Market Overview:

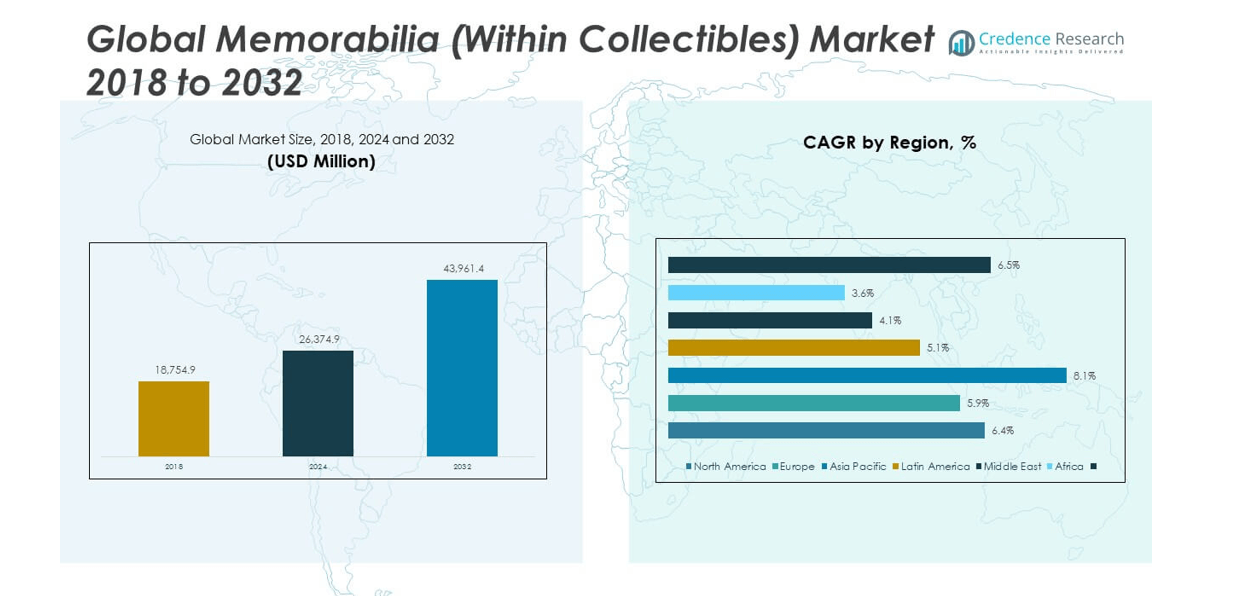

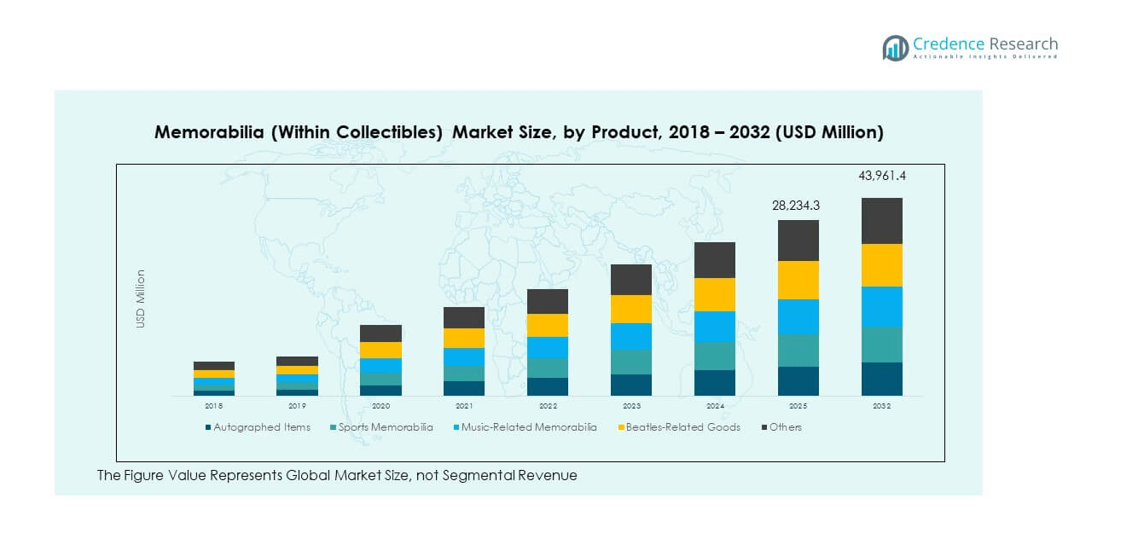

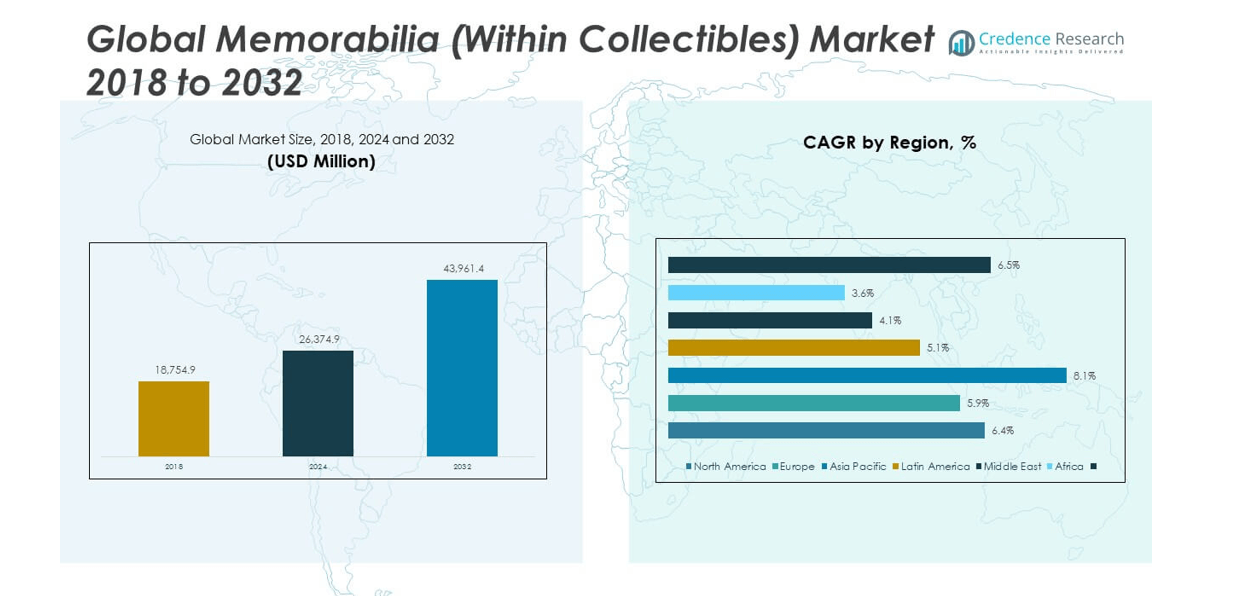

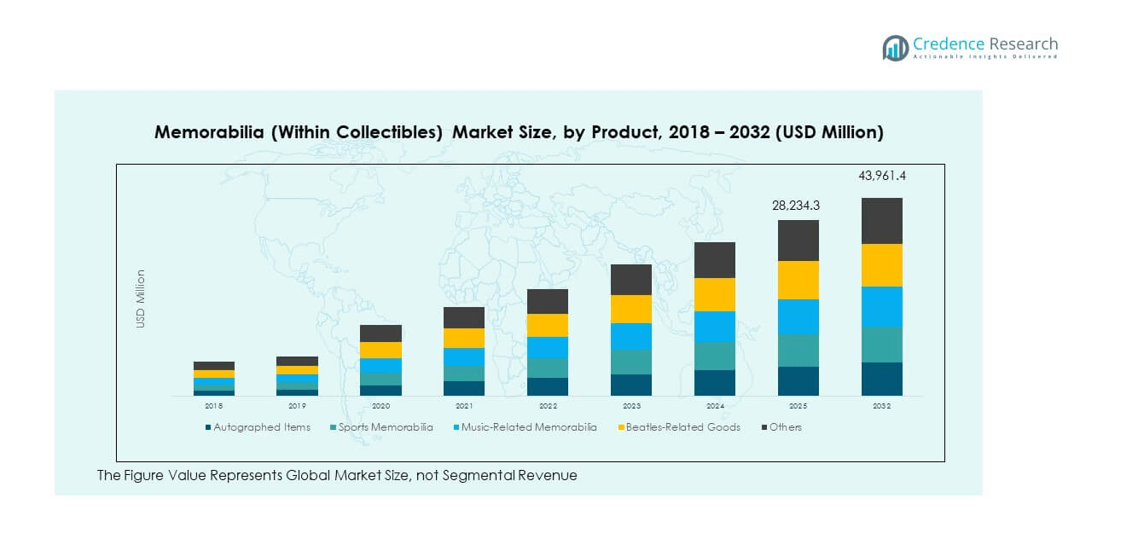

The Global Memorabilia (Within Collectibles) Market size was valued at USD 18,754.9 million in 2018 to USD 26,374.90 million in 2024 and is anticipated to reach USD 43,961.40 million by 2032, at a CAGR of 6.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Memorabilia (Within Collectibles) Market Size 2024 |

USD 26,374.90 million |

| Memorabilia (Within Collectibles) Market, CAGR |

6.50% |

| Memorabilia (Within Collectibles) Market Size 2032 |

USD 43,961.40 million |

The market’s growth trajectory reflects increasing interest in rare, unique, and emotionally significant items, driven by a mix of nostalgia, investment appeal, and cultural influence. Strong demand from both seasoned collectors and first-time buyers is reinforcing steady expansion, with digital platforms enabling broader accessibility and global trade in high-value memorabilia.

The market is witnessing robust demand fueled by rising disposable incomes, expanding online marketplaces, and the influence of pop culture on consumer preferences. Celebrity endorsements, sporting achievements, and historical events are driving the premium value of collectibles. Auction houses and specialized platforms are innovating with authentication technologies to boost buyer confidence, while the emergence of fractional ownership models is widening participation. This convergence of emotional value and investment potential is enhancing the sector’s long-term stability.

