Market Overview

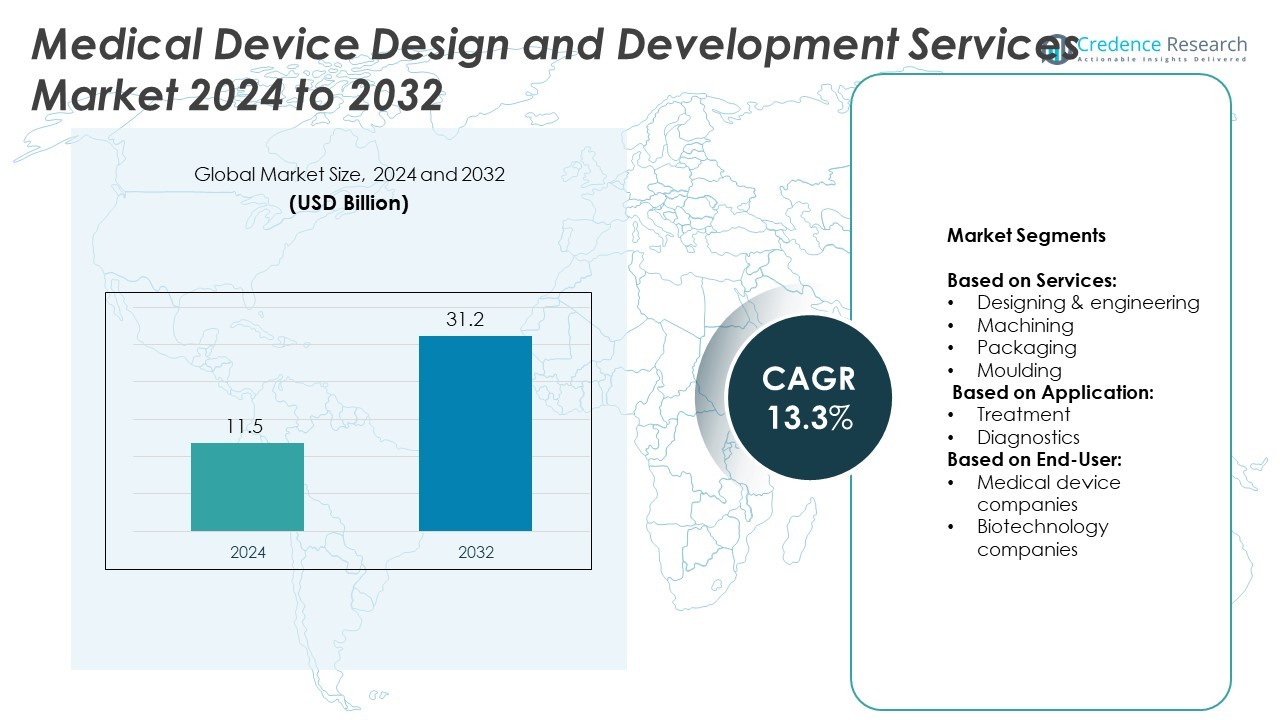

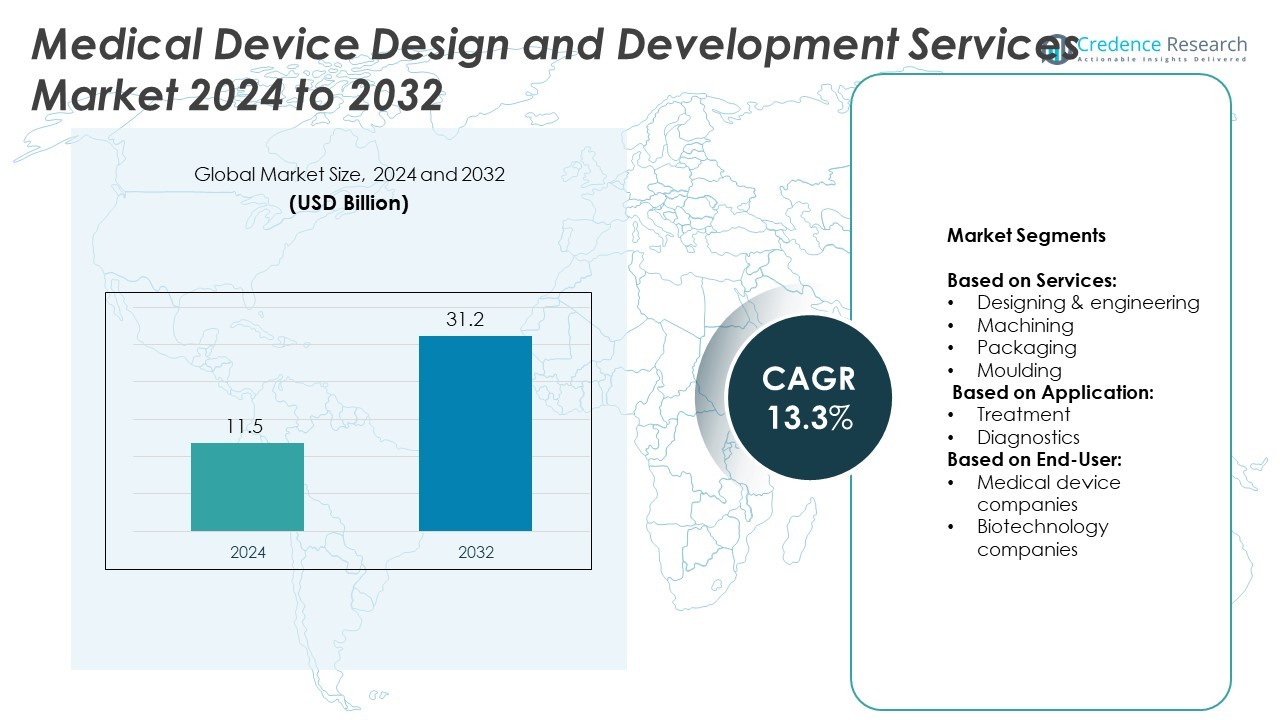

Medical Device Design and Development Services market size was valued at USD 11.5 billion in 2024 and is anticipated to reach USD 31.2 billion by 2032, at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Device Design and Development Services Market Size 2024 |

USD 11.5 Billion |

| Medical Device Design and Development Services Market, CAGR |

13.3% |

| Medical Device Design and Development Services Market Size 2032 |

USD 31.2 Billion |

The Medical Device Design and Development Services market is driven by rising demand for advanced, user-centric devices, growing regulatory complexity, and increased outsourcing by OEMs and startups. Companies seek faster time-to-market, cost efficiency, and compliance support, fueling service provider demand. Key trends include the adoption of digital engineering tools, human-centered design, and eco-friendly product strategies. Wearable technologies and personalized healthcare devices also boost innovation, making full-cycle design services a critical part of modern medtech development.

North America leads the Medical Device Design and Development Services market due to strong healthcare infrastructure and high R&D activity. Europe follows with strict regulatory standards and growing demand for quality-compliant devices. Asia-Pacific shows rapid growth driven by manufacturing expansion and rising healthcare investments. Latin America and the Middle East & Africa show steady potential through local development and regional partnerships. Key players active across these regions include Jabil, Integer Holdings Corporation, Cambridge Design Partnership, and Celestica.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medical Device Design and Development Services market was valued at USD 11.5 billion in 2024 and is projected to reach USD 31.2 billion by 2032, growing at a CAGR of 13.3%.

