Market Overview:

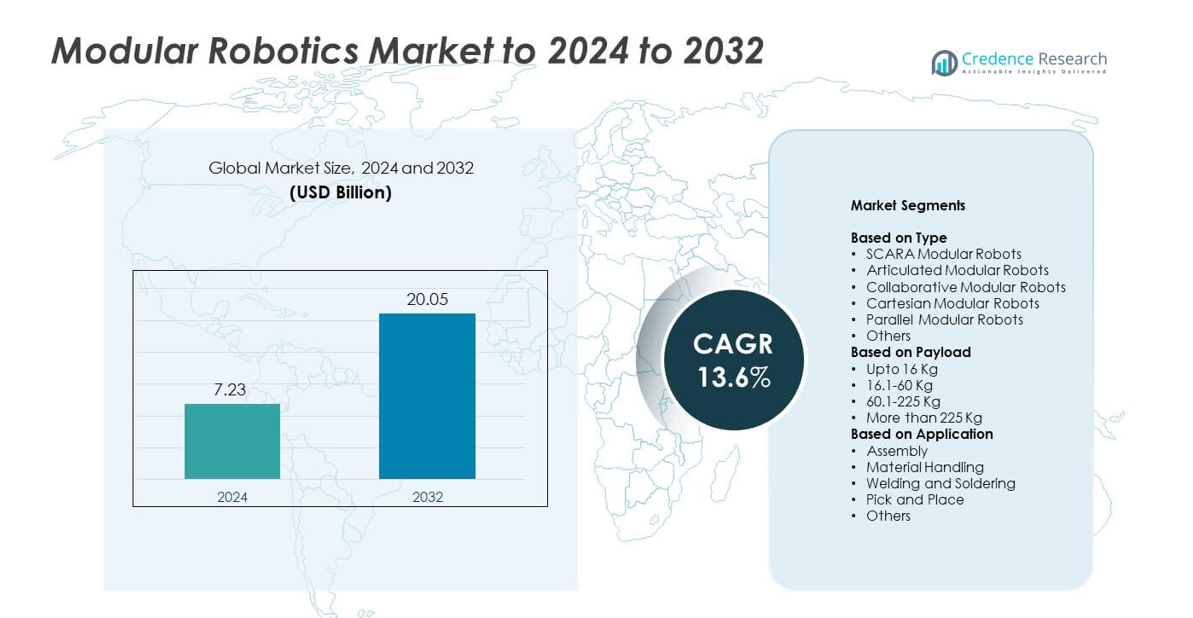

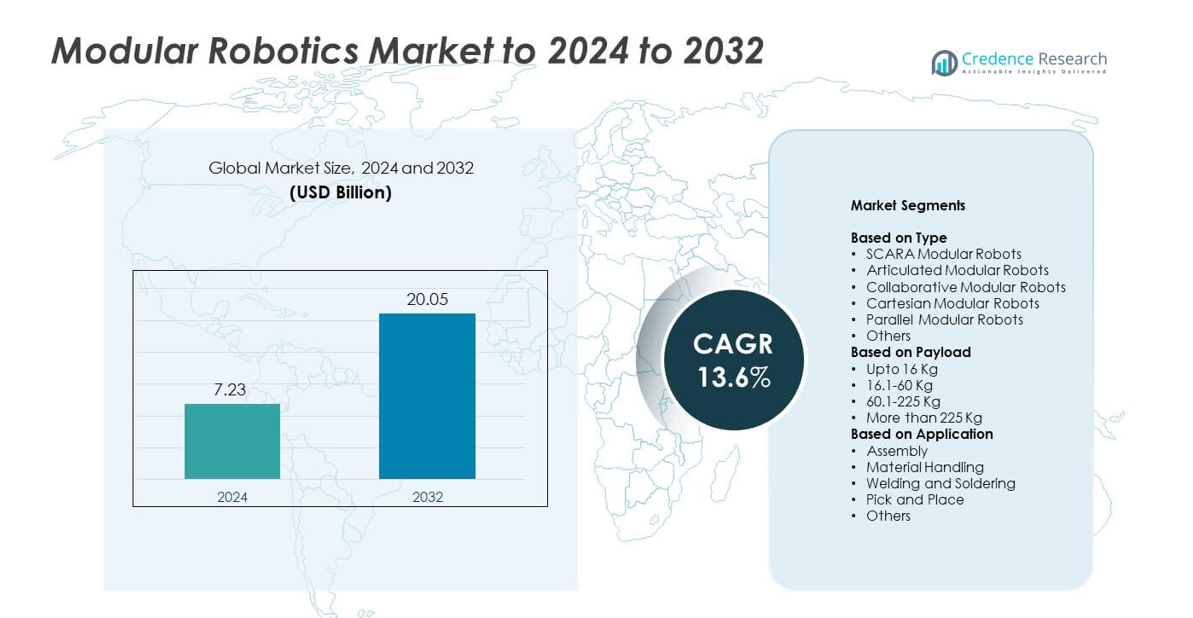

Modular Robotics Market size was valued USD 7.23 Billion in 2024 and is anticipated to reach USD 20.05 Billion by 2032, at a CAGR of 13.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Robotics Market Size 2024 |

7.23 Billion |

| Modular Robotics Market, CAGR |

13.6% |

| Modular Robotics Market Size 2032 |

USD 20.05 Billion |

The modular robotics market is shaped by major companies such as Mitsubishi Electric Corporation, Universal Robots, Yaskawa Electric Corporation, FANUC Corporation, Denso Robotics, Midea Group (KUKA AG), ABB Ltd., Kawasaki Heavy Industries Ltd., Nachi-Fujikoshi Corporation, and Omron Corporation. These players compete through advanced modular platforms, collaborative systems, and AI-enabled control technologies that support flexible production. North America remained the leading region in 2024 with about 34% share, driven by strong automation use in automotive, electronics, and logistics. Europe held nearly 29% share, supported by Industry 4.0 programs, while Asia Pacific followed closely with about 28% share due to rapid manufacturing expansion.

Market Insights

- Modular Robotics Market was valued at USD 7.23 Billion in 2024 and is projected to reach USD 20.05 Billion by 2032, growing at a CAGR of 13.6%.

- Strong demand for automation in automotive and electronics production drives market growth, with articulated modular robots holding about 44% share in 2024.

- Trends include rising use of collaborative modular robots, AI-enabled path optimization, and flexible reconfigurable manufacturing systems across high-mix production lines.

- Competition intensifies as major players expand modular platforms, integrate vision systems, and strengthen global service networks to support faster deployment.

- North America led the market with around 34% share, followed by Europe at 29% and Asia Pacific at 28%, supported by rapid industrial expansion and strong adoption of modular systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Articulated modular robots led the type segment in 2024 with about 44% share. These robots gained strong adoption due to their wide motion range, high flexibility, and use in complex industrial tasks. Manufacturers preferred articulated systems for automotive, electronics, and metal fabrication lines where precision and multi-axis control are essential. SCARA and collaborative robots also expanded as demand rose for compact setups and safer human-robot interaction. Growth stayed strong as factories adopted modular layouts to speed deployment, reduce integration cost, and scale production with minimal downtime.

