Market Overview

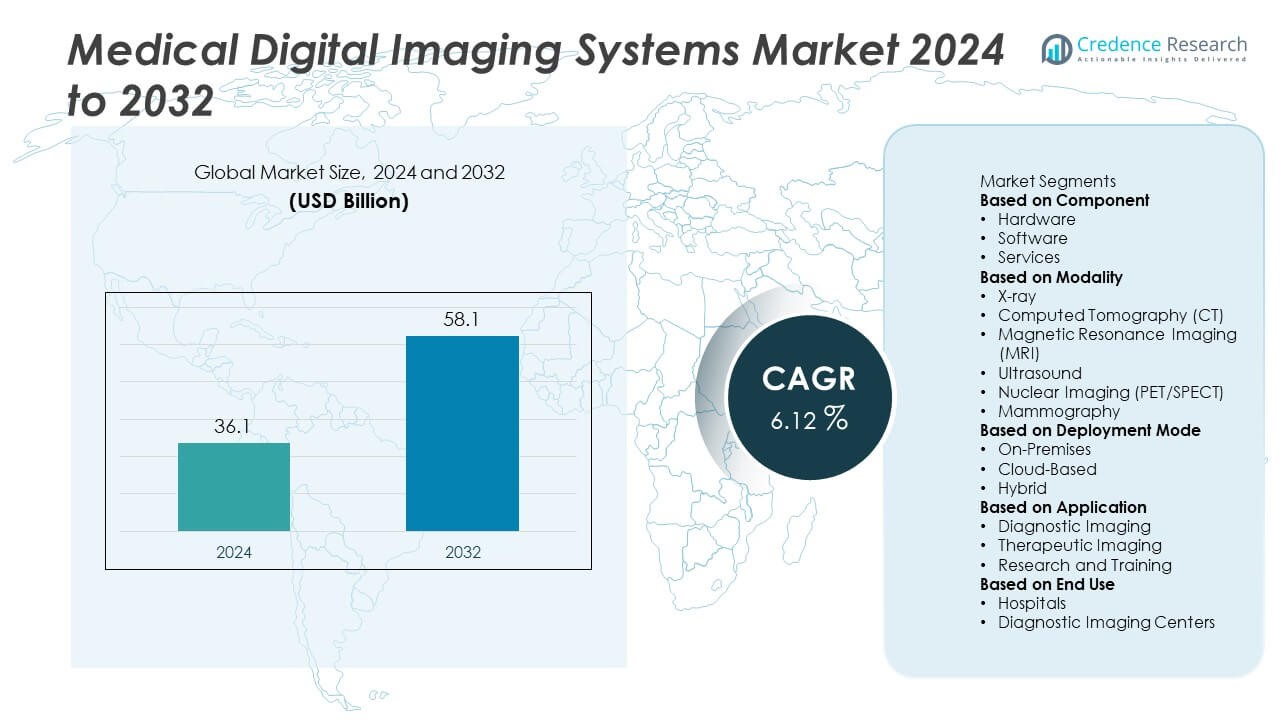

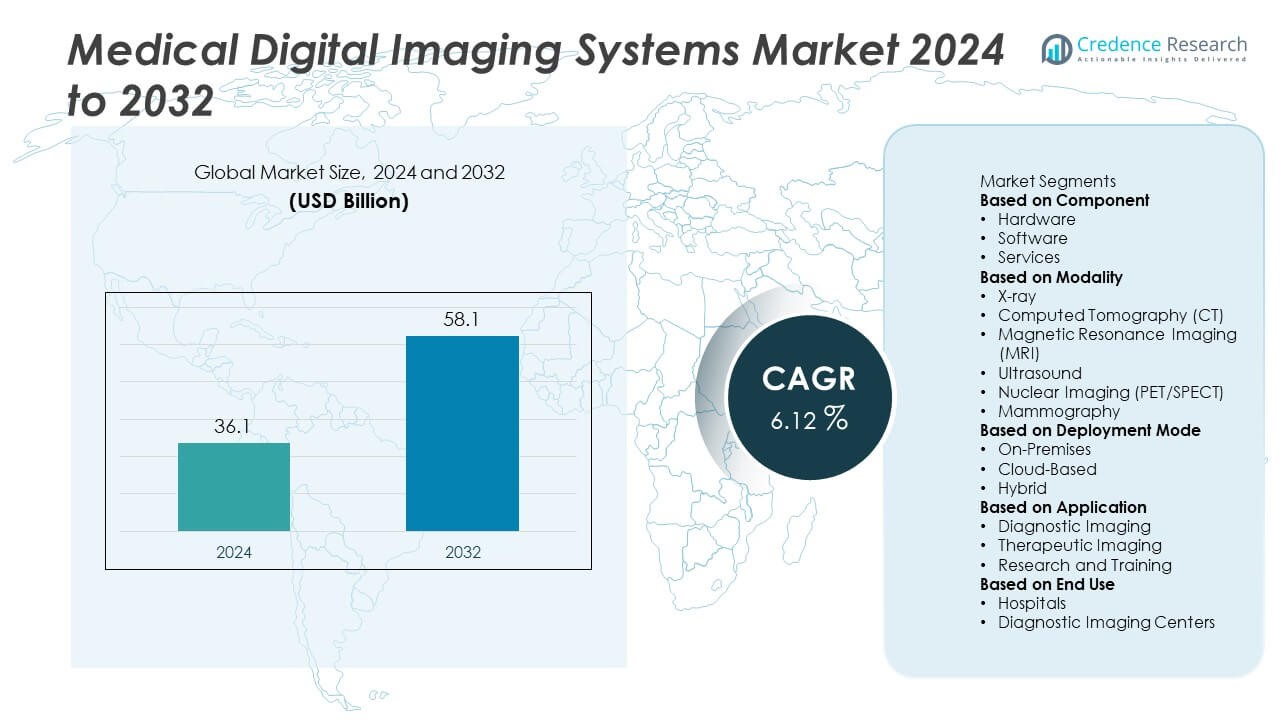

The Medical Digital Imaging Systems Market was valued at USD 36.1 billion in 2024 and is expected to reach USD 58.1 billion by 2032, growing at a CAGR of 6.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Digital Imaging Systems Market Size 2024 |

USD 36.1 Billion |

| Medical Digital Imaging Systems Market, CAGR |

6.12% |

| Medical Digital Imaging Systems Market Size 2032 |

USD 58.1 Billion |

The Medical Digital Imaging Systems Market is driven by the rising prevalence of chronic diseases, growing demand for early diagnosis, and continuous advancements in imaging technologies. Hospitals and diagnostic centers adopt advanced modalities such as MRI, CT, and hybrid imaging to enhance diagnostic accuracy.

The Medical Digital Imaging Systems Market shows strong regional variation shaped by infrastructure, technology adoption, and healthcare priorities. North America leads with high adoption of AI-driven imaging and integration with electronic health records, supported by advanced hospital networks. Europe follows with emphasis on precision medicine and wide use of MRI, CT, and hybrid modalities for oncology and cardiology. Asia-Pacific demonstrates rapid growth fueled by expanding healthcare investments, rising prevalence of chronic diseases, and increasing patient demand for early diagnosis. Latin America and the Middle East & Africa display steady adoption as governments modernize healthcare infrastructure and encourage partnerships with global technology providers. Prominent companies driving innovation include GE Healthcare, Siemens Healthineers, and Koninklijke Philips N.V., which focus on advanced imaging platforms, AI integration, and improved diagnostic accuracy. Canon Medical Systems Corporation and FUJIFILM VisualSonics Inc. also play key roles in expanding ultrasound, MRI, and specialized imaging solutions across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medical Digital Imaging Systems Market was valued at USD 36.1 billion in 2024 and is projected to reach USD 58.1 billion by 2032, growing at a CAGR of 6.12% during the forecast period.

- Rising prevalence of chronic diseases such as cardiovascular disorders, cancer, and neurological conditions is driving demand for advanced imaging solutions in hospitals and diagnostic centers.

- Key trends include integration of artificial intelligence, machine learning, and 3D imaging, which improve diagnostic accuracy, speed, and overall workflow efficiency across healthcare systems.

- The market is highly competitive, with companies like GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., and Canon Medical Systems Corporation investing heavily in AI-driven imaging platforms, hybrid modalities, and cloud-enabled solutions.

