Market Overview:

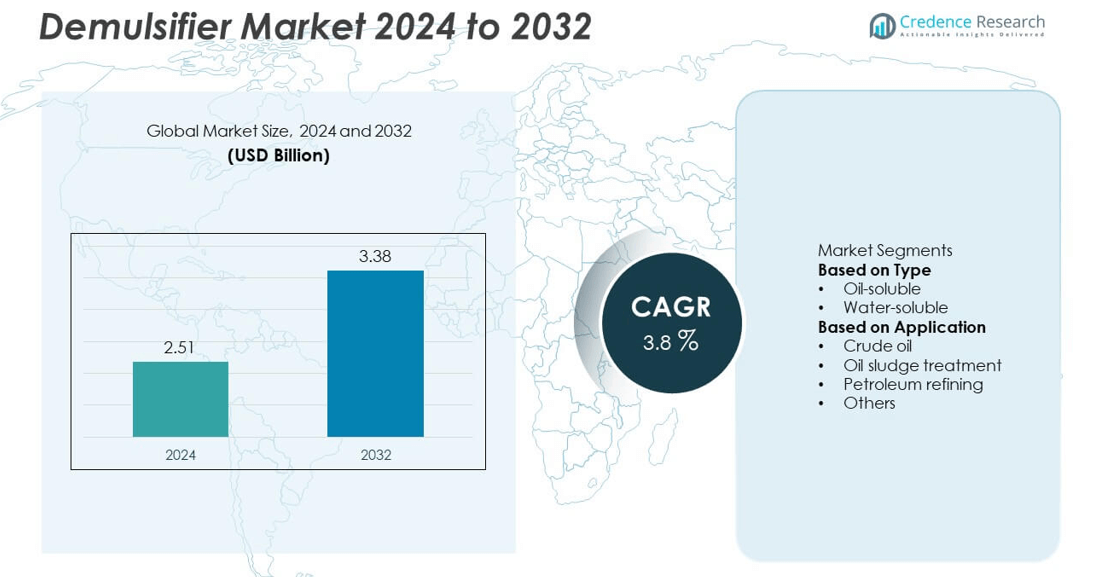

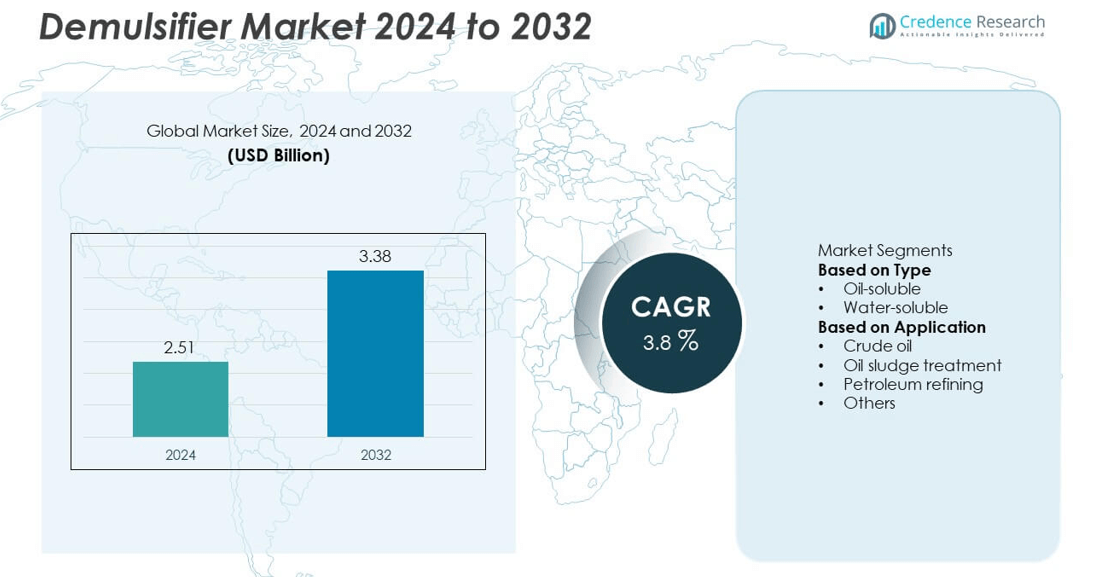

The demulsifier market was valued at USD 2.51 billion in 2024 and is projected to reach USD 3.38 billion by 2032, growing at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Demulsifier Market Size 2024 |

