| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Micro LED Market Size 2024 |

USD 1,267.15 Million |

| Micro LED Market, CAGR |

77.08% |

| Micro LED Market Size 2032 |

USD 122,469.53 Million |

Market Overview

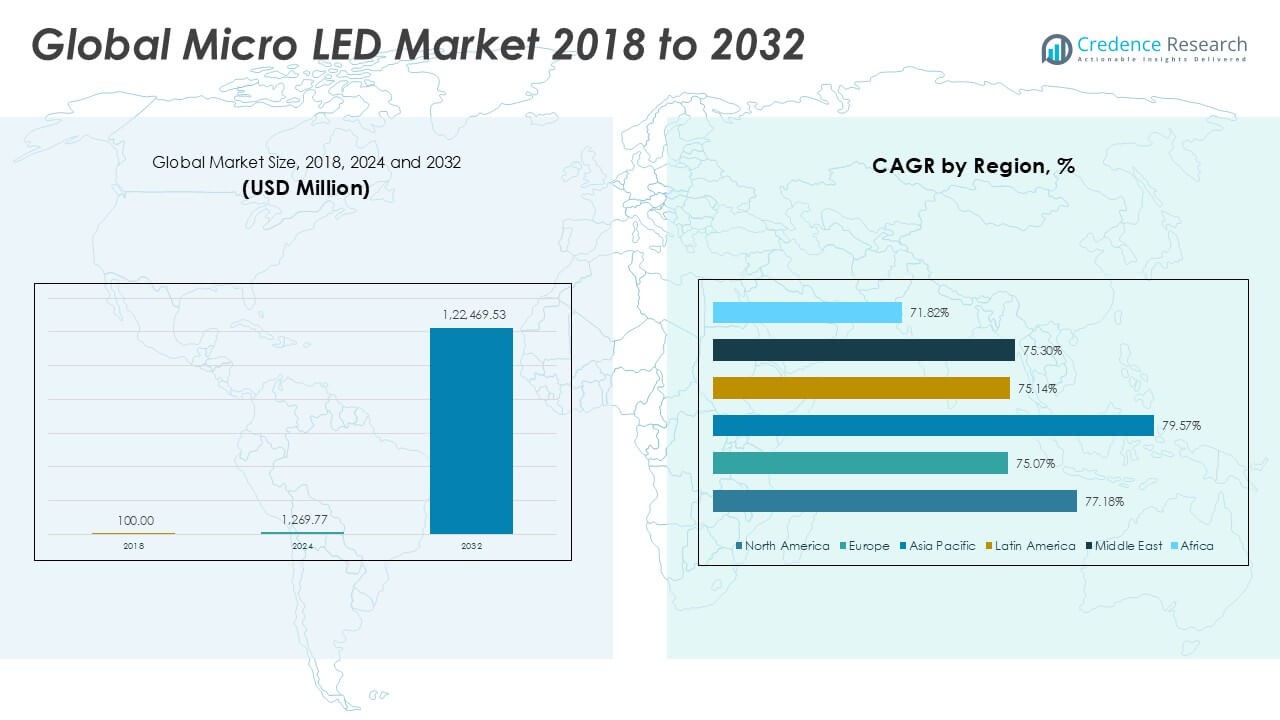

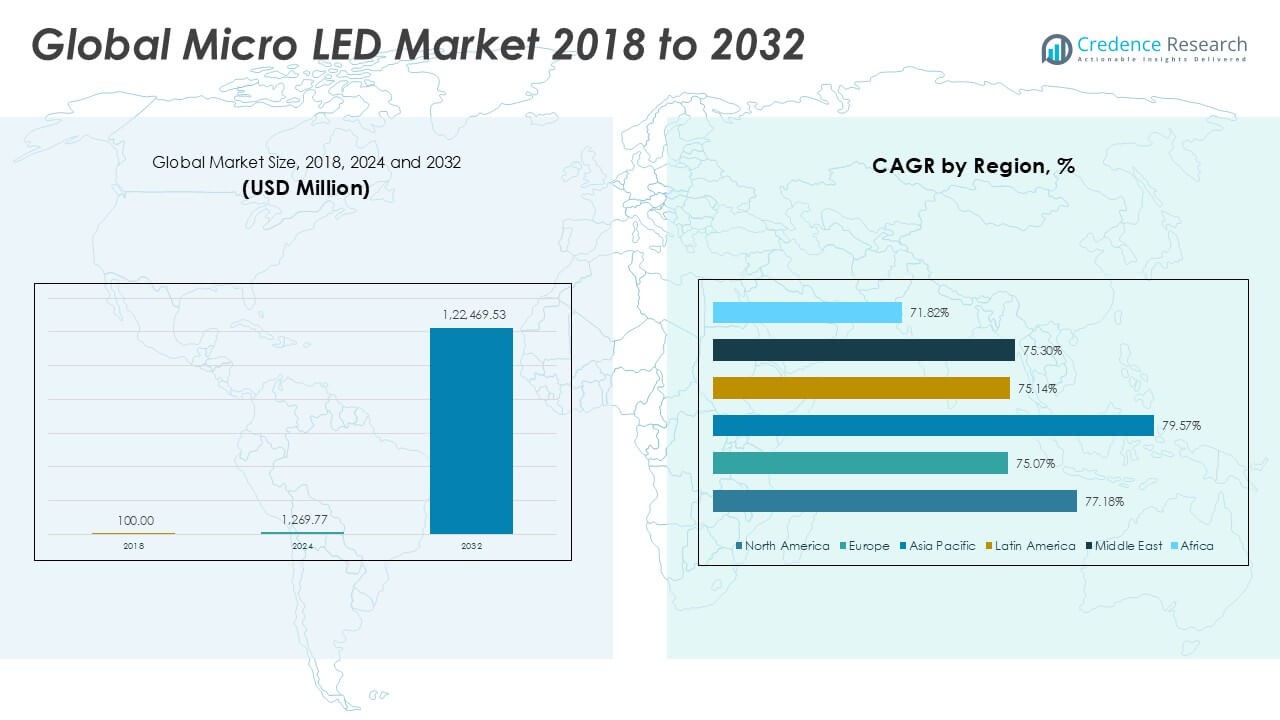

The Micro LED Market size was valued at USD 100.00 million in 2018, grew to USD 1,267.15 million in 2024, and is anticipated to reach USD 122,469.53 million by 2032, at a CAGR of 77.08% during the forecast period.

The Micro LED market is gaining momentum due to rising demand for energy-efficient, high-brightness display technologies across consumer electronics, automotive, and industrial sectors. Micro LEDs offer superior contrast, faster response times, and longer lifespans compared to OLED and LCD counterparts, making them increasingly attractive for premium applications such as smartwatches, TVs, AR/VR headsets, and automotive displays. Growing investments in R&D and manufacturing infrastructure by key players further accelerate technological advancements and cost optimization. The shift toward miniaturized and flexible displays also propels adoption in next-generation wearables and foldable devices. Market trends include strategic collaborations for mass transfer and packaging innovations, integration of AI for display optimization, and increasing adoption in transparent and 3D displays. However, high production complexity and cost remain key challenges. As demand for compact, high-resolution, and durable display solutions continues to rise, Micro LED technology is positioned to disrupt traditional display markets and unlock new revenue streams across diverse industries.

