Market Overview

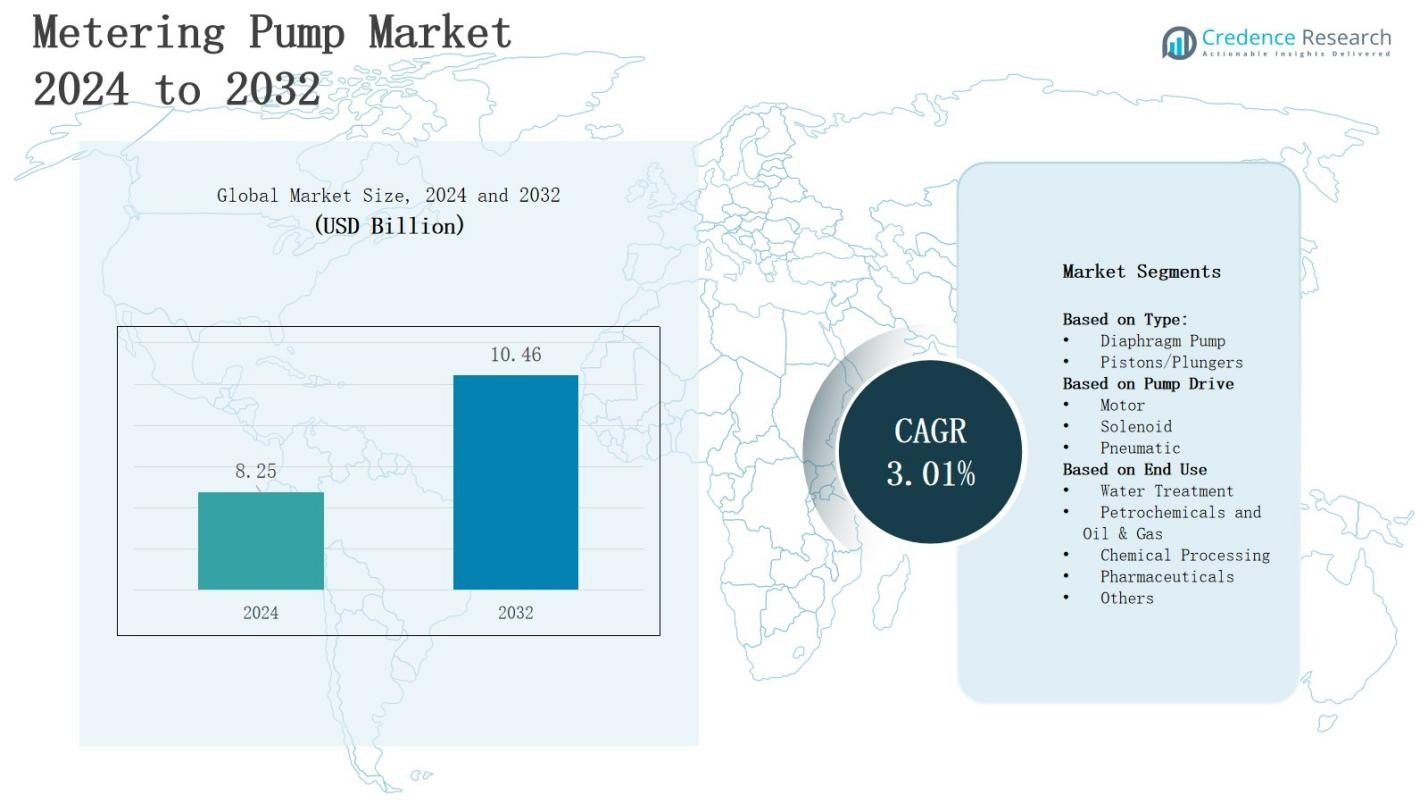

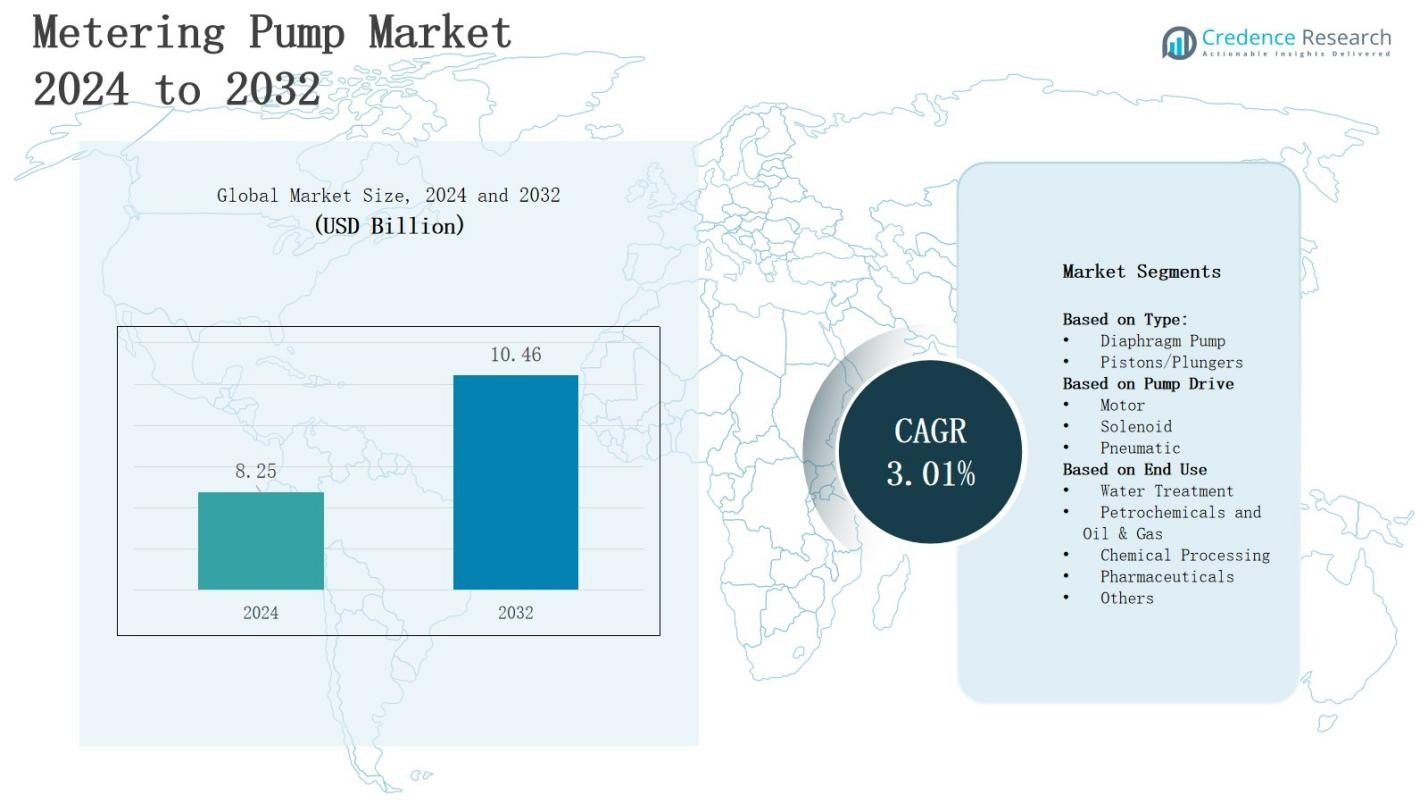

The metering pump market is projected to grow from USD 8.25 billion in 2024 to USD 10.46 billion by 2032, registering a CAGR of 3.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Metering Pumps Market Size 2024 |

USD 8.25 Billion |

| Metering Pumps Market, CAGR |

3.01% |

| Metering Pumps Market Size 2032 |

USD 10.46 Billion |

The metering pump market is driven by increasing demand across water and wastewater treatment, chemical processing, and oil and gas industries, where precise fluid dosing is essential for operational efficiency and regulatory compliance. Rising emphasis on safe and sustainable water management, coupled with rapid industrialization in emerging economies, further accelerates adoption. Technological advancements, including digital and smart metering pumps with automation and remote monitoring capabilities, are reshaping industry practices by enhancing accuracy and reducing maintenance costs. Additionally, growing investments in infrastructure development and environmental regulations supporting pollution control contribute significantly to the market’s positive growth trajectory.