- Demand is rising due to the push for advanced, patient-focused devices and the need for regulatory compliance support.

- Key trends include adoption of digital simulation tools, sustainability in design, and development of wearable and connected medical technologies.

- Market competition is shaped by full-service providers offering rapid prototyping, regulatory expertise, and scalable production solutions.

- Challenges include navigating complex global regulatory environments and the high cost of design services for startups and smaller firms.

- North America leads in innovation and infrastructure, while Europe emphasizes quality compliance; Asia-Pacific grows fast through local production and healthcare expansion.

- Players like Jabil, Celestica, Cambridge Design Partnership, and Integer Holdings strengthen the market with integrated design and development capabilities.

Market Drivers

Rising Demand for Advanced Medical Technologies and Devices

The growing need for innovative diagnostic and therapeutic devices drives demand for design and development services. Healthcare systems are adopting minimally invasive tools, wearables, and AI-integrated systems to enhance patient outcomes. Companies seek expert partners to help speed up product development and reduce risk. This shift benefits service providers offering design, prototyping, and engineering support. The Medical Device Design and Development Services market gains traction from this strong focus on tech-driven healthcare solutions. It supports product pipelines from ideation to market entry. This trend is expected to sustain growth across all medical device categories.

- For instance, Flex, a global manufacturing and technology partner, has collaborated with numerous health and medical companies to help manufacture over 25 connected health devices. These include biosensors and drug-delivery wearables, which are sometimes integrated with mobile telemetry apps developed by their clients.