The geographical landscape of the Micro LED Market highlights strong activity across North America, Asia Pacific, and Europe. North America leads in innovation and early adoption, driven by demand for premium consumer electronics and advanced automotive systems. Asia Pacific, with manufacturing powerhouses like China, South Korea, and Japan, dominates in large-scale production and technological advancement, particularly for smartphones, televisions, and AR/VR displays. Europe contributes through automotive innovation and sustainability-focused lighting solutions, supported by leading OEMs and strong regulatory frameworks. Key players in the Micro LED Market include Samsung Electronics Co., Ltd., known for its cutting-edge display innovations; LG Electronics, active in consumer display integration; AUO Corporation, focusing on mini and Micro LED panel development; and Sony Corporation, a pioneer in high-end Micro LED display walls. These companies continue to invest in R&D, patent development, and strategic partnerships to scale production and expand their global presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Micro LED Market was valued at USD 100.00 million in 2018, reached USD 1,267.15 million in 2024, and is projected to reach USD 122,469.53 million by 2032, registering a CAGR of 77.08% during the forecast period.

- The market is driven by the growing demand for high-brightness, energy-efficient displays across consumer electronics, automotive, and AR/VR applications.

- Micro LED displays offer superior contrast, faster response times, and longer operational life, making them increasingly preferred over OLED and LCD technologies in next-generation devices.

