Market Overview

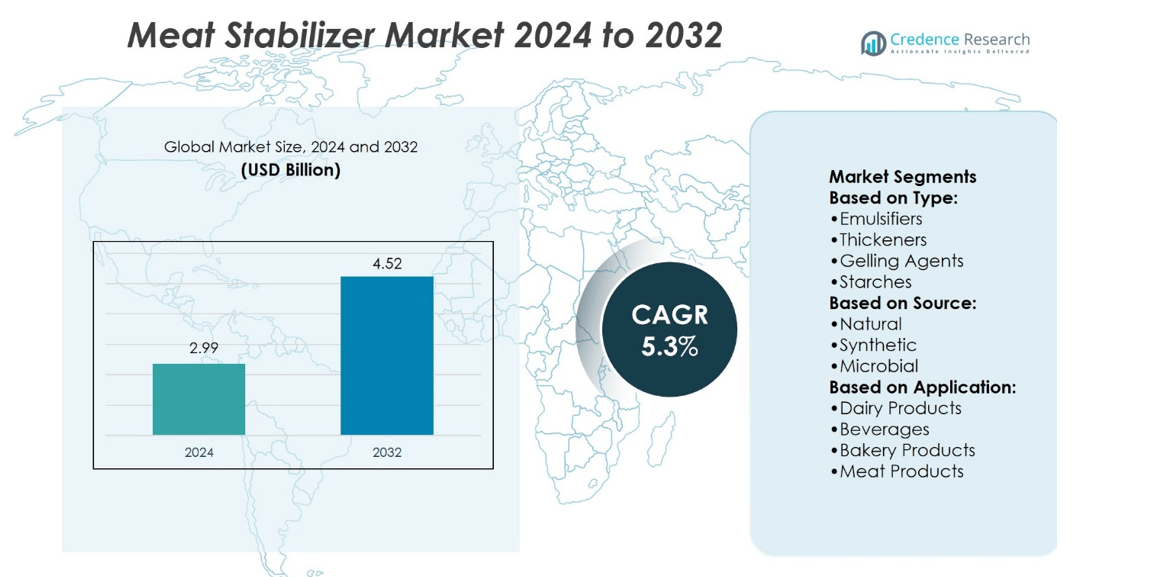

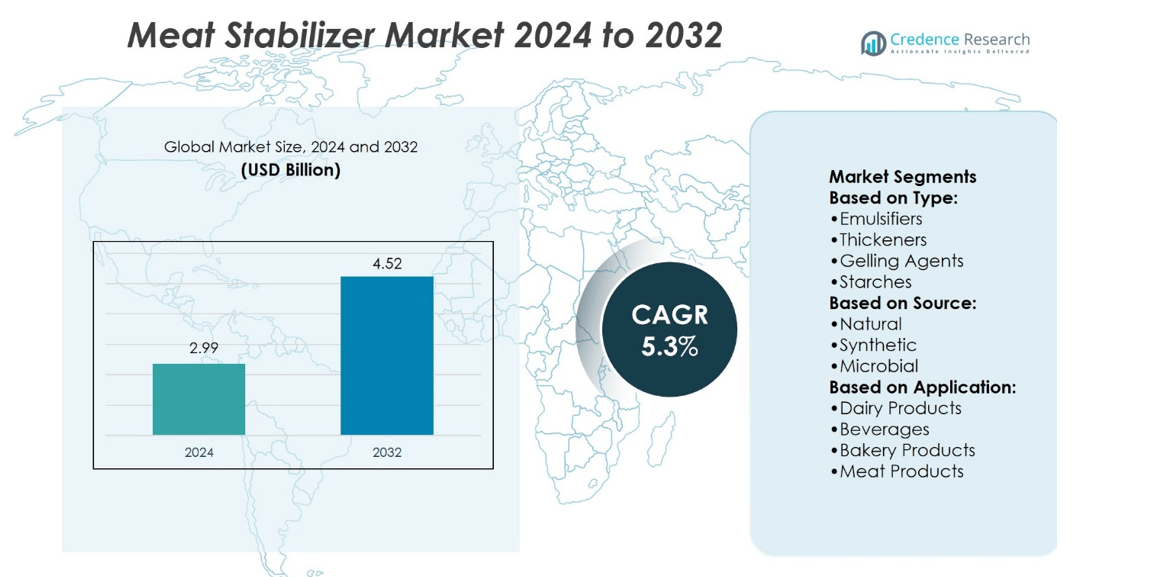

The Global Meat Stabilizer Market size was valued at USD 2.99 billion in 2024 and is anticipated to reach USD 4.52 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Meat Stabilizer Market Size 2024 |

USD 2.99 billion |

| Meat Stabilizer Market, CAGR |

5.3% |

| Meat Stabilizer Market Size 2032 |

USD 4.52 billion |

The Meat Stabilizer Market is driven by rising demand for processed and convenience foods, increasing focus on product quality, and the need to extend shelf life without compromising taste or texture. Manufacturers actively adopt stabilizers to maintain uniformity, improve water retention, and enhance product appearance. Growing health awareness fuels demand for clean-label and natural stabilizer alternatives, pushing innovation in plant-based and multifunctional formulations. Expanding global meat exports and stricter food safety regulations strengthen the market’s momentum. Industry trends highlight continuous research, sustainable sourcing, and partnerships between food ingredient suppliers and meat processors to deliver advanced, compliant, and consumer-friendly solutions.

The Meat Stabilizer Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America and Europe lead with advanced processing technologies and high consumer demand for packaged meat. Asia-Pacific is witnessing rapid growth due to rising meat consumption and urbanization. Latin America and the Middle East & Africa present emerging opportunities driven by changing dietary patterns. Key players include Ingredion, Cargill, Tate & Lyle, Kerry, BASF, and Hydrosol, focusing on innovation and global expansion.

Market Insights

- Meat Stabilizer Market size was valued at USD 2.99 billion in 2024 and is projected to reach USD 4.52 billion by 2032, growing at a CAGR of 5.3%.

