Market Overview:

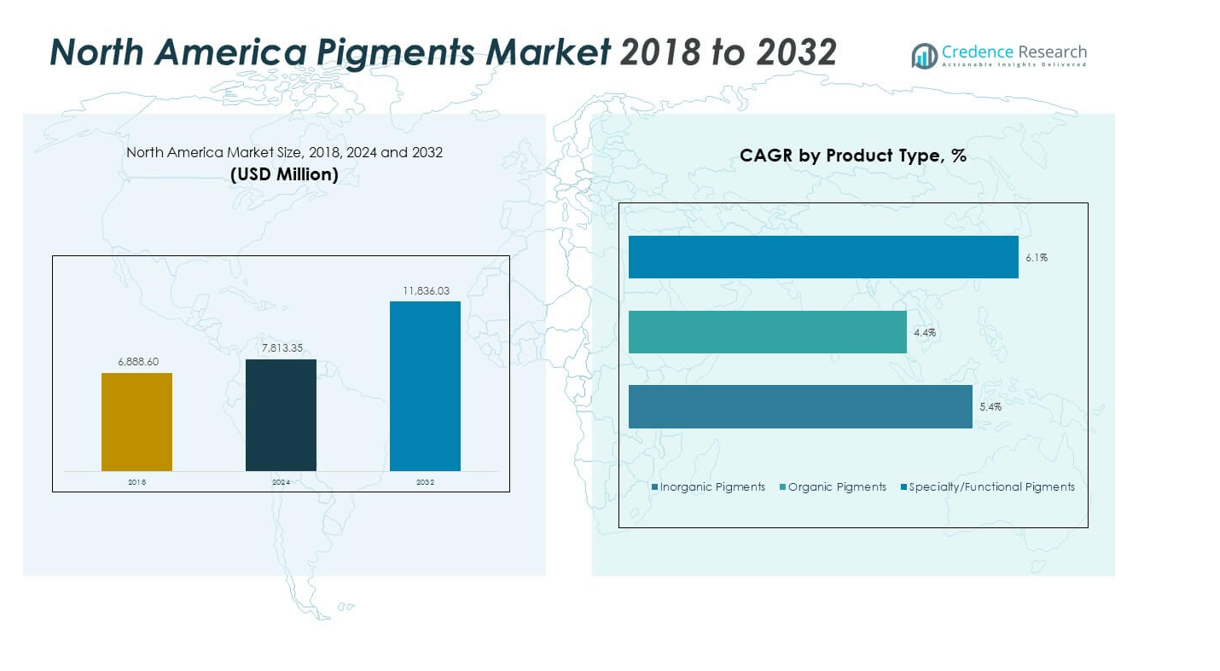

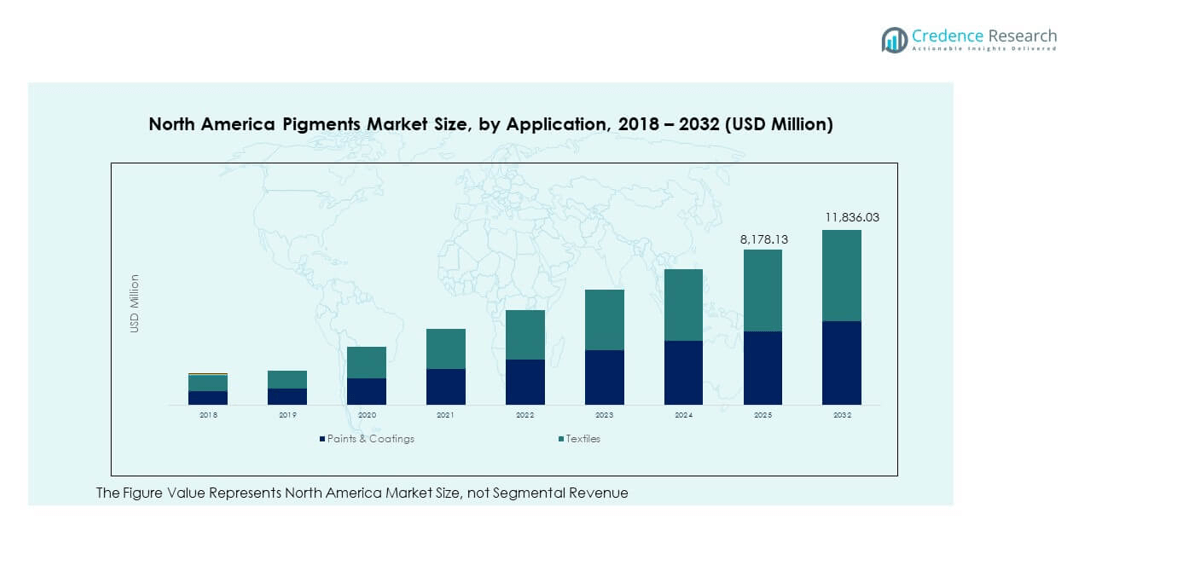

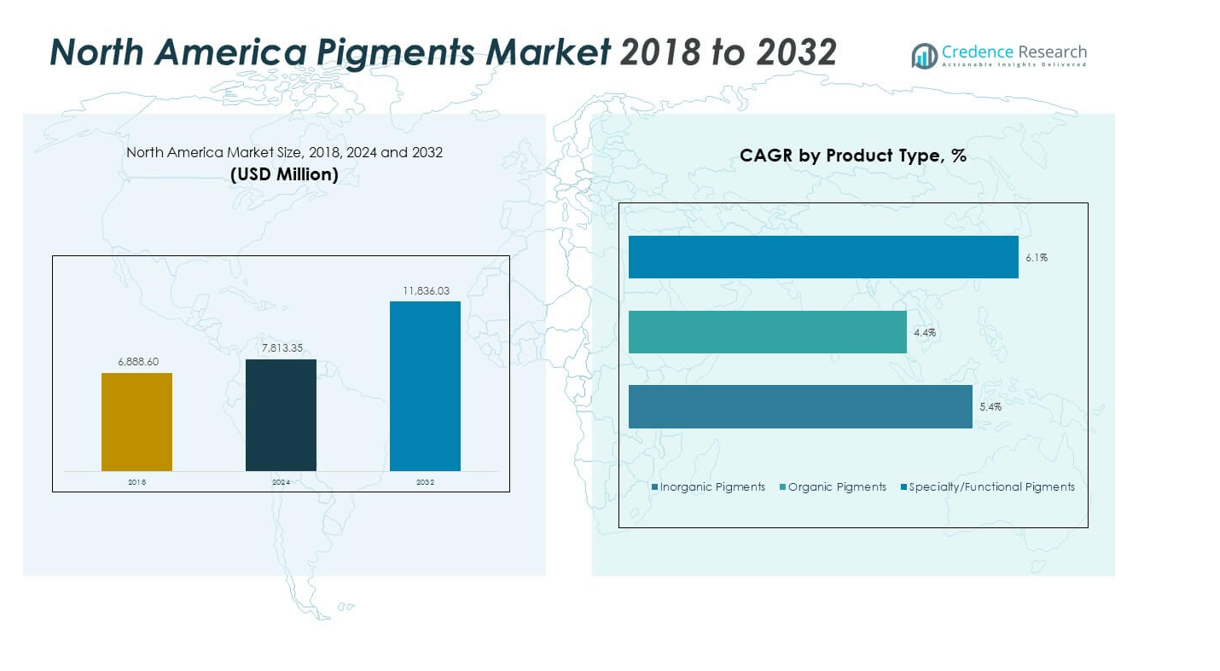

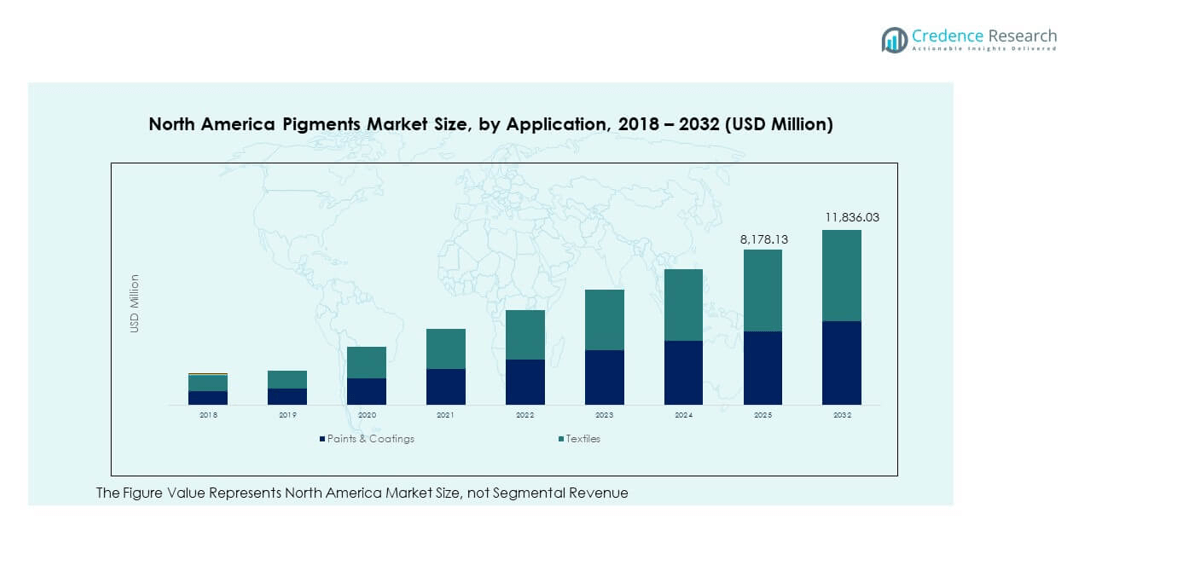

The North America Pigments Market size was valued at USD 6,888.60 million in 2018 to USD 7,813.35 million in 2024 and is anticipated to reach USD 11,836.03 million by 2032, at a CAGR of 5.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Pigments Market Size 2024 |

USD 7,813.35 million |

| North America Pigments Market, CAGR |

5.39% |

| North America Pigments Market Size 2032 |

USD 11,836.03 million |

Growth in the North America Pigments Market is fueled by expanding demand across construction, automotive, and packaging industries. Rising adoption of eco-friendly and high-performance pigments supports market expansion. Technological advancements in coatings, plastics, and printing inks improve durability, color retention, and environmental performance. Increasing investment in sustainable manufacturing processes and low-VOC formulations drives long-term growth. The growing preference for premium pigments with enhanced dispersion and heat stability further strengthens regional competitiveness.

The United States dominates the market due to its strong industrial base, advanced production technologies, and growing demand from architectural coatings and automotive manufacturing. Canada maintains steady progress through sustainable pigment innovation and expanding applications in green construction and packaging. Mexico emerges as a fast-growing market supported by rising industrialization, lower production costs, and growing exports in coatings and plastics. Together, these countries contribute to a dynamic and well-diversified pigment ecosystem across North America.

Market Insights

- The North America Pigments Market was valued at USD 6,888.60 million in 2018, reached USD 7,813.35 million in 2024, and is expected to attain USD 11,836.03 million by 2032, expanding at a CAGR of 5.39% during the forecast period.

- The United States leads with a 62% share due to its strong industrial base and advanced pigment manufacturing infrastructure, followed by Canada with 21%, supported by eco-conscious production, and Mexico with 17%, driven by expanding export-oriented industries.

