| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Industrial Fasteners Market Size 2024 |

USD 2,492.20 Million |

| Mexico Industrial Fasteners Market, CAGR |

4.71% |

| Mexico Industrial Fasteners Market Size 2032 |

USD 3,600.57 Million |

Market Overview:

The Mexico Industrial Fasteners Market is projected to grow from USD 2,492.20 million in 2024 to an estimated USD 3,600.57 million by 2032, with a compound annual growth rate (CAGR) of 4.71% from 2024 to 2032.

The growth of Mexico’s industrial fasteners market is primarily fueled by the expansion of key sectors such as automotive, construction, and manufacturing. The country’s automotive industry has seen significant growth, with increased production and exports driving the demand for high-quality fasteners used in vehicle assembly. Infrastructure development initiatives led by the Mexican government also contribute to this demand, as new construction projects require durable fasteners to ensure structural integrity. Furthermore, advancements in the manufacturing sector, including automation and the adoption of advanced technologies, are increasing the need for precision-engineered fasteners that meet stringent quality standards. The shift towards renewable energy projects in Mexico, including wind and solar power installations, further supports the demand for specialized fasteners that can withstand harsh environmental conditions, providing additional market growth opportunities.

Mexico is a key player in the Latin American industrial fasteners market, benefiting from its strategic location, proximity to the United States, and its participation in trade agreements like the USMCA. Major industrial hubs such as Nuevo León, Guanajuato, and Puebla are driving fastener demand due to their concentration of automotive and manufacturing facilities. The country’s rapid urbanization and industrialization have led to increased demand for fasteners in construction and infrastructure projects. As Mexico continues to experience robust economic growth, particularly in these sectors, it presents a favorable environment for the industrial fasteners market to expand, making the country a central player in the regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mexico Industrial Fasteners Market is expected to grow significantly, driven by the expansion of key sectors like automotive, aerospace, and construction, with a projected increase from USD 2,492.20 million in 2024 to USD 3,600.57 million by 2032.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- Mexico’s automotive industry remains a primary driver, with increased production and exports necessitating the demand for high-quality fasteners used in vehicle assembly and parts manufacturing.

- Government investments in infrastructure, such as transportation networks and urban development, continue to drive fastener demand, particularly for large-scale construction projects requiring durable, high-strength fasteners.

- Technological advancements in manufacturing, including automation and robotics, are pushing the demand for precision-engineered fasteners that meet modern production needs across various industries.

- The rise in renewable energy projects, particularly in wind and solar power, is fueling demand for specialized fasteners designed to withstand challenging environmental conditions.

- The market faces challenges such as raw material price fluctuations, which can impact production costs and lead to higher prices for consumers, affecting overall profitability.

- Mexico’s reliance on the importation of raw materials for fastener production makes the market vulnerable to global trade uncertainties, such as tariffs or shipping delays, affecting production timelines and supply chains.

Market Drivers:

Expansion of the Automotive Industry

The automotive industry in Mexico is a key driver of the industrial fasteners market. As the country remains a major hub for automotive manufacturing and exports, the demand for industrial fasteners continues to rise. Fasteners are integral components in vehicle assembly, used in everything from engine parts to body structures. Mexico’s automotive sector is witnessing consistent growth, with major global manufacturers setting up production facilities in the country due to its strategic location, competitive labor costs, and favorable trade agreements such as the USMCA. This expansion significantly contributes to the increasing requirement for reliable and high-quality fasteners, ensuring the market’s continued growth.

Government Investments in Infrastructure

Mexico’s ongoing investment in infrastructure development plays a critical role in driving demand for industrial fasteners. The Mexican government has embarked on numerous large-scale projects aimed at improving transportation networks, urban development, and energy infrastructure. For example, the ongoing expansion and modernization of Mexico City’s airport and major highway projects have required extensive use of high-strength and durable fasteners to meet safety and longevity standards. These projects require a wide variety of fasteners for the construction of bridges, highways, airports, and buildings. The need for high-strength, durable fasteners in these large-scale construction projects directly correlates with the expansion of the industrial fasteners market. As the country continues to prioritize infrastructure development, the demand for fasteners in both public and private sector construction will remain strong.