- Rising demand for processed and convenience foods drives the need for stabilizers to improve texture, shelf life, and product quality.

- Growing preference for clean-label and natural ingredients fuels innovation in plant-based and multifunctional stabilizer formulations.

- Key players such as Ingredion, Cargill, Tate & Lyle, Kerry, BASF, and Hydrosol focus on innovation, partnerships, and global expansion.

- Stringent food safety regulations and high production costs act as restraints, challenging smaller players in competitive markets.

- North America and Europe dominate due to advanced processing technologies and strong packaged meat demand, while Asia-Pacific grows rapidly with rising urbanization.

- Latin America and the Middle East & Africa show emerging opportunities, supported by shifting dietary preferences and increasing adoption of processed meat products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Demand for Processed and Convenient Meat Products

The Meat Stabilizer Market gains momentum from the strong rise in consumer demand for processed and ready-to-eat meat products. It benefits from the role stabilizers play in extending shelf life, improving texture, and maintaining flavor consistency across diverse product lines. Food manufacturers depend on stabilizers to deliver uniform quality in sausages, cold cuts, and poultry-based meals. Growing urbanization and busy lifestyles push consumers toward packaged meat items, creating steady requirements for stabilizing solutions. It helps companies maintain product safety and appeal during long distribution cycles. This consumer-driven trend continues to anchor market growth globally.

- For instance, Kerry Group, a leading supplier of food stabilizers and functional ingredients, reported supplying its meat preservation and texture solutions to over 18,000 food and beverage companies globally in 2022, reflecting the widespread application of stabilizers in processed meat production.

