Market Overview

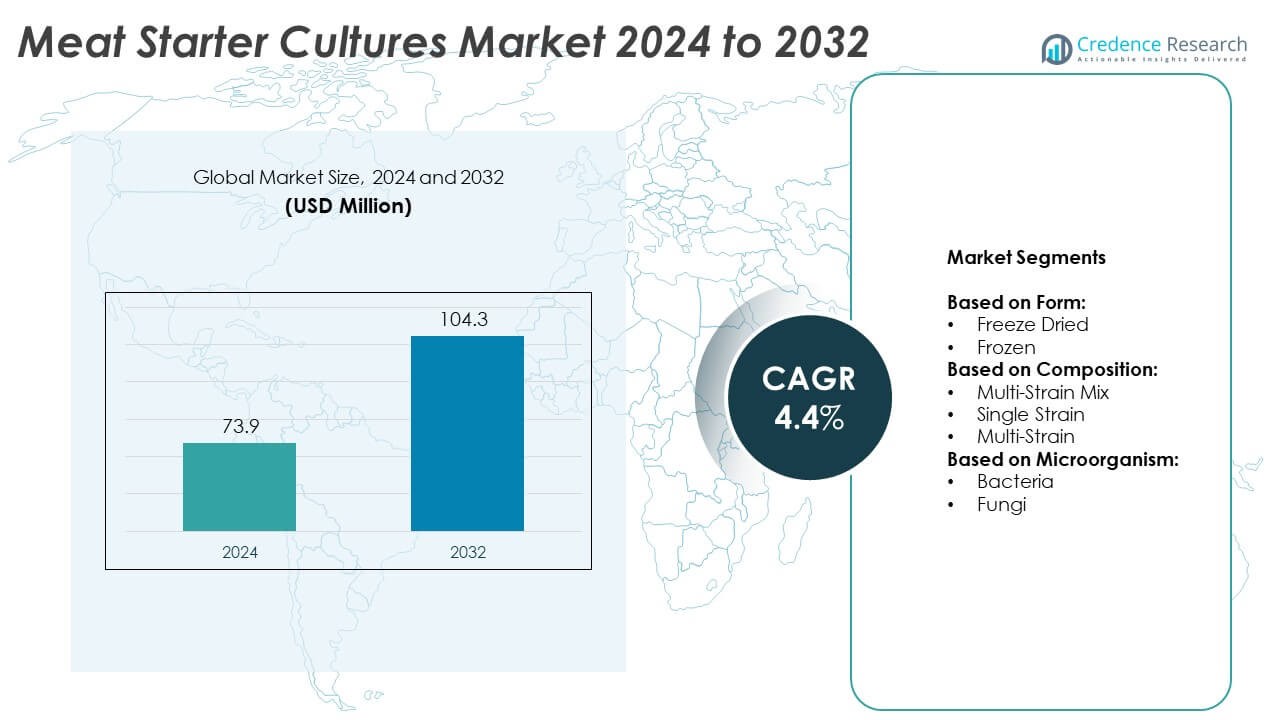

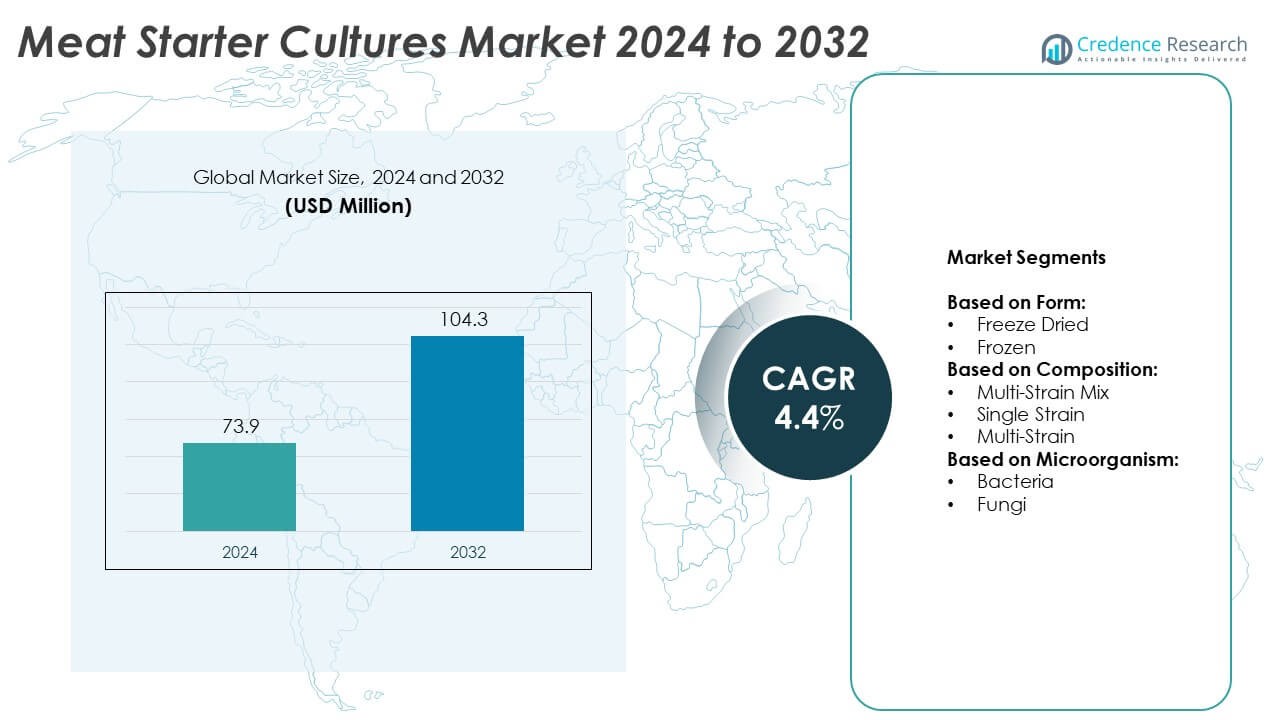

Meat Starter Cultures Market size was valued at USD 73.9 million in 2024 and is anticipated to reach USD 104.3 million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Meat Starter Cultures Market Size 2024 |

USD 73.9 Million |

| Meat Starter Cultures Market, CAGR |

4.4% |

| Meat Starter Cultures Market Size 2032 |

USD 104.3 Million |

The Meat Starter Cultures market grows through rising demand for processed and ready-to-eat meat, supported by technological advancements in fermentation and preservation techniques. Consumers favor clean-label and natural solutions, pushing manufacturers to develop additive-free cultures that enhance safety, flavor, and shelf life. It benefits from increasing use in sausages, salami, and specialty meat products, while automation and bioengineered strains improve efficiency and consistency. Expanding demand for artisanal and regional offerings further drives innovation and strengthens global market opportunities.

Meat Starter Cultures Market shows strong regional growth patterns, with Europe leading through established traditions of fermented meat production and strict regulatory standards. North America advances with technological adoption in processing, while Asia-Pacific grows rapidly due to urbanization and shifting diets. Latin America and the Middle East & Africa offer rising opportunities with expanding infrastructure and evolving food preferences. Key players such as Novozymes A/S, DuPont, dsm-firmenich, and Biochem S.r.l. strengthen their presence through innovation, tailored formulations, and global partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Meat Starter Cultures market was valued at USD 73.9 million in 2024 and is projected to reach USD 104.3 million by 2032, growing at a CAGR of 4.4% during the forecast period.

- Rising demand for processed and ready-to-eat meat products, coupled with advancements in fermentation technologies, drives steady market growth globally.

- Increasing preference for clean-label and natural starter culture solutions fuels innovation in microbial strain development and bioengineered formulations.

- The market is moderately concentrated, with leading players like Novozymes A/S, DuPont, dsm-firmenich, LB Bulgaricum, and Biochem S.r.l. focusing on research, partnerships, and regional expansion.

