Market Overview

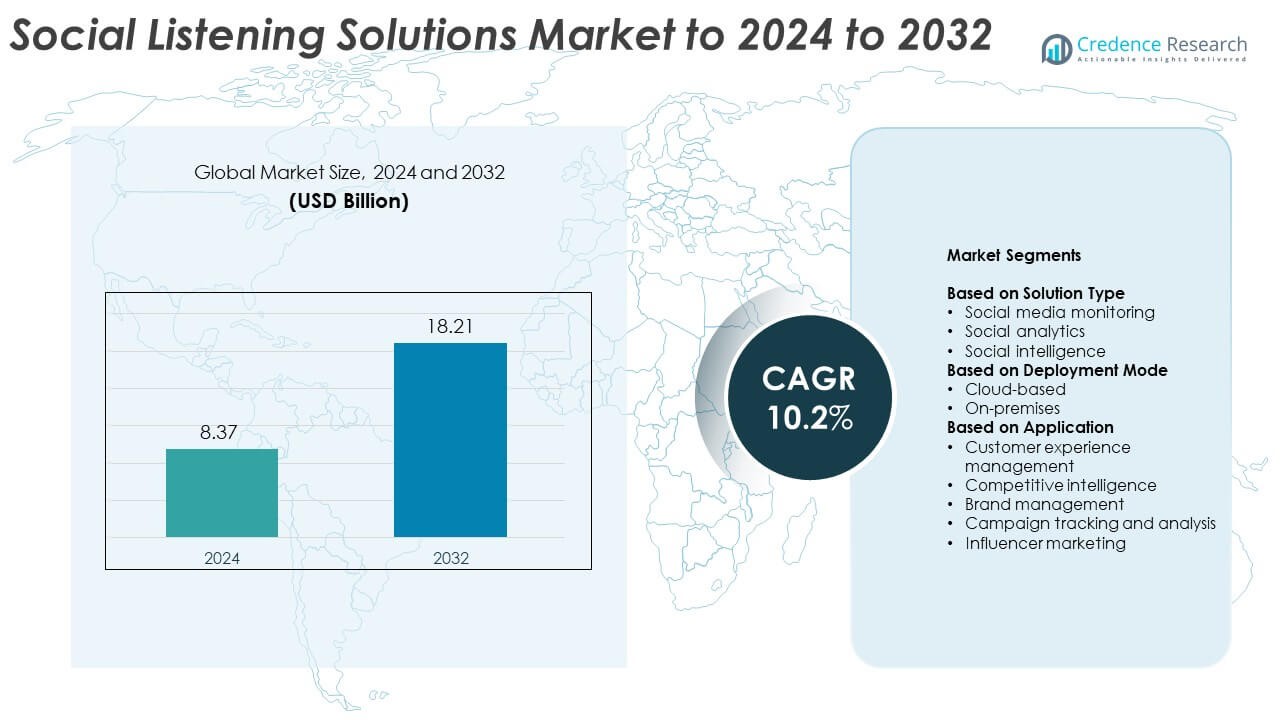

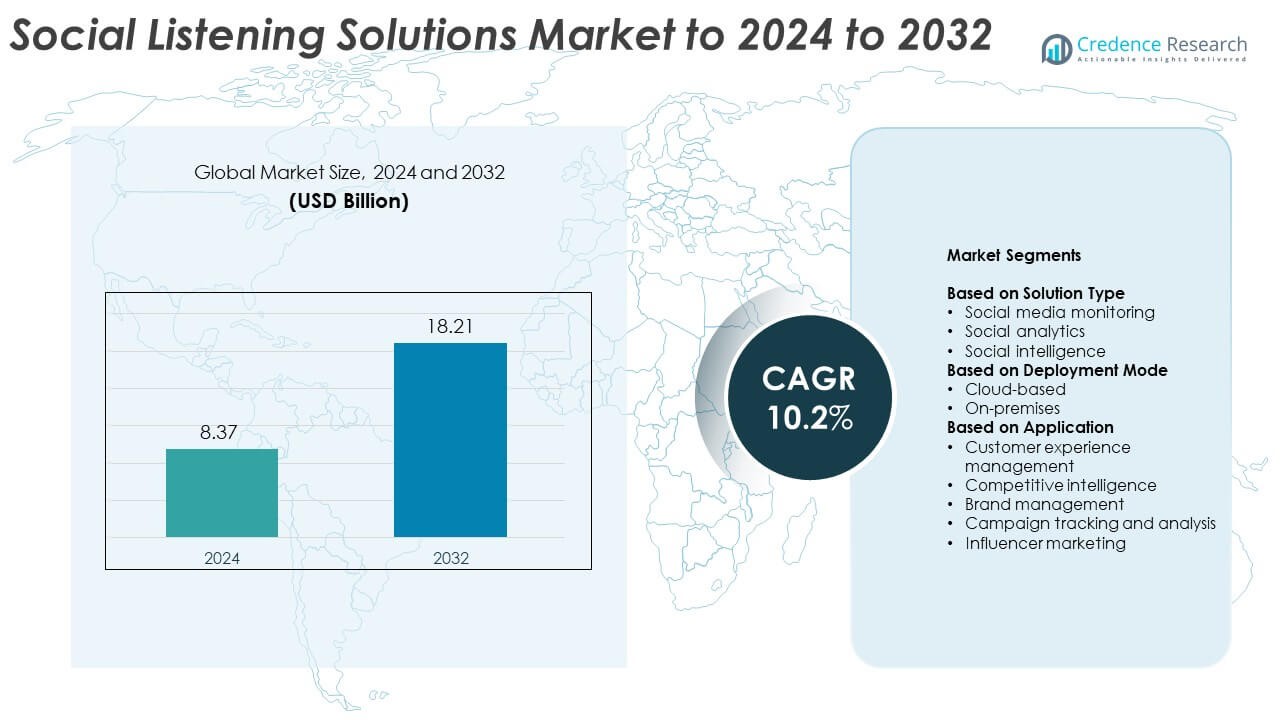

The Social Listening Solutions Market size was valued at USD 8.37 Billion in 2024 and is anticipated to reach USD 18.21 Billion by 2032, at a CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Social Listening Solutions Market Size 2024 |

USD 8.37 Billion |

| Social Listening Solutions Market, CAGR |

10.2% |

| Social Listening Solutions Market Size 2032 |

USD 18.21 Billion |

The Social Listening Solutions Market is highly competitive, featuring major participants such as Sprinklr, Talkwalker, Brandwatch, Meltwater, Sprout Social, NetBase Quid, Hootsuite, Crimson Hexagon, and Cision. These companies focus on advanced analytics, AI-driven insights, and predictive modeling to strengthen customer intelligence and enhance decision-making accuracy. The market is witnessing strong adoption of integrated, cloud-based platforms that combine sentiment tracking, influencer analysis, and campaign performance measurement. Continuous innovation in automation, real-time monitoring, and multilingual sentiment analysis is reshaping competitive strategies. Regionally, North America leads the market with a 39.2% share, driven by widespread adoption of digital analytics and enterprise-level investments in customer experience optimization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Social Listening Solutions Market was valued at USD 8.37 Billion in 2024 and is projected to reach USD 18.21 Billion by 2032, growing at a CAGR of 10.2%.

• Rising demand for real-time consumer insights and AI-driven analytics tools is driving market expansion across industries such as retail, media, and BFSI.

• Predictive analytics, influencer engagement tracking, and multilingual sentiment analysis are emerging as key trends improving decision-making and brand monitoring.