- High costs of advanced imaging systems, combined with maintenance and training requirements, remain significant restraints for smaller clinics and emerging economies, limiting widespread adoption.

- North America leads due to advanced healthcare infrastructure and strong technology adoption, Europe follows with emphasis on precision medicine, and Asia-Pacific shows rapid growth fueled by expanding healthcare investments and rising medical tourism.

- Emerging opportunities lie in cloud-based imaging platforms and personalized medicine, where remote access, collaborative diagnostics, and tailored treatment planning strengthen adoption, creating new pathways for long-term growth and innovation.

Market Drivers

Rising Burden of Chronic Diseases Driving Adoption of Advanced Imaging Modalities

The Medical Digital Imaging Systems Market gains momentum from the global rise in chronic conditions such as cardiovascular disease, cancer, and neurological disorders. These health challenges require early detection and precise monitoring, creating strong demand for advanced imaging tools. Hospitals and diagnostic centers adopt digital platforms to improve diagnostic accuracy and treatment planning. It provides clinicians with sharper visualization of organs, tissues, and abnormalities. Governments and healthcare providers invest in infrastructure to handle growing patient loads. The growing focus on preventive healthcare also strengthens adoption.

- For instance, GE Healthcare’s Revolution Apex CT system features a Gemstone Clarity detector that can achieve a best-in-class spatial resolution of 0.23 mm. This enables detailed imaging for demanding scans, including cardiac and oncology procedures, to aid in early-stage disease detection for high-risk patients.

Technological Innovations Enhancing Image Quality and Diagnostic Accuracy

Continuous advancements in imaging technologies fuel adoption across diverse medical settings. The Medical Digital Imaging Systems Market benefits from the integration of artificial intelligence, 3D imaging, and machine learning algorithms. It enhances diagnostic speed while reducing errors in interpretation. Companies focus on upgrading devices with higher resolution, faster processing, and improved software capabilities. Clinicians leverage AI-assisted imaging to detect subtle patterns that might be overlooked in manual assessments. These innovations drive higher efficiency and better clinical outcomes.

- For instance, The Siemens Healthineers AI-Rad Companion family of AI-powered applications is designed to assist radiologists in interpreting medical images by automating repetitive tasks, such as organ and lesion quantification, and integrating results into the clinical workflow.

Expanding Healthcare Infrastructure Across Emerging Economies Increasing Market Penetration

Improved healthcare infrastructure in emerging markets supports wider access to digital imaging technologies. The Medical Digital Imaging Systems Market witnesses rising demand from hospitals and diagnostic labs in Asia-Pacific, Latin America, and the Middle East. Governments invest in modern facilities to meet rising healthcare needs. It enables healthcare providers to expand access to advanced diagnostic services in urban and semi-urban regions. Public-private partnerships further accelerate deployment of advanced systems. Rising medical tourism in developing nations strengthens the need for state-of-the-art imaging technologies.

Growing Shift Toward Digital Platforms and Integration with Health Information Systems

Healthcare systems emphasize digitization to improve efficiency, interoperability, and patient care. The Medical Digital Imaging Systems Market benefits from integration with electronic health records and cloud-based storage. It ensures seamless sharing of imaging data across multiple stakeholders, improving collaboration in diagnosis and treatment. Hospitals adopt cloud solutions to manage large volumes of imaging data effectively. The ability to access images remotely enhances telemedicine services. This digital transformation reduces operational costs while improving patient outcomes across global healthcare systems.

Market Trends

Integration of Artificial Intelligence and Machine Learning Transforming Imaging Practices

The Medical Digital Imaging Systems Market experiences a strong trend toward embedding artificial intelligence and machine learning into diagnostic workflows. These tools assist radiologists in identifying patterns and anomalies with greater accuracy. It reduces human error and shortens reporting time. Automated image analysis enables faster detection of complex conditions such as cancer and neurological disorders. Healthcare providers invest in AI-powered platforms to enhance efficiency and precision. This integration also supports predictive diagnostics, improving treatment planning and patient outcomes.

- For instance, Philips’ AI-powered IntelliSpace Portal 12 can reduce the time required for a full cardiac MRI functional analysis to under 5 minutes by using AI-based segmentation for ventricles. There is no reliable information from Philips claiming the software processes “more than 1,500 images per second.”