Technological Advancements in Manufacturing

Mexico’s manufacturing sector has increasingly adopted automation and advanced production technologies, which has directly influenced the demand for industrial fasteners. As manufacturers focus on improving production efficiency and product quality, the need for precision-engineered fasteners has grown. Automated assembly lines and robotics, common in industries such as automotive and electronics, require fasteners that meet high standards of precision and performance. This technological shift in the manufacturing sector drives the demand for more sophisticated fastener solutions that can handle the complexities of modern production processes.

Growth in Renewable Energy Projects

The expansion of renewable energy projects in Mexico is another significant driver of the industrial fasteners market. The country’s commitment to increasing the share of renewable energy in its energy mix, particularly in wind and solar power installations, has spurred demand for specialized fasteners. For instance, according to the National Renewable Energy Labs, Mexico’s installed capacity of clean energy plants reached 31,369 MW in 2022, mainly from hydro, wind, and photovoltaic solar PV plants. These fasteners must be designed to withstand harsh environmental conditions such as high winds, moisture, and temperature fluctuations. As the government and private companies continue to invest in clean energy infrastructure, the demand for durable and reliable fasteners in this sector will further contribute to the overall growth of the market.

Market Trends:

Technological Advancements in Manufacturing Processes

The industrial fasteners market in Mexico is experiencing a significant transformation due to the adoption of advanced manufacturing technologies. Industries are increasingly integrating automation, robotics, and computer numerical control (CNC) systems into their production lines. For instance, Okuma America Corporation also launched its next-generation CNC machine, the OSP-P500, in September 2023, featuring advanced technology integration to optimize modern manufacturing operation. These innovations enhance precision, reduce human error, and improve overall efficiency in fastener manufacturing. As a result, there is a growing demand for high-quality, precision-engineered fasteners that meet the stringent requirements of modern manufacturing processes. This trend is particularly evident in the automotive and aerospace sectors, where the need for lightweight and durable fasteners is paramount.

Shift Towards Sustainable and Eco-friendly Materials

Environmental concerns and regulatory pressures are driving the shift towards sustainable and eco-friendly materials in the industrial fasteners market. Manufacturers are increasingly opting for recyclable and corrosion-resistant materials, such as stainless steel and aluminum alloys, to produce fasteners. For instance, BUMAX, a supplier of stainless steel fasteners, reports that approximately 80% of the stainless steel it sources comes from recycled raw materials, contributing to a significant reduction in lifecycle environmental impact and maintenance costs. This shift not only aligns with global sustainability goals but also meets the growing consumer demand for environmentally responsible products. Additionally, the use of such materials can lead to cost savings in the long term due to their durability and reduced need for replacements.

Customization and Specialized Fastener Solutions

There is a notable trend towards customization and the development of specialized fastener solutions tailored to specific industry needs. As industries such as automotive, construction, and renewable energy evolve, the demand for fasteners with unique specifications such as resistance to extreme temperatures, high tensile strength, and compatibility with advanced materials has increased. Manufacturers are responding by offering bespoke fastener solutions that cater to these specific requirements, thereby enhancing product performance and reliability.

Growth of E-commerce and Online Distribution Channels

The rise of e-commerce has significantly impacted the distribution channels of industrial fasteners in Mexico. Online platforms are increasingly being used by manufacturers and suppliers to reach a broader customer base, streamline ordering processes, and reduce lead times. This digital shift allows for greater transparency, improved inventory management, and enhanced customer service. Consequently, businesses are investing in digital infrastructure and logistics to capitalize on the growing trend of online procurement in the industrial sector.

Market Challenges Analysis:

Raw Material Price Fluctuations

One of the key challenges facing the Mexico industrial fasteners market is the volatility in raw material prices. Fasteners are primarily made from metals such as steel, aluminum, and copper, which are subject to price fluctuations due to factors such as global demand, supply chain disruptions, and geopolitical tensions. These price variations can significantly impact the overall cost of production, leading to higher prices for end consumers. Manufacturers in Mexico face the challenge of managing these price fluctuations, which can erode profit margins and increase operational costs, especially for small to medium-sized enterprises that have less flexibility in their pricing strategies.

Dependence on Importation of Raw Materials

Another challenge is Mexico’s dependence on the importation of raw materials for fastener production. Despite having a well-developed manufacturing sector, Mexico imports a substantial amount of the raw materials used to produce industrial fasteners, including high-grade steel and alloys. This reliance on foreign suppliers makes the market vulnerable to supply chain disruptions, fluctuating exchange rates, and global trade uncertainties. Any disruptions in international trade, such as tariffs or shipping delays, can result in production bottlenecks and affect the timely availability of fasteners in the market.

