Market Overview

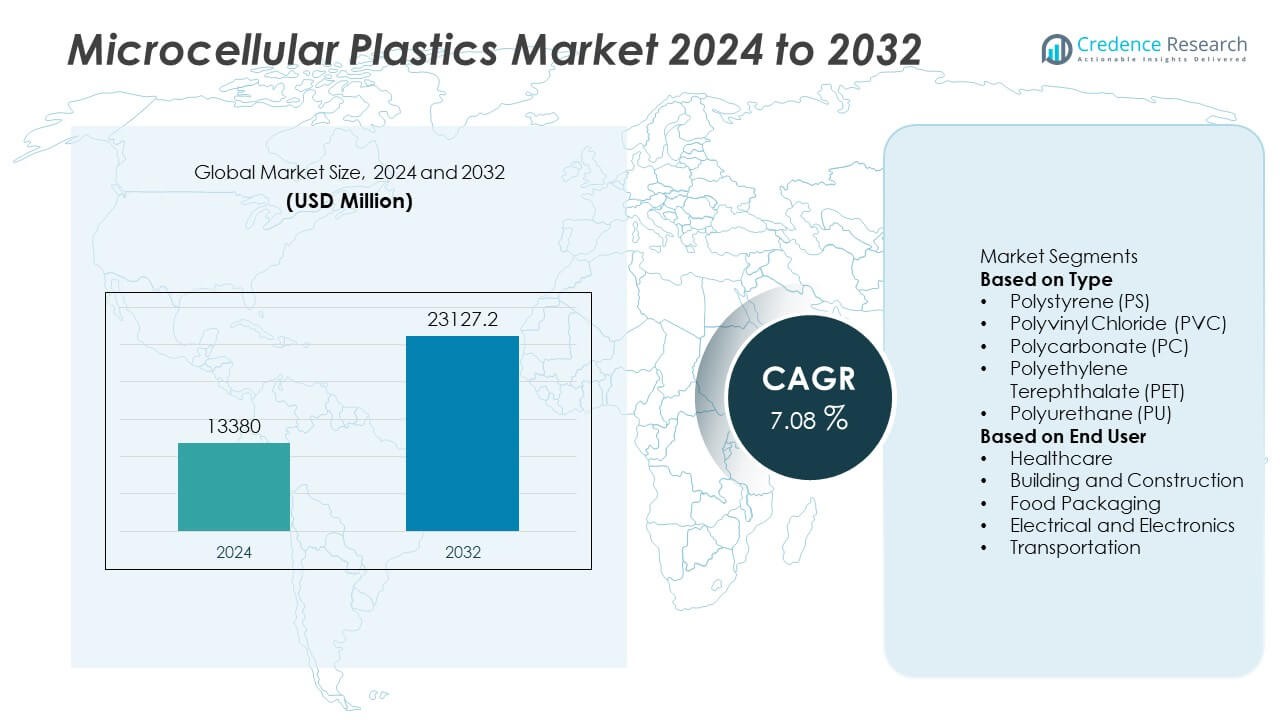

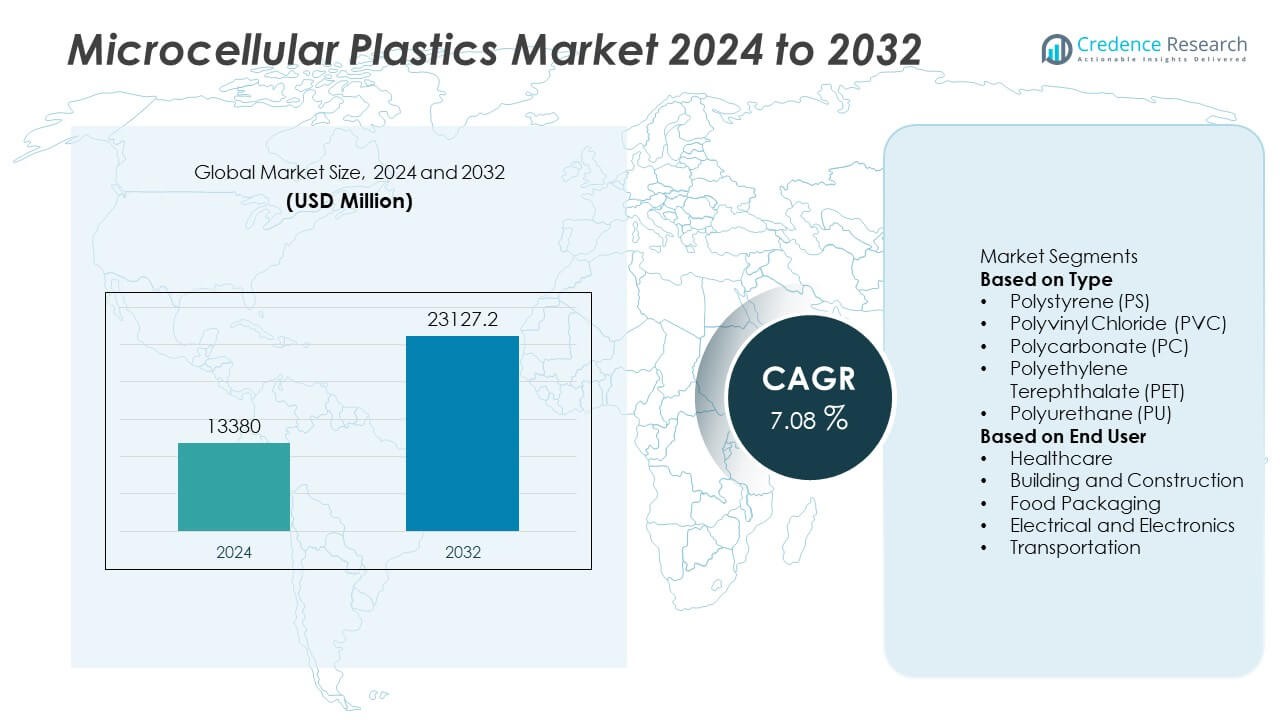

The Microcellular Plastics Market size was valued at USD 13,380 million in 2024 and is projected to reach USD 23,127.2 million by 2032, growing at a CAGR of 7.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Microcellular Plastics Market Size 2024 |

USD13,380 Million |

| Microcellular Plastics Market, CAGR |

7.08% |

| Microcellular Plastics Market Size 2032 |

USD 23,127.2 Million |

The Microcellular Plastics Market grows on the strength of increasing demand for lightweight, durable, and eco-friendly materials across automotive, packaging, and electronics industries. It reduces material usage and enhances energy efficiency, making it highly attractive for manufacturers seeking sustainable solutions. The market benefits from rising adoption in electric vehicles where weight reduction improves battery performance and driving range.

The Microcellular Plastics Market shows strong geographical presence across North America, Europe, and Asia-Pacific, with Asia-Pacific emerging as a leading hub due to its large manufacturing base and expanding automotive and packaging industries. North America demonstrates steady growth, supported by innovation in lightweight materials for aerospace and automotive applications, while Europe advances through sustainability-driven initiatives and stringent regulations promoting eco-friendly materials. Rapid industrialization and infrastructure development in emerging economies further accelerate adoption in various end-use industries. Key players shaping the competitive landscape include Dow Chemical Company, Borealis AG, INEOS Capital Ltd., and MicroGREEN Polymers, Inc., all of which invest in research and development to improve processing techniques and material performance. Companies focus on strategic collaborations, advanced production technologies, and expansion into high-demand regions to strengthen their market positioning.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Microcellular Plastics Market was valued at USD 13,380 million in 2024 and is projected to reach USD 23,127.2 million by 2032, growing at a CAGR of 7.08% during the forecast period.

- Strong demand for lightweight and durable materials in automotive, aerospace, and consumer goods industries drives adoption of microcellular plastics for energy efficiency and cost savings.

- The market trends highlight increasing focus on sustainable materials, with bio-based and recyclable microcellular plastics gaining traction to meet regulatory and environmental requirements.

- Competitive analysis shows that key players such as Dow Chemical Company, Borealis AG, INEOS Capital Ltd., and MicroGREEN Polymers, Inc. lead the market through investments in R&D, product innovation, and regional expansions.

- Market restraints include high production costs, complex processing requirements, and limited scalability of certain advanced materials, which pose challenges for widespread adoption across smaller industries.