Expanding Focus on Food Safety and Product Quality

The Meat Stabilizer Market is driven by increasing regulatory emphasis on food safety and strict quality standards. It supports manufacturers in complying with global food safety frameworks by reducing microbial risks and ensuring stability during processing. Rising consumer awareness of product integrity heightens demand for additives that improve consistency without compromising safety. It allows companies to differentiate their offerings by ensuring uniform taste, color, and texture in meat products. Stabilizers also address oxidation challenges that affect appearance and nutritional value. This alignment with regulatory and consumer expectations drives wider adoption across meat processing sectors.

- For instance, DSM-Firmenich reported that its food safety and preservation solutions, including meat stabilizers and antimicrobials, are applied in more than 45,000 food and beverage products globally each year, ensuring compliance with international quality and safety standards.

Growing Role of Technological Advancements in Food Processing

The Meat Stabilizer Market experiences growth due to ongoing technological developments in food processing and preservation. It leverages innovations in hydrocolloids, enzymes, and emulsifiers to enhance product stability and functionality. Advanced formulation techniques allow producers to use stabilizers that perform under high heat or freezing conditions. It encourages investment in research and development to meet evolving consumer preferences for healthier meat products with reduced additives. Companies adopt stabilizer blends that improve efficiency in manufacturing while lowering operational costs. This focus on technology accelerates industry innovation and expands practical applications of stabilizers.

Rising Preference for Natural and Clean Label Solutions

The Meat Stabilizer Market reflects a growing preference for natural and clean-label ingredients. It supports food companies in meeting rising consumer demand for transparency and reduced synthetic additives. Manufacturers focus on plant-based stabilizers and naturally derived solutions that align with health-conscious consumption patterns. It offers opportunities for differentiation by enabling products that balance safety, taste, and sustainability. Global brands respond by reformulating meat products to include stabilizers perceived as safer and more natural. This consumer-driven trend creates strong prospects for market expansion in both developed and emerging economies.

Market Trends

Increasing Shift Toward Clean-Label and Natural Stabilizers

The Meat Stabilizer Market shows a clear trend toward clean-label and natural ingredient adoption. It supports manufacturers in reformulating products with plant-based or naturally derived stabilizers to satisfy consumer demand for transparency. Buyers increasingly prefer meat products free from synthetic additives, preservatives, and artificial enhancers. Companies invest in natural alternatives such as carrageenan, guar gum, and pectin to align with these preferences. It creates opportunities for premium offerings in retail channels. This trend strengthens trust between brands and health-conscious consumers while maintaining product quality and safety.

- For instance, Tate & Lyle reported that it produces more than 1.7 million tonnes of plant-based ingredients annually, including clean-label stabilizers and texturizers derived from corn and other natural sources, which are increasingly used in reformulated meat and processed food products to meet consumer preference for natural labeling.

Integration of Advanced Stabilizer Blends for Efficiency

The Meat Stabilizer Market benefits from the integration of multifunctional stabilizer blends designed for efficiency in processing. It enables food producers to achieve multiple functions such as texture improvement, water retention, and microbial stability through single formulations. Manufacturers adopt blends that enhance production speed while lowering costs associated with individual additives. It also reduces complexity in supply chains, making operations more streamlined. Companies increasingly use customized blends tailored to regional meat consumption patterns. This shift supports innovation and broadens the application scope across various meat categories.

- For instance, Corbion reported in 2022 that its functional ingredient portfolio, including multifunctional stabilizer blends for meat and poultry, was supplied to customers in more than 100 countries, supporting large-scale adoption of integrated solutions that improve efficiency in meat processing.

Rising Influence of Plant-Based and Hybrid Meat Products

The Meat Stabilizer Market adapts to the rising popularity of plant-based and hybrid meat alternatives. It plays a crucial role in ensuring texture, flavor, and stability in products blending animal protein with plant-based ingredients. Stabilizers provide the binding strength needed to mimic conventional meat properties. It allows producers to expand product portfolios in response to flexitarian diets and sustainability-driven preferences. Growth in this segment fuels demand for stabilizers compatible with diverse protein bases. This trend highlights the market’s adaptability to evolving consumer habits.

