Market Overview:

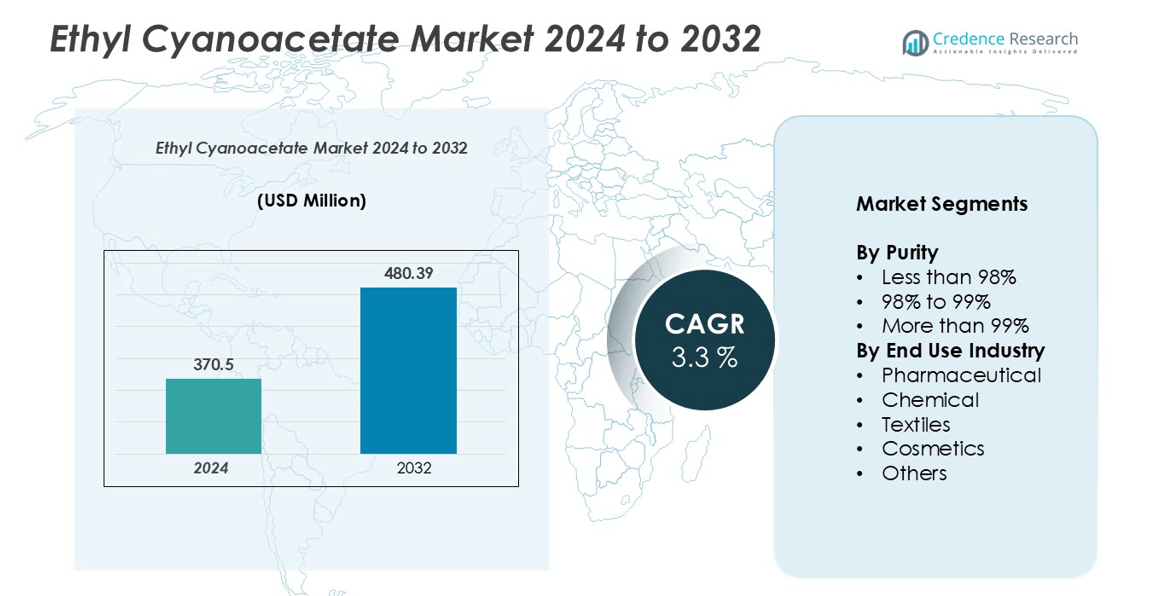

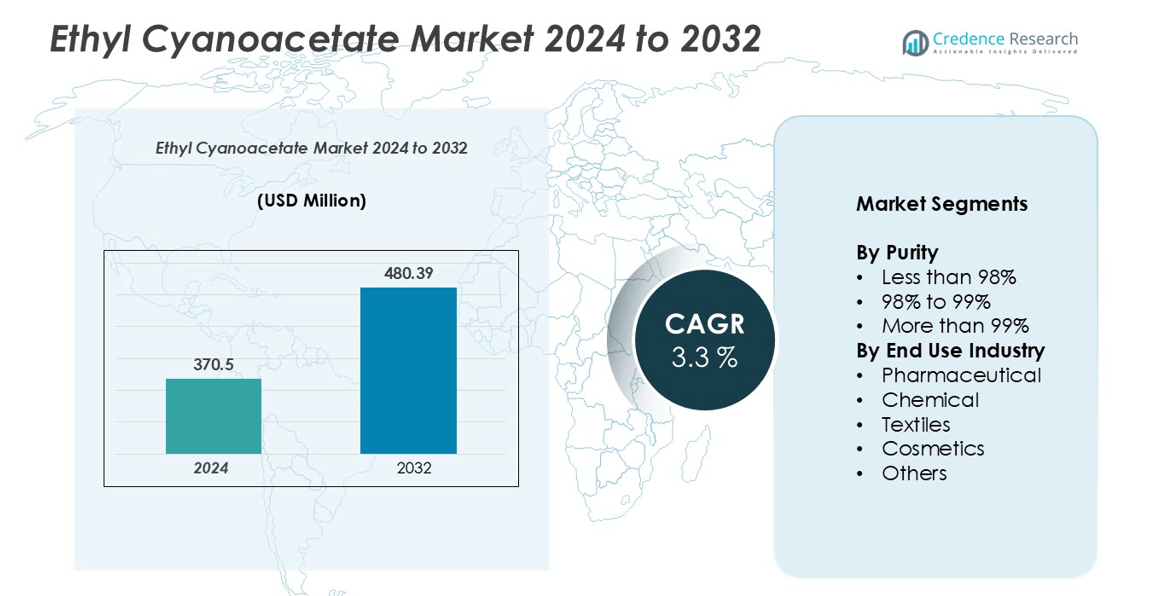

The ethyl cyanoacetate market size was valued at USD 370.5 million in 2024 and is anticipated to reach USD 480.39 million by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethyl Cyanoacetate Market Size 2024 |

