Market Overview

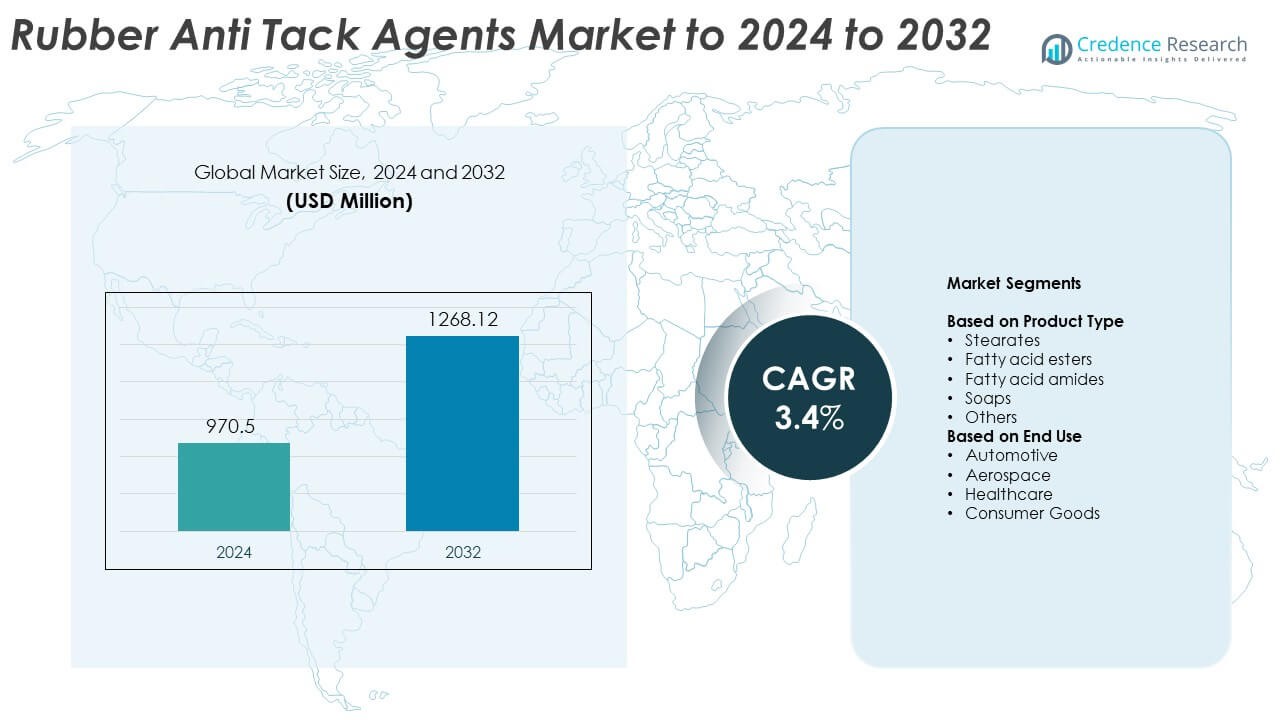

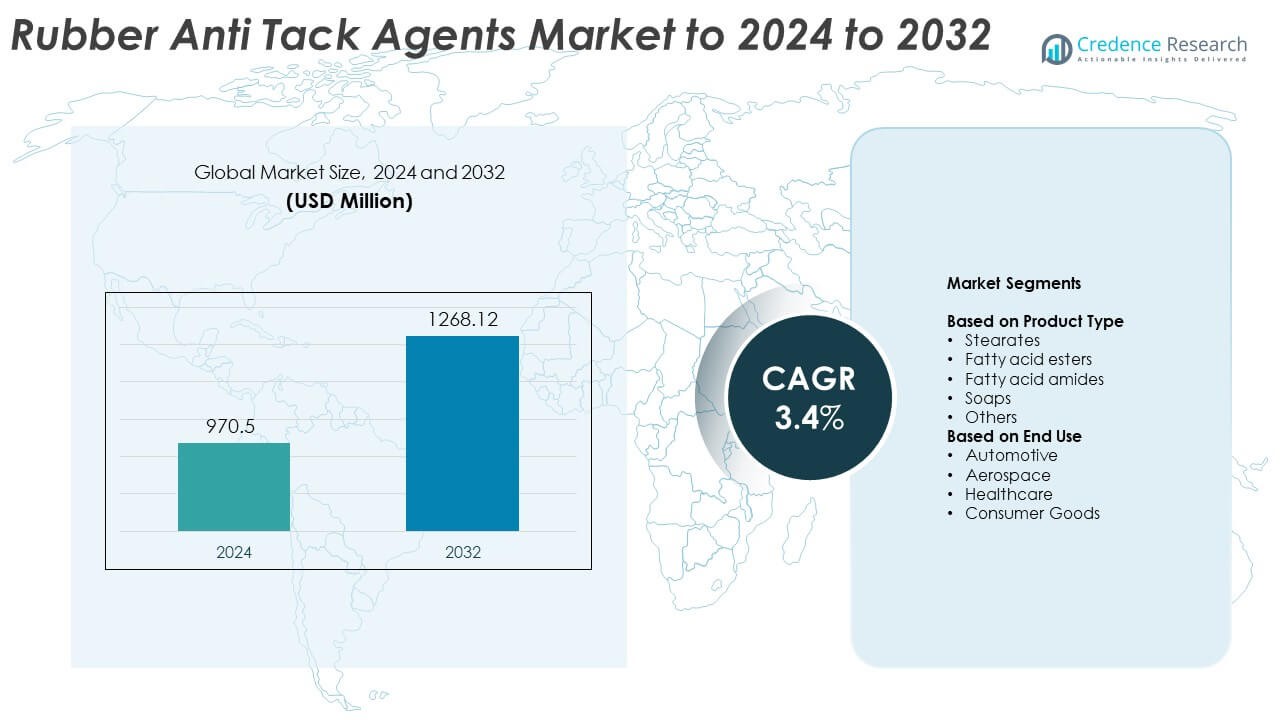

Rubber Anti Tack Agents Market size was valued at USD 970.5 Million in 2024 and is anticipated to reach USD 1,268.12 Million by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber Anti Tack Agents Market Size 2024 |

USD 970.5 Million |

| Rubber Anti Tack Agents Market, CAGR |

3.4% |

| Rubber Anti Tack Agents Market Size 2032 |

USD 1,268.12 Million |

The rubber anti-tack agents market is dominated by global players such as BASF SE, Solvay SA, Evonik Industries AG, Wacker Chemie AG, Kraton Corporation, and Chem-Trend L.P. These companies focus on developing sustainable, high-performance formulations that enhance process efficiency and comply with environmental standards. Strategic mergers, regional expansions, and R&D investments strengthen their global presence and product portfolios. Asia Pacific leads the market with a 37.9% share in 2024, driven by extensive tire manufacturing and industrial growth in China, India, and Japan. North America and Europe follow, supported by strong automotive production and regulatory emphasis on eco-friendly formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The rubber anti-tack agents market was valued at USD 970.5 Million in 2024 and is projected to reach USD 1,268.12 Million by 2032, growing at a CAGR of 3.4%.

- Growth is fueled by increasing tire production, expanding automotive manufacturing, and rising demand for process-efficient rubber compounding solutions.

- The market is witnessing a shift toward eco-friendly, water-based, and bio-derived formulations to meet global environmental and safety regulations.

- Competition remains strong among major players focusing on innovation, strategic partnerships, and sustainable product development to enhance market presence.

