Market Overview

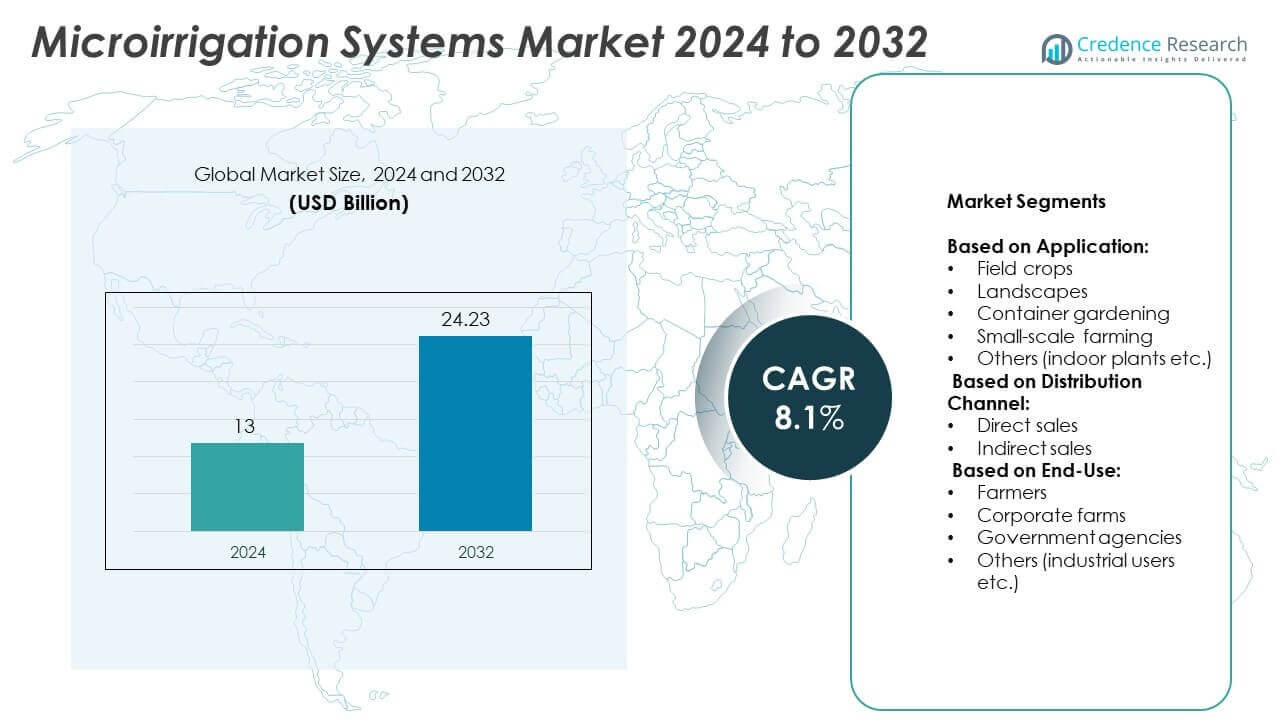

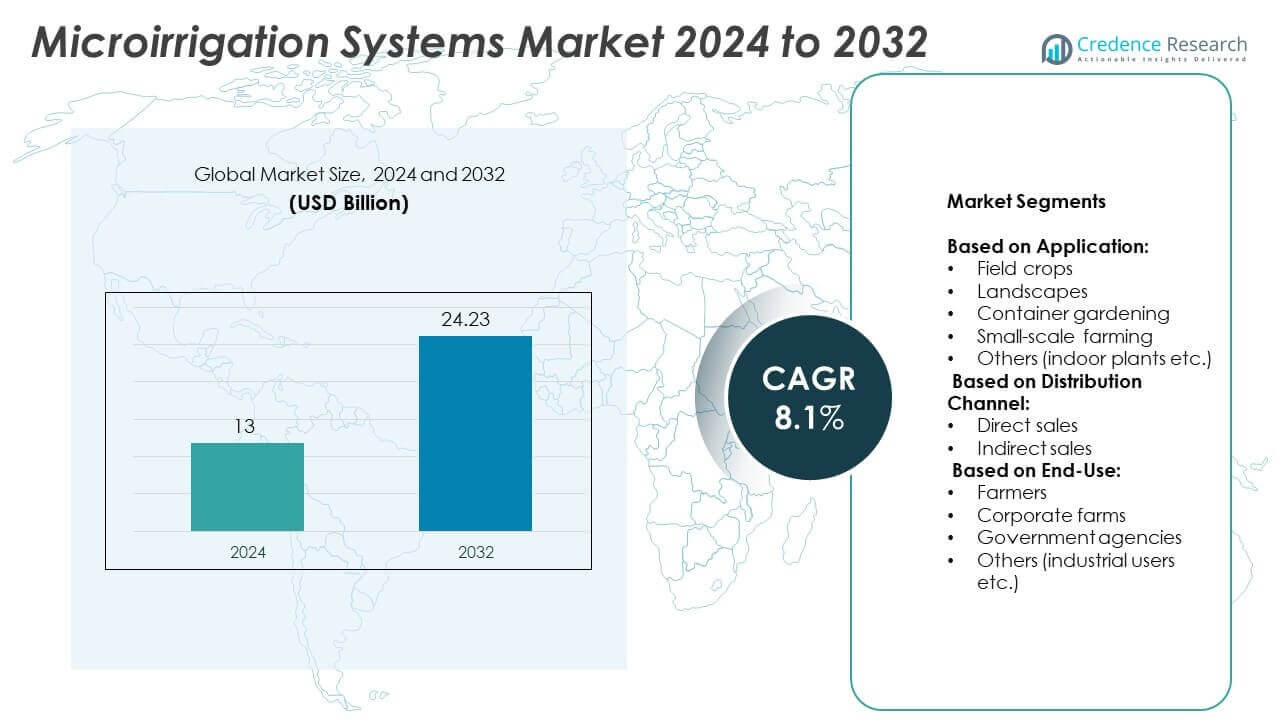

Microirrigation Systems Market size was valued at USD 13 billion in 2024 and is anticipated to reach USD 24.23 billion by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Microirrigation Systems Market Size 2024 |

USD 13 Billion |

| Microirrigation Systems Market, CAGR |

8.1% |

| Microirrigation Systems Market Size 2032 |

USD 24.23 Billion |

The Microirrigation Systems market grows due to rising water scarcity, government subsidies, and demand for precision farming. Farmers adopt drip and sprinkler systems to improve yield while conserving resources. Smart irrigation technologies and automation tools support real-time control and efficient water use. Urban farming, greenhouse cultivation, and climate-resilient agriculture further drive system deployment. The market benefits from increased awareness, digital integration, and regulatory push toward sustainable agricultural practices across both developed and emerging economies.

Asia-Pacific leads the Microirrigation Systems market due to large-scale government programs and widespread adoption across field and horticulture crops. North America follows with strong technological integration and focus on water-efficient farming. Europe shows steady growth in vineyards and greenhouse applications, driven by sustainability mandates. Latin America and the Middle East & Africa adopt systems in response to water stress and crop diversification. Key players in the market include Netafim, Jain Irrigation Systems, Rivulis, and Rain Bird Corporation

Market Insights

- Microirrigation Systems market was valued at USD 13 billion in 2024 and is projected to reach USD 24.23 billion by 2032, growing at a CAGR of 8.1%.

- Water scarcity, rising food demand, and supportive government schemes drive strong adoption of drip and sprinkler systems.

- Integration of smart irrigation tools, IoT-based monitoring, and fertigation systems reshape market trends across all farm scales.

- Leading players include Netafim, Jain Irrigation Systems, Rivulis, Toro, Rain Bird Corporation, and Valmont, each offering end-to-end precision irrigation solutions.

- High initial investment costs, system maintenance, and lack of skilled labor limit adoption, especially in small and remote farms.

- Asia-Pacific leads due to widespread programs like India’s PMKSY and China’s push for water-efficient farming, while North America and Europe show stable growth driven by tech-driven agriculture.

