Market Overview

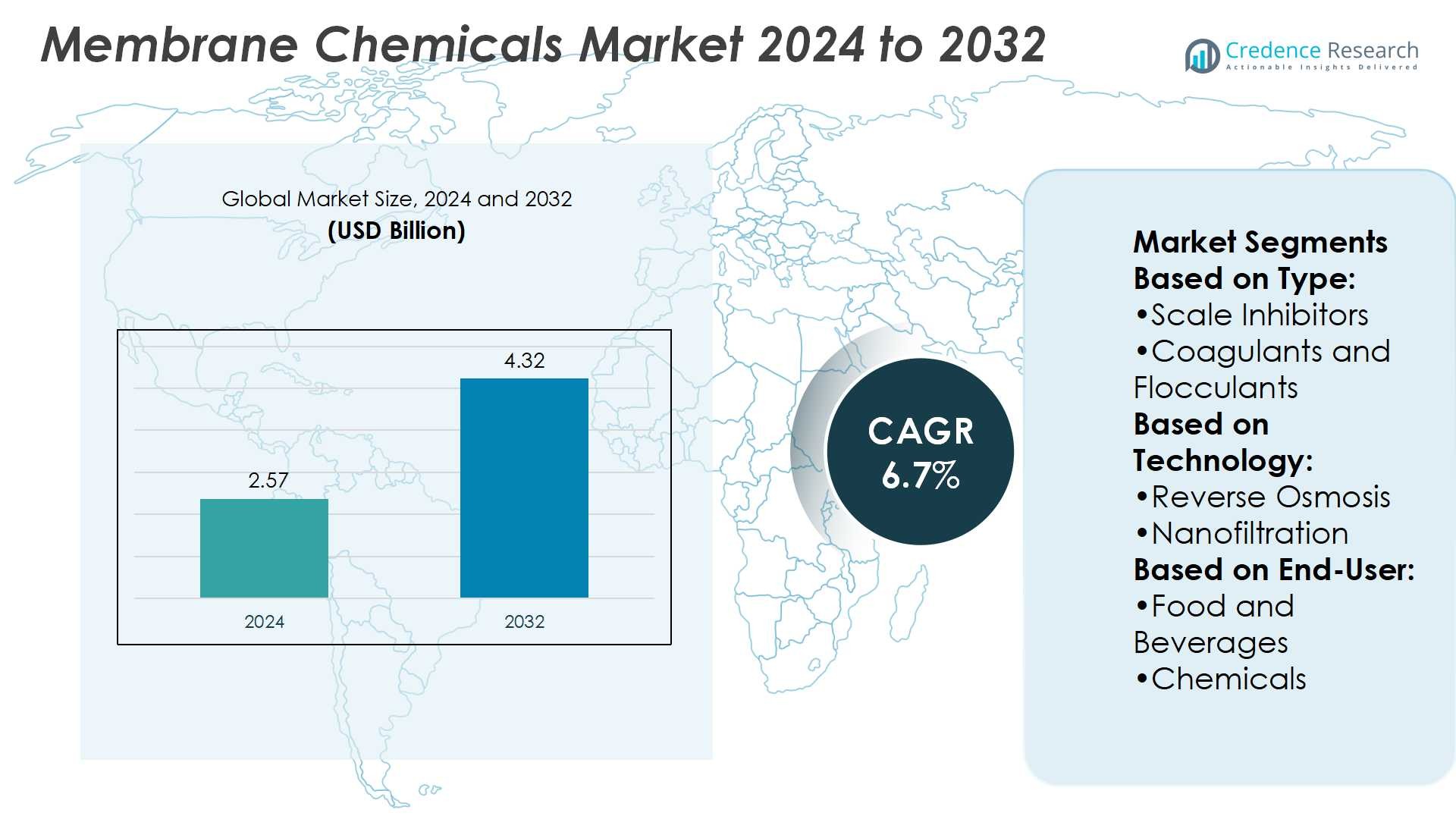

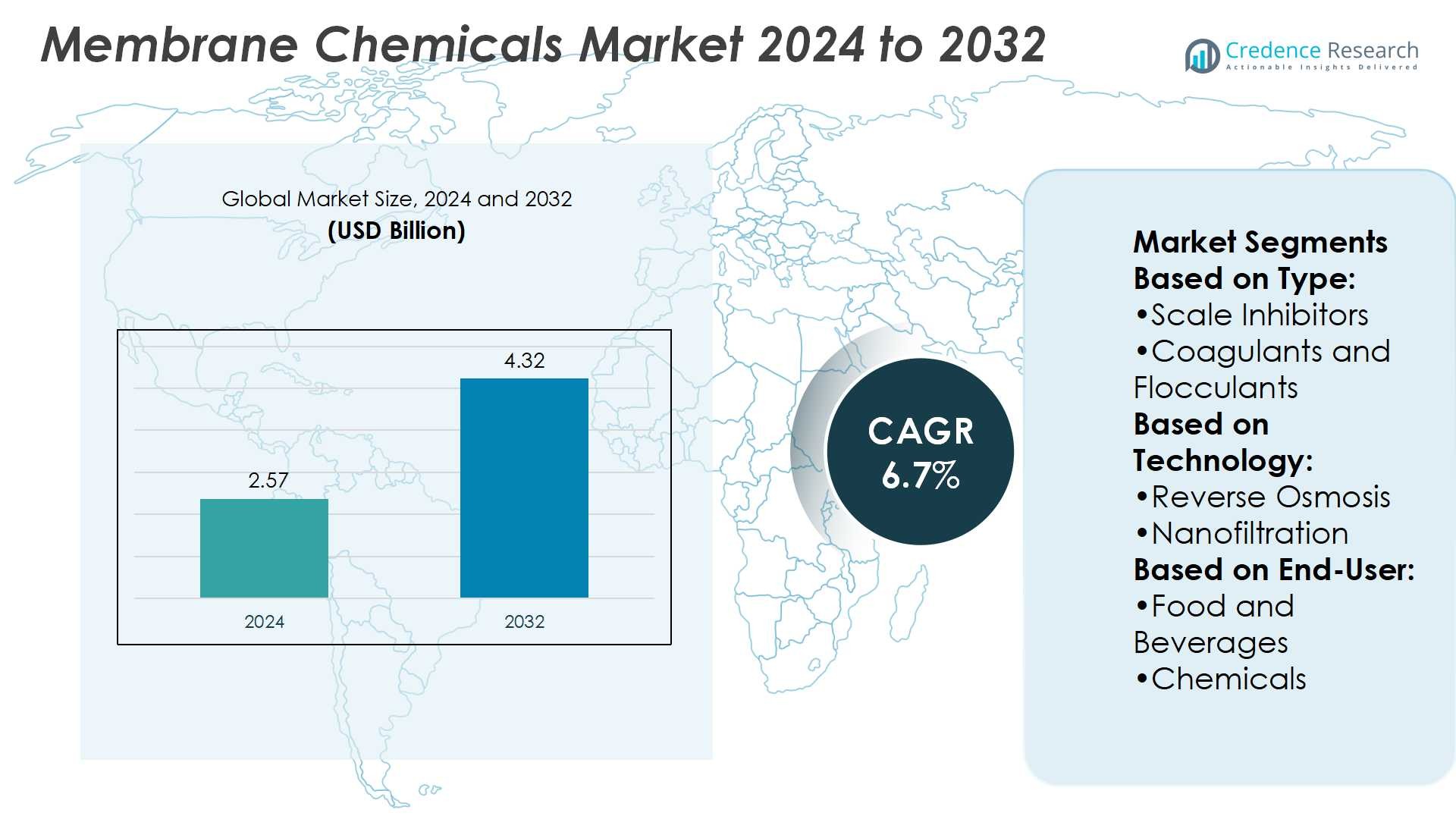

Membrane Chemicals Market size was valued at USD 2.57 billion in 2024 and is anticipated to reach USD 4.32 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Membrane Chemicals Market Size 2024 |

USD 2.57 Billion |

| Membrane Chemicals Market, CAGR |

6.7% |

| Membrane Chemicals Market Size 2032 |

USD 4.32 Billion |

The Membrane Chemicals Market is driven by rising global water scarcity, stricter environmental regulations, and growing investments in advanced water and wastewater treatment facilities. Industries such as food and beverages, power generation, and pharmaceuticals increasingly depend on high-quality water, creating strong demand for efficient membrane maintenance solutions. The market also benefits from the expansion of desalination projects and industrial water reuse programs. Key trends include the shift toward eco-friendly and biodegradable formulations, integration of digital monitoring for precise chemical dosing, and the development of high-performance blends that extend membrane lifespan while ensuring compliance with sustainability standards.