USD 2.51 billion |

| Demulsifier Market , CAGR |

3.8% |

| Demulsifier Market Size 2032 |

USD 3.38 billion |

The demulsifier market is led by major players such as Clariant, Dow Chemical, Croda International, Halliburton, Akzo Nobel, BASF, National Chemical & Petroleum Industries, Ecolab, Baker Hughes, and Dorf Ketal. These companies dominate through advanced chemical formulations, strong R&D capabilities, and extensive global supply networks. Continuous innovation in environmentally friendly and high-performance demulsifiers strengthens their competitive edge in the oil and gas sector. North America held the leading position with a 36% market share in 2024, supported by robust crude oil production and refinery operations, followed by Europe with 27%, driven by sustainable chemical adoption and offshore exploration activities.

Market Insights

- The demulsifier market was valued at USD 2.51 billion in 2024 and is projected to reach USD 3.38 billion by 2032, growing at a CAGR of 3.8% during the forecast period.

- Market growth is driven by rising crude oil production, increasing refinery operations, and growing demand for efficient separation of oil-water emulsions in upstream and downstream processes.

- Key trends include the development of bio-based, low-toxicity demulsifiers and integration of advanced chemical formulations designed for high-temperature and offshore applications.

- The market is competitive, with major players such as Clariant, Dow Chemical, BASF, Halliburton, and Ecolab focusing on innovation, eco-friendly product development, and expansion into emerging oil-producing regions.

- North America led with a 36% share in 2024, followed by Europe at 27% and Asia-Pacific at 24%; by type, oil-soluble demulsifiers dominated with a 63% share, while the crude oil segment accounted for 54% of total demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The oil-soluble segment dominated the demulsifier market with a 63% share in 2024. Its leadership is driven by strong demand in crude oil processing and petroleum refining, where effective separation of water-in-oil emulsions is critical. Oil-soluble demulsifiers offer better compatibility with hydrocarbon systems and deliver faster emulsion breaking, improving operational efficiency. The growing use of high-viscosity crude and offshore production enhances product demand. Continuous R&D efforts focused on improving thermal stability and performance under extreme field conditions further support this segment’s dominance.

- For instance, Clariant developed its PHASETREAT™ WET demulsifier using nanoemulsion technology, which allows for faster phase separation in high-viscosity crude. The technology reduces demulsifier dosages by up to 75% compared to conventional formulations.

By Application

The crude oil segment accounted for a 54% share in 2024, making it the leading application area in the demulsifier market. Its dominance stems from the rising need to separate water and salts from crude before refining. Increasing global crude output, particularly from offshore and shale reserves, drives segment growth. Efficient demulsification enhances oil quality, minimizes corrosion, and reduces refining costs. The shift toward advanced formulations with high efficiency and low environmental impact continues to strengthen crude oil applications in both upstream and downstream operations.

- For instance, Baker Hughes offers high-performance demulsifier solutions, such as its TRETOLITE™ CLEAR and XERIC™ product lines, which have been shown to significantly enhance dehydration efficiency and reduce maintenance downtime across refinery separation units, leading to improved oil and water separation.

Key Growth Drivers

Expanding Crude Oil Production and Refining Activities

Rising global crude oil production and refinery expansions are major drivers of the demulsifier market. Oil producers increasingly rely on demulsifiers to improve dehydration efficiency and minimize corrosion in equipment. Growing demand for high-quality crude processing, particularly from offshore and shale reserves, has strengthened the adoption of advanced demulsification formulations. The focus on optimizing separation efficiency and maintaining operational stability continues to fuel demand across upstream and downstream sectors.

- For instance, BASF offers its Basorol® line of demulsifier bases with advanced polymer chemistry to create formulations that enable efficient water separation. By designing tailor-made formulations for different types of crude oil, demulsifiers can help reduce interfacial tension, improve dehydration performance, and minimize fouling incidents.

