Market Overview:

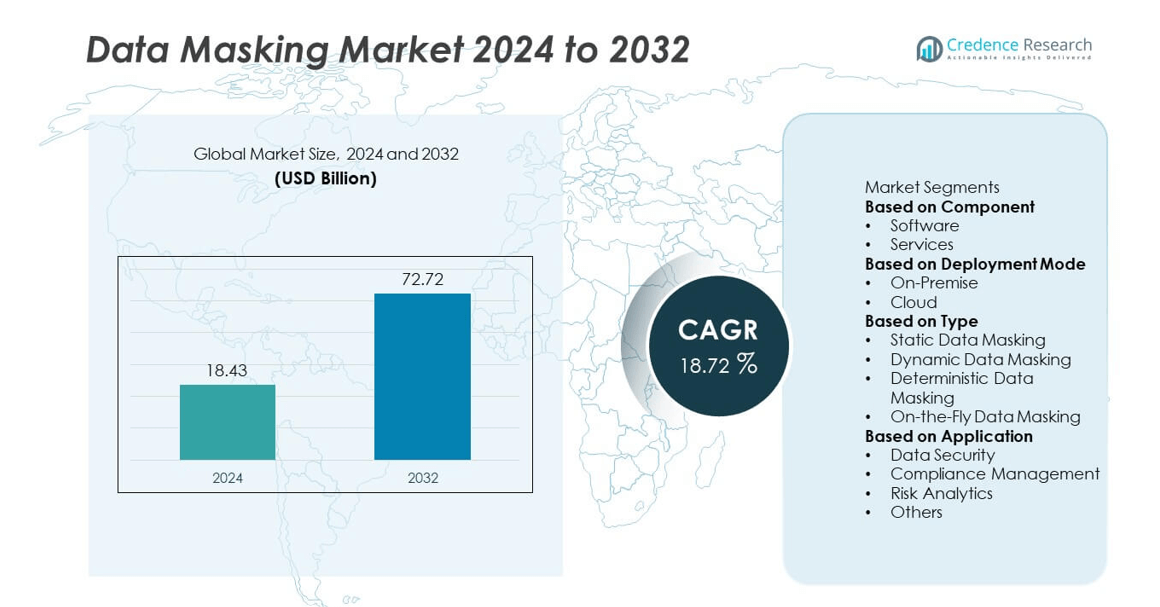

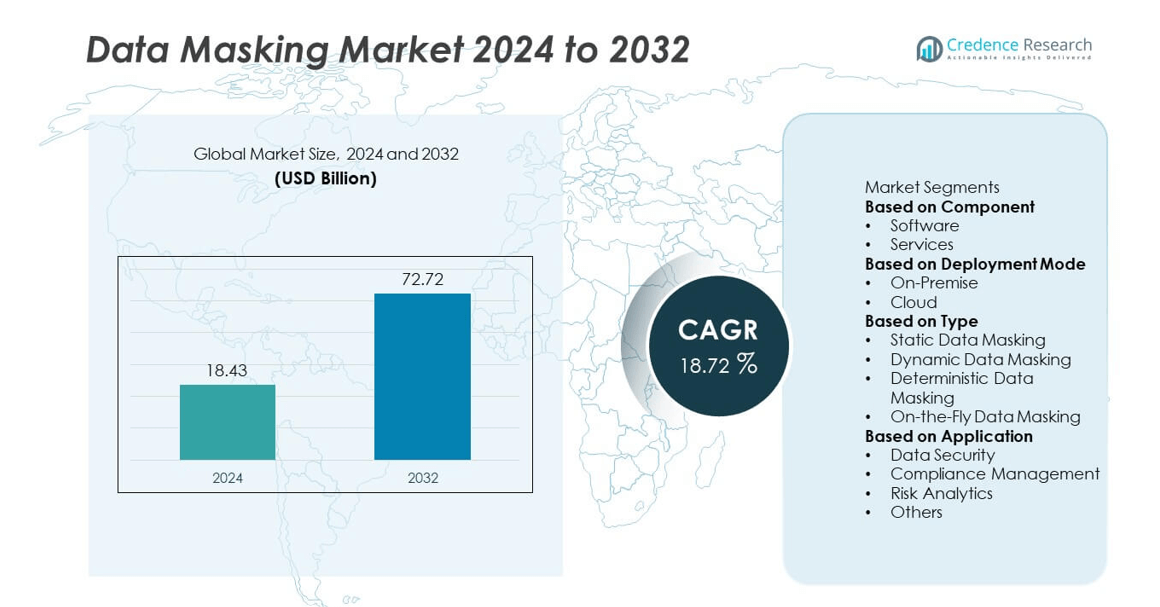

The global Data Masking Market was valued at USD 18.43 billion in 2024 and is projected to reach USD 72.72 billion by 2032, growing at a CAGR of 18.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Masking Market Size 2024 |