- Mexico represents the fastest-growing region, supported by rising construction, plastics, and packaging activities, and its increasing role as a low-cost manufacturing and export hub.

- Paints & coatings dominate the market with an estimated 60% share, primarily supported by growth in automotive and construction applications.

- Textiles represent roughly 40% of total pigment consumption, driven by demand for high-quality, color-stable dyes in apparel and technical fabrics across North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Construction and Automotive Industries Accelerates Pigment Consumption

Growth in construction and automotive manufacturing has led to higher use of pigments in paints, coatings, and plastics. Expanding infrastructure projects across the United States and Canada increase pigment application in decorative coatings and industrial paints. The shift toward energy-efficient buildings supports reflective and infrared-resistant pigments. Automotive manufacturers prefer advanced pigments that enhance finish, durability, and UV resistance. These industries rely on high-performance colorants to meet design and protection needs. The North America Pigments Market benefits from government initiatives promoting eco-friendly and corrosion-resistant materials. It experiences consistent demand due to renovation activities and sustainable architecture trends.

- For instance, BASF’s EFFLORESCENCE automotive coating technology, recognized with a Red Dot Award in 2024, achieves over 65% light reflection and reduces car body heating, while simplifying the paint process to a single layer and lowering energy consumption during manufacturing.

Advancement in Coating Technologies Strengthens Market Penetration Across Industries

Rapid adoption of waterborne and powder coatings creates strong opportunities for pigment manufacturers. These technologies require high dispersibility, stability, and color accuracy, prompting innovation in pigment formulations. Growing investment in nanotechnology and hybrid pigments enhances product performance. Coatings used in aerospace and marine applications demand weather resistance and high opacity. The North America Pigments Market experiences steady growth from the expanding coating sector. It relies on advanced production methods to meet varied industrial needs. The development of multifunctional pigments ensures durability and visual appeal in protective coatings. Industrial users increasingly prioritize pigment quality to achieve consistent surface finish and performance.

Growing Preference for Eco-Friendly Pigments Supporting Regulatory Compliance

Tightening environmental regulations encourage a shift toward sustainable pigment solutions. Manufacturers invest in low-VOC and heavy-metal-free pigments to meet regional compliance standards. Bio-based pigments gain acceptance across packaging, textile, and printing applications. Rising consumer awareness about environmental safety accelerates adoption of green alternatives. It drives innovation in pigment formulations that reduce emissions and waste. The North America Pigments Market gains momentum through eco-conscious product development. Regulatory frameworks such as EPA guidelines strengthen demand for compliant materials. Continuous R&D ensures high-quality, safe, and biodegradable pigment solutions.

- For instance, at the American Coatings Show 2024, Clariant showcased Ceridust 8170 M, a PTFE-free and PFAS-free texturing agent for powder coatings that reduces energy consumption in the extrusion process and complies with EU REACH regulations.

Expansion of Digital Printing and Packaging Industries Driving Pigment Innovation

The rise of digital printing and packaging solutions promotes pigment diversification. E-commerce growth increases the need for visually appealing, durable printed materials. High-performance pigments offer vivid color reproduction and enhanced print stability. Technological advances improve dispersion control for consistent ink performance. It benefits printing applications that demand precision and long-lasting color. The North America Pigments Market expands with demand from flexible packaging and decorative printing. Growing use of digital labels and product customization supports pigment consumption. Ink manufacturers emphasize quality pigments to achieve higher contrast and faster curing.

Market Trends

Shift Toward High-Performance Pigments with Enhanced Functional Properties

Industries adopt high-performance pigments for superior heat stability and chemical resistance. Demand rises for colorants that maintain integrity under harsh environments. Titanium dioxide and specialty organic pigments dominate due to their optical clarity. Coatings, plastics, and electronics sectors rely on these materials for durability. The North America Pigments Market evolves toward advanced pigment grades. It reflects the trend of integrating nanostructured materials into formulations. High-purity pigments improve color consistency across varied substrates. Manufacturers invest in refining pigment morphology for long-term performance.