- High production costs, complex regulatory compliance, and limited awareness among small-scale meat processors act as key restraints impacting market adoption.

- Europe leads the market due to strong traditions of fermented meat products and stringent quality regulations, while North America and Asia-Pacific witness growing adoption supported by technological advancements and changing consumer preferences.

- Emerging economies in Latin America and the Middle East & Africa present untapped opportunities, supported by evolving food habits, rising disposable incomes, and increased investments in modern meat processing infrastructure.

Market Drivers

Rising Demand for Processed and Ready-to-Eat Meat Products

The Meat Starter Cultures market benefits from the increasing global consumption of processed and ready-to-eat meat products. Consumers seek convenient, protein-rich options that maintain consistent taste, texture, and quality. Starter cultures help enhance flavor, extend shelf life, and ensure product safety, making them essential for large-scale production. It drives higher adoption among manufacturers aiming to meet growing consumer expectations. Demand from quick-service restaurants and packaged food sectors strengthens the market presence. Changing dietary habits and urban lifestyles continue to support this steady rise in consumption.

- For instance, in a controlled fermentation test of mealworm paste using six commercial starter cultures, the pH dropped from 6.68 to between 4.60 and 4.95 within 72 hours, showcasing reliable acidification performance of starter blends

Technological Advancements in Fermentation and Preservation Techniques

The market gains momentum from advancements in fermentation technologies and precision-driven starter culture formulations. Innovations in bacterial strain development improve flavor profiles, accelerate production cycles, and enhance preservation capabilities. It enables manufacturers to produce safe, high-quality meat products while meeting regulatory standards. Companies invest in automation and bioengineering solutions to optimize culture performance. Adoption of advanced preservation methods reduces spoilage risks and ensures product consistency. These developments expand opportunities for premium and specialty meat categories.

- For instance, in a sausage fermentation study, the initial inoculation of mixed starter cultures was 10⁷ CFU per gram of meat, followed by a 24-hour fermentation at 30 °C and 80% RH, and then nine days of ripening at 15 °C and 60% RH

Increasing Focus on Food Safety and Quality Standards

Strict food safety regulations and rising awareness of contamination risks drive the adoption of starter cultures in meat production. These cultures inhibit harmful microorganisms while supporting predictable fermentation outcomes. It ensures compliance with global quality standards and enhances consumer trust in packaged meat products. Regulatory bodies emphasize controlled fermentation processes to improve safety and traceability. Manufacturers prioritize certified and standardized starter culture solutions to maintain quality benchmarks. Growing demand for clean-label, additive-free meat products also strengthens this trend.

Expanding Applications Across Diverse Meat Processing Segments

Starter cultures find growing applications across processed meat segments, including sausages, salami, dry-cured products, and fermented specialties. It supports efficient production while improving texture, aroma, and color stability. Manufacturers utilize customized culture blends to achieve unique regional taste preferences. The increasing popularity of ethnic and artisanal meat products boosts market opportunities. High adoption in both small-scale specialty processing and industrial production underpins steady growth. Continuous innovation in formulations aligns with evolving consumer expectations for quality and variety.

Market Trends

Growing Adoption of Bioengineered and High-Performance Starter Cultures

The Meat Starter Cultures market observes rising demand for bioengineered strains that deliver improved efficiency and product consistency. Manufacturers focus on developing high-performance cultures to enhance fermentation speed, flavor control, and shelf-life stability. It supports large-scale production where precision and quality remain critical. Advanced strain combinations enable consistent texture and superior taste across diverse meat products. Investments in research and biotechnology allow companies to create starter cultures tailored for specific applications. This trend strengthens the competitiveness of producers in global markets.

- For instance, probiotic lactic acid bacteria such as L. acidophilus, L. casei, and L. rhamnosus have been incorporated into salami formulations at daily intake rates of 30–50 grams, demonstrating feasibility in functional meat product development

Shift Toward Clean-Label and Natural Starter Culture Solutions

Consumer preference for clean-label and naturally derived food ingredients drives innovation in the market. Manufacturers increasingly develop starter cultures free from synthetic additives and chemical preservatives. It supports growing demand for minimally processed, healthier meat options. Companies focus on meeting regulatory guidelines while ensuring product safety and quality. Natural cultures enhance brand value for producers targeting health-conscious consumers. The shift toward transparency in ingredient sourcing further amplifies this trend globally.