Adoption of Sustainable and Functional Food Ingredients

The Meat Stabilizer Market demonstrates a trend toward sustainable and functional ingredients that go beyond basic stabilization. It supports the inclusion of stabilizers with added nutritional or health-related benefits, such as fiber enrichment or sodium reduction. Food manufacturers adopt solutions that align with environmental sustainability by sourcing renewable raw materials. It enhances brand positioning by reflecting corporate responsibility goals and consumer environmental awareness. Companies focus on reducing carbon footprints through eco-friendly formulations and packaging. This shift advances both sustainability and functionality in the global meat sector.

Market Challenges Analysis

Regulatory Pressures and Compliance Constraints

The Meat Stabilizer Market faces significant challenges from evolving regulatory frameworks and stringent food safety standards. It requires manufacturers to constantly reformulate products to meet compliance with regional and international guidelines. Regulatory bodies enforce strict scrutiny of stabilizer ingredients, creating barriers for synthetic additives and artificial compounds. It raises costs for producers who must invest in research and testing to secure approvals. Consumer advocacy groups further push for clean-label declarations, adding pressure on companies to maintain transparency. This constant regulatory shift makes long-term planning and product consistency more complex for the industry.

Rising Raw Material Costs and Consumer Perception Barriers

The Meat Stabilizer Market encounters difficulties linked to fluctuating raw material prices and negative consumer perceptions. It depends heavily on agricultural commodities and natural extracts, making stabilizer pricing vulnerable to supply disruptions and climatic uncertainties. Higher costs reduce margins for manufacturers and increase challenges in maintaining competitive pricing. Consumer skepticism toward chemical-sounding stabilizers limits acceptance, even when they are safe and approved. It compels companies to invest in marketing strategies to build trust and reposition stabilizers as functional and beneficial. These factors collectively restrict broader adoption and hinder expansion in price-sensitive regions.

Market Opportunities

Expansion in Functional and Value-Added Meat Products

The Meat Stabilizer Market presents strong opportunities through the rising demand for functional and value-added meat products. It enables producers to innovate by incorporating stabilizers that improve texture, extend shelf life, and enhance nutritional appeal. Growing consumer interest in fortified meat items with reduced sodium, higher protein, or added fiber creates space for specialized stabilizer solutions. It allows brands to differentiate and command premium pricing in competitive markets. The opportunity extends to processed categories such as sausages, ready-to-eat meals, and cold cuts where quality consistency is critical. Companies that align stabilizer development with health-focused innovation stand to capture significant growth potential.

Growth Potential in Emerging Economies and Plant-Based Expansion

The Meat Stabilizer Market benefits from rising meat consumption in emerging economies and the parallel growth of plant-based alternatives. It supports manufacturers in Asia-Pacific, Latin America, and the Middle East where demand for packaged and processed meat continues to accelerate. Expanding retail infrastructure and urban lifestyles increase the need for stabilizers that ensure safety and durability in hot climates. It also opens avenues in plant-based and hybrid meat segments that require stabilizers for texture and binding. Local producers seek affordable, scalable solutions that balance cost efficiency with product quality. These developments create robust opportunities for global and regional suppliers alike.

Market Segmentation Analysis:

By Type

The Meat Stabilizer Market is segmented by type into emulsifiers, thickeners, gelling agents, starches, and texturizers. Emulsifiers dominate usage due to their ability to maintain uniform texture and prevent fat separation in processed meats. It plays a critical role in sausages, cold cuts, and ready-to-eat meals where product consistency is essential. Thickeners and starches are gaining traction in value-added products, offering moisture retention and structural stability during processing. Gelling agents and texturizers serve niche segments, especially in premium products that demand specific mouthfeel or enhanced binding strength. The diversity of functions across these categories ensures broad adoption in meat processing and packaged food industries.