- Companies are focusing on mass transfer innovations, silicon backplane integration, and chip miniaturization to reduce production costs and enable large-scale deployment.

- High manufacturing complexity, low yield rates, and the need for precision assembly remain key challenges to market expansion, especially in cost-sensitive product segments.

- Asia Pacific leads in manufacturing and technological advancement, while North America and Europe show strong adoption in premium electronics and automotive displays.

- Major players such as Samsung Electronics Co., Ltd., LG Electronics, Sony Corporation, and AUO Corporation are investing heavily in R&D, strategic alliances, and product innovation to maintain competitive advantage and accelerate commercialization.

Market Drivers

Surging Demand for High-Performance Display Technologies Across Consumer Devices

The Micro LED Market is driven by growing consumer expectations for advanced display performance in smartphones, televisions, and wearable electronics. Users seek higher brightness, deeper contrast, and improved energy efficiency, which Micro LED displays deliver more effectively than LCD and OLED technologies. Its low power consumption and excellent visibility under sunlight make it highly suitable for outdoor and portable devices. Leading consumer electronics brands are integrating Micro LED into high-end product lines to differentiate from competitors. Demand for bezel-less, thinner screens with better refresh rates continues to increase across mobile and TV segments. It supports next-generation user experiences, aligning with evolving product standards in global consumer markets.

- For instance, Samsung unveiled its 110-inch Micro LED TV with 4K resolution and 8.8 million individually controlled pixels, delivering a peak brightness of 2,000 nits.

Accelerated Investment in Manufacturing Infrastructure and Process Optimization

The Micro LED Market benefits from significant investments in fabrication infrastructure, transfer technology, and material optimization. Companies focus on developing mass transfer processes that can efficiently assemble millions of micro-sized LEDs onto substrates. It helps address one of the major barriers to commercialization—scalability and cost. Equipment manufacturers and display panel providers are establishing pilot lines and production facilities to streamline yield rates and reduce production losses. Governments and private sector alliances are offering incentives to scale advanced display manufacturing. These investments strengthen supply chain readiness and reduce reliance on legacy LCD and OLED processes.

- For instance, AUO launched a dedicated Micro LED pilot line at its Longtan facility, achieving transfer speeds of up to 3 million chips per hour using laser-based mass transfer systems.

Expanding Applications in Automotive and Augmented Reality Displays

The Micro LED Market sees expanding use cases across the automotive sector and augmented reality devices, where durability, brightness, and compact form factor are critical. Automotive interiors are rapidly integrating heads-up displays, infotainment panels, and dashboard systems that demand high-resolution, sunlight-readable displays. It supports thermal stability and longer lifespan, essential in automotive environments. AR and MR headsets also require lightweight, high-pixel-density displays to deliver immersive experiences without battery drain. Enterprises and defense sectors adopt Micro LED to improve visual clarity in rugged AR applications. This versatility drives adoption across sectors beyond traditional consumer electronics.

Rising Demand for Energy Efficiency and Environmental Sustainability

The Micro LED Market responds to increasing global focus on energy efficiency and reduced environmental impact in electronics. It consumes significantly less power than OLEDs and contains no organic materials prone to degradation. Manufacturers highlight its low energy footprint and long operational life as key sustainability advantages. Regulatory bodies across North America, Europe, and Asia promote low-energy technologies through efficiency standards. Businesses and consumers prioritize durable, eco-friendly display options in their procurement choices. It aligns with broader environmental goals in product development and corporate responsibility strategies.

Market Trends

Advancements in Mass Transfer and Backplane Technologies Enabling Commercial Scalability

The Micro LED Market is witnessing rapid innovation in mass transfer and backplane technologies to support commercial-scale production. Transferring microscopic LEDs onto substrates with high precision remains a major technical challenge, but new methods such as elastomer stamp printing and laser-assisted transfer are improving alignment accuracy and speed. It allows manufacturers to increase yield rates and reduce defect levels during assembly. Companies are also investing in advanced silicon and CMOS-based backplanes to support higher pixel density and improved thermal performance. These developments are critical for reducing production costs and making Micro LED viable for mainstream applications. It reflects a shift from prototype-level projects to scalable commercial solutions.

- For instance, PlayNitride developed its proprietary PixeLED Transfer® technology capable of transferring 100 million Micro LED chips in under 50 minutes, enabling commercial viability in medium-sized displays.

