Market Overview

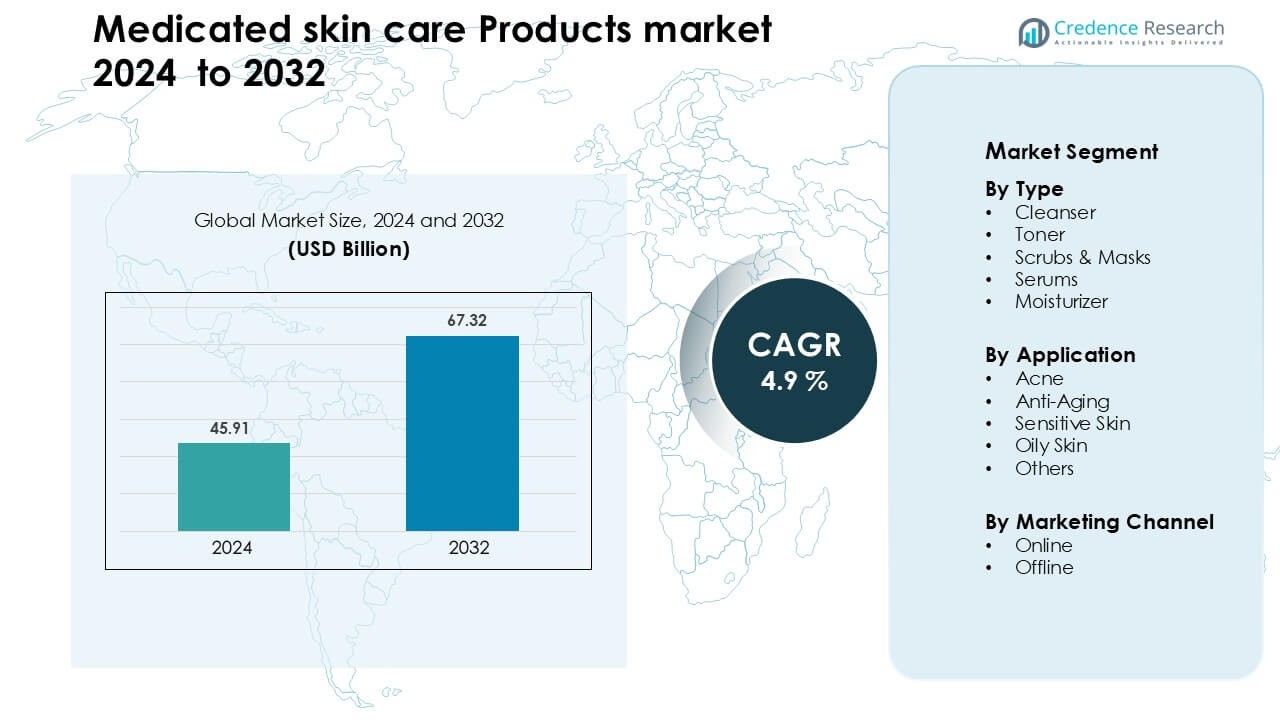

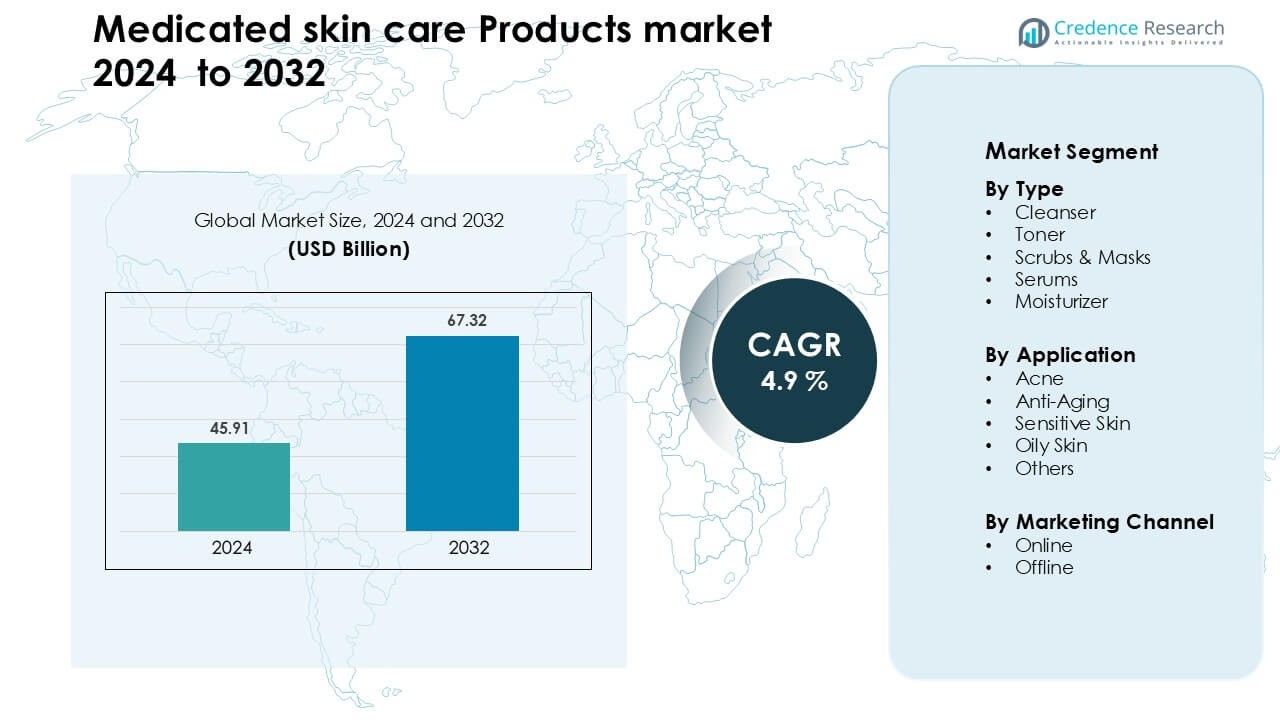

Medicated skin care Products market was valued at USD 45.91 billion in 2024 and is anticipated to reach USD 67.32 billion by 2032, growing at a CAGR of 4.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medicated Skin Care Products Market Size 2024 |

USD 45.91 Billion |

| Medicated Skin Care Products Market, CAGR |

4.9 % |

| Medicated Skin Care Products Market Size 2032 |

USD 67.32 Billion |

The Medicated Skin Care Products market is shaped by leading companies such as Coty Inc., Shiseido Co., Ltd., Johnson & Johnson, Inc., Revlon, Colgate-Palmolive Company, Unilever, Avon Products, Inc., Procter & Gamble (P&G), L’Oréal S.A., and Beiersdorf AG. These players strengthen their positions through clinically proven formulas, dermatologist-backed product lines, and strong retail and e-commerce networks. Innovation in active ingredients for acne, anti-aging, and sensitive-skin care continues to support competitive growth. North America led the global market in 2024 with about 37% share, driven by high treatment awareness, strong dermatologist access, and rising demand for clinical-grade formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Medicated skin care Products market was valued at USD 45.91 billion in 2024 and is anticipated to reach USD 67.32 billion by 2032, growing at a CAGR of 4.9 % during the forecast period.

- Strong demand for acne-care solutions and dermatologist-recommended products drives growth, with the cleanser segment holding about 34% share due to rising use of daily treatment routines.

- Ingredient-focused trends such as retinoids, niacinamide, and ceramide-rich barrier-repair formulas boost premium product adoption across digital and pharmacy channels.

- Competition intensifies as leading players expand clinical-grade lines and invest in fragrance-free, hypoallergenic, and sensitive-skin-friendly innovations to retain consumer trust.

- North America led the market with nearly 37% share, followed by Europe at 28% and Asia Pacific at 25%, supported by high awareness, strong dermatologist access, and rising online purchases of medicated skincare solutions.

Market Segmentation Analysis:

By Type

The cleanser segment led the medicated skin care products market in 2024 with about 34% share due to strong demand for dermatologically tested face washes, antibacterial formulas, and pH-balanced solutions. Consumers favored cleansers because these products act as the first treatment step for acne, excess oil, and buildup removal. Growth remained supported by rising awareness of multi-step routines and greater doctor recommendations for medicated cleansing agents. Serums and moisturizers grew steadily as brands launched targeted formulas that address pigmentation, dryness, and treatment recovery needs.