Stringent Regulatory Compliance and Quality Requirements

Medical device manufacturers face complex regulations across global markets. Regulatory agencies such as the FDA and EMA demand high levels of documentation, safety testing, and validation. These compliance needs push companies to outsource services to experts in regulatory science and product testing. Service providers help ensure faster approval timelines and reduce costly redesigns. The Medical Device Design and Development Services market benefits from this push for quality and traceability. It positions service firms as strategic partners rather than just technical vendors. Their role is critical in meeting evolving global standards.

- For instance, Carbon has developed certified resins like Medical Polyurethane 100 (MPU 100) for use in 3D-printed medical devices. This resin has been tested for biocompatibility and is durable, allowing it to withstand sterilization using methods such as ethylene oxide, e-beam, and gamma irradiation.

Increasing Outsourcing by OEMs and Startups Alike

Original equipment manufacturers and medtech startups increasingly rely on external partners to handle design and development phases. Startups often lack in-house expertise, while large OEMs seek to reduce internal R&D costs. This dynamic drives consistent demand for full-cycle development solutions including industrial design, prototyping, and usability engineering. The Medical Device Design and Development Services market expands as firms specialize in scalable, efficient support models. It creates a flexible and cost-effective way for device developers to bring innovations to market. Growth in startup funding and venture capital also supports this outsourcing trend.

Growing Importance of User-Centered and Value-Based Design

Healthcare providers emphasize improved usability and clinical value in selecting devices. Designers now focus on ergonomics, safety, and human factors engineering. Service firms help integrate these elements from the earliest design stages. This shift reflects a broader healthcare move toward value-based care. The Medical Device Design and Development Services market aligns with user-centered strategies to improve both outcomes and satisfaction. It ensures devices meet real-world clinical needs while reducing user error. This design focus adds long-term value to medical device innovations

Market Trends

Adoption of Digital Engineering and Simulation Tools Across Development Phases

Companies are integrating advanced software tools such as CAD, CFD, and FEA to improve product design. These digital solutions help visualize and test performance before physical prototypes are built. Simulation allows teams to detect design flaws early, cutting time and development costs. The Medical Device Design and Development Services market benefits from clients demanding precision and reduced failure rates. It supports virtual prototyping, reducing reliance on physical iteration. Digital tools also support design validation under regulatory standards. This trend is shaping how new devices reach market readiness.

- For instance, Modine used Simcenter STAR-CCM+ to cut CAD cleanup time from three days down to one is accurate and supported by a Siemens case study.

Rising Focus on Human-Centered and Inclusive Design

Medical devices now must serve diverse populations with different needs and abilities. Service providers are aligning their design strategies to meet patient-centric goals. Usability engineering, inclusive features, and feedback-based iterations play a larger role. The Medical Device Design and Development Services market advances by focusing on intuitive use and patient safety. It meets growing expectations from clinicians, patients, and caregivers. Firms specialize in research-driven design that supports both function and accessibility. This trend helps reduce usage errors and improve patient outcomes.

- For instance, RQM+ supported over 1,000 MedTech clients. RQM+ is a partner to 19 of the top 20 medical device companies.

Shift Toward Eco-Friendly and Sustainable Design Practices

Medical device companies face pressure to lower environmental impact and adopt greener manufacturing methods. Designers now consider materials, recyclability, and energy efficiency during early product planning. Regulations and hospital purchasing policies increasingly favor sustainable options. The Medical Device Design and Development Services market responds by offering services aligned with life cycle sustainability goals. It helps clients choose bio-compatible, non-toxic, and low-carbon materials. Sustainability adds value across both compliance and brand positioning. Service firms that integrate eco-friendly strategies gain a competitive edge.

Expansion of Wearables and Home-Based Monitoring Devices

Healthcare delivery is shifting toward outpatient and home care settings. This drives demand for wearable and remote monitoring devices that support real-time data collection. Service providers help design compact, durable, and connected solutions. The Medical Device Design and Development Services market adapts to this shift by focusing on wireless integration and mobile compatibility. It supports firms developing devices used outside traditional clinical settings. Market demand is high for devices that ensure comfort, accuracy, and battery life. This trend is reshaping product specifications and user experience priorities.

Market Challenges Analysis

Complex Regulatory Landscape Slows Development and Increases Risk

Navigating diverse global regulatory frameworks remains one of the toughest challenges for device developers. Each region enforces its own requirements for design validation, clinical trials, and documentation. Delays in approvals or non-compliance can lead to costly redesigns or market rejection. The Medical Device Design and Development Services market must adapt to changing guidelines from authorities like the FDA, EMA, and MDR. It requires continuous expertise in global standards and timely updates to design protocols. Service providers face growing pressure to ensure documentation and testing meet every jurisdiction’s criteria. This complexity increases timelines and resource needs during development.

