| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Massive MIMO Technology Market Size 2024 |

USD 6,450.58 Million |

| Massive MIMO Technology Market, CAGR |

14.45% |

| Massive MIMO Technology Market Size 2032 |

USD 20,437.12 Million |

Market Overview:

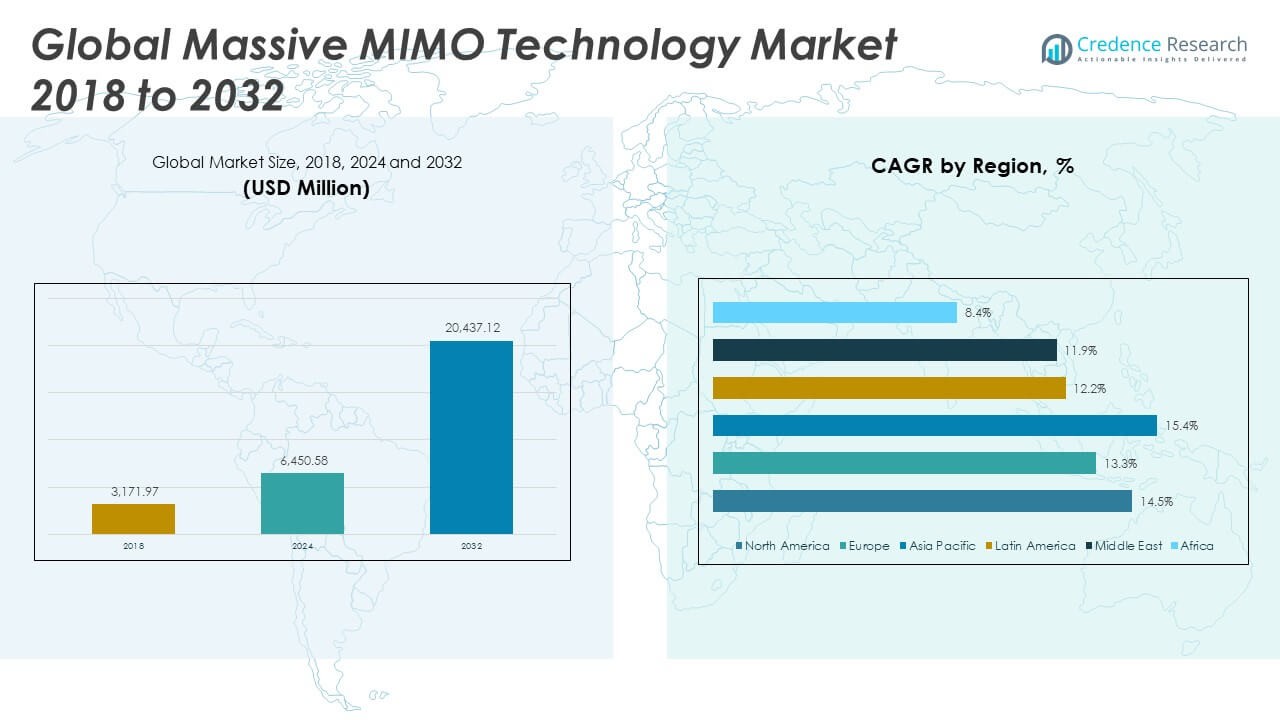

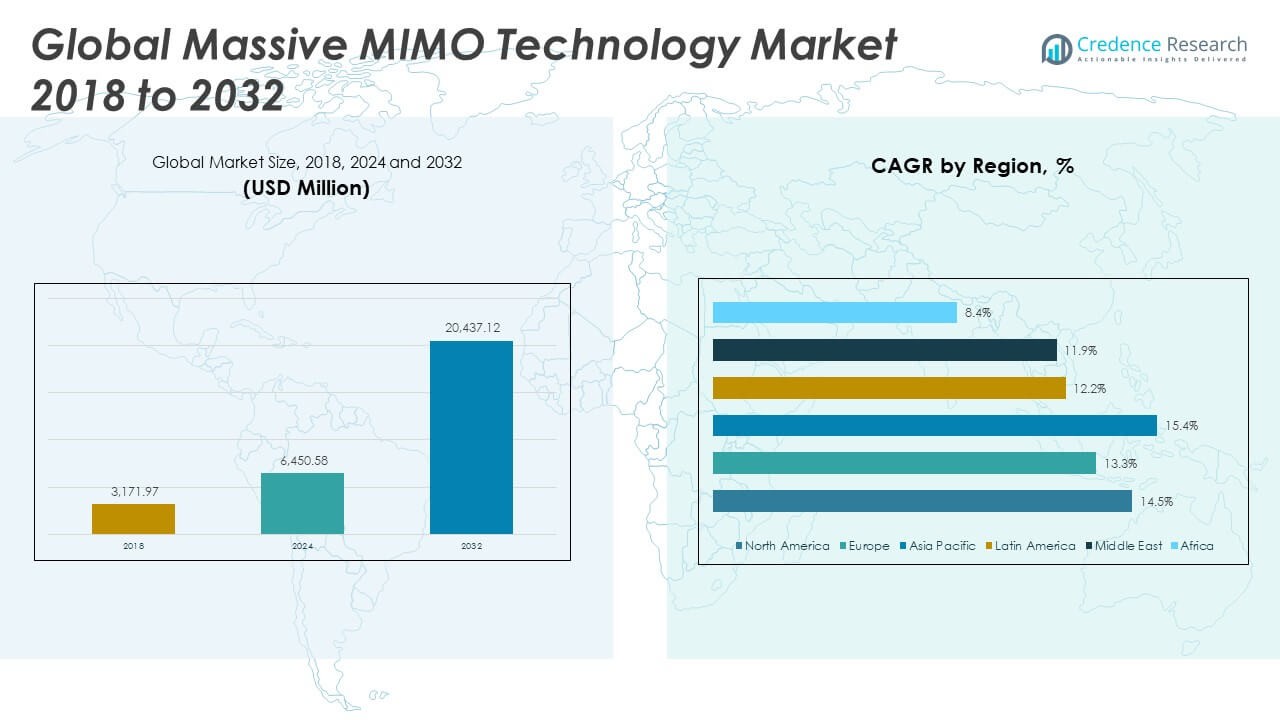

The Global Massive MIMO Technology Market size was valued at USD 3,171.97 million in 2018 to USD 6,450.58 million in 2024 and is anticipated to reach USD 20,437.12 million by 2032, at a CAGR of 14.45% during the forecast period.

The global Massive MIMO technology market is being propelled by several transformative drivers. Foremost among these is the rapid global deployment of 5G networks, which heavily rely on Massive MIMO to deliver higher data rates, improved spectral efficiency, and low latency. The surge in Internet of Things (IoT) adoption and the advancement of Industry 4.0 are also fueling demand for scalable and robust wireless communication infrastructure, for which Massive MIMO serves as a critical enabler. As mobile data traffic continues to grow exponentially, network operators are increasingly turning to network densification strategies, where Massive MIMO helps optimize spectrum usage and expand coverage. Furthermore, the rising consumer expectation for enhanced mobile broadband services is accelerating the integration of Massive MIMO into telecommunications networks. The evolution of virtualized and software-defined network architectures further amplifies the role of Massive MIMO, offering flexible and dynamic configurations to meet varying network demands.

Regionally, Asia-Pacific dominates the global Massive MIMO technology market, driven by aggressive 5G rollouts, large-scale investments in telecom infrastructure, and a vast mobile subscriber base. Countries like China, South Korea, and Japan are at the forefront of deploying Massive MIMO to meet growing data needs and support advanced digital services. North America follows closely, with the United States experiencing strong momentum due to early adoption of 5G and the presence of leading technology providers. The U.S. market is particularly dynamic, supported by substantial infrastructure investments and strategic public-private partnerships. In Europe, countries are progressively expanding 5G coverage, with a focus on enhancing mobile broadband and supporting emerging applications in smart cities and IoT ecosystems. Meanwhile, regions such as Latin America, the Middle East, and Africa are witnessing gradual adoption, with growth prospects linked to ongoing infrastructure development and increasing mobile connectivity. Each of these regions contributes uniquely to the global trajectory of the Massive MIMO market, shaping its future through diverse technological and economic dynamics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Massive MIMO Technology Market is projected to grow from USD 6,450.58 million in 2024 to USD 20,437.12 million by 2032, at a strong CAGR of 14.45%.