Rising Integration in Wearables, Foldable Displays, and Transparent Panels

The Micro LED Market is gaining traction in wearables, foldable screens, and transparent displays, driven by its form factor flexibility and mechanical resilience. Smartwatches, fitness trackers, and smart glasses require compact displays with high luminance and battery efficiency, which Micro LED offers. It delivers sharper resolution and improved visual clarity without the burn-in issues seen in OLED. Foldable devices benefit from its durability and reduced panel thickness, supporting innovation in mobile device design. Transparent Micro LED panels are also emerging in automotive windshields, retail signage, and AR applications. It supports future-ready product categories focused on user experience and interactive display environments.

- For instance, LG Display showcased a 77-inch transparent Micro LED panel with 40% transparency and 500 nits brightness, targeting smart retail and mobility segments.

Strategic Collaborations and Patent Activity Shaping Competitive Positioning

The Micro LED Market is shaped by strategic alliances among technology developers, display panel makers, and component suppliers. Companies are forming joint ventures and licensing agreements to share expertise, accelerate time-to-market, and manage intellectual property. It encourages faster development cycles and coordinated product launches across regions. Patent filings related to chip architecture, color conversion, and packaging continue to rise globally, reflecting intense competition. Leading players focus on securing proprietary technologies to gain a sustainable advantage. It fosters a dynamic innovation environment centered on protecting and commercializing new display concepts.

Increased Adoption in Large-Scale Digital Signage and Public Displays

The Micro LED Market is experiencing growing interest in large-format displays for commercial and public use. Airports, stadiums, retail environments, and command centers demand high-resolution, modular panels with long operational lifespans. It offers superior brightness and seamless scalability, supporting ultra-large screens without visible bezels. Manufacturers are launching Micro LED video walls and signage systems tailored to diverse ambient conditions. These applications require minimal maintenance and deliver stable performance over time. It reinforces Micro LED’s role in replacing traditional LED and LCD systems in high-impact, professional settings.

Market Challenges Analysis

High Manufacturing Complexity and Cost Remain Major Barriers to Mass Adoption

The Micro LED Market faces significant challenges due to the complex manufacturing processes involved in producing high-resolution displays. Mass transfer, pixel repair, and color conversion require extreme precision, pushing the limits of current equipment capabilities. It increases production costs and limits scalability, particularly for consumer applications like smartphones and tablets. Companies must invest in advanced machinery and cleanroom facilities to maintain quality control. Low yield rates during early-stage production further contribute to high unit prices, restricting adoption to premium segments. These technical hurdles slow down the timeline for mainstream commercialization.

Lack of Standardization and Supply Chain Maturity Delays Industry Progress

The Micro LED Market also struggles with fragmented supply chains and a lack of industry-wide standardization in design and fabrication. It hampers interoperability between component suppliers, display makers, and device manufacturers. Limited availability of specialized equipment and skilled labor creates bottlenecks across production cycles. New entrants face high entry barriers, while even established players require strategic collaborations to overcome integration issues. The absence of standardized testing and performance metrics complicates product validation and regulatory approval. It slows down innovation diffusion and delays time-to-market for new Micro LED-based products.

Market Opportunities

Emerging Use in Augmented Reality and Next-Generation Wearables Expands Market Scope

The Micro LED Market holds strong potential in augmented reality (AR), mixed reality (MR), and next-generation wearable devices that demand compact, bright, and energy-efficient displays. AR headsets and smart glasses require micro-displays with high pixel density and low power consumption to ensure user comfort and extended usage. It provides advantages over OLED and LCD by offering superior contrast and no image burn-in. Military, healthcare, and industrial sectors are exploring Micro LED for advanced visualization tools. Its integration in fitness trackers, smartwatches, and enterprise wearables opens new product categories for mass customization. These niche but fast-growing sectors provide long-term growth prospects for specialized Micro LED solutions.

Expansion into Automotive Displays and Smart Infrastructure Enhances Commercial Potential

The Micro LED Market has significant opportunities in automotive infotainment, heads-up displays, and advanced driver-assistance systems. It performs well in extreme lighting and temperature conditions, making it ideal for dashboards, center consoles, and exterior signal lighting. Vehicle manufacturers seek high-resolution, durable display solutions that align with evolving in-car technology ecosystems. Smart cities and public infrastructure projects also create demand for durable, high-visibility digital signage and control room panels. It enables large-format, seamless, and low-maintenance solutions for transportation hubs, retail spaces, and control centers. These sectors represent high-value markets with strong demand for display innovation.

