Market Overview

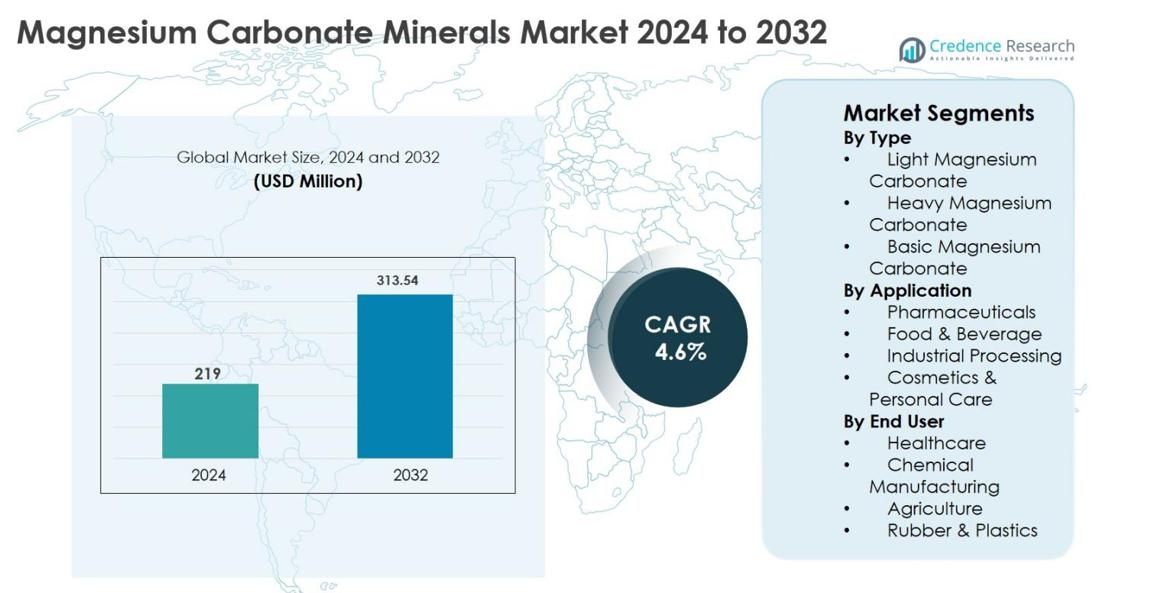

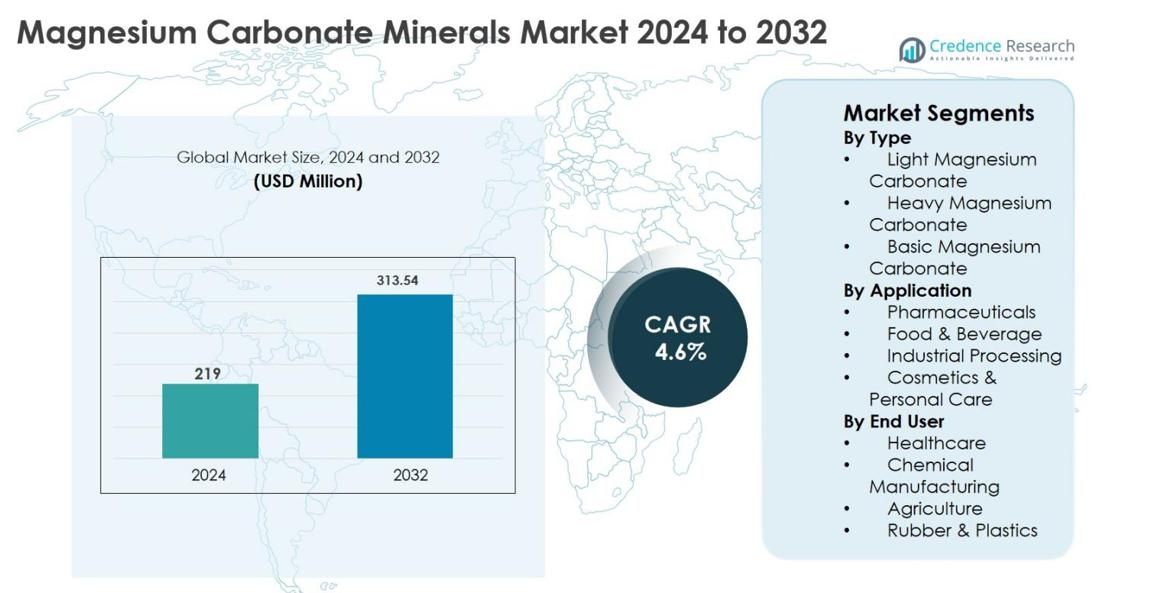

Magnesium Carbonate Minerals market size was valued at USD 219 million in 2024 and is anticipated to reach USD 313.54 million by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Magnesium Carbonate Minerals Market Size 2024 |

USD 219 million |

| Magnesium Carbonate Minerals Market, CAGR |

4.6% |

| Magnesium Carbonate Minerals Market Size 2032 |

USD 313.54 million |

Magnesium Carbonate Minerals market is led by a mix of global and regional manufacturers that focus on high-purity and application-specific grades to serve pharmaceutical, food, and industrial demand. Key players such as Grecian Magnesite, Kyowa Chemical Industry Co., Ltd., Dr. Paul Lohmann, Lehmann&Voss&Co. KG, Konoshima Chemical Co. Ltd., SCORA S.A.S, Buschle and Lepper, NUOVA SIMA, Yingkou Magnesite Chemical, and Persia Paya Madan strengthen market presence through quality differentiation, capacity optimization, and long-term supply partnerships. Asia-Pacific dominates the Magnesium Carbonate Minerals market with a 34.6% share, supported by abundant raw material availability and large-scale manufacturing in China, Japan, and India. Europe follows with 25.7% share, driven by pharmaceutical and specialty chemical production, while North America accounts for 28.4%, supported by strong healthcare and industrial consumption.

Market Insights

- Magnesium Carbonate Minerals market was valued at USD 219 million in 2024 and is projected to reach USD 313.54 million by 2032, growing at a CAGR of 4.6% during the forecast period, supported by steady demand from healthcare, food, and industrial applications.