- Asia Pacific led the market with a 37.9% share in 2024, followed by North America at 28.4% and Europe at 24.6%, while the stearates segment dominated overall product demand with a 37.5% share.

Market Segmentation Analysis:

By Product Type

The stearates segment dominated the rubber anti-tack agents market with a 37.5% share in 2024. Stearates are widely preferred due to their superior lubricating and anti-adhesive properties, enabling uniform coating and reduced compound sticking during rubber processing. Their high thermal stability and compatibility with various rubber grades make them ideal for tire and industrial rubber production. Growing tire manufacturing and increased demand for high-performance rubber products further drive stearate consumption across major economies. Fatty acid esters and amides are gaining traction for their eco-friendly and biodegradable formulations.

- For instance, Struktol WB 212 runs at 1–3 phr, with 49–63 °C dropping point and 1.10 specific gravity, used to prevent sticking and speed filler uptake.

By End Use

The automotive segment accounted for the largest share of 48.6% in 2024, driven by rising global tire and automotive component production. Anti-tack agents are extensively used in tire manufacturing, conveyor belts, and rubber seals to prevent compound adhesion and ensure smooth processing. Expanding electric vehicle production and demand for lightweight, durable rubber components further boost consumption. The aerospace and healthcare sectors are also adopting these agents for high-performance rubber products requiring precision molding and surface stability.

- For instance, Bridgestone is adding ~1.1 million tires per year capacity at its Pune plant by 2029, signaling sustained tire output growth.

