribbons and dust bags, supporting sustainability while preserving luxury appeal. Their initiatives include encouraging box reuse and recycling programs at boutiques to reduce waste.

Increasing collaborations between packaging manufacturers and luxury retailers for innovation

Collaborative strategies between packaging producers and global luxury brands foster design innovation. It leads to the development of unique packaging formats with advanced finishes and superior craftsmanship. The Luxury Rigid Boxes Market gains from these partnerships through shared expertise and resources. Joint ventures often create packaging that aligns with both branding and sustainability goals. Luxury retailers seek exclusive solutions to maintain product differentiation in competitive markets. Collaborations encourage experimentation with new textures, coatings, and digital design techniques. These partnerships shape the future of luxury packaging aesthetics and performance.

Market Challenges Analysis:

High production costs and complex manufacturing processes limiting adoption

Production of luxury rigid boxes involves specialized techniques, premium raw materials, and high labor input. It increases manufacturing costs, making scalability a challenge for small and medium-sized brands. The Luxury Rigid Boxes Market faces barriers when emerging brands attempt to balance costs with brand image. Complex processes including embossing, foiling, and structural customization add to overall expenses. Limited automation in certain regions restricts large-scale adoption. Rising input costs such as paperboard and specialty coatings further burden profitability. Maintaining consistency in high-quality finishes also remains difficult.

Counterfeiting risks and regulatory pressures affecting packaging authenticity

Counterfeit luxury goods remain a major challenge for premium packaging manufacturers. It forces brands to invest in tamper-proof designs and authentication features. The Luxury Rigid Boxes Market addresses this issue through smart packaging technologies but adoption adds cost pressures. Regulatory policies on sustainable packaging add another layer of compliance for global brands. Companies must balance design excellence with regulatory requirements to maintain market presence. Non-compliance may result in penalties and loss of consumer trust. Industry players need consistent innovation to manage both authenticity and sustainability.

Market Opportunities:

Expanding e-commerce and luxury gifting culture driving premium packaging adoption

E-commerce growth reshapes luxury packaging needs, as consumers demand premium unboxing experiences. It accelerates demand for rigid boxes that provide both protection and elegance during delivery. The Luxury Rigid Boxes Market benefits from the parallel rise of luxury gifting culture worldwide. Consumers associate premium packaging with prestige and value. Online platforms increasingly partner with packaging manufacturers for tailored solutions. Seasonal and festive demand further enhances opportunities for high-quality rigid boxes. The gifting trend fuels continuous innovation in packaging design and branding.

Emerging markets and sustainable packaging advancements offering growth avenues

Emerging economies in Asia Pacific and Latin America open strong growth opportunities with rising disposable incomes. It supports increasing adoption of luxury goods, boosting demand for premium packaging solutions. The Luxury Rigid Boxes Market leverages sustainable innovations, including recyclable and biodegradable options, to attract eco-conscious buyers. Local manufacturers expand production capabilities to meet both domestic and export demand. Collaboration with international brands enhances product visibility in global markets. Adoption of smart and sustainable solutions provides long-term growth potential. Advancements in eco-friendly design align with global sustainability targets.

Market Segmentation Analysis:

The Luxury Rigid Boxes Market demonstrates strong segmentation across materials, product types, applications, and end-user industries.

By material, paper and paper board dominate due to sustainability demand and cost efficiency, while plastics and metals hold relevance for premium durability and aesthetics. Fabrics and wood are niche segments catering to ultra-luxury packaging, with other materials supporting specialized needs.

By packaging type, hinged lid and shoulder neck boxes lead due to their structural strength and elegant presentation. Collapsible formats are gaining traction for storage efficiency, while telescopic and sleeve boxes offer versatility across product categories.

By application, jewelry, cosmetics, and perfumes represent the largest demand base due to the strong association of packaging with brand identity and gifting culture. Watches and fashion accessories continue to strengthen the segment, while electronics and gadgets show rising adoption for premium consumer technology. Wines, spirits, confectionery, and chocolates add consistent value through their emphasis on gifting and luxury consumption. Corporate gifts form an expanding niche, driven by branding initiatives across industries.

- For instance, the cosmetics and fragrance industry drives luxury packaging demand with premium bespoke boxes reflecting brand sophistication.

By end user, the Luxury Rigid Boxes Market further diversifies through its role in end-user industries, where fashion accessories and apparel dominate, followed by food and beverages requiring visually appealing yet durable packaging. Consumer goods and consumer electronics adopt these solutions to enhance market differentiation. Other industries contribute through bespoke packaging requirements, highlighting the adaptability of rigid boxes.

- For instance, fashion brands rely heavily on luxury rigid boxes for accessories and apparel to elevate brand image and enhance customer loyalty.