Market Insights:

- The market size was valued at USD 18,754.9 million in 2018, reached USD 26,374.90 million in 2024, and is projected at USD 43,961.40 million by 2032, growing at a CAGR of 6.50%.

- Demand is driven by sports, entertainment, and historical memorabilia linked to high-profile personalities and events.

- Counterfeit risks and fluctuating cultural relevance remain notable restraints.

- North America leads the market, followed by Europe and Asia-Pacific.

- Online platforms and auction houses dominate sales channels globally.

- Authentication technology adoption is reshaping trust in high-value transactions.

- Emerging economies present new growth avenues through localized offerings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Popularity of Pop Culture and Sports-Driven Collectibles:

The Global Memorabilia (Within Collectibles) Market benefits from strong consumer demand tied to cultural and sporting milestones. High-profile sporting events, music tours, and entertainment franchises stimulate renewed interest in merchandise and rare items. Iconic athletes, musicians, and movie stars influence consumer sentiment, creating scarcity-driven value spikes for related memorabilia. Collectors view these pieces as both personal passion investments and long-term financial assets. Major sports leagues and entertainment studios actively commercialize memorabilia through exclusive releases, limited editions, and event-specific merchandise.

- For instance, Heritage Auctions reported a record $962 million in sales during the first half of 2025, driven by strong demand for pop culture, sports memorabilia, and entertainment collectibles. The company experienced significant sales of comic art and sports artifacts, attracting new generational collectors fueled by high-profile sporting moments and entertainment milestones.

Growing Investment Appeal and Asset Diversification:

It is increasingly seen as an alternative investment avenue, appealing to collectors and investors seeking diversification beyond traditional assets. Rare items, especially those linked to historic events or iconic figures, often appreciate in value over time. The market’s resilience during economic fluctuations has positioned it as a niche yet stable investment class. Auction records for sports jerseys, music artifacts, and historical documents reinforce confidence in memorabilia as a wealth preservation tool. High-net-worth individuals and investment firms are entering the segment with targeted acquisitions.

- For instance, Christie’s recorded a 30% increase in luxury goods auctions by mid-2025, including sales of high-value historical sports memorabilia such as championship-worn jerseys and signed music albums, highlighting the market’s appeal as a wealth preservation asset. High-net-worth individuals and investment firms participated heavily in targeted acquisitions during the first half of 2025, reinforcing collectibles as alternative investments.