- For instance, CP Kelco completed an expansion in 2024 at its Matão, Brazil facility to produce approximately 5,000 tonnes of citrus fiber annually, which serves as a natural, label-friendly stabilizer and texturizer derived from upcycled citrus peels.

By Source

The Meat Stabilizer Market by source includes natural, synthetic, and microbial stabilizers. Natural stabilizers such as carrageenan, guar gum, and pectin are increasingly preferred due to consumer demand for clean-label and plant-based solutions. It drives reformulation efforts by producers who want to replace chemical-sounding additives with transparent alternatives. Synthetic stabilizers remain relevant for cost-sensitive markets, offering reliable performance at scale. Microbial-derived stabilizers provide innovation opportunities, particularly in enhancing fermentation-based products. Regional regulatory variations influence adoption, but natural stabilizers continue to capture stronger attention globally. This source-based segmentation reflects both functional needs and consumer-driven preferences.

- For instance, Nexira (France) is a global leader in acacia gum production, with an annual capacity of over 35,000 metric tons, much of which is supplied to meat and processed food manufacturers as a natural stabilizer to improve texture and extend product stability.

By Application

The Meat Stabilizer Market by application extends beyond meat products to dairy, beverages, bakery, and sauces and dressings. Meat products represent the largest share, as stabilizers ensure binding, texture, and extended shelf life in diverse categories from poultry to beef. It ensures safety, taste, and appearance in processed foods distributed across global retail networks. Dairy applications use stabilizers to maintain creaminess and prevent phase separation, while bakery products rely on them for softness and freshness. Beverages utilize stabilizers to preserve consistency in juices and protein drinks. Sauces and dressings apply stabilizers for viscosity control and long-term stability. The wide scope of applications underlines the essential role of stabilizers across the food and beverage industry.

Segments:

Based on Type:

- Emulsifiers

- Thickeners

- Gelling Agents

- Starches

Based on Source:

- Natural

- Synthetic

- Microbial

Based on Application:

- Dairy Products

- Beverages

- Bakery Products

- Meat Products

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Meat Stabilizer Market at around 38.5% in 2024. The United States contributes the majority, supported by its advanced meat processing sector and strong consumer preference for packaged and ready-to-eat meat products. It benefits from stringent food safety standards that encourage the use of stabilizers to improve quality, extend shelf life, and ensure consistency. Canada and Mexico add to the regional demand through expanding retail channels and rising convenience food consumption. Food manufacturers continue to invest in research to meet clean-label and natural ingredient demand. It remains the most mature market with steady growth potential driven by innovation and consumer trust.

Europe

Europe represents the third-largest regional share of the Meat Stabilizer Market at nearly 25% in 2024. Germany, France, and the UK lead demand due to strong consumer focus on product quality, safety, and natural formulations. It reflects high adoption of plant-based stabilizers such as carrageenan, guar gum, and pectin, aligned with health-conscious and sustainability-driven preferences. The European Union’s strict regulations push producers to maintain transparency and clean-label claims. Growth is also supported by premium meat categories and strong retail distribution networks. It continues to present opportunities for innovation in natural blends and functional stabilizers.

Asia-Pacific

Asia-Pacific holds the second-largest share of the Meat Stabilizer Market at about 27% in 2024 and stands out as the fastest-growing region. China, India, and Japan dominate demand, driven by rising disposable incomes, urbanization, and higher consumption of processed meat products. It benefits from government initiatives promoting food safety and investment in modern processing facilities. Expanding retail and e-commerce channels increase consumer access to packaged food, strengthening stabilizer adoption. Companies are focusing on cost-effective and scalable solutions to serve growing middle-class populations. It is positioned to gain further share as dietary patterns shift toward convenience and packaged meat.

