Market Overview

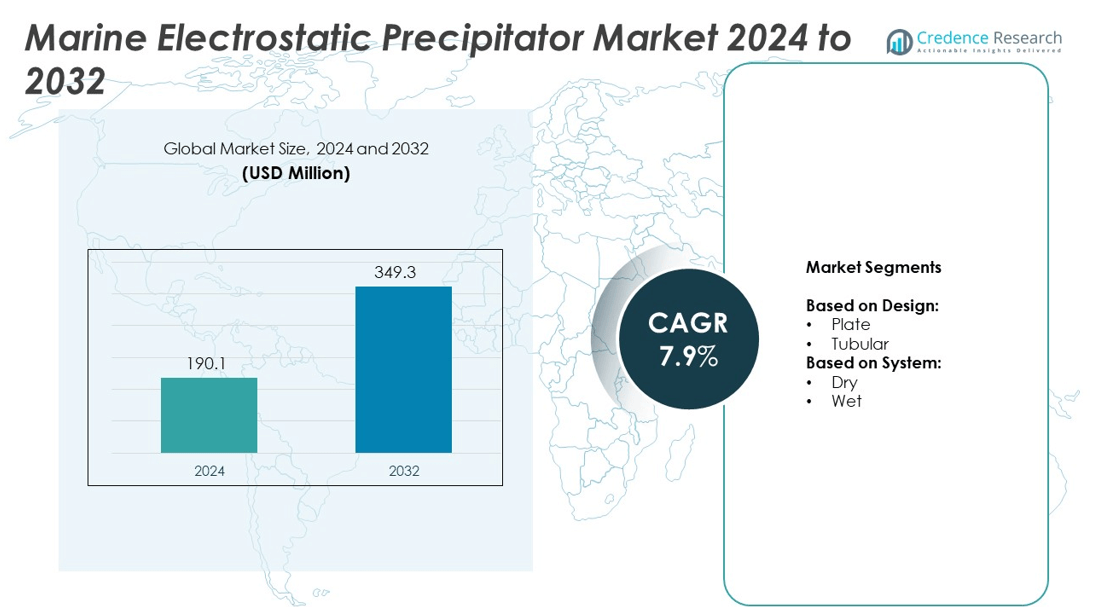

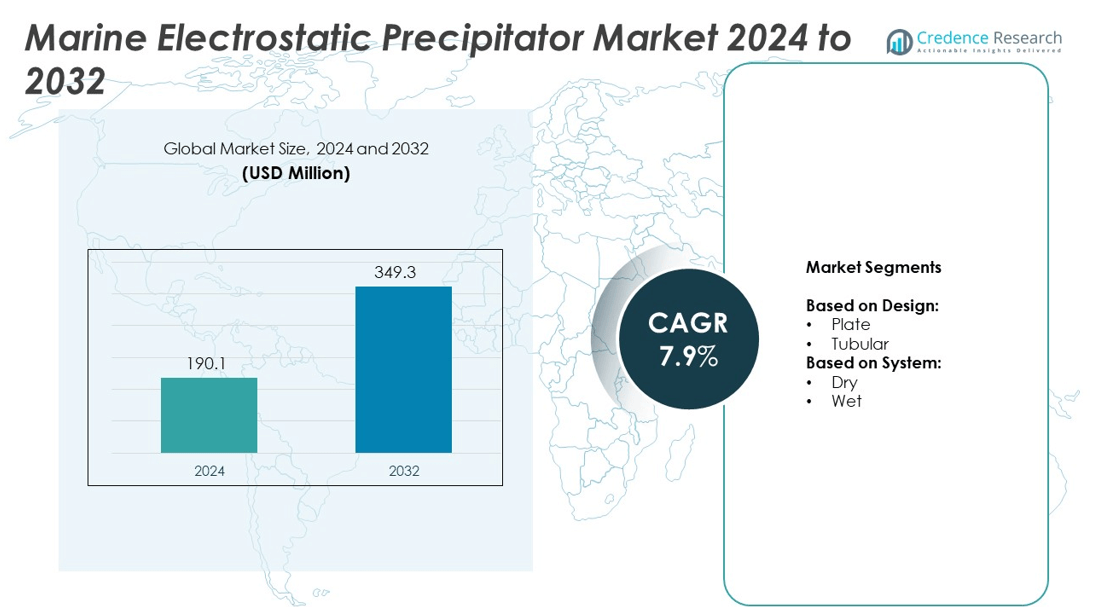

Marine Electrostatic Precipitator Market size was valued at USD 190.1 million in 2024 and is anticipated to reach USD 349.3 million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Electrostatic Precipitator Market Size 2024 |