Digital Platforms Expanding Accessibility and Global Reach:

Online marketplaces and specialized auction platforms are transforming market dynamics by connecting sellers and buyers globally. Advanced search features, high-definition product displays, and secure payment systems are enhancing transparency and efficiency. Digital marketing campaigns and social media exposure amplify reach, making memorabilia more visible to niche collector communities. E-commerce penetration reduces geographic barriers, allowing rare items to be traded internationally with ease. Authentication and provenance tracking through blockchain further strengthen buyer confidence.

Authentication Advancements and Consumer Trust:

Authentication has become a critical growth driver as counterfeit concerns challenge credibility. It is benefiting from technological innovations such as blockchain certification, tamper-proof holograms, and third-party verification services. Leading auction houses and memorabilia firms are integrating these solutions into standard practices to ensure authenticity. This boosts buyer trust, attracts first-time investors, and reinforces market credibility. The premium segment is particularly reliant on transparent authentication to justify high-value transactions.

Market Trends:

Rise of Fractional Ownership Models:

A growing trend is the adoption of fractional ownership for high-value memorabilia, enabling multiple investors to share ownership of rare items. This democratizes access to premium collectibles, traditionally reserved for elite buyers. Platforms facilitating such models allow participants to trade shares, much like traditional assets, opening the sector to younger demographics.

- For instance, Collectable is a U.S.-based platform specializing in fractional ownership of high-value sports memorabilia. It enables users to invest in shares of rare items, such as iconic sports cards and memorabilia, with prices for shares starting as low as a few dollars. Collectable also features a secondary market for trading these shares, designed to comply with SEC regulations and facilitate seamless peer-to-peer transactions.

Integration of AR and VR for Immersive Collecting Experiences:

Technology is enhancing consumer engagement through augmented and virtual reality tools. Buyers can view 3D models of collectibles, attend virtual auctions, and explore historical narratives linked to items. This immersive interaction increases perceived value and enhances purchase intent, especially among digitally native consumers.

- For instance, VeVe is a leader in the digital collectibles market, offering users AR features to view 3D models of digital assets in real-world environments. Collectors can showcase digital art or branded collectibles from franchises such as Marvel and DC Comics using augmented reality.

Pop Culture Crossovers and Collaborative Releases:

Collaborations between brands, celebrities, and sports teams are producing limited-edition memorabilia that appeal to multiple fan bases. These crossovers, often launched with strategic marketing campaigns, generate hype and sell out quickly, creating immediate secondary market value.

Sustainability and Ethical Collecting Practices:

The market is witnessing a gradual shift toward ethical sourcing, sustainable packaging, and environmentally conscious production for newly manufactured memorabilia. Consumers, particularly millennials and Gen Z, are more inclined to support brands with transparent and responsible business practices.

Market Challenges Analysis:

High Risk of Counterfeiting and Fraud:

The Global Memorabilia (Within Collectibles) Market faces persistent threats from counterfeit goods and fraudulent listings, which erode buyer confidence. Unscrupulous sellers exploit the high-value nature of rare items, targeting inexperienced collectors. Even with advancements in authentication, fake items continue to infiltrate online marketplaces. This necessitates continuous investment in verification systems and buyer education programs.

Volatility in Consumer Demand and Price Fluctuations:

The market is sensitive to cultural relevance and event-driven spikes, leading to fluctuating demand patterns. Prices for memorabilia linked to trending personalities or events can rise sharply, only to decline when public interest wanes. Economic downturns and reduced discretionary spending further influence purchasing decisions, affecting long-term stability.

Market Opportunities:

Expansion into Emerging Markets:

Rising disposable incomes and expanding digital access in Asia-Pacific, Latin America, and the Middle East present untapped opportunities. Local sports icons, music stars, and cultural heritage are fueling regional demand for customized memorabilia. Market players can capitalize by establishing localized auction platforms and direct-to-consumer models.

Leveraging Technology for Market Differentiation:

Integration of blockchain authentication, AI-driven valuation tools, and immersive digital showcases offers competitive differentiation. These innovations can increase transparency, attract tech-savvy collectors, and strengthen loyalty among high-value buyers.