- For instance, in a raw sausage fermentation study, starter cultures were applied at an inoculation level of 10⁶–10⁷ CFU per gram of meat, ensuring reliable fermentation performance

Rising Integration of Automation and Digital Fermentation Technologies

Automation and digital tools transform starter culture production and fermentation monitoring processes. The Meat Starter Cultures market benefits from advanced data-driven systems that optimize strain performance and quality control. It enables real-time tracking of pH levels, temperature, and fermentation cycles. Automated solutions reduce production errors and minimize manual intervention in complex processes. Manufacturers deploy AI-driven platforms to enhance consistency and scalability. The adoption of such smart technologies accelerates operational efficiency across production facilities.

Increasing Popularity of Specialty and Regional Meat Products

Starter cultures play a central role in developing distinctive flavors and textures for specialty and regional meat products. It supports the demand for authentic and premium offerings in both local and international markets. Producers experiment with customized cultures to cater to evolving consumer preferences. Growth in gourmet, ethnic, and artisanal meat categories drives innovation in tailored formulations. Expanding availability of culture blends for dry-cured and fermented meats strengthens product diversity. This trend opens opportunities for small-scale and large-scale manufacturers alike.

Market Challenges Analysis

Stringent Regulatory Standards and Compliance Complexities

The Meat Starter Cultures market faces significant challenges due to strict regulatory frameworks across different regions. Manufacturers must comply with varying food safety laws, labeling requirements, and ingredient approvals, which increase operational complexity. It becomes critical to maintain consistent quality and ensure traceability throughout the production process. Delays in regulatory approvals slow down product launches and limit market expansion opportunities. Companies invest heavily in testing and certification to meet evolving global standards. These compliance demands create financial and technical burdens, especially for small and mid-sized producers aiming to compete with established players.

High Production Costs and Limited Awareness Among Small-Scale Processors

Rising costs associated with research, advanced fermentation technologies, and specialized strain development pose challenges for manufacturers. The Meat Starter Cultures market requires significant investment in innovation to deliver high-performance and clean-label solutions. It impacts pricing strategies, making premium starter cultures less accessible to smaller processors. Many local meat producers lack awareness of the benefits of starter cultures, leading to slower adoption in emerging economies. Limited technical expertise in fermentation management further restricts market penetration. Addressing cost optimization and education gaps remains essential for sustaining wider industry growth.

Market Opportunities

Expansion of Clean-Label and Functional Meat Product Segments

The Meat Starter Cultures market presents strong opportunities through the rising demand for clean-label and functional meat products. Consumers increasingly prefer natural ingredients, minimal processing, and healthier formulations. It drives manufacturers to develop innovative starter cultures that support additive-free and preservative-free solutions. Functional cultures offering enhanced probiotic properties and improved nutritional value open new growth avenues. Companies investing in bioengineered solutions tailored to health-conscious preferences strengthen their competitive edge. This shift supports the expansion of premium and value-added meat categories globally.

Growing Demand in Emerging Economies and Specialty Meat Markets

Rapid urbanization, rising disposable incomes, and evolving dietary habits in developing regions create new opportunities for market growth. The Meat Starter Cultures market benefits from increasing adoption of processed and fermented meats in Asia-Pacific, Latin America, and the Middle East. It enables manufacturers to tap into underserved segments and introduce culture-based solutions that align with regional taste preferences. Rising popularity of artisanal, ethnic, and gourmet meat products further fuels demand for customized formulations. Strategic partnerships with local producers enhance market penetration and brand positioning. These trends strengthen the potential for wider global reach and product diversification.

