Market Overview

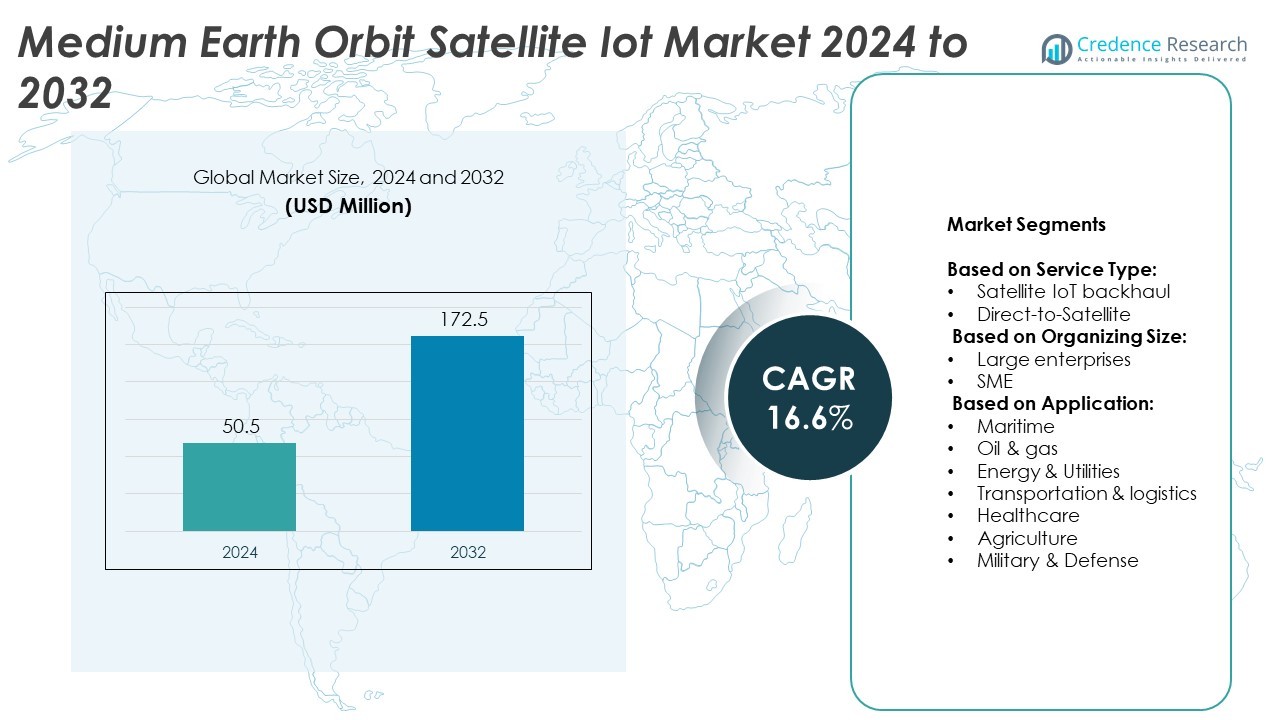

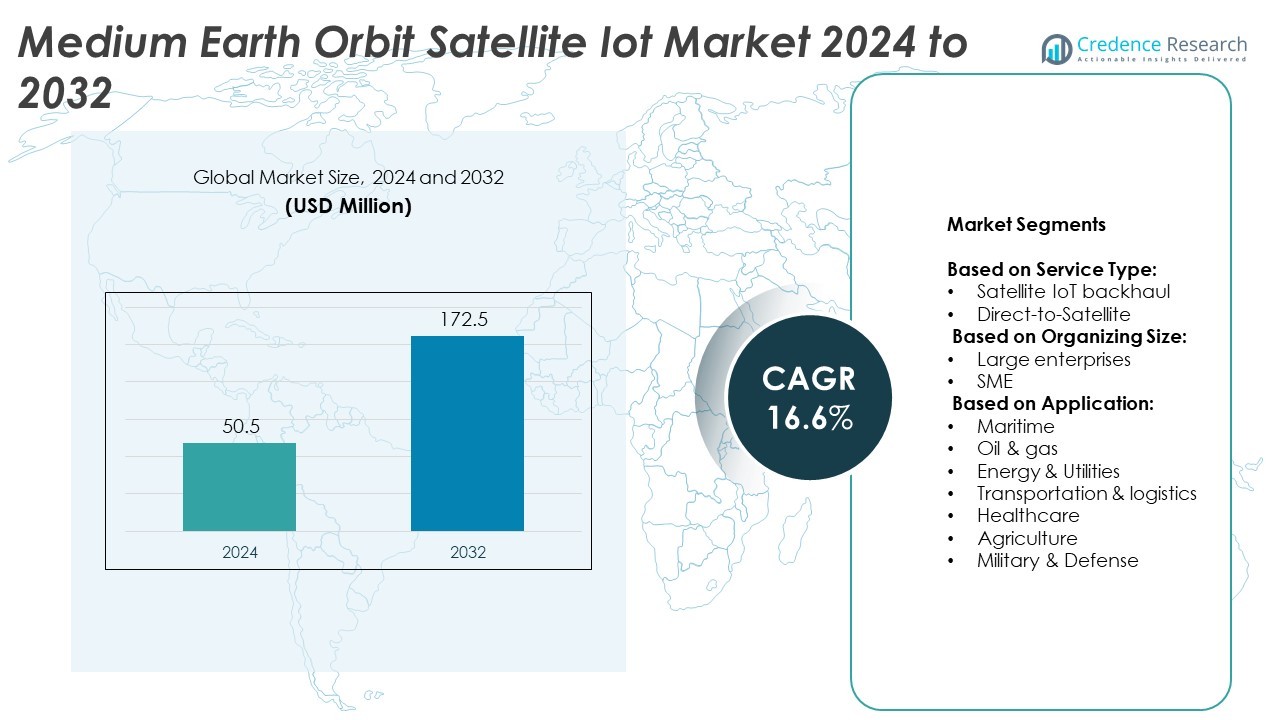

Medium Earth Orbit Satellite IoT Market size was valued at USD 50.5 million in 2024 and is anticipated to reach USD 172.5 million by 2032, at a CAGR of 16.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Earth Orbit Satellite IoT Market Size 2024 |

USD 50.5 Million |

| Medium Earth Orbit Satellite IoT Market, CAGR |

16.6% |

| Medium Earth Orbit Satellite IoT Market Size 2032 |

USD 172.5 Million |

The Medium Earth Orbit Satellite IoT market grows steadily due to increasing demand for seamless global connectivity and reliable real-time data transmission. Industries adopt MEO-enabled IoT solutions to enhance asset tracking, predictive maintenance, and operational efficiency across remote and underserved regions. Advancements in high-throughput satellite technologies and low-latency communication drive wider adoption in sectors like energy, logistics, defense, and healthcare. It benefits from rising integration with AI, edge computing, and analytics platforms, enabling smarter IoT ecosystems.

The Medium Earth Orbit Satellite IoT market demonstrates strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads adoption due to advanced infrastructure and high investment in IoT-driven satellite solutions, while Asia Pacific shows rapid growth supported by digital transformation and expanding smart applications. Europe focuses on cross-border connectivity and sustainability initiatives. Key players driving innovation and competitiveness include SES S.A., Inmarsat Global Limited, Intelsat, and EchoStar Corporation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medium Earth Orbit Satellite IoT market was valued at USD 50.5 million in 2024 and is expected to reach USD 172.5 million by 2032, growing at a CAGR of 16.6% during the forecast period.

- Rising demand for reliable global connectivity and real-time data transmission drives adoption of MEO-based IoT solutions across various industries, including logistics, energy, and defense.

- Key market trends include the integration of AI, edge computing, and high-throughput satellite technologies, enabling faster communication, predictive analytics, and efficient IoT device management.

- The competitive landscape features leading players such as SES S.A., Inmarsat Global Limited, Intelsat, EchoStar Corporation, ORBCOMM Inc., and Eutelsat Communications, focusing on innovation and strategic partnerships to strengthen market presence.

- High deployment costs, complex infrastructure requirements, and regulatory compliance challenges act as significant restraints, slowing adoption for small and medium-sized enterprises.

- North America dominates the market due to strong satellite infrastructure and high investment in IoT technologies, while Asia Pacific shows rapid growth driven by industrial digitalization and increasing demand for smart applications.

- Europe emphasizes cross-border connectivity and sustainability projects, while Latin America and the Middle East & Africa experience emerging opportunities through investments in energy, agriculture, and defense-based IoT solutions.

