Market Overview:

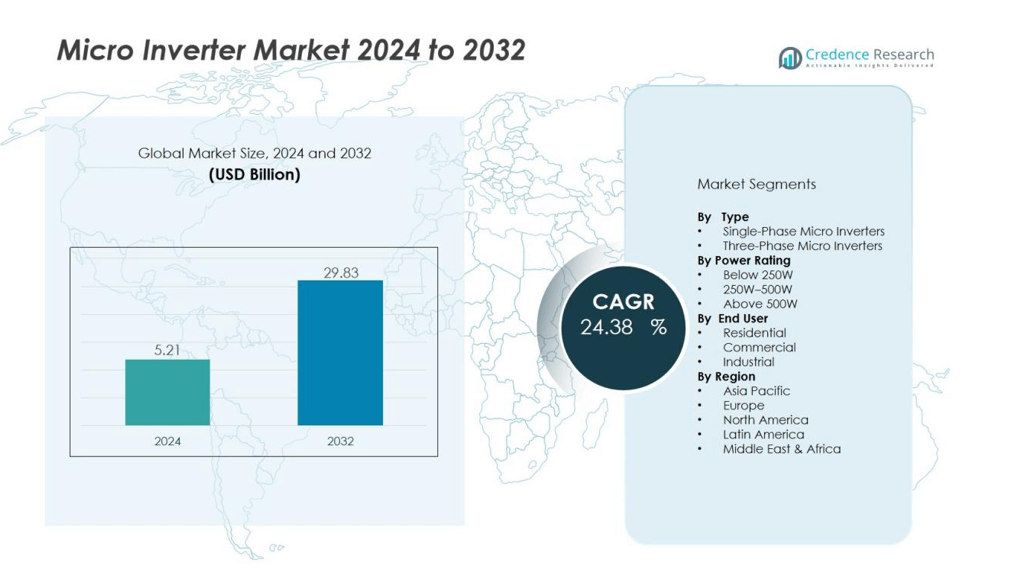

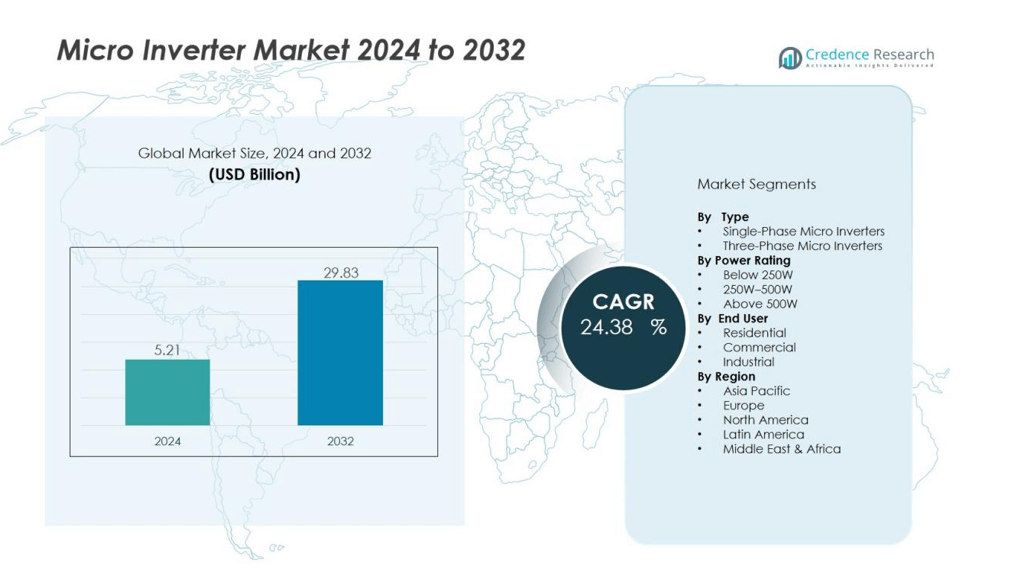

The micro inverter market size was valued at USD 5.21 billion in 2024 and is anticipated to reach USD 29.83 billion by 2032, at a CAGR of 24.38 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Micro Inverter Market Size 2024 |

USD 5.21 billion |

| Micro Inverter Market, CAGR |

24.38% |

| Micro Inverter Market Size 2032 |

USD 29.83 billion |

Key drivers of the market include the rising deployment of rooftop solar systems and government incentives for renewable energy. Micro inverters provide higher efficiency, enhanced monitoring, and improved safety compared to traditional string inverters, making them a preferred choice in urban and residential settings. Technological advancements, such as integration with smart grid systems and storage solutions, further strengthen adoption. Increasing consumer preference for sustainable energy sources continues to accelerate market growth.