- Latin America and the Middle East & Africa witness rising adoption backed by donor-led programs, export-focused agriculture, and desert farming initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Water Scarcity and the Need for Efficient Irrigation Technologies Drive System Adoption

Declining freshwater availability continues to pressure agricultural producers to adopt precision irrigation solutions. Microirrigation Systems help conserve water by delivering it directly to plant roots, reducing wastage from evaporation and runoff. Governments promote efficient irrigation through incentives, especially in drought-prone regions. The Microirrigation Systems market grows as water-intensive crops like fruits and vegetables shift to drip and sprinkler methods. It also supports groundwater recharge and reduces dependency on flood irrigation. Producers in regions like India, Israel, and parts of the U.S. actively invest in micro-level systems to meet long-term sustainability goals.

- For instance, Netafim’s drip irrigation systems are known to save between 40% and 70% of water compared to traditional methods. The company operates in more than 110 countries.

Government Support and Subsidies Enhance Market Penetration in Emerging Economies

Government initiatives to improve farm productivity encourage the use of drip and sprinkler systems. India’s PMKSY scheme and similar programs in Brazil and China have accelerated technology adoption. The Microirrigation Systems market benefits from subsidies on equipment costs and low-interest loans. It enables small and marginal farmers to access modern irrigation tools. Public-private partnerships in agriculture also improve awareness and training around system deployment. These programs align with national goals for food security and climate-resilient agriculture.

- For instance, Jain Irrigation Systems is a key manufacturer and installer of micro-irrigation systems in India, actively involved in the government’s PMKSY (Pradhan Mantri Krishi Sinchayee Yojana) scheme. The company has a long history of executing large-scale irrigation projects, including a project in Karnataka that covered over 12,767 hectares

Expansion of High-Value Crop Cultivation Creates Strong Demand for Precise Irrigation

Farmers growing vegetables, fruits, and flowers increasingly adopt microirrigation to improve yields and reduce costs. These crops require accurate water management to avoid disease and optimize quality. The Microirrigation Systems market responds with advanced systems suited for row crops and greenhouse farming. It supports fertigation and uniform moisture distribution across irregular fields. Improved income potential from export-quality produce also drives technology uptake. Higher return on investment influences commercial farm operations to replace outdated methods.

Rising Focus on Sustainable Agriculture and Smart Farming Practices Accelerates System Integration

Sustainability goals in agriculture push stakeholders toward resource-efficient irrigation. Microirrigation Systems align with regenerative farming practices and precision agriculture models. It enables data-driven irrigation based on soil moisture, weather, and crop needs. Smart controllers and IoT integration enhance water-use efficiency and remote monitoring. The Microirrigation Systems market evolves with technology upgrades that ensure minimal environmental impact. Institutional buyers and agri-tech startups are also integrating these systems into broader farm automation platforms.

Market Trends

Integration of Smart Irrigation Technologies Supports Real-Time Water Management and Automation

Digital tools and IoT-based platforms are reshaping irrigation practices across commercial farms. Smart controllers, wireless sensors, and satellite-based soil moisture mapping drive precision in water delivery. The Microirrigation Systems market incorporates these technologies to reduce manual intervention and improve crop performance. It enables farmers to remotely monitor irrigation schedules and adjust based on real-time data. Cloud-based analytics help optimize water use and reduce operational costs. Demand for automation aligns with labor shortages and rising input costs in global agriculture.

- For instance, Rivulis offers Manna Irrigation Intelligence, a satellite-based software that provides site-specific irrigation recommendations and crop monitoring to growers worldwide, including strawberry farmers, in the 2023/2024 season, despite a 9% decrease in overall strawberry production in Huelva, Spain, largely due to drought, the export value increased by 8% to over 616 million euros.

Surge in Greenhouse and Controlled Environment Farming Accelerates System Uptake

Controlled farming environments rely on accurate water and nutrient delivery to maintain crop health. Microirrigation Systems support these conditions by enabling consistent moisture and fertigation control. The Microirrigation Systems market expands as greenhouse infrastructure grows in Europe, Asia, and North America. It allows growers to cultivate high-value crops in climate-resistant settings. Precision irrigation ensures minimal water loss and promotes energy efficiency. These systems also integrate well with vertical farming and polyhouse structures.