Rising Adoption of 3D and Hybrid Imaging Modalities Across Clinical Applications

The demand for advanced visualization techniques is rising across hospitals and diagnostic centers. The Medical Digital Imaging Systems Market benefits from the adoption of 3D and hybrid imaging methods that combine multiple modalities. It provides comprehensive anatomical and functional insights, improving diagnostic clarity. Surgeons increasingly rely on 3D imaging for planning complex procedures. Hybrid systems such as PET-CT and SPECT-CT gain popularity for oncology and cardiology. The ability to capture multi-dimensional data makes these technologies central to modern healthcare.

- For instance, Siemens Healthineers’ Biograph Vision PET/CT system features a 3.2 mm crystal resolution, enabling clinicians to detect lesions as small as 4 mm, significantly enhancing precision in oncology diagnostics.

Expansion of Cloud-Based Imaging and Remote Access Solutions

Digital transformation in healthcare creates opportunities for cloud-enabled imaging solutions. The Medical Digital Imaging Systems Market sees growing preference for platforms that store, process, and share imaging data securely. It allows physicians to access scans remotely, improving collaboration and patient care. Cloud integration also supports telemedicine, which is expanding in both developed and developing regions. Healthcare systems invest in scalable platforms to manage growing imaging volumes. This trend ensures cost efficiency and enables broader access to diagnostic services.

Increasing Focus on Personalized Medicine and Precision Diagnostics

The shift toward patient-specific treatment drives demand for tailored imaging solutions. The Medical Digital Imaging Systems Market supports this shift by offering technologies that deliver detailed and individualized data. It enables physicians to track disease progression at a granular level. Imaging biomarkers are being developed to guide targeted therapies. Advanced imaging supports decision-making in oncology, cardiology, and neurology. This trend strengthens the role of imaging in delivering effective and personalized healthcare strategies.

Market Challenges Analysis

High Costs of Advanced Imaging Systems Limiting Wider Accessibility

The Medical Digital Imaging Systems Market faces a major challenge from the high cost of advanced equipment. Procurement and installation expenses place a significant burden on hospitals, especially in developing regions. It restricts adoption in smaller clinics and diagnostic centers with limited budgets. The financial barrier also affects upgrades to newer, more efficient technologies. Maintenance, calibration, and staff training further add to overall costs. These financial pressures create disparities in access to high-quality imaging, limiting patient reach in cost-sensitive markets.

Regulatory Complexities and Data Security Concerns Slowing Market Expansion

Strict regulatory frameworks for product approval and data handling challenge manufacturers and healthcare providers. The Medical Digital Imaging Systems Market must comply with evolving standards related to patient safety and data privacy. It creates delays in product launches and increases compliance costs. Data breaches in healthcare systems raise concerns about secure handling of sensitive imaging records. Integration with digital health platforms requires strong cybersecurity measures, which increase operational complexity. These challenges slow adoption and require continuous innovation to ensure compliance and trust.

Market Opportunities

Rising Demand for Early Diagnosis Creating Growth Potential in Healthcare Systems

The Medical Digital Imaging Systems Market holds strong opportunities due to the global focus on early disease detection. Growing awareness of preventive care increases the need for timely imaging in oncology, cardiology, and neurology. It enables clinicians to detect conditions at an early stage, improving survival rates and reducing treatment costs. Governments and private players invest in screening programs, expanding demand for advanced imaging systems. Emerging healthcare policies that prioritize diagnostic efficiency further create avenues for market growth. Widening access to healthcare in developing economies strengthens the opportunity for digital imaging adoption.

Expansion of AI-Enabled Imaging and Personalized Medicine Supporting Market Growth

Technological integration presents significant opportunities for healthcare providers and device manufacturers. The Medical Digital Imaging Systems Market benefits from the increasing use of AI, cloud computing, and image-guided therapies. It supports personalized medicine by enabling detailed insights into patient-specific conditions. Hospitals and research institutions adopt AI-driven imaging to optimize treatment plans and improve accuracy. Cloud-based solutions create opportunities for global data sharing and collaborative diagnostics. The trend toward precision healthcare strengthens market relevance, creating long-term opportunities for innovation and expansion.