Market Segmentation Analysis:

By Form:

The Meat Starter Cultures market divides into freeze-dried and frozen forms. Freeze-dried cultures dominate due to longer shelf life, easy transport, and reliable stability. Frozen cultures hold strong presence where higher viability and freshness are required. It shows clear demand segmentation between convenience-driven and performance-focused buyers. Producers continue refining both formats to match evolving processing requirements. The balance between shelf stability and activity defines this category’s growth.

- For instance, Italian salami production processes involved initial LAB inoculation levels of approximately 5.5 log CFU/g, and coagulase-negative staphylococci (CNS) levels of about 5.7 log CFU/g in the meat mixture before fermentation

By Composition:

The market includes multi-strain mix, single strain, and multi-strain types. Multi-strain mix gains preference in industrial use for its ability to ensure consistent fermentation and flavor development. Single strain is chosen where specific texture or safety attributes are required. Multi-strain formats lead in premium applications due to versatility and broad functionality. It reflects how producers align product composition with end-user needs. Each composition type supports product innovation in meat processing. This structure enhances value creation across varied applications.

- For instance, in Ventricina salami production, the internal pH dropped from 5.70 to about 4.75 over approximately 13 days, reflecting active starter culture fermentation

By Microorganism:

It includes bacteria and fungi. Bacteria dominate due to their critical role in controlling fermentation, improving shelf life, and ensuring safety. Fungi maintain niche use where unique flavor profiles or surface ripening are essential. It highlights the technical role of microbial selection in shaping meat quality. Producers expand research in both categories to strengthen market offerings. The Luxury Handbags market demonstrates a similar pattern, where consumer preferences and functional requirements shape segmental growth. This approach underlines how specific categories define overall market performance.

Segments:

Based on Form:

Based on Composition:

- Multi-Strain Mix

- Single Strain

- Multi-Strain

Based on Microorganism:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant position in the Meat Starter Cultures market, accounting for 32% of the global share in 2024. The region’s dominance is driven by high demand for processed and ready-to-eat meat products, supported by strong consumer preference for convenient and premium food options. It benefits from advanced technological adoption and a well-established meat processing industry. Strict regulatory standards from agencies such as the USDA and FDA encourage the use of controlled starter cultures to ensure food safety and product quality. Major manufacturers in the U.S. and Canada invest heavily in R&D to develop innovative solutions focused on clean-label, natural, and functional starter cultures. Rising health awareness and growing demand for protein-rich diets further strengthen market growth in this region.

Europe

Europe represents the largest share in the Meat Starter Cultures market, contributing 38% of the overall revenue in 2024. The region’s leadership stems from strong traditions of fermented meat products, including salami, sausages, and dry-cured specialties. It benefits from stringent food safety regulations set by the European Food Safety Authority (EFSA), which accelerate the adoption of high-quality starter cultures for controlled fermentation. Leading countries such as Germany, Italy, France, and Spain dominate production due to well-established meat processing facilities and advanced research infrastructure. Demand for natural, additive-free, and clean-label products fuels innovation in starter culture development. European companies lead in developing bioengineered strains and customized formulations catering to diverse taste preferences and regional specialties.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the Meat Starter Cultures market, holding 20% of the global share in 2024. Rising population, rapid urbanization, and evolving dietary habits drive the demand for processed meat and value-added products. It benefits from increasing investments in modern meat processing facilities and expanding retail distribution networks. Countries like China, Japan, India, and South Korea emerge as high-potential markets due to their growing middle-class populations and preference for convenient, protein-rich foods. Local manufacturers collaborate with international players to introduce innovative starter culture solutions tailored to regional cuisines and flavor profiles. Growing awareness of food safety standards and technological adoption further support market expansion in this region.

Latin America

Latin America captures 6% of the Meat Starter Cultures market share in 2024, driven by the rising consumption of processed meats across Brazil, Argentina, and Mexico. Economic development and increasing investments in modern meat processing infrastructure boost the demand for advanced starter culture solutions. It benefits from a growing preference for packaged, fermented, and premium meat products. International companies are strengthening their presence through partnerships with local producers to improve accessibility and product quality. Expanding consumer awareness regarding food safety and quality standards supports steady growth across the region.

