Market Overview:

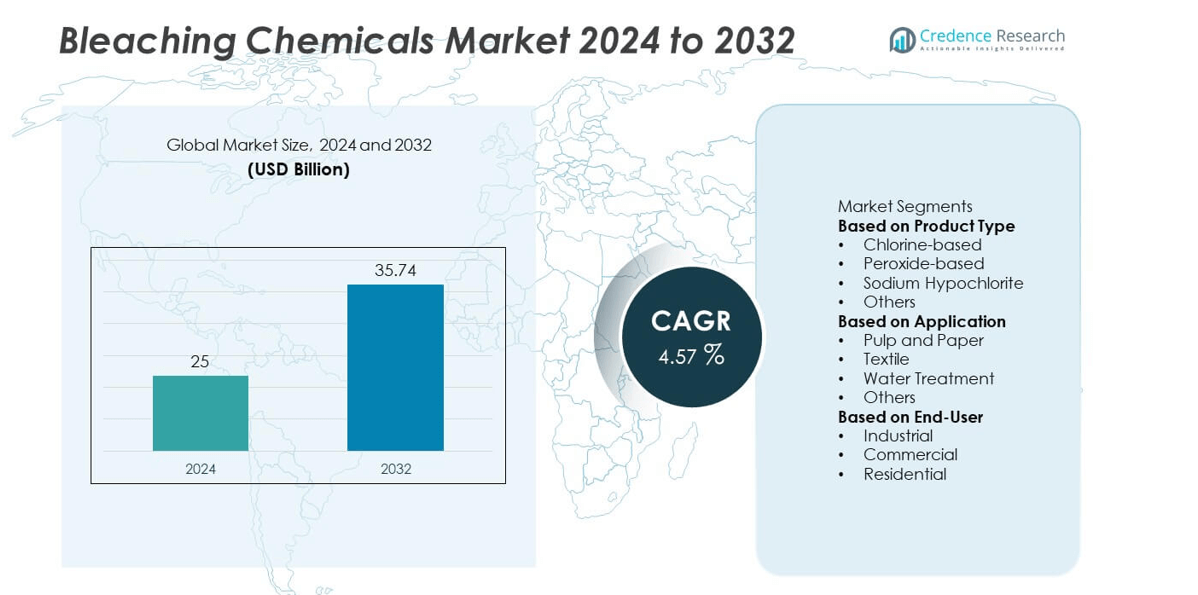

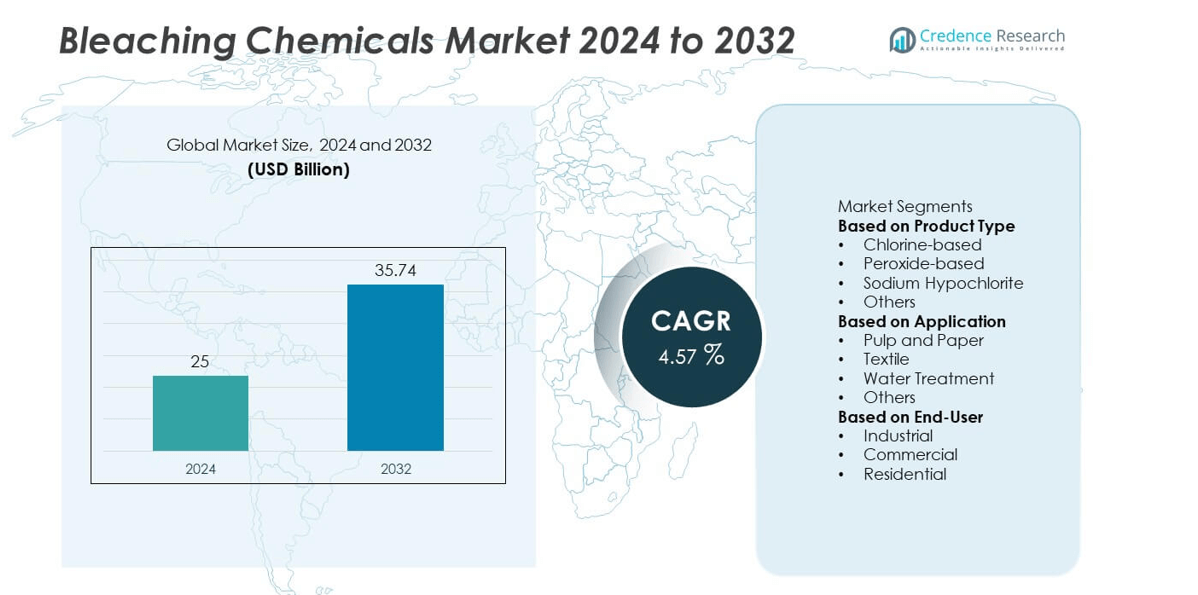

The Bleaching Chemicals market was valued at USD 25 billion in 2024 and is projected to reach USD 35.74 billion by 2032, growing at a CAGR of 4.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bleaching Chemicals Market Size 2024 |