- Rapid deployment of 5G networks remains the primary growth driver, as Massive MIMO enables enhanced data speeds, low latency, and higher network capacity.

- The surge in IoT devices and Industry 4.0 adoption increases demand for scalable and robust wireless infrastructure supported by Massive MIMO.

- Growing mobile data traffic and consumer expectations for seamless broadband push operators toward network densification using Massive MIMO.

- The transition to virtualized and software-defined network architectures enhances deployment flexibility and resource efficiency for telecom providers.

- High infrastructure costs, complex antenna installations, and limited spectrum availability continue to challenge market scalability.

- Asia-Pacific leads global adoption, followed by North America and Europe, while Latin America, the Middle East, and Africa show rising potential through ongoing telecom infrastructure development.

Market Drivers:

Growing Demand for High-Capacity and Low-Latency Networks Fuels Adoption

The Global Massive MIMO Technology Market benefits significantly from rising data traffic and consumer expectations for faster, more reliable mobile services. Network operators are under pressure to support data-intensive applications, such as video streaming, cloud gaming, and real-time collaboration tools. Massive MIMO enhances spectral efficiency and enables simultaneous data transmission to multiple users, improving overall network performance. This capability becomes essential in densely populated urban environments where conventional technologies fall short. Massive MIMO also supports low-latency communication, aligning with the technical requirements of next-generation applications. The technology helps network providers meet quality-of-service targets while managing the growing strain on infrastructure.

For instance, Ericsson has deployed Massive MIMO in over 50 commercial 5G networks worldwide as of 2024, reporting up to a 3x increase in network capacity and a 40% improvement in spectral efficiency with Massive MIMO. Additionally,

Expansion of 5G Infrastructure Spurs Massive MIMO Integration

The accelerated global rollout of 5G infrastructure directly drives demand in the Global Massive MIMO Technology Market. 5G networks require advanced antenna systems to deliver ultra-fast speeds, and Massive MIMO is a core enabler of this transformation. It supports higher frequency bands and multiple data streams, which are critical for achieving the throughput and reliability promised by 5G. Telecom operators are investing heavily in network upgrades to remain competitive and meet regulatory expectations. Government initiatives and spectrum auctions further encourage the adoption of Massive MIMO across developed and developing economies. The increasing integration of 5G services across industries, including manufacturing and transportation, further boosts deployment.

Nokia, for example, has announced Massive MIMO deployment in more than 45 commercial 5G networks, reporting a 2.5x increase in spectral efficiency and enhanced user throughput. Massive MIMO is a core enabler of 5G transformation, supporting higher frequency bands and multiple data streams critical for achieving the throughput and reliability promised by 5G.

Proliferation of Connected Devices and IoT Ecosystems Drives Network Densification

The increasing number of connected devices and the expansion of IoT ecosystems elevate the need for network densification, which strengthens the case for Massive MIMO deployment. Each device added to the network increases the demand for consistent and uninterrupted connectivity. Massive MIMO technology allows network operators to handle this surge efficiently by supporting more simultaneous connections without sacrificing performance. It optimizes coverage and capacity in both urban and rural areas, providing flexibility in diverse deployment scenarios. The Global Massive MIMO Technology Market sees strong growth from enterprises seeking to future-proof their networks for smart operations. This trend accelerates innovation and supports critical communication needs in real-time industrial and consumer environments.

Transition Toward Virtualized and Software-Defined Networks Enhances Deployment Flexibility

The telecommunications sector is moving toward network virtualization and software-defined architecture to increase scalability and operational efficiency. Massive MIMO aligns well with these strategies, enabling operators to reconfigure and allocate resources dynamically. The Global Massive MIMO Technology Market gains momentum as service providers seek flexible infrastructure that adapts to variable user demand and traffic patterns. Software-driven control of antenna arrays allows efficient spectrum usage and rapid deployment in high-demand areas. It reduces reliance on hardware-based scaling and shortens the time-to-market for new services. The growing emphasis on cost-effective, agile networks ensures continued investment in Massive MIMO as a key strategic technology.