USD 18.43 billion |

| Data Masking Market, CAGR |

18.72% |

| Data Masking Market Size 2032 |

USD 72.72 billion |

The global data masking market is led by key players including IBM Corporation, Oracle Corporation, Informatica Inc., Broadcom Inc. (Symantec), Micro Focus International plc, Delphix Corp., Mentis Inc., Protegrity USA Inc., Imperva Inc., and Dataguise Inc. These companies dominate through robust data protection portfolios, AI-driven automation, and compliance-focused solutions tailored for hybrid and multi-cloud environments. North America emerged as the leading region with a 37.6% market share in 2024, supported by stringent data privacy regulations and high enterprise adoption. Europe followed with 29.8%, driven by GDPR enforcement, while Asia-Pacific, holding 23.4%, is projected to experience the fastest growth during the forecast period.

Market Insights

- The global data masking market was valued at USD 18.43 billion in 2024 and is projected to reach USD 72.72 billion by 2032, growing at a CAGR of 18.72% during 2025–2032.

- Rising data privacy regulations such as GDPR, CCPA, and HIPAA are driving adoption across BFSI, healthcare, and government sectors to protect sensitive information.

- The market is witnessing strong trends toward AI-driven dynamic masking, cloud integration, and real-time data protection, enabling enterprises to enhance compliance and operational efficiency.

- Leading players including IBM, Oracle, Informatica, and Broadcom dominate through technological innovation, partnerships, and region-specific compliance solutions.

- North America led the market with a 37.6% share, followed by Europe with 29.8%, while Asia-Pacific held 23.4% and is expected to record the fastest growth due to rising digitalization and expanding cloud infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The software segment dominated the data masking market with a 63.4% share in 2024. Its dominance stems from high adoption in data-driven enterprises for automated masking and integration with database management tools. Software-based masking solutions provide faster implementation and scalability for structured and unstructured data across hybrid environments. Increasing data privacy regulations, such as GDPR and CCPA, have accelerated the use of software platforms that ensure compliance and prevent unauthorized access. The service segment, though smaller, is expanding rapidly due to rising demand for consulting and managed data protection services.

- For instance, Informatica Inc. integrated its Dynamic Data Masking solution, which can dynamically mask, hide, or block sensitive information based on user roles and privileges. This technology works as a transparent proxy between applications and databases, enhancing security for production environments and supporting a broad range of data sources, including major databases like Oracle and SQL Server.

By Deployment Mode

The on-premise segment accounted for a 57.1% share of the data masking market in 2024. It remains dominant due to enterprise preference for in-house data control, especially in regulated sectors like banking and government. Organizations dealing with sensitive financial or healthcare data rely on on-premise solutions for higher data sovereignty and custom security configurations. However, the cloud segment is gaining traction as hybrid IT models expand. Cloud-based masking tools are increasingly favored for flexible scalability and seamless integration with cloud storage and analytics platforms.

- For instance, Oracle Corporation extended its Data Safe cloud service to support on-premise databases, which includes a library of over 150 predefined sensitive data types, helping to improve compliance in financial and healthcare sectors.

By Type

Static data masking led the market with a 46.8% share in 2024, driven by its suitability for non-production environments such as testing and development. It offers consistent, repeatable masking that ensures sensitive data remains unusable outside production while maintaining realistic datasets. Dynamic data masking is growing steadily due to rising use in real-time access control and analytics workflows. Enterprises are adopting dynamic solutions to protect live transactional data while ensuring business continuity, especially across banking, retail, and telecom networks handling high user data volumes.

Key Growth Drivers

Rising Data Privacy Regulations

Strict data protection laws such as GDPR, HIPAA, and CCPA are driving the adoption of data masking solutions. Organizations are required to safeguard sensitive information across databases, applications, and analytics platforms. Data masking ensures compliance by anonymizing personal identifiers while maintaining usability for testing and analytics. The growing emphasis on regulatory adherence and risk reduction is pushing enterprises to deploy robust masking frameworks, particularly across sectors like BFSI, healthcare, and government, where penalties for non-compliance are high.