Rising Demand for Enhanced Oil Recovery Operations

Enhanced oil recovery (EOR) projects are increasing globally, boosting the consumption of demulsifiers to manage water-in-oil emulsions during production. These agents help maintain production efficiency by improving separation processes and protecting refinery systems. Growth in aging oil fields and the shift toward unconventional reserves are expanding demulsifier use. Companies are developing high-performance, temperature-resistant formulations to ensure stable operations under harsh production conditions.

- For instance, Halliburton offers solutions like its custom demulsifier systems for tertiary recovery to help operators improve production, even in mature and complex reservoirs with increasing water cuts. The company provides integrated chemical EOR processes that have been field-proven to achieve improved recovery factors, increased oil production rates, and lowered water cuts.

Shift Toward Environmentally Friendly Formulations

Stricter environmental regulations are driving the development of biodegradable and non-toxic demulsifiers. Producers are investing in green chemistry to replace conventional surfactant-based chemicals with sustainable alternatives. Demand is growing for formulations with lower environmental impact that maintain high separation efficiency. This trend aligns with global sustainability goals and supports the oil industry’s transition to eco-compliant operations.

Key Trends & Opportunities

Development of Bio-Based and Low-Toxicity Demulsifiers

The market is witnessing a shift toward bio-based demulsifiers derived from natural surfactants and renewable resources. These eco-friendly formulations meet regulatory standards while maintaining high performance in crude separation. Advancements in bio-surfactant technology provide opportunities for producers to serve environmentally sensitive oilfields. Growing acceptance in North America and Europe is expected to enhance adoption in the coming years.

- For instance, Croda International developed its ECO Brij™ and ECO Tween™ surfactant series using 100% bio-based ethylene oxide. These surfactants offer performance identical to their petrochemical-based alternatives, and are manufactured with renewable energy.

Integration of Nanotechnology and Advanced Chemistry

Manufacturers are exploring nanotechnology and molecular engineering to design demulsifiers with improved interfacial activity and stability. Nanoemulsion-based demulsifiers offer faster and more efficient separation, even under extreme conditions. These innovations enhance oil recovery efficiency and reduce chemical dosage, improving cost-effectiveness. The integration of advanced materials science is expected to drive new product launches and industrial applications.

- For instance, chemical demulsifiers are utilized in the oil and gas industry to separate water-in-oil emulsions. Some formulations, including advanced nanoparticle-based and polyether demulsifiers, have demonstrated high efficiency and fast separation times under laboratory and pilot conditions.

Key Challenges

Environmental Regulations and Compliance Issues

Strict regulations governing chemical discharge and environmental safety limit the use of certain demulsifier components. Non-biodegradable formulations face restrictions in several oil-producing regions. Compliance with REACH, EPA, and similar frameworks raises operational costs for manufacturers. The need to balance performance and sustainability creates technical and economic challenges for the industry.

Fluctuations in Crude Oil Prices and Production Rates

Volatile crude oil prices directly affect upstream activities, influencing demand for demulsifiers. Production slowdowns or refinery shutdowns during low-price periods reduce chemical consumption. Market instability also discourages long-term investments in enhanced oil recovery and processing efficiency. Stable pricing and sustained production levels remain critical to maintaining steady demand across applications.

Regional Analysis

North America

North America held the largest 36% share in 2024, supported by strong oil production in the U.S. and Canada. The region’s extensive upstream operations and refining capacity drive steady demand for demulsifiers in crude processing and dehydration systems. Shale oil extraction and enhanced oil recovery projects further boost consumption. Key manufacturers are investing in high-performance, low-toxicity formulations to meet stringent environmental regulations. The integration of advanced chemical technologies and the recovery of refinery utilization rates continue to strengthen the region’s dominance in the global demulsifier market.

Europe

Europe accounted for a 27% share in 2024, driven by refinery modernization and strict environmental compliance standards. The U.K., Germany, and Norway lead regional consumption due to strong offshore exploration activities in the North Sea. The adoption of eco-friendly demulsifiers is increasing, supported by EU regulatory frameworks promoting sustainable chemical use. Companies are focusing on research partnerships to develop biodegradable formulations suitable for sensitive ecosystems. Stable refining operations and growing investments in oilfield chemical innovation contribute to consistent market growth across Europe.