Regionally, North America leads the micro inverter market due to strong policy support, widespread residential solar adoption, and advanced infrastructure. Europe follows with rapid expansion driven by strict emission regulations and renewable energy targets. Asia-Pacific is expected to grow at the fastest pace, fueled by large-scale solar projects in China, India, and Japan, along with favorable government subsidies. Emerging markets in Latin America and the Middle East & Africa are steadily adopting micro inverter solutions to diversify their energy mix.

Market Insights:

- The micro inverter market size was valued at USD 5.21 billion in 2024 and is projected to reach USD 29.83 billion by 2032, growing at a CAGR of 24.38% during the forecast period.

- Rising adoption of rooftop solar systems continues to drive demand, with homeowners favoring micro inverters for efficiency under shaded or uneven panel conditions.

- Government incentives, subsidies, and tax credits create a favorable environment, encouraging wider adoption of micro inverters across residential and small commercial sectors.

- Technological advancements, including integration with smart grids, storage compatibility, and real-time monitoring, strengthen system reliability and user control.

- High upfront costs and installation complexity remain challenges, particularly in price-sensitive regions where affordability influences solar adoption decisions.

- North America held 41% market share in 2024, supported by strong policies, tax credits, and widespread residential solar installations.

- Asia-Pacific recorded 23% market share and is expected to grow fastest, fueled by large-scale projects in China, India, and Japan along with government-backed subsidies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Rooftop Solar Systems:

The micro inverter market is driven by the growing deployment of rooftop solar systems across residential and small commercial sectors. Homeowners are increasingly choosing micro inverters for their ability to optimize individual panel output, which maximizes energy generation. It ensures higher system efficiency even under partial shading or panel mismatch conditions. This advantage positions micro inverters as a preferred solution in urban and suburban environments.

- For instance, Enphase Energy’s IQ8P microinverter supports solar panels up to 480 W, significantly enhancing energy harvesting in residential rooftop systems, reflecting cutting-edge innovation in rooftop solar technology.

Government Incentives and Renewable Energy Policies:

Supportive government policies and financial incentives strongly influence the expansion of the micro inverter market. Many countries provide subsidies, tax credits, and feed-in tariffs to encourage solar adoption. It creates a favorable environment for consumers and businesses to invest in distributed energy solutions. The alignment of policy frameworks with global sustainability goals continues to drive steady demand for advanced inverter technologies.

- For instance, Siemens plans to manufacture solar inverters at a new facility in Kenosha, Wisconsin, expected to reach a production capacity of 800 MW per year, supported by U.S. federal incentives under the Inflation Reduction Act.

Technological Advancements and Grid Integration:

Ongoing innovation in inverter technology strengthens the appeal of micro inverters. The market benefits from advancements in smart grid compatibility, energy storage integration, and real-time monitoring features. It improves overall system reliability while offering users greater control over energy production. These developments enhance the long-term value proposition of micro inverters across diverse applications.

Growing Demand for Sustainable and Reliable Energy:

The rising focus on sustainability and energy independence is a key driver of the micro inverter market. Consumers and businesses seek reliable, safe, and efficient solar energy systems that reduce reliance on fossil fuels. It meets the demand for decentralized power generation and improved energy security. The transition toward cleaner power solutions continues to expand opportunities for micro inverters worldwide.

Market Trends:

Integration of Smart Features and Energy Storage Solutions:

The micro inverter market is witnessing a strong trend toward integration with smart energy management systems and storage solutions. Manufacturers are embedding monitoring software and IoT-based platforms that provide real-time performance insights to end users. It enables predictive maintenance, improved fault detection, and optimization of power generation. The rising adoption of hybrid solar systems that combine storage with micro inverters further strengthens this trend. Growing demand for intelligent and connected energy solutions in both residential and commercial projects is shaping product innovation. This integration aligns with the broader movement toward digitalization and decentralized energy management.

- For instance, Enphase Energy’s Ensemble system integrates micro-inverter technology with AC battery storage, allowing homeowners to monitor and control energy production on a per-panel basis, delivering precise real-time data and scalable energy storage solutions in over 1 million residential homes globally.

