Market Overview

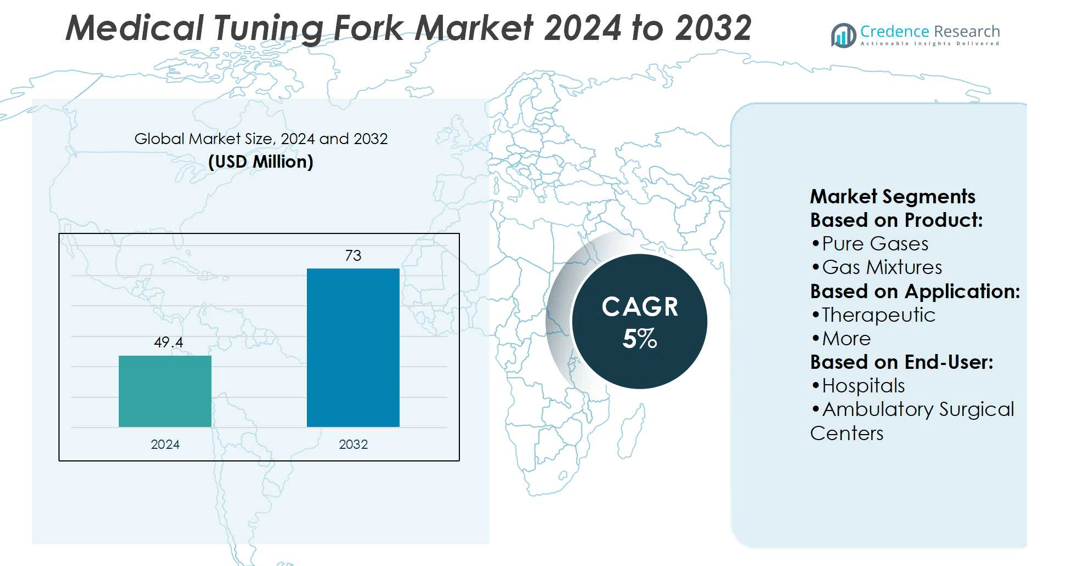

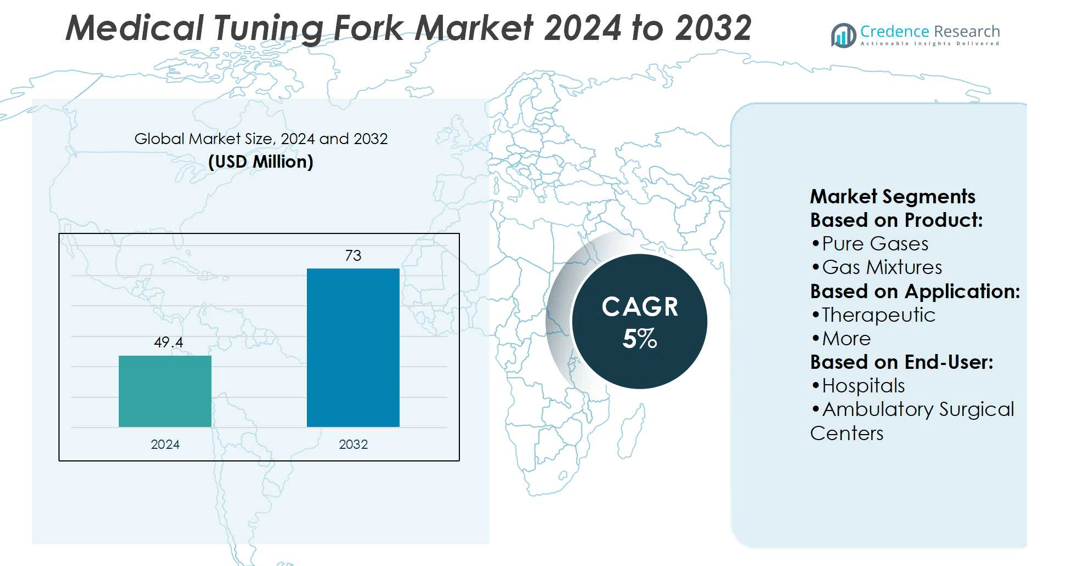

Medical Tuning Fork Market size was valued at USD 49.4 million in 2024 and is anticipated to reach USD 73 million by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Tuning Fork Market Size 2024 |

USD 49.4 million |

| Medical Tuning Fork Market, CAGR |

5% |

| Medical Tuning Fork Market Size 2032 |

USD 73 million |

The Medical Tuning Fork Market grows through rising demand for simple, reliable diagnostic tools in neurology and audiology. Healthcare professionals use tuning forks to detect neuropathy, fractures, and hearing loss, supporting early intervention and cost-effective screening. Increasing prevalence of diabetes, aging populations, and rising cases of nerve disorders drive consistent adoption in hospitals and clinics. Medical schools continue to train students with tuning forks, sustaining long-term use in practice. Preventive healthcare programs and community screenings further strengthen market demand. Growing integration into rehabilitation and sports medicine also highlights their versatility, ensuring steady market relevance across regions.