- Growth is driven by rising pharmaceutical and nutraceutical consumption, where magnesium carbonate is widely used in antacids and excipients, along with expanding industrial processing demand for fillers and stabilizing agents in chemicals, rubber, and plastics.

- Market trends highlight increasing preference for high-purity and pharmaceutical-grade products, with Light Magnesium Carbonate holding 42.6% share by type and Pharmaceuticals accounting for 38.9% share by application due to regulatory compliance and formulation efficiency.

- Competitive dynamics reflect moderate consolidation, with players focusing on quality differentiation, customized grades, and long-term supply contracts, while cost-efficient Asian producers and premium European suppliers shape pricing and positioning.

- Regionally, Asia-Pacific leads with 34.6% share, followed by North America at 28.4% and Europe at 25.7%, while Healthcare remains the dominant end user with 41.3% share, supported by global healthcare expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Magnesium Carbonate Minerals market by type is led by Light Magnesium Carbonate, which accounted for 42.6% market share in 2024 due to its high purity, low bulk density, and wide usability across pharmaceutical and food-grade applications. Light magnesium carbonate is preferred for tablet formulation, antacids, and food additives because of its superior absorbency and safety profile. Demand is further supported by rising pharmaceutical production and stringent quality standards. Heavy magnesium carbonate follows, driven by industrial uses, while basic magnesium carbonate serves niche applications in cosmetics and specialty chemicals.

- For instance, Scora S.A. supplies Light Magnesium Carbonate for antacid preparations and tablet production, leveraging its role as a diluent and stabilizer that enhances drug release in moisture-sensitive medications.