USD 190.1 million |

| Marine Electrostatic Precipitator Market, CAGR |

7.9% |

| Marine Electrostatic Precipitator Market Size 2032 |

USD 349.3 million |

The Marine Electrostatic Precipitator market grows due to strict emission regulations, rising seaborne trade, and demand for retrofit-friendly systems. Operators adopt ESPs to reduce particulate emissions without switching fuels. Trends show increased use of hybrid systems, modular designs, and digital monitoring tools. Manufacturers focus on efficiency under varying engine loads and integration in compact marine spaces. Government incentives and environmental mandates further support system deployment across commercial, naval, and offshore vessels, driving continued innovation and adoption globally.

North America leads the Marine Electrostatic Precipitator market, followed by Europe and Asia Pacific, driven by early regulatory adoption and strong shipbuilding activity. Regions like the Middle East and Latin America show emerging demand through port upgrades and offshore operations. Technological innovation and retrofitting programs expand the market across both developed and developing economies. Key players include Siemens Energy, Fuji Electric, and Andritz Group, with Valmet and Mitsubishi Heavy Industries also playing active roles in product development and system integration.

Market Insights

- The Marine Electrostatic Precipitator market was valued at USD 190.1 million in 2024 and is projected to reach USD 349.3 million by 2032, growing at a CAGR of 7.9%.

- Regulatory frameworks such as IMO’s MARPOL Annex VI are key drivers, pushing vessel operators to adopt emission control systems for compliance.

- Hybrid ESP systems combining particulate and gas control functions are gaining traction among shipowners aiming for comprehensive emission solutions.

- Dry systems are more widely adopted due to ease of maintenance, lower operating costs, and compatibility with various ship types.

- Leading players like Siemens Energy, Fuji Electric, and Andritz Group focus on modular design and system reliability to meet fleet-wide retrofitting needs.

- High installation costs and performance variability under low-load conditions remain key restraints for widespread adoption in smaller or aging fleets.

- North America leads in deployment due to early regulation and infrastructure readiness, while Europe and Asia Pacific follow closely with expanding green shipping policies and strong shipbuilding capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Stricter Maritime Emission Regulations Drive Adoption Across Commercial Fleets

The International Maritime Organization (IMO) enforces strict sulfur and particulate matter limits under MARPOL Annex VI. These regulations push shipping operators to integrate emission control technologies. Marine Electrostatic Precipitators offer effective particulate reduction without high operational costs. It supports compliance without depending entirely on low-sulfur fuels. Fleet operators view these systems as a long-term solution to meet international standards. Compliance pressure accelerates system retrofits across both cargo and passenger vessels.

- For instance GEA Group manufactures and supplies wet-type electrostatic precipitator (WESP) units for marine applications. This technology is designed to meet stringent emission limits and is capable of achieving very high particle separation, with benchmark performance often cited at dust concentrations as low as 1 mg/m³N at the system outlet. Actual performance can vary depending on the specific application.

Growth in Global Seaborne Trade Expands Market Scope

Seaborne trade continues to rise with growing demand for goods and energy transport. Larger shipping volumes contribute to higher exhaust emissions, requiring pollution mitigation. The Marine Electrostatic Precipitator market gains traction as vessel owners prioritize clean technologies. It provides scalable emissions control suitable for bulk carriers, oil tankers, and container ships. Increased port regulations worldwide also promote cleaner in-port operations. These developments create a strong use case for adoption in both new-build and retrofit scenarios.

- For instance, a scrubber and wet ESP combo in marine engine tests removed more than 98.5% of particles when using heavy fuel oil

Technology Advancements Improve System Efficiency and Integration

Modern electrostatic precipitators use advanced controls and modular designs to improve performance. Integration with marine engines has become simpler due to compact layouts and real-time monitoring features. It reduces energy loss and supports continuous operation during long voyages. Developers focus on reducing weight, maintenance needs, and footprint. Innovations improve capture rates even under variable engine loads. These improvements increase reliability and ease of adoption among vessel operators.