Market Trends:

Increased Deployment of mmWave Spectrum Accelerates Technology Integration

The adoption of millimeter-wave (mmWave) spectrum is transforming wireless communication strategies. Operators are utilizing mmWave frequencies to meet the bandwidth demands of data-heavy applications and dense user environments. These high-frequency bands require advanced antenna technologies for effective coverage and performance. The Global Massive MIMO Technology Market aligns with this shift, as it enables the use of multiple antennas to overcome signal limitations associated with mmWave propagation. Vendors are developing equipment tailored to mmWave characteristics, promoting faster implementation across urban networks. It allows operators to deliver enhanced speed, reliability, and user experience in high-density locations.

For instance, Verizonreported that by late 2024, its 5G Ultra Wideband service—powered by mmWave—covered over 200 million people in the U.S., enabling peak download speeds exceeding 4 Gbps in select urban areas.

Growing Investments in Smart Cities and Urban Connectivity Drive Demand

Governments and private sector players are investing heavily in smart city infrastructure to support intelligent transportation, surveillance, and energy systems. These initiatives rely on robust wireless communication frameworks capable of managing high data volumes and low-latency requirements. The Global Massive MIMO Technology Market is positioned to meet these needs through its ability to provide improved spectrum efficiency and wide-area coverage. Cities deploying smart grids and public safety networks increasingly turn to Massive MIMO to maintain seamless connectivity. It supports scalable communication backbones that adapt to evolving urban demands. This trend supports long-term growth and positions the technology at the center of digital infrastructure development.

Integration of Artificial Intelligence Optimizes Network Efficiency

The telecom industry is leveraging artificial intelligence (AI) to enhance network management and performance. AI algorithms are being embedded into Massive MIMO systems to automate antenna configuration, interference mitigation, and load balancing. This development improves spectral utilization and reduces operational costs. The Global Massive MIMO Technology Market benefits from AI-driven enhancements that improve responsiveness and system intelligence. Vendors are incorporating machine learning tools to enable predictive maintenance and real-time network optimization. It elevates service quality and allows networks to adapt dynamically to shifting traffic patterns.

Rising Focus on Energy-Efficient Infrastructure Encourages Technological Innovation

Operators are under pressure to reduce energy consumption and minimize the environmental impact of telecom infrastructure. This focus on sustainability is prompting innovations in Massive MIMO hardware and software design. The Global Massive MIMO Technology Market responds to this shift with low-power antenna systems, dynamic beamforming techniques, and efficient thermal management solutions. Manufacturers are optimizing radio units to consume less power without compromising performance. It supports green network initiatives and aligns with regulatory guidelines on emissions and energy use. These developments create new opportunities for eco-conscious solutions in network expansion strategies.

For example, Ericsson’s dual-band Massive MIMO radios incorporate liquid cooling, reducing site energy use by up to 40% compared to air-cooled systems. It supports green network initiatives and aligns with regulatory guidelines on emissions and energy use.

Market Challenges Analysis:

High Implementation Costs and Complex Infrastructure Hinder Adoption

The high cost of deploying Massive MIMO infrastructure poses a significant barrier to market growth, especially for small and mid-sized network operators. Equipment expenses, site upgrades, and the need for advanced base stations increase capital expenditure. The Global Massive MIMO Technology Market faces further challenges in managing the physical complexity of large antenna arrays, which require precise calibration and installation. Network densification in urban areas also demands additional investment in real estate, power supply, and cooling systems. It creates logistical hurdles that slow down deployment timelines and inflate operational budgets. Operators must balance performance goals with financial constraints to sustain long-term investment in this technology.

Spectrum Availability and Technical Standardization Remain Unresolved

Limited availability of suitable spectrum bands continues to restrict the full potential of Massive MIMO systems. Operators struggle to secure consistent access to high-frequency ranges required for optimal functionality. The Global Massive MIMO Technology Market encounters further delays due to the lack of global standardization in deployment practices and interoperability requirements. Differences in regulatory frameworks across regions create uncertainty for vendors and telecom companies. It leads to fragmented rollouts and incompatibility issues that affect service consistency. The absence of unified standards complicates R&D efforts and slows the pace of innovation across the ecosystem.

For example, a 2023 GSMA survey found that significant portion of telecom executives cited inconsistent technical standards and interoperability requirements as key challenges, leading to fragmented rollouts and increased integration costs. These disparities hinder the pace of innovation and complicate efforts to deliver uniform service quality across different markets.