The metering pump market demonstrates diverse geographical growth, with Asia-Pacific leading at 34% share, followed by North America at 28% and Europe at 24%, while Latin America and the Middle East & Africa hold 8% and 6% respectively. It expands through strong demand in water treatment, chemicals, oil and gas, and pharmaceuticals across these regions. Key players include Ingersoll Rand, Dover Corporation, Grundfos Holding A/S, Milton Roy Company, ProMinent GmbH, SEKO S.p.A., SPX Flow Inc., Verder Group, Watson-Marlow, Flowserve Corporation, GEA Group AG, and ITC.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The metering pump market is projected to grow from USD 8.25 billion in 2024 to USD 10.46 billion by 2032, registering a CAGR of 3.01%, supported by rising demand in water treatment, chemicals, and oil and gas industries.

- By type, the diaphragm pump segment dominates with 62% share due to its reliability, low maintenance, and suitability for handling hazardous fluids in water treatment, chemical processing, and pharmaceutical applications.

- By pump drive, the motor-driven pump segment leads with 55% share, offering durability, high-volume dosing, and strong integration with digital automation systems across large-scale industries.

- By end use, the water treatment segment accounts for 41% share, driven by rising global demand for clean water, regulatory compliance, and government-backed initiatives for sustainable water management.

- Regionally, Asia-Pacific leads with 34% share, followed by North America at 28%, Europe at 24%, Latin America at 8%, and the Middle East & Africa at 6%, with key players including Ingersoll Rand, Dover Corporation, Grundfos, Milton Roy, ProMinent, SEKO, SPX Flow, Verder Group, Watson-Marlow, Flowserve, GEA Group, and ITC.

Market Drivers

Rising Demand from Water and Wastewater Treatment

The metering pump market benefits significantly from the growing need for efficient water and wastewater treatment solutions worldwide. Industrial expansion, urbanization, and rising population levels continue to stress existing water resources, creating urgent demand for precise chemical dosing systems. It supports treatment plants in meeting stringent quality standards by ensuring accurate delivery of disinfectants and additives. Governments emphasize sustainable water management practices, pushing industries to adopt advanced pumps. This strong demand strengthens consistent market growth.

- For instance, in wastewater treatment plants, metering pumps are essential for dosing chemicals such as disinfectants, coagulants, and pH adjusters precisely to ensure water quality and compliance with regulations.

Expanding Applications in Chemical Processing Industries

Chemical processing remains a major driver for the metering pump market, supported by the need for accurate dosing in handling hazardous and sensitive fluids. Industries depend on these pumps for precise injection of acids, alkalis, and other critical substances that influence product quality and safety. It enables controlled operations, reducing risks of waste and contamination. Growing production in pharmaceuticals, food additives, and specialty chemicals fuels adoption. Strict compliance requirements reinforce reliance on advanced pump technology.

Technological Advancements and Smart Solutions

The metering pump market is evolving through the introduction of smart and automated systems that improve accuracy, reduce downtime, and increase operational efficiency. Manufacturers integrate digital monitoring, IoT connectivity, and predictive maintenance features into modern pump designs. It allows industries to streamline processes and minimize human error, supporting cost control and productivity. Demand for energy-efficient and user-friendly solutions rises steadily. Smart technologies also enhance safety in applications requiring precision fluid control.

- For instance, Good Energy partnered with SMS to install Britain’s first polyphase SMETS2 smart meter, enabling high-volume electricity users to connect to smart grids with improved accuracy and remote monitoring capabilities, significantly advancing energy management for complex electrical setups.

Infrastructure Development and Environmental Regulations

Infrastructure projects worldwide drive the metering pump market by increasing demand for reliable dosing systems in construction, power generation, and water management. Governments implement stricter environmental regulations that mandate effective treatment of effluents and pollutants. It encourages industries to invest in durable, high-performance metering pumps capable of meeting sustainability goals. Rising investments in industrial automation enhance adoption across diverse sectors. Compliance pressures and regulatory frameworks accelerate market penetration of advanced pumping systems.