Market Segmentation Analysis:

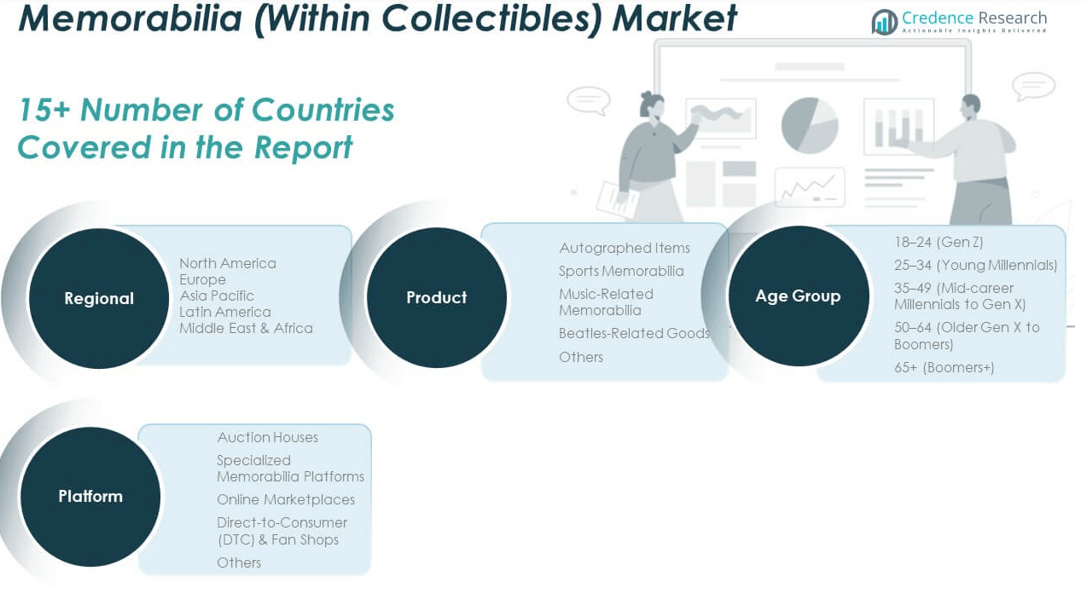

By Product

The Global Memorabilia (Within Collectibles) Market features diverse product categories catering to varied collector preferences. Autographed items remain highly desirable due to their authenticity and rarity, often commanding premium prices. Sports memorabilia holds a dominant share, fueled by global sporting events, championship wins, and athlete endorsements. Music-related memorabilia attracts enthusiasts seeking concert-used instruments, signed albums, and setlists. Beatles-related goods maintain a niche yet enduring demand, reflecting the group’s lasting cultural influence. The others segment covers movie props, historical documents, and vintage toys, appealing to a wide spectrum of collectors and investors.

- For instance, A Beatles Jr. vintage toy guitar (1964) sold in 2019 for $8,750. Complete sets of Beatles dolls/figures have reached $200–$50,000 depending on condition and rarity.

By Age Group

The market captures strong engagement across age demographics. 18–24 (Gen Z) buyers favor pop culture collectibles and esports merchandise, driven by digital engagement and influencer culture. 25–34 (Young Millennials) show a preference for limited-edition sports and entertainment memorabilia. 35–49 (Mid-career Millennials to Gen X) represent a high-spending segment, with strong interest in vintage sports items and rare music memorabilia. 50–64 (Older Gen X to Boomers) lean toward historical collectibles and iconic sports artifacts, while 65+ (Boomers+) display a deep appreciation for antiques, heritage pieces, and early-era sports equipment.

- For instance, Gen Z buyers are most attracted to pop culture and esports collectibles, while Millennials favor limited-edition sports and entertainment memorabilia. Collectors 50–64 tend toward historical and iconic sports items; the 65+ demographic prefers antiques and heritage artifacts.

By Platform

Distribution channels in the market range from traditional to digital. Auction houses dominate high-value transactions through their prestige, established credibility, and robust authentication services. Specialized memorabilia platforms serve targeted communities with curated offerings. Online marketplaces expand accessibility, enabling global reach for sellers and buyers. Direct-to-consumer (DTC) and fan shops thrive on official merchandise partnerships with sports teams, music artists, and entertainment brands. The others category includes private sales, collector fairs, and pop-up events that cater to exclusive buyer networks.