Key Growth Drivers

Expansion of Global Tire Manufacturing

The growing tire manufacturing industry remains a major driver for the rubber anti-tack agents market. Rising vehicle production and replacement tire demand are increasing the need for anti-tack coatings to prevent compound adhesion during processing. Manufacturers rely on these agents to improve efficiency, reduce waste, and ensure uniform compound separation. The expansion of tire production facilities in countries such as China, India, and Indonesia further accelerates product adoption across natural and synthetic rubber applications.

- For instance, Michelin’s Roanne site now makes 90% 19-inch-and-above tires, showing the shift to high-performance output that needs reliable anti-tack.

Shift Toward Environmentally Friendly Formulations

Rising environmental regulations are pushing manufacturers to develop eco-friendly and non-toxic anti-tack agents. Water-based and biodegradable formulations are replacing solvent-based variants, reducing volatile emissions and workplace hazards. Companies are investing in bio-based raw materials like fatty acid derivatives to align with global sustainability standards. The growing focus on green manufacturing in the rubber and automotive sectors continues to boost adoption of sustainable anti-tack solutions.

- For instance, Evonik lists VOC = 0.1% (DIN ISO 11890-2) for TEGO® Variplus SK, reflecting ultra-low emissions in coating additives.

Technological Advancements in Rubber Processing

Advancements in rubber compounding and mixing technologies are enhancing the role of anti-tack agents in process optimization. Modern formulations enable better dispersion, improved coating consistency, and reduced contamination. Automation in tire and component manufacturing requires precise anti-tack application for consistent quality. Continuous R&D efforts toward improving temperature resistance and performance stability are driving innovation in product development and industrial use.

Key Trends & Opportunities

Adoption of Water-Based Anti-Tack Systems

Water-based anti-tack agents are gaining popularity due to their low environmental impact and superior safety profile. These formulations minimize volatile organic compound emissions and ensure better compatibility with diverse rubber types. Growing demand from the automotive and healthcare sectors for non-toxic, odorless, and sustainable solutions offers significant growth opportunities. Manufacturers are increasingly introducing high-performance, water-based products to capture emerging regulatory-driven markets.

- For instance, H.L. Blachford specifies a fast-drying zinc paste at 25% solids for water-cooled batch-off use, illustrating quantified water-based formulations.

Rising Demand in Electric Vehicle Manufacturing

The expansion of electric vehicle production is creating new opportunities for rubber anti-tack agents. These materials are essential in the manufacture of lightweight tires, seals, and vibration-damping components used in EVs. Enhanced thermal stability and performance consistency are crucial to meet EV-specific design requirements. The shift toward high-efficiency tire compounds supports the demand for advanced anti-tack agents that ensure defect-free processing.

- For instance, Goodyear reported a decline in tire unit volume for the second quarter of 2025, with total tire unit volumes decreasing by 5.3%. This was driven by lower volume in the Americas (down 2.6%) and Asia Pacific (down 15.6%).

Key Challenges

Fluctuations in Raw Material Prices

Volatility in the prices of raw materials such as fatty acids, stearates, and metallic soaps poses a significant challenge. Dependence on petroleum-based feedstocks affects production costs and profit margins for manufacturers. Supply chain disruptions and varying regional availability further complicate pricing stability. Companies are focusing on backward integration and renewable material sourcing to mitigate the impact of cost fluctuations.

Stringent Environmental Regulations

Tightening environmental laws regarding chemical use and emissions are challenging conventional anti-tack formulations. Restrictions on VOCs and solvent-based agents are compelling manufacturers to reformulate existing products. Compliance with global standards such as REACH and EPA guidelines increases development costs. Companies must balance regulatory adherence with maintaining performance efficiency and process compatibility.

Regional Analysis

North America

North America held a 28.4% share of the rubber anti-tack agents market in 2024, driven by strong tire manufacturing activity and steady automotive demand. The United States leads the region, supported by established production facilities from major tire and rubber component manufacturers. Growing investments in sustainable and high-performance rubber compounds further support market expansion. Technological adoption in rubber processing, coupled with stringent quality standards in automotive and aerospace sectors, continues to boost demand for advanced anti-tack formulations across the region.

Europe

Europe accounted for 24.6% of the global market in 2024, led by Germany, France, and Italy. The region benefits from its well-developed automotive and industrial rubber sectors, emphasizing process efficiency and sustainability. Strict environmental regulations encourage the adoption of water-based and bio-derived anti-tack agents. Continuous innovation in eco-friendly compounds aligns with the European Green Deal objectives, driving market growth. Expanding applications in aerospace and healthcare further enhance product utilization across the continent’s advanced manufacturing hubs.