USD 370.5 million |

| Ethyl Cyanoacetate Market, CAGR |

3.3% |

| Ethyl Cyanoacetate Market Size 2032 |

USD 480.39 million |

The ethyl cyanoacetate market is dominated by key players such as Merck, Loba Chemie, Tokyo Chemical Industry, Central Drug House, Sisco Research Laboratories, HeBei ChengXin, Pravin Dyechem, Shandong Xinhua Pharma, Emco Dyestuff, SimSon Pharma, and Tiande Chemical, who lead through advanced manufacturing capabilities, high-purity product offerings, and strong distribution networks. Asia-Pacific emerges as the leading region with approximately 32% of the global market share, driven by rapid pharmaceutical manufacturing growth and expanding specialty chemical and textile industries in China, India, and Japan. North America and Europe follow with 28% and 25% market shares, respectively, supported by mature pharmaceutical sectors, stringent quality standards, and R&D investments. These companies focus on product innovation, sustainable production, and regional expansion strategies to strengthen their market positions, ensuring steady growth and competitive advantage in the global ethyl cyanoacetate market.

Market Insights

- The global ethyl cyanoacetate market was valued at USD 370.5 million in 2024 and is projected to reach USD 480.39 million by 2032, growing at a CAGR of 3.3% during the forecast period.

- Growth is driven by rising demand from the pharmaceutical industry for high-purity intermediates used in APIs, as well as increasing applications in specialty chemicals, textiles, and cosmetics.

- Key trends include a shift toward high-purity and sustainable grades, expanding production in emerging economies like China and India, and the growing use of ethyl cyanoacetate in cosmetic formulations and textile finishing.

- The market is highly competitive, led by players such as Merck, Loba Chemie, Tokyo Chemical Industry, Central Drug House, and Sisco Research Laboratories, focusing on quality, technological advancement, and regional expansion.

- Market restraints include strict environmental and safety regulations, along with fluctuating raw material prices, which may affect production costs and supply consistency. North America holds 28%, Europe 25%, and Asia-Pacific 32% of the market, with high-purity segments dominating overall demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Purity:

The ethyl cyanoacetate market is segmented by purity into less than 98%, 98% to 99%, and more than 99%. The more than 99% purity segment dominates the market, accounting for the largest share due to its extensive use in high-grade pharmaceutical and specialty chemical synthesis. This purity level ensures superior reaction efficiency and consistent product performance, making it preferred in applications requiring stringent quality control. Increasing demand for fine chemicals and pharmaceutical intermediates continues to drive the growth of this segment, supported by advancements in purification technologies.

- For instance, Tokyo Chemical Industry Co., Ltd. (TCI) manufactures ethyl cyanoacetate with 99.5% purity, used in synthesizing active pharmaceutical ingredients and heterocyclic compounds.

By End Use Industry:

The market is categorized into pharmaceutical, chemical, textiles, cosmetics, and others. The pharmaceutical segment holds the dominant market share, primarily driven by the compound’s role as a precursor in the synthesis of active pharmaceutical ingredients (APIs) and intermediates. Growing R&D investments in drug formulation and the rising production of therapeutic compounds have strengthened the demand for ethyl cyanoacetate. Furthermore, its chemical stability and compatibility with various synthesis processes make it indispensable in modern pharmaceutical manufacturing.

- For instance, Ethyl cyanoacetate serves as a key chemical precursor in the multi-step synthesis of the anticonvulsant drug ethosuximide, which is used to treat absence seizures in patients with epilepsy, highlighting its important role as a building block in the pharmaceutical industry.

Key Growth Drivers

Expanding Pharmaceutical Applications

The pharmaceutical industry serves as a major growth driver for the ethyl cyanoacetate market. This compound is widely utilized as a building block in the synthesis of active pharmaceutical ingredients (APIs), including barbiturates, vitamins, and anti-cancer drugs. The rising prevalence of chronic diseases has increased global drug production, boosting demand for high-purity ethyl cyanoacetate. Additionally, advancements in organic synthesis and formulation processes have expanded its applicability in new drug development. The compound’s versatility, coupled with stringent quality requirements in the pharmaceutical sector, continues to drive steady consumption and market growth.

- For instance, the global demand for ethyl cyanoacetate is indeed rising, particularly in pharmaceutical applications for synthesizing active ingredients for various drugs, including antivirals and antibiotics. Merck KGaA is one of the market players that supplies this material, alongside other companies like Shandong Xinhua Pharmaceutical and Tokyo Chemical Industry.