Market Drivers

Rising Demand for Reliable and Global Connectivity

The Medium Earth Orbit Satellite IoT market is experiencing strong growth due to increasing demand for reliable, low-latency connectivity across remote and underserved regions. Businesses and governments are adopting MEO-based IoT solutions to enable real-time data exchange, critical monitoring, and seamless communication in areas where terrestrial networks fail. It provides broader coverage compared to low-earth alternatives, making it ideal for maritime, oil & gas, energy, and logistics applications. Industries rely on its enhanced capabilities to improve operational efficiency and ensure uninterrupted data flow. The growing dependence on connected devices further accelerates deployment across multiple sectors.

- For instance, SES’s O3b MEO satellite constellation operates at an altitude of approximately 8,063 km, offering round-trip latency as low as 140 ms for data services—a stark contrast to the latency of GEO satellites—making it ideal for latency-sensitive IoT use-cases like maritime tracking

Expanding Applications Across Diverse Industries

The Medium Earth Orbit Satellite IoT market benefits from widespread integration across industries such as agriculture, transportation, defense, and energy. It supports large-scale monitoring, predictive analytics, and asset tracking for organizations seeking operational precision and cost efficiency. Maritime operators leverage MEO-enabled IoT solutions for fleet management and navigation, while energy companies depend on it for pipeline monitoring and remote facility supervision. Defense sectors increasingly adopt MEO systems for secure communication and intelligence sharing. Its versatility continues to attract investment from enterprises exploring digital transformation.

- For instance, 3GPP’s Release 17 now standardizes 5G NTN (Non-Terrestrial Network) satellite communications—including MEO and LEO—enabling seamless satellite-IoT integration into broader telecom networks.

Advancements in Satellite Communication Technologies

The Medium Earth Orbit Satellite IoT market is driven by continuous technological advancements that enhance capacity, speed, and coverage. Companies are adopting high-throughput satellites (HTS) and next-generation payload designs to deliver superior connectivity with reduced latency. It enables IoT-driven networks to manage massive device ecosystems while supporting critical business applications. Enhanced data processing capabilities and improved bandwidth efficiency strengthen real-time communication for mission-critical operations. These developments make MEO satellite IoT a strategic solution for industries demanding high reliability.

Growing Investment and Strategic Collaborations

The Medium Earth Orbit Satellite IoT market benefits from increasing investments and partnerships among satellite operators, IoT platform providers, and enterprises. Governments and private organizations are funding infrastructure expansion to enhance network availability and performance. It attracts collaborations aimed at developing integrated IoT ecosystems that combine advanced analytics, AI, and edge computing. Strategic alliances accelerate innovation, reduce deployment costs, and improve global connectivity coverage. With expanding stakeholder participation, the market strengthens its competitive position and scalability.

Market Trends

Integration of MEO Satellites with IoT-Driven Ecosystems

The Medium Earth Orbit Satellite IoT market is witnessing a strong trend of integrating MEO satellite networks with advanced IoT ecosystems. Companies are adopting unified platforms that combine satellite data with IoT analytics to enable real-time decision-making. It supports applications in transportation, energy, maritime, and agriculture, improving operational visibility and performance. Businesses prefer MEO-based IoT networks for their ability to handle high-volume data while maintaining low latency. The shift toward connected ecosystems strengthens automation and predictive capabilities across industries.

- For instance, SES’s O3b mPOWER constellation—an evolution of O3b—entered commercial service in April 2024 and supports coverage of nearly 95 percent of the world’s population, expanding IoT reach across industries.

Rising Adoption of High-Throughput and Low-Latency Solutions

The Medium Earth Orbit Satellite IoT market continues to evolve with the growing deployment of high-throughput satellites (HTS) and low-latency communication solutions. Organizations demand faster data transfer speeds to manage critical IoT-driven operations effectively. It delivers enhanced network performance, enabling large-scale IoT device connectivity even in challenging environments. Maritime operators, oilfield companies, and defense agencies are adopting HTS-enabled MEO solutions for uninterrupted operations. This trend drives significant innovation in hardware, ground systems, and data-processing platforms.

- For instance, MEO satellites can achieve round-trip latencies between 100 and 150 ms, substantially improving response times over traditional GEO solutions and enabling smoother IoT deployments across sectors.