- For instance, Rain Bird’s ESP-LXIVM controller series, released in February 2020, includes the LX-IVM Pro model, which supports up to 240 stations

Adoption of Sustainable Farming Certifications Promotes Eco-Friendly Irrigation Practices

Global food retailers and agribusinesses increasingly require sustainable sourcing from certified producers. Irrigation systems that minimize water usage and soil degradation help meet these certification criteria. The Microirrigation Systems market grows with rising demand for Rainforest Alliance, GLOBALG.A.P., and LEAF-accredited products. It supports producers in meeting audit requirements for water stewardship. Brands link eco-labeling with microirrigation as a tool to demonstrate responsible farming. This trend is strong among exporters and premium product growers.

Rise in Turnkey Project Solutions by System Providers Enhances Market Accessibility

Vendors now offer complete irrigation solutions covering design, installation, training, and after-sales support. This service model reduces complexity for small and mid-sized farms deploying new systems. The Microirrigation Systems market shifts toward bundled offerings that include pumps, filters, controllers, and software. It helps customers overcome integration challenges and boosts first-time adoption. Companies also focus on localized support to address region-specific crop needs. These bundled models increase penetration in semi-urban and remote areas.

Market Challenges Analysis

High Initial Investment and Maintenance Costs Limit Adoption Among Small-Scale Farmers

Upfront expenses for equipment, installation, and filtration units remain a key barrier to adoption. Many smallholders in developing regions lack access to credit or subsidies for microirrigation upgrades. The Microirrigation Systems market faces slow uptake in fragmented landholding areas where economies of scale are difficult to achieve. It requires regular maintenance of emitters, pipes, and pumps to prevent clogging and ensure performance. Poor water quality further increases filtration costs, adding to long-term ownership burden. Limited awareness of total lifecycle savings keeps many farmers reliant on flood irrigation.

Technical Complexity and Infrastructure Gaps Hamper Efficient Deployment in Remote Areas

Farmers often struggle with installation and system calibration without proper training or support. Inadequate infrastructure, such as unreliable electricity and poor water pressure, affects system performance in rural zones. The Microirrigation Systems market contends with delays in scaling across regions lacking extension services. It depends on skilled labor for setup and timely repairs, which are often unavailable in remote areas. System misuse or poor design can lead to uneven water distribution and crop damage. These challenges slow adoption despite the technology’s proven agronomic benefits.

Market Opportunities

Expansion of Agri-Tech Partnerships Creates Growth Channels Across Developing Economies

Collaborations between system manufacturers, agri-tech startups, and financial institutions drive new business models. Microirrigation equipment is now bundled with mobile-based advisory tools, weather services, and financing support. The Microirrigation Systems market benefits from integrated offerings that reduce barriers for smallholders. It enables service-based irrigation access through leasing, pay-per-use, or cooperative models. Startups and NGOs also bridge knowledge gaps through digital training platforms. These innovations create scalable frameworks suited for emerging markets in Africa, Southeast Asia, and Latin America.

Rising Demand for Climate-Resilient Farming Unlocks Scope for Custom Solutions

Extreme weather patterns, water stress, and soil degradation push farmers toward adaptive irrigation strategies. Microirrigation supports climate-smart agriculture by improving water efficiency, reducing runoff, and lowering emissions. The Microirrigation Systems market sees new opportunities in designing systems tailored to soil type, slope, and crop cycle. It also enables integration with renewable energy-powered pumps, enhancing sustainability. Governments and global donors prioritize resilient infrastructure, creating funding channels for precision irrigation. These trends position microirrigation as a core solution in long-term food security planning.

Market Segmentation Analysis:

By Application:

Field crops dominate the Microirrigation Systems market due to large-scale deployment in cereals, pulses, and oilseeds. These crops demand high water efficiency in arid and semi-arid regions. Landscapes follow, driven by adoption in urban parks, resorts, and sports fields where water conservation is a priority. Container gardening and small-scale farming segments grow with rising urban agriculture and backyard cultivation trends. These systems cater to kitchen gardens, terrace farms, and peri-urban production units. Others, including indoor plants, gain interest in commercial greenhouses and climate-controlled spaces where uniform moisture delivery is critical.