North America leads the Medical Tuning Fork Market with strong adoption in hospitals and training institutions, followed by Europe with widespread preventive healthcare programs. Asia Pacific shows rapid growth supported by large patient populations and expanding healthcare infrastructure, while Latin America and the Middle East & Africa record steady adoption in community care. Key players driving the market include Abbott, GE Healthcare, Medtronic, Siemens Healthineers AG, Boston Scientific Corporation, F. Hoffmann-La Roche Ltd., Johnson & Johnson Services Inc., Stryker, Koninklijke Philips N.V., and Fresenius Medical Care AG.

Market Insights

- Medical Tuning Fork Market size was valued at USD 49.4 million in 2024 and is anticipated to reach USD 73 million by 2032, at a CAGR of 5%.

- Rising demand for simple, reliable diagnostic tools in neurology and audiology drives market growth.

- Increasing prevalence of diabetes, aging populations, and nerve disorders supports consistent adoption in hospitals and clinics.

- Market trends highlight growing integration of tuning forks in rehabilitation, sports medicine, and preventive healthcare programs.

- Competition remains strong with global players focusing on precision, durability, and medical training support.

- Restraints include limited accuracy compared to advanced diagnostic equipment and slower adoption in developed regions.

- North America leads, Europe follows with preventive programs, Asia Pacific shows fastest growth, while Latin America and Middle East & Africa record steady adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Adoption in Neurological and Hearing Assessments

The Medical Tuning Fork Market expands through increasing use in neurological and hearing diagnostics. Healthcare professionals rely on tuning forks for vibration sense evaluation and auditory testing. It supports early detection of neuropathy, fractures, and hearing loss in clinical practice. Demand rises in hospitals and specialty clinics, where quick and cost-effective diagnostic tools hold importance. Medical schools also continue to adopt tuning forks for training and academic use. Growing awareness among practitioners drives consistent integration into examination protocols.

- For instance, GE Healthcare’s Vscan Air CL dual-probe ultrasound weighs 205 ± 3 grams and supports 50 minutes of continuous scanning with 80 % B-mode and 20 % color Doppler output on a full charge—enabling point-of-care musculoskeletal imaging light enough for therapists to carry between patients without interruption.

Rising Demand from Orthopedic and Rehabilitation Practices

Orthopedic specialists use tuning forks to evaluate bone fractures and healing progress. It provides a simple yet reliable method for identifying stress fractures without immediate imaging. Rehabilitation centers employ tuning forks to monitor recovery in patients with musculoskeletal injuries. Increasing sports-related injuries fuel adoption across physiotherapy and sports medicine. The Medical Tuning Fork Market gains momentum as healthcare systems emphasize non-invasive diagnostics. Continuous usage across diverse practices strengthens its role as a standard assessment instrument.

- For instance, Siemens Healthineers provides advanced training tools that extend beyond traditional methods. Its SmartSimulator offers up to 25 GB of cloud storage, with 15 hours of access and 90 days validity for simulated device training per trial package.

Integration into Routine Clinical Examinations

Tuning forks remain a standard tool in general clinical examinations due to their low cost and ease of use. Physicians employ them to differentiate between conductive and sensorineural hearing loss. It also plays a role in quick neurological screenings where advanced tools are unavailable. Rural clinics and low-resource healthcare facilities continue to depend on tuning forks for primary diagnostics. Their portability and long lifespan make them indispensable across multiple care settings. Widespread clinical reliance ensures stable market demand across regions.

Support from Medical Training and Education

Medical universities and training institutions continue to integrate tuning forks in teaching programs. Students learn vibration sense testing and auditory assessment through structured curriculum exercises. It provides hands-on exposure to fundamental diagnostic techniques at an early stage. The Medical Tuning Fork Market benefits from this continued integration in medical education. Consistent adoption ensures new healthcare professionals remain familiar with tuning fork applications. Ongoing use in academic settings sustains long-term relevance and strengthens future demand.