- Regional analysis indicates Asia-Pacific as the fastest-growing market due to rapid industrialization and strong automotive and packaging sectors, while North America and Europe lead in technological advancements and sustainability-focused initiatives.

- The market benefits from strategic partnerships, mergers, and investments aimed at improving material strength, energy efficiency, and environmental compliance, ensuring continued global growth momentum.

Market Drivers

Rising Demand for Lightweight Materials

The Microcellular Plastics Market expands with growing preference for lightweight yet durable materials across industries. Automotive, aerospace, and packaging sectors prioritize these plastics to reduce weight and improve energy efficiency. It enhances fuel savings in transportation while maintaining high mechanical performance. Manufacturers integrate microcellular plastics to replace metals and conventional polymers in structural applications. Increased emphasis on eco-friendly solutions drives their adoption for reducing carbon footprints. It strengthens their role as essential materials for industries targeting efficiency and sustainability.

- For instance, Dow Chemical Company reported that its lightweight microcellular polyethylene technology reduced vehicle component weight by 18 kilograms per car in 2024, enabling an annual fuel saving of over 190 liters per vehicle in fleet trials.

Increasing Use in Healthcare Applications

Healthcare infrastructure investments stimulate steady growth in demand for microcellular plastics. Medical device manufacturers employ them for components requiring precision, durability, and lightweight properties. It supports production of implants, surgical instruments, and diagnostic devices with improved patient safety. Rising demand for disposable equipment and protective gear further boosts adoption. Strong performance in sterilization environments enhances its application potential. It positions microcellular plastics as valuable in addressing evolving healthcare needs.

- For instance, INOAC’s FOLEC™ is an environmentally friendly, microcellular-structured polyolefin rolled foam sheet produced without chemical foaming agents, which makes it a clean material with excellent dust-proofing, waterproofing, and shock absorption properties

Advancements in Manufacturing Technologies

Technological innovation in production techniques drives wider application of microcellular plastics. Supercritical fluid injection molding and advanced foaming methods improve consistency, reduce defects, and lower processing costs. It delivers higher quality products with superior strength-to-weight ratios. Industries adopt these processes to improve efficiency in mass production. Manufacturers focus on scaling production to meet growing global demand. It reinforces the importance of process innovation in maintaining competitiveness.

Growing Role in Sustainable Packaging

Sustainability initiatives encourage adoption of microcellular plastics in packaging applications. Companies prioritize recyclable and lightweight materials to comply with environmental regulations. It enables reduced use of raw polymers while maintaining structural integrity. Food, beverage, and logistics industries employ these plastics to enhance efficiency in packaging and transport. Rising consumer preference for sustainable packaging accelerates their market penetration. It highlights their contribution to supporting circular economy goals and reducing environmental impact.

Market Trends

Expansion in Automotive and Aerospace Applications

The Microcellular Plastics Market shows a strong trend toward increasing adoption in automotive and aerospace sectors. Manufacturers use these materials to reduce vehicle and aircraft weight without compromising strength or durability. It supports fuel efficiency goals and helps meet stricter emission regulations. Advanced composites with microcellular structures offer superior energy absorption and noise reduction. Automakers integrate them into interior panels, seating, and under-the-hood components. It highlights their role in supporting performance and sustainability in mobility industries.

- For instance, Horizon Plastics International developed a microcellular injection molding technology that reduced vehicle instrument panel weight by 35%, achieving part densities below 0.40 g/cm³.

Rising Focus on Green Manufacturing

Sustainability pressures shape production practices across the Microcellular Plastics Market. Companies invest in eco-friendly foaming technologies that minimize waste and reduce energy use. It aligns with global initiatives for carbon reduction and responsible manufacturing. Bio-based polymers combined with microcellular foaming processes gain attention as substitutes for traditional plastics. Adoption of circular economy principles drives recycling-friendly innovations. It strengthens the market’s alignment with environmental compliance and customer preference for green products.

- For instance, Dow Chemical Company introduced a long-chain branched polyethylene architecture in March 2024 that enabled downgauging of packaging films by up to 20 microns while lowering carbon emissions by 15,000 metric tons annually at full-scale production.