Market Trends

Integration of Digital and Smart Pumping Technologies

The metering pump market is witnessing a strong trend toward digitalization and smart technologies that enhance operational accuracy and reliability. Companies introduce pumps equipped with IoT connectivity, automated control features, and predictive maintenance capabilities. It enables real-time monitoring of performance and improves safety in industries requiring precise dosing. Demand grows for solutions that reduce human error and improve productivity. The integration of digital platforms aligns with broader industry movements toward smart manufacturing systems.

- For instance, Grundfos has developed Smart Dosing Pumps that use IoT sensors and automated controls to adjust flow rates and optimize energy consumption in real time, enhancing efficiency and reducing downtime.

Sustainability and Energy-Efficient Pump Designs

Sustainability drives innovation within the metering pump market, with a clear shift toward energy-efficient and environmentally friendly designs. Manufacturers develop pumps that consume less power while maintaining high precision and durability. It reflects growing pressure from industries to comply with global sustainability standards. Companies also emphasize recyclable materials and eco-friendly production processes. Demand for sustainable equipment strengthens in water treatment, food processing, and pharmaceuticals, highlighting the market’s alignment with evolving environmental objectives.

- For instance, Milton Roy offers MAD and HAD pumps engineered for sustainable, long-term chemical dosing solutions with advanced technologies that reduce chemical waste and extend equipment life, particularly in water treatment and chemical processing industries.

Increasing Role of Automation Across Industrial Applications

Automation is reshaping the metering pump market, driven by the need for streamlined processes and enhanced productivity. Industries rely on automated dosing systems to ensure consistent performance across water treatment, oil and gas, and chemical manufacturing. It reduces manual intervention and supports compliance with strict quality standards. Automated pumps improve process efficiency, limit downtime, and optimize resource use. Widespread adoption of automation reflects a broader trend toward digital transformation in industrial infrastructure.

Growing Adoption in Emerging Economies

The metering pump market experiences rising adoption in emerging economies, where industrialization, urbanization, and infrastructure projects expand rapidly. Demand for efficient water management solutions and compliance with stricter pollution control standards intensify the use of metering pumps. It supports diverse industries such as energy, mining, and chemicals that require accurate dosing systems. Government-led initiatives for clean water and sustainable industrial growth further accelerate adoption. Emerging markets represent significant growth opportunities for global and regional manufacturers.

Market Challenges Analysis

High Initial Costs and Maintenance Complexities

The metering pump market faces challenges due to high initial investment requirements and ongoing maintenance demands. Many small and medium-sized enterprises hesitate to adopt advanced systems because of the costs associated with installation, calibration, and training. It creates barriers for companies with limited budgets, slowing overall adoption. Maintenance complexity further adds to operating expenses, particularly in industries handling corrosive or hazardous fluids. Frequent replacement of parts and skilled technician requirements make cost management difficult for end-users.

Technical Limitations and Operational Inefficiencies

The metering pump market also struggles with technical limitations that affect efficiency and performance in demanding applications. Inconsistent dosing accuracy under variable operating conditions impacts reliability for critical processes. It challenges industries such as pharmaceuticals and food processing that require strict precision. Pumps also face issues with wear and tear when handling abrasive or viscous fluids, reducing operational lifespan. Dependence on electricity and limited compatibility with certain digital systems restrict flexibility. These issues hinder wider adoption across global industries.

Market Opportunities

Expansion in Water Treatment and Environmental Applications

The metering pump market holds strong opportunities in the growing water treatment and environmental management sectors. Rising global concerns over water scarcity and stricter pollution control regulations drive demand for advanced dosing solutions. It provides accurate chemical injection, ensuring compliance with water quality standards and sustainability goals. Rapid urbanization and industrial growth create significant opportunities in municipal and industrial wastewater treatment. Government initiatives for clean water infrastructure amplify the role of metering pumps in addressing environmental challenges.

Adoption of Advanced Technologies Across Industries

The metering pump market benefits from opportunities linked to digitalization, automation, and the integration of smart technologies. Industries increasingly prefer systems with IoT-enabled monitoring, predictive maintenance, and enhanced energy efficiency. It helps organizations improve accuracy, reduce downtime, and optimize operating costs. Expansion in pharmaceuticals, food and beverages, and specialty chemicals creates fertile ground for next-generation pump adoption. Growing demand for automated and sustainable equipment reinforces the market’s potential for long-term growth across diverse global sectors.