Demand for Fuel Flexibility and Cost Control Supports Market Expansion

Rising fuel prices and the shift to low-emission fuels present cost challenges for fleet operators. Marine electrostatic systems offer a cost-effective way to manage emissions regardless of fuel type. It reduces particulate output without requiring constant fuel switching. This flexibility aligns with fleet managers’ efforts to reduce operating expenses. Long-term savings in fuel and compliance penalties justify the investment. The Marine Electrostatic Precipitator market benefits from this growing focus on total cost of ownership.

Market Trends

Rising Integration of Hybrid Emission Control Systems

Shipowners increasingly deploy hybrid systems combining electrostatic precipitators with scrubbers or catalytic converters. This integrated setup enhances removal efficiency for both particulates and gaseous pollutants. It supports compliance with multiple emission norms in a single configuration. Hybrid systems reduce the need for frequent component changes and lower operational downtime. It allows flexible adaptation to varying port and international regulations. The Marine Electrostatic Precipitator market reflects this shift toward comprehensive pollution control solutions.

- For instance, GEA Group supplies scrubber-WESP systems for marine applications that are capable of achieving high particulate removal efficiency. While specific performance varies depending on the system design and operating conditions, independent testing of similar combined systems in marine engine tests has demonstrated particulate removal efficiency exceeding 98.5% across various engine loads

Shift Toward Compact and Modular System Designs

Manufacturers now offer smaller, modular units tailored for space-constrained engine rooms. These systems simplify installation on retrofitted vessels and support easier maintenance schedules. It reduces weight without compromising capture efficiency or air throughput. Modular units support fleet-wide standardization and faster replacement cycles. This design evolution aligns with demands from commercial and defense maritime sectors. It supports long-term system scalability and operational flexibility.

- For instance, FLSmidth’s CompactClean™ ESP achieves dust emission control down to 5 mg/Nm³ and supports modular, preassembled installation completed in weeks rather than months. It also features a flow capacity range between 11,500 and 47,500 Am³/h depending on configuration.

Digital Monitoring and Predictive Maintenance Gain Traction

Operators are adopting digital sensors and real-time monitoring tools to track system performance. These tools help detect early-stage faults, schedule predictive maintenance, and avoid unexpected failures. It enhances uptime and reduces inspection costs across large vessel fleets. Data-driven maintenance tools extend equipment life and improve return on investment. This trend also supports regulatory reporting and environmental audits. The Marine Electrostatic Precipitator market aligns with broader digitalization trends across the maritime industry.

Growing Preference for Retrofit Solutions in Aging Fleets

A large number of commercial ships in operation exceed 15 years of service. Retrofitting emission control systems on these older vessels offers a faster route to compliance. It avoids the high cost and lead times of commissioning new builds. Operators seek retrofit-friendly systems that meet standards without major design overhauls. The market responds with adaptable units that integrate with legacy marine engine models. This retrofit demand continues to shape design and deployment priorities.

Market Challenges Analysis

High Installation and Retrofit Costs Limit Wider Adoption

Marine Electrostatic Precipitator systems involve significant upfront investment, especially for retrofits on aging vessels. These costs include equipment purchase, shipyard labor, and system integration with existing exhaust layouts. Many small and mid-sized fleet operators hesitate to allocate capital without immediate regulatory pressure. It creates a gap between large global fleets and regional players in terms of adoption. System downtime during retrofit further adds to operational expenses and voyage delays. The Marine Electrostatic Precipitator market must address cost barriers to expand in price-sensitive segments.

Performance Variability Across Engine Loads and Fuel Types

Electrostatic systems can show inconsistent results when ships operate at varying speeds and engine loads. Performance can decline under low-load conditions common in slow steaming and port maneuvers. It affects particle capture efficiency and system reliability. Fuel type also impacts emission profiles and may require tuning or additional filtration layers. These technical limitations require frequent calibration and may increase maintenance complexity. It limits operator confidence in relying solely on these systems for full compliance.

Market Opportunities

Expansion of Green Shipping Programs and Government Incentives

Global initiatives promoting sustainable shipping create strong openings for emission control technologies. Governments and port authorities offer tax relief, fuel rebates, or docking priority to vessels with low-emission systems. These benefits improve return on investment for operators adopting electrostatic solutions. It supports adoption beyond compliance, encouraging proactive environmental upgrades. The Marine Electrostatic Precipitator market stands to benefit from this favorable policy environment. Long-term green fleet certification programs also create a competitive advantage for early adopters.