Asia Pacific

Asia Pacific dominated the market with a 37.9% share in 2024, supported by large-scale tire and rubber production in China, India, and Japan. Rapid industrialization, urban growth, and automotive sector expansion contribute to strong regional demand. Local manufacturers increasingly invest in automation and advanced compounding technologies to improve product quality and production yield. The shift toward electric vehicle manufacturing in major Asian economies is further strengthening the need for high-performance rubber anti-tack agents with better temperature and chemical resistance.

Latin America

Latin America captured an 5.8% share in 2024, primarily driven by growing automotive and industrial activity in Brazil and Mexico. Expanding tire manufacturing and regional rubber processing industries support steady product demand. Investments in industrial modernization and trade partnerships with North American manufacturers enhance technology transfer. The adoption of eco-friendly formulations is gradually increasing, supported by rising environmental awareness and regulatory developments. Emerging local suppliers are focusing on cost-efficient, water-based anti-tack solutions to strengthen competitiveness in regional markets.

Middle East and Africa

The Middle East and Africa region held a 3.3% share in 2024, showing moderate growth due to expanding infrastructure and industrial projects. Rising automotive assembly operations in South Africa and Saudi Arabia are driving the demand for rubber compounds and related processing chemicals. Government initiatives promoting manufacturing diversification also contribute to steady consumption. The increasing use of anti-tack agents in conveyor belts and construction materials supports regional industrialization, although limited production capabilities and high import dependence constrain faster market expansion.

Market Segmentations:

By Product Type

- Stearates

- Fatty acid esters

- Fatty acid amides

- Soaps

- Others

By End Use

- Automotive

- Aerospace

- Healthcare

- Consumer Goods

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rubber anti-tack agents market is highly competitive, with leading companies such as BASF SE, Solvay SA, Evonik Industries AG, Wacker Chemie AG, Kraton Corporation, Trelleborg AB, Continental AG, Chem-Trend L.P., Schill & Seilacher “Struktol” GmbH, Eastman Chemical Company, Excelitas Technologies Corp., Dover Chemical Corporation, Michelman, Inc., R.T. Vanderbilt Company, Inc., Omnova Solutions Inc., Hawkins, Inc., Hutchinson SA, and Samyang Corporation. Market players are emphasizing the development of eco-friendly, water-based formulations to comply with environmental regulations and reduce VOC emissions. Continuous research into bio-based materials and process optimization supports performance enhancement and sustainability goals. Companies are expanding their regional presence through strategic collaborations, acquisitions, and partnerships with tire and rubber manufacturers. The adoption of automation, precision coating technologies, and customized formulations enables improved product efficiency and uniform compound separation. Intense competition drives innovation, with firms focusing on reliability, production consistency, and cost optimization to strengthen their global market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Solvay SA

- Evonik Industries AG

- Wacker Chemie AG

- Kraton Corporation

- Trelleborg AB

- Continental AG

- Chem-Trend L.P.

- Schill & Seilacher “Struktol” GmbH

- Eastman Chemical Company

- Excelitas Technologies Corp.

- Dover Chemical Corporation

- Michelman, Inc.

- T. Vanderbilt Company, Inc.

- Omnova Solutions Inc.

- Hawkins, Inc.

- Hutchinson SA

- Samyang Corporation

Recent Developments

- In 2025, Schill & Seilacher “Struktol” GmbH continued to offer advanced, organosiloxane-based specialty lubricants known for their stability at high temperatures and function as anti-tack agents.

- In 2023, Evonik Industries AG offered a wide range of anti-tack agents, including fatty acid esters, stearates, and soaps, addressing different market needs.

- In 2023, Chem-Trend L.P. continued to offer its established Mono-Coat product line, known for its semi-permanent release agent technology in the rubber molding industry.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing tire and automotive component manufacturing will continue to drive strong product demand.

- Adoption of eco-friendly, water-based anti-tack formulations will expand under tightening environmental norms.

- Increased focus on process automation in rubber compounding will enhance product performance requirements.

- Electric vehicle production growth will create new opportunities for advanced rubber processing materials.

- Asia Pacific will remain the leading market due to rapid industrialization and high tire output.

- Continuous R&D in biodegradable and bio-based agents will strengthen sustainability portfolios.

- Strategic collaborations between rubber producers and chemical firms will optimize formulation efficiency.

- Regulatory pressure on solvent-based products will accelerate innovation in safer alternatives.

- Digital monitoring technologies in manufacturing will improve coating precision and reduce material waste.

- Expanding applications in healthcare and aerospace sectors will diversify product demand beyond automotive.