Segmentation:

By Product:

- Autographed Items

- Sports Memorabilia

- Music-Related Memorabilia

- Beatles-Related Goods

- Others

By Age Group:

- 18–24 (Gen Z)

- 25–34 (Young Millennials)

- 35–49 (Mid-career Millennials to Gen X)

- 50–64 (Older Gen X to Boomers)

- 65+ (Boomers+)

By Platform:

- Auction Houses

- Specialized Memorabilia Platforms

- Online Marketplaces

- Direct-to-Consumer (DTC) & Fan Shops

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Memorabilia (Within Collectibles) Market size was valued at USD 7,140.31 million in 2018 to USD 9,752.71 million in 2024 and is anticipated to reach USD 16,274.59 million by 2032, at a CAGR of 6.6% during the forecast period. Holding the largest global share at 37%, it benefits from a mature collector culture, high purchasing power, and deep-rooted sports and entertainment industries. The U.S. dominates with a robust auction ecosystem, celebrity-driven demand, and extensive sports memorabilia trade. Canada and Mexico are emerging segments, with increasing online participation and growing fan engagement in global sporting and cultural events. Authentication services and premium-grade auction houses enhance buyer confidence in the region.

Europe

The Europe Global Memorabilia (Within Collectibles) Market size was valued at USD 5,626.47 million in 2018 to USD 7,912.47 million in 2024 and is anticipated to reach USD 13,185.11 million by 2032, at a CAGR of 6.7%. With 30% market share, Europe thrives on rich historical heritage, strong cultural institutions, and a tradition of fine art and collectible trading. The UK, Germany, and France lead in sports, music, and historical memorabilia segments, while Italy and Spain show growth potential driven by sports fandom and tourism-related purchases. Online platforms are bridging the gap between heritage auction houses and younger collectors seeking contemporary pop culture items.

Asia-Pacific

The Asia-Pacific Global Memorabilia (Within Collectibles) Market size was valued at USD 4,277.13 million in 2018 to USD 5,802.48 million in 2024 and is anticipated to reach USD 9,671.33 million by 2032, at a CAGR of 6.8%. Holding a 22% market share, Asia-Pacific is expanding rapidly due to rising disposable incomes, growing fan bases for sports and entertainment, and the influence of digital commerce. China, Japan, and Australia lead, with increasing traction in India and Southeast Asia. Celebrity endorsements, sports events, and music concerts are key demand drivers. Platforms offering localized experiences and language-based interfaces are gaining strong adoption.

Latin America

The Latin America Global Memorabilia (Within Collectibles) Market size was valued at USD 970.91 million in 2018 to USD 1,318.75 million in 2024 and is anticipated to reach USD 2,217.79 million by 2032, at a CAGR of 6.9%. Representing 5% of the market, growth is supported by the passionate sports culture, particularly in football. Brazil and Argentina dominate demand, with increasing interest in music and entertainment memorabilia. The region benefits from cross-border e-commerce and social media-driven collecting trends, although currency fluctuations and import restrictions remain challenges.

Middle East

The Middle East Global Memorabilia (Within Collectibles) Market size was valued at USD 582.23 million in 2018 to USD 791.25 million in 2024 and is anticipated to reach USD 1,327.71 million by 2032, at a CAGR of 6.8%. With a 3% market share, the region’s demand is concentrated in the GCC, driven by affluent buyers, luxury lifestyle preferences, and interest in rare and culturally significant items. Sports memorabilia linked to global events hosted in the region, such as Formula 1 and FIFA tournaments, is a key growth segment. Auction houses are increasingly establishing partnerships with regional art fairs and cultural festivals.