Market Trends

Shift Toward Standardized Diagnostic Tools

The Medical Tuning Fork Market shows a trend toward standardized diagnostic practices across healthcare facilities. Hospitals and clinics prefer forks with calibrated frequencies, particularly 128 Hz and 512 Hz, to ensure consistent results. It supports uniformity in neurological and hearing assessments, which improves patient outcomes. Regulatory bodies and accreditation standards also encourage the use of precise diagnostic instruments. Growing demand for evidence-based practices strengthens the shift toward uniform medical tools. This trend ensures reliability in both urban and rural healthcare environments.

- For instance, Boston Scientific’s EDUCARE online education platform offers personalized, on-demand training content for healthcare professionals. In its 2023 performance report, the company announced that more than 59,000 healthcare professionals in approximately 145 countries accessed the EDUCARE platform during that year.

Increasing Use in Neurological Screenings

Neurological screenings continue to expand across primary care, fueling demand for tuning forks. Physicians use these devices to detect peripheral neuropathy in diabetic and aging populations. It provides quick assessments without the need for advanced imaging technologies. Early detection of neuropathic conditions reduces treatment delays and complications. Rising cases of nerve-related disorders encourage practitioners to include tuning forks in regular checkups. This growing reliance highlights their role in preventive healthcare strategies worldwide.

- For instance, Roche offers high-precision digital tools for neurological assessments that extend beyond traditional methods. Its PD Mobile Application v2 includes 10 active smartphone tests and passive monitoring via smartwatch. In a study of 316 early-stage Parkinson’s patients, average daily testing adherence reached 96.29 %, with users contributing 12.79 hours per day of passive data collection via smartwatch.

Adoption in Sports and Rehabilitation Medicine

Sports medicine and rehabilitation centers incorporate tuning forks into injury management protocols. Orthopedic specialists use them to identify stress fractures and monitor bone healing. It offers a non-invasive method that complements imaging tools in follow-up care. Physiotherapists value their portability for on-field evaluations of athletes. Rising sports injuries and physical therapy cases increase adoption across these practices. This trend strengthens the versatility of tuning forks in broader medical applications.

Integration into Medical Training Programs

Medical training institutions emphasize hands-on diagnostic learning with tuning forks. Students are trained in hearing assessments, fracture detection, and neurological testing. It ensures that future practitioners remain skilled in these traditional yet essential diagnostic methods. Universities maintain consistent use of tuning forks in structured curricula. This integration preserves their importance across multiple generations of healthcare providers. The Medical Tuning Fork Market benefits from this continuous focus on practical education.

Market Challenges Analysis

Limited Accuracy Compared to Advanced Diagnostics

The Medical Tuning Fork Market faces challenges from limited precision compared to advanced diagnostic equipment. Tuning forks cannot provide detailed data like audiometers, imaging systems, or digital diagnostic devices. It restricts their use in complex neurological or auditory conditions where high accuracy is required. Physicians often rely on more advanced tools for confirmatory testing, reducing dependence on tuning forks. This limitation creates barriers to adoption in high-tech healthcare facilities. Growing demand for accuracy in diagnostics intensifies the pressure on tuning fork manufacturers.

Declining Adoption in Developed Healthcare Systems

Developed regions witness slower adoption of tuning forks due to rapid modernization in healthcare infrastructure. Hospitals increasingly invest in electronic diagnostic systems, reducing the use of manual tools. It challenges the long-term role of tuning forks in advanced medical settings. Younger practitioners may also prefer digital solutions that integrate with electronic health records. The Medical Tuning Fork Market must adapt to evolving clinical expectations to remain relevant. Without innovation or new applications, its role risks diminishing in technologically advanced environments.

Market Opportunities

Expansion in Emerging Healthcare Markets

The Medical Tuning Fork Market holds strong opportunities in emerging economies where access to advanced diagnostic equipment remains limited. Clinics and hospitals in rural areas depend on cost-effective, durable tools for basic screening. It offers reliable results for neurological and auditory tests without requiring expensive infrastructure. Rising government investment in primary healthcare strengthens demand for simple diagnostic devices. Training programs for rural health workers also include tuning forks to expand diagnostic reach. Growing healthcare awareness across developing regions provides a steady opportunity for market growth.