By Application

By application, Pharmaceuticals dominated the Magnesium Carbonate Minerals market with a 38.9% share in 2024, supported by strong demand for antacids, excipients, and laxative formulations. Magnesium carbonate is widely used as a buffering agent and stabilizer in drug manufacturing, ensuring formulation consistency and efficacy. Growth is driven by expanding global pharmaceutical manufacturing, rising digestive health awareness, and increasing OTC drug consumption. Food & beverage applications benefit from clean-label trends, while industrial processing and cosmetics show steady growth due to functional and absorbent properties.

- For instance, Bayer uses magnesium carbonate as an excipient and antacid component in certain digestive health and OTC products, consistent with pharmacopeial standards for magnesium compounds.

By End User

In terms of end users, the Healthcare segment held the largest share of 41.3% in 2024, driven by extensive use of magnesium carbonate in pharmaceutical formulations, nutraceuticals, and medical-grade compounds. Healthcare manufacturers favor magnesium carbonate for its chemical stability, non-toxicity, and regulatory acceptance. Rising healthcare spending, growing aging populations, and increased demand for digestive and mineral supplements support segment growth. Chemical manufacturing follows with strong industrial demand, while agriculture and rubber & plastics contribute through soil treatment and filler applications, respectively.

Key Growth Drivers

Rising Demand from Pharmaceutical and Healthcare Applications

The Magnesium Carbonate Minerals market benefits significantly from expanding pharmaceutical and healthcare demand, where magnesium carbonate is widely used as an active ingredient and excipient in antacids, laxatives, tablets, and nutraceutical formulations. Its buffering capacity, chemical stability, and non-toxic profile make it suitable for regulated medical applications. Growth in global pharmaceutical manufacturing, increased prevalence of gastrointestinal disorders, and rising consumption of over-the-counter digestive medications are accelerating demand. Aging populations and growing preventive healthcare awareness further support higher intake of mineral supplements. In addition, stricter quality standards in drug manufacturing are driving demand for high-purity light magnesium carbonate, reinforcing its importance across both prescription and consumer healthcare products.

- For instance, Merck KGaA (MilliporeSigma) offers high‑purity light magnesium carbonate grades specifically qualified as antacid, tablet excipient, and nutraceutical ingredient under pharmacopeial standards.

Expansion of Industrial Processing and Chemical Manufacturing

Industrial processing represents a strong growth driver for the Magnesium Carbonate Minerals market due to its extensive use as a filler, neutralizing agent, and flame retardant precursor. Chemical manufacturers utilize magnesium carbonate in ceramics, rubber, plastics, and insulation materials to improve thermal resistance and product stability. Rapid industrialization in emerging economies, along with rising infrastructure development, supports demand for construction materials incorporating magnesium compounds. Growth in specialty chemicals and functional additives further enhances consumption. Manufacturers increasingly favor magnesium carbonate for its cost-effectiveness and compatibility with diverse industrial formulations, ensuring sustained uptake across chemical processing and materials manufacturing industries.

- For instance, Lhoist supplies magnesium carbonate and related magnesium products for refractory, ceramics, and insulation applications, emphasizing improved heat resistance and performance in industrial materials

Growing Adoption in Food, Beverage, and Consumer Applications

The food and beverage sector is emerging as a notable growth driver, driven by magnesium carbonate’s use as an anti-caking agent, acidity regulator, and nutritional additive. Clean-label trends and rising consumer awareness of mineral fortification are encouraging food manufacturers to incorporate magnesium-based ingredients. Demand is supported by growth in dietary supplements, sports nutrition products, and fortified foods. Additionally, cosmetics and personal care manufacturers are increasing usage due to magnesium carbonate’s absorbent and texture-enhancing properties. Expanding consumer goods production and rising disposable incomes in developing regions further strengthen demand across food, beverage, and lifestyle applications.

Key Trends & Opportunities

Shift Toward High-Purity and Pharmaceutical-Grade Magnesium Carbonate

A major trend in the Magnesium Carbonate Minerals market is the increasing focus on high-purity and pharmaceutical-grade products. Regulatory compliance, especially in healthcare and food applications, is pushing manufacturers to invest in advanced processing and purification technologies. This shift creates opportunities for suppliers offering consistent quality, traceability, and customized grades. Pharmaceutical and nutraceutical companies prefer suppliers capable of meeting stringent pharmacopoeia standards, driving long-term supply agreements. As demand for OTC medications and supplements rises globally, producers that emphasize quality differentiation and regulatory alignment are well positioned to capture higher margins and strengthen market presence.