Latin America

Latin America accounts for around 6% of the Meat Stabilizer Market in 2024. Brazil and Argentina lead consumption, supported by strong meat production industries and rising urban lifestyles. It shows growing demand for processed meat, snacks, and ready-to-eat items that require stabilizers for texture and preservation. Regional producers focus on affordable stabilizer solutions to cater to cost-sensitive markets. Multinational players are expanding operations in the region to capitalize on this emerging demand. It demonstrates promising opportunities for long-term growth through modernization of the food sector.

Middle East & Africa

The Middle East & Africa holds the smallest share at nearly 3.5% of the Meat Stabilizer Market in 2024. The region is gradually adopting stabilizers as meat consumption rises in urban areas and modern retail formats expand. It faces challenges from limited cold-chain infrastructure but continues to develop with increased demand for safe, packaged food. Gulf countries such as Saudi Arabia and the UAE represent stronger demand, supported by growing food imports and processing industries. Africa shows gradual uptake, mainly in South Africa, where retail channels are better established. It remains a developing market with significant potential in the coming decade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kerry (Ireland)

- BASF (Germany)

- ADM (US)

- Hydrosol (Germany)

- Tate & Lyle (UK)

- Ashland (US)

- Cargill (US)

- Nexira (France)

- CP Kelco (US)

- DowDuPont (US)

Competitive Analysis

The Meat Stabilizer Market players include Ingredion (US), Hydrosol (Germany), Palsgaard (Denmark), ADM (US), CP Kelco (US), Tate & Lyle (UK), Cargill (US), DowDuPont (US), Nexira (France), Kerry (Ireland), Ashland (US), and BASF (Germany). The Meat Stabilizer Market reflects an intensely competitive environment shaped by innovation, sustainability goals, and shifting consumer preferences. Companies focus on expanding clean-label and natural stabilizer portfolios to meet rising demand for transparency and health-oriented formulations. It shows increasing emphasis on research and development to create multifunctional blends that improve texture, extend shelf life, and enhance product safety. Firms also strengthen competitiveness through strategic partnerships with meat processors, expansion into emerging markets, and investment in advanced processing technologies. Sustainability initiatives, including the use of renewable raw materials and reduced environmental impact, play a growing role in brand differentiation. The landscape continues to evolve as manufacturers balance performance, cost efficiency, and regulatory compliance while capturing growth opportunities worldwide.

Recent Developments

- In May 2025, Austrade Inc. introduced a non-GMO hydrolyzed sunflower lecithin powder designed for functional beverage production. The manufacturing process involves enzymatic hydrolysis combined with concentration technology.

- In July 2024, Nestle launched Maggi Rindecarne which is a plant-based meat extender combining soy and spices. The product is currently available in Chile.

- In April 2024, Nasoya, a pioneer in the plant-based foods revolution, expanded into the new plant-based meat category with the launch of Plantspired Plant-Based Chick’n. The new product is available in two flavors: Bee-Free Honey and Kung-Pao.

- In April 2023, Lypid Taiwan Co., Ltd., a Taiwan-based plant-based meat company, launched a new plant-based, vegan pork belly product. The new product is made from 100% plant-based ingredients and has a smoky and juicy flavor mimicking real meat.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for meat stabilizers will grow as processed meat products gain popularity among urban consumers.

- Rising consumption of convenience foods will support higher use of stabilizers for texture and shelf-life improvement.

- Clean-label and natural ingredient trends will push manufacturers to develop plant-based stabilizer solutions.

- Technological advancements in food science will enhance multifunctional stabilizers that improve taste and appearance.

- Expanding fast-food and quick-service restaurant chains will create consistent demand for meat stabilizer applications.

- Increasing global meat exports will drive the adoption of stabilizers for preservation and safety during long transit.

- Stringent food safety regulations will encourage innovation in stabilizers that meet compliance requirements.

- Growth in emerging economies will expand the market as meat consumption patterns shift toward packaged products.

- Strategic collaborations between stabilizer producers and meat processors will strengthen product development pipelines.

- Sustainability initiatives will lead to greater focus on stabilizers derived from eco-friendly and renewable sources.