Africa

The Africa Global Memorabilia (Within Collectibles) Market size was valued at USD 582.23 million in 2018 to USD 791.25 million in 2024 and is anticipated to reach USD 1,327.71 million by 2032, at a CAGR of 6.8%. Holding a 3% market share, Africa’s market is at a nascent stage, with growing traction in South Africa, Nigeria, and Egypt. Demand is emerging for sports memorabilia, particularly linked to football and athletics, alongside historical and cultural artifacts. Limited infrastructure for authentication and auction services presents challenges, but mobile commerce and diaspora demand create new opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Heritage Auctions

- Sotheby’s

- Christie’s

- Goldin Auctions

- Lelands

- RRAuction

- Upper Deck

- Fanatics Collectibles

- Steiner Sports (now part of Fanatics)

- Julien’s Auctions

Competitive Analysis:

The Global Memorabilia (Within Collectibles) Market is characterized by a blend of established auction houses, specialized memorabilia dealers, and modern e-commerce platforms. It features both heritage brands like Sotheby’s, Christie’s, and Heritage Auctions, as well as emerging online-first players such as Fanatics Collectibles and specialized marketplaces. Competition is driven by exclusivity, authentication reliability, and access to rare, high-demand items. Companies differentiate themselves by securing high-profile consignments, leveraging celebrity endorsements, and integrating digital innovations such as blockchain-based authentication. Partnerships with sports leagues, entertainment franchises, and cultural institutions further strengthen brand credibility and market reach.

Recent Developments:

- In July 2025, Heritage Auctions reported record sales exceeding $962 million in the first half of the year, the strongest start in the company’s history. Expanding its global footprint, Heritage opened new offices in Munich and Tokyo and announced plans to open more locations in Montreal and other cities in 2026. The company also plans a 10–12% increase in workforce focusing on collectibles and fine art experts, driven by rising confidence in online bidding platforms, especially mobile auctions.

- In mid-2025, Sotheby’s highlighted strong luxury sales performance with a focus on jewelry, watches, and fine art sales across global hubs. It continues to expand its presence in Asia and the Middle East, opening new dedicated sales floors, such as the newly launched Maison in Hong Kong situated in Landmark Chater. Sotheby’s emphasized a record number of younger buyers, particularly in luxury categories, with digital auctions driving over 28% of Day Sale transactions under third-party guarantees, reinforcing its innovative auction model.

- In the first half of 2025, Christie’s maintained strong auction results with a remarkable 30% increase in luxury goods sales, tallying $468 million. It successfully sold nine out of the top ten most expensive jewels in 2025 and staged major auctions including a $72 million sale led by a 624-carat deep blue diamond. Christie’s continues expanding its Middle East presence with an office in Saudi Arabia and increased buyer participation from that region by 14%.

- Goldin Auctions reported record-breaking sales in early 2025 with over $150 million in transactions within the sports memorabilia segment. Its most notable sale was a Michael Jordan autographed jersey, which fetched $10.1 million. The auction house also expanded its virtual bidding platform, improving accessibility and live engagement for collectors worldwide.

- In 2025, Lelands broadened its presence in the sports collectibles market by hosting over 30 live and online auctions, specializing in rare baseball memorabilia. Lelands announced partnerships with major sports entities to secure exclusive consignments, growing their portfolio to include key historic and signed artifacts.

Market Concentration & Characteristics:

The Global Memorabilia (Within Collectibles) Market exhibits a moderately consolidated structure, with leading players holding significant influence through exclusive item sourcing and brand heritage. It is marked by high entry barriers due to the need for authentication expertise, global networks, and trust-based buyer relationships. Growth is reinforced by repeat purchases from dedicated collectors, steady investment interest, and cross-industry collaborations. The market remains event-driven, with cultural and sporting milestones driving transactional peaks, while online platforms continue to expand reach beyond traditional auction environments.

Report Coverage:

The research report offers an in-depth analysis based on product segments and distribution platforms, detailing market performance across different age groups and regions. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will strengthen through increasing integration of memorabilia into investment portfolios.

- Online marketplaces will expand global reach, attracting first-time buyers and younger collectors.

- Authentication technology adoption will enhance buyer trust and reduce counterfeit circulation.

- Sports-related memorabilia will retain dominance, supported by global sporting events.

- Music and entertainment segments will see heightened interest driven by pop culture trends.

- Emerging markets will contribute significantly through localized product offerings and platforms.

- Partnerships between auction houses and digital platforms will optimize hybrid sales models.

- Sustainability practices in production and packaging will influence purchasing decisions.

- Fractional ownership models will broaden access to premium collectibles.

- Cross-industry collaborations will create new collectible categories appealing to multiple fan bases.