Market Overview:

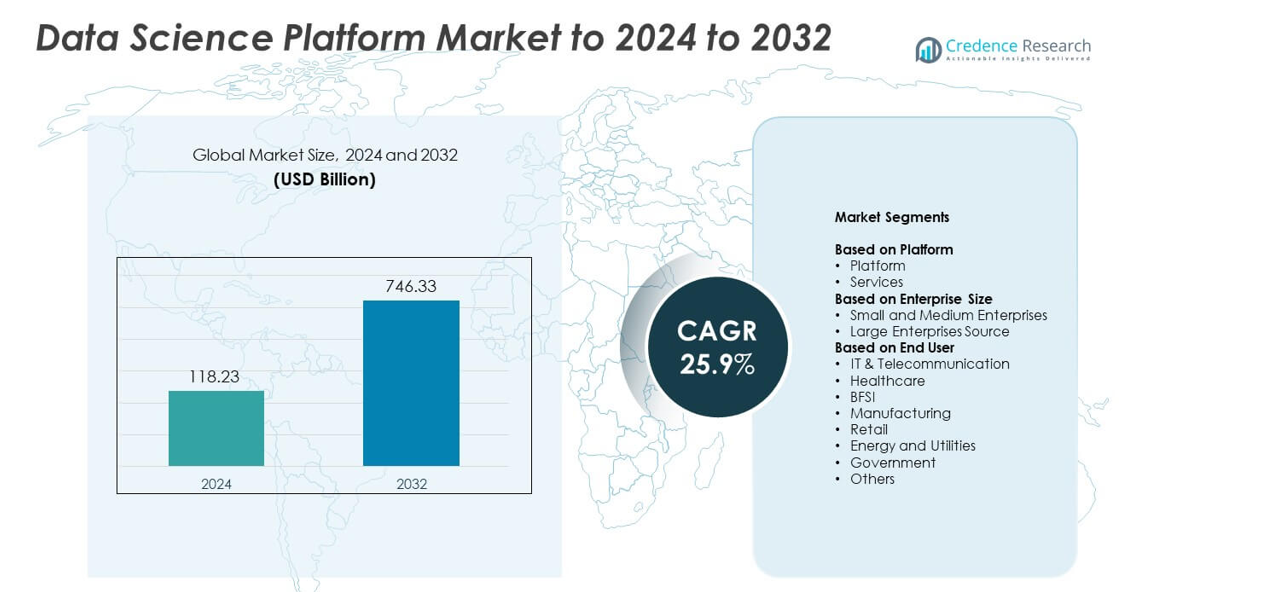

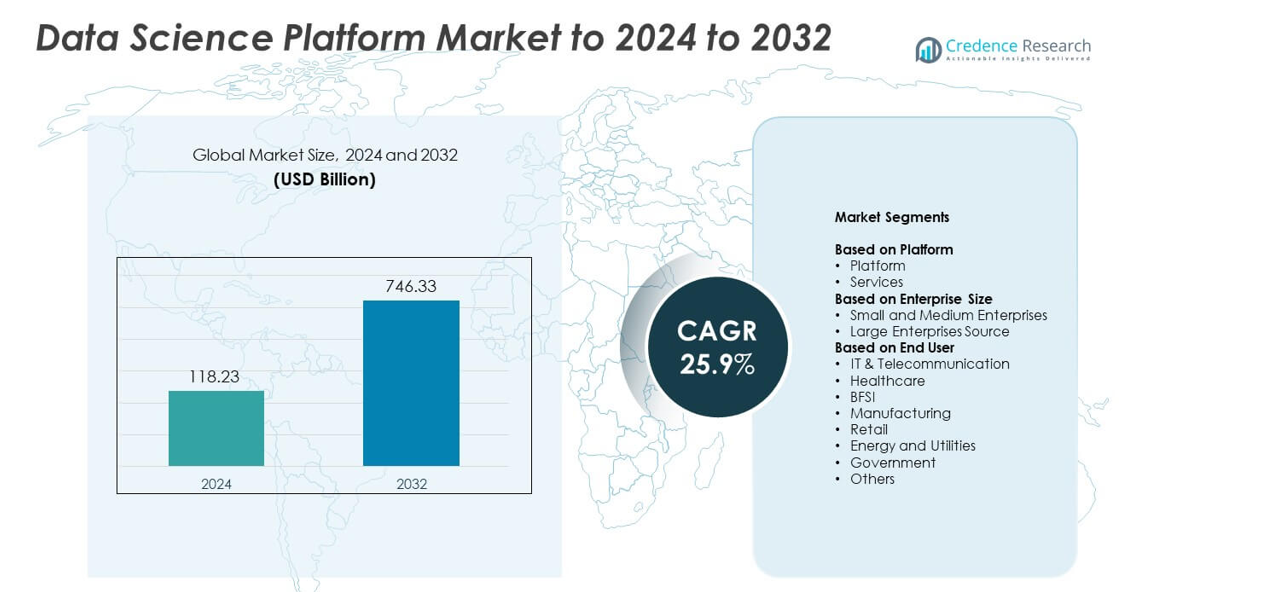

Data Science Platform Market size was valued at USD 118.23 billion in 2024 and is anticipated to reach USD 746.33 billion by 2032, at a CAGR of 25.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Science Platform Market Size 2024 |

USD 118.23 billion |

| Data Science Platform Market, CAGR |

25.9% |

| Data Science Platform Market Size 2032 |

USD 746.33 billion |

The Data Science Platform Market is shaped by major players such as Oracle, SAP, Google LLC, Cloud Software Group, Inc., The MathWorks, Inc., Microsoft, Alteryx, IBM Corporation, SAS Institute Inc., and H2O.ai, each expanding advanced analytics and AI-driven solutions for global enterprises. These companies strengthen their position through cloud-native platforms, automated machine learning, and strong data governance features. North America led the market in 2024 with about 37% share, driven by high AI adoption, strong digital infrastructure, and large-scale enterprise investments. Europe and Asia Pacific followed as key growth regions supported by rising analytics deployments and expanding cloud usage.

Market Insights

- The Data Science Platform Market was valued at USD 118.23 billion in 2024 and is projected to reach USD 746.33 billion by 2032, growing at a CAGR of 25.9%.

- Strong demand for AI and machine learning adoption drives market expansion, with enterprises scaling predictive analytics, automation, and cloud-based data workflows across operations.

- Generative AI, AutoML, and low-code adoption shape major trends as companies seek faster model development and wider analytics use among non-technical teams.

- The market remains competitive with global vendors enhancing cloud-native platforms, governance tools, and industry-specific solutions; the platform segment led with about 71% share in 2024.

- North America dominated the market with nearly 37% share in 2024, followed by Europe at about 28% and Asia Pacific at roughly 25%, while IT and telecommunication remained the leading end-user segment with around 29% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Platform