Market Opportunities:

The expansion of 5G-enabled applications presents significant growth avenues for the Global Massive MIMO Technology Market. Use cases in autonomous mobility, telemedicine, and industrial automation demand high-capacity, low-latency networks, which Massive MIMO supports efficiently. Telecom providers are targeting these verticals to generate new revenue streams beyond consumer mobile services. It enables enhanced connectivity for mission-critical operations and real-time decision-making. As enterprises adopt 5G for private networks, demand for tailored Massive MIMO solutions continues to rise. This trend creates opportunities for vendors to develop application-specific technologies and services.

Governments and telecom operators are prioritizing digital inclusion through rural connectivity programs and public infrastructure upgrades. The Global Massive MIMO Technology Market stands to benefit from this momentum, as it provides scalable and cost-effective solutions for underserved regions. It allows operators to maximize coverage while minimizing site density, making it suitable for wide-area deployment. Public investments in healthcare, education, and emergency response systems also require high-performance networks. These initiatives create long-term demand for Massive MIMO equipment and integration services in both developed and emerging economies.

Market Segmentation Analysis:

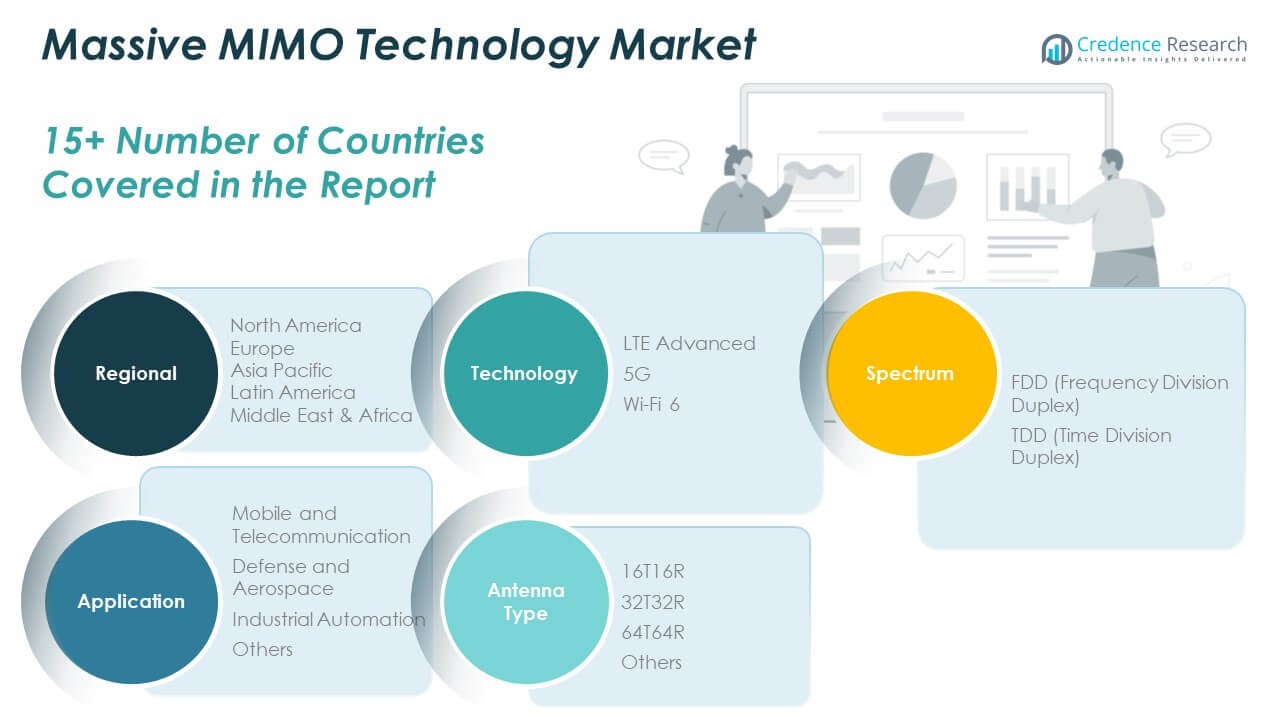

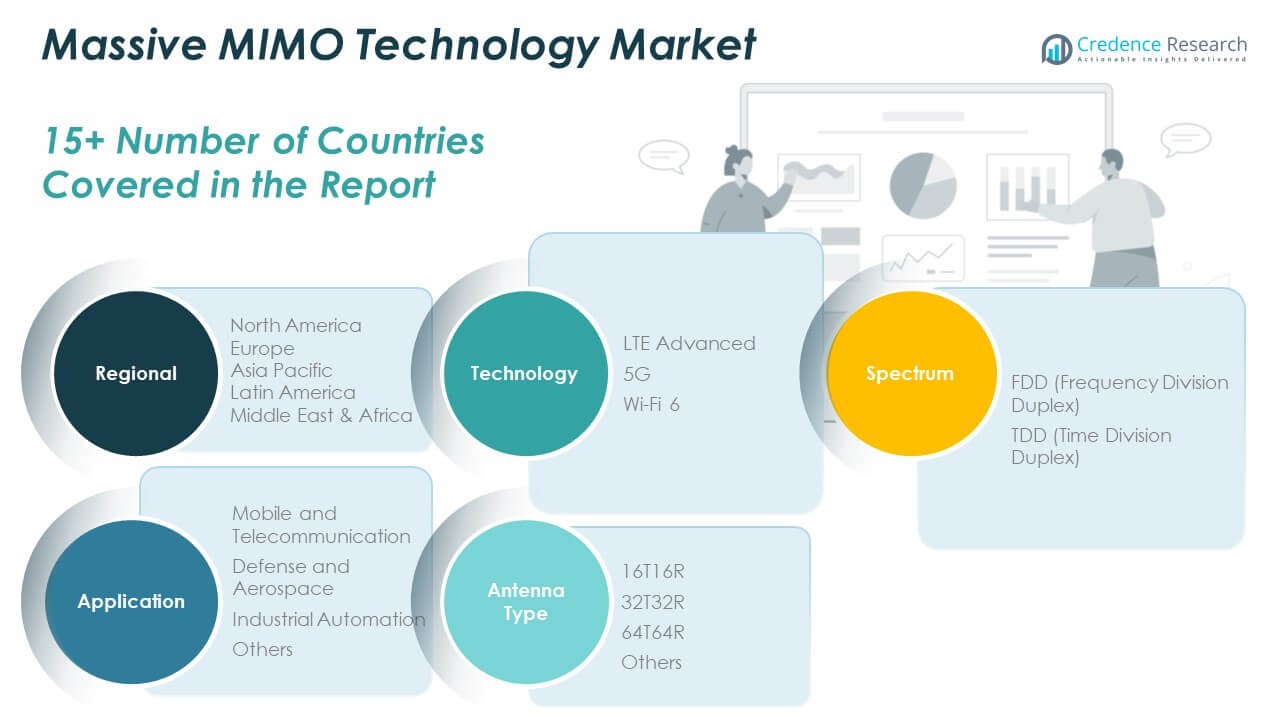

The Global Massive MIMO Technology Market is segmented by technology, spectrum, application, and antenna type, each contributing to its growth and adoption across industries.

By technology segment, 5G dominates due to its high data throughput and low latency, followed by LTE Advanced, which remains relevant in existing 4G infrastructure. Wi-Fi 6 is gaining traction in enterprise environments for its ability to handle dense traffic and improve connectivity.

By spectrum, Time Division Duplex (TDD) leads due to its efficient utilization of bandwidth and alignment with 5G deployments. Frequency Division Duplex (FDD) still holds a significant share, particularly in legacy systems and lower frequency bands. The Global Massive MIMO Technology Market benefits from the growing shift toward TDD in urban and high-traffic zones.

By application, mobile and telecommunication sectors are the primary users, driven by consumer demand for high-speed connectivity. Defense and aerospace sectors are adopting Massive MIMO for secure and robust communications. Industrial automation presents emerging opportunities, where real-time data transmission is critical. Others include education and public services, contributing niche demand.

By antenna type, 64T64R configurations are widely used in commercial 5G networks due to their capacity to handle multiple data streams. 32T32R and 16T16R systems serve mid-range and small cell deployments. Other configurations support specialized use cases in limited-spectrum or cost-sensitive environments.