• The market is moderately consolidated, with players focusing on innovation, automation, and cloud-based deployment to enhance data accuracy and scalability.

• North America led with a 39.2% share in 2024, followed by Europe at 27.5% and Asia Pacific at 22.3%, while the social analytics segment dominated globally with a 44.6% share.

Market Segmentation Analysis:

By Solution Type

The social analytics segment dominated the Social Listening Solutions Market in 2024, accounting for a 44.6% share. Its leadership is driven by the rising need for real-time sentiment analysis and performance measurement across digital platforms. Businesses use social analytics to identify consumer trends, evaluate campaign effectiveness, and forecast brand reputation. Advanced AI-powered analytics tools enable accurate interpretation of structured and unstructured data, improving decision-making and marketing agility. Increasing adoption of predictive insights and automated dashboards by enterprises continues to strengthen the dominance of social analytics solutions.

- For instance, Brandwatch reports 1.7 trillion historical conversations (since 2010) and ingests 501 million new conversations daily, enabling robust social analytics at scale.

By Deployment Mode

The cloud-based segment held the largest share of 67.3% in 2024, supported by its scalability, cost efficiency, and ease of integration. Organizations increasingly favor cloud deployment for accessing large volumes of social data in real time. It allows flexible data processing across multiple digital touchpoints and seamless integration with CRM and marketing automation tools. The shift toward remote work environments and the rising adoption of SaaS-based platforms have further accelerated cloud deployment. Continuous improvements in data security and compliance frameworks are enhancing trust in cloud-based models globally.