Integration with Preventive and Educational Programs

Preventive healthcare initiatives create new pathways for tuning fork adoption in early detection practices. Screening programs for diabetes, neuropathy, and hearing loss can integrate tuning forks as quick assessment tools. The Medical Tuning Fork Market benefits from rising focus on low-cost diagnostic solutions in public health campaigns. It also gains traction in medical education where hands-on exposure remains essential. Universities and training institutes maintain demand by embedding tuning forks into academic curricula. Expanding educational and preventive frameworks ensure sustained opportunities for future adoption.

Market Segmentation Analysis:

By Product

The Medical Tuning Fork Market divides by product into pure gases and gas mixtures. Pure gases dominate due to their precise frequency output, which supports accurate neurological and auditory testing. It ensures consistency in vibration strength, making them essential for clinical and academic use. Gas mixtures, while less common, serve specialized therapeutic and diagnostic applications where variable frequencies are needed. These variations offer flexibility for research and training in advanced medical programs. The steady reliance on pure frequency devices secures strong demand in this segment.

- For instance, Johnson & Johnson does not publicly supply tuning forks or gas-based diagnostic tools.Their Advance Case Management (ACM) digital platform predicts implant sizes with over 90% accuracy—plus or minus one size for knee surgeries—and achieves up to a 60% reduction in instrument trays and sterilization costs in orthopedic operating rooms.

By Application

The market by application highlights the therapeutic segment as a key area of use. Tuning forks are widely applied in bone fracture detection, nerve sensitivity evaluation, and auditory screening. It provides healthcare professionals with a non-invasive, low-cost tool to aid early diagnosis. Therapeutic applications also extend into physiotherapy and rehabilitation, where tuning forks support monitoring of healing progress. The portability and durability of these instruments increase their adoption in both clinical and field settings. Expanding applications across different therapeutic areas sustain long-term relevance.

- For instance,Philips delivers notable innovations far beyond traditional tuning-fork applications. The Ingenia Ambition MR system leverages its BlueSeal fully-sealed magnet design, needing only 7 liters of helium over its lifetime, compared to approximately 1,500 liters in conventional systems, while using up to 53 % less power per patient.

By End User

End users of the Medical Tuning Fork Market include hospitals, ambulatory surgical centers, home healthcare, and pharmaceutical and biotechnology companies. Hospitals represent the largest segment due to high patient volumes and routine use in neurological and orthopedic assessments. It provides physicians with a simple and effective method for rapid testing in busy clinical environments. Ambulatory surgical centers adopt tuning forks for post-surgery monitoring and rehabilitation support. Home healthcare grows steadily as patients seek convenient diagnostic tools for personal monitoring. Pharmaceutical and biotechnology companies also integrate tuning forks into research studies and product testing. This broad end-user base strengthens overall market stability and expansion.

Segments:

Based on Product:

Based on Application:

Based on End-User:

- Hospitals

- Ambulatory Surgical Centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America dominates with approximately 35% share, supported by advanced healthcare facilities, high per capita healthcare spending, and strong awareness of preventive diagnostics. Hospitals across the United States and Canada rely on tuning forks for neurological screening, fracture evaluation, and hearing loss detection. It is also used in emergency and primary care settings because of its simplicity and reliability. Medical schools and training institutions continue to integrate tuning forks into their curricula, ensuring new professionals are familiar with their use. Growing cases of diabetes and neuropathy further expand demand in clinical practice. The presence of leading manufacturers and distributors also secures a steady supply chain, reinforcing the region’s leadership in the global market.

Europe

Europe accounts for about 25% share, making it the second-largest regional contributor. Strong public healthcare systems and widespread insurance coverage support consistent adoption across hospitals and clinics. It is commonly used in audiology and neurology practices throughout Germany, France, the UK, and Nordic countries. Preventive healthcare initiatives and government-led screening programs highlight the importance of simple diagnostic tools in community healthcare. Universities and medical training centers maintain tuning forks in educational programs, sustaining long-term usage. The European market benefits from strict regulatory standards, which drive demand for high-quality, calibrated products. Awareness campaigns on early diagnosis of hearing loss and diabetic neuropathy also add to regional growth.

Asia Pacific (APAC)

Asia Pacific holds nearly 20% share, with strong growth potential driven by population size, rising chronic diseases, and healthcare infrastructure expansion. Countries such as India, China, and Japan experience increasing demand for cost-effective diagnostic tools due to rising cases of hearing impairment and neuropathy. It is widely adopted in rural areas where access to advanced equipment is limited, making tuning forks essential for primary healthcare providers. Government initiatives supporting preventive care and early diagnosis programs also contribute to rising adoption. Growing investments in healthcare infrastructure, along with training programs for rural health workers, further expand usage. Rising medical education in China and India ensures new practitioners are trained with tuning forks, supporting long-term market sustainability.