- For instance, in February 2025, Chemours Company launched Ti-Pure™ TS-6706, a TMP- and TME-free version of its flagship Ti-Pure™ R-706 universal titanium dioxide grade. This innovation maintains reliable performance in coatings applications requiring appearance-critical, high gloss, excellent durability, blue undertone, and hiding power across both waterborne and solvent-based systems, validated through extensive laboratory and silo-scale flow behavior tests.

Growing Penetration of Smart Pigments Across Industrial and Consumer Goods Applications

Smart pigments, including thermochromic and photochromic types, gain traction in textiles, packaging, and automotive coatings. These pigments respond to temperature, light, or pH, creating dynamic designs. Adoption of such technologies enables interactive product aesthetics. The North America Pigments Market observes significant demand for functional colorants with sensory response. It supports innovation in product labeling, apparel, and decorative materials. Smart pigments attract premium markets through their customization potential. Rising investments in R&D for optical effects and UV resistance boost competitiveness. Manufacturers explore hybrid pigments that combine visual and functional attributes.

- For instance, LCR Hallcrest is recognized as a leading innovator in smart pigments for packaging applications across North America. Its photochromic inks, which change color under UV light, are widely used in product authentication, interactive packaging, and security printing.

Increasing Automation in Pigment Manufacturing Enhancing Quality and Cost Efficiency

Automation and digital monitoring improve process stability in pigment production. Advanced equipment enables consistent particle size, color uniformity, and dispersion. Companies deploy AI-based quality control to enhance precision. Automated systems reduce human error and enhance sustainability through waste reduction. The North America Pigments Market benefits from these technological improvements. It ensures manufacturers achieve greater operational efficiency and scalability. Automation also supports compliance with safety and environmental norms. Consistent production quality enhances brand reliability in regional and export markets.

Rising Integration of Pigments in Additive Manufacturing and 3D Printing

The additive manufacturing sector adopts pigments to enhance visual and structural characteristics. Pigments enable vibrant coloration in polymers and resins used for 3D printing. Formulators develop heat-stable and lightfast materials suited for complex builds. It contributes to the versatility of 3D-printed components. The North America Pigments Market experiences rising use of pigment-dispersed filaments. Growth in consumer electronics and prototyping industries strengthens this integration. Technological advances in dispersion techniques improve compatibility with additive systems. Pigment producers expand portfolios for next-generation digital manufacturing.

Market Challenges Analysis

Rising Raw Material Costs and Supply Chain Disruptions Impacting Profit Margins

Fluctuations in the prices of raw materials such as titanium dioxide, zinc oxide, and petrochemical feedstocks affect production stability. Geopolitical tensions and trade restrictions disrupt pigment imports and exports. It creates volatility in operational costs for regional manufacturers. High logistics expenses further increase the burden on small-scale producers. The North America Pigments Market faces challenges in balancing cost efficiency and product quality. Energy-intensive production processes elevate carbon emissions and operational risks. Limited raw material sourcing options reduce flexibility during demand surges. Companies focus on backward integration and local sourcing to manage uncertainties.

Stringent Environmental Regulations Increasing Compliance and Production Costs

Environmental authorities enforce strict standards on heavy metal and VOC emissions. Manufacturers must invest in cleaner technologies and waste treatment systems. It drives up production costs and slows capacity expansion. Smaller firms struggle to maintain profitability under new sustainability frameworks. The North America Pigments Market adapts by shifting toward bio-based materials. Stringent rules on chemical waste management increase capital expenditure requirements. Regulatory audits and certification processes extend time-to-market cycles. Producers emphasize continuous innovation to meet both economic and environmental targets.