- For instance, Hunter Industries, a manufacturer of irrigation products, offers various solutions that can be assembled into turnkey kits. Its micro-irrigation offerings include a variety of filters (such as the HFR kit with a 150-mesh filter screen and flow rates of up to 15 GPM) and pressure regulators.

By Distribution Channel:

Direct sales account for a significant share, driven by large farm operations and government procurement models. Direct engagement enables manufacturers to offer end-to-end solutions, including system design, customization, and post-installation support. The Microirrigation Systems market expands through indirect sales, involving dealers, retailers, and e-commerce platforms. It improves access to equipment in rural and semi-urban zones where farm input outlets serve as primary purchase points. Channel partnerships also help in last-mile delivery and training support. Growth in indirect routes is tied to regional demand fluctuations and awareness programs.

- For instance, Netafim has undertaken significant projects in Africa, including a 15,600-hectare project in Rwanda and a 10,000-hectare project in Eswatini

By End-Use:

Individual farmers remain the leading users due to widespread application in open-field agriculture. These users adopt systems to reduce water usage, improve yields, and lower labor dependency. Corporate farms contribute a growing share, supported by scalable infrastructure and precision farming mandates. It enables consistent irrigation across large contiguous land holdings with minimal water loss. Government agencies deploy microirrigation in public sector farming, reforestation, and horticulture missions. Others include industrial parks and institutional campuses investing in landscape irrigation or controlled farming facilities.

Segments:

Based on Application:

- Field crops

- Landscapes

- Container gardening

- Small-scale farming

- Others (indoor plants etc.)

Based on Distribution Channel:

- Direct sales

- Indirect sales

Based on End-Use:

- Farmers

- Corporate farms

- Government agencies

- Others (industrial users etc.)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 22.4% of the global Microirrigation Systems market, driven by high adoption in the United States and Canada. The region emphasizes water conservation in response to drought conditions across states like California, Arizona, and Texas. Large-scale farms in the U.S. Midwest use drip and sprinkler systems to reduce water use and improve productivity in crops such as corn, soybeans, and vegetables. It also benefits from strong regulatory support through initiatives like the Environmental Quality Incentives Program (EQIP), which subsidizes precision irrigation systems. Technological integration with remote sensing, GPS-based irrigation scheduling, and IoT-based water management systems is widespread. Canada also contributes to market growth through adoption in greenhouse vegetables, floriculture, and specialty crops across provinces like Ontario and British Columbia. The regional focus on climate-smart agriculture supports continued system penetration across varied applications.

Europe

Europe holds a 19.6% share in the Microirrigation Systems market, supported by advanced farming infrastructure and strong policy mandates. Countries like Spain, Italy, France, and the Netherlands implement microirrigation in vineyards, orchards, and greenhouse farming. European Union policies, including the Common Agricultural Policy (CAP), promote sustainable irrigation practices and incentivize water-saving equipment. The region’s emphasis on organic and high-value crop production further encourages the use of precise irrigation to maintain soil quality and reduce runoff. Germany and the Netherlands lead in automation and sensor-based irrigation technologies. It benefits from well-developed supply chains, manufacturer presence, and access to smart agri-tech platforms. Water scarcity in Southern Europe continues to push adoption across Mediterranean agricultural belts.

Asia-Pacific

Asia-Pacific dominates the global market with a 34.1% share, led by India, China, and Australia. India stands out due to strong government support under schemes like PMKSY (Per Drop More Crop), which funds microirrigation systems for small and marginal farmers. Adoption spans horticulture, sugarcane, cotton, and groundnut crops. China uses microirrigation across vegetable farms, orchards, and protected cultivation systems to increase water use efficiency. The region’s massive agricultural population and fragmented landholdings offer long-term growth potential for customized, low-cost systems. Australia leads in the deployment of automated irrigation across large-scale orchards and vineyards, particularly in drought-prone states like South Australia and Victoria. It also invests in solar-powered microirrigation pumps for off-grid farms. Asia-Pacific continues to attract investments from global and regional vendors seeking market expansion.