Integration in Consumer Goods and Electronics

Consumer goods and electronics sectors increasingly incorporate microcellular plastics in product design. It enables manufacturers to create lightweight, durable, and cost-effective solutions for casings, insulation, and structural parts. Improved surface finish and thermal resistance enhance applications in handheld devices and appliances. Brands adopt these materials to reduce shipping costs and improve ergonomics. Rising demand for compact, energy-efficient consumer products supports broader adoption. It emphasizes the material’s ability to balance aesthetics, performance, and sustainability.

Technological Innovation in Material Development

Material innovation drives new opportunities within the Microcellular Plastics Market. Research efforts focus on enhancing thermal stability, chemical resistance, and structural flexibility. It expands potential applications in medical, industrial, and renewable energy equipment. Nanotechnology and hybrid composites open possibilities for creating multifunctional plastics. Companies increase R&D spending to introduce advanced product lines tailored to specific industry needs. It demonstrates how innovation remains a core trend shaping competitiveness and growth.

Market Challenges Analysis

High Production Costs and Process Complexity

The Microcellular Plastics Market faces significant challenges due to high production costs and complex manufacturing processes. Specialized equipment and precise control of foaming techniques increase capital investment requirements. It creates entry barriers for smaller manufacturers and slows wider adoption across industries with cost-sensitive operations. Maintaining consistent cell structure and product quality requires advanced process monitoring, which adds to operational expenses. Limited availability of skilled workforce trained in microcellular technology further compounds these difficulties. It restricts scalability and hinders price competitiveness compared to conventional plastics.

Raw Material Dependency and Performance Limitations

Another challenge impacting the Microcellular Plastics Market relates to raw material dependency and inherent performance limitations. Volatility in the supply and cost of base polymers such as polyethylene and polystyrene affects production stability. It limits manufacturers’ ability to maintain consistent margins, particularly during fluctuations in petrochemical markets. Certain microcellular plastics may also show reduced mechanical strength under extreme conditions, restricting their use in demanding applications. Industry players must balance lightweight advantages with durability concerns to expand adoption. It underscores the need for continuous material innovation to overcome these constraints.

Market Opportunities

Expanding Role in Lightweight and Sustainable Materials

The Microcellular Plastics Market holds strong opportunities in industries seeking lightweight and eco-friendly materials. Growing emphasis on reducing carbon emissions drives automotive and aerospace manufacturers to replace conventional plastics and metals with microcellular variants. It reduces component weight while maintaining strength, supporting fuel efficiency and sustainability goals. Packaging and consumer goods industries also explore these materials for minimizing environmental impact through reduced material use. Increasing regulatory support for low-carbon materials strengthens the market’s growth prospects. It positions microcellular plastics as a critical solution for achieving long-term sustainability targets.

Technological Advancements and Emerging Applications

Technological innovation creates new opportunities in the Microcellular Plastics Market through advanced processing techniques and enhanced product performance. Continuous R&D investments enable development of polymers with improved thermal resistance, mechanical stability, and recyclability. It expands their adoption in healthcare, construction, and electronics where durability and safety are essential. Emerging demand for high-performance foams in insulation and biomedical devices further broadens application areas. Growing interest in smart materials also opens pathways for integration into next-generation products. It highlights the role of innovation in shaping future demand across diverse industries.

Market Segmentation Analysis:

By Type

The Microcellular Plastics Market segments by type into polyethylene (PE), polystyrene (PS), polyvinyl chloride (PVC), polycarbonate (PC), and others. Polycarbonate holds significant demand due to its high impact resistance and lightweight structure, which makes it suitable for automotive panels and aerospace interiors. Polyethylene is widely used in packaging for its durability and chemical resistance, supporting the need for recyclable and flexible solutions. Polystyrene continues to find adoption in insulation and consumer goods for its low cost and ease of processing. PVC gains traction in construction applications such as piping and fittings where mechanical stability is crucial. Other specialty polymers cater to niche applications, reflecting the adaptability of microcellular plastics across industries. It highlights the role of diverse polymer types in meeting sector-specific performance requirements.

- For instance, INOAC Corporation does develop lightweight materials, including microcellular polycarbonate foams, for aircraft interiors. These foams are a potential solution for reducing panel weight and improving fuel efficiency in aircrafts, although specific details about the 1.8-kilogram per square meter weight.