- For instance, Kyowa Chemical Industry supplies magnesium carbonate USP as an antacid, laxative, and excipient, emphasizing high quality and safety for pharmaceutical use.

Emerging Demand from Sustainable and Specialty Material Applications

Sustainability trends are opening new opportunities for magnesium carbonate in eco-friendly and specialty materials. Its role in flame-retardant formulations, carbon-neutral building materials, and environmentally safer fillers aligns with growing ESG and regulatory pressures. Research into magnesium-based alternatives for conventional additives is expanding its potential in green construction and energy-efficient insulation materials. These developments offer opportunities for innovation-driven manufacturers to enter high-value segments. Increasing investments in sustainable infrastructure and low-emission materials further support long-term growth opportunities for magnesium carbonate suppliers.

- For instance, Grecian Magnesite develops magnesium‑based products for construction and insulation, highlighting reduced environmental impact and improved fire resistance in comparison with conventional materials.

Key Challenges

Volatility in Raw Material Supply and Production Costs

The Magnesium Carbonate Minerals market faces challenges related to raw material availability and cost fluctuations, particularly linked to magnesite mining and energy-intensive processing. Variations in mining regulations, environmental restrictions, and geopolitical factors can disrupt supply chains and impact pricing stability. Rising energy and transportation costs further pressure production margins, especially for manufacturers operating in cost-sensitive markets. Smaller producers may struggle to absorb these cost increases, affecting competitiveness. Managing supply chain efficiency and securing long-term raw material sources remain critical challenges for market participants.

Regulatory and Environmental Compliance Pressures

Increasing regulatory scrutiny on mining activities and chemical processing poses a significant challenge for the Magnesium Carbonate Minerals market. Environmental regulations related to emissions, waste management, and land restoration increase operational complexity and compliance costs. Pharmaceutical and food-grade applications require adherence to strict safety and quality standards, raising barriers to entry for new players. Failure to meet evolving regulatory requirements can limit market access and slow product approvals. Companies must balance compliance investments with cost efficiency to maintain sustainable operations and market growth.

Regional Analysis

North America

North America accounted for 28.4% of the Magnesium Carbonate Minerals market in 2024, driven by strong demand from pharmaceutical, food, and specialty chemical industries. The region benefits from well-established healthcare infrastructure and high consumption of antacids, nutraceuticals, and OTC medications using magnesium carbonate. Stringent quality and safety regulations support the use of high-purity grades, particularly light magnesium carbonate. Industrial applications in rubber, plastics, and flame-retardant materials also contribute to steady demand. Ongoing investments in pharmaceutical manufacturing and growing health awareness continue to support stable market growth across the United States and Canada.

Europe

Europe held a 25.7% market share in 2024, supported by advanced pharmaceutical production, strong chemical manufacturing, and regulatory emphasis on product quality. Countries such as Germany, France, and Italy are key consumers due to their robust healthcare and specialty chemicals sectors. Magnesium carbonate is widely used in pharmaceuticals, cosmetics, and food processing across the region. Sustainability initiatives and demand for environmentally compliant materials further drive adoption in industrial and construction-related applications. Strict regulatory frameworks encourage the use of pharmaceutical-grade magnesium carbonate, supporting premium product demand and consistent consumption across Western and Central Europe.

Asia-Pacific

Asia-Pacific dominated the Magnesium Carbonate Minerals market with a 34.6% share in 2024, driven by large-scale production capacity, abundant raw material availability, and rapid industrial growth. China, Japan, and India are major contributors, supported by expanding pharmaceutical manufacturing, chemical processing, and food industries. Rising healthcare expenditure, growing population, and increasing consumption of OTC medicines accelerate demand. The region also benefits from cost-effective manufacturing and strong exports of magnesium carbonate products. Expanding cosmetics, agriculture, and rubber industries further strengthen regional demand, making Asia-Pacific the fastest-growing regional market.