Market Opportunities

Expanding Demand for Bio-Based and Recyclable Pigments Across Consumer Industries

Rising environmental awareness and green packaging initiatives open new opportunities. Bio-based pigments derived from natural sources meet brand sustainability goals. It supports strong adoption in packaging, textiles, and personal care products. The North America Pigments Market gains traction as manufacturers explore biodegradable alternatives. Development of compostable and recyclable colorants aligns with zero-waste objectives. Collaboration with packaging converters and brand owners enhances market reach. Government incentives for eco-friendly product lines encourage rapid commercialization.

Technological Innovation in Functional Pigments for Advanced Applications

Advances in nanotechnology create high-value pigment opportunities for electronics, defense, and solar applications. Functional pigments improve infrared reflectivity, conductivity, and UV protection. It drives integration into smart coatings and sensors. The North America Pigments Market benefits from such high-tech diversification. Partnerships with electronics and aerospace firms foster new product lines. Custom-engineered pigments with multifunctional benefits gain industry preference. Innovation enhances competitiveness and long-term revenue growth.

Market Segmentation Analysis

By Product Type

Inorganic pigments dominate due to superior opacity, chemical stability, and UV resistance. Titanium dioxide leads this category, widely used in paints, plastics, and coatings for its brightness and non-reactive nature. Zinc oxide pigments offer antimicrobial properties beneficial for packaging and healthcare applications. The North America Pigments Market witnesses steady growth in organic pigments due to vibrant hues and environmental benefits. Specialty pigments, including pearlescent and metallic variants, attract demand in automotive and luxury packaging for aesthetic finishes.

- For instance, The Chemours Company North America’s leading TiO2 supplier reported in its 2024 Sustainability Report that it achieved a 52% reduction in greenhouse gas emissions (Scope 1 and 2) from its titanium dioxide pigment manufacturing, tracking toward its 2030 goals while supplying pigment for paints and coatings.

By Application

Paints and coatings account for the largest pigment consumption across industrial and decorative uses. Plastics follow closely due to rising demand for durable coloration in packaging and consumer goods. Printing inks utilize pigments for color consistency and quick-drying formulations in digital and flexographic printing. Textiles employ pigments for long-lasting shades in synthetic fibers. The North America Pigments Market also finds growth in leather finishing and niche sectors such as ceramics and cosmetics. Expanding end-user diversity supports continued pigment demand across applications.

- For instance, PPG Industries reported in 2025 that its CORAFLON® Platinum powder coating, tested by Atlas Material Testing Solutions to FGIA/AAMA 2605 standards, showed only a 6% color loss over five years and achieved 20 times greater color retention than competing products in architectural use.

Segmentation

By Product Type

- Inorganic Pigments

- Titanium Dioxide (TiO₂)

- Zinc Oxide

- Others

- Organic Pigments

- Specialty/Functional Pigments

By Application

- Paints & Coatings

- Textiles

- Printing Inks

- Plastics

- Leather

- Other Applications

Regional Analysis

United States – Dominant Market with Advanced Industrial Integration (62% Share)

The United States holds a 62% share of the North America Pigments Market, driven by strong industrial production and technological innovation. Its demand is concentrated in paints, coatings, plastics, and printing inks, supported by mature construction and automotive sectors. The country’s advanced R&D infrastructure promotes the development of high-performance, eco-friendly pigments. It benefits from the presence of major global producers such as Chemours, Tronox, and Kronos Worldwide. Government support for sustainable manufacturing and strict environmental regulations encourage the adoption of low-VOC and bio-based pigments. Expansion in 3D printing, digital packaging, and high-end coatings further reinforces market growth across key industries.

Canada – Steady Growth Backed by Sustainable Industrial Expansion (21% Share)

Canada accounts for 21% of the regional market, reflecting consistent growth supported by its eco-conscious production standards. Demand for pigments is rising in architectural coatings, automotive paints, and polymer applications. Canadian industries emphasize clean technology and resource efficiency, creating opportunities for green pigment manufacturers. It benefits from trade relationships with the U.S. and global suppliers, ensuring a stable supply chain. The Canadian construction sector’s focus on energy-efficient infrastructure fuels pigment consumption. Domestic innovation in nanomaterials and organic pigments enhances color performance while meeting environmental standards. Increasing demand from packaging and textile industries sustains long-term expansion prospects.