Rising Demand in Specialty Chemicals

Ethyl cyanoacetate plays a vital role in producing specialty chemicals used across coatings, adhesives, and agrochemical intermediates. The growing industrial demand for efficient and reactive intermediates is propelling its usage in precision chemical synthesis. Manufacturers are focusing on improving production efficiency and product purity to cater to evolving customer requirements. Moreover, its compatibility with various chemical reactions makes it indispensable in producing high-performance materials. The continuous expansion of specialty chemical manufacturing hubs in Asia-Pacific further enhances its market potential.

- For instance, Laxmi Organic Industries is a prominent specialty chemicals manufacturer that has invested in state-of-the-art production facilities to cater to demand. The investments confirm its commitment to expanding both its essentials and specialty chemicals businesses.

Increasing Adoption in Textile and Cosmetic Formulations

The compound’s application in textile finishing agents and cosmetic formulations is emerging as a key growth factor. Ethyl cyanoacetate enhances fabric quality, dye adhesion, and color fastness in textiles, while in cosmetics, it serves as a functional ingredient in fragrance and skincare formulations. Growing consumer preference for premium textiles and high-quality personal care products is driving industrial utilization. With the cosmetics and textile industries emphasizing product innovation and performance, ethyl cyanoacetate’s role as a versatile chemical intermediate is expanding, particularly in developing economies with rising disposable incomes.

Key Trends & Opportunities

Shift Toward High-Purity and Sustainable Grades

A significant trend shaping the ethyl cyanoacetate market is the increasing focus on high-purity and eco-friendly product variants. Manufacturers are investing in advanced purification processes and sustainable synthesis routes to minimize impurities and reduce environmental impact. The shift aligns with global regulatory standards favoring cleaner chemical production. As industries such as pharmaceuticals and electronics demand higher-grade intermediates, suppliers developing sustainable and ultra-pure ethyl cyanoacetate stand to gain competitive advantage. This trend opens opportunities for innovation and premium market positioning.

- For instance, Merck KGaA, a German multinational science and technology company, provides high-purity chemical products, including ethyl cyanoacetate, to the pharmaceutical industry for use in manufacturing, research, and development. The company’s commitment to quality and innovation aligns with an ongoing industry-wide shift towards more sustainable chemical production.

Expansion Across Emerging Economies

Emerging economies in Asia-Pacific, including China and India, are creating substantial growth opportunities for ethyl cyanoacetate manufacturers. Expanding chemical and pharmaceutical manufacturing bases, coupled with supportive government policies for industrial development, are fueling market penetration. Increasing foreign investments and the establishment of export-oriented production facilities are enhancing regional supply capabilities. Additionally, the rising demand for textiles, cosmetics, and specialty chemicals in these regions provides new avenues for market expansion, positioning Asia-Pacific as a key growth frontier for global suppliers.

- For instance, Laxmi Organic Industries Ltd. is expanding its ethyl acetate capacity by 70,000 metric tons per annum at its Lote facility in Maharashtra. This was announced by the company as part of a larger capital expenditure plan.

Key Challenges

Environmental and Safety Regulations

Stringent environmental and safety regulations governing the use and disposal of chemical intermediates pose a significant challenge to the ethyl cyanoacetate market. As a compound that requires careful handling due to potential toxicity, manufacturers must invest heavily in compliance measures, safe storage, and waste management systems. Adhering to evolving global standards such as REACH and EPA regulations increases operational costs. These regulatory pressures may limit production scalability and affect profit margins, particularly for small and medium-sized producers lacking advanced safety infrastructure.

Fluctuating Raw Material Prices and Supply Constraints

Volatility in raw material prices, particularly for key feedstocks like cyanoacetic acid and ethanol, poses a major challenge for market participants. Supply disruptions caused by geopolitical tensions, trade restrictions, or energy price fluctuations can impact production consistency and pricing stability. Manufacturers are increasingly focusing on securing long-term supplier partnerships and optimizing supply chain efficiency to mitigate risks. However, persistent uncertainty in raw material availability may affect production planning, limit cost competitiveness, and slow overall market growth momentum.

Regional Analysis

North America

North America holds a significant share of the global ethyl cyanoacetate market, accounting for approximately 28%. The region’s dominance is driven by a robust pharmaceutical and specialty chemical sector, particularly in the U.S. and Canada, where high-purity intermediates are in strong demand for APIs and R&D activities. Advanced manufacturing infrastructure, stringent quality standards, and well-established distribution networks further reinforce market leadership. Pharmaceutical applications contribute the largest portion of consumption, followed by specialty chemicals. Continuous innovation and adherence to regulatory frameworks ensure steady growth, maintaining North America’s prominent position in the global ethyl cyanoacetate market.

Europe

Europe represents a substantial share of the ethyl cyanoacetate market, contributing around 25% of the global total. Germany, France, and the U.K. lead demand due to mature pharmaceutical, chemical, and cosmetic industries requiring high-purity intermediates. Emphasis on sustainable production processes and compliance with EU regulations drives advanced manufacturing adoption. Pharmaceutical intermediates dominate regional consumption, followed by chemical and cosmetic applications. Ongoing R&D investments and industrial modernization strengthen Europe’s stable and innovative market position, ensuring sustained demand and a significant share in the global ethyl cyanoacetate landscape.