Latin America

Latin America accounted for 6.2% of the Magnesium Carbonate Minerals market in 2024, supported by gradual growth in pharmaceutical, agriculture, and food processing sectors. Countries such as Brazil and Mexico lead regional consumption due to expanding healthcare access and increasing use of mineral supplements. Industrial applications in rubber and plastics contribute to steady demand, while agriculture benefits from magnesium-based soil treatment products. Improving manufacturing capabilities and rising consumer health awareness support market expansion. However, dependence on imports and price sensitivity moderate growth compared to developed regions.

Middle East & Africa

The Middle East & Africa region captured 5.1% of the market share in 2024, driven by growing pharmaceutical consumption and expanding chemical and construction industries. Rising healthcare investments, particularly in Gulf countries, support demand for magnesium carbonate in medical and nutraceutical applications. Industrial growth in insulation, ceramics, and specialty chemicals contributes to moderate consumption levels. Africa shows gradual adoption through agriculture and basic chemical processing. While market penetration remains limited, improving healthcare infrastructure and industrial diversification initiatives are expected to support long-term growth across the region.

Market Segmentations:

By Type

- Light Magnesium Carbonate

- Heavy Magnesium Carbonate

- Basic Magnesium Carbonate

By Application

- Pharmaceuticals

- Food & Beverage

- Industrial Processing

- Cosmetics & Personal Care

By End User

- Healthcare

- Chemical Manufacturing

- Agriculture

- Rubber & Plastics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Magnesium Carbonate Minerals market features a moderately consolidated landscape, characterized by the presence of established global manufacturers and regionally strong producers competing on product purity, application specialization, and supply reliability. Key players such as Grecian Magnesite, Kyowa Chemical Industry Co., Ltd., Dr. Paul Lohmann, Lehmann&Voss&Co. KG, Konoshima Chemical Co. Ltd., SCORA S.A.S, Buschle and Lepper, NUOVA SIMA, Yingkou Magnesite Chemical, and Persia Paya Madan focus on serving pharmaceutical, food, and industrial-grade demand. Companies emphasize high-purity and customized grades to meet stringent regulatory requirements, particularly in healthcare and food applications. Strategic priorities include capacity expansion, process optimization, and long-term supply agreements with pharmaceutical and chemical manufacturers. Asia-based players benefit from cost-efficient production and raw material availability, while European firms leverage quality leadership and regulatory compliance, shaping competitive differentiation across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Canada Nickel Company Inc. and NetCarb advanced their strategic partnership to develop a zero-carbon industrial cluster in Northeastern Ontario that leverages carbon sequestration to produce by-products including magnesium-based products, supporting future magnesium mineral applications.

- In May 2025, MediSun Energy and EMSTEEL launched the UAE’s first pilot project to transform desalination brine into renewable blue energy and magnesium carbonate, marking a novel product pathway for sustainable magnesium carbonate generation

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Magnesium Carbonate Minerals market will witness steady demand growth driven by expanding pharmaceutical and nutraceutical production worldwide.

- Increasing use of high-purity and pharmaceutical-grade magnesium carbonate will shape product development strategies.

- Industrial processing applications will continue to support volume growth, particularly in chemicals, rubber, and plastics.

- Food and beverage manufacturers will adopt magnesium carbonate to meet clean-label and mineral fortification requirements.

- Asia-Pacific will remain the leading production and consumption hub due to raw material availability and cost-efficient manufacturing.

- Manufacturers will invest in process optimization and capacity expansion to improve quality consistency and supply reliability.

- Sustainability-focused applications such as flame retardants and eco-friendly building materials will create new growth avenues.

- Regulatory compliance will increasingly influence supplier selection, especially for healthcare and food-grade products.

- Strategic partnerships with pharmaceutical and specialty chemical companies will strengthen long-term market positioning.

- Technological advancements in purification and processing will enhance product performance and application versatility.