Middle East & Africa

The Middle East & Africa region accounts for 4% of the Meat Starter Cultures market share in 2024, driven by gradual adoption of processed and packaged meat products. It experiences growing demand from countries like Saudi Arabia, the UAE, and South Africa, where rising disposable incomes influence consumption patterns. Expansion of cold chain logistics and improved retail channels enhance market penetration. International and regional players invest in capacity-building initiatives to meet diverse consumer preferences and strengthen product availability. Increasing focus on food safety regulations and advanced processing technologies supports the steady development of this emerging market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DuPont (U.S.)

- BIOPROX (France)

- Novozymes A/S (Denmark)

- Dalton Biotecnologie S.r.l. (Italy)

- LB Bulgaricum (Bulgaria)

- dsm-firmenich (Netherlands)

- Igea Srl (Italy)

- Biochem S.r.l. (Italy)

- Genesis Laboratories LTD (U.K.)

- Mediterranea Biotecnologie Srl (Italy)

Competitive Analysis

Novozymes A/S (Denmark), DuPont (U.S.), dsm-firmenich (Netherlands), LB Bulgaricum (Bulgaria), Biochem S.r.l. (Italy), Dalton Biotecnologie S.r.l. (Italy), Mediterranea Biotecnologie Srl (Italy), Igea Srl (Italy), Genesis Laboratories LTD (U.K.), BIOPROX (France)The Meat Starter Cultures market demonstrates an increasingly competitive landscape with key players focusing on innovation, product diversification, and regional expansion. These companies emphasize the development of advanced microbial strains to enhance product quality, improve fermentation efficiency, and meet growing clean-label demands. It drives significant investments in R&D to create high-performance and customized solutions for various meat applications. These Companies leverage their strong technological capabilities and global presence to dominate large-scale meat processing solutions. It strengthens their ability to serve multinational manufacturers seeking reliability and regulatory compliance. These Companies focuses on innovation in bioengineered starter cultures designed for natural, additive-free products, enabling companies to meet evolving consumer expectations. European-based players specialize in regionally tailored formulations, supporting traditional meat processing practices while expanding into emerging markets. It allows them to cater to diverse taste profiles and cultural preferences effectively. They enhance their competitiveness by delivering premium solutions for artisanal and specialty meat categories, focusing on safety and quality consistency. The competitive environment underscores the importance of continuous innovation, advanced strain development, and collaboration with meat processors to strengthen market positioning and capture emerging growth opportunities.

Recent Developments

- In February 2024, Novozymes completed its merger with Chr. Hansen and officially formed the new biosolutions company Novonesis

- In 2024, Lallemand Specialty Cultures announced its commitment to the Cocagne project, an innovative research and development initiative led by Bel Group, aiming to revolutionize the plant-based food market by developing fermented and ripened plant-based cheese alternatives.

- In Sept, 2023, DSM-Firmenich launched Delvo®Fresh starter cultures, designed to provide impressive pH stability throughout the production of indulgent mild yogurt and its shelf life.

Report Coverage

The research report offers an in-depth analysis based on Form, Composition, Microorganism and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Companies increasingly adopt advanced microbial strains focused on safety, flavor, and shelf‑life improvements.

- Industry stakeholders invest in clean‑label and natural starter culture solutions to meet evolving consumer demands.

- Developers integrate biotechnology innovations to tailor starter cultures for diverse regional and artisanal meat products.

- Manufacturers incorporate digital tools and data analytics to optimize fermentation processes and ensure consistency.

- Supply chains strengthen traceability systems to support transparency and compliance with global food safety standards.

- Small‑scale processors gain access to cost‑effective starter culture options through targeted market offerings.

- Collaborations between research institutions and industry players push technical advancements and strain optimization.

- Regulatory alignment across key markets simplifies approval processes and facilitates global product launches.

- Expanding demand in emerging markets drives customization of culture blends suited to local taste profiles.

- Market entrants focus on niche segments, such as probiotic‑enhanced or functional meat products, to differentiate and grow.