The platform segment led the Data Science Platform Market in 2024 with about 71% share. This dominance came from strong adoption of unified analytics platforms that combine data preparation, model training, and deployment in one environment. Enterprises preferred integrated platforms because they reduce tool fragmentation and improve workflow speed across teams. Growth stayed strong as organizations adopted AI-driven automation, scalable cloud environments, and advanced machine learning capabilities. Service adoption also increased, but platform solutions remained ahead due to higher demand for end-to-end data lifecycle management.

- For instance, Databricks confirmed in 2024/2025 that its platform was used by more than 15,000 global organizations.

By Enterprise Size

Large enterprises dominated the enterprise size segment in 2024 with nearly 64% share. Adoption remained high due to large-scale data pipelines, complex AI workloads, and strong budgets for advanced analytics. Large organizations used enterprise-grade platforms to manage structured and unstructured data across global operations. Demand grew as companies focused on automation, operational intelligence, and cloud migration. Small and medium enterprises expanded usage as well, but their share stayed lower because many lacked in-house data teams and relied more on affordable, simplified solutions.

- For instance, Snowflake reported in its 2024 filings that it had more than 691 Forbes Global 2000 customers, reflecting heavy usage by large enterprises across global regions.

By End User

The IT and telecommunication segment held the largest share in 2024 with around 29%. This sector used data science platforms to enhance network optimization, customer analytics, fraud detection, and predictive maintenance. Telecom operators increased AI-based insights to support 5G rollout and real-time service management. BFSI, healthcare, and retail also showed strong growth, but IT and telecommunication stayed ahead due to high data volume and continuous digital transformation. Demand increased further as companies adopted cloud-native analytics and machine learning to improve service delivery and operational accuracy.

Key Growth Drivers

Rising Adoption of AI and Machine Learning

Growing use of AI and machine learning across enterprises drives strong demand for unified data science platforms. Companies rely on these platforms to speed model development, manage large datasets, and automate workflows. Cloud-native tools help teams improve productivity and reduce operational delays. Adoption increases as organizations integrate predictive analytics into customer experience, fraud detection, and process optimization. This shift positions AI-enabled platforms as a core element of digital transformation.