Asia-Pacific

Asia-Pacific accounts for the largest market share globally, approximately 32%, and is the fastest-growing region for ethyl cyanoacetate. China, India, and Japan lead production and consumption, supported by rapid industrialization, rising pharmaceutical manufacturing, and expanding specialty chemical and textile sectors. Increasing foreign investment, export-oriented facilities, and favorable government policies drive market expansion. High adoption in cosmetics and textile finishing further reinforces regional growth. Cost-effective production and a large consumer base position Asia-Pacific as a key driver of global market growth, with significant opportunities for both local and international suppliers.

Latin America

Latin America holds a moderate share of the ethyl cyanoacetate market, estimated at 10%, with Brazil and Mexico as primary contributors. Growth is driven by expanding pharmaceutical production, cosmetic formulations, and specialty chemical applications. Rising investments in healthcare and chemical industries increase demand for high-quality intermediates. However, limited local production and reliance on imports restrict market share. Urbanization and industrial development are creating new opportunities for ethyl cyanoacetate suppliers to expand their presence, while strategic partnerships could enhance regional penetration and increase market share in the coming years.

Middle East & Africa

The Middle East & Africa (MEA) contributes roughly 5% to the global ethyl cyanoacetate market. Growth is supported by increasing pharmaceutical manufacturing, chemical processing, and investment in industrial infrastructure in countries such as Saudi Arabia, UAE, and South Africa. Although the market share remains smaller compared to other regions, rising demand for high-purity intermediates in pharmaceuticals, cosmetics, and specialty chemicals is notable. MEA offers opportunities for import substitution, strategic collaborations, and local production expansion to strengthen market presence and gradually increase its contribution to the global ethyl cyanoacetate market.

Market Segmentations:

By Purity

- Less than 98%

- 98% to 99%

- More than 99%

By End Use Industry

- Pharmaceutical

- Chemical

- Textiles

- Cosmetics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The ethyl cyanoacetate market is highly competitive, characterized by the presence of global and regional players focusing on product quality, innovation, and market expansion. Leading companies such as Merck, Loba Chemie, Tokyo Chemical Industry, Central Drug House, and Sisco Research Laboratories hold significant market shares due to their established manufacturing capabilities, extensive distribution networks, and consistent supply of high-purity intermediates. Regional players like HeBei ChengXin, Pravin Dyechem, Shandong Xinhua Pharma, Emco Dyestuff, SimSon Pharma, and Tiande Chemical are gaining traction by offering cost-effective solutions and catering to local demand in pharmaceuticals, specialty chemicals, textiles, and cosmetics. Market competition is driven by product differentiation, technological advancements in synthesis and purification processes, and strategic partnerships or collaborations to expand regional presence. Companies are also investing in sustainable production methods and high-purity grades to meet stringent regulatory requirements, enhancing their competitiveness and strengthening market positioning in the global ethyl cyanoacetate landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Central Drug House

- Emco Dyestuff

- HeBei ChengXin

- Loba Chemie

- Merck

- Pravin Dyechem

- Shandong Xinhua Pharma

- SimSon Pharma

- Sisco Research Laboratories

- Tiande Chemical

- Tokyo Chemical Industry

Recent Developments

- In April 2024, Turkey notified the WTO’s Committee on Safeguards about initiating a safeguard investigation on ethyl acetate. The investigation, launched on April 6, 2024, invited interested parties to submit questionnaires within 30 days to the Ministry.

- In March 2023, Researchers transformed ethyl cyanoacrylate, traditionally used in Super Glue, into a closed-loop recyclable plastic. The scalable process enabled plastic recycling with over 90% yield, offering a sustainable alternative to unrecycled plastics like poly(styrene)

Report Coverage

The research report offers an in-depth analysis based on Purity, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by rising pharmaceutical and specialty chemical demand.

- High-purity ethyl cyanoacetate will continue to dominate due to its critical applications in APIs and fine chemicals.

- Expansion in emerging economies, particularly in Asia-Pacific, will create new growth opportunities.

- Increasing adoption in cosmetic formulations and textile finishing is likely to enhance market penetration.

- Manufacturers are expected to invest in sustainable and eco-friendly production processes.

- Technological advancements in purification and synthesis will improve product quality and efficiency.

- Strategic partnerships and collaborations will strengthen regional distribution and market reach.

- Regulatory compliance and adherence to safety standards will shape production and operational practices.

- Market competition will intensify with regional players focusing on cost-effective solutions.

- Rising R&D activities in pharmaceuticals and specialty chemicals will continue to drive product innovation and application expansion.