Expansion of Applications in Industrial and Defense Sectors

The Medium Earth Orbit Satellite IoT market benefits from increasing usage across industrial and defense applications. Industries adopt MEO-based IoT systems for asset tracking, predictive maintenance, and operational intelligence. It plays a crucial role in enabling secure communications for defense operations and supporting critical infrastructure monitoring. Energy firms rely on it for remote site surveillance and pipeline integrity management. Growing demand from security-sensitive sectors fuels continued investment in advanced IoT-enabled satellite capabilities.

Growing Focus on AI-Powered Data Management

The Medium Earth Orbit Satellite IoT market is transforming through the integration of artificial intelligence and edge computing in satellite networks. Companies leverage AI-driven systems to optimize bandwidth allocation, automate IoT device communication, and enhance predictive analytics. It enables faster decision-making for industries requiring real-time operational insights. AI-based solutions improve data accuracy while minimizing latency in critical applications. This trend supports a shift toward intelligent, autonomous IoT ecosystems that maximize satellite efficiency.

Market Challenges Analysis

High Deployment Costs and Infrastructure Complexity

The Medium Earth Orbit Satellite IoT market faces challenges related to high deployment costs and complex infrastructure requirements. Establishing MEO satellite networks demands significant investments in satellite manufacturing, ground stations, and data management systems. It creates barriers for small and medium enterprises that lack the resources to adopt advanced IoT-enabled satellite solutions. Ensuring seamless integration with existing terrestrial and cloud-based networks adds further technical complexities. Limited funding and long project timelines delay network expansion and reduce scalability across regions. Companies must balance capital-intensive deployments with the growing need for cost-efficient connectivity solutions.

Regulatory Constraints and Data Security Concerns

The Medium Earth Orbit Satellite IoT market is also impacted by strict regulatory frameworks and rising concerns over data privacy. Compliance with international frequency allocation policies and licensing procedures often delays service rollouts in key markets. It requires operators to manage complex cross-border regulations while ensuring uninterrupted IoT connectivity. Growing cyber threats and potential breaches raise the demand for stronger encryption and advanced security protocols. Industries handling sensitive operational data face greater risks when deploying satellite-powered IoT solutions. Addressing regulatory restrictions and improving data protection measures remain critical for sustaining market growth.

Market Opportunities

Expanding IoT Integration Across Emerging Industries

The Medium Earth Orbit Satellite IoT market presents significant opportunities through its growing adoption in emerging industries. Enterprises across agriculture, maritime, transportation, and energy sectors are deploying IoT-enabled MEO satellite solutions to enhance operational efficiency and ensure seamless data transmission in remote areas. It supports critical applications such as asset tracking, environmental monitoring, and predictive maintenance, enabling industries to optimize performance and reduce downtime. Increasing demand for real-time analytics creates opportunities for providers to deliver integrated IoT platforms with advanced connectivity features. The expanding scope of connected ecosystems strengthens the potential for widespread adoption across diverse sectors.

Rising Demand for Global Connectivity and Smart Solutions

The Medium Earth Orbit Satellite IoT market benefits from rising demand for uninterrupted global connectivity and intelligent IoT-driven solutions. Businesses seek reliable satellite-based networks to manage remote operations, streamline logistics, and ensure continuity in critical applications. It offers scalable solutions for industries looking to expand coverage beyond terrestrial network limitations. Growing investments in smart infrastructure, autonomous systems, and data-driven technologies accelerate the adoption of MEO-enabled IoT platforms. Providers focusing on innovative applications and collaborative partnerships can leverage these opportunities to establish a strong competitive edge in the evolving IoT ecosystem.

Market Segmentation Analysis:

By Service Type:

Organizational size, and application, reflecting its diverse adoption across industries. By service type, the market is divided into Satellite IoT backhaul and Direct-to-Satellite communication. Satellite IoT backhaul supports data transmission between IoT devices and central networks by leveraging MEO satellites for high-capacity, low-latency connectivity. It is preferred by enterprises managing extensive IoT ecosystems requiring continuous real-time data exchange. Direct-to-Satellite services gain traction among industries seeking seamless device-to-satellite communication without dependency on terrestrial networks, enabling reliable coverage in remote and underserved areas.

- For instance, by mid-2025, SES had launched eight of the planned 13 O3b mPOWER satellites and established 12 operational ground gateways worldwide—co-located with major data centers (e.g., Microsoft Azure)—signaling robust network expansion.