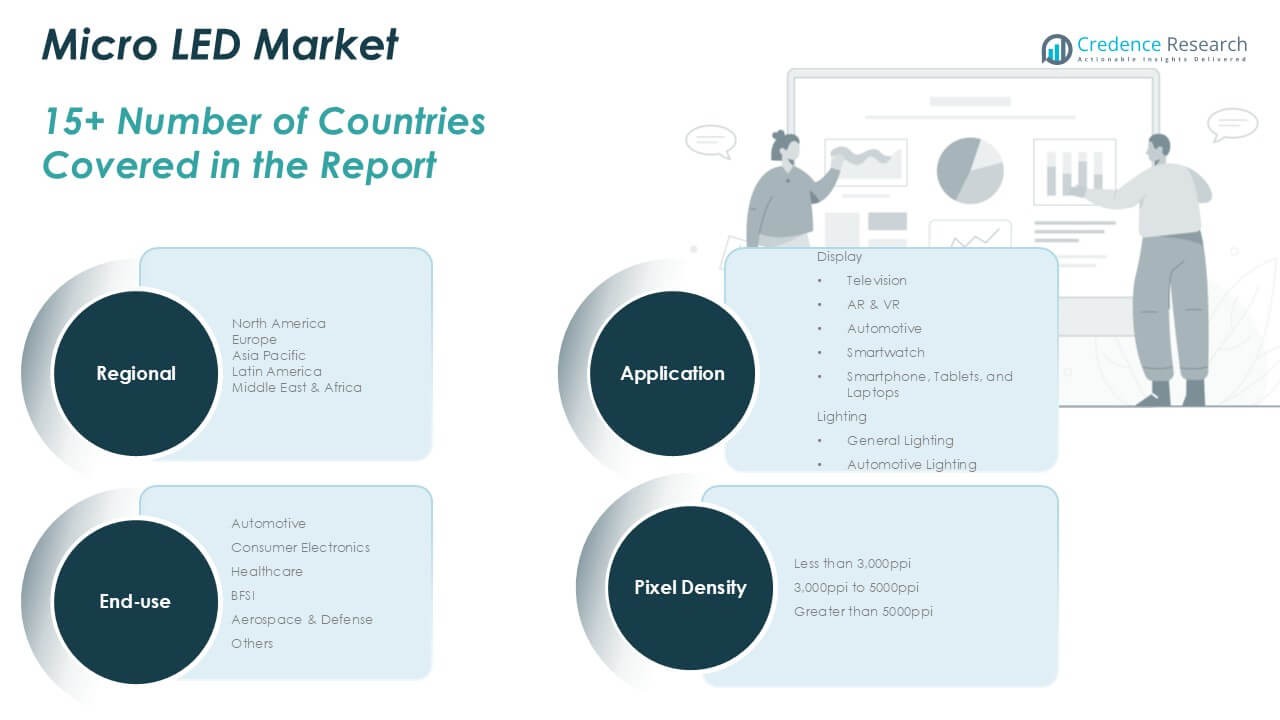

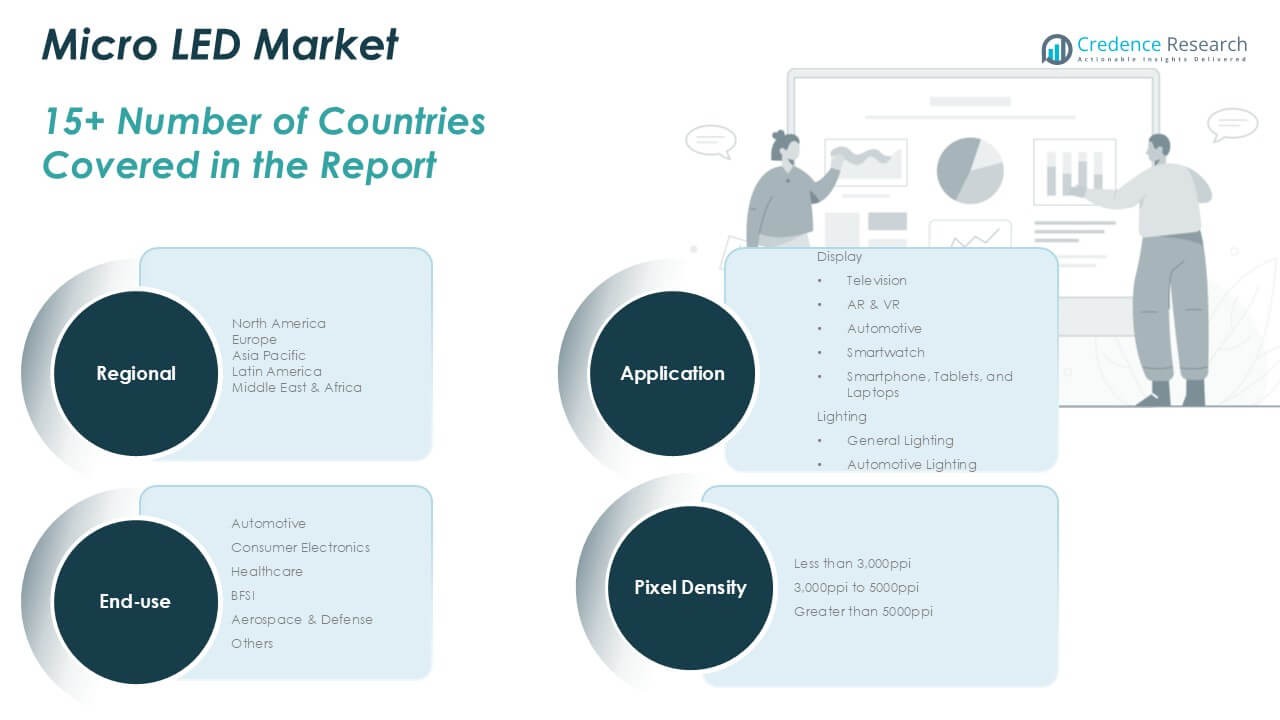

Market Segmentation Analysis:

By Pixel Density:

The Micro LED Market, segmented by pixel density, shows clear performance differentiation across device types. Displays with less than 3,000 ppi are suited for large-format applications such as televisions and public signage, where high pixel count is less critical. The 3,000 ppi to 5,000 ppi range dominates premium consumer electronics, balancing resolution with manageable production complexity. It supports applications like smartwatches, smartphones, and tablets, where clarity and compact size are both essential. Displays above 5,000 ppi cater to advanced AR/VR headsets and specialized defense applications, offering ultra-high resolution for immersive and precision-dependent environments.

- For instance, Jade Bird Display has developed Micro LED micro displays with over 6,000 ppi specifically designed for AR glasses, featuring ultra-low power consumption and compact form factor.

By Application:

The Micro LED Market serves a wide range of use cases. Television displays remain a major segment due to growing demand for large, bezel-free screens with high brightness and contrast. AR & VR applications are gaining traction, leveraging Micro LED’s high pixel density and fast response time for immersive user experiences. Automotive displays are adopting Micro LED for dashboards and heads-up displays requiring durability and visibility under varying light conditions. Smartwatches benefit from its low power consumption and compact size, while smartphones, tablets, and laptops utilize it to enhance display quality and battery life. Lighting applications include general lighting solutions where longevity and efficiency are priorities, and automotive lighting systems where stability under extreme temperatures is critical.

- For instance, Sony’s Crystal LED display system is used in commercial applications such as virtual production studios, offering seamless 8K resolution and ultra-high color accuracy in automotive and broadcast environments.

By End-Use:

The Micro LED Market finds strong demand in consumer electronics, which leads due to widespread integration in personal devices. Automotive follows, driven by the shift toward advanced cockpit designs and smart lighting systems. Healthcare leverages Micro LED for surgical displays and diagnostic imaging tools that require high-definition output. The BFSI sector integrates Micro LED in secure ATMs and customer interface panels to improve visibility and user interaction. Aerospace and defense use Micro LED in heads-up displays, cockpit panels, and AR-guided equipment where clarity and reliability are essential. Other sectors include industrial and retail applications, where Micro LED supports high-visibility digital signage and interactive display systems.