The Membrane Chemicals Market shows strong growth across regions, with Asia-Pacific holding the largest share due to rapid industrialization and urbanization, followed by North America and Europe, driven by advanced infrastructure and strict regulations. Latin America and the Middle East & Africa present emerging opportunities through expanding desalination and municipal projects. Key players include Veolia, Kemira, Genesys, H2O Innovation, King Lee Technologies, L K CHEMICALS, Lenntech B.V., Reverse Osmosis Chemicals International, Thermax Limited, and Universal Water Chemicals Pvt Ltd.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Membrane Chemicals Market was valued at USD 2.57 billion in 2024 and is projected to reach USD 4.32 billion by 2032, at a CAGR of 6.7%.

- Rising global water scarcity, strict environmental regulations, and investments in water treatment facilities are key growth drivers.

- Industries such as food and beverages, power generation, and pharmaceuticals increase demand for efficient membrane maintenance solutions.

- The market trends include eco-friendly and biodegradable formulations, digital monitoring, and high-performance chemical blends.

- Competition focuses on innovation, sustainability, technical expertise, and long-term service contracts.

- High operational costs and complex dosing requirements remain major restraints for wider adoption.

- Asia-Pacific holds the largest share, followed by North America and Europe, while Latin America and the Middle East & Africa show emerging growth opportunities supported by desalination and municipal projects.

Market Drivers

Expanding Demand for Clean Water and Wastewater Treatment

The Membrane Chemicals Market is driven by rising global water scarcity and stricter environmental regulations. Governments and municipalities invest in advanced water and wastewater treatment facilities to ensure safe supply. Membrane chemicals support the efficiency of these systems by preventing fouling, scaling, and microbial growth. The increasing adoption of desalination plants further strengthens market growth. Industries such as food and beverages, power generation, and pharmaceuticals rely heavily on purified water for operations. This dependence positions membrane chemicals as essential in sustaining industrial productivity.

- For instance, under a $550 million contract in the U.S., Veolia will design, build, and operate an ultrafiltration and reverse osmosis membrane treatment facility. The plant will be capable of recycling approximately 8,000 cubic meters (m³) of water per day, which is equivalent to 2.1 million gallons per day.

Rising Adoption of Membrane-Based Technologies in Industrial Applications

Industrial sectors are shifting toward membrane-based processes due to their efficiency and reduced operational costs. The Membrane Chemicals Market benefits from this transition as chemicals extend membrane lifespan and lower replacement costs. Strong demand comes from chemical processing, oil and gas, and electronics manufacturing where water quality is critical. It supports consistent output and compliance with stringent quality standards. Companies focus on advanced formulations that enhance resistance against biofouling and mineral deposits. This innovation ensures reliable operations across diverse industrial segments.

- For instance, Kemira’s KemConnect™ platform helped the Arnhem Zuid wastewater treatment plant in the Netherlands reduce polymer usage by approximately 45%, cut annual costs by 150,000, and lower its CO₂ footprint by 20 tons equivalent through digitally-enhanced chemical optimization.

Technological Advancements and Innovation in Chemical Formulations

The development of advanced membrane chemical solutions contributes to higher performance and cost savings. The Membrane Chemicals Market sees strong investment in research for eco-friendly and high-efficiency products. Modern formulations include biodegradable agents and improved anti-scaling solutions, aligning with sustainability goals. Manufacturers emphasize reducing chemical dosage without compromising effectiveness. These innovations increase acceptance among environmentally conscious industries. It creates opportunities for suppliers to capture long-term contracts in regulated markets.

Growth in Energy Sector and Increasing Focus on Sustainability

The energy industry requires high-purity water for power plants and refineries, fueling demand for treatment solutions. The Membrane Chemicals Market gains traction in this sector as operators prioritize efficiency and cost control. Rising global emphasis on sustainable practices drives adoption of low-toxicity and recyclable chemicals. Companies integrate greener alternatives to meet regulatory compliance and improve brand reputation. The shift toward renewable energy facilities also expands applications for membrane cleaning solutions. This broad adoption ensures continuous growth for the industry.