- For instance, FANUC reported that its cumulative production of CNC units reached 5 million in February 2022″

By Payload

The up to 16 kg payload category dominated the payload segment in 2024 with nearly 39% share. This range remained popular because lightweight robots fit well in electronics, consumer goods, and small-component assembly lines. These robots offered high speed, low energy use, and easy redeployment across tasks, supporting flexible production cycles. Mid-range payload systems between 16.1–60 kg grew due to rising automotive and packaging activity. Heavy payload robots above 225 kg saw stable demand in metalworking and heavy machinery but held a smaller share due to limited use cases.

- For instance, Universal Robots disclosed an installed base of over 100,000 collaborative robots worldwide by early 2025.

By Application

Assembly was the leading application in 2024 with about 36% share. Companies selected modular robots for assembly because they improve precision, shorten cycle times, and support frequent line changes. Electronics, automotive, and appliance makers used modular platforms to boost output and reduce human-error rates. Material handling and pick-and-place applications grew as warehouses automated repetitive lifting and sorting tasks. Welding and soldering applications showed steady progress, supported by demand for consistent joint quality and higher safety in high-heat environments.

Key Growth Drivers

Rising Industrial Automation Adoption

Global manufacturers increased automation to boost throughput, reduce labor gaps, and improve product quality. Modular robotics gained strong traction because companies can scale systems quickly without redesigning full production lines. Flexible robotic modules support multi-product assembly, fast reconfiguration, and shorter commissioning time. Many industries moved to modular layouts to reduce integration cost and handle rising customization demand. This shift strengthened adoption across automotive, electronics, and consumer goods sectors, making automation expansion a major growth driver for the modular robotics market.