- For instance, La Roche-Posay’s Effaclar Purifying Foaming Gel is formulated at a physiological pH of 5.5, which helps maintain the skin’s natural balance. It contains zinc PCA, an ingredient that in manufacturer testing has been shown to reduce sebum production. The product is dermatologist-tested and described as a non-irritating cleanser suitable for sensitive and acne-prone skin.

By Application

Acne treatment dominated the application segment in 2024 with nearly 39% share, driven by rising cases of hormonal acne, pollution-linked skin issues, and higher adoption of salicylic acid, benzoyl peroxide, and retinoid-based products. Dermatologists continued to push medicated solutions over cosmetic alternatives, which boosted product confidence. Anti-aging solutions saw rapid traction due to strong interest in peptides and retinoids, while sensitive skin products expanded as more consumers sought hypoallergenic and fragrance-free formulations.

- For instance, Galderma reported successful Phase III trial data for a gel combining 0.3% adapalene and 2.5% benzoyl peroxide, where 503 moderate-to-severe acne patients treated over 12 weeks saw mean reductions of 27 inflammatory lesions (–68.7%) and 40 non-inflammatory lesions (–68.3%) compared to lower efficacy in the vehicle group.

By Marketing Channel

The online channel held the leading position in 2024 with around 58% share as consumers preferred digital platforms for easy access to dermatologist-backed brands, prescription-strength formulations, and ingredient-based shopping filters. E-commerce growth accelerated due to influencer-led awareness and subscription models that ensured repeat purchases. Offline retail stayed significant across pharmacies and dermatology clinics, where professional advice and product trials supported brand trust. The shift toward online buying remained strong as digital platforms offered better discounts, wider assortments, and detailed clinical information.

Key Growth Drivers

Rising Dermatological Conditions and Treatment Awareness

Growing cases of acne, dermatitis, hyperpigmentation, and rosacea continue to push demand for medicated skin care products. Consumers increasingly seek clinically validated solutions rather than cosmetic alternatives, which drives higher adoption of prescription-grade cleansers, serums, and moisturizers. Dermatologists play a major role by recommending targeted treatments that address inflammation, bacterial growth, and barrier repair. Social awareness campaigns, digital dermatology platforms, and easy access to online consultations further raise product visibility. Rising pollution, hormonal imbalances, and lifestyle stress also elevate the need for daily medicated routines. This shift toward science-backed ingredients supports long-term category expansion.

- For instance, VisualDx, a digital diagnostic tool used by dermatologists, contains over 45,000 medical images that clinicians can leverage during remote consults helping improve accuracy in diagnosis of hyperpigmentation, rosacea, and other skin disorders.

Ingredient-Based Purchasing and Product Innovation

Consumers now study ingredients closely, leading to strong demand for active-based formulations such as salicylic acid, niacinamide, retinoids, ceramides, and azelaic acid. Brands respond with advanced treatment serums, barrier-strengthening moisturizers, and dermatologist-developed solutions that target specific concerns. The market benefits from improved formulation science, including encapsulation technology, stabilized retinoids, and microbiome-friendly blends that increase efficacy and reduce irritation. Innovation also expands across textures, fragrance-free variants, and multi-functional products. Growing trust in clinical transparency encourages companies to highlight concentrations, clinical trial results, and dermatological approvals. This ingredient-driven mindset significantly boosts product differentiation and repeat purchases.

- For instance, researchers developed silica microparticles from sugarcane by-products to encapsulate retinol: this formulation released less than 60% of its retinol content over 24 hours, showing sustained release and increased stability compared to free retinol.

E-commerce Expansion and Personalized Skin Care

Online platforms have transformed access to medicated skin care, offering consumers detailed product information, dermatologist reviews, and ingredient comparison tools. E-pharmacies, D2C brands, and beauty marketplaces provide wider assortments and personalized routines through AI-based diagnostics, quizzes, and virtual consultations. Subscription models promote consistent usage, while digital communities enhance awareness around treatment timelines and product layering. Many consumers also prefer online channels for privacy when purchasing acne or pigmentation treatments. The rise of tele-dermatology strengthens brand credibility and accelerates adoption across urban and semi-urban regions. These online-led shifts make personalized medicated care more accessible and scalable.