Market Trends

Rising Focus on Sustainable and Eco-Friendly Chemical Solutions

The Membrane Chemicals Market is witnessing a shift toward environmentally responsible formulations. Manufacturers develop biodegradable and low-toxicity products to align with global sustainability goals. Demand for green chemistry grows as industries seek to reduce environmental impact while maintaining operational efficiency. It reflects regulatory pressure and customer preference for safer water treatment solutions. Companies highlight eco-certifications and compliance credentials to strengthen their market position. This trend creates competitive differentiation and supports long-term adoption.

- For instance, Universal Water Chemicals Pvt Ltd has successfully executed 1,000 water treatment and wastewater management projects, serving over 50,000 customers across five Indian states.

Increasing Integration of Smart Monitoring and Digital Solutions

Digitalization in water treatment drives greater use of smart monitoring for membrane performance. The Membrane Chemicals Market benefits as predictive maintenance and IoT-enabled systems track chemical dosage more accurately. Automation reduces chemical wastage and improves membrane life cycles. It provides operators with real-time insights for efficient system management. Industries adopt software platforms that integrate chemical performance data into operational planning. This enhances reliability and optimizes long-term resource use.

- For instance, Lenntech has provided industrial turnkey plants with a capacity of up to 5,000 m³/day. Some reference projects indicate capacities of 5,400 m³/day and even up to 10,000 m³/day, demonstrating that projects can exceed 5,000 m³/day.

Advancements in High-Performance and Specialized Formulations

Growing complexity in industrial water treatment requires more advanced chemical formulations. The Membrane Chemicals Market responds with high-performance anti-fouling, anti-scaling, and cleaning agents. Specialized solutions target sector-specific challenges in oil and gas, pharmaceuticals, and food processing. It enables industries to manage critical water purity standards effectively. Manufacturers introduce tailored blends designed to withstand aggressive operating conditions. This innovation trend drives premium product adoption across global industries.

Expanding Role of Membrane Chemicals in Desalination Projects

The rising need for freshwater supply strengthens the role of desalination facilities worldwide. The Membrane Chemicals Market benefits from this expansion through higher chemical demand for cleaning and protection. Chemicals ensure uninterrupted performance in large-scale plants under harsh operating conditions. It supports governments and private operators in securing sustainable water resources. Advanced solutions minimize energy use and extend the lifespan of membranes. This trend positions the market as a vital enabler of global water security.

Market Challenges Analysis

High Operational Costs and Dependence on Complex Treatment Processes

The Membrane Chemicals Market faces challenges due to high operational costs associated with advanced water treatment systems. Procurement of premium chemicals, continuous monitoring, and specialized maintenance raise overall expenditure. Small and medium industries struggle to afford long-term adoption of such solutions. It becomes more critical in regions with limited financial resources and less-developed infrastructure. Complex dosing requirements and technical expertise further increase the dependency on skilled professionals. These factors create barriers for wider adoption across emerging economies.

Environmental Concerns and Regulatory Compliance Pressures

Stringent environmental regulations challenge the Membrane Chemicals Market by restricting the use of certain formulations. Compliance with global and regional standards requires continuous product testing and reformulation. It places financial and operational pressure on manufacturers aiming to innovate while staying compliant. Environmental groups and customers push for safer, eco-friendly alternatives, forcing companies to adjust strategies. High scrutiny and certification demands delay product approvals, impacting market entry timelines. These challenges emphasize the need for sustainable innovation without compromising effectiveness.

Market Opportunities

Growing Demand from Emerging Economies and Industrial Expansion

The Membrane Chemicals Market holds strong opportunities in emerging economies where water scarcity and industrialization accelerate adoption. Rapid urban growth increases the need for advanced treatment facilities in Asia-Pacific, the Middle East, and Africa. Industrial expansion in pharmaceuticals, power generation, and food processing requires reliable membrane performance supported by specialized chemicals. It creates demand for scalable and cost-effective chemical solutions suited for diverse applications. Public-private partnerships in infrastructure projects also open new revenue streams for suppliers. Rising investments in industrial water reuse further strengthen long-term growth potential.