Segmentation:

By Technology Segment

By Spectrum Segment

- FDD (Frequency Division Duplex)

- TDD (Time Division Duplex)

By Application Segment

- Mobile and Telecommunication

- Defense and Aerospace

- Industrial Automation

- Others

By Antenna Type Segment

- 16T16R

- 32T32R

- 64T64R

- Others

By Region Segment

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

The North America Massive MIMO Technology Market size was valued at USD 1,009.16 million in 2018 to USD 2,022.99 million in 2024 and is anticipated to reach USD 6,433.90 million by 2032, at a CAGR of 14.50% during the forecast period. North America holds a prominent share in the Global Massive MIMO Technology Market due to early 5G adoption and strong telecom infrastructure. The United States leads the region, supported by strategic investments from major operators and equipment manufacturers. Massive MIMO plays a crucial role in expanding network capacity and reducing latency for high-demand urban centers. It supports critical applications in smart cities, autonomous transportation, and high-bandwidth services. Network operators prioritize spectrum efficiency and low-latency delivery, making Massive MIMO integral to future-ready deployments. The region continues to innovate in mmWave and TDD-based architectures to strengthen its competitive advantage.

The Europe Massive MIMO Technology Market size was valued at USD 665.95 million in 2018 to USD 1,288.31 million in 2024 and is anticipated to reach USD 3,754.72 million by 2032, at a CAGR of 13.30% during the forecast period. Europe demonstrates steady growth in the Global Massive MIMO Technology Market, driven by widespread 5G rollouts and government-led digital infrastructure programs. Countries like Germany, France, and the UK are leading adopters of advanced wireless technologies. Massive MIMO supports Europe’s emphasis on public service innovation, industrial automation, and rural broadband coverage. The region encourages open network architecture and multi-vendor deployments, fostering interoperability. It also benefits from EU-backed investments aimed at strengthening cross-border connectivity. Europe’s regulatory clarity and strong R&D ecosystem sustain its momentum in deploying efficient and scalable Massive MIMO solutions.

The Asia Pacific Massive MIMO Technology Market size was valued at USD 1,265.87 million in 2018 to USD 2,678.37 million in 2024 and is anticipated to reach USD 9,050.67 million by 2032, at a CAGR of 15.40% during the forecast period. Asia Pacific leads the Global Massive MIMO Technology Market in terms of volume and growth rate, driven by large-scale 5G infrastructure projects. China, Japan, and South Korea are at the forefront of adopting advanced network solutions. The region’s dense urban populations and high mobile penetration rates increase the demand for capacity and speed. Massive MIMO supports extensive IoT networks, smart manufacturing, and connected mobility solutions across industrial zones. It enables telecom providers to scale operations efficiently while ensuring high service quality. Asia Pacific continues to dominate market expansion through government support, domestic innovation, and large-scale commercial deployments.

The Latin America Massive MIMO Technology Market size was valued at USD 118.79 million in 2018 to USD 237.79 million in 2024 and is anticipated to reach USD 643.83 million by 2032, at a CAGR of 12.20% during the forecast period. Latin America is an emerging contributor to the Global Massive MIMO Technology Market, with rising investments in mobile broadband infrastructure. Countries such as Brazil and Mexico are upgrading telecom networks to accommodate growing internet demand. Massive MIMO helps address capacity constraints in urban areas while extending coverage to underserved regions. Operators in the region are exploring cost-effective deployment strategies to maximize spectral efficiency. It allows for phased rollouts that align with evolving consumer needs and budget constraints. Public-private partnerships and spectrum auctions are expected to accelerate market penetration in the coming years.

The Middle East Massive MIMO Technology Market size was valued at USD 85.32 million in 2018 to USD 157.98 million in 2024 and is anticipated to reach USD 418.76 million by 2032, at a CAGR of 11.90% during the forecast period. The Middle East is witnessing a steady rise in the Global Massive MIMO Technology Market, fueled by smart city initiatives and national digitization strategies. Countries such as the UAE and Saudi Arabia are deploying Massive MIMO to support 5G coverage across metropolitan and industrial zones. It enables enhanced connectivity for public services, oil and gas operations, and security infrastructure. Operators focus on spectrum reallocation and infrastructure upgrades to meet growing data demands. The region’s emphasis on innovation and diversification supports ongoing expansion. Massive MIMO helps bridge connectivity gaps and lays the foundation for data-driven economies.