- For instance, FANUC (a competitor of KUKA) reported that its cumulative production of industrial robots reached 1 million by August 2023

Expanding Use Across SMEs

Small and medium manufacturers adopted modular robots to raise output while controlling operational cost. Compact modules reduce upfront investment and allow firms to automate step by step, lowering financial risk. Easy installation and low maintenance attract SMEs that lack deep engineering teams. Modular systems also replace repetitive manual work and improve safety in small plants. Growing government incentives for automation in emerging markets further accelerated SME adoption. This expansion across smaller factories has become a major growth driver for overall market growth.

- For instance, Techman Robot had cumulative shipments of over 15,000 cobots worldwide as of September 2024, driven significantly by SME adoption

Growth in Collaborative and Flexible Production Systems

Companies invested in flexible production systems to manage changing product cycles and shorter market timelines. Collaborative modular robots gained attention due to safer operation, space efficiency, and simple programming features. These robots support mixed workflows where humans and machines work together, reducing bottlenecks during peak demand. Industries with high product variability, such as electronics and consumer goods, valued the adaptability of collaborative modules. This shift toward flexible, human-friendly automation established collaborative robotics as a major growth driver.

Key Trends & Opportunities

Shift Toward Reconfigurable Manufacturing

Manufacturers are moving from fixed lines to reconfigurable production systems to handle fast design changes and rising customization needs. Modular robots play a central role by allowing plants to add, remove, or reposition modules within minutes. This trend helps companies cut downtime and manage high-mix, low-volume output. The opportunity lies in supporting digital factories that rely on rapid adjustments and data-driven control. As Industry 4.0 expands, reconfigurable setups will open strong adoption pathways for modular robotic platforms.

- For instance, Kawasaki Heavy Industries had shipped approximately 288,000 industrial robots cumulatively by March 31, 2023, supporting flexible and reconfigurable manufacturing environments across automotive and electronics production lines.

Integration of AI and Vision Technologies

AI-driven path optimization and advanced machine vision strengthened modular robot performance across industries. Plants now deploy robots that detect parts, track movements, and correct errors in real time. This trend enhances accuracy in pick-and-place, inspection, and assembly tasks. The opportunity emerges from using AI to reduce programming time and support predictive maintenance. As vision-powered modules offer improved autonomy, manufacturers gain more efficient and intelligent production lines, reinforcing long-term demand for modular robotic systems.

- For instance, Cognex reported shipping over 4.5 million machine vision systems cumulatively as of mid-to-late 2024 data, demonstrating strong integration of AI-enabled vision in robotics.

Rising Demand in Logistics and Warehousing

Logistics companies accelerated automation to manage e-commerce growth and labor shortages. Modular robots support sorting, palletizing, and high-speed material handling tasks with simple reconfiguration and minimal training needs. This trend presents a strong opportunity for modular robotics to penetrate fulfillment centers and distribution hubs. As warehouses redesign workflows to manage rising order volumes, modular systems help build scalable layouts that support rapid operational shifts.

Key Challenges

High Initial Integration and Customization Complexity

Many manufacturers struggle with integration planning, system compatibility, and custom engineering when deploying modular robots. Small plants lack specialized staff to configure modules, connect software layers, and align robots with existing equipment. These issues increase deployment time and limit adoption in markets with low technical readiness. Integration complexity also raises supplier dependence and slows large-scale rollout across industries. This challenge remains a major barrier, especially for companies transitioning from manual to semi-automated operations.

Skilled Workforce Gap in Robotics and Automation

The modular robotics market faces a widening talent gap in programming, maintenance, and robotic system optimization. Many regions lack technicians who can operate and troubleshoot modular systems, slowing adoption in mid-sized factories. Workforce shortages in robotics engineering also increase training needs and raise operational risk for first-time adopters. As companies modernize plants, the shortage of skilled labor becomes a significant challenge, limiting long-term expansion and reducing the speed of digital transformation in key industries.

Regional Analysis

North America

North America held about 34% share in 2024, supported by strong adoption of automation in automotive, electronics, and logistics industries. The United States led demand due to large investments in modular assembly lines and collaborative robot deployments. Canada expanded use across metal fabrication and food processing plants, driven by labor shortages and rising productivity needs. Widespread integration of AI-enabled robotics and strong presence of global robot manufacturers further strengthened market growth. Regional companies adopted modular layouts to reduce downtime, improve flexibility, and scale production, keeping North America the leading market.