Innovation in Sustainable Solutions and Integration with Advanced Technologies

The push for sustainable operations drives opportunities for eco-friendly chemical development and digital integration. The Membrane Chemicals Market benefits from increasing acceptance of biodegradable formulations and reduced chemical footprints. It aligns with strict regulations while offering competitive advantages to forward-looking companies. Advanced analytics and IoT-enabled monitoring create added value by optimizing chemical dosage and reducing operational downtime. Companies that combine innovation in formulations with digital tools gain broader market penetration. This convergence opens pathways to long-term partnerships with industries seeking sustainable and efficient solutions.

Market Segmentation Analysis:

By Type

The Membrane Chemicals Market is segmented into scale inhibitors, coagulants and flocculants, pH adjusters, antiscalants, biocides, and others. Scale inhibitors dominate due to their essential role in preventing mineral deposition that reduces system efficiency. Coagulants and flocculants find growing demand in industries with high suspended solids, ensuring improved membrane protection. pH adjusters maintain system stability and reduce corrosion risks in diverse applications. Antiscalants offer tailored solutions for desalination and power generation facilities. Biocides gain traction in healthcare, municipal, and food sectors to control microbial growth effectively. Other specialty chemicals provide customized protection, enabling performance in unique water treatment environments.

- For instance, Thermax Limited has deployed hollow-fibre nanofiltration modules with a combined treatment capacity of 5 million liters per day, along with ultrafiltration systems capable of handling 25 million liters per day.

By Technology

The market covers reverse osmosis, nanofiltration, ultrafiltration, microfiltration, and others. Reverse osmosis represents the largest share due to its widespread use in desalination plants and industrial water purification. Nanofiltration gains attention for selective removal of organic compounds and divalent salts, offering efficiency in pharmaceuticals and food industries. Ultrafiltration is favored in municipal water supply projects where fine particulate removal is critical. Microfiltration contributes to cost-effective solutions in beverage and dairy processing. It supports industries that require consistent output with lower operational expenses. Other niche technologies continue to serve specialized requirements across global markets.

- For instance, H₂O Innovation secured the largest water reuse contract in its history for the Donald C. Tillman Advanced Water Purification Facility. This system combines ultrafiltration and reverse osmosis to treat 24 million gallons per day, helping deliver recycled water to more than 200,000 residents in Los Angeles.

By End-User

The Membrane Chemicals Market serves food and beverages, chemicals, paper and pulp, and municipal sectors. Food and beverage industries demand high-purity water to maintain product quality and safety standards. Chemicals and petrochemicals industries rely on tailored chemical blends to ensure compliance with strict process requirements. Paper and pulp operations adopt membrane chemicals to manage wastewater and enhance water reuse efficiency. Municipal applications represent a major growth segment due to rising urbanization and stricter environmental regulations. It reflects global investments in water treatment infrastructure to secure safe supply and sustainable operations. This diverse end-user base highlights the widespread relevance of membrane chemical solutions across industries.

Segments:

Based on Type:

- Scale Inhibitors

- Coagulants and Flocculants

Based on Technology:

- Reverse Osmosis

- Nanofiltration

Based on End-User:

- Food and Beverages

- Chemicals

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for nearly 25% of the Membrane Chemicals Market. Strong demand comes from advanced water treatment infrastructure and strict environmental standards. Industries such as pharmaceuticals, food and beverages, and power generation rely heavily on membrane protection. It benefits from ongoing investments in sustainable water reuse and desalination projects. The region also leads in innovation, with companies focusing on eco-friendly formulations. Growing adoption of digital monitoring enhances efficiency in chemical dosing and membrane life cycle management. North America remains a steady and mature market with strong long-term demand.

Europe

Europe holds around 22% of the Membrane Chemicals Market. Demand is driven by high regulatory pressure on water quality and sustainability goals. The region invests in biodegradable and low-toxicity chemicals to comply with EU directives. It serves industries such as biotech, pharmaceuticals, and municipal utilities that require advanced purification. Companies emphasize innovation in anti-scaling and biofouling control agents. It also benefits from strong research networks and public-private collaborations for water security. Europe’s focus on sustainability and innovation strengthens its role as a key market.