- For instance, OpenAI announced in November 2023 that ChatGPT reached over 100 million weekly active users

Expansion of Cloud-Based Data Infrastructure

Enterprises continue to migrate analytics workloads to cloud environments, boosting platform adoption. Cloud-based data science platforms allow flexible scaling, quick deployment, and improved collaboration across distributed teams. Organizations benefit from reduced infrastructure costs and greater access to advanced ML tools. Cloud integration supports real-time processing, enabling faster business decisions. As enterprises modernize data pipelines, demand for scalable cloud platforms grows rapidly.

- For instance, Amazon Web Services reported on Pi Day (March 14, 2025) that Amazon S3 stored more than 400 trillion objects, supporting large-scale cloud analytics pipelines across global enterprises.

Increasing Data Volume Across Industries

Rising data generation from connected devices, digital services, and enterprise applications fuels platform adoption. Companies need centralized environments to handle structured and unstructured data efficiently. Platforms support advanced modeling, automated pipelines, and strong governance, enabling enterprises to extract meaningful insights. High data velocity in sectors such as telecom, finance, and retail strengthens the need for robust analytics frameworks. This rising dependency makes data science platforms essential for strategic decision-making.

Key Trends & Opportunities

Growth of Generative AI Integration

Enterprises adopt generative AI to create predictive models, automate content, and enhance data exploration. Data science platforms integrate generative AI features that accelerate experimentation and reduce manual coding. Adoption rises as companies use these capabilities for simulation, forecasting, and synthetic data generation. This creates opportunities for platform providers to expand toolsets and attract advanced AI users. Generative AI enhances productivity and helps enterprises innovate at greater speed.

- For instance, NVIDIA stated in 2024 that the company’s ecosystem spans approximately 40,000 companies and nearly 5 million developers, while more than 1,600 generative AI companies specifically were building on NVIDIA CUDA, TensorRT, and related AI frameworks, as confirmed in its official GTC announcements and annual reviews.

Rising Use of AutoML and Low-Code Tools

AutoML and low-code features transform model development by reducing the need for specialized coding skills. Teams use automated model selection, hyperparameter tuning, and deployment tools to shorten development cycles. This trend supports wider adoption among business analysts and non-technical users. Platforms offering easy interfaces gain market advantage as organizations push for democratized analytics. The shift expands market reach and encourages broader enterprise experimentation with AI-driven insights.

- For instance, Google confirmed in 2024 that its Vertex AI and AI Studio platforms processed billions of requests, with the total number of API calls reaching approximately 150 billion in a single month by late 2024/early 2025.

Industry-Specific Platform Customization

Vendors increasingly design platforms tailored to healthcare, BFSI, retail, and manufacturing needs. These sector-focused solutions include domain models, compliance support, and specialized data pipelines. Demand rises as industries require faster deployment and regulatory alignment. Customization helps enterprises address unique challenges with higher precision. Providers offering vertical solutions unlock new growth opportunities and strengthen their competitive position.

Key Challenges

Data Privacy and Regulatory Compliance Issues

Strict data protection laws create operational hurdles for organizations adopting data science platforms. Companies must manage sensitive information while meeting global regulations related to consent, retention, and cross-border data transfer. Compliance demands increase development time and require strong governance frameworks. Industries such as healthcare and finance face higher scrutiny, raising the complexity of data workflows. These constraints limit platform flexibility and slow enterprise adoption.

Shortage of Skilled Data Professionals

The market faces a limited supply of trained data scientists, ML engineers, and analytics experts. Many enterprises struggle to build teams capable of handling complex modeling, data integration, and platform optimization. This shortage slows project execution and reduces returns on platform investments. Companies depend heavily on training, automation, and low-code tools to bridge the gap. Talent constraints remain a major barrier, especially for small and medium enterprises.

Regional Analysis

North America

North America led the data science platform market in 2024 with about 37% share. The region maintained leadership due to strong cloud adoption, large AI investments, and advanced enterprise digitalization. Companies in technology, telecom, and banking accelerated use of predictive analytics and automated machine learning tools. The United States drove most of the demand as enterprises scaled big data pipelines and strengthened real-time decision systems. Ongoing 5G expansion and high deployment of enterprise AI solutions continued to support platform growth, keeping North America the most mature and influential regional market.