- For instance, IBM Corporation’ InfoSphere Optim Data Privacy offers 30 predefined data classifications and privacy rules to help meet HIPAA, GLBA and other mandates.

Growing Volume of Data Breaches

The increasing frequency of cyberattacks has highlighted the need for data-centric security measures. Data masking provides an effective layer of protection by substituting real data with fictitious yet realistic values. As cyber incidents targeting confidential records rise, organizations are prioritizing masking to prevent exposure of sensitive datasets. The rise in ransomware attacks, data leaks, and insider threats across industries is prompting companies to invest heavily in masking solutions integrated with real-time monitoring systems.

- For instance, Protegrity USA, Inc. released version 8.1 of its Data Protection Platform to include dynamic data masking and monitoring capabilities within a single store, enabling real-time masking at the point of user access.

Adoption of Cloud and Big Data Technologies

The expansion of cloud computing and big data analytics is boosting demand for scalable data masking solutions. Enterprises are generating vast data volumes across distributed and hybrid environments, creating higher risks of exposure. Cloud-native masking platforms allow seamless integration with SaaS, PaaS, and IaaS systems, enabling secure data handling during migration and analytics. The growing adoption of hybrid IT infrastructure has made dynamic and on-the-fly masking essential for maintaining privacy while ensuring operational efficiency.

Key Trends & Opportunities

Integration with AI and Machine Learning

AI-driven automation is transforming data masking by improving accuracy and reducing manual effort. Machine learning algorithms can identify sensitive data patterns across structured and unstructured formats more efficiently. Vendors are incorporating intelligent pattern recognition and adaptive masking policies to enhance compliance workflows. This integration offers opportunities for predictive security analytics and automated policy management, helping enterprises reduce human error and accelerate deployment timelines in complex IT ecosystems.

- For instance, Microsoft Purview integrated AI-based data classification, enabling automatic detection of more than 200 predefined sensitive information types across unstructured repositories through its Data Map.

Rising Demand for Real-Time Masking Solutions

The surge in real-time data access across digital platforms has increased the need for dynamic masking solutions. Enterprises are deploying real-time masking to protect live transactional data used in analytics, APIs, and customer service systems. This trend supports compliance without restricting data usability. The shift toward low-latency and high-performance masking engines presents opportunities for vendors offering scalable solutions capable of securing sensitive data in milliseconds across distributed environments.

- For instance, Broadcom Inc. via its Test Data Manager supports both static and dynamic masking (on-the-fly) in production and non-production use cases, enabling enterprises to mask test data as it’s accessed in real time.

Growing Focus on Data Governance Frameworks

Organizations are aligning data masking with broader governance initiatives to manage data quality, accessibility, and privacy. Strong governance frameworks ensure consistent policy enforcement across applications and departments. As enterprises enhance their governance maturity, data masking becomes integral to secure data lifecycle management. This focus creates opportunities for solution providers offering governance-driven masking tools integrated with metadata management, lineage tracking, and auditing capabilities.

Key Challenges

Complex Implementation in Legacy Systems

Integrating modern data masking tools into legacy databases remains a major challenge. Older systems often lack the flexibility or documentation required for smooth integration, increasing project timelines and costs. Enterprises face compatibility issues when deploying masking across heterogeneous environments. The need for customized connectors and manual intervention slows adoption, particularly among large organizations with diverse IT ecosystems spanning decades of data infrastructure.

High Costs and Resource Requirements

Comprehensive data masking implementation involves substantial costs in software licensing, customization, and maintenance. Skilled professionals are required to configure masking logic and ensure regulatory compliance, further driving operational expenses. Small and medium enterprises often find the cost barrier restrictive, delaying adoption. Additionally, ongoing updates and scaling to accommodate large data volumes add to resource strain, making affordability a key limitation in widespread deployment.

Regional Analysis

North America

North America held the largest share of 37.6% in the global data masking market in 2024. The region’s dominance is supported by stringent data privacy regulations, including CCPA and HIPAA, which drive adoption across banking, healthcare, and IT sectors. High investment in cybersecurity infrastructure and rapid digital transformation further boost demand. The presence of major technology providers such as IBM, Oracle, and Informatica enhances solution availability. The growing use of AI-driven masking tools and strong enterprise focus on compliance management continue to sustain North America’s leadership in the forecast period.

Europe

Europe accounted for a 29.8% share of the data masking market in 2024, driven by robust enforcement of GDPR and data localization requirements. Financial institutions and government agencies are leading adopters due to high compliance needs. Countries such as Germany, France, and the UK are investing in privacy-preserving data technologies. Rising demand for data protection in cross-border operations and the shift toward hybrid cloud solutions further strengthen market expansion. European enterprises increasingly favor advanced masking tools that align with regional regulatory frameworks and ensure secure data sharing across multiple platforms.