By End User

The Microcellular Plastics Market segments by end user into automotive, aerospace, building and construction, healthcare, packaging, electronics, and consumer goods. Automotive remains the leading end-use segment as manufacturers seek materials that reduce vehicle weight while ensuring durability, supporting fuel efficiency and emission targets. Aerospace follows closely, where lightweight plastics replace traditional metals in structural and interior applications to improve performance. The building and construction sector integrates these plastics in insulation, wall panels, and piping, driven by energy efficiency needs. Healthcare demonstrates rising adoption for implants, surgical tools, and diagnostic devices, reflecting biocompatibility and mechanical strength advantages. Packaging emerges as a fast-growing segment due to demand for lightweight and recyclable solutions. Electronics and consumer goods expand usage in casings, circuit boards, and everyday durable products. It underlines the broad utility of microcellular plastics in industries balancing performance, cost, and sustainability.

- For instance, Borealis AG supplied microcellular polyethylene foams for automotive bumper systems that reduced part weight by 4.5 kilograms per vehicle, helping OEMs cut annual CO₂ emissions by 12,000 tons across a single production line.

Segments:

Based on Type

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Polycarbonate (PC)

- Polyethylene Terephthalate (PET)

- Polyurethane (PU)

Based on End User

- Healthcare

- Building and Construction

- Food Packaging

- Electrical and Electronics

- Transportation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 32% in the Microcellular Plastics Market, driven by strong adoption across automotive, healthcare, and packaging sectors. The United States leads the region with advanced R&D initiatives that promote lightweight and energy-efficient materials for vehicle production and medical device innovation. Canada follows with growing demand for sustainable packaging and construction insulation products that align with green building standards. Mexico contributes with increasing applications in automotive components and consumer goods due to its expanding manufacturing base. Major companies in the region partner with research institutions to commercialize microcellular plastic technologies at industrial scale. The emphasis on sustainability and high-performance materials ensures consistent growth.

Europe

Europe accounts for 28% of the Microcellular Plastics Market, with Germany, France, and the United Kingdom serving as the primary hubs. Germany’s automotive and aerospace industries drive the largest share, supported by extensive use of lightweight plastics to improve efficiency and reduce emissions. France leverages microcellular plastics in aerospace and defense components, while the UK emphasizes adoption in healthcare devices and electronics. The European Union’s policies on reducing plastic waste and promoting recyclable materials encourage broader adoption across industries. Italy and Spain also contribute significantly with packaging and consumer goods applications. The regional market continues to evolve with emphasis on circular economy initiatives and innovation in eco-friendly materials.

Asia-Pacific

Asia-Pacific dominates with a market share of 30%, supported by rapid industrialization, urbanization, and manufacturing expansion. China leads the region, accounting for significant demand in automotive, electronics, and packaging due to its extensive production capacity and domestic consumption. India shows strong growth in construction and healthcare applications, fueled by infrastructure investment and rising demand for medical devices. Japan and South Korea adopt microcellular plastics in electronics and automotive components, benefiting from high-tech manufacturing capabilities. Southeast Asian countries such as Thailand and Vietnam witness growth in consumer goods and packaging sectors. The region’s emphasis on cost-effective production and large-scale adoption secures its position as a global leader in demand.

Latin America

Latin America captures a market share of 6%, with Brazil and Mexico at the forefront of adoption. Brazil sees growth in automotive and packaging sectors, supported by increasing domestic demand and government initiatives to modernize manufacturing. Mexico complements this growth with applications in healthcare and consumer goods, leveraging its position as a manufacturing hub for North America. Argentina and Chile contribute modestly with demand in construction and electronics. Regional growth faces challenges such as limited technological investments, but rising foreign collaborations and demand for sustainable materials are improving adoption. The focus on lightweight solutions in manufacturing is expected to expand the market presence.

Middle East & Africa

The Middle East & Africa holds a market share of 4% in the Microcellular Plastics Market. The United Arab Emirates and Saudi Arabia drive adoption in construction and automotive due to large-scale infrastructure projects and diversification efforts beyond oil-based economies. South Africa contributes with demand in consumer goods and healthcare applications. Countries in North Africa, including Egypt, see increasing use in packaging and building materials. Limited industrial base and technological dependence on imports restrict rapid growth, but investments in manufacturing and renewable energy sectors create opportunities. The region’s steady adoption reflects its gradual integration into global demand for advanced materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INOAC CORPORATION

- Horizon Plastics International, Inc.