Emerging Demand from Offshore and Defense Marine Sectors

Offshore platforms and naval fleets seek efficient emission solutions with minimal maintenance demands. These environments often involve long deployment cycles and strict air quality controls. It creates demand for durable, compact systems that maintain high filtration efficiency. Electrostatic precipitators offer this performance with lower consumable requirements compared to other methods. Integration in naval vessels also supports stealth operations by reducing thermal and exhaust signatures. This untapped segment opens new revenue channels beyond commercial shipping.

Market Segmentation Analysis:

By Design:

The plate-type segment holds a significant share in the Marine Electrostatic Precipitator market. These systems are preferred for their simple construction, ease of cleaning, and high particulate capture efficiency. Plate designs suit large engine systems where stable airflow and predictable exhaust patterns improve performance. It also supports easy maintenance in scheduled dry-docking cycles, making it viable for both retrofit and new-build applications. Tubular electrostatic precipitators are gaining interest for compact marine spaces, particularly in vessels with limited engine room layouts. Tubular units provide high performance in variable load conditions and offer better adaptability to modern propulsion systems. The segment continues to evolve with improved material coatings and modular options to meet diverse vessel requirements.

- For instance, researchers observed that a scaled tubular ESP with 16 ionizer channels and 10 mm plate spacing captured over 95% of ultrafine particles at a gas flow rate of 1200 m³/h, consuming just 5 W and maintaining a pressure drop of 5 Pa.

By System:

The dry system segment dominates due to its wide applicability and lower operational complexity. Dry electrostatic precipitators operate without liquid cleaning agents, making them suitable for vessels prioritizing low maintenance. It supports long operational cycles and reduces handling of wastewater or sludge, which aligns with maritime environmental restrictions. The Marine Electrostatic Precipitator market benefits from dry systems offering ease of integration and reduced lifecycle costs. Wet electrostatic precipitators hold strong demand in applications with high moisture or sticky particulate emissions, such as engines using heavy fuel oil. Wet systems deliver higher collection efficiency for submicron particles and reduce backpressure risks. Shipowners operating under emission control areas (ECAs) consider wet systems to ensure compliance with stricter local particulate norms.

- For instance, Alfa Laval manufactures advanced exhaust gas cleaning systems, including scrubbers (such as the PureSOx platform) and Wet Electrostatic Precipitators (WESP), for marine applications. Studies on combined scrubber-WESP systems by other industry players, such as research conducted at VTT Technical Research Centre of Finland with a Valmet system, have demonstrated over 98.5% removal of particulate matter (PM) using Heavy Fuel Oil (HFO) and 99% removal of black carbon (BC) with Marine Diesel Oil (MDO). Alfa Laval’s washwater treatment systems, which can include technologies like decanter centrifuges, are used for water purification.

Segments:

Based on Design:

Based on System:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32.4% of the Marine Electrostatic Precipitator market. This strong share is driven by early regulatory enforcement, widespread green port initiatives, and steady investments in clean marine technologies. The United States and Canada continue to update maritime environmental frameworks under bodies like the EPA and Transport Canada. Vessel operators are required to control emissions near coastal zones and inland waterways. Demand stems from retrofits in existing cargo fleets and adoption in new LNG-powered vessels. Naval and research vessels also adopt electrostatic systems to meet air quality goals and reduce visible exhaust trails. Presence of key technology developers and ship retrofitting facilities further supports regional growth.

Europe

Europe holds a market share of 27.6%, driven by stringent maritime environmental policies under the European Union and regional maritime authorities. Regulations such as the Sulphur Directive and Emission Control Areas (ECAs) in the North Sea and Baltic Sea require low-emission operation. European shipbuilders prioritize integration of electrostatic systems to meet these targets. Ports in Germany, Netherlands, and Scandinavia offer financial incentives to cleaner vessels. Commercial shipping firms seek advanced dry and wet ESP systems for compliance and operational flexibility. Demand also rises from inland river fleets and ferry operators serving high-traffic coastal routes. Innovation in emission control solutions from Germany, France, and Italy contributes to system adoption.

Asia Pacific

Asia Pacific represents 21.3% of the market, supported by major shipbuilding activity and rising focus on clean shipping in countries like China, South Korea, and Japan. Governments in the region enforce stricter controls around large port cities, including Shanghai, Busan, and Yokohama. Shipowners prioritize emission technologies that meet both international and domestic norms. China’s push for green shipping corridors and coastal emission monitoring boosts system deployment. Shipyards in South Korea and Japan integrate plate and dry-type ESP systems in both commercial and defense vessels. The region also benefits from growing maritime trade volumes and modernization of older fleets. Local technology providers enhance regional competitiveness through cost-efficient system offerings.