USD 25 billion |

| Bleaching Chemicals Market, CAGR |

4.57% |

| Bleaching Chemicals Market Size 2032 |

USD 35.74 billion |

The bleaching chemicals market is led by key players such as Ashland Global Holdings Inc., Evonik Industries AG, Akzo Nobel N.V., Ecolab Inc., Aditya Birla Chemicals, Kemira Oyj, Arkema Group, Clariant AG, The Dow Chemical Company, and Solvay S.A. These companies maintain a strong global presence through product innovation, sustainability initiatives, and long-term supply agreements with industrial users. They focus on developing eco-friendly and high-performance bleaching agents to meet tightening environmental standards. Asia Pacific emerged as the leading region with a 36.4% share in 2024, driven by expanding paper, textile, and water treatment industries. Rapid industrialization and government investments in sustainable chemical production continue to strengthen the region’s dominance.

Market Insights

- The bleaching chemicals market was valued at USD 25 billion in 2024 and is projected to reach USD 35.74 billion by 2032, registering a CAGR of 4.57% during the forecast period.

- Rising demand from the pulp and paper, textile, and water treatment industries is driving market expansion, supported by industrialization and growing hygiene awareness.

- The market is witnessing a shift toward eco-friendly and chlorine-free bleaching agents, with hydrogen peroxide and oxygen-based solutions gaining preference.

- Key players such as Akzo Nobel N.V., Evonik Industries AG, The Dow Chemical Company, and Kemira Oyj are focusing on innovation, mergers, and sustainable product development to strengthen competitiveness.

- Asia Pacific dominated the market with a 36.4% share in 2024, followed by North America at 27.3%, driven by strong industrial activity and adoption of green bleaching technologies across key end-use sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The chlorine-based segment dominated the bleaching chemicals market with a 41.6% share in 2024. Its strong position is driven by widespread use in pulp and paper manufacturing, textile processing, and water disinfection. Chlorine compounds, including sodium hypochlorite and chlorine dioxide, are preferred for their high oxidizing capacity and cost efficiency. Despite environmental concerns, their effectiveness in large-scale bleaching operations sustains demand. Growing industrial applications in developing economies continue to reinforce the dominance of chlorine-based chemicals, supported by ongoing technological advancements in safer and more controlled chlorine usage.

- For instance, Kemira Oyj invested approximately €50 million in a new sodium chlorate production line at its Joutseno facility in Finland. The expansion, completed in 2017, used Kemira’s proprietary in-house technology and significantly increased the site’s capacity. The new line was built to meet the growing demand for bleaching chemicals driven by pulp mill expansions in the Nordics.

By Application

The pulp and paper segment held the largest share of 37.8% in 2024, owing to its extensive use of bleaching agents for lignin removal and brightness enhancement. The global rise in packaging material and printing paper production drives consumption across paper mills. Hydrogen peroxide and chlorine dioxide are widely used to achieve high whiteness levels while meeting environmental regulations. Increasing demand for eco-friendly, high-quality paper products, combined with modernization in paper processing plants, further strengthens this segment’s leadership in the bleaching chemicals market.

- For instance, Evonik Industries plans to increase hydrogen peroxide capacity at its Antwerp, Belgium, site to meet the increasing demand, particularly from the pulp and paper industry. Additionally, the company is collaborating on a regional project in Antwerp to use recycled wastewater for its operations, which will eliminate the need for over 2 million cubic meters of drinking water annually and support sustainable practices.

By End-User

The industrial segment accounted for a 58.5% share in 2024, emerging as the leading end-user category. Industries such as textiles, pulp and paper, and wastewater treatment rely heavily on bleaching chemicals for large-scale operations. Expanding industrial output in emerging economies and rising investment in water purification facilities are key growth drivers. The increasing shift toward sustainable bleaching solutions and continuous process automation enhances efficiency and safety. Growing demand from chemical manufacturing and sanitation industries continues to support the segment’s leading position globally.