Asia-Pacific

Asia-Pacific captured a 24% share in 2024, emerging as one of the fastest-growing regions in the demulsifier market. Expanding oil refining capacity in China, India, and Southeast Asia drives significant product demand. Rapid industrialization and increasing energy consumption support market expansion. The region benefits from government-backed exploration projects and investments in offshore drilling. Local manufacturers are enhancing production capabilities to meet regional requirements for both oil-soluble and water-soluble demulsifiers. Rising focus on efficient crude treatment and cost-effective formulations strengthens Asia-Pacific’s position in global trade.

Latin America

Latin America held an 8% share in 2024, supported by strong oilfield activity in Brazil, Mexico, and Venezuela. The region’s large offshore reserves and refinery expansion projects drive demand for demulsification chemicals. Governments are encouraging investment in local refining and crude processing infrastructure, creating new growth opportunities. However, economic instability and fluctuating oil production present challenges to consistent growth. Ongoing partnerships with global chemical producers are improving product accessibility and technological advancement in the regional market.

Middle East & Africa

The Middle East & Africa accounted for a 5% share in 2024, driven by the dominance of large oil producers such as Saudi Arabia, the UAE, and Nigeria. Expanding refining and petrochemical projects, along with enhanced oil recovery initiatives, increase regional demand for high-performance demulsifiers. The focus on maintaining crude quality and operational efficiency strengthens adoption across upstream applications. However, dependence on imported specialty chemicals and price-sensitive markets remain challenges. Ongoing investments in domestic chemical production and sustainable oilfield operations are expected to support long-term growth.

Market Segmentations:

By Type

- Oil-soluble

- Water-soluble

By Application

- Crude oil

- Oil sludge treatment

- Petroleum refining

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the demulsifier market includes leading players such as Clariant, Dow Chemical, Croda International, Halliburton, Akzo Nobel, BASF, National Chemical & Petroleum Industries, Ecolab, Baker Hughes, and Dorf Ketal. These companies compete through innovation, product diversification, and global distribution networks. Leading manufacturers focus on developing high-performance, environmentally compliant demulsifiers tailored for complex crude oil operations. Continuous R&D investments aim to improve efficiency, temperature resistance, and biodegradability. Strategic partnerships with oil producers and refinery operators strengthen market presence and customer relationships. Companies are also expanding production capacities and regional supply chains to meet increasing demand from Asia-Pacific and the Middle East. Sustainability initiatives, including bio-based and low-toxicity formulations, remain central to competitive strategies, helping top players align with global environmental standards while maintaining operational performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clariant

- Dow Chemical

- Croda International

- Halliburton

- Akzo Nobel

- BASF

- National Chemical & Petroleum Industries

- Ecolab

- Baker Hughes

- Dorf Ketal

Recent Developments

- In June 2023, Clariant launched its PHASETREAT™ WET demulsifier solution, which uses nanoemulsion technology to cut chemical dosage by up to 75 % for oil and gas demulsification.

- In 2023, Baker Hughes introduced a new generation of eco-friendly demulsifiers aimed at reducing environmental impact in upstream operations.

- In 2023, Dow Chemical expanded its demulsifier portfolio with the DOWSIL brand featuring improved water-droplet removal capability.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demulsifier market is expected to grow steadily through 2032, supported by rising crude oil production and refinery expansion.

- Demand will increase as oil producers focus on efficient water separation to enhance output quality.

- Oil-soluble demulsifiers will continue to dominate due to their superior performance in crude processing.

- The adoption of eco-friendly and biodegradable formulations will accelerate with stricter environmental regulations.

- Technological innovation will drive the development of high-performance demulsifiers for offshore and high-temperature operations.

- Asia-Pacific will emerge as the fastest-growing region due to expanding refining capacity and energy demand.

- North America will maintain its leadership position with strong shale oil and enhanced recovery projects.

- Strategic partnerships between chemical manufacturers and oil producers will boost customized product development.

- Companies will invest more in R&D to create low-toxicity, cost-effective, and efficient separation solutions.

- Sustainability initiatives and regulatory compliance will shape long-term market competitiveness and product innovation.