Asia-Pacific

Asia-Pacific captured a 23.4% share of the data masking market in 2024 and is expected to record the fastest growth during the forecast period. Expanding digitalization, growing cloud adoption, and increasing cyber risks are driving demand across India, China, Japan, and South Korea. Governments are introducing data protection regulations similar to GDPR, accelerating enterprise investments in privacy technologies. The rapid growth of e-commerce, BFSI, and IT services sectors further amplifies demand for dynamic and cloud-based masking solutions. Local technology providers are also enhancing market penetration through affordable and region-specific data security offerings.

Latin America

Latin America accounted for a 5.2% share of the global data masking market in 2024. The region is witnessing increased adoption in Brazil, Mexico, and Argentina due to evolving data protection laws and rising cyber threats. Enterprises in BFSI and healthcare are prioritizing masking to ensure compliance with national privacy frameworks. Growing investment in IT modernization and cloud services supports deployment of flexible masking platforms. Although adoption is at an early stage, regional digital transformation initiatives and the rise of fintech and telecom firms are expected to accelerate market growth in the coming years.

Middle East & Africa

The Middle East & Africa region held a 4.0% share of the global data masking market in 2024. Growing digital banking, healthcare digitization, and government smart city projects are increasing the need for secure data management. Countries such as the UAE and Saudi Arabia are leading adoption through strong cybersecurity policies. Enterprises are focusing on implementing dynamic masking to protect critical infrastructure data. Increasing investments in cloud infrastructure and compliance-focused IT strategies are expected to drive sustained growth as the region advances toward stricter data protection regulations and localized privacy frameworks.

Market Segmentations:

By Component

By Deployment Mode

By Type

- Static Data Masking

- Dynamic Data Masking

- Deterministic Data Masking

- On-the-Fly Data Masking

By Application

- Data Security

- Compliance Management

- Risk Analytics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the data masking market is characterized by strong participation from key players such as IBM Corporation, Oracle Corporation, Informatica Inc., Broadcom Inc. (Symantec), Micro Focus International plc, Delphix Corp., Mentis Inc., Protegrity USA Inc., Imperva Inc., and Dataguise Inc. These companies compete through advanced data security technologies, regulatory compliance solutions, and AI-enabled masking automation. Leading vendors focus on expanding product portfolios to support hybrid and multi-cloud environments while enhancing scalability and real-time performance. Strategic initiatives such as acquisitions, partnerships, and cloud integrations are strengthening their global presence. Continuous innovation in dynamic and on-the-fly masking tools, along with growing adoption in BFSI, healthcare, and government sectors, is intensifying market competition. Vendors are also investing in region-specific compliance capabilities and analytics integration to address diverse data protection requirements and capture emerging growth opportunities across the global enterprise security ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM Corporation

- Oracle Corporation

- Informatica Inc.

- Broadcom Inc. (Symantec)

- Micro Focus International plc

- Delphix Corp.

- Mentis Inc.

- Protegrity USA, Inc.

- Imperva Inc.

- Dataguise Inc.

Recent Developments

- In October 2025, Informatica Inc. released enhancements in its Data Integration platform that include a “Data Masking transformation” feature for column-level masking rules within its cloud native environments.

- In April 2025, IBM Corporation announced enhancements to its Cloud Pak for Data platform that enable advanced masking criteria via its Watsonx governance offering.

- In March 2025, Delphix Corp. introduced the “Delphix Compliance Services” product supporting masking and compliance across over 170 data sources, including Azure and Microsoft Fabric pipelines

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and machine learning will enhance automation in data masking processes.

- Real-time masking solutions will gain traction across live transactional and analytics systems.

- Cloud-native masking platforms will expand as hybrid and multi-cloud adoption rises globally.

- Integration with data governance and compliance frameworks will become a strategic focus.

- SMEs will increase adoption as cost-effective and scalable SaaS-based solutions emerge.

- Dynamic masking will surpass static methods due to demand for continuous data protection.

- Regulatory compliance will remain a core driver, especially across BFSI and healthcare sectors.

- Vendors will invest in low-latency and high-performance masking technologies.

- Partnerships between data security and cloud service providers will intensify market growth.

- Asia-Pacific will evolve as the fastest-growing region due to rapid digital transformation and regulatory reforms.