Segmentation:

By Material

- Metals

- Plastics

- Paper & Paper Board

- Fabrics

- Wood

- Other Materials

By Packaging Type / Product Type

- Hinged Lid Box

- Collapsible Box

- Rigid Sleeve Box

- Shoulder Neck Box

- Telescopic Box

- Others

By Application

- Jewelry

- Cosmetics & Perfumes

- Watches

- Fashion Accessories

- Electronics & Gadgets

- Wines & Spirits

- Confectionery & Chocolates

- Corporate Gifts

- Others

By End-User Industry

- Fashion Accessories & Apparel

- Food & Beverages

- Consumer Goods

- Consumer Electronics

- Other End-User Industries

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America holds a significant position in the Luxury Rigid Boxes Market with 28% share, supported by the strong presence of luxury brands and high consumer purchasing power. The United States leads demand with established fashion, cosmetics, and electronics industries. Canada contributes steadily, driven by growing retail infrastructure and premium product sales. It benefits from the region’s focus on sustainable packaging and eco-friendly materials that align with consumer preferences. The mature luxury retail environment and consistent e-commerce expansion further reinforce the need for high-quality rigid boxes. Packaging manufacturers in the region continue to invest in innovation to meet evolving design requirements.

Europe accounts for 32% share, making it the leading regional market. The presence of globally recognized luxury houses in France, Italy, and the United Kingdom drives packaging demand. Germany also plays a strong role with its advanced packaging manufacturing capabilities. It is supported by consumers who prioritize premium aesthetics and sustainability, pushing brands to adopt recyclable and eco-certified materials. Demand in the region is also shaped by regulatory pressure to minimize plastic use. European manufacturers focus on innovation in rigid box design, balancing luxury appeal with sustainability standards. Strong export demand for European luxury goods reinforces packaging growth.

Asia Pacific captures 27% share and emerges as the fastest-growing regional market. China dominates with its expanding luxury consumer base, followed by India and Japan with rising disposable incomes and strong retail growth. It benefits from a rapidly growing middle class that is increasingly investing in branded products. The e-commerce boom in Asia Pacific fuels demand for premium packaging that ensures durability and consumer appeal. Local manufacturers are forming partnerships with global brands to strengthen market presence. Rising demand for gifting and luxury goods across festivals and cultural events further accelerates growth. Latin America holds 7% share, supported by Brazil and Mexico, while the Middle East & Africa contribute 6% with demand centered in GCC countries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Robinson Plc

- DS Smith Plc

- Pak Factory

- Madovar Packaging Inc. / LLC

- Burt Rigid Box, Inc.

- Holmen AB ADR (Iggesund)

- Parksons Packaging Ltd.

- WestRock Company

- Sunrise Packaging

- Stora Enso

- Elegant Packaging

- Elite Marking Systems

- Design Packaging, Inc.

- Bigso Box of Sweden

- ACG

- Crown Holdings, Inc

- GPA Global

- Cosfibel Group

- PUSTERLA 1880

Competitive Analysis:

The Luxury Rigid Boxes Market features intense competition with both global packaging leaders and specialized luxury providers. Established players such as DS Smith Plc, WestRock Company, and Stora Enso leverage large-scale production capabilities and sustainable material expertise to secure contracts with global brands. Boutique manufacturers like Madovar Packaging Inc., Burt Rigid Box, Inc., and Hunter Luxury focus on premium craftsmanship and customization to cater to high-end clients. It reflects a landscape where innovation, design flexibility, and sustainability remain critical differentiators. Companies expand their portfolios through eco-friendly materials, digital printing, and structural innovations to meet evolving consumer preferences. Strategic partnerships with luxury brands strengthen market presence and enable competitive positioning. Regional players such as Parksons Packaging Ltd. and Bigso Box of Sweden enhance local supply while competing with global providers. The market remains highly fragmented, with competition driven by branding excellence, product innovation, and the ability to deliver sustainable yet luxury-focused packaging.

Recent Developments:

- In July 2024, Procos, a prominent packaging provider based in Germany, unveiled three new editions of its robust Grace Box line alongside innovative denim tote bags, responding to rising demand for sustainable packaging in the luxury rigid boxes market.

- In December 2024, Veritiv Operating Company announced its successful acquisition of Orora Packaging Solutions, strengthening its capabilities in specialty packaging distribution and expanding its luxury rigid box portfolio across North America and beyond.

Report Coverage:

The research report offers an in-depth analysis based on materials, product types, applications, and end-user industries. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing emphasis on eco-friendly materials will redefine design choices and strengthen brand alignment.

- Digital printing and smart packaging features will expand personalization and enhance consumer engagement.

- E-commerce growth will accelerate demand for durable and visually appealing packaging formats.

- Luxury gifting culture will drive innovation in structural design and premium finishing options.

- Expanding middle-class populations in emerging economies will create strong opportunities for premium packaging adoption.

- Collaborations between luxury brands and packaging manufacturers will lead to exclusive, high-value product lines.

- Regulatory pressures on sustainability will encourage recyclable and biodegradable rigid box production.

- Minimalist and contemporary aesthetics will dominate packaging trends across fashion, jewelry, and cosmetics.

- Investments in advanced automation will improve scalability and reduce production complexities for manufacturers.

- Continuous innovation in lightweight yet durable designs will improve efficiency while preserving luxury appeal.