The Africa Massive MIMO Technology Market size was valued at USD 26.89 million in 2018 to USD 65.13 million in 2024 and is anticipated to reach USD 135.24 million by 2032, at a CAGR of 8.40% during the forecast period. Africa represents a nascent but gradually growing segment of the Global Massive MIMO Technology Market. Limited access to reliable broadband and underdeveloped telecom infrastructure hinder widespread adoption. However, initiatives aimed at expanding 4G and 5G coverage are creating room for growth. Massive MIMO offers a scalable solution to increase capacity and improve rural connectivity. Countries like South Africa and Egypt are at the forefront of early deployment efforts. It enables operators to leapfrog legacy systems and deliver improved mobile services efficiently. Localized infrastructure support and foreign investments will play a vital role in shaping the market’s future trajectory.

Key Player Analysis:

- Samsung

- Huawei

- Nokia

- Verizon

- ZTE

- Airtel

- Zillnk

- Tejas Networks

- Comba

- Ericsson

Competitive Analysis:

The Global Massive MIMO Technology Market features intense competition among established telecom equipment providers and emerging network solution vendors. Leading players such as Huawei, Ericsson, Nokia, and Samsung dominate the landscape through large-scale 5G deployments and advanced R&D capabilities. These companies invest in antenna innovation, AI integration, and energy-efficient systems to enhance performance and reduce operational costs. The market also includes regional players like ZTE, Tejas Networks, and Comba, which offer customized solutions to address local infrastructure needs. It encourages strategic partnerships, technology licensing, and acquisitions to strengthen global presence. New entrants focus on software-defined architectures and flexible hardware to capture niche segments. The market remains highly dynamic, driven by rapid technological advancements and evolving spectrum regulations. Companies that adapt quickly to shifting operator demands and offer scalable, cost-effective Massive MIMO systems maintain a competitive edge. Continuous innovation, compliance, and network performance will define long-term success in this expanding market.

Recent Developments:

- Comba Telecom, on February 24, 2025, announced at MWC 2025 the launch of next-generation antenna systems, DAS solutions, and private network innovations. Notably, Comba introduced the upgraded Helifeed Green Antenna Series for higher energy efficiency, an advanced in-building antenna series for deep coverage, and the ComFlex MAX multi-band, multi-operator DAS with Open RAN BBU integration. The company also teased a new product aimed at transforming wireless testing and optimization.

- At MWC Barcelona 2025, Huawei announced several major partnerships and innovations. Notably, MTN Nigeria and Huawei completed the first commercial FDD tri-band Massive MIMO deployment, significantly boosting LTE traffic and user data rates. Additionally, Huawei launched its AI-Centric 5.5G solutions, including GigaGear, GreenPulse, and GainLeap, which aim to improve network operations, energy efficiency, and enable new business models for telecom operators.

Market Concentration & Characteristics:

The Global Massive MIMO Technology Market exhibits moderate to high market concentration, with a few dominant players controlling a significant share of total revenue. Companies such as Huawei, Ericsson, Nokia, and Samsung lead in large-scale deployments and proprietary technology development. It features strong barriers to entry due to high capital requirements, complex R&D, and strict compliance with telecom standards. The market is characterized by rapid innovation cycles, strategic collaborations, and increasing emphasis on software-defined solutions. Vendors compete on factors such as antenna performance, energy efficiency, scalability, and integration with 5G infrastructure. It reflects a technology-driven environment where adaptability and network optimization capabilities are critical. Emerging players target underserved regions and niche applications to gain traction, while established firms focus on global rollouts and premium solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on technology, spectrum, application, and antenna type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-speed, low-latency networks will continue to drive Massive MIMO integration across telecom infrastructures.

- 5G expansion across emerging and developed markets will create sustained opportunities for equipment vendors.

- Growth in smart cities and connected public services will accelerate adoption in urban regions.

- Increasing enterprise use of private 5G networks will boost demand for customized Massive MIMO systems.

- AI-powered network optimization will enhance spectral efficiency and reduce operational costs.

- Advancements in energy-efficient antenna systems will align with global sustainability goals.

- Rising investments in industrial automation will create new applications across manufacturing and logistics.

- Government initiatives to improve rural connectivity will encourage deployment in underserved areas.

- Greater focus on interoperability and open RAN architecture will reshape vendor strategies.

- Continued innovation and competitive pricing will influence market share dynamics among global and regional players.