Segments:

Based on Pixel Density:

- Less than 3,000 ppi

- 3,000 ppi to 5,000 ppi

- Greater than 5,000 ppi

Based on Application:

- Television

- AR & VR

- Automotive

- Smartwatch

- Smartphone, Tablets, and Laptops

- General Lighting

- Automotive Lighting

Based on End-Use:

- Automotive

- Consumer Electronics

- Healthcare

- BFSI

- Aerospace & Defense

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Micro LED Market

North America Micro LED Market grew from USD 34.50 million in 2018 to USD 433.52 million in 2024 and is projected to reach USD 42,050.33 million by 2032, reflecting a compound annual growth rate (CAGR) of 77.18%. North America is holding a 34% market share. The United States leads the region due to early adoption of advanced display technologies in consumer electronics, automotive, and defense applications. Strong R&D investment, a robust semiconductor ecosystem, and major display manufacturers support rapid innovation and commercialization. Canada is emerging in healthcare display integration and micro-display development for wearables. The region benefits from favorable intellectual property protections and high consumer demand for premium devices. It remains central to high-value AR/VR and automotive cockpit innovations.

Europe Micro LED Market

Europe Micro LED Market grew from USD 19.47 million in 2018 to USD 233.76 million in 2024 and is projected to reach USD 20,632.77 million by 2032, reflecting a CAGR of 75.07%. Europe is holding a 17% market share. Germany, France, and the United Kingdom lead regional growth, driven by advancements in automotive displays and industrial-grade lighting systems. The region emphasizes energy efficiency and long-term durability, aligning with Micro LED’s core strengths. Automotive OEMs and luxury consumer electronics brands are integrating Micro LED into dashboards and infotainment displays. It benefits from EU-funded innovation programs and green technology mandates. The region supports strong collaboration between universities, manufacturers, and design studios.

Asia Pacific Micro LED Market

Asia Pacific Micro LED Market grew from USD 29.50 million in 2018 to USD 383.62 million in 2024 and is projected to reach USD 41,224.27 million by 2032, reflecting a CAGR of 79.57%. Asia Pacific is holding a 34% market share. China, South Korea, and Japan dominate regional production, driven by heavy investments in microfabrication, display panel assembly, and miniaturization technologies. Taiwan supports the ecosystem with advanced chip packaging and backplane solutions. It gains from vertical integration across supply chains and high-volume electronics manufacturing. Regional firms are accelerating commercialization for smartphones, TVs, and wearables. Government support and aggressive patent filings enhance competitive advantages in this market.

Latin America Micro LED Market

Latin America Micro LED Market grew from USD 6.45 million in 2018 to USD 80.96 million in 2024 and is projected to reach USD 7,168.14 million by 2032, reflecting a CAGR of 75.14%. Latin America is holding a 6% market share. Brazil and Mexico lead the adoption of Micro LED displays in automotive and signage applications. Local demand for energy-efficient lighting and infotainment upgrades is growing, supported by rising urbanization. Consumer electronics imports featuring Micro LED panels are increasing in retail and commercial sectors. It remains reliant on external suppliers for components but shows growing interest in regional manufacturing hubs. Government digital transformation initiatives provide new growth channels.

Middle East Micro LED Market

Middle East Micro LED Market grew from USD 5.42 million in 2018 to USD 65.63 million in 2024 and is projected to reach USD 5,853.25 million by 2032, reflecting a CAGR of 75.30%. The Middle East is holding a 5% market share. The UAE and Saudi Arabia are investing in smart infrastructure and digital signage systems using Micro LED for high-visibility displays. Demand for advanced cockpit and control room panels is rising in aviation and energy sectors. Regional events and entertainment venues also require durable, high-brightness display solutions. It benefits from rising smart city projects and technology adoption in public sector applications. Growing interest in AR-based tourism and education adds further scope.

Africa Micro LED Market

Africa Micro LED Market grew from USD 4.66 million in 2018 to USD 69.67 million in 2024 and is projected to reach USD 5,540.77 million by 2032, reflecting a CAGR of 71.82%. Africa is holding a 5% market share. South Africa leads the regional adoption, followed by Nigeria and Kenya, where smart building projects and commercial displays create demand. Telecommunication firms and banks are adopting high-resolution Micro LED panels for branch-level displays. The region still faces challenges in production capability but is exploring partnerships for imports and system integration. It supports display upgrades in transport hubs, retail chains, and education sectors. Urbanization and digital economy expansion will influence long-term demand.

Key Player Analysis

- AUO Corporation

- Cincoze Co., Ltd.

- Cooledge Lighting Inc.

- Cree LED

- eLux, Inc.