Expansion in Residential and Small-Scale Applications:

A significant trend shaping the micro inverter market is the rapid expansion in residential and small-scale solar projects. Homeowners prefer micro inverters for their scalability, safety, and ability to maintain performance under variable conditions. It addresses common challenges such as shading and uneven panel orientation, which are frequent in urban environments. Manufacturers are responding by introducing compact, cost-effective models tailored for rooftop installations. The emphasis on decentralized power generation and self-sufficiency continues to support residential adoption. Growing investments in net-metering programs and government-led initiatives further reinforce the widespread use of micro inverters in distributed energy systems.

- For instance, Enphase Energy’s IQ7+ microinverters deliver a peak conversion efficiency of 97.5% and support solar modules up to 350 W, enabling uninterrupted power output even under partial shading conditions.

Market Challenges Analysis:

High Initial Costs and Installation Complexity:

The micro inverter market faces challenges from higher upfront costs compared to traditional string inverters. Consumers often perceive the investment as expensive, particularly in price-sensitive regions where budget remains a key decision factor. It also involves greater installation complexity since each solar panel requires a separate inverter. This increases labor time and maintenance needs, discouraging adoption in large-scale projects. Limited awareness among end users about long-term efficiency benefits further restricts acceptance. Price competitiveness against alternative inverter technologies continues to be a critical barrier.

Reliability Concerns and Limited Large-Scale Suitability:

Another challenge in the micro inverter market is related to long-term reliability under harsh operating conditions. Heat and environmental stress can affect durability, creating concerns about replacement and service costs. It makes some customers hesitant to deploy the technology across utility-scale projects. Micro inverters are more suited for residential and small commercial systems, which limits their application in broader energy infrastructure. Manufacturers face pressure to enhance product lifespans and reduce maintenance requirements. Addressing these concerns is essential to expand penetration in competitive solar markets.

Market Opportunities:

Expansion of Distributed Energy and Residential Solar Projects:

The micro inverter market presents strong opportunities with the global rise of distributed energy systems. Increasing adoption of residential rooftop solar projects drives demand for efficient and scalable inverter solutions. It enables households to optimize energy production even under variable conditions, creating long-term savings. Growing interest in energy independence and net-metering programs further enhances adoption prospects. Governments continue to support small-scale renewable installations with subsidies and incentives, opening new growth avenues. Manufacturers can expand market share by focusing on cost-effective models for residential use.

Integration with Energy Storage and Smart Grid Systems:

Growing integration of micro inverters with energy storage and smart grid platforms offers significant opportunities. The technology aligns with the demand for real-time monitoring, digital control, and hybrid solar systems. It strengthens system flexibility while meeting evolving needs for reliability and safety. Expanding deployment of smart cities and connected energy infrastructure accelerates adoption potential across diverse regions. Rising consumer awareness of sustainable energy solutions supports long-term market penetration. Companies investing in advanced product designs and software-enabled features are well positioned to capture this demand.

Market Segmentation Analysis:

By Type:

The micro inverter market by type is segmented into single-phase and three-phase units. Single-phase micro inverters dominate residential applications due to their scalability, ease of installation, and efficiency in rooftop systems. It continues to gain preference among homeowners aiming for higher output under shaded or uneven panel conditions. Three-phase models are expanding in small commercial projects where balanced load management and higher power handling are critical. The availability of advanced monitoring features supports adoption across both segments.

- For Instance, the Q2000 model specifically supports four 550W+ solar modules and offers a peak efficiency of 97.5% and maximum power point tracking efficiency of 99.8%. Read more about SPARQ’s products on their website.

By Power Rating:

The market by power rating is divided into segments below 250W, between 250W–500W, and above 500W. Inverters below 250W hold a major share due to their suitability for residential panels. It remains widely deployed in small-scale installations where lower power modules are common. The 250W–500W category is growing steadily with rising use in medium-capacity systems. Units above 500W are emerging in niche applications where higher efficiency and larger panels are adopted. The expansion of diverse solar panel capacities drives demand across these categories.

- For instance, Enphase Energy’s IQ7 microinverters, which include models like the standard IQ7 (with a maximum continuous output of 240W) and the IQ7+ (290W), are widely used in residential solar systems.

By End-User:

The micro inverter market by end-user includes residential, commercial, and industrial sectors. Residential installations lead due to rising demand for distributed solar power and government-backed incentives. It provides households with safe, efficient, and flexible energy generation. Commercial adoption is increasing in offices, educational institutes, and small businesses focused on sustainability. Industrial usage remains limited but is gradually expanding with interest in reliable backup power. Each segment contributes to the overall momentum of the market across global regions.