Key Trend & Opportunity

Growth of Dermatologist-Endorsed and Clinical-Grade Brands

Dermatologist-backed brands are gaining traction as consumers prioritize credibility and scientific validation. Companies now highlight clinical trials, before–after results, and safety certifications to strengthen trust. This trend creates opportunities for collaborations between skincare labs and dermatologists, enabling targeted treatments for acne, sensitivity, aging, and pigmentation. Clinical-grade formulas aligned with prescription standards attract both young users dealing with acne and older consumers managing age-related concerns. The opportunity widens with the rise of sensitive skin-friendly solutions and barrier-repair science, pushing brands to invest in gentle yet effective ingredients. This clinical positioning helps differentiate products in a competitive market.

- For instance, Galderma, the parent company behind clinical brands like Cetaphil, reported having more than 600 R&D professionals working in-house and has secured over 250 major regulatory approvals in the past five years, underscoring its commitment to rigorous dermatological science.

Rising Demand for Barrier-Repair and Microbiome-Friendly Formulations

As awareness of skin barrier health increases, demand grows for formulations featuring ceramides, peptides, centella asiatica, and probiotic blends. Brands focus on restoring hydration, reducing inflammation, and maintaining microbiome balance, supporting long-term skin resilience. This trend opens strong opportunities in moisturizers and serums designed for sensitive, acne-prone, and post-treatment skin. Microbiome science is also gaining importance as companies explore ingredients that support healthy bacterial diversity. These innovations allow brands to expand premium segments and introduce advanced therapeutic lines for dermatology clinics. The shift toward gentle, barrier-strengthening formulas meets rising consumer expectations for effective yet low-irritation treatment options.

- For instance, a randomized double-blind clinical trial of a ceramide cream (formulated to mimic the skin’s natural lipid system) reported that after a single application, skin hydration increased significantly over 24 hours, and transepidermal water loss (TEWL) decreased substantially compared to placebo.

Key Challenge

Risk of Irritation and Ingredient Sensitivity

Medicated skin care often contains strong actives such as retinoids, acids, and benzoyl peroxide, which may cause redness, peeling, or allergic reactions when used incorrectly. Consumers with sensitive or compromised skin face greater risk, leading to hesitancy in adopting potent treatments. Misuse due to lack of routine guidance also increases irritation cases, which can push users back toward cosmetic alternatives. Brands must invest in clearer dosage instructions, starter-strength variants, and compatibility guidelines to minimize risk. Growing demand for safe formulations pressures companies to balance high efficacy with improved tolerability.

High Price Points and Limited Access in Developing Regions

Medicated skin care products, especially dermatologist-developed or clinically tested formulas, often carry premium price tags that limit adoption among price-sensitive consumers. In developing regions, lower dermatology access and limited retail penetration further restrict market reach. Many users rely on generic or cosmetic substitutes due to affordability concerns. High import duties and compliance costs also raise final product prices. To overcome these hurdles, brands need localized manufacturing, affordable clinical-grade lines, and stronger distribution partnerships. Addressing these access barriers remains essential for expanding market presence across emerging economies.

Regional Analysis

North America

North America held the largest share in 2024 with about 37%. Demand grew due to high awareness of dermatology-backed products, strong access to specialists, and higher use of active ingredients such as retinoids and acids. Consumers preferred clinical brands sold through pharmacies, e-commerce, and dermatologist offices. Rising cases of acne and sensitivity also increased interest in medicated cleansing and barrier repair. The U.S. remained the key market as digital dermatology platforms expanded treatment access. Canada showed steady growth supported by clean-label formulas and strong pharmacy networks.

Europe

Europe accounted for nearly 28% of the market in 2024. Growth stayed strong due to strict product safety rules, rising demand for fragrance-free and dermatologically tested solutions, and increased interest in sensitive-skin care. Countries such as Germany, France, and the U.K. led adoption as consumers trusted pharmacy brands and clinically proven ingredients. Anti-aging and barrier-repair routines grew faster due to aging populations and high awareness of skin health. E-commerce expanded across Western Europe, improving access to dermatologist-endorsed products and advanced treatment serums.