- Europa Science Ltd

- Innolux Corporation

- KYOCERA Corporation

- LEYARD

- LG Electronics

- OSRAM GmbH

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Unilumin

Competitive Analysis

The Micro LED Market features intense competition among leading technology and display manufacturers focused on innovation, commercialization, and scalability. Key players include Samsung Electronics Co., Ltd., LG Electronics, Sony Corporation, AUO Corporation, Innolux Corporation, Cree LED, KYOCERA Corporation, and Leyard. These companies invest heavily in R&D to enhance mass transfer techniques, improve pixel density, and reduce production complexity. Firms invest heavily in research and development to enhance pixel density, reduce power consumption, and extend display durability. Strategic priorities include developing proprietary technologies, securing patents, and building advanced pilot production lines. Partnerships with semiconductor foundries, panel manufacturers, and system integrators help accelerate time-to-market and streamline supply chains. Competitors differentiate by targeting specific applications such as large-format commercial displays, high-end televisions, automotive dashboards, and AR/VR devices based on their core technology strengths. The competitive landscape remains dynamic, driven by evolving customer demands, declining production costs, and expanding application scopes across consumer, industrial, and enterprise markets. Success in this market hinges on technological excellence, production scalability, and the ability to meet performance and efficiency standards required for next-generation display systems.

Recent Developments

- In January 2024, Samsung Electronics unveiled its new collections of QLED, MICRO LED, OLED, and Lifestyle displays. This launch marks the beginning of AI-driven screens, featuring an advanced AI processor designed to transform features of smart displays. These latest offerings enhance audio and visual quality and boast AI-enhanced functionalities protected by Samsung Knox. They aim to motivate and support diverse personal lifestyles.

- In January 2024, AUO Corporation unveiled its transparent Micro LED display series featuring a 60-inch display at a global professional audiovisual integration event, ISE 2024. This versatile technology seamlessly integrates into diverse settings, delivering an advanced visual experience for applications such as digital signage, commercial displays, corporate meeting rooms, and residential interiors.

- In May 2023, Q-Pixel Inc., a company based in Los Angeles, unveiled an unprecedented development in the display technology sector. They introduced the first-ever full-color, ultra high-resolution Micro LED screen with Polychromatic Micro LED technology. This full-color LED screen boasts an unparalleled pixel density of 5000 pixels per inch (PPI).

- In January 2023, LG Display unveiled an autonomous concept car outfitted with numerous revolutionary and future automotive displays, including the industry’s first 18-inch slidable automotive OLED screen, based on its core technologies such as P-OLED and LTPS LCD.

Market Concentration & Characteristics

The Micro LED Market exhibits a moderately concentrated structure, with a limited number of companies controlling key technological capabilities and production processes. It remains in a pre-mass commercialization phase, where high entry barriers related to cost, technical complexity, and intellectual property restrict widespread participation. The market is defined by vertically integrated players who manage in-house R&D, chip fabrication, backplane design, and assembly. Strategic collaborations and joint ventures are common, allowing companies to pool expertise in mass transfer technology, color tuning, and advanced packaging. It is characterized by rapid innovation cycles and high capital intensity, driven by the need for precision manufacturing and custom design. Product differentiation focuses on resolution, brightness, energy efficiency, and form factor adaptability across application segments. It supports niche markets such as AR/VR, wearables, and automotive displays, where performance advantages justify premium pricing. The Micro LED Market continues to evolve with incremental production improvements and targeted deployment in high-value applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Pixel Density, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Micro LED market will experience increased adoption in premium consumer electronics such as televisions, smartphones, and smartwatches.

- Mass production techniques will improve, reducing manufacturing costs and accelerating market scalability.

- AR and VR headsets will integrate Micro LED displays to deliver high brightness and pixel density with minimal power consumption.

- Automotive applications will expand with wider use in dashboards, heads-up displays, and advanced lighting systems.

- Large-format digital signage and control room panels will increasingly rely on Micro LED for seamless, high-resolution output.

- Strategic partnerships across the value chain will support faster innovation and time-to-market for commercial products.

- Continued investment in R&D will lead to thinner, more flexible Micro LED panels for foldable and wearable devices.

- Government incentives and tech funding will support infrastructure development for advanced display manufacturing.

- Healthcare and aerospace sectors will adopt Micro LED for surgical visualization and mission-critical display systems.

- Competitive differentiation will shift toward energy efficiency, extended lifespan, and integration versatility across industries.