Intense Market Competition

The Mexico industrial fasteners market is highly competitive, with numerous local and international players vying for market share. As manufacturers are increasingly focusing on providing customized and specialized solutions, the pressure to offer high-quality products at competitive prices has intensified. Smaller companies, in particular, face challenges in competing with large-scale manufacturers that have better economies of scale and greater access to capital for technological advancements. This intense competition can make it difficult for smaller players to maintain profitability while also meeting the growing demands for innovation and product differentiation.

Regulatory Compliance and Standards

Compliance with stringent regulatory standards for industrial fasteners poses another challenge for manufacturers in Mexico. Fasteners are subject to various quality certifications and industry-specific regulations, particularly in sectors like aerospace and automotive, where safety and reliability are paramount. For example, the Fastener Quality Act (FQA) in the United States requires fasteners to meet consensus standards for fit, form, and function, with regulated product markings and penalties for non-compliance, which affects Mexican exporters supplying the U.S. market. Adhering to these standards requires continuous investment in quality control processes, testing equipment, and employee training, which can increase operational costs and impact production timelines.

Market Opportunities:

The Mexico industrial fasteners market presents significant growth opportunities, particularly due to the ongoing expansion of the automotive and manufacturing sectors. As Mexico continues to strengthen its position as a global manufacturing hub, particularly in industries like automotive, aerospace, and electronics, the demand for high-quality, precision-engineered fasteners is poised for substantial growth. The Mexican government’s focus on enhancing infrastructure, alongside increasing investments in renewable energy projects, creates additional opportunities for fastener manufacturers. These sectors require durable, specialized fasteners to meet their unique demands, such as resistance to extreme temperatures or environmental conditions, driving the need for advanced fastener solutions.

Furthermore, the growing trend towards sustainability offers another opportunity for growth. The increasing shift toward eco-friendly materials, such as recyclable alloys and corrosion-resistant fasteners, provides manufacturers with the chance to cater to the rising consumer demand for environmentally responsible products. By incorporating sustainable practices and offering products made from eco-friendly materials, fastener manufacturers can differentiate themselves in a competitive market. The rise of e-commerce also facilitates new business opportunities by enabling manufacturers to tap into broader markets with streamlined distribution channels, enhancing accessibility and customer reach. These factors combined position the Mexico industrial fasteners market for continued expansion, making it an attractive opportunity for stakeholders in the industry.