Europe

Europe held nearly 28% share in 2024, supported by steady adoption of advanced analytics across manufacturing, automotive, and financial services. Strict data governance laws encouraged structured data science practices, driving investments in secure and compliant platforms. Germany, the United Kingdom, and France led the regional demand as enterprises expanded AI-driven automation. Growing interest in generative AI and industry-specific solutions also supported market expansion. Increased focus on energy efficiency, supply chain intelligence, and digital transformation kept Europe an important and rapidly evolving market.

Asia Pacific

Asia Pacific accounted for around 25% share in 2024 and showed the fastest growth due to rising digital transformation across China, India, Japan, and South Korea. Cloud migration, large data creation, and expanding AI capability programs boosted platform adoption. Telecom, retail, and BFSI companies scaled machine learning use to manage growing customer bases. Government initiatives promoting AI innovation further enhanced regional growth. Expanding startup ecosystems and rapid enterprise modernization positioned Asia Pacific as a key future growth hub for data science platforms.

Latin America

Latin America captured about 6% share in 2024, with adoption driven by growing digitalization in Brazil, Mexico, and Argentina. Companies increased use of cloud analytics and machine learning to streamline operations and improve customer management. The region benefited from rising investments in fintech, telecom modernization, and retail digital platforms. Limited access to advanced talent slowed adoption, but improved cloud availability supported market expansion. Gradual growth in AI readiness and enterprise automation kept Latin America on a steady upward path.

Middle East and Africa

Middle East and Africa held nearly 4% share in 2024, supported by rising digital transformation in the UAE, Saudi Arabia, and South Africa. Governments drove adoption by investing in national AI strategies and advanced data infrastructure. Enterprises in energy, telecom, and public services used analytics platforms to enhance efficiency and automate operations. Cloud service expansion and smart city projects boosted demand, though skill shortages and lower enterprise maturity limited wider penetration. Increased focus on innovation and diversification created a stable foundation for long-term market growth.

Market Segmentations:

By Platform

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises Source

By End User

- IT & Telecommunication

- Healthcare

- BFSI

- Manufacturing

- Retail

- Energy and Utilities

- Government

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Data Science Platform Market is shaped by leading companies such as Oracle, SAP, Google LLC, Cloud Software Group, Inc., The MathWorks, Inc., Microsoft, Alteryx, IBM Corporation, SAS Institute Inc., and H2O.ai. The market continues to advance as global vendors invest in cloud-native architectures, integrated machine learning tools, and strong automation capabilities. Providers focus on expanding AI-driven workflows that improve accuracy, reduce development time, and support enterprise-scale deployments. Competition strengthens as companies enhance security, governance, and real-time analytics features to meet rising regulatory and operational demands. Vendors also differentiate through industry-specific solutions designed for healthcare, financial services, manufacturing, and telecom. Growing adoption of generative AI and AutoML pushes firms to expand model management, collaborative environments, and low-code interfaces. Strategic partnerships, product upgrades, and ecosystem expansion remain central competitive priorities as enterprises seek unified platforms that manage full data lifecycles efficiently.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oracle

- SAP

- Google LLC

- Cloud Software Group, Inc.

- The MathWorks, Inc.

- Microsoft

- Alteryx

- IBM Corporation

- SAS Institute Inc.

- H2O.ai

Recent Developments

- In 2025, Google launched Gemini 2.5 models, featuring improved reasoning capabilities and real-time cost-effective performance enhancements for enterprise users.

- In 2025, H2O.ai introduced significant updates with its enterprise platform h2oGPTe featuring new agentic AI capabilities designed for secure, scalable, and customer-controlled AI deployments.

- In 2024, IBM partnered with Telefónica Tech to accelerate enterprise adoption of AI and analytic tools, addressing evolving enterprise needs in data science workflows.

Report Coverage

The research report offers an in-depth analysis based on Platform, Enterprise Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as enterprises scale AI and machine learning adoption.

- Cloud-native platforms will gain stronger traction across global industries.

- Generative AI integration will enhance model development and automation.

- AutoML and low-code tools will support wider use among non-technical teams.

- Industry-specific platform customization will accelerate deployment in regulated sectors.

- Real-time analytics demand will rise with increased data flow from connected systems.

- Vendors will strengthen governance and compliance features to meet stricter regulations.

- Collaboration tools will grow as teams adopt distributed and hybrid work models.

- Edge analytics capabilities will expand for faster on-device processing.

- Global talent shortages will push providers to deliver more automated and guided workflows.