- For instance, Sprinklr states it unifies listening across 30+ channels and pulls from 1 billion+ monthly sources, supporting large, cloud-scale workloads.

By Application

Customer experience management emerged as the leading segment in 2024, capturing a 36.8% share of the market. The dominance stems from the growing emphasis on improving brand engagement and service personalization through social insights. Companies use listening tools to track feedback, measure satisfaction, and address issues proactively. AI-driven sentiment and behavioral analysis help brands tailor strategies that align with customer expectations. The need to enhance loyalty and retention, especially in competitive digital markets, continues to drive the adoption of social listening for customer experience optimization.

Key Growth Drivers

Rising Demand for Real-Time Consumer Insights

Businesses are increasingly adopting social listening tools to monitor real-time consumer opinions and brand sentiment across platforms. The ability to detect emerging issues, assess campaign performance, and understand customer expectations enables faster and more informed decision-making. Companies in sectors like retail, media, and BFSI use these insights to refine strategies and enhance engagement. The growing reliance on digital interactions and social data for strategic planning continues to boost the adoption of social listening solutions.

- For instance, NetBase Quid, through its “Quid News” feature, provides access to data from over 90,000 sources across 226 countries in 96 languages.

Integration of AI and Advanced Analytics

AI-driven analytics have become a crucial driver in expanding the capabilities of social listening platforms. Machine learning algorithms enhance data accuracy by identifying patterns in vast datasets and delivering actionable insights. Automated sentiment analysis, keyword tracking, and predictive modeling improve customer profiling and trend forecasting. The growing adoption of natural language processing (NLP) tools further strengthens solution efficiency, enabling organizations to extract deeper meaning from complex user-generated content.

- For instance, Lucidya reports >92% sentiment accuracy across 15 Arabic dialects, improving precision on region-specific analysis.

Expansion of Omnichannel Engagement Strategies

Brands are leveraging social listening to build cohesive customer engagement across multiple channels. Integration with CRM, marketing automation, and e-commerce systems allows a unified understanding of consumer behavior. This approach supports consistent messaging, stronger loyalty, and personalized campaigns. The shift toward omnichannel strategies in retail, healthcare, and technology sectors has accelerated demand for social listening tools that align marketing and communication efforts across digital ecosystems.

Key Trends & Opportunities

Growth of Influencer and Community Analytics

The rising influence of social media creators has prompted demand for specialized tools that track influencer engagement and community sentiment. Social listening platforms now help brands identify high-performing influencers and assess the impact of collaborations. Enhanced analytics provide deeper visibility into follower authenticity and content performance. This evolution enables companies to optimize influencer strategies, expand outreach, and measure ROI more effectively, creating major opportunities for platform providers.

- For instance, YouScan documented a campaign surpassing 4.5 million social reactions, quantified via visual-listening analytics.

Shift Toward Predictive and Prescriptive Insights

A growing trend in the market is the transition from descriptive analytics to predictive and prescriptive insights. Organizations are utilizing AI-powered tools to anticipate shifts in consumer perception and emerging brand crises. Predictive models enable proactive marketing responses and risk management. Vendors offering integrated solutions with forecasting and automated reporting capabilities are gaining strong competitive advantages in this evolving landscape.

- For instance, Black Swan Data’s TPV algorithm reports 89% trend-prediction accuracy at 6 months, enabling proactive planning.

Key Challenges

Data Privacy and Compliance Concerns

The collection and processing of social data pose increasing privacy and compliance challenges. Stricter data protection regulations such as GDPR and CCPA require organizations to ensure transparent data usage. Non-compliance can result in heavy penalties and brand damage. Many enterprises face difficulties balancing personalized engagement with ethical data practices. Addressing these concerns through secure data management frameworks remains a key challenge for vendors in the market.

Integration Complexity and Data Silos

Integrating social listening tools with existing enterprise systems such as CRM, ERP, and marketing platforms can be complex and resource-intensive. Disparate data sources often create silos, limiting the ability to obtain unified insights. Inconsistent data formats and system incompatibility delay deployment and reduce analytical accuracy. Vendors must focus on enhancing interoperability and developing APIs that simplify data exchange to overcome this persistent challenge.

Regional Analysis

North America

North America held the largest share of 39.2% in the Social Listening Solutions Market in 2024. The region’s dominance is driven by strong digital marketing adoption and advanced analytics integration across industries. Major enterprises in the United States and Canada utilize social listening for brand reputation management and customer engagement. The presence of key players and high investment in AI-based tools support market expansion. Growing demand for data-driven decision-making in sectors such as retail, healthcare, and BFSI continues to strengthen North America’s leading position.