Mexico – Emerging Manufacturing Hub with Expanding Production Capacity (17% Share)

Mexico represents 17% of the North America Pigments Market, driven by rapid industrialization and a growing export-oriented manufacturing base. The country’s strong presence in automotive, plastics, and packaging sectors drives pigment consumption. It serves as a strategic production and export hub due to competitive labor costs and regional trade agreements. Foreign investment in pigment production and downstream industries enhances supply chain efficiency. It experiences rising demand for high-durability and cost-effective colorants suited for industrial coatings and consumer products. The government’s focus on industrial modernization supports technology upgrades and local pigment production capacity expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DIC Corporation

- Kronos Worldwide, Inc.

- Sudarshan Chemical Industries Limited

- Venator Materials PLC

- The Chemours Company

- Tronox Holdings Plc

- ALTANA AG

- LB Group

- Shepherd Color Company

- Trust Chem Co., Ltd.

Competitive Analysis

The North America Pigments Market is moderately consolidated, with major players holding a dominant share through diversified portfolios and global operations. Key participants such as DIC Corporation, Kronos Worldwide, Venator Materials PLC, The Chemours Company, and Tronox Holdings Plc emphasize R&D investment to enhance pigment performance and sustainability. It focuses on innovations in eco-friendly and high-durability pigments for coatings, plastics, and inks. Regional companies pursue mergers, capacity expansion, and collaborations to strengthen supply reliability. Competition intensifies through the introduction of bio-based and smart pigments catering to industrial and consumer applications. Market leaders continue to expand production networks and improve operational efficiency to maintain competitive advantage.

Recent Developments

- In July 2025, Saint-Gobain North America revealed the acquisition of Interstar Materials Inc., a company specializing in pigment granules and dispensers for the U.S. and Canadian construction sectors. This strategic move enables Saint-Gobain to strengthen its Construction Chemicals segment and advance its innovation focus, particularly in the pigment business for concrete and construction materials.

- In July 2024, Kronos Worldwide completed the acquisition of the remaining 50% joint venture interest in Louisiana Pigment Company, L.P. (LPC) from Venator Investments, Ltd for upfront payment plus earn-out potential. This move positions LPC as a wholly-owned subsidiary of Kronos, expected to deliver operational efficiencies and strategic synergies across North America, specifically enhancing titanium dioxide capacity and supply reliability for domestic customers.

- In July 2024, Sudarshan Chemical Industries announced a strategic partnership with LBB Specialties for the North American pigments market, aiming to distribute high-quality, vibrant pigments tailored for the cosmetics and personal care segments. The partnership leverages Sudarshan’s manufacturing expertise and LBB’s market reach, targeting emerging consumer trends for safe and beautiful cosmetics.

Report Coverage

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America Pigments Market will expand steadily, driven by growth in construction, automotive, and packaging industries.

- Increased adoption of eco-friendly and bio-based pigments will reshape production strategies across regional manufacturers.

- Advancements in nanotechnology and smart pigments will support performance-driven applications in coatings and electronics.

- Rising demand for digital printing pigments will enhance market penetration across packaging and textile sectors.

- Expanding 3D printing adoption will create new pigment formulation opportunities for heat and UV-resistant materials.

- Strategic investments in automation and AI-based quality control will improve pigment consistency and operational efficiency.

- Strong regulatory push for low-VOC and sustainable pigments will drive product innovation and compliance upgrades.

- Growing preference for high-performance and specialty pigments will sustain premium pricing and product differentiation.

- Regional producers will expand capacity through mergers and technology collaborations to strengthen supply stability.

- The North America Pigments Market will benefit from integration of renewable raw materials and circular economy initiatives.