Segmentations:

By Type:

- Single-Phase Micro Inverters

- Three-Phase Micro Inverters

By Power Rating:

- Below 250W

- 250W–500W

- Above 500W

By End-User:

- Residential

- Commercial

- Industrial

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America held 41% market share in the global micro inverter market in 2024. The region benefits from extensive residential solar adoption, favorable government incentives, and advanced grid infrastructure. It continues to lead due to strong net-metering policies and tax credit programs that encourage solar installations. Increasing demand for energy independence in households and small businesses fuels consistent adoption. The presence of leading manufacturers and technology providers further strengthens growth prospects. Rising investments in smart grid modernization support future expansion of micro inverters across the region.

Europe:

Europe accounted for 29% market share in the global micro inverter market in 2024. Strict environmental regulations and ambitious renewable energy targets drive widespread adoption of solar technologies. It gains momentum from government subsidies, carbon reduction commitments, and focus on decentralized energy production. Countries like Germany, the Netherlands, and the United Kingdom are leading adopters due to high rooftop solar penetration. Growing emphasis on sustainable urban development supports demand across residential and small commercial applications. The trend toward eco-friendly and safe solar systems ensures steady expansion of micro inverters in European markets.

Asia-Pacific:

Asia-Pacific held 23% market share in the global micro inverter market in 2024. Rapid urbanization, strong solar capacity additions, and supportive policy frameworks drive significant growth in the region. It is led by China, India, and Japan, which prioritize renewable energy expansion to reduce reliance on fossil fuels. Rising residential solar adoption, coupled with government subsidies, strengthens opportunities in urban and semi-urban areas. Manufacturers are increasingly targeting the region due to rising energy demand and favorable production costs. Expanding smart city initiatives and large-scale solar projects highlight the region’s growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Deye Inverter

- Darfon Electronics Corporation

- Enphase

- Fimer Group

- Fenice Energy

- Sparq Systems

- Sensol

- Statcon Energiaa

- SunEvo Solar

- Solis Solar

- Tata Power Solar

Competitive Analysis:

The micro inverter market is highly competitive, shaped by global players and regional specialists. Key companies include Deye Inverter, Darfon Electronics Corporation, Enphase, Fimer Group, Fenice Energy, Sparq Systems, and Sensol. It is defined by strong product innovation, focus on efficiency, and integration with smart energy management systems. Enphase leads with a wide product portfolio and advanced monitoring capabilities, while Deye and Darfon emphasize scalable designs for residential and commercial segments. Fimer Group and Fenice Energy focus on sustainability-driven solutions and regional expansion. Sparq Systems and Sensol strengthen competition by targeting niche applications with cost-effective and reliable technologies. Strategic partnerships, R&D investments, and new product launches remain central to strengthening market presence. It continues to evolve with companies aiming to enhance durability, compatibility with energy storage, and safety standards to meet global demand for reliable and efficient solar energy solutions.

Recent Developments:

- In December 2024, Deye released the world’s first 20kW Low-Voltage Three-Phase Hybrid Inverter, the Deye SUN-20K-SG05LP3, featuring advanced SiC MOSFET technology and a 48V battery setup without requiring a BMS box.

- In February 2025, Enphase Energy formed a strategic business partnership with ITOCHU Corporation to promote microinverters for solar panels in Japan.

Report Coverage:

The research report offers an in-depth analysis based on Type, Power Rating, End-User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The micro inverter market will expand with rising adoption of residential rooftop solar projects.

- It will gain momentum through supportive government incentives and favorable renewable energy policies.

- Manufacturers will focus on cost optimization to address price-sensitive regions and improve accessibility.

- Integration with smart grid infrastructure and digital monitoring platforms will strengthen product adoption.

- Energy storage compatibility will emerge as a critical feature driving hybrid solar system deployment.

- It will benefit from increasing consumer demand for safe, reliable, and decentralized energy solutions.

- Technological innovations will enhance durability, efficiency, and performance under diverse environmental conditions.

- Global sustainability goals will continue to encourage investments in distributed solar energy solutions.

- It will witness strong opportunities in emerging markets driven by urbanization and growing power needs.

- Partnerships, acquisitions, and R&D initiatives by key players will shape competitive strategies and long-term growth.