Europe

Europe accounted for nearly 29% share in 2024, driven by advanced manufacturing hubs in Germany, France, Italy, and the United Kingdom. Strong emphasis on Industry 4.0, energy-efficient automation, and workplace safety encouraged adoption of modular robotics across automotive, aerospace, and machinery sectors. The region benefited from robust engineering capabilities and strong government support for digital transformation. Demand increased in electronics and packaging industries as companies sought flexible production systems. High labor costs and focus on precision engineering pushed manufacturers to deploy modular robots for improved output across diverse industrial environments.

Asia Pacific

Asia Pacific captured about 28% share in 2024, supported by rapid industrialization and strong manufacturing bases in China, Japan, South Korea, and India. China expanded modular robotics use in electronics, automotive, and consumer goods production. Japan and South Korea increased adoption of collaborative modules for precision assembly and semiconductor tasks. India showed rising interest due to automation incentives and growing automotive component output. Regional growth accelerated as factories upgraded legacy systems with modular robots to improve speed and reduce labor dependency. Expanding export-driven industries further strengthened market demand.

Latin America

Latin America held around 5% share in 2024, with adoption driven mainly by automotive, food processing, and consumer goods industries. Brazil led regional demand, supported by expanding manufacturing lines and rising interest in modular platforms that reduce operational cost. Mexico saw steady integration in electronics and automotive assembly due to cross-border production links with North America. The region gradually invested in flexible automation to improve efficiency amid labor shortages and rising production targets. Despite slower adoption than major markets, modular robotics demand continued to grow as industries modernized.

Middle East and Africa

Middle East and Africa accounted for nearly 4% share in 2024, driven by gradual expansion of industrial automation in the UAE, Saudi Arabia, and South Africa. Manufacturing diversification programs supported early adoption of modular robots in logistics, packaging, and metalworking. Demand increased as factories sought scalable automation systems to reduce import dependency and improve operational reliability. Robotics use in warehousing and automotive assembly also gained momentum, particularly in Gulf countries. While adoption remained lower than other regions, improving infrastructure and industrial investment continued to expand market opportunities.

Market Segmentations:

By Type

- SCARA Modular Robots

- Articulated Modular Robots

- Collaborative Modular Robots

- Cartesian Modular Robots

- Parallel Modular Robots

- Others

By Payload

- Upto 16 Kg

- 16.1-60 Kg

- 60.1-225 Kg

- More than 225 Kg

By Application

- Assembly

- Material Handling

- Welding and Soldering

- Pick and Place

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The modular robotics market features leading players such as Mitsubishi Electric Corporation, Universal Robots, Yaskawa Electric Corporation, FANUC Corporation, Denso Robotics, Midea Group (KUKA AG), ABB Ltd., Kawasaki Heavy Industries Ltd., Nachi-Fujikoshi Corporation, and Omron Corporation. The market shows strong competition as companies invest in advanced modular platforms that support flexible manufacturing and fast reconfiguration. Vendors focus on improving precision, safety, and energy efficiency to meet rising automation needs across automotive, electronics, and logistics sectors. Many firms enhance their portfolios with collaborative modules, AI-enabled controls, and vision-based systems to strengthen performance. Partnerships with system integrators and digital solution providers help expand reach in global markets. Companies also invest in localized production and after-sales support to address industry-specific needs and reduce deployment time. Growing demand for scalable automation encourages continuous innovation, keeping competition active and technology-driven across major industrial regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, ABB introduced the IRB 6730S, IRB 6750S, and IRB 6760 large industrial robots equipped with OmniCore advanced automation controllers

- In 2025, Yaskawa Electric Corporation introduced the MOTOMAN NEXT product concept showcasing AI robotics at Automatica.

- In 2025, Universal Robots introduced the UR15 collaborative robot (cobot), which is their fastest cobot featuring a 15 kg payload, 5 m/s speed, and AI readiness.

Report Coverage

The research report offers an in-depth analysis based on Type, Payload, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Modular robotics adoption will rise as factories shift toward flexible production systems.

- Collaborative modular robots will gain stronger demand due to safer human-machine interaction.

- AI integration will enhance robot autonomy and reduce programming time across industries.

- Electronics and automotive sectors will remain the largest users of modular robotic platforms.

- Warehouse automation will expand as e-commerce firms increase investment in scalable robotic modules.

- SMEs will adopt modular robots faster because of lower setup cost and easy system reconfiguration.

- Vision-enabled modules will support higher precision in inspection and assembly tasks.

- Heavy-duty modular robots will grow in metal, machinery, and fabrication lines.

- Governments will promote automation through incentives, boosting adoption in emerging markets.

- Cloud-connected modular robotics will support predictive maintenance and remote optimization.