Market Segmentation Analysis:

By Type

In the metering pump market, the diaphragm pump segment holds the dominant share of 62%, driven by its reliability, low maintenance requirements, and suitability for handling corrosive and hazardous fluids. Its ability to provide precise dosing in critical applications such as water treatment, chemical processing, and pharmaceuticals strengthens demand. The design minimizes leakage risks and ensures long operational life, making it the preferred choice for industries prioritizing accuracy, safety, and compliance with strict regulatory standards.

- For instance, Iwaki Co., Ltd. supplies electromagnetic diaphragm metering pumps, which are extensively adopted in chemical dosing systems for semiconductor manufacturing, due to their corrosion resistance and precise micro-liter control.

By Pump Drive

The motor-driven pump segment leads the metering pump market with a share of 55%, supported by its widespread use in large-scale industrial operations requiring consistent and high-volume dosing. It offers strong performance, durability, and efficiency in handling diverse fluids across oil and gas, petrochemicals, and water treatment applications. Growing industrial automation further drives adoption, as motor-driven pumps integrate easily with digital control systems. Their reliability in continuous operations positions them as the most preferred pump drive category globally.

- For instance, Verderflex’s Dura motor-driven hose pumps are widely deployed in wastewater treatment plants across Europe to handle abrasive sludge, ensuring continuous 24/7 operation with minimal downtime.

By End Use

The water treatment segment represents the largest share of 41% in the metering pump market, fueled by rising global demand for clean water and compliance with stringent environmental regulations. These pumps ensure precise chemical dosing for disinfection, pH control, and wastewater treatment, making them indispensable in municipal and industrial facilities. Population growth, urbanization, and sustainability initiatives accelerate investments in water treatment infrastructure. Expanding government programs for clean and safe water access continue to support strong demand in this segment.

Segments:

Based on Type:

- Diaphragm Pump

- Pistons/Plungers

Based on Pump Drive

Based on End Use

- Water Treatment

- Petrochemicals and Oil & Gas

- Chemical Processing

- Pharmaceuticals

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 28% share of the metering pump market, driven by strong demand from water treatment, chemical processing, and oil and gas sectors. Strict regulatory frameworks on wastewater management and environmental protection create steady demand for advanced dosing technologies. It benefits from a mature industrial base, high adoption of automation, and continuous innovation by leading manufacturers. Investments in upgrading municipal water infrastructure reinforce market growth. Rising shale gas activities also expand application scope in the region.

Europe

Europe holds 24% share of the metering pump market, supported by stringent environmental policies and advanced industrial infrastructure. Demand for precision dosing equipment remains high in chemical, pharmaceutical, and food industries where compliance with safety and quality standards is critical. It benefits from strong innovation in sustainable technologies and energy-efficient designs. EU directives on water quality and pollution control fuel adoption across municipal and industrial facilities. Ongoing infrastructure modernization continues to reinforce demand across key economies.

Asia-Pacific

Asia-Pacific dominates the metering pump market with a 34% share, led by rapid industrialization, urban expansion, and infrastructure development in countries such as China, India, and Japan. Expanding chemical processing, pharmaceuticals, and water treatment sectors significantly increase adoption of metering pumps. It gains momentum from rising government investments in clean water initiatives and pollution control programs. Strong demand in oil and gas operations across the region further accelerates market growth. Manufacturing competitiveness strengthens regional industry presence globally.

Latin America

Latin America captures 8% share of the metering pump market, driven by growing demand from oil and gas, mining, and water treatment industries. Governments emphasize improving wastewater treatment and environmental compliance, creating opportunities for adoption. It benefits from industrial expansion in Brazil and Mexico, where petrochemical and energy industries require reliable dosing solutions. Rising investments in infrastructure development further support growth. Limited technological penetration still poses challenges but also highlights untapped potential in the region.