Asia-Pacific

Asia-Pacific dominates with a 34% share of the Membrane Chemicals Market. Rapid urbanization, rising industrialization, and water scarcity fuel demand in China, India, and Southeast Asia. Strong investments in desalination and wastewater treatment create growth opportunities. It records rising adoption in food processing, chemicals, and electronics industries. Governments in the region allocate large budgets for municipal water projects. Companies benefit from expanding demand for scalable, cost-effective solutions. Asia-Pacific remains both the largest and fastest-growing regional market.

Latin America

Latin America contributes about 10% of the Membrane Chemicals Market. Growth is moderate, supported by industrial expansion in Brazil, Mexico, and Argentina. Municipal water treatment projects are increasing but remain limited compared to Asia and North America. It offers opportunities for affordable and efficient chemical solutions suited to cost-sensitive markets. Food and beverage industries rely on membrane protection to maintain quality. Rising urban populations drive slow but steady demand for advanced water purification. Latin America shows promise as infrastructure investments expand.

Middle East & Africa

The Middle East & Africa hold nearly 9% of the Membrane Chemicals Market. Water scarcity drives heavy reliance on desalination, creating strong demand for membrane chemicals. Gulf countries invest in large-scale plants requiring advanced antiscalants and biocides. It also serves power generation and municipal sectors with high-purity water needs. North Africa shows gradual adoption of advanced water treatment technologies. Infrastructure gaps still limit faster expansion but open space for new suppliers. This region holds long-term growth potential tied to water security strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Reverse Osmosis Chemicals International

- Veolia

- Kemira

- L K CHEMICALS

- Universal Water Chemicals Pvt Ltd

- Lenntech B.V.

- King Lee Technologies

- Thermax Limited

- H2O Innovation

- Genesys

Competitive Analysis

The Membrane Chemicals Market companies include Veolia, Kemira, Genesys, H2O Innovation, King Lee Technologies, L K CHEMICALS, Lenntech B.V., Reverse Osmosis Chemicals International, Thermax Limited, and Universal Water Chemicals Pvt Ltd. The competitive landscape of the Membrane Chemicals Market is defined by innovation, sustainability, and service differentiation. Companies compete on the basis of advanced formulations that enhance membrane durability, reduce fouling, and optimize operational costs. The market places strong emphasis on developing eco-friendly solutions to meet strict environmental regulations and customer demand for greener alternatives. Competition also revolves around providing technical expertise, after-sales services, and integration of digital monitoring tools for predictive maintenance. Firms that invest in research, focus on customer-centric solutions, and adapt to diverse industrial requirements strengthen their market presence. The industry continues to evolve with rising adoption of smart technologies and sustainable practices, creating opportunities for differentiation and long-term growth.

Recent Developments

- In May 2025, Egypt signed a new financing agreement with the African Development Bank Group (AfDB) for the fourth phase of the Abu Rawash Water Treatment Plant project. This phase will expand the plant’s treatment.

- In March 2025, Memsift Innovations, a leader in advanced membrane technologies, partnered with the Murugappa Group to introduce the GOSEP ultrafiltration membrane. Coinciding with the product launch, both companies inaugurated a state-of-the-art membrane manufacturing facility, marking a major advancement in separation and water treatment technologies.

- In January 2025, Toray Industries, Inc. introduced a high-efficiency separation membrane module tailored for biopharmaceutical manufacturing (see note 1). The new design achieves more than double the filtration output of conventional units by minimizing clogging, raising yields beyond 90% and enhancing purification.

- In June 2024, Asahi Kasei revealed that it began commercial sales of a membrane system designed to produce WFI (water for injection), a sterile-grade water essential for injectable pharmaceuticals.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business,product offerings, investments, revenue streams, and key applications. Additionally, the reportincludes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and biodegradable membrane chemicals will rise with sustainability goals.

- Adoption of smart monitoring and digital dosing tools will expand in treatment facilities.

- Growth in desalination projects will create consistent opportunities for advanced antiscalants.

- Industrial expansion in Asia-Pacific will strengthen demand for tailored chemical solutions.

- Municipal water treatment upgrades will boost usage of high-performance membrane cleaners.

- Stricter environmental regulations will drive innovation in low-toxicity chemical formulations.

- Energy sector requirements for ultra-pure water will increase reliance on specialized blends.

- Integration of predictive maintenance systems will improve efficiency and reduce chemical waste.

- Emerging economies will invest more in cost-effective membrane protection solutions.

- Long-term contracts will favor suppliers offering both technical expertise and sustainable products.