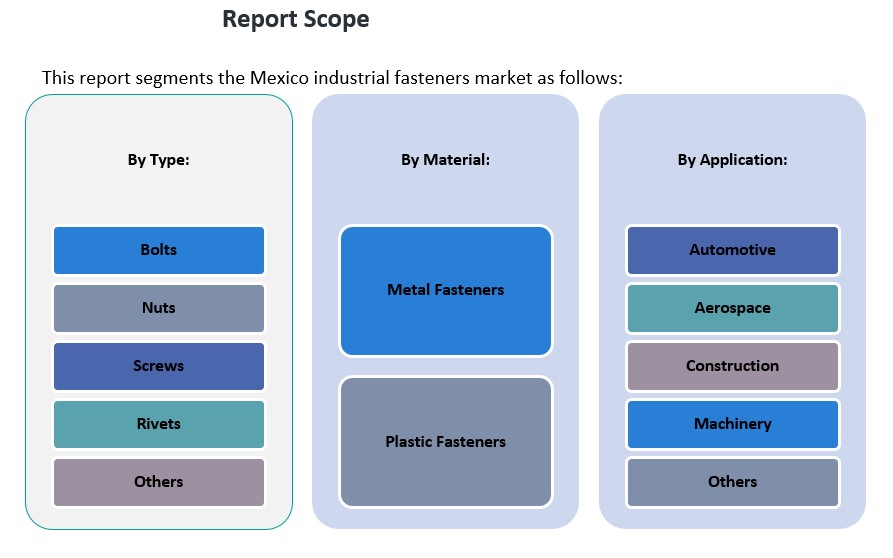

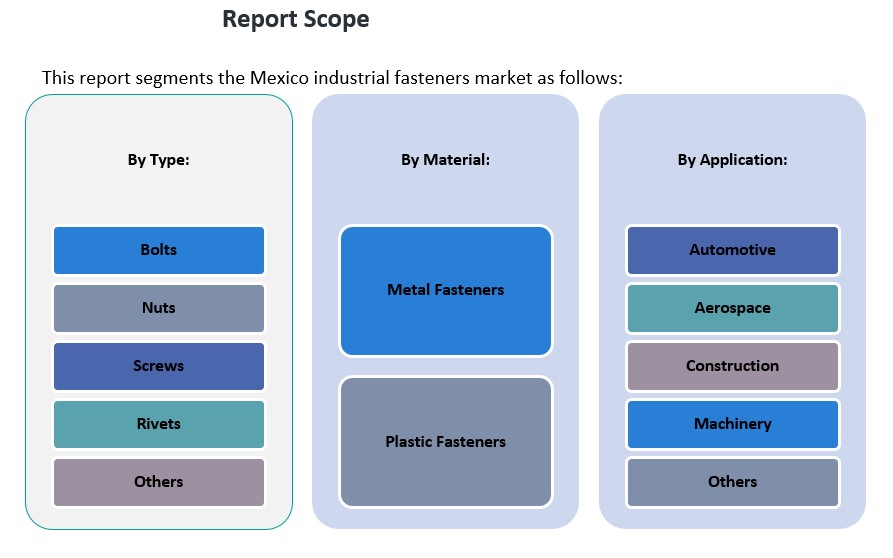

Market Segmentation Analysis:

The Mexico industrial fasteners market is segmented across various types, applications, and materials, each contributing significantly to its growth.

By Type, the market is dominated by bolts, nuts, and screws, which are widely used across multiple industries due to their essential role in fastening components together. Bolts and nuts are particularly prevalent in automotive and construction applications, where they are used for securing heavy-duty parts. Screws are commonly found in machinery, electronics, and household products, while rivets are essential in aerospace and construction sectors for joining metals and other materials. The Others segment includes fasteners such as washers, anchors, and clips, which also have broad applications across various industries.

By Application, the automotive sector holds the largest share of the market due to the robust automotive manufacturing industry in Mexico, which is a major consumer of industrial fasteners for vehicle assembly. The aerospace industry is another significant contributor, where fasteners are used in aircraft manufacturing and maintenance, requiring high-strength, lightweight solutions. Construction and machinery applications also form a considerable portion of the market, driven by infrastructure development and industrial machinery manufacturing. The Others segment covers fasteners used in sectors like electronics and renewable energy, which are witnessing growing demand for specialized fastener solutions.

By Material, metal fasteners dominate the market, given their strength, durability, and suitability for a wide range of industrial applications. Plastic fasteners, though a smaller segment, are gaining traction in industries that prioritize lightweight materials, such as aerospace and electronics, due to their resistance to corrosion and ease of installation.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The Mexico industrial fasteners market exhibits robust growth, driven by key industrial hubs across various regions of the country. Each region plays a critical role in the overall market, with unique sectoral demands influencing fastener consumption and production.

Northern Mexico: Automotive Manufacturing Hub

Northern Mexico, particularly the states of Nuevo León, Coahuila, and Chihuahua, holds the largest share of the industrial fasteners market, accounting for approximately 40% of the total market. This region is a significant automotive manufacturing hub, home to numerous global automotive giants, including General Motors, Ford, and Fiat Chrysler. As automotive manufacturing continues to thrive in these areas, the demand for high-quality fasteners used in vehicle assembly, components, and parts manufacturing remains substantial. The concentration of manufacturing plants in northern Mexico ensures that this region remains the dominant player in the market.

Central Mexico: Aerospace and Industrial Machinery

Central Mexico, including states such as Querétaro, Guanajuato, and San Luis Potosí, represents around 30% of the total market share. Querétaro, in particular, has emerged as a key hub for aerospace manufacturing, hosting companies like Bombardier and Safran. The demand for precision-engineered fasteners in the aerospace industry, as well as in the growing industrial machinery sector, drives significant fastener consumption in this region. The increasing adoption of high-precision fasteners to meet the demands of aerospace and machinery manufacturing further solidifies central Mexico’s position in the market.

Southern Mexico: Infrastructure and Construction

While southern Mexico accounts for a smaller share, approximately 15%, the region is witnessing growing demand for industrial fasteners due to infrastructure development projects. States such as Oaxaca, Chiapas, and Guerrero are benefiting from government investments in urban development and transportation infrastructure. These projects require durable and high-strength fasteners, thereby contributing to the region’s share in the overall market. Although it has a smaller market share compared to the north and central regions, southern Mexico is expected to see steady growth driven by increasing infrastructure projects.