Key Growth Drivers

Rising Demand from Pulp and Paper Industry

The growing global production of paper and packaging materials is a major driver for the bleaching chemicals market. Bleaching agents such as chlorine dioxide and hydrogen peroxide are widely used to improve paper brightness and remove impurities. Increasing demand for high-quality, recyclable, and eco-friendly paper products further strengthens market growth. Modernization in pulp processing and the shift toward elemental chlorine-free (ECF) bleaching enhance process efficiency while meeting environmental standards.

- For instance, International Paper has made significant investments in its Riverdale mill in Selma, Alabama, to produce high-quality containerboard while meeting modern environmental standards

Expanding Textile Manufacturing and Processing

Rapid expansion of the textile industry, particularly in Asia Pacific, is fueling the demand for bleaching chemicals. These agents are essential for fabric whitening, stain removal, and preparation for dyeing. Hydrogen peroxide remains a preferred choice due to its strong bleaching performance and reduced environmental impact. Rising global apparel production and growing demand for clean, bright fabrics support continued chemical adoption in textile processing facilities worldwide.

- For instance, Archroma offers innovative peroxide-based bleaching systems that can reduce water consumption in textile processing. Studies have shown that optimized one-bath cotton bleaching processes can achieve a high whiteness index of 139.5, alongside significant reductions in water usage, chemical use, and energy consumption compared to conventional methods.

Increasing Water Treatment Activities

The expansion of industrial and municipal water treatment facilities drives significant demand for bleaching chemicals. Chlorine-based agents are extensively used for disinfection, odor control, and removal of organic contaminants. Growing urbanization, stricter water quality regulations, and heightened awareness about sanitation are boosting consumption. The integration of advanced treatment technologies and sustainable chlorine management practices further promotes product use across various regions.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Green Bleaching Agents

Environmental concerns are pushing the industry toward eco-friendly alternatives such as hydrogen peroxide and ozone-based solutions. These agents offer effective bleaching with minimal toxic residue, aligning with global sustainability goals. Regulatory frameworks favoring green chemistry encourage producers to innovate low-impact formulations. This transition creates opportunities for chemical manufacturers to develop biodegradable and energy-efficient bleaching products that reduce wastewater contamination.

- For instance, Solvay is partnering with Sapio at its Rosignano facility to build a green hydrogen plant to supply its peroxides production. The new plant will produce 756 tons of green hydrogen annually, powered by a 9.5 MW photovoltaic installation, and is projected to reduce CO2 emissions from the site’s peroxides-related operations by 15%.

Technological Advancements in Bleaching Processes

Continuous innovation in process optimization is transforming the bleaching chemicals landscape. Advanced control systems and automated dosing technologies enhance precision, safety, and resource efficiency. Adoption of oxygen-based and non-chlorine bleaching processes in pulp and textile industries supports compliance with environmental standards. Integration of digital monitoring and closed-loop systems also reduces chemical waste, improving profitability and sustainability for manufacturers.

- For instance, Andritz provides advanced bleaching technologies for pulp mills that include real-time process monitoring and control to minimize chemical and energy consumption. The company’s technologies are proven to achieve uniform pulp quality, which reduces variations in kappa number, significantly improving operational consistency and environmental performance.

Key Challenges

Environmental and Health Concerns

Stringent environmental regulations related to chlorine emissions and toxic byproducts pose a challenge for manufacturers. Prolonged exposure to certain chlorine compounds can harm workers and ecosystems. Compliance with discharge standards increases operational costs and limits the use of traditional agents. Companies are under pressure to develop alternative solutions that maintain performance while minimizing ecological risks and ensuring worker safety.

Fluctuating Raw Material Prices

Volatility in raw material prices, particularly for chlorine and caustic soda, affects production costs and market stability. Supply chain disruptions and varying energy costs further influence pricing structures. Manufacturers face challenges in maintaining profitability while meeting quality and regulatory standards. Developing efficient production methods and securing long-term supply agreements are becoming critical to sustain competitiveness in the global bleaching chemicals market.

Regional Analysis

North America

North America held a 27.3% share in 2024, driven by strong demand from the paper, textile, and water treatment industries. The United States remains the leading market due to well-established pulp and paper manufacturing and high environmental compliance standards. The growing focus on wastewater management and hygiene product production is further boosting consumption. Technological advancements in chlorine dioxide and hydrogen peroxide-based bleaching processes also support regional growth. The adoption of eco-friendly formulations aligns with sustainability goals, strengthening North America’s position in the global bleaching chemicals market.