Europe

Europe accounted for a 27.5% share of the market in 2024, supported by rising adoption of social analytics for compliance and consumer sentiment monitoring. Countries such as the United Kingdom, Germany, and France are emphasizing customer-centric marketing strategies driven by real-time insights. The demand for multilingual data analysis tools has increased with the expansion of regional digital ecosystems. European firms are focusing on ethical data use and privacy-compliant analytics, reinforcing the adoption of transparent and regulated social listening practices across industries.

Asia Pacific

Asia Pacific captured a 22.3% share in 2024, emerging as the fastest-growing regional market. Rapid digitalization, expanding e-commerce activity, and social media engagement in countries such as China, India, and Japan are fueling growth. Businesses are leveraging social listening to understand diverse consumer behaviors and local market dynamics. The rise of homegrown social platforms and government-backed digital transformation initiatives further enhance adoption. Increasing investment in AI and cloud technologies by enterprises continues to strengthen the region’s growth potential in social listening applications.

Latin America

Latin America accounted for a 6.4% share of the global market in 2024. The growing popularity of platforms such as Instagram, X, and WhatsApp for brand promotion has driven adoption across Brazil, Mexico, and Argentina. Regional businesses are increasingly using social listening to monitor brand perception and improve customer experience. Expanding digital marketing budgets and greater focus on influencer engagement support steady growth. However, limited technological infrastructure and uneven data integration capabilities remain key barriers to full-scale implementation.

Middle East and Africa

The Middle East and Africa region held a 4.6% share of the market in 2024. The adoption of social listening tools is increasing due to the rising penetration of smartphones and digital media. Organizations in the United Arab Emirates, Saudi Arabia, and South Africa are investing in social analytics to enhance brand visibility and track consumer sentiment. Growth is further supported by government-led digital transformation programs. However, slower technological adoption in several African economies continues to restrain large-scale market development.

Market Segmentations:

By Solution Type

- Social media monitoring

- Social analytics

- Social intelligence

By Deployment Mode

By Application

- Customer experience management

- Competitive intelligence

- Brand management

- Campaign tracking and analysis

- Influencer marketing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Social Listening Solutions Market is characterized by strong competition among key players such as Sprinklr, Talkwalker, Brandwatch, Meltwater, Sprout Social, NetBase Quid, Hootsuite, Crimson Hexagon, and Cision. Market participants are focusing on expanding AI-driven analytics, machine learning integration, and predictive modeling to enhance the accuracy of sentiment insights. Companies are also emphasizing platform interoperability, offering seamless integration with CRM and marketing automation tools. Strategic partnerships with digital marketing agencies and cloud service providers are becoming common to extend service reach. Continuous innovation in data visualization, multilingual analysis, and real-time monitoring capabilities supports product differentiation. Vendors are prioritizing user-friendly interfaces and automated reporting to attract small and medium enterprises. Growing demand for actionable social insights across industries is pushing competitors to strengthen their SaaS offerings and improve scalability. The competitive environment remains dynamic, with frequent product enhancements and mergers to expand global footprints.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Sprout Social acquired NewsWhip, a Dublin-based company specializing in content and trend discovery, to further bolster its analytics.

- In 2024, Hootsuite acquired Talkwalker, a leading AI-powered social listening solution. The move was designed to merge social media management with AI-driven social listening into a single platform.

- In 2024, Cision announced a collaboration with Google Cloud to leverage its generative AI and Gemini models across Cision’s products. This partnership provides customers with enhanced AI insights and faster workflow capabilities.

Report Coverage

The research report offers an in-depth analysis based on Solution Type, Deployment Mode, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing reliance on AI-driven sentiment analysis will enhance real-time decision-making for brands.

- Integration with CRM and marketing platforms will create unified customer engagement ecosystems.

- Predictive analytics adoption will increase for forecasting consumer trends and market shifts.

- Cloud-based deployment will continue to dominate due to scalability and cost efficiency.

- Demand for multilingual and region-specific social analytics will expand among global enterprises.

- Increasing influencer marketing activity will drive advanced community and engagement analytics tools.

- Data privacy and compliance frameworks will shape future product development and adoption.

- SMEs will increasingly adopt affordable SaaS-based social listening platforms for brand management.

- Partnerships between analytics providers and digital marketing firms will strengthen solution portfolios.

- Enhanced visualization and automated reporting features will improve usability and data-driven strategy execution.