High Cost and Resource Intensity Limits Entry for Smaller Players

Medical device design demands skilled professionals, expensive tools, and advanced testing facilities. Smaller companies and startups often struggle to afford full-scale development services. This limits innovation from new entrants who lack access to capital or technical teams. The Medical Device Design and Development Services market faces gaps in service affordability and customization. It must balance cost with quality to remain accessible to all segments of the industry. High R&D costs also impact pricing models and client retention. These challenges may slow growth if not addressed through scalable and flexible service models.

Market Opportunities

Growing Demand for Personalized and Connected Healthcare Devices

The rise of personalized medicine and remote care creates new opportunities in device design. Patients expect tools that match individual health needs and integrate with mobile platforms. Service providers can help develop wearable, IoT-enabled, and data-driven devices that support real-time monitoring. The Medical Device Design and Development Services market benefits by offering design capabilities tailored to connected and custom-fit products. It enables clients to bring differentiated solutions to market that improve patient engagement. Demand grows for designs that combine clinical accuracy with ease of use. This shift encourages innovation across diagnostics, therapy, and rehabilitation tools.

Expansion of Healthcare Access in Emerging Markets

Emerging economies are investing in healthcare infrastructure and expanding medical access to underserved populations. These regions seek cost-effective, durable, and user-friendly devices suited to local needs. Design service providers can support companies entering these markets by adapting products to meet regional constraints. The Medical Device Design and Development Services market sees growth through localization, frugal innovation, and support for scalable production. It allows global manufacturers to customize solutions for varied clinical settings. Opportunities arise from government-backed health programs and rising private sector involvement. These trends open new channels for growth in both design complexity and volume.

Market Segmentation Analysis:

By Services:

Designing and engineering hold the leading share due to high demand for product innovation. Companies rely on external partners for concept development, technical drawings, prototyping, and validation. It improves device performance, usability, and compliance from early stages. The Medical Device Design and Development Services market benefits from growing complexity in medical technology, which requires expert-led planning and design. Machining also contributes significantly by supporting precision manufacturing for surgical instruments and implants. Moulding and packaging services remain essential for delivering functional and regulatory-compliant products ready for distribution.

- For instance, in 2024, Phillips-Medisize helped its biopharma customers develop over 441 million lifesaving and life-enhancing drug delivery devices.

By Application:

Treatment-related devices dominate the market due to rising global disease burdens. Devices such as surgical systems, infusion pumps, and therapeutic implants require consistent design support and safety validation. The Medical Device Design and Development Services market meets this demand by offering expertise in function-specific engineering and testing. Diagnostics also holds a strong position as providers develop imaging tools, sensors, and rapid diagnostic kits. Growth in point-of-care testing and personalized health monitoring fuels development across this application segment.

- In November 2022, Donatella announced it had opened a new 2,600-square-foot ISO 7 clean-room. This expansion boosted its capacity to assemble Class I, II, and III medical devices and added to its high-volume production capabilities.

By End-User:

Medical device companies form the core customer base due to their broad product pipelines and regulatory exposure. These firms seek outsourced support to reduce R&D timelines and ensure quality control. The Medical Device Design and Development Services market aligns well with their need for integrated, full-cycle solutions. Biotechnology companies show increasing engagement as they expand into diagnostic platforms and combination products. Their reliance on precision design and compact formats creates opportunity for service providers offering advanced design, prototyping, and usability studies.

Segments:

Based on Services:

- Designing & engineering

- Machining

- Packaging

- Moulding

Based on Application:

Based on End-User:

- Medical device companies

- Biotechnology companies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the highest share in the Medical Device Design and Development Services market at 39.4%. The region benefits from a strong presence of leading medical device companies, advanced healthcare infrastructure, and a favorable regulatory framework. High R&D investment and access to a skilled engineering workforce strengthen its market position. Companies in the United States and Canada actively outsource design services to improve efficiency and reduce product launch times. FDA guidance encourages early involvement of design control processes, which supports service provider demand. The region continues to lead in innovative product development, especially in digital health and wearable medical devices. Robust collaboration between contract design firms and OEMs also supports steady growth.

Europe

Europe accounts for 26.8% of the global market share, driven by strict regulatory standards and strong demand for quality-compliant devices. The region’s focus on product safety and risk management supports demand for expert-led design services. Countries such as Germany, France, and the United Kingdom have large medtech sectors that rely on outsourced partners. MDR (Medical Device Regulation) implementation has intensified demand for design documentation and usability validation. The Medical Device Design and Development Services market in Europe benefits from companies aiming to meet high clinical and safety benchmarks. Collaborative R&D networks and public-private partnerships continue to support service providers. Growing interest in sustainable design also shapes demand across European markets.