Market Segmentation Analysis:

By Component

The Medical Digital Imaging Systems Market is segmented into hardware, software, and services. Hardware remains the largest contributor, driven by demand for advanced scanners, detectors, and high-resolution imaging devices. It plays a central role in delivering clear and accurate visuals required for effective diagnosis. Software is growing rapidly with the integration of artificial intelligence and analytics that enhance image interpretation and workflow efficiency. Services, including maintenance, training, and technical support, are also expanding as healthcare facilities seek reliable system performance and longevity. The rising need for advanced imaging solutions sustains steady growth across all component categories.

- For instance, Canon Medical’s Aquilion ONE / INSIGHT Edition CT system uses 320 detector rows, capturing 16 cm of anatomy in a single rotation, significantly reducing scan time while improving workflow efficiency in high-volume hospitals.

By Modality

Market segmentation by modality includes X-ray, computed tomography (CT), magnetic resonance imaging (MRI), ultrasound, nuclear imaging, and others. The Medical Digital Imaging Systems Market sees strong adoption of X-ray and CT due to their wide clinical applications in cardiology, oncology, and orthopedics. It is supported by rising demand for MRI in neurology and musculoskeletal assessments. Ultrasound adoption continues to expand due to its non-invasive nature and affordability. Nuclear imaging technologies, including PET and SPECT, are witnessing higher use in oncology and cardiology diagnostics. Growing need for hybrid imaging modalities that combine functional and anatomical data strengthens the appeal of advanced systems across hospitals and diagnostic centers.

- For instance, the Siemens Healthineers MAGNETOM Terra MRI system operates at 7 Tesla, offering an in-plane spatial resolution of 0.2 mm for brain imaging, which supports advanced neurology research and clinical practice.

By Deployment Mode

Deployment mode is classified into on-premise and cloud-based systems. The Medical Digital Imaging Systems Market shows steady use of on-premise systems, particularly in large hospitals with robust IT infrastructure. It provides direct control over data management and security, ensuring compliance with regulatory requirements. Cloud-based systems are gaining momentum due to scalability, remote access, and cost efficiency. The trend toward telemedicine and cross-border collaboration strengthens adoption of cloud solutions. Growing healthcare digitization encourages providers to shift toward flexible deployment options, supporting wider integration of digital imaging across clinical settings.

Segments:

Based on Component

- Hardware

- Software

- Services

Based on Modality

- X-ray

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Nuclear Imaging (PET/SPECT)

- Mammography

Based on Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid

Based on Application

- Diagnostic Imaging

- Therapeutic Imaging

- Research and Training

Based on End Use

- Hospitals

- Diagnostic Imaging Centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 38% of the Medical Digital Imaging Systems Market in 2024, making it the leading region. The region benefits from advanced healthcare infrastructure, high adoption of innovative technologies, and a strong presence of leading imaging manufacturers. It has widespread integration of artificial intelligence, 3D imaging, and hybrid modalities across hospitals and diagnostic centers. The United States drives growth through large-scale investments in early disease detection and preventive healthcare programs. Canada also shows steady adoption, supported by government funding in digital healthcare. Favorable reimbursement policies and continuous product innovation strengthen the region’s dominance in the global market.

Europe

Europe holds 27% of the Medical Digital Imaging Systems Market in 2024, supported by strong demand for advanced diagnostic imaging in countries such as Germany, France, and the United Kingdom. The region emphasizes precision medicine and personalized care, boosting adoption of MRI, CT, and nuclear imaging modalities. It benefits from collaborative research programs and funding from the European Union for healthcare innovation. Hospitals across Western Europe integrate imaging solutions with electronic health records to improve efficiency and interoperability. Eastern European markets show rising potential as governments modernize healthcare infrastructure. The region’s focus on advanced oncology and cardiology diagnostics drives continuous growth.

Asia-Pacific

Asia-Pacific represents 22% of the Medical Digital Imaging Systems Market in 2024, with rapid expansion driven by growing healthcare investments in China, India, and Japan. The region benefits from an increasing burden of chronic diseases and strong demand for early diagnostic solutions. It is also supported by rising healthcare expenditure and government initiatives to expand hospital infrastructure. Japan leads in technological innovation, particularly in MRI and ultrasound systems, while China and India focus on scaling diagnostic capacity. Rising medical tourism in countries like Thailand and Singapore further supports adoption of advanced imaging systems. Expanding access to healthcare strengthens the long-term growth potential of this region.