Middle East & Africa

The Middle East & Africa holds a smaller share at 9.1%, though prospects grow with investments in port infrastructure and offshore operations. The UAE and Saudi Arabia lead the adoption due to cleaner shipping policies and expanding naval fleets. Offshore oil and gas vessels in the Persian Gulf require high-performance emission control systems. Africa’s coastal shipping remains underdeveloped, but ports in South Africa and Nigeria push for greener docking practices. Retrofits in LNG carriers and marine support vessels support moderate growth. Importantly, international charters operating in these waters often equip vessels with ESPs to ensure cross-border compliance.

Latin America

Latin America contributes 9.6% to the market, driven by growing environmental awareness and shipping reforms in Brazil, Chile, and Argentina. Brazil’s maritime industry modernizes coastal fleets and enforces new emission limits near populated port areas. Dry ESP systems gain traction in older container ships and tugboats serving industrial zones. Governments adopt clean shipping incentives in partnership with international environmental agencies. The Panama Canal Authority encourages low-emission vessels through priority slots and reduced tariffs. Limited domestic manufacturing capacity may constrain local uptake, though imports from North America and Europe fill this gap effectively.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Energy

- Fuji Electric

- Valmet

- Sumitomo Heavy Industries

- KC Cottrell India

- Andritz Group

- Kraft Powercon

- Mitsubishi Heavy Industries

- McGill AirClean

- GEA Group

Competitive Analysis

The leading players in the Marine Electrostatic Precipitator market include Siemens Energy, Fuji Electric, Valmet, Sumitomo Heavy Industries, KC Cottrell India, Andritz Group, Kraft Powercon, Mitsubishi Heavy Industries, McGill AirClean, and GEA Group. These companies compete by offering advanced emission control systems tailored for various marine applications, including cargo, offshore, and defense vessels. They focus on integrating compact, modular, and high-efficiency systems that meet IMO regulations and regional emission standards. Their R&D efforts target improved particle capture under fluctuating engine loads and reduced system weight for easier vessel integration. Each player leverages strong engineering capabilities and regional service networks to support large fleet operators and shipyards. Competitive differentiation lies in long-term reliability, low maintenance needs, and flexibility for retrofitting older vessels. Most companies pursue joint ventures or licensing agreements to expand reach in high-growth regions such as Asia-Pacific and the Middle East. The market sees growing interest in digitally connected ESP systems, allowing real-time monitoring and predictive maintenance. Players also develop hybrid emission control packages that combine ESPs with scrubbers or catalytic converters. Strategic focus remains on lifecycle value, operational uptime, and ease of compliance with tightening emission limits. The market reflects steady innovation, regulatory alignment, and regional expansion among the top competitors.

Recent Developments

- In 2025, Andritz Group finalized the acquisition of LDX Solutions enhancing its emission‑reduction capabilities.

- In 2024, Fuji Electric continues developing its marine electrostatic precipitator (ESP) as part of its ship exhaust gas treatment systems and highlights ongoing design under development.

- In October 2022, Mitsubishi Heavy Industries Power Environmental Solutions developed a new “Ionic Wind Type Electrode” electrostatic precipitator for reducing particulate emissions. The system enhances collection efficiency while significantly reducing installation space. It demonstrated high durability and stable performance after two years of testing. This innovation supports the maritime sector’s compliance with stricter IMO MARPOL Annex VI regulations.

Report Coverage

The research report offers an in-depth analysis based on Design, System and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth due to increasing adoption of low-emission systems in global fleets.

- Demand will rise from retrofitting older vessels to meet tightening emission control regulations.

- Hybrid electrostatic systems will gain traction as operators seek combined solutions for multiple pollutants.

- Compact and modular system designs will support installation in space-limited engine rooms.

- Naval, offshore, and research vessels will emerge as strong adopters of high-efficiency ESP technologies.

- Digital monitoring and predictive maintenance tools will improve operational efficiency and system reliability.

- Government subsidies and port-based emission incentives will drive market expansion in developing regions.

- Local manufacturing in Asia and the Middle East will strengthen regional supply and cost competitiveness.

- Innovation in materials and low-power operation will support system use across varied marine environments.

- Shipbuilders will increasingly integrate ESP units into new vessels to ensure compliance from launch.