Asia-Pacific

Asia-Pacific holds a market share of 21.3%, with strong growth potential due to expanding manufacturing capacity and rising healthcare needs. Countries like China, Japan, India, and South Korea are investing in medtech innovation and digital healthcare. Domestic firms and global players are increasing design outsourcing to reduce cost and accelerate product localization. The Medical Device Design and Development Services market in Asia-Pacific gains support from government initiatives, startup growth, and an expanding clinical trial base. Japan maintains a leadership role in high-tech diagnostics, while India offers cost-effective development hubs. Regulatory modernization across the region enhances service demand for compliance-oriented design.

Latin America

Latin America represents 7.2% of the global market, supported by gradual improvements in healthcare infrastructure and medtech investments. Brazil and Mexico lead regional development, with local firms and subsidiaries of global players investing in product customization. The Medical Device Design and Development Services market benefits from increasing interest in portable, low-cost medical solutions suited to rural populations. Challenges remain in regulatory variation and cost constraints, but the long-term outlook stays positive. Local partnerships and regional trade agreements may further accelerate adoption of outsourced design models.

Middle East and Africa

The Middle East and Africa region holds a share of 5.3%, reflecting early-stage growth and infrastructure expansion. Countries such as the UAE, Saudi Arabia, and South Africa show rising demand for diagnostic and home-based devices. Local and international firms are seeking support to adapt products to regional needs and regulatory expectations. The Medical Device Design and Development Services market here remains small but promising, with increased government support for healthcare access and medtech innovation. Public-private initiatives and local manufacturing development may drive future market gains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- StarFish Product Engineering

- Cambridge Design Partnership

- Integer Holdings Corporation

- Jabil

- Donatelle

- Sanmina Corporation

- Veranex

- Creation Technologies

- Planet Innovation

- Cirtec Medical

- Nordson Corporation

- Quest Global

- Celestica

- Plexus Corporation

- Flex

Competitive Analysis

Key players in the Medical Device Design and Development Services market include Celestica, Cambridge Design Partnership, Creation Technologies, Cirtec Medical, Donatelle, Flex, Integer Holdings Corporation, Jabil, Nordson Corporation, Planet Innovation, Plexus Corporation, Quest Global, Sanmina Corporation, StarFish Product Engineering, and Veranex. These companies compete by offering integrated solutions that span the full product lifecycle—from concept and prototyping to testing, regulatory support, and manufacturing. Each firm invests in advanced engineering capabilities, ISO-certified facilities, and cross-functional teams to meet client-specific needs. Strategic differentiation is achieved through specialization in complex device categories such as implants, drug delivery systems, and wearable monitors. Global players focus on scale and geographic reach, while niche firms target innovation and speed-to-market. Competitive advantage also comes from regulatory expertise and track records in FDA and CE approvals. Long-term partnerships with OEMs help ensure repeat contracts and stable revenue. Leading service providers maintain strong investment in digital engineering tools and sustainability practices. The market remains fragmented, with both large contract manufacturers and innovation-focused design studios coexisting. Successful players balance cost-efficiency, design precision, and compliance support, positioning themselves as strategic partners in a fast-evolving medtech landscape.

Recent Developments

- In July 2025, Celestica the company highlighted its Value Analysis/Value Engineering (VAVE) approach to help customers design innovative medical products more swiftly and cost‑effectively.

- In May 2025, Creation Technologies the company celebrated a ribbon-cutting of its expanded Denver Product Realization Center.

- In April 2025, Cirtec announced a Costa Rica expansion, more than doubling its manufacturing footprint and boosting global production for neuromodulation and structural heart device markets

Report Coverage

The research report offers an in-depth analysis based on Services, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth will follow demand for AI‑integrated and remote monitoring medical devices.

- Service providers will adopt digital twins and cloud-based simulation tools to accelerate design cycles.

- Regulators will drive stronger collaboration with providers to streamline compliance and approval processes.

- Market entry will increase for firms offering modular and scalable design platforms.

- Demand will rise for eco-conscious design methods using biodegradable and recyclable materials.

- Providers will expand into personalized device development through patient-specific modeling.

- Cross-industry partnerships will grow, combining expertise from wearable tech and medtech sectors.

- Providers will invest in near-patient manufacturing to support rapid deployment and localization.

- Adoption of remote usability testing and virtual validation will improve design efficiency.

- Market competition will shift toward firms with integrated services—from concept through post‑market surveillance.