Middle East & Africa

The Middle East & Africa region represents 6% share of the metering pump market, largely supported by oil and gas, petrochemicals, and water treatment industries. Growing desalination projects across Gulf countries create strong demand for precision dosing technologies. It gains further momentum from infrastructure development and rising investments in industrial diversification. Water scarcity challenges accelerate adoption of efficient treatment solutions. Emerging pharmaceutical and chemical industries also contribute, reinforcing the region’s growing role in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The metering pump market is highly competitive, with global and regional players focusing on innovation, efficiency, and product differentiation to strengthen their positions. Companies such as Ingersoll Rand, Dover Corporation, Grundfos Holding A/S, Milton Roy Company, ProMinent GmbH, and SEKO S.p.A. drive growth through advanced technologies and expanded service portfolios. SPX Flow, Inc. (Lone Star), Verder Group, Watson-Marlow Fluid Technology Group (Spirax Group), Flowserve Corporation, GEA Group AG, and Injection Technical Control Inc. (ITC) emphasize precision, sustainability, and automation to meet evolving industrial requirements. It reflects strong competition based on reliability, compliance, and cost efficiency across water treatment, chemicals, and oil and gas applications. Players invest in smart dosing solutions with IoT integration, predictive maintenance, and energy-efficient designs to align with customer demand for digital and sustainable operations. Strategic mergers, acquisitions, and global expansions remain central to strengthening supply networks and market penetration. The competitive landscape continues to evolve with companies targeting emerging economies to capture opportunities driven by industrialization and infrastructure growth.

Recent Developments

- In May 2025, Lutz-Jesco GmbH acquired the FXM line of peristaltic metering pumps from Valmet to strengthen its portfolio and enhance its position in industrial and municipal fluid handling markets.

- In January 2025, LMI Pumps launched its new TD Series Chemical Metering Pump featuring advanced FLUXDRIVE technology to enhance process control across industries.

- In February 2025, LMI Pumps introduced the beta/X metering pump, highlighting its ease of use, durable design, PFAS-free materials, and full recyclability

- In December 2024, KNF introduced its FM 50 diaphragm pump series, offering precise liquid metering at flow rates of 100–500 ml/min, ±2% setpoint accuracy, and stable performance across varied conditions.

Market Concentration & Characteristics

The metering pump market reflects a moderately concentrated structure, characterized by the presence of global leaders and strong regional players competing on technology, efficiency, and application-specific solutions. Key companies including Ingersoll Rand, Dover Corporation, Grundfos Holding A/S, Milton Roy, ProMinent GmbH, SEKO S.p.A., SPX Flow Inc., Verder Group, Watson-Marlow, Flowserve Corporation, GEA Group, and ITC dominate through product innovation, energy-efficient designs, and integrated digital solutions. It is shaped by consistent demand from water treatment, chemical processing, and oil and gas industries where precision and compliance are critical. The market demonstrates steady growth potential through expansion in emerging economies, driven by industrialization and stricter environmental regulations. It shows strong emphasis on automation, IoT integration, and sustainability, reflecting the shift toward advanced dosing technologies. Competitive intensity remains high, with players focusing on mergers, acquisitions, and global distribution networks to expand presence and meet evolving customer requirements.

Report Coverage

The research report offers an in-depth analysis based on Type, Pump Drive, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing water and wastewater treatment needs will drive sustained demand for precise metering pump solutions.

- Smart automated pumps with digital features will expand adoption across industries seeking efficiency and accuracy.

- Energy-efficient, sustainable pump designs will gain preference due to stricter environmental regulations and operational cost control.

- Expanding pharmaceutical and specialty chemical industries will create strong opportunities for advanced dosing pump technologies.

- Rapid industrialization and infrastructure growth in emerging economies will accelerate adoption of metering pump systems.

- IoT integration and predictive maintenance features will improve reliability and reduce downtime across industrial operations.

- Oil and gas industries will continue requiring durable, high-performance dosing pumps for critical fluid control.

- Government clean water programs and pollution control measures will support broad adoption of metering pumps.

- Market competition will intensify with innovation-driven strategies from global leaders and strong regional players.

- Increasing desalination and water recycling projects worldwide will enhance utilization of advanced metering pump technologies.