Asia Pacific

Asia Pacific held about 25% share in 2024 and remained the fastest-growing region. Urban pollution, humidity, and rising acne cases drove adoption of medicated cleansers, serums, and moisturizers. Consumers in China, Japan, South Korea, and India showed rising interest in clinical ingredients and barrier-support routines. K-beauty and J-beauty strongly shaped treatment trends through active-rich yet gentle formulas. Growth accelerated through online platforms, dermatologist clinics, and youth-driven awareness. Expanding disposable incomes and strong beauty culture supported long-term market expansion.

Latin America

Latin America captured around 6% share in 2024 with steady growth. Consumers in Brazil, Mexico, and Argentina increased use of medicated acne and pigmentation treatments due to climate stress, pollution, and sun exposure. Pharmacy chains and dermatology clinics played a major role in brand adoption. Online sales expanded as e-commerce platforms offered wider access to dermatologist-approved products. Rising interest in sensitive-skin care and lightweight treatment formulas supported market traction. Economic constraints limited premium product uptake but boosted demand for affordable clinical-grade solutions.

Middle East & Africa

The Middle East & Africa region held nearly 4% share in 2024. Growth rose as consumers sought medicated solutions for acne, pigmentation, and sun-related damage. Hot climates and high UV exposure increased demand for dermatology-backed cleansers, serums, and moisturizers. The UAE and Saudi Arabia led adoption with strong retail networks and premium product demand. Africa showed early-stage growth, driven by expanding pharmacy access and online platforms. Price sensitivity influenced buying patterns, pushing brands to offer value-driven clinical formulas. The region gained momentum with rising awareness of skin health and dermatologist guidance.

Market Segmentations:

By Type

- Cleanser

- Toner

- Scrubs & Masks

- Serums

- Moisturizer

By Application

- Acne

- Anti-Aging

- Sensitive Skin

- Oily Skin

- Others

By Marketing Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Medicated Skin Care Products market features global players such as Coty Inc., Shiseido Co., Ltd., Johnson & Johnson, Inc., Revlon, Colgate-Palmolive Company, Unilever, Avon Products, Inc., Procter & Gamble (P&G), L’Oréal S.A., and Beiersdorf AG. Companies compete on clinically tested formulations, dermatologist endorsements, and strong portfolios across acne, anti-aging, and sensitive-skin products. Many brands invest in active ingredient innovation, such as retinoids, niacinamide, ceramides, and salicylic acid, while expanding fragrance-free and hypoallergenic lines. E-commerce, D2C channels, and pharmacy networks remain key distribution pillars. Strategic moves include acquisitions of niche derma brands, partnerships with dermatologists, and localized product lines for Asia Pacific and Latin America. Marketing focuses on clinical claims, before–after results, and transparent ingredient labelling to strengthen consumer trust.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coty Inc.

- Shiseido Co., Ltd.

- Johnson & Johnson, Inc.

- Revlon

- Colgate-Palmolive Company

- Unilever

- Avon Products, Inc.

- Procter & Gamble (P&G)

- L’Oréal S.A.

- Beiersdorf AG

Recent Developments

- In 2025, Johnson & Johnson, Inc. submitted a New Drug Application (NDA) for icotrokinra, a first-in-class oral peptide blocking the IL-23 receptor for moderate to severe plaque psoriasis (skin-medical condition).

- In June 2025, Shiseido Co., Ltd. announced the development of its Reservoir in Skin technology, which aids delivery and retention of natural moisturizing factors in the skin s stratum corneum.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Marketing Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dermatologist-developed products will grow as consumers prefer clinically backed solutions.

- Ingredient-focused shopping will expand, with higher use of retinoids, acids, and ceramides.

- Online diagnostics and AI-based skin assessments will shape personalized treatment routines.

- Sensitive-skin and barrier-repair formulas will gain more traction across all age groups.

- Brands will increase investment in microbiome-friendly and low-irritation formulations.

- Pharmacy and derma-clinic channels will strengthen due to rising trust in professional recommendations.

- Premium medicated serums and treatment kits will see faster adoption among urban consumers.

- Regulatory focus on product safety and ingredient transparency will intensify.

- Emerging markets will witness higher adoption as access to dermatology improves.

- Sustainability-aligned packaging and cleaner formulations will influence brand preference.