By Organizing Size:

The Medium Earth Orbit Satellite IoT market serves both large enterprises and small and medium-sized enterprises (SMEs). Large enterprises dominate adoption due to their extensive operations, global reach, and higher capacity to invest in advanced IoT-enabled MEO solutions. It enables organizations to manage multiple assets, improve operational intelligence, and ensure real-time monitoring across geographically distributed facilities. SMEs are emerging as a growing segment driven by increasing affordability of satellite-enabled IoT platforms and the need for efficient asset tracking and logistics management.

- For instance, Inmarsat GX5 satellite, launched in partnership with Airbus, delivers 20 gigabits per second (Gbps) of Ka-band capacity and supports real-time IoT connectivity for aviation, maritime, and defense applications, enabling reliable global coverage for mission-critical operations.

By Application:

The Medium Earth Orbit Satellite IoT market serves both large enterprises and small and medium-sized enterprises (SMEs). Large enterprises dominate adoption due to their extensive operations, global reach, and higher capacity to invest in advanced IoT-enabled MEO solutions. It enables organizations to manage multiple assets, improve operational intelligence, and ensure real-time monitoring across geographically distributed facilities. SMEs are emerging as a growing segment driven by increasing affordability of satellite-enabled IoT platforms and the need for efficient asset tracking and logistics management.

Segments:

Based on Service Type:

- Satellite IoT backhaul

- Direct-to-Satellite

Based on Organizing Size:

Based on Application:

- Maritime

- Oil & gas

- Energy & Utilities

- Transportation & logistics

- Healthcare

- Agriculture

- Military & Defense

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Medium Earth Orbit Satellite IoT market, accounting for 36% of the global revenue in 2024. The region benefits from advanced satellite infrastructure, strong investments in IoT platforms, and growing demand for real-time data solutions across industries. Enterprises leverage MEO satellite IoT systems to enhance operational efficiency in sectors such as energy, logistics, and defense. It is driven by increasing adoption of high-throughput satellite technologies and government initiatives supporting digital transformation. Maritime operations along the U.S. and Canadian coasts further accelerate integration of IoT-enabled satellite solutions for navigation and asset tracking. Key players in the region continue to invest in developing scalable MEO systems to support emerging applications and large-scale IoT deployments.

Europe

Europe represents a significant portion of the Medium Earth Orbit Satellite IoT market, contributing 28% of the total share. The region’s growth is supported by strict regulatory compliance requirements, widespread digital adoption, and rising demand for cross-border connectivity. Industries depend on MEO satellite IoT networks for applications in energy grids, transport infrastructure, and environmental monitoring. It plays a critical role in advancing smart port management and optimizing maritime trade routes across European waterways. Government-funded projects focused on sustainability and climate monitoring encourage broader satellite-enabled IoT adoption. Key satellite providers in Europe are also investing heavily in expanding coverage and improving data throughput capabilities to meet the evolving demands of IoT ecosystems.

Asia Pacific

Asia Pacific emerges as the fastest-growing region in the Medium Earth Orbit Satellite IoT market, securing 22% of the global share in 2024. Rapid industrialization, urbanization, and digitalization in countries like China, Japan, India, and South Korea drive strong demand for IoT-enabled satellite solutions. It enables enterprises to manage assets, monitor infrastructure, and maintain communication across geographically diverse areas where terrestrial networks remain limited. The expansion of smart city initiatives and investment in automation technologies further supports market growth. Maritime and agriculture sectors lead adoption as industries seek improved monitoring and predictive analytics powered by MEO-based IoT platforms. Increasing partnerships between global satellite providers and regional telecom operators strengthen infrastructure and accelerate deployment across remote and rural regions.

Latin America

Latin America accounts for 8% of the Medium Earth Orbit Satellite IoT market share, driven by growing demand for connectivity solutions in underserved regions. Industries adopt MEO satellite IoT platforms to manage energy distribution, track logistics, and monitor agricultural production in remote areas. It provides reliable communication for oil exploration and maritime navigation, supporting economic activities in Brazil, Mexico, and Argentina. Governments across the region are introducing policies to improve broadband availability and foster IoT adoption in infrastructure and healthcare. Rising investment from international satellite operators also boosts the availability of cost-effective MEO solutions for small and medium enterprises.