Latin America

Latin America holds 13.5% of the Microirrigation Systems market, with strong contributions from Brazil, Mexico, and Chile. Brazil integrates microirrigation in citrus, sugarcane, and coffee plantations to optimize resource use and meet export quality standards. Mexico sees wide adoption in avocado, tomato, and berry farming in regions like Michoacán and Jalisco. Chile uses drip systems in vineyards and stone fruit orchards located in the arid zones of central Chile. Government subsidies, combined with increasing water stress and pressure to improve yield per hectare, support regional market expansion. It also benefits from technology transfer programs led by Israel and the U.S., which improve awareness and equipment access. Local manufacturers focus on low-cost drip kits tailored to smallholder needs.

Middle East & Africa

The Middle East & Africa region represents 10.4% of the global market, driven by rising water scarcity and the need for efficient irrigation in desert farming. Countries like Israel, Saudi Arabia, and the UAE lead in microirrigation deployment through advanced water reuse systems and saline water-compatible solutions. Israel remains a global pioneer in drip technology, exporting systems and offering technical training across the region. Africa sees gradual growth, with adoption supported by donor-backed agricultural development projects in Kenya, Ethiopia, and South Africa. These systems are widely used in floriculture, horticulture, and maize cultivation. It supports food security objectives and aligns with national goals for sustainable farming and rural livelihood enhancement. Private players and NGOs play a crucial role in building awareness and extending affordable technologies to low-income farming communities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ecoflo India

- Valmont

- Novagric

- Hunter

- Automat Industries

- T-L Irrigation

- Lindsay

- Toro

- Adritec Europe

- Rain Bird Corporation

- Captain Polyplast

- Rivulis

- Netafim

- Jain Irrigation Systems

- N-Drip

Competitive Analysis

The Microirrigation Systems market features strong competition among key players including Ecoflo India, Valmont, Novagric, Hunter, Automat Industries, T-L Irrigation, Lindsay, Toro, Adritec Europe, Rain Bird Corporation, Captain Polyplast, Rivulis, Netafim, Jain Irrigation Systems, and N-Drip. These companies compete on product innovation, regional reach, technical service, and integration with smart agriculture platforms. Market leaders focus on offering complete irrigation solutions that include design, filtration, fertigation, and digital monitoring. Many players invest in localized manufacturing and dealer networks to strengthen rural market access. Global companies prioritize R&D in drip and sprinkler technologies tailored to climate-resilient farming. Regional players gain traction by offering cost-effective kits and government-aligned solutions for smallholders. The shift toward automated and solar-powered systems creates new ground for competitive differentiation. Firms also expand through strategic partnerships with agri-tech startups and public sector schemes. Leading vendors maintain a presence across multiple continents, enabling rapid deployment in both developed and emerging economies. Competitive intensity remains high, driven by rising demand for sustainable irrigation, smart farm integration, and compliance with global sustainability certifications.

Recent Developments

- In 2024, Lindsay Corporation launched the FieldNET NextGen user interface. This interface was the culmination of a Beta test program that had been running for over a year with feedback from farmers

- In 2024, Rivulis opened a new micro-irrigation factory in North America to shorten lead times and meet regional demand.

- In September 2024, Netafim released the GrowSphere operating system combining hardware, analytics, and agronomic guidance into a single user environment.

Report Coverage

The research report offers an in-depth analysis based on Application, Distribution Channel, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as governments increase funding for sustainable irrigation practices.

- Demand for smart irrigation systems will grow with the rise of precision farming technologies.

- Adoption will accelerate in emerging economies due to rising food security concerns and water scarcity.

- Manufacturers will offer more bundled services including system design, installation, and maintenance.

- Cloud-based monitoring and real-time control tools will become standard in commercial farm operations.

- Microirrigation will play a critical role in climate-resilient agriculture across drought-prone regions.

- Public-private partnerships will support technology transfer and local system manufacturing.

- Low-cost microirrigation kits will drive uptake among smallholder and marginal farmers.

- Global certification requirements will push growers to adopt water-efficient systems for compliance.

- Integration with solar-powered pumps will increase off-grid irrigation capacity in remote areas.