Latin America

Latin America holds nearly 10% share in the Medical Tuning Fork Market, with demand driven by healthcare system improvements in Brazil, Mexico, and Argentina. Hospitals and clinics use tuning forks in routine neurological and hearing assessments, particularly in community health programs. It sees growing adoption in medical schools across the region, where practical diagnostic training is emphasized. Rising awareness of diabetes-related neuropathy and age-related hearing loss encourages clinicians to adopt these tools for early screening. Public health initiatives and gradual expansion of primary healthcare infrastructure support further integration of tuning forks into diagnostic practices. Manufacturers and distributors are also expanding presence in Latin America to capture growing opportunities, especially in urban and semi-urban healthcare markets.

Middle East & Africa (MEA)

The Middle East & Africa region contributes around 10% share to the global market. Growth is supported by healthcare modernization efforts in Gulf countries and increasing investments in African healthcare systems. Hospitals in urban centers use tuning forks in neurology and orthopedics, while rural clinics employ them as low-cost diagnostic tools. International health organizations and aid programs help expand access to these instruments across underserved regions. It also benefits from training programs that raise awareness among healthcare professionals about the value of simple diagnostic tools. Although adoption is slower compared to developed regions, gradual improvements in healthcare infrastructure support steady growth. Rising government initiatives to strengthen basic diagnostics will continue to shape demand in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Abbott (U.S.)

- GE Healthcare (U.S.)

- Medtronic (Ireland)

- Siemens Healthineers AG (Germany)

- Boston Scientific Corporation (U.S.)

- Hoffmann-La Roche Ltd. (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Stryker (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Fresenius Medical Care AG (Germany)

Competitive Analysis

The Medical Tuning Fork Market features players include Abbott, GE Healthcare, Medtronic, Siemens Healthineers AG, Boston Scientific Corporation, F. Hoffmann-La Roche Ltd., Johnson & Johnson Services Inc., Stryker, Koninklijke Philips N.V., and Fresenius Medical Care AG. The Medical Tuning Fork Market remains moderately competitive, with global and regional manufacturers focusing on precision, durability, and affordability. Companies aim to enhance product accuracy for neurological and auditory diagnostics while maintaining low production costs to meet demand in both developed and emerging markets. Strong distribution networks and partnerships with hospitals, clinics, and medical schools support wider adoption. Competition is also shaped by regulatory compliance, as quality standards influence purchasing decisions across regions. Smaller firms compete by offering cost-effective products, while larger manufacturers emphasize advanced designs and integration with medical training programs. This mix of innovation and price-driven strategies ensures balanced growth and sustained relevance across diverse healthcare systems.

Recent Developments

- In January 2025, Atlas Copco Group announced the acquisition of Medi-teknique Ltd. (“Medi-teknique”), a British company specializing in medical gas maintenance and services. With this acquisition, the company expanded its footprint in the UK.

- In January 2025, Air Liquide announced that it has partnered with 20 hospitals and clinics in six European countries (Germany, Belgium, France, Italy, the Netherlands, and Spain) to assist them in reducing their carbon footprint.

- In February 2024, Boston Scientific Corporation received U.S. FDA approval for its WaveWriter spinal cord stimulator systems used in the treatment of chronic lower back and leg pain.

- In January 2024, GE Healthcare entered into an agreement to acquire MIM Software, one of the leading providers of medical imaging analysis and AI solutions. The company specializes in areas such as radiation oncology, molecular radiotherapy, diagnostic imaging, and urology in various healthcare settings.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Medical Tuning Fork Market will see steady demand in neurological and hearing diagnostics.

- Hospitals and clinics will continue to adopt tuning forks for quick and low-cost screening.

- Medical schools will sustain market growth by training new professionals in diagnostic use.

- Preventive healthcare programs will expand tuning fork applications in early detection practices.

- Emerging economies will create strong opportunities due to limited access to advanced tools.

- Digital healthcare expansion will encourage integration of tuning forks with modern training platforms.

- Sports medicine and rehabilitation centers will increase reliance on tuning forks for injury care.

- Aging populations worldwide will drive demand for vibration sense and hearing assessments.

- Research institutions will explore new applications for tuning forks in therapeutic practices.

- Global manufacturers will focus on improving calibration and durability to meet quality standards.