Key Player Analysis:

- Arconic Inc.

- Illinois Tool Works Inc.

- STANLEY Engineered Fastening

- Hilti Corporation

- Acument Global Technologies

- Fastenal Company

- Nucor Corporation

- PennEngineering

- TriMas Corporation

- Parker Fasteners

Competitive Analysis:

The Mexico industrial fasteners market is highly competitive, with both local and international players striving for market share. Key global manufacturers, such as Stanley Black & Decker, Fastenal, and Hilti, dominate the market by offering a broad range of high-quality fasteners for various industries, including automotive, aerospace, and construction. These companies leverage advanced manufacturing technologies and strong distribution networks to maintain their competitive edge. In addition, regional players such as Grupo Industrial Saltillo and GBS Fasteners focus on providing tailored solutions to meet local market demands, particularly in the automotive and machinery sectors. The market is also characterized by increasing product differentiation, with manufacturers offering specialized fasteners that cater to specific needs, such as high-strength materials for automotive and aerospace applications. The ongoing expansion of manufacturing and infrastructure projects in Mexico presents opportunities for both established players and new entrants to grow their market presence.

Recent Developments:

- In April 2024, TR Fastenings, a leading provider of industrial fasteners, announced the launch of its new Plas-Tech 30-20 screws, specifically engineered for high-temperature environments. These screws are made from modified polyphthalamide, making them suitable for demanding automotive, electronics, and industrial applications. The new product offers increased strength, reduced weight, and exceptional resistance to chemicals and moisture, reflecting TR Fastenings’ commitment to expanding its portfolio with innovative solutions for challenging operating conditions.

- On February 25, 2025, Miller Electric Mfg. LLC, a wholly-owned subsidiary of Illinois Tool Works (ITW), announced a strategic partnership with Novarc Technologies. This collaboration focuses on developing AI-powered welding solutions under the Miller® Copilot™ line, aiming to enhance productivity, address labor shortages, and improve precision in industries such as shipbuilding and heavy equipment manufacturing.

- In January 2023, Hilti North America announced the addition of more than 30 new cordless tools to its Nuron battery-powered platform, expanding its portfolio to over 100 tools. This expansion, showcased at the World of Concrete event, includes advanced tools such as a diamond core rig, rotating lasers, and cut-off saws, reinforcing Hilti’s leadership in cordless jobsite solutions

Market Concentration & Characteristics:

The Mexico industrial fasteners market exhibits moderate concentration, with a mix of global and regional players contributing to its dynamics. Approximately 60% of the market is held by international corporations such as Stanley Black & Decker, Fastenal, and Hilti, which leverage their extensive product portfolios, advanced manufacturing capabilities, and robust distribution networks to maintain a competitive edge. The remaining 40% is comprised of regional manufacturers like Grupo Industrial Saltillo and GBS Fasteners, which focus on providing tailored solutions to meet local market demands, particularly in the automotive and machinery sectors. The market is characterized by a diverse product range, including bolts, nuts, screws, rivets, and washers, catering to various industries such as automotive, aerospace, construction, and machinery. Manufacturers are increasingly emphasizing product differentiation through innovation, quality, and customization to meet the specific needs of different sectors. Additionally, there is a growing trend towards the adoption of sustainable materials and manufacturing processes, driven by environmental considerations and regulatory requirements. The competitive landscape is further influenced by factors such as technological advancements, supply chain efficiencies, and the ability to offer specialized fastener solutions that comply with industry standards and certifications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Mexico industrial fasteners market is expected to continue its steady growth, driven by expanding manufacturing sectors.

- Automotive manufacturing will remain the primary contributor, with rising demand for precision fasteners in vehicle assembly.

- Aerospace production in Mexico is set to increase, further bolstering the need for high-performance fasteners.

- Infrastructure development projects will continue to drive the demand for durable fasteners, particularly in the construction industry.

- Technological advancements in fastener production will lead to higher precision and customized solutions.

- The shift towards sustainable materials will gain momentum, encouraging eco-friendly fastener production.

- Increased adoption of automation in manufacturing will elevate the need for specialized fasteners in automated systems.

- E-commerce platforms will become a critical channel for fastener distribution, improving market accessibility.

- The rise of renewable energy projects in Mexico will create additional opportunities for fastener manufacturers.

- Competitive pressures will encourage both global and local players to invest in product innovation and quality enhancements.