Europe

Europe accounted for a 25.1% share in 2024, supported by stringent environmental regulations and advancements in green bleaching technologies. Countries such as Germany, Finland, and Sweden lead in sustainable pulp and paper manufacturing, relying on peroxide and oxygen-based bleaching agents. The textile industry’s shift toward environmentally safe processes continues to encourage chemical innovation. Rising water treatment activities across industrial sectors also contribute to steady demand. The region’s strong focus on circular economy principles and low-emission manufacturing enhances its role in shaping future bleaching chemical trends.

Asia Pacific

Asia Pacific dominated the bleaching chemicals market with a 36.4% share in 2024, fueled by rapid industrialization and expanding paper and textile industries. China and India drive major consumption through large-scale production and export-oriented manufacturing. The rise of packaging and hygiene product demand further stimulates growth. Governments are promoting sustainable bleaching alternatives to reduce pollution and improve energy efficiency. Increasing investments in industrial wastewater treatment and the shift toward hydrogen peroxide-based processes support long-term market expansion across the region’s emerging economies.

Middle East & Africa

The Middle East & Africa region captured a 6.5% share in 2024, led by expanding industrial water treatment and chemical processing sectors. Growing infrastructure projects and increased textile production in countries like Saudi Arabia, the UAE, and South Africa drive market growth. Water scarcity challenges are prompting governments to adopt advanced disinfection and bleaching technologies. Although adoption remains moderate, the trend toward eco-friendly solutions and industrial modernization initiatives is creating new opportunities for bleaching chemical suppliers across the region.

Latin America

Latin America represented a 4.7% share in 2024, supported by growing demand from pulp and paper, textile, and water treatment industries. Brazil, Mexico, and Chile lead the market, driven by increasing investment in industrial infrastructure and manufacturing activities. The region is witnessing a gradual shift toward sustainable bleaching agents to meet global export standards. Expanding paper packaging production and government-backed environmental initiatives are fostering market development. Although regulatory frameworks are still evolving, rising awareness of sustainable chemical usage supports steady long-term growth across Latin America.

Market Segmentations:

By Product Type

- Chlorine-based

- Peroxide-based

- Sodium Hypochlorite

- Others

By Application

- Pulp and Paper

- Textile

- Water Treatment

- Others

By End-User

- Industrial

- Commercial

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the bleaching chemicals market features leading players such as Ashland Global Holdings Inc., Evonik Industries AG, Akzo Nobel N.V., Ecolab Inc., Aditya Birla Chemicals, Kemira Oyj, Arkema Group, Clariant AG, The Dow Chemical Company, and Solvay S.A. These companies compete through technological innovation, capacity expansion, and the development of eco-friendly bleaching solutions. Major players focus on improving product efficiency, safety, and sustainability by adopting green chemistry and low-emission manufacturing processes. Strategic mergers, acquisitions, and collaborations help strengthen global supply chains and broaden application portfolios. Continuous R&D investments in hydrogen peroxide and chlorine-free technologies enhance market competitiveness. Rising environmental regulations and the shift toward sustainable bleaching methods are pushing companies to innovate while maintaining cost efficiency and product performance across diverse industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Kemira also announced a joint‐venture with International Flavors & Fragrances Inc. (IFF) to build a biobased-materials plant (capable of supplying fibre/bleaching chemical markets) in Finland.

- In January 2025, Evonik Industries AG established a joint venture with Fuhua Tongda Chemicals Company in Leshan, China to produce specialty hydrogen peroxide grades for solar panels, semiconductors and food packaging (bleaching/oxidative agent relevance).

- In 2024, Evonik signed an agreement to supply its “Way to GO₂” certified carbon-neutral hydrogen peroxide to Steinbeis Papier for recycled-paper bleaching applications

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increased industrial demand from pulp, textile, and water treatment sectors.

- Hydrogen peroxide and other green bleaching agents will gain traction due to stricter environmental standards.

- Manufacturers will invest more in chlorine-free and low-emission bleaching technologies to meet regulatory norms.

- Digital process optimization and automation will enhance operational efficiency and product consistency.

- Demand from the paper packaging and hygiene sectors will boost long-term consumption.

- Strategic partnerships between global and regional players will expand distribution networks.

- Energy-efficient production methods will become a key focus to reduce operational costs.

- Asia Pacific will remain the leading region, driven by industrial growth and manufacturing expansion.

- Europe will strengthen its role through sustainable chemical innovation and regulatory compliance.

- Adoption of eco-certified and biodegradable bleaching solutions will shape the market’s future direction.