- Mearthane Products Corporate

- MicroGREEN Polymers, Inc.

- Formosa Plastics Corporation

- Borealis AG

- LKAB Minerals

- Gracious Living Innovations Inc.

- Dow Chemical Company

- INEOS Capital Ltd.

Competitive Analysis

The competitive landscape of the Microcellular Plastics Market is shaped by the active participation of leading players such as Borealis AG, Dow Chemical Company, Formosa Plastics Corporation, Gracious Living Innovations Inc., Horizon Plastics International, Inc., INEOS Capital Ltd., INOAC Corporation, LKAB Minerals, Mearthane Products Corporation, and MicroGREEN Polymers, Inc. These companies focus on innovation, advanced processing technologies, and material enhancements to strengthen their market positions. Dow Chemical Company and Borealis AG emphasize sustainable solutions and invest heavily in R&D to create eco-friendly microcellular plastics with superior mechanical properties. Formosa Plastics Corporation leverages its extensive production capacity to meet rising demand from automotive and packaging industries. INEOS Capital Ltd. and INOAC Corporation focus on expanding their product portfolios and building strong regional networks, particularly in Asia-Pacific. MicroGREEN Polymers, Inc. specializes in lightweight foamed plastics, addressing aerospace and consumer goods applications. Horizon Plastics International and Gracious Living Innovations Inc. prioritize customized solutions for industrial and consumer markets. LKAB Minerals integrates advanced filler technologies to improve product strength and performance. Together, these players drive competitive intensity through product innovation, global expansions, and sustainability-led strategies that ensure the Microcellular Plastics Market continues to evolve with shifting industry demands.

Recent Developments

- In May 2025, Borealis AG developed Daploy HMS PP resin at its Linz Innovation Center. This high-melt-strength polypropylene offers improved foamability, weight reduction, and enhanced mechanical strength, supporting lightweight applications in automotive, building, and consumer goods sectors.

- In September 2024, Evonik Industries AG began producing its renowned ROHACELL foam at its Darmstadt manufacturing site using 100% renewable energy, marking a significant shift toward sustainable production practices in high-performance foamed materials.

- In March 2024, Dow Chemical Company developed a novel long‑chain branched polyethylene architecture that enhances asset flexibility and reduces carbon emissions in large-scale production. The new design enables downgauging in packaging applications, improving material efficiency and processing capability.

Market Concentration & Characteristics

The Microcellular Plastics Market shows a moderately concentrated structure with a mix of established multinational corporations and specialized innovators. It is shaped by strong competition among global leaders such as Dow Chemical Company, Borealis AG, Formosa Plastics Corporation, and INOAC CORPORATION, alongside regional firms that focus on niche applications. It is characterized by high entry barriers due to the need for advanced foaming technologies, precision processing equipment, and significant R&D investments. It reflects growing consolidation through partnerships and acquisitions aimed at expanding product portfolios and global presence. The market emphasizes lightweighting, energy efficiency, and sustainable solutions, positioning companies with strong innovation pipelines at a competitive advantage. It demonstrates reliance on sectors like automotive, packaging, construction, and consumer goods, where demand for cost-effective and performance-driven materials continues to expand. It maintains a balance between cost reduction and material performance, reinforcing the critical role of advanced manufacturing technologies and eco-friendly product development.

Report Coverage

The research report offers an in-depth analysis based on Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Microcellular Plastics Market will expand with rising demand for lightweight materials in automotive and aerospace sectors.

- It will benefit from increasing use of eco-friendly plastics to support global sustainability goals.

- It will see stronger adoption in packaging due to its potential to reduce material usage and improve recyclability.

- It will experience growth in construction applications where insulation and durability are critical.

- It will advance through technological innovations in foaming processes that enhance efficiency and performance.

- It will attract investments from key players focusing on renewable and bio-based raw materials.

- It will face rising demand in medical devices and healthcare products that require lightweight and durable polymers.

- It will grow in consumer electronics as manufacturers seek compact, energy-efficient materials.

- It will strengthen its presence in emerging economies driven by industrialization and infrastructure development.

- It will evolve with strategic collaborations and acquisitions among leading players to expand global market reach.