Middle East & Africa

The Middle East & Africa contributes 6% of the Medium Earth Orbit Satellite IoT market, with growing adoption across energy, defense, and transportation sectors. Oil and gas operators in the Gulf region deploy IoT-enabled MEO satellites to monitor offshore drilling and ensure operational safety. It supports critical applications in asset tracking, desert agriculture, and logistics management where terrestrial coverage remains limited. Defense and security agencies rely on MEO satellite IoT networks for secure communication and border surveillance. Ongoing infrastructure development initiatives combined with investments in space technology enhance the region’s capacity to integrate advanced IoT solutions. Expansion of cross-border partnerships between global operators and regional providers further drives accessibility to scalable satellite-enabled IoT systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oil & gas

- Healthcare

- Agriculture

- Maritime

- Military & Defense

- Transportation & logistics

- Energy & Utilities

- Others

Competitive Analysis

The competitive landscape of the Medium Earth Orbit Satellite IoT market features leading players such as SES S.A., Inmarsat Global Limited, Intelsat, EchoStar Corporation, ORBCOMM Inc., Eutelsat Communications, Telesat, Viasat Inc., and Thales Group. These companies focus on expanding their MEO satellite infrastructure, enhancing IoT integration capabilities, and developing high-throughput solutions to meet growing global connectivity demands. The market demonstrates strong competition, with participants investing heavily in research and development to improve coverage, reduce latency, and deliver seamless device-to-satellite communication. It is characterized by strategic collaborations between satellite operators, IoT platform providers, and telecom companies to deliver integrated solutions for industries such as maritime, energy, logistics, and defense. Key players adopt mergers, partnerships, and technological innovations to strengthen their market positions and gain a competitive edge. Growing demand for secure and reliable data transmission drives providers to enhance performance through advanced payload designs and AI-powered analytics. The increasing focus on expanding IoT-enabled applications across remote regions further intensifies competition. Companies actively explore opportunities in emerging markets to address connectivity gaps, improve scalability, and offer cost-effective solutions that cater to a wide range of industries and enterprise requirements.

Recent Developments

- In July 2025, SES launched its ninth and tenth O3b mPOWER satellites, expanding capacity and coverage

- In August 2024, Lockheed Martin acquired Terran Orbital, a move aimed at enhancing its advanced satellite manufacturing capabilities. This strategic acquisition underscores Lockheed Martin’s commitment to strengthening its position in the evolving satellite technology landscape.

- In 2024, Portal Space Systems, led by former SpaceX Propulsion VP, unveiled the Supernova satellite bus. Designed for exceptional in-space maneuverability, the bus can transition from Low-Earth Orbit (LEO) to Geostationary Orbit (GEO) in hours, MEO in minutes, and Cislunar space in days.

Market Concentration & Characteristics

The Medium Earth Orbit Satellite IoT market demonstrates a moderately concentrated structure, with a few dominant players driving innovation, service expansion, and technological advancements. Leading companies invest heavily in enhancing satellite capacity, optimizing data transmission, and integrating IoT-driven solutions across industries. It focuses on delivering low-latency, high-throughput connectivity to support critical applications in energy, logistics, defense, healthcare, and agriculture. Market concentration is influenced by high capital requirements, complex infrastructure, and technological expertise, creating significant entry barriers for new participants. Competitive dynamics are shaped by strategic partnerships, mergers, and advancements in high-performance satellite constellations to meet growing global connectivity demands. It also reflects characteristics such as strong integration of IoT ecosystems, increased adoption of real-time analytics, and rapid expansion into underserved regions. Continuous innovation and growing investments strengthen market positioning, while evolving customer needs drive providers to deliver scalable, secure, and efficient IoT-enabled satellite solutions.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Organizing Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Medium Earth Orbit Satellite IoT market will experience steady growth driven by rising demand for global connectivity solutions.

- Increasing adoption of IoT-enabled satellite systems will enhance operational efficiency across diverse industries.

- Advancements in high-throughput satellite technologies will improve data speed, coverage, and reliability.

- Expanding integration of artificial intelligence and edge computing will strengthen real-time decision-making capabilities.

- Growing applications in defense, energy, logistics, and healthcare will accelerate the market’s expansion.

- Strategic partnerships between satellite operators, IoT providers, and telecom companies will drive innovation and scalability.

- Deployment of direct-to-satellite IoT solutions will enhance accessibility in remote and underserved regions.

- Increasing investment in smart infrastructure and automation will boost adoption of MEO-based IoT platforms.

- Rising demand for secure and resilient data transmission will encourage technological improvements.

- Continuous expansion of satellite constellations will support large-scale IoT device connectivity and global network reliability.