Latin America

Latin America captures 7% of the Medical Digital Imaging Systems Market in 2024, with Brazil and Mexico driving regional demand. Rising investments in healthcare modernization support the adoption of advanced diagnostic technologies. It is supported by increasing prevalence of chronic diseases, particularly cardiovascular conditions and cancer, which create a strong need for imaging services. Public and private partnerships promote access to advanced systems in urban areas. Despite infrastructure gaps in rural regions, gradual improvements in healthcare access are visible. Growing medical tourism in select countries provides further opportunities for imaging technology deployment.

Middle East and Africa

The Middle East and Africa account for 6% of the Medical Digital Imaging Systems Market in 2024. The region shows steady progress through government-led healthcare reforms and hospital infrastructure development. It benefits from investments in modern diagnostic facilities in the Gulf Cooperation Council (GCC) countries. Africa demonstrates slower adoption due to economic constraints, but South Africa and Nigeria display growth potential. It is supported by increasing partnerships with international healthcare providers and medical technology companies. Rising demand for better oncology and cardiovascular imaging services drives gradual expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Samsung Medison Co., Ltd.

- Carestream Health

- GE Healthcare

- Mindray Medical International

- Koning Corporation

- Hitachi

- Siemens Healthineers

- FUJIFILM VisualSonics Inc.

- Canon Medical Systems Corporation

- Koninklijke Philips N.V.

Competitive Analysis

The competitive landscape of the Medical Digital Imaging Systems Market is defined by leading players such as GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems Corporation, FUJIFILM VisualSonics Inc., Samsung Medison Co., Ltd., Hitachi, Carestream Health, Mindray Medical International, and Koning Corporation. These companies focus on innovation, strategic partnerships, and product advancements to strengthen their market positions. They emphasize integration of artificial intelligence, machine learning, and 3D imaging to improve diagnostic accuracy and efficiency. Investments in hybrid imaging modalities, including PET-CT and SPECT-CT, highlight their commitment to comprehensive solutions for oncology, cardiology, and neurology. Leading manufacturers also expand their portfolios with cloud-enabled imaging platforms, supporting data sharing and remote access across healthcare systems. Many players strengthen global presence through collaborations with hospitals, research institutions, and governments, ensuring wider adoption in both developed and emerging regions. Continuous R&D efforts, coupled with regulatory compliance and strong service networks, sustain competitive advantage while addressing rising demand for personalized medicine and digital healthcare transformation.

Recent Developments

- In August 2025, Samsung India introduced next‑generation mobile AI‑powered CT scanners—CereTom Elite, OmniTom Elite (including PCD version), and BodyTom 32/64—to bring advanced diagnostics closer to patients in diverse setups.

- In July 2025, GE Healthcare rolled out the floor‑mounted digital X‑ray system Definium Pace Select ET.

- In June 2025, Mindray Medical expanded its Project 2025 partnering with global institutions to establish over 50 ultrasound training centers worldwide, driving clinician education and wider technology adoption

- In March 2025, GE expanded its collaboration with NVIDIA on autonomous imaging—targeting X‑ray and ultrasound systems.

Report Coverage

The research report offers an in-depth analysis based on Component, Modality, Deployment Mode, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of artificial intelligence will improve image interpretation and decision support.

- Demand for 3D and hybrid imaging systems will rise for better anatomical and functional insights.

- Cloud-based platforms will expand access and enable remote diagnostics across regions.

- Personalized medicine will drive demand for imaging tailored to individual patient needs.

- Telemedicine growth will rely on seamless image sharing and remote collaboration.

- Investments in emerging markets will boost infrastructure and technology reach.

- Regulatory standards will evolve to include AI validation and data security requirements.

- Development of low-cost, portable imaging devices will improve access in underserved areas.

- Cross-industry partnerships will foster innovation in imaging modalities and workflows.

- Focus on